In recent years, routinely once a month, MHProNews provides data to industry pros obtained from the Institute of Building Technology and Safety (IBTS), which in turn collects data under contract for the U.S. Department of Housing and Urban Development (HUD). That data, which is also used by others in MHVille, is effectively “official” federal data. We also provide earlier in the month all or much of the monthly national production snapshot generated by the Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR). Additionally, the U.S. Census Bureau produces a periodic report that updates information on manufactured housing. Some of that information (production/shipments) from the Census Bureau is rounded off, and thus is less accurate than the IBTS produced figures. That noted, the Census’ cost on new HUD Code manufactured homes data is presumably more accurate than their production/shipment insights. That cost data from Census is also ‘official’ federal data. Those facts, additional trends, and more information recapping recent reports in MHVille are all provided in this news-analysis. But before providing that, let’s flash back to remarks made in Louisville, KY a few years back by an executive from Ashley Furniture who attended that year’s manufactured housing industry trade show. The Louisville Show has been a fixture in manufactured housing almost annually for some 50 years, save for a couple of interruptions in the 21st century due to declining attendance one year as the manufactured home industry was in decline and due to COVID19 on another occasion.

That Ashely executive had walked (toured, inspected) several of the new manufactured homes on display. He was apparently a supplier to one or more of the firms which had homes being exhibited. This writer and that executive chatted for a bit, and he expressed his amazement and positive impressions about manufactured homes. Naturally, this writer agreed with that, but mentioned conversationally what manufactured home sales nationally had been. The Ashley executive was stunned. ‘Why are sales so low?’ Quite so. A brief explanation was given, but the obviously gent had difficulty accepting that homes that were so reasonably priced would be selling at such low levels.

Flashback years earlier to a discussion with two ladies from then central Wisconsin based Moxie Magazine. This writer and they were sitting in a model home in Colonial Gardens in Weston, WI. The home was a 3 bedroom, 2 bath single section manufactured home. While decorated, staged, and lighted, it was hardly the fanciest or largest model at that property. When one of the ladies asked what the price of the home was, the reply was given. One of the women from Moxie burst into tears. While it was not the first or last time that something was said or done (or not said or done) by this writer that caused a woman to cry, it was the first time it happened in the course of a discussion with media touring a model home. So, naturally, I asked – why the tears? She explained that she and her husband had bought a house some months previously in the Wausau WI metro that was about 100 years old. The home, she said, was drafty. The utility bills were high. Nor, per that regional media rep, was their home as attractive as the model we sat in. Yet that model home was far less expensive.

Many such true tales could be told that span decades of hands-on experiences in manufactured housing. Working in retail sales, retail management, land-lease community sales, manufactured home community (MHC) management, with factories, financial services firms, associations and others, there have been thousands of encounters with ‘the general public,’ with public officials, and an array of professionals involving modern manufactured homes. Before launching what today is called MHProNews and our MHLivingNews sister site, this writer was a periodic contributor to several trade publications, which are regrettably now defunct. Over three decades of experience as a front line sales person, manager, business owner, consultant, and as trade media could be shared. There are numerous awards and recognition that today are stored, but which once adorned walls in various offices from Texas to Wisconsin, or from Florida to Illinois. This writer has been to manufactured home communities and retail centers in Canada and in dozens of states in the U.S. from California to Maine. There is a breadth of experience that only a small sliver of living manufactured housing professionals could claim. Based solely on what others have said, it is fair to say that this writer is a praised expert in many segments of manufactured housing. Don’t ask me to repair a home or install one, but over the years, I’ve participated in or oversaw set ups, installations, refurb, repairs and the like.

Those decades of insights are woven into every article and commentary that this writer provides. We are not prone to baseless conspiracy theories. We vigorously denied some claims a decade or more ago that since then the evidence, trends, and insights which have emerged caused this seasoned MHVille advocate and ‘true believer’ to be compelled to embrace. There is a case to be made that it is better to admit an error and move on as circumstances warrant than it is to deny reality. Denying reality is like denying gravity. There can be serious consequences to doing either one.

With that introduction, some facts.

Part I

Washington, D.C., May 3, 2024 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production increased again in March 2024. Just-released statistics indicate that HUD Code manufacturers produced 8,447 new homes in March 2024, a 10.4% increase over the 7,646 new HUD Code homes produced in March 2023. Cumulative production for 2024 now totals 24,277 homes, a 14.6% increase over the 21,174 HUD Code homes produced over the same period in 2023.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current reporting year (2024) and prior year (2023) shipments per category as indicated — are:

More from that report by MHARR is found in the headlines recap further below.

Next, per the U.S. Census Bureau, is the following data.

| Average Sales Price of New Manufactured Homes by Region and Size of Home | ||||||||||||||

