For Manufactured Housing Institute (MHI) members, you can get this kind of information about production and shipment data through a “member only” login. But MHI doesn’t make this information available to the general public. Why not? The National Association of Realtors (NAR), the Recreational Vehicle Industry Association (RVIA), National Association Home Builders (NAHB), and the Manufactured Housing Association for Regulatory Reform (MHARR) are just some examples of sister, related or other housing nonprofits that publicly provide for free what MHI denies to the public. The case can be made that MHI tries to imply that they are the only national trade association in manufactured housing, perhaps hoping that outsiders looking in don’t look deep enough in a Google, Bing, Yahoo or other search and thus find MHARR. Since the inception of the MHARR website, national manufactured home production data which includes the top states shipment and production stats are provided for all to see at this link here.

Which again begs the question: why doesn’t MHI make this information available to the general public? Is it possibly embarrassment? Because on the one hand, the stats that follow below will once more reveal that manufactured housing production is in a year-over-year decline during an affordable housing crisis.

Whatever their motivation, it is what it is. MHI has opted to hide the production and shipment data. MHARR, NAR, NAHB, RVIA reveal their respective industry’s data. Facts are what they are. In the case of MHARR, there are indications that MHProNews may do a separate report on which will indicate that more people are finding the MHARR website as a result of their making data publicly available. So, in a curious sense, it may be a blessing in disguise for pro-growth MHARR that MHI apparently lacks transparency on production and shipment data. More on that in Part II, along with additional facts, analysis and commentary.

Following another down-day for MHVille and the broader equities markets, Part III is our Daily Business News on MHProNews markets report.

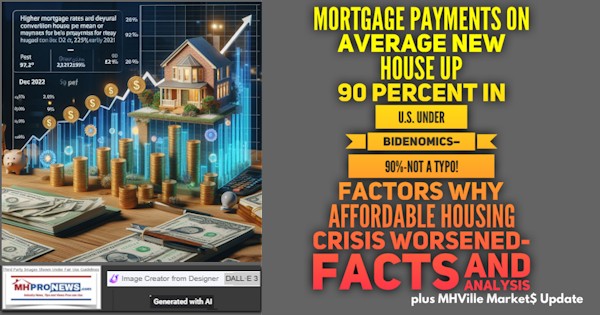

But to further tee up in this preface the Part I on state-by-state manufactured housing industry data, consider these pull quotes from Markets Insider and Redfin, previously reported in a more detailed report linked here.

> In recent months, the US housing market has seen mortgage rates fall while inventory stays tight.

> New home sales are down 27%, and existing home sales have declined 40% since January 2022.

> Meanwhile, homebuilder stocks notched a banner year in 2023.

“US housing market is facing historic unaffordability and it’s kept countless Americans sidelined or forced to face hefty monthly home payments.”

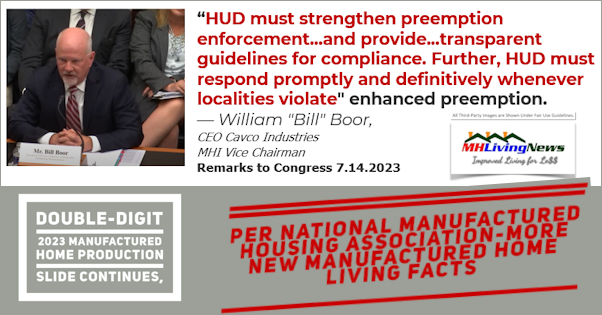

That teaser reveals that the potential opportunity for manufactured housing is perhaps never greater. Indeed, MHI Chairman and Cavco Industries CEO William “Bill” Boor previously said similarly when he proclaimed that manufactured housing has a “great opportunity” to “catch up” to conventional site building. Yet, despite their own leader’s words, the actual results for manufactured housing are going down? Again, more on that will be explored in Part II.

Part I

| Institute for Building Technology & Safety | |||||||||

| Shipments and Production Summary Report 11/01/2023 – 11/30/2023 | |||||||||

MHProNews note: SW = single section a.k.a. “single wide” manufactured home. MW = multi-sectional (at least two, but could be three or four) a.k.a. “multi-wide” manufactured home. Note each section is a “floor.”

Shipments |

||||

| State | SW | MW | Total | Floors |

| Dest. Pending | 36 | 6 | 42 | 48 |

| Alabama | 201 | 218 | 419 | 637 |

| Alaska | 1 | 0 | 1 | 1 |

| Arizona | 48 | 98 | 146 | 246 |

| Arkansas | 91 | 74 | 165 | 239 |

| California | 36 | 187 | 223 | 418 |

| Colorado | 20 | 17 | 37 | 54 |

| Connecticut | 7 | 1 | 8 | 9 |

| Delaware | 13 | 16 | 29 | 45 |

| District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 185 | 427 | 612 | 1,044 |

| Georgia | 132 | 237 | 369 | 608 |

| Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 7 | 32 | 39 | 75 |

| Illinois | 33 | 24 | 57 | 81 |

| Indiana | 92 | 38 | 130 | 168 |

| Iowa | 17 | 9 | 26 | 35 |

| Kansas | 16 | 10 | 26 | 36 |

| Kentucky | 106 | 189 | 295 | 485 |

| Louisiana | 246 | 129 | 375 | 505 |

| Maine | 33 | 26 | 59 | 85 |

| Maryland | 86 | 11 | 97 | 108 |

| Massachusetts | 0 | 14 | 14 | 27 |

| Michigan | 121 | 100 | 221 | 321 |

| Minnesota | 36 | 24 | 60 | 84 |

| Mississippi | 153 | 129 | 282 | 412 |

| Missouri | 83 | 58 | 141 | 199 |

| Montana | 19 | 12 | 31 | 43 |

| Nebraska | 22 | 4 | 26 | 30 |

| Nevada | 24 | 32 | 56 | 88 |

| New Hampshire | 13 | 11 | 24 | 35 |

| New Jersey | 13 | 16 | 29 | 45 |

| New Mexico | 59 | 72 | 131 | 206 |

| New York | 57 | 57 | 114 | 171 |

| North Carolina | 153 | 275 | 428 | 704 |

| North Dakota | 11 | 16 | 27 | 43 |

| Ohio | 94 | 51 | 145 | 196 |

| Oklahoma | 98 | 110 | 208 | 318 |

| Oregon | 24 | 63 | 87 | 155 |

| Pennsylvania | 56 | 72 | 128 | 201 |

| Rhode Island | 0 | 0 | 0 | 0 |

| South Carolina | 132 | 245 | 377 | 622 |

| South Dakota | 25 | 6 | 31 | 37 |

| Tennessee | 99 | 196 | 295 | 492 |

| Texas | 636 | 752 | 1,388 | 2,151 |

| Utah | 4 | 12 | 16 | 28 |

| Vermont | 11 | 8 | 19 | 27 |

| Virginia | 32 | 68 | 100 | 168 |

| Washington | 16 | 72 | 88 | 164 |

| West Virginia | 33 | 52 | 85 | 137 |

| Wisconsin | 29 | 22 | 51 | 73 |

| Wyoming | 4 | 8 | 12 | 20 |

| Canada | 0 | 0 | 0 | 0 |

| Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 3,463 | 4,306 | 7,769 | 12,124 |

MHProNews note: SW = single section a.k.a. “single wide” manufactured home. MW = multi-sectional (at least two, but could be three or four) a.k.a. “multi-wide” manufactured home. Note each section is a “floor.”

Production |

||||

| State | SW | MW | Total | Floors |

| States Shown(*) | 218 | 277 | 495 | 776 |

| Alabama | 724 | 682 | 1,406 | 2,092 |

| *Alaska | 0 | 0 | 0 | 0 |

| Arizona | 68 | 103 | 171 | 275 |

| *Arkansas | 0 | 0 | 0 | 0 |

| California | 24 | 175 | 199 | 380 |

| *Colorado | 0 | 0 | 0 | 0 |

| *Connecticut | 0 | 0 | 0 | 0 |

| *Delaware | 0 | 0 | 0 | 0 |

| *District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 58 | 217 | 275 | 498 |