| By Month of Shipment | ||||||||||||||

| (Dollars) |

| United States | Northeast | |||||

| Total1 | Single | Double | Total1 | Single | Double | |

| 2023 | ||||||

| December | 121,300 | 79,600 | 149,600 | 124,100 | 83,500 | 156,600 |

| November | 126,600 | 85,900 | 154,100 | 122,600 | 92,400 | 158,200 |

| October | 120,000 | 83,300 | 147,700 | 118,900 | 84,300 | 151,900 |

| September | 119,700 | 80,400 | 151,700 | 128,700 | 85,400 | 172,800 |

| August | 128,800 | 89,800 | 154,600 | 132,500 | 105,200 | 158,400 |

| July | 118,000 | 82,300 | 150,200 | 122,700 | 72,900 | 143,100 |

| June | 121,400 | 85,400 | 153,900 | 121,800 | 85,300 | 149,800 |

| May | 129,900 | 86,300 | 160,200 | 120,900 | 89,800 | 146,000 |

| April | 125,000 | 86,100 | 153,600 | 123,900 | 87,000 | 160,800 |

| March | 124,700 | 85,200 | 155,400 | 135,200 | 100,600 | 172,900 |

| February | 128,100 | 89,200 | 160,400 | 136,600 | 107,000 | 167,800 |

| January | 126,100 | 82,100 | 156,900 | 122,900 | 86,700 | 148,300 |

| 2022 | ||||||

| December | 122,100 | 80,200 | 155,700 | 113,900 | 75,300 | 158,300 |

| November | 125,200 | 88,000 | 155,200 | 119,200 | 93,900 | 146,700 |

| October | 128,300 | 81,400 | 160,400 | 127,000 | 86,400 | 155,300 |

| September | 130,400 | 95,800 | 159,400 | 131,300 | 101,400 | 162,000 |

| August | 125,700 | 86,500 | 158,800 | 117,800 | 74,700 | 145,100 |

| July | 131,800 | 85,200 | 161,600 | 129,700 | 93,300 | 157,400 |

| June | 126,900 | 87,600 | 159,600 | 118,500 | 92,700 | 134,100 |

| May | 124,900 | 85,800 | 159,200 | 121,500 | 82,100 | 148,500 |

| April | 132,000 | 83,100 | 168,000 | 128,900 | 87,200 | 154,700 |

| March | 129,200 | 87,300 | 156,600 | 117,900 | 97,400 | 145,300 |

| February | 128,000 | 87,700 | 156,300 | 130,600 | 76,000 | 152,700 |

| January | 122,500 | 84,600 | 152,800 | 120,600 | 85,900 | 141,800 |

| 2021 | ||||||

| December | 123,200 | 80,900 | 150,300 | 104,700 | 73,900 | 127,200 |

| November | 111,900 | 76,400 | 139,900 | 100,900 | 71,600 | 133,500 |

| October | 112,000 | 81,700 | 138,200 | 110,300 | 74,400 | 138,700 |

| September | 118,300 | 78,800 | 141,300 | 102,100 | 76,100 | 124,100 |

| August | 112,000 | 80,000 | 138,000 | 105,000 | 86,000 | 117,000 |

| July | 118,700 | 76,000 | 137,800 | 98,500 | 74,100 | 125,700 |

| June | 106,800 | 70,200 | 128,100 | 101,600 | 73,700 | 124,200 |

| May | 106,500 | 69,900 | 128,300 | 98,400 | 69,900 | 121,500 |

| April | 100,200 | 66,700 | 122,500 | 95,900 | 73,800 | 113,300 |

| March | 98,100 | 63,300 | 123,200 | 91,400 | 58,600 | 121,300 |

| February | 98,300 | 65,400 | 122,500 | 88,300 | 59,400 | 113,800 |

| January | 95,000 | 64,100 | 118,500 | 102,600 | 67,900 | 116,200 |

| 2020 | ||||||

| December | 90,200 | 62,600 | 110,800 | 93,600 | 58,200 | 115,300 |

| November | 92,600 | 63,500 | 112,800 | 85,600 | 63,600 | 103,900 |

| October | 89,400 | 57,200 | 110,000 | 91,000 | 57,700 | 112,100 |

| September | 87,300 | 58,300 | 107,800 | 84,800 | 61,000 | 105,600 |

| August | 88,200 | 57,700 | 109,300 | 87,600 | 56,700 | 109,600 |

| July | 84,200 | 59,800 | 102,700 | 78,600 | 58,600 | 100,300 |

| June | 85,600 | 52,900 | 109,800 | 91,700 | 55,400 | 117,000 |

| May | 85,900 | 55,200 | 109,100 | 79,100 | 56,300 | 100,200 |

| April | 86,900 | 53,300 | 108,200 | 86,100 | 53,900 | 105,200 |

| March | 82,900 | 53,800 | 106,900 | 79,100 | 54,400 | 102,400 |

| February | 83,400 | 55,600 | 107,500 | 81,500 | 54,000 | 109,800 |

| January | 86,400 | 55,300 | 107,900 | 77,700 | 52,900 | 104,800 |

| 2019 | ||||||

| December | 86,400 | 54,400 | 105,700 | 79,500 | 54,000 | 98,500 |

| November | 81,600 | 52,100 | 107,100 | 79,200 | 49,400 | 113,100 |

| October | 81,700 | 53,900 | 103,800 | 80,600 | 61,200 | 101,600 |

| September | 81,500 | 55,600 | 101,800 | 84,100 | 59,600 | 103,700 |

| August | 84,100 | 49,200 | 107,900 | 81,900 | 45,700 | 101,200 |

| July | 82,000 | 54,000 | 106,500 | 88,000 | 51,600 | 129,500 |

| June | 84,400 | 52,800 | 103,800 | 84,800 | 57,800 | 109,100 |

| May | 78,100 | 53,800 | 98,100 | 76,400 | 49,200 | 105,200 |

| April | 78,900 | 55,700 | 100,700 | 82,000 | 59,300 | 109,000 |

| March | 78,900 | 50,400 | 102,100 | 74,500 | 48,000 | 98,400 |

| February | 85,000 | 52,600 | 107,600 | 74,100 | 52,300 | 97,500 |

| January | 81,800 | 53,400 | 103,400 | 86,600 | 60,100 | 109,000 |

| Midwest | South | West | |||||||

| Total1 | Single | Double | Total1 | Single | Double | Total1 | Single | Double | |

| 2023 | |||||||||

| 116,300 | 82,600 | 157,500 | 119,200 | 79,100 | 145,600 | 140,800 | 76,600 | 168,000 | December |

| 116,800 | 83,900 | 157,300 | 125,100 | 85,200 | 150,000 | 149,600 | 90,600 | 175,900 | November |

| 111,400 | 84,600 | 149,400 | 119,900 | 83,000 | 147,400 | 135,100 | 82,200 | 146,100 | October |

| 116,000 | 83,500 | 159,400 | 115,900 | 78,000 | 144,500 | 142,300 | 87,600 | 178,400 | September |

| 113,900 | 92,200 | 145,900 | 128,500 | 86,500 | 153,800 | 149,500 | 94,400 | 163,300 | August |

| 116,000 | 81,400 | 153,400 | 114,900 | 82,600 | 149,300 | 137,000 | 84,800 | 154,900 | July |

| 111,800 | 84,200 | 153,700 | 120,100 | 85,300 | 152,600 | 140,000 | 89,500 | 162,400 | June |

| 104,900 | 82,900 | 141,000 | 132,500 | 87,800 | 161,600 | 149,700 | 79,800 | 171,800 | May |

| 112,300 | 87,000 | 148,900 | 123,200 | 83,200 | 150,100 | 150,600 | 105,100 | 173,400 | April |

| 109,400 | 88,600 | 152,000 | 123,800 | 80,800 | 153,100 | 140,800 | 94,900 | 162,000 | March |

| 114,400 | 85,300 | 158,800 | 127,800 | 88,200 | 157,900 | 144,000 | 92,800 | 170,000 | February |

| 107,200 | 83,600 | 153,100 | 129,200 | 81,200 | 158,300 | 131,500 | 81,300 | 156,700 | January |