| Georgia | 161 | 334 | 495 | 830 |

| *Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 23 | 60 | 83 | 147 |

| *Illinois | 0 | 0 | 0 | 0 |

| Indiana | 413 | 168 | 581 | 749 |

| *Iowa | 0 | 0 | 0 | 0 |

| *Kansas | 0 | 0 | 0 | 0 |

| *Kentucky | 0 | 0 | 0 | 0 |

| *Louisiana | 0 | 0 | 0 | 0 |

| *Maine | 0 | 0 | 0 | 0 |

| *Maryland | 0 | 0 | 0 | 0 |

| *Massachusetts | 0 | 0 | 0 | 0 |

| *Michigan | 0 | 0 | 0 | 0 |

| Minnesota | 53 | 50 | 103 | 153 |

| *Mississippi | 0 | 0 | 0 | 0 |

| *Missouri | 0 | 0 | 0 | 0 |

| *Montana | 0 | 0 | 0 | 0 |

| *Nebraska | 0 | 0 | 0 | 0 |

| *Nevada | 0 | 0 | 0 | 0 |

| *New Hampshire | 0 | 0 | 0 | 0 |

| *New Jersey | 0 | 0 | 0 | 0 |

| *New Mexico | 0 | 0 | 0 | 0 |

| *New York | 0 | 0 | 0 | 0 |

| North Carolina | 179 | 289 | 468 | 757 |

| *North Dakota | 0 | 0 | 0 | 0 |

| *Ohio | 0 | 0 | 0 | 0 |

| *Oklahoma | 0 | 0 | 0 | 0 |

| Oregon | 39 | 146 | 185 | 341 |

| Pennsylvania | 161 | 211 | 372 | 583 |

| *Rhode Island | 0 | 0 | 0 | 0 |

| *South Carolina | 0 | 0 | 0 | 0 |

| *South Dakota | 0 | 0 | 0 | 0 |

| Tennessee | 475 | 720 | 1,195 | 1,917 |

| Texas | 867 | 874 | 1,741 | 2,626 |

| *Utah | 0 | 0 | 0 | 0 |

| *Vermont | 0 | 0 | 0 | 0 |

| *Virginia | 0 | 0 | 0 | 0 |

| *Washington | 0 | 0 | 0 | 0 |

| *West Virginia | 0 | 0 | 0 | 0 |

| *Wisconsin | 0 | 0 | 0 | 0 |

| *Wyoming | 0 | 0 | 0 | 0 |

| *Canada | 0 | 0 | 0 | 0 |

| *Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 3,463 | 4,306 | 7,769 | 12,124 |

| THE ABOVE STATISTICS ARE PROVIDED AS A MONTHLY | (*) THESE STATES HAVE FEWER THAN THREE PLANTS. | ||||||||

| SUBSCRIPTION SERVICE. REPRODUCTION IN PART OR | FIGURES ARE AGGREGATED ON FIRST LINE ABOVE | ||||||||

| IN TOTAL MUST CARRY AN ATTRIBUTION TO IBTS, INC. | TOTALS TO PROTECT PROPRIETARY INFORMATION. | ||||||||

| Ashok K Goswami, PE, COO, 45207 Research Place, Ashburn, VA | |||||||||

Part II – Additional Information with More MHProNews Analysis and Commentary

As Cavco and MHI leader Bill Boor’s remarks themselves suggested, in order to properly frame manufactured housing industry potential, it is useful – and arguably necessary – to see what the broader conventional housing market data reveals. Per the National Association of Realtors (NAR), consider the following.

Florida (249,064) and Texas (174,261) led in positive net migration, while California (-341,866), New York (-244,137), and Illinois (-115,719) had negative net migration in 2022. https://t.co/jqS8l1FN09

— NAR Research (@NAR_Research) January 14, 2024

According to newly released data from the U.S. Census Bureau, the number of people who moved between states rose from approximately 7.9 million in 2021 to approximately 8.2 million in 2022. https://t.co/Q9eacQBIlE

— NAR Research (@NAR_Research) January 12, 2024

So, millions of people have been moving every year. Most of those moves could, in theory, be a prospect for a manufactured home. This is a data point that MHProNews has periodically reported for years. For instance, we previously reported that in just one year some 8 million young adults moved back in with mom and dad.

Again, per NAR, insights on where people are moving, and which states they are leaving.

32 states had inbound moving rates higher than 50% in 2022. Affordability issues and the ability to work remotely drove Americans to move to neighboring or cheaper states; Florida and Texas were leading with the highest migration gains that year. https://t.co/mT8OmQ5tdr pic.twitter.com/aC4z5dSQZC

— NAR Research (@NAR_Research) January 9, 2024

Unlike MHI, NAR gives updates on interest rates like the one below.

Instant Reaction: Mortgage Rates, January 11, 2024. “Mortgage interest rates continue to hold steady at 6.66% this week. As mortgage interest rates have been flat since December 21, home buyers can plan smartly as they enter the buying market.” https://t.co/aNkbrNAib8 pic.twitter.com/F7iZimjLBn

— NAR Research (@NAR_Research) January 11, 2024

That slide in financing rates for mortgages should mean that more people can get qualified.

But it also might mean that some people who were on the bubble of buying a manufactured home vs. a conventional house could decide to opt for the conventional house.