| 2022 | |||||||||

| 104,700 | 82,300 | 144,300 | 124,000 | 80,700 | 155,400 | 134,700 | 77,600 | 162,400 | December |

| 113,600 | 89,100 | 147,600 | 126,000 | 86,500 | 155,800 | 138,400 | 89,500 | 161,800 | November |

| 113,500 | 87,500 | 156,700 | 128,100 | 77,000 | 160,000 | 153,600 | 86,200 | 167,300 | October |

| 114,600 | 93,000 | 155,500 | 130,300 | 94,400 | 158,500 | 148,600 | 107,500 | 163,900 | September |

| 110,900 | 87,500 | 151,900 | 126,400 | 86,000 | 159,400 | 144,100 | 93,400 | 166,400 | August |

| 110,800 | 83,600 | 156,100 | 131,300 | 82,900 | 158,700 | 156,800 | 97,300 | 178,200 | July |

| 112,500 | 90,100 | 146,500 | 125,300 | 88,200 | 159,900 | 154,200 | 68,400 | 174,500 | June |

| 112,300 | 83,600 | 148,800 | 124,400 | 85,900 | 162,400 | 142,000 | 91,900 | 156,100 | May |

| 110,400 | 80,500 | 147,800 | 132,100 | 83,500 | 169,900 | 155,400 | 82,400 | 176,600 | April |

| 118,500 | 90,000 | 154,200 | 127,400 | 85,200 | 154,400 | 156,100 | 89,800 | 171,600 | March |

| 115,900 | 82,400 | 155,500 | 126,300 | 89,500 | 155,000 | 150,100 | 85,100 | 163,600 | February |

| 108,300 | 82,800 | 145,400 | 122,700 | 85,400 | 153,300 | 140,800 | 80,700 | 161,000 | January |

| 2021 | |||||||||

| 103,300 | 88,200 | 129,400 | 123,500 | 80,000 | 149,600 | 145,200 | 76,900 | 170,600 | December |

| 107,300 | 78,100 | 143,800 | 110,700 | 77,000 | 138,400 | 128,800 | 68,400 | 145,500 | November |

| 101,000 | 81,000 | 132,600 | 110,700 | 81,900 | 136,400 | 131,600 | 85,000 | 150,400 | October |

| 109,300 | 80,900 | 142,300 | 119,300 | 78,500 | 142,200 | 132,100 | 76,200 | 141,600 | September |

| 100,000 | 77,000 | 132,000 | 112,000 | 80,000 | 139,000 | 135,000 | 79,000 | 143,000 | August |

| 110,500 | 79,100 | 139,300 | 119,200 | 74,500 | 137,100 | 131,100 | 81,700 | 142,800 | July |

| 94,900 | 65,600 | 125,800 | 107,500 | 70,700 | 128,000 | 116,400 | 72,200 | 131,500 | June |

| 94,300 | 67,500 | 128,200 | 109,900 | 70,600 | 129,200 | 104,400 | 70,300 | 125,500 | May |

| 85,400 | 61,800 | 125,400 | 100,400 | 67,700 | 122,200 | 118,400 | 65,000 | 125,000 | April |

| 86,400 | 60,800 | 119,100 | 98,100 | 63,700 | 122,400 | 113,000 | 67,300 | 130,800 | March |

| 87,300 | 62,400 | 118,100 | 98,100 | 67,100 | 121,800 | 116,900 | 60,900 | 131,900 | February |

| 83,000 | 62,100 | 112,700 | 94,000 | 64,600 | 117,300 | 113,400 | 62,300 | 129,500 | January |

| 2020 | |||||||||

| 77,100 | 55,800 | 107,900 | 90,100 | 64,500 | 109,900 | 108,800 | 64,500 | 115,900 | December |

| 81,000 | 62,400 | 117,400 | 92,600 | 64,200 | 109,700 | 115,400 | 60,100 | 128,200 | November |

| 81,700 | 58,300 | 108,000 | 87,400 | 56,500 | 107,900 | 108,900 | 61,200 | 120,000 | October |

| 72,100 | 52,800 | 98,300 | 86,900 | 58,400 | 105,700 | 110,100 | 68,600 | 126,600 | September |

| 75,900 | 59,500 | 97,600 | 87,900 | 56,800 | 109,100 | 104,900 | 60,500 | 119,500 | August |

| 72,600 | 56,900 | 97,000 | 83,700 | 59,500 | 101,300 | 103,700 | 72,100 | 113,200 | July |

| 81,400 | 56,100 | 115,200 | 82,700 | 51,700 | 106,800 | 102,700 | 55,600 | 117,000 | June |

| 73,400 | 56,800 | 100,900 | 85,200 | 54,100 | 108,500 | 105,100 | 60,700 | 117,800 | May |

| 79,500 | 57,000 | 105,000 | 84,000 | 51,600 | 106,100 | 111,800 | 64,500 | 120,300 | April |

| 79,200 | 55,300 | 108,400 | 82,000 | 53,300 | 106,900 | 92,600 | 54,300 | 106,700 | March |

| 70,900 | 55,200 | 98,200 | 82,000 | 55,300 | 105,600 | 103,500 | 59,600 | 118,900 | February |

| 74,200 | 55,400 | 101,800 | 86,200 | 55,200 | 108,100 | 103,400 | 59,900 | 111,300 | January |

| 2019 | |||||||||

| 70,200 | 54,400 | 96,100 | 87,900 | 54,600 | 106,900 | 97,700 | 52,100 | 107,600 | December |

| 73,400 | 50,600 | 104,000 | 79,500 | 52,500 | 104,800 | 101,400 | 54,100 | 114,700 | November |

| 72,100 | 53,800 | 100,200 | 81,600 | 52,500 | 103,400 | 96,600 | 58,800 | 109,100 | October |

| 71,900 | 55,900 | 98,400 | 80,200 | 55,100 | 99,300 | 99,500 | 55,300 | 113,000 | September |

| 75,700 | 52,500 | 99,800 | 81,400 | 48,700 | 106,600 | 107,500 | 48,200 | 120,700 | August |

| 74,400 | 53,900 | 105,700 | 78,100 | 54,900 | 100,300 | 108,400 | 45,700 | 121,000 | July |

| 72,600 | 52,700 | 97,100 | 83,400 | 53,200 | 100,500 | 100,600 | 47,000 | 118,800 | June |

| 72,300 | 56,000 | 98,100 | 75,800 | 53,600 | 95,000 | 96,300 | 55,000 | 106,800 | May |

| 70,800 | 56,700 | 91,900 | 77,100 | 54,000 | 99,300 | 95,400 | 63,600 | 109,100 | April |

| 71,300 | 49,900 | 96,300 | 77,800 | 50,900 | 101,600 | 92,900 | 49,100 | 108,500 | March |

| 72,500 | 56,000 | 97,200 | 84,800 | 52,600 | 106,600 | 103,100 | 43,500 | 119,400 | February |

| 68,000 | 54,200 | 98,000 | 81,100 | 51,400 | 101,700 | 95,800 | 59,000 | 110,400 | January |

Notice, from the data above, that in December 2023 the “average” new sales price for a new HUD Code manufactured home was$121,300. In the prior year, December 2022 that “average” new manufactured home was $122,100. Prices on new manufactured homes dipped slightly.

The same can’t generally be said about new conventional housing, nor about resale existing housing, where prices have steadily climbed. In an era where inflation is a big issue for most voters and virtually all Americans, manufactured housing could be touted as a beacon for savings. If only there was a national post-production trade group that were busily doing that kind of promotion…

Manufactured housing, according to MHARR (see report linked among the headlines below), is often a fourth of the price of resale or new conventional housing.

While a new ‘site built’ house or a new manufactured home both obviously need a property (lot, home site, etc.) for placement (building or installation), an apples-to-apples comparison reflects that on a cost-per-square foot basis, manufactured homes are about half the cost per square foot as new conventional construction.

The late William Wade “Bill” Matchneer, J.D., was the first administrator for the revitalized HUD Office of Manufactured Housing Programs following the enactment of the Manufactured Housing Improvement Act (MHIA) of 2000 (sometimes referred to as the MHIA, the MHIA of 2000, the 2000 Reform Law, 2000 Reform Act, etc.).

Matchneer, in his own words praised manufactured homes, said that while they are not always “a mansion perhaps,” but they are nevertheless good quality affordable homes. Matchneer, an attorney, was not given to emotional outbursts. Facts and evidence are supposed to matter to attorneys. That noted, one might detect in this video interview below a sense of pride Matchneer had in manufactured housing, as he says – among other points – that in some ways a manufactured home can be superior in performance to a conventional house, despite perceptions and common stigmas. Per the late Matchneer’s wife, this video interview posted below was shown to guests following his death at a remembrance. Clearly, the video means something to her and it meant a lot to Bill Matchneer, she said.

With those notions in mind, the savings possible from a broader use of modern manufactured homes for affordable housing seekers is stunning to many. As was noted above, that Ashley executive and that lady who bought a conventional house where just two examples out of millions possible where people were surprised by facts related to the industry.

Click the image for instructions to download or expand to a larger size.

Note that the manufactured homes in the video interview and photo array above are all what MHARR calls “mainstream” manufactured homes. Yet those models were produced years before CrossMods. Additionally, these photos and that video illustrate the point that there were residential style manufactured homes years before CrossMods. And those mainstream manufactured homes that often have residential features sold for significantly less than CrossMods. As an MHI member producer told MHProNews, a firm that opted not to build those models, they ran the numbers. CrossMods, that top-level executive said, do not pencil out. Meaning, the money saved on lower finance costs do not offset the added expense of production and installation.

Another MHI member producer, one that is building CrossMods, told MHProNews that the product has not taken off. See Part IV of the Saturday report on the Daily Business News on MHProNews, linked below, to learn more.