Note that as the perceived ‘threat of Trump getting re-elected grows‘ – from the Biden backing-Davos crowd at the World Economic Forum (WEF) – the interest rates may slide is a factoid that merits monitoring. Because the excuse used by the Federal Reserve to raise rates was to help bring inflation down to 2 percent. Despite the fact that inflation is not tamed to that rate, as the Federal Reserve claimed it was trying to do, could be construed as a type of pro-Biden pre-election policy. Whatever the motivation of the Fed and mortgage lenders, the net result is that conventional housing is somewhat more affordable than they were just a few weeks ago, even though they are still near 21st century highs in unaffordability.

Whether or not NAR’s Lawrence Yun ends up correct in this prognosis or not, at least they are providing conventional housing data and they are making an evidence-based prognosis. NAR do so in a public fashion, no member login is required. So again: what possible excuse can MHI have for not doing the same? More on that further below, but for now, here is what Dr. Yun said.

“The worst in home sales is over. The worst in housing affordability is over. This year will be a year of home sales recovery,” Lawrence Yun, chief economist at the National Association of Realtors, told FOX Television Stations. https://t.co/TpfcfTONvk

— NAR Research (@NAR_Research) January 7, 2024

Instant Reaction: Jobs, January 5, 2024. “All in all, jobs are being added, raising long-term housing and commercial real estate demand. However, short-term dynamics are more influenced by the movements in mortgage rates and the bond market.” https://t.co/QEqwT34CWU pic.twitter.com/ISMSOHGeWP

— NAR Research (@NAR_Research) January 5, 2024

“Although declining mortgage rates did not induce more homebuyers to submit formal contracts in November, it has sparked a surge in interest, as evidenced by a higher number of lockbox openings,” Yun said. https://t.co/gal570pfqV

— NAR Research (@NAR_Research) January 4, 2024

Nearly a quarter of first-time homebuyers lived with family or their parents before buying their own home in 2023, according to data from NAR. WATCH: https://t.co/gwzIkeHgZO

— NAR Research (@NAR_Research) January 3, 2024

Look again at the report previously published by MHProNews about young adults moving back home in with mom and pop. Per NAR, that can be the first step to those young adults buying their own home. They may be saving on rent and utilities, so in time they will have the downpayment to buy. Where is MHI’s messaging to bring those potential buyers out to consider manufactured housing? Oh, it is missing. It has been for years. Who says? Bing AI driven Copilot.

> “Circa 2005 the Manufactured Housing Institute paid for a marketing analysis that came to be known as the Roper Report. The Roper Report was supposed to lay the groundwork for a national marketing campaign. In November 2011, Kevin Clayton in a video interview with Robert Miles that the industry, a common euphemism for the Manufactured Housing Institute used by association leaders, was ready to do a GoRVing style national media campaign. Those statements are accurate, correct? So, is there any known evidence online that a national manufactured housing marketing campaign similar to the RVIA GoRVing campaign has begun? If not, do you see any explanation online of why that hasn’t begun?”

Per Bing Copilot is the drill down (ellipsis edits out speculation and sticks to the known facts).

I also could not find any explanation online as to why such a campaign has not begun…”

Let’s briefly explore speculative remarks by Copilot edited out, which said this.

…It is possible that the industry has not yet found a suitable approach to launch such a campaign, or that the campaign has been delayed due to unforeseen circumstances.”

By way of expert analysis, that bit of conjecture by Copilot is nonsense. The RVIA’s GoRVing campaign has shown the way that Manufactured Housing could have followed for close to 3 decades. Furthermore, in the information age, nor could there be a campaign off-line that is not reported online. To illustrate, consider this Q&A with Bing Copilot about its relatively pro-MHI excuse.

> “Pardon me, Bing, the facts are useful but the speculation is not well thought out. For example. Don’t you agree that even if a GoRVing style campaign were launched all in print, cable, or broadcast, there would still be evidence for it online in the way of press releases, social media posts, and remarks on the Manufactured Housing Institute’s own website, isn’t that correct? Futhermore, while it is possible that they haven’t found a “suitable approach” for such a campaign, that was part of the purpose of the Roper Report. They have paid to find out how to do such a campaign. Even if they didn’t pay for such research, the example of the RVIA’s GoRVing campaign should be a useful template, isn’t that all logical and correct?

Regarding the Roper Report, you are correct that it was supposed to lay the groundwork for a national marketing campaign. However, I could not find any information online about the results of the report or whether it was used to launch a campaign. …”

Among the links Copilot provided in the reply above was to the following satirical slam on MHI, found in the report linked below. Apparently, Copilot has a sense of humor.

Back to what NAR has shared.