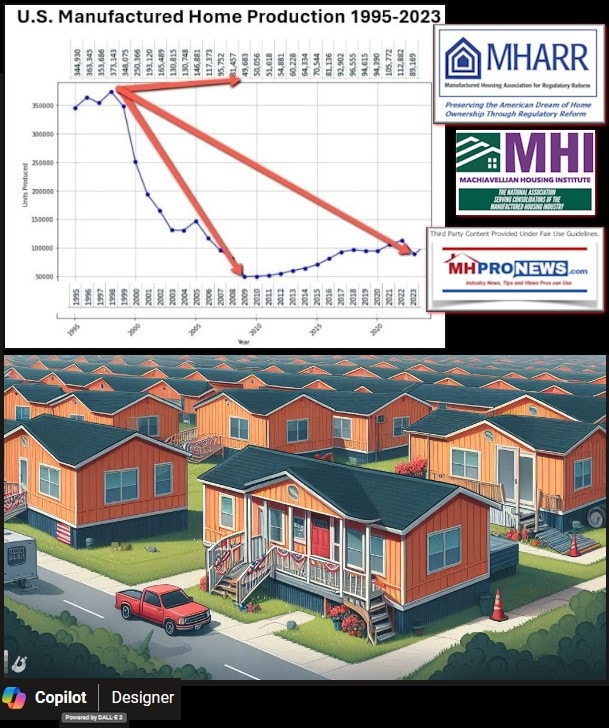

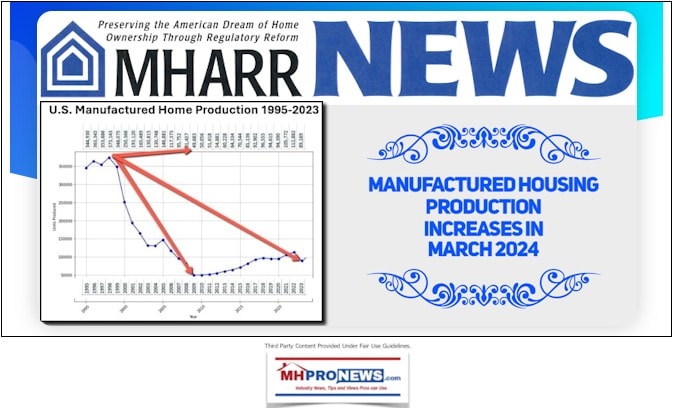

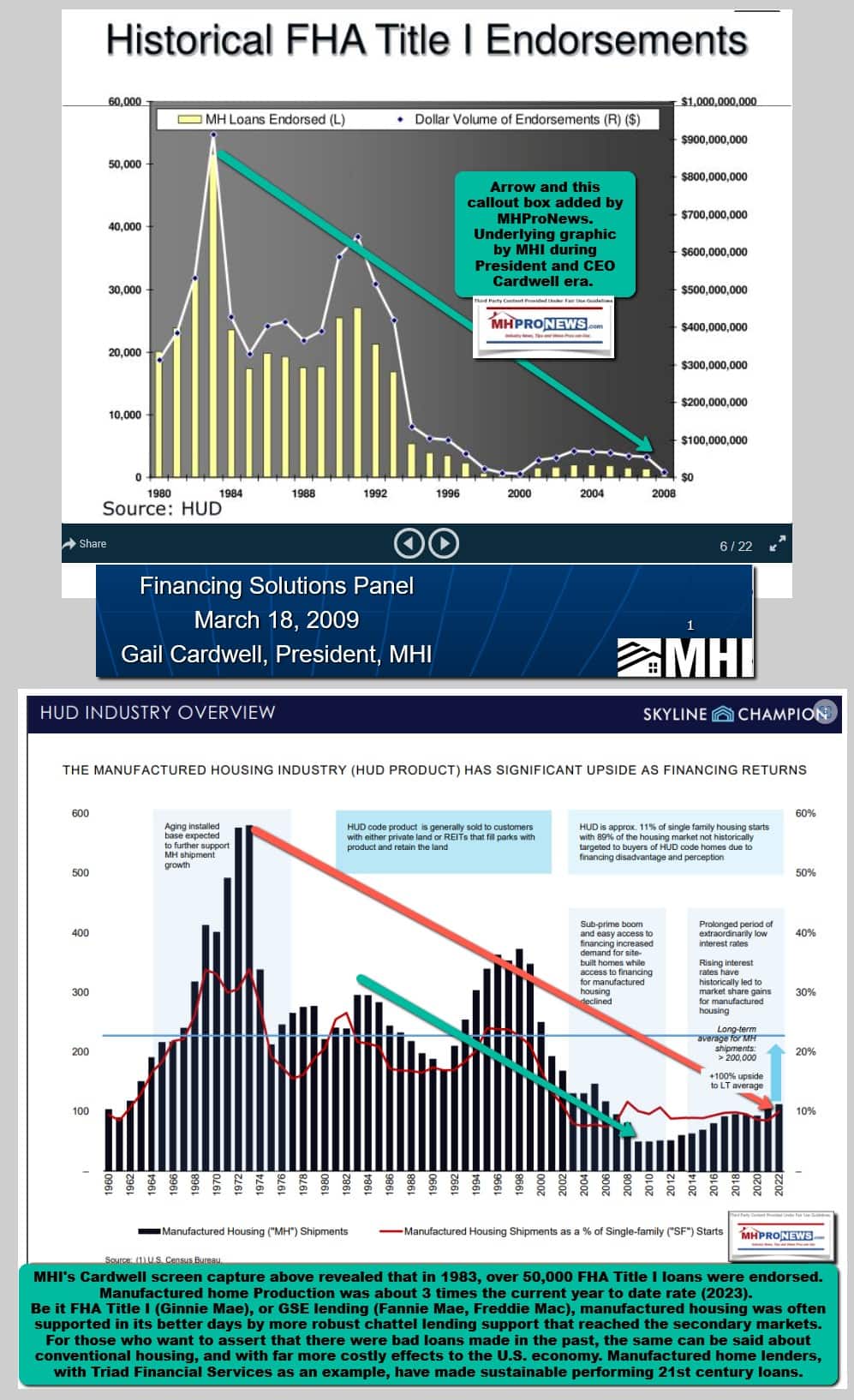

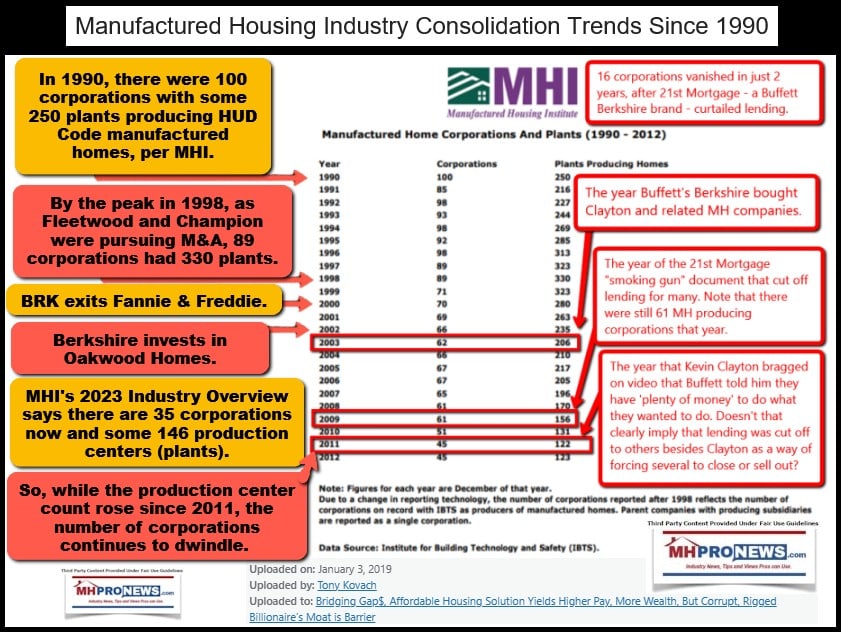

Yet despite appeal, favorable federal laws, widely bipartisan support for the MHIA (2000 Reform Law) and DTS, manufactured housing production has dropped sharply in the 21st century. What is going on? Bing’s AI powered Copilot has previously indicated that this table is unique to MHLivingNews and MHProNews.

Table

| YEAR | PRODUCTION |

|---|---|

| 1995 | 344,930 |

| 1996 | 363,345 |

| 1997 | 353,686 |

| 1998 | 373,143 |

| 1999 | 348,075 |

| 2000 | 250,366 |

| 2001 | 193,120 |

| 2002 | 165,489 |

| 2003 | 130,815 |

| 2004 | 130,748 |

| 2005 | 146,881 |

| 2006 | 117,373 |

| 2007 | 95,752 |

| 2008 | 81,457 |

| 2009 | 49,683 |

| 2010 | 50,056 |

| 2011 | 51,618 |

| 2012 | 54,881 |

| 2013 | 60,228 |

| 2014 | 64,334 |

| 2015 | 70,544 |

| 2016 | 81,136 |

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

| 2022 | 112,882 |

| 2023 | 89,169 |

To learn more about why manufactured home production is so low, see several of the reports linked in the weekly headlines recap that follows.

Don’t miss today’s postscript.

With no further adieu, here are the headlines for the week that was from 5.12 to 5.19.2024.