More than a fifth of adult millennials chose to live rent-free before buying their own houses, according to NAR. https://t.co/qj1bGQeUVx

— NAR Research (@NAR_Research) January 2, 2024

November’s pending home sales showed no movement from last month and fell 5.2% from a year ago. https://t.co/VkPRuiS3WA #NARPHS

— NAR Research (@NAR_Research) January 2, 2024

The REALTORS® Confidence Index (RCI) survey gathers on-the-ground information from REALTORS® based on their real estate transactions in the month. More insights here: https://t.co/s9d72P8kh4 pic.twitter.com/Gzvg5pXG1C

— NAR Research (@NAR_Research) January 1, 2024

Among prospective home buyers, there is a knowledge gap of FHA, VA loans, and low down payment programs. Many prospective home buyers do not even consider these programs due to not understanding them or a lack of awareness that they exist. https://t.co/6KgbEmGRlU

— NAR Research (@NAR_Research) December 31, 2023

Pending home sales in November were unchanged compared with October and 5.2% lower than November of last year, according to the National Association of Realtors. WATCH: https://t.co/1XI8wtultt

— NAR Research (@NAR_Research) December 31, 2023

Dr. Yun makes the point that MHI should be making. More building is needed. It isn’t as if MHI leaders aren’t aware of such facts, which Kevin Clayton and Bill Boor, among others, have at various times and ways mentioned.

“Even more homebuilding will be needed with the housing shortage persisting in most markets,” Yun wrote. https://t.co/2KvtxZmnTq

— NAR Research (@NAR_Research) December 29, 2023

Let’s see what the National Association of Home Builders (NAHB) have said about their profession’s data – via X-posts (formerly Twitter).

Home builder confidence jumped seven points in January on lower mortgage rates, according to the latest NAHB/@WellsFargo Housing Market Index (HMI). The HMI posted a reading of 44, up from 37 in December. | #economy #realestate #housing pic.twitter.com/Rg47097pP6

— NAHB 🏠 (@NAHBhome) January 17, 2024

According to the latest Producer Price Index report, growth in the average price of residential construction building materials fell from 15% in 2022 to 1.3% in 2023. Building materials prices rose just 0.1% in December after increasing 0.1% in November. https://t.co/L4IL8Q0Eux

— NAHB 🏠 (@NAHBhome) January 16, 2024

The Labor Department on Wednesday published a final rule changing its policy for determining independent contractor status under the Fair Labor Standard Act. Importantly, this proposed test will not impact tests by the IRS or other federal agencies. https://t.co/tyxMIkInfn

— NAHB 🏠 (@NAHBhome) January 11, 2024

Note the topic immediately above on new is part of a Biden regime shift on independent contractor status that could prove harmful to smaller businesses. It is part of a Biden-era shift that MHProNews has reported on, but that was ignored in MHI’s most recent emails.

Note that site builders are paying more for their employees than previously, per NAHB.

Average hourly earnings for residential building workers was $30.71/hour in November 2023, up 4% from $29.52/hour a year ago. This was 14.1% higher than wages in manufacturing and 8.9% higher than transportation and warehousing wages https://t.co/8G8FgJjdyQ #CareersinConstruction

— NAHB 🏠 (@NAHBhome) January 9, 2024

There were 459,000 open construction jobs in November. The count was 348,000 a year ago, during a period of housing market cooling. The recent rise indicates an ongoing skilled labor shortage in the construction sector. https://t.co/EfkBreabMa | #CareersinConstruction

— NAHB 🏠 (@NAHBhome) January 8, 2024

This next NAHB tweeted item ought to be four stars of possible panic for those pushing CrossMod®. Why? Because while the data on cost for 3d printing of housing is still not normative, perhaps because so few are being produced, some sources indicate that the potential savings for 3D printing housing might be similar to the comparative savings between a conventional site-built house and the MHI branded, and Clayton Homes backed, CrossMod® type units pricing. Time will tell, but that ought to be part of the SWOT analysis.

With interest in 3D printing technology growing in home building, NAHB’s Construction Liability, Risk Management, and Building Materials Committee recently partnered with law firm Akerman on a 3D Printing Best Practices Guidance document for members. https://t.co/Rkgjcgv0jj

— NAHB 🏠 (@NAHBhome) January 2, 2024

Have you seen any indication that MHI is covering this 3D topic on their website?