Part II – Sunday Weekly MHVille Headlines Recap

What’s New from Washington, D.C. based MHARR

What’s New on MHLivingNews

What’s New on the Masthead

Select Items from the Words of Wisdom from Tim Connor, CSP

What’s New on the Daily Business News on MHProNews

Saturday 5.18.2024

Friday 5.17.2024

Thursday 5.16.2024

Wednesday 5.15.2024

Tuesday 5.14.2024

Monday 5.13.2024

Sunday 5.12.2024

Postscript (Part III)

1) Mainstream media often cite each other in their reports. Sometimes, mainstream media takes pot shots at each other. Left-leaning CNN and MSNBC may take shots at right-leaning Fox News or Newsmax. To provide balance in our reports, for a decade or more, this platform’s Daily Business News on MHProNews reports have featured a headline recap from left and right leaning sources. More information, not less, can routinely be beneficial and is thus better.

2) Similarly, MHProNews has periodically looked at work-product from rivals in manufactured housing trade media and blogging. It is common in mainstream media, common in other professions, and ought to be common in MHVille too. There are times when left or right leaning media deliberately seems to omit information that doesn’t fit their agenda. Who says? Media observers. For that matter, insiders with mainstream news outlets.

3) Not only is hindsight potentially 20/20, as the quotation above illustrates, sometimes remarks viewed in hindsight are clearer than when they were first uttered.

4) By sourcing items from across the political spectrum, and by sourcing items from across the manufactured housing spectrum, MHProNews and our MHLivingNews sister site have built up the runaway largest and most read trade platforms serving the manufactured housing industry. Per a recent report from SimilarWeb about MHInsider, our primary cPanel serving MHProNews has some 30+ times the traffic as measured by visitors as MHI-involved MHInsider does. Our page views are about 100+ times the rate of engagement, per that same source and the server-based data provided to MHProNews by Webalizer. MHI’s website has more traffic than MHInsider does, but it still pales in comparison to the visitor and pageviews rates reported about our platform. By periodically peering into what bloggers like Frank Rolfe or George Allen have to say, again, the most complete, the most robust and well rounded reports are found here.

5) While our articles are routinely longer, the engagement rates as measured by pageviews and visitors speak volumes. People want to know. As more Americans realize that news is often biased, providing longer articles that lay out facts and statements in context gives thinking readers the opportunity to see things they literally won’t find on any other single site in manufactured housing. While that takes time and effort, it is arguably worth it for both us and for our growing numbers of readers.

6) While some in MHVille make boastful remarks about themselves and their platforms, citing some vacuous and self-serving MHI award or MHI-linked award for ‘cred,’

7) MHI’s behavior and claims are inconsistent with their rhetoric in several respects. It has been so for several years.

8) Similarly, the ‘circle fest in a hot-tub’ bloggers and publishers largely in league with MHI are inconsistent and often self-contradictory.

9) Of particular concern, perhaps, is ManufacturedHomes.com. They reportedly have several MHARR members as clients, which is of course each of their respective right. That said, ManufacturedHomes.com has apparently played favorites with MHI, so much so, that MHI has given them an award too.

10) We respect the right of individuals and organizations to be express themselves, right or wrong, because we freely admit to past mistakes too. That said, by following the suggestions of the Society of Professional Journalists Code of Ethical Conduct, we admit those errors and strive to learn from them. What we don’t seek to do is keep repeating an error.

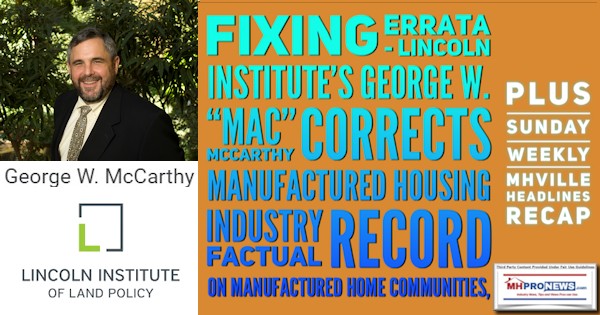

11) Per Webalizer as of 18-May-2024 07:14 CDT, our primary cPanel on MHProNews has had in the past 11.5 months 2,259,103 visitors and 12,584,490 pageviews. We are not a listing site where people come to shop for housing. We are a Manufactured Housing “Industry News, Tips, and Views Pros Can Use” © site. An information and news analysis – site. Yet we apparently blow away the rivals and competition, apparently enjoying more traffic than MHI, MHInsider, ManufacturedHomes.com’s ‘news blog,’ MHReview, and other bloggers sites combined. We’ve invited them to share their data as transparently as we have. There are no obvious takers. Embarrassed, are they? Yet, they boast about all sorts of things, until we come with the pinprick of evidence and truth that pops their respective balloons. To be clear, it isn’t that we make a career out of busting someone’s bubble. It is rather that their bubble’s need to be burst because they say such often outrageous things. See the report on George Allen and related linked above or here. If they had a leg to stand on, and the courage to debate the issues constraining manufactured housing publicly live or virtually, one might think that they would do so. They were silent again last week when invited to respond to the latest reports, or any report on MHProNews.

12) Because we ground our reports in facts, evidence, and applied common sense, the reports we publish routinely stand the test of time. Thus, they are often visited months or years after they are initially published. Facts and evidence have value.

From time to time, a rival will for whatever reason admit that we have the superior platform. For instance.

- Darren Krolewski, senior executive with Datacomp, MHVillage, MHInsider.

- A ManufacturedHomes.com linked official said that when people at meetings or events are talking about something that they read in an industry trade publication, it is something that they read on MHProNews.

- Frank Rolfe, during a bus tour of a manufactured home community spotted me and introduced this writer for MHProNews to the other attendees on the tour as a ‘celebrity’ from the manufactured home industry.