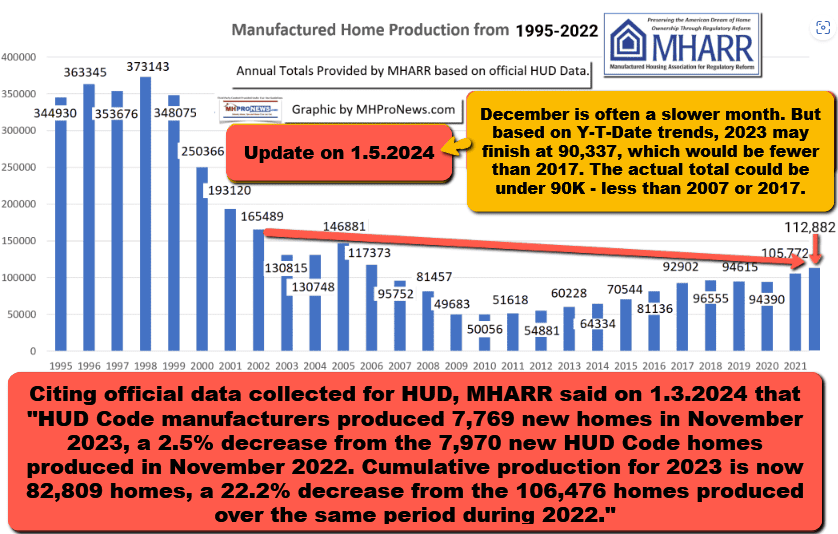

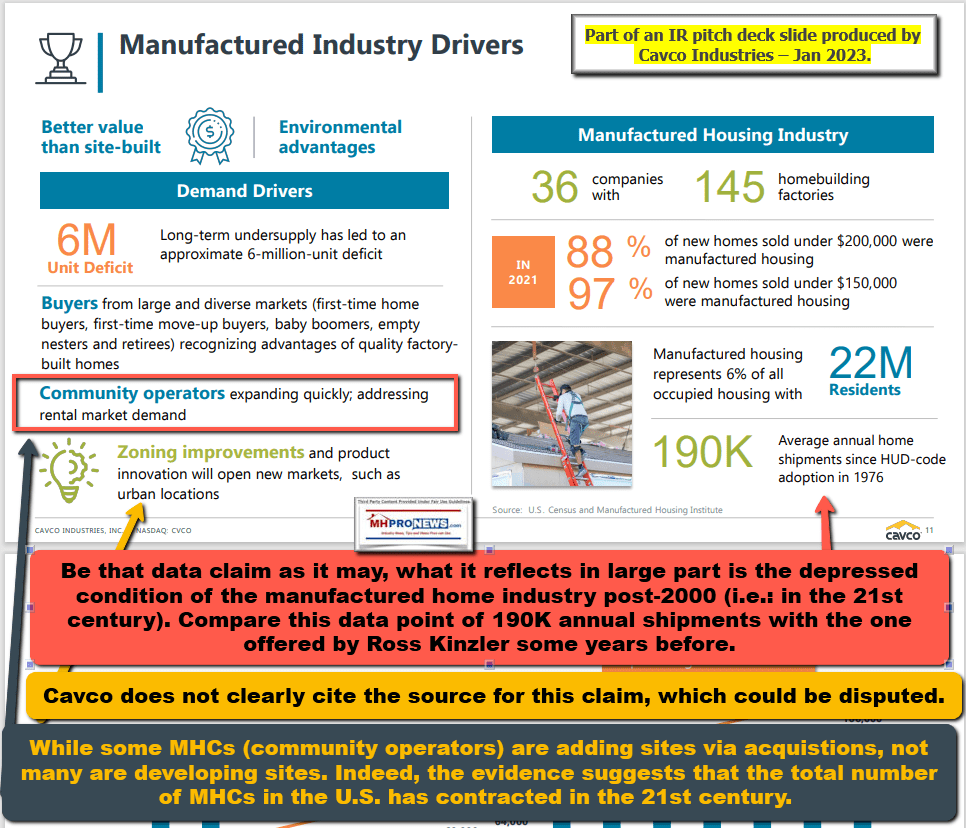

Per the NAHB, and supported by Census Bureau data, far lower cost mainstream manufactured home sales trail conventional housing by a wide margin. Manufactured housing might finish the year at about 90,000 units (+/-).

Sales of new single-family homes came in an annual rate of 590,000 in November, down 12.2% from October, but up 1.4% from Nov. 2022. The median sales price of new houses sold last month was $434,700 compared to $462,300 in Nov. 2022. | #realestate #economy #homesales pic.twitter.com/wmoMdXFut5

— NAHB 🏠 (@NAHBhome) December 22, 2023

Home sales unexpectedly rose in November on easing mortgage rates, but a chronic shortage of houses could limit further gains. Per @nardotrealtor, existing home sales grew 0.8% last month to an annual rate of 3.82 million units. https://t.co/4tKt2Q01uh #realestate #economy

— NAHB 🏠 (@NAHBhome) December 20, 2023

By comparison, per the most recent checks, MHI is producing no such public data on their website. Nor has MHI done so for the public for some years.

It could potentially be a civil and/or criminal liability issue, per legal sources, to knowingly provide misleading information to the public. Yet MHI’s home page on 1.17.2024 said in part that their goal is to provide businesses: “Get the tools, platform and information you need” to “Grow your business.”

The MHI home page also proclaims:

The Manufactured Housing Institute is the only national trade organization representing all segments of the factory-built housing industry. We are your trusted partner, advocate and industry leader.”

How can MHI claim to be prepared to ‘educate’ and ‘grow’ some individual business when the industry is collectively in retreat once again in the 21st century’s well documented affordable housing crisis?

So, if MHI’s stated claims about being pro-growth were true, then the publishing of public statistics or authentic news reports would not undermine their home page claims.

But because the production and shipment data points to a reality that is different than what MHI claims, then their apparent lack of ‘news’ – despite having a section of their website that they claim is ‘news’ – would mean that outsiders looking in would have to go beyond MHI to a site like ours or MHARR’s in order to find the facts that could begin to shed light on the measurably poor performance of MHI’s leadership.

Simply stating the paragraph above, once the facts are known, MHI’s own website is arguably evidence against them. Which may explain why they wouldn’t respond to the inquiries shown in the report below.

After MHProNews – quietly at first, then increasingly more publicly later – began calling out the obvious disconnects between remarks made by prior MHI President and CEO Richard “Dick” Jennison and his live on camera statements, Jennison publicly pivoted (see video below). Following exposure by MHProNews, Jennison said on camera that the industry could and should aim for 500,000 new HUD Code home produced and shipped annually. That would be almost 550 percent more production than the industry will likely produce when the final figures are in for 2023. Such vexing (to MHI) facts being so, why is it than some 9 years later that MHI can’t ‘lead’ the industry to such an outcome? Are they merely dangling growth as a possibility, while their “big boy” insider brands are busily consolidating the industry instead?

The remarks by Jennison above where in 2014. Note what the production was that year. Given what MHI says on their IRS Form 990s, someone at MHI may be guilty of perjury.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

On paper and on their website, MHI’s leaders still try to sound like they are pro-growth.

But as then Knudson Law legal researcher Samuel Strommen observed, MHI’s intention can be inferred from their behavior.