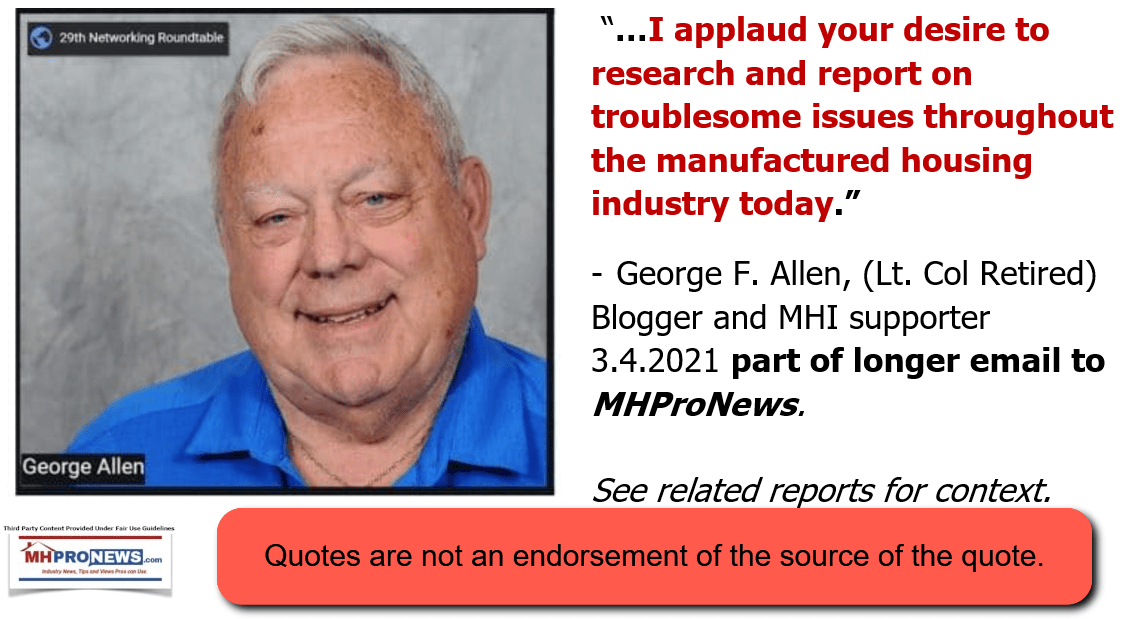

- George Allen, hardly someone who reportedly wants to praise anyone or any firm who doesn’t pay him in some form or fashion, said the following. He did so despite several critiques of he and his ‘educational’ content.

- Kurt Kelley may be one of the most likeable and gentlemanly professionals in manufactured housing. We gladly shared articles by Kurt for Years on MHProNews. Well after he launched MHReview, Kelley said this via email.

13) They may all (not certainly but may) have a higher net worth than this writer does. Reporting things that are not popular in some circles may have a price. But the race is not over. Before this writer hangs up his keyboard and puts himself out to pasture (or passes this platform onto the next generation of truth-tellers), the value of speaking the truth as best as it can be known at the time has potential power. Potential power is often worth money.

14) Because so many (not all) others in MHVille share a narrative that may or may not comport with all known facts and evidence, they have de facto ceded ‘the high ground.’ They have de facto provided us with a ‘durable competitive advantage’ that results in sharing the truth consistently and persistently.

As a result, evidence-based reports that no one else in MHVille has yet to have the cojones to touch are routinely found only on MHLivingNews and/or MHProNews. The headlines for the week in review (Part II above) or some samples below as shown, are just some reasons why people in or beyond MHVille found our content enduring and relevant.

15) The information in Part I of this article, and the other linked reports, are eye opening evidence of reality. The reality is that manufactured housing is underperforming during an affordable housing crisis. MHI postures efforts that magically fail, year after year, to significantly move the needle to the kind of production levels that MHI’s own prior presidents said where possible.

The following image can be expanded. Click to follow prompts on your device or download and open to a larger size.

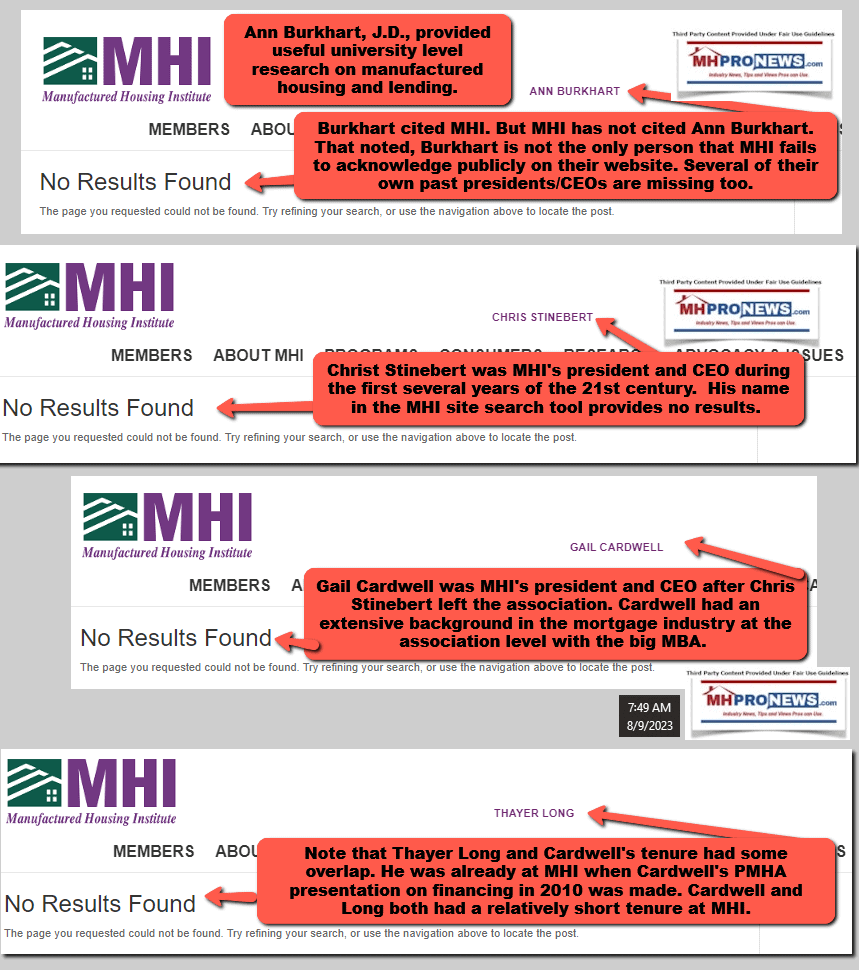

16) MHI’s periodic revision of their website seem to deploy Orwellian or Soviet-style memory hole methods. Someone who may be inconvenient to the latest narrative from ‘their party’ or ‘the MHI regime’ is systematically erased from their public pages.

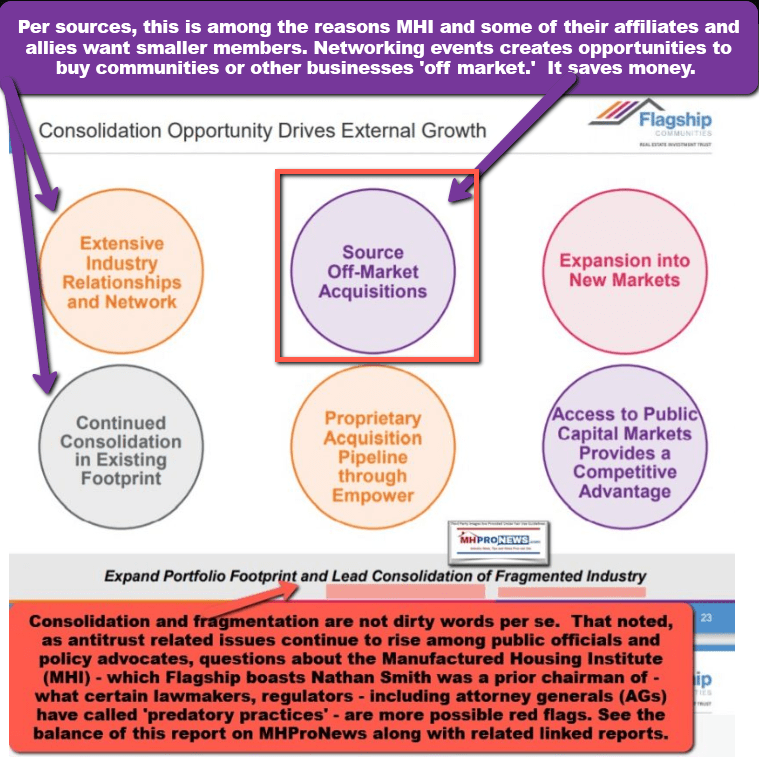

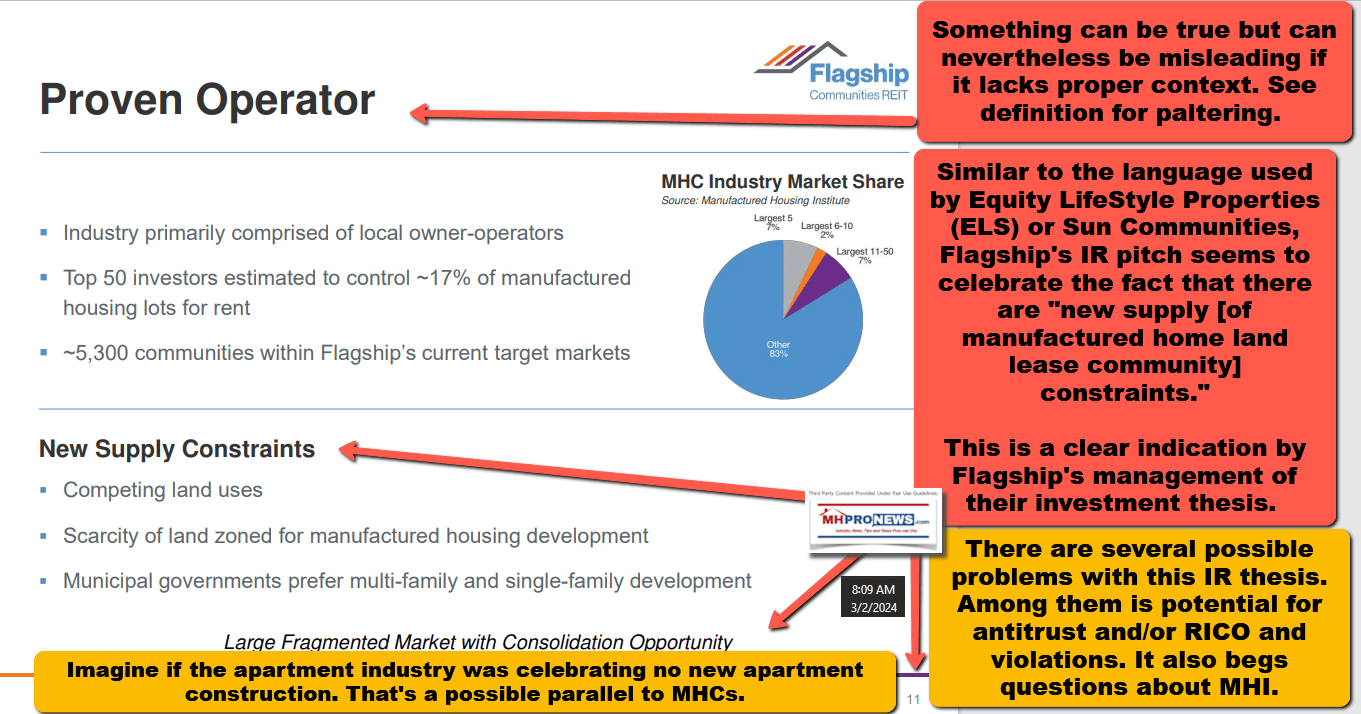

17) It ought to be obvious. The powers that be in manufactured housing want the industry to underperform at this time. The reason that is increasingly obvious is because the largest firms have hundreds of millions to billions of dollars available to take the legal and marketing steps necessary to ‘grow the business.’ Yet, they do not do so. What that implies by behavior is that they are consolidation focused, not organic growth focused — at least they are not production growth and robust community development oriented at this time.

18) What investors have spent billions of dollars in recent years trying to ‘reinvent the wheel’ that manufactured housing already provides are added reasons why the industry should be soaring instead of snoring.

19) MHProNews respects the education and experiences of those we critique. Lesli Gooch may be the least savvy and perhaps most conflicted of the bunch, on some levels. But even “Dr. Gooch” ought to realize after years in the industry that what MHI is and has been doing hasn’t worked, won’t work, and that doing the same thing over and over is a fool’s errand. Even a blind squirrel finds some nuts. So, how is it that MHI keeps making the same mistakes year after year, and almost throughout the 21st century of MHVille history? Simple. It is because the powers that be want the industry smaller at this time for their own selfish reasons.

20) When Allen, or Rolfe, or others periodically let some truth slip out, it is all the more evidence that consolidation is the short-term goal. As Marty Lavin, J.D., has observed, you get more of what you encourage and less of what you discourage.

21) By posturing efforts that lead to nowhere save more consolidation, MHI and others who host events get the benefit of attracting professionals to their venues that otherwise would not come. By attracting people to those venues, they are now opportunities for ‘off market deals.’

The bottom line? There is apparent corruption in manufactured housing. No one could be this incompetent in MHI circles at the levels that they are operating at. They apparently like the status quo, or they would be busy using their resources to change the status quo.

Enough said for today. There is plenty ahead next week, more deeper dives into issues that in one particular case has merited an update. Another update is pending on a major MHI member firm on the legal front. Don’t miss that and more in the days ahead. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’