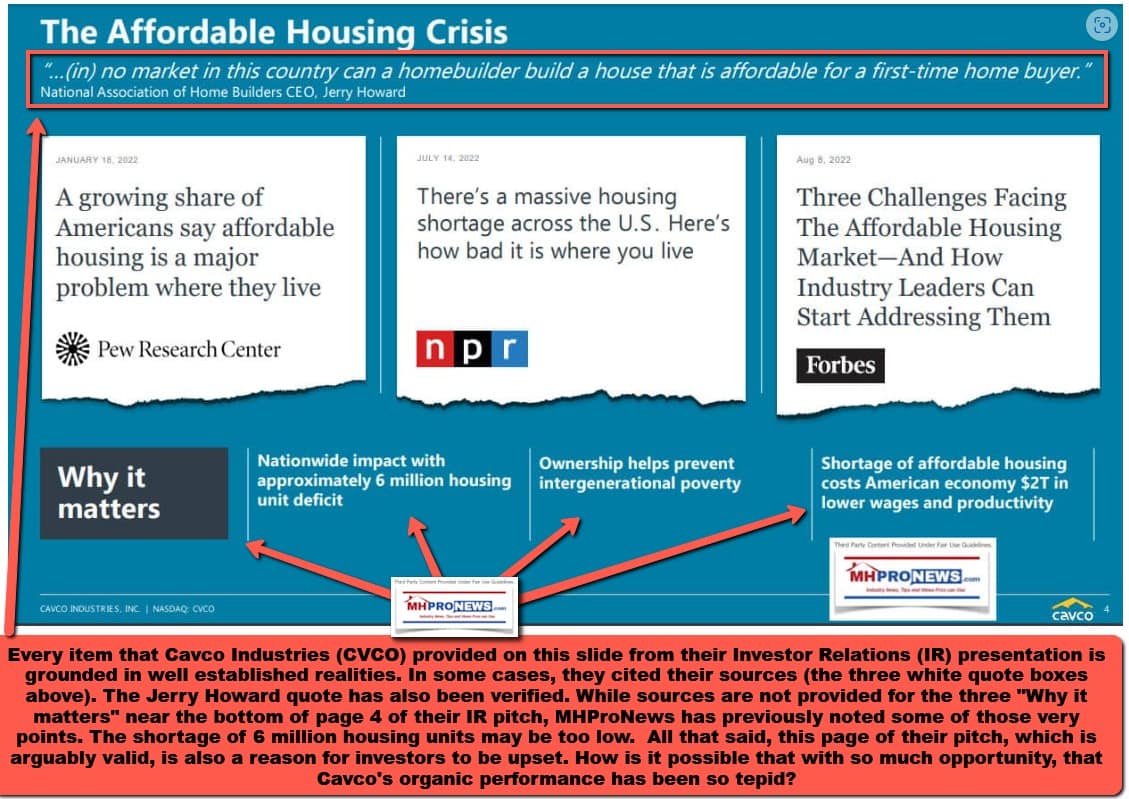

The brief romp through NAR and NAHB X-posts above reveal that there are millions of homes that could be built and sold by manufactured housing. Cavco Industries has suggested as much to their investors.

For example. What if William “Bill” Boor was serious about getting “enhanced preemption” under the Manufactured Housing Improvement Act (MHIA) enforced, as Boor claimed he wanted in remarks to Congress on 7.14.2023. If Boor was sincere, then why hasn’t MHI and/or Cavco Industries sued to get enhanced preemption enforced? Aren’t the billions of dollars in potentially much higher annual sales a big enough enticement? This won’t seem so esoteric to those who recall the ‘debacle’ Cavco suffered in the litigation that arose during the leadership of Cavco’s prior CEO and Chairman, Joseph “Joe” Stegmayer. Possible whistleblowers at MHI member brands, take note of the Cavco experience.

If Boor’s request to Congress is taken at face value, then he is apparently failing his stockholders by not pursuing both litigation and lobbying to get the MHIA and its enhanced preemption provision enforced. Over 23 years have gone by since the MHIA was signed into law. The hesitancy to press the issue makes no sense, UNLESS…

…the authentic purpose of the remarks is to POSTURE efforts while industry underperformance leads to more industry consolidation. While that may seem to benefit shareholders, in the sense that it is driving smaller brands to sell out to MHI’s so-called Big Three, it is arguably fraught with legal, competitive, and other risks.

This relatively focused review thus appears to raise several possible elements of concern which under SEC rules could be considered material breaches of the fiduciary duties of several publicly-traded MHI member firms. If so, then it is also apparently a breach of the duties of MHI’s board members. To that point, the fact that MHI insiders have told MHProNews that apparent conflicts of interest by MHI’s CEO Gooch were known by MHI leaders, who apparently have looked the other way. That is yet another concern that independents, shareholders, and public officials alike should be leaning into.

These behaviors logically have ripple effects. Among them? Well, per Cavco Industries, a lack of affordable housing in the U.S. is apparently a $2 trillion dollar drag on the U.S. economy.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

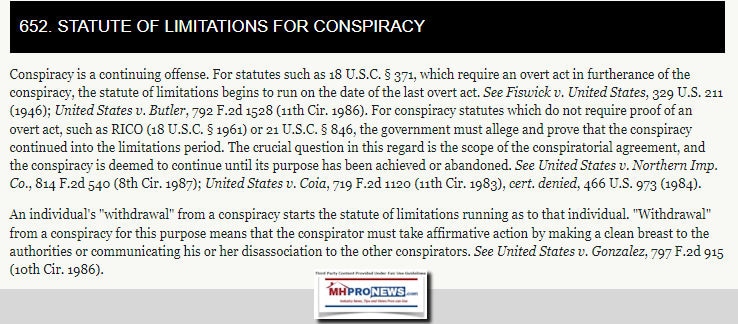

While Cavco couldn’t withstand a class action, RICO, or other civil antitrust suit of that magnitude, and even with Skyline Champion and Berkshire Hathaway couldn’t withstand that type of suit, tossing BlackRock into the mix could certainly bring them closer to it. And if Strommen’s assertions are correct, which are arguably buttressed by other economic and legal researchers – then the apparent conspiracy involving top brands at MHI could someday face a giant civil and/or criminal suit.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

The powers that be, meaning the Big Three along with their larger community allies at MHI, can’t have it both ways. They can’t claim to be pro-organic growth, and then yield primarily growth through consolidation. They can’t claim that there are millions of units that are needed, and then fail to do the types of common-sense things that are needed to make attaining that growth a reality.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

The logical disconnects in their stated positions are numerous. The evidence to support legal action is arguably growing, as this article and those linked herein evidence. And that apparent evidence is before discovery starts in. Given what was discovered by the SEC in their recently settled case against Cavco, and the obvious disconnects between what MHI leaders claim and what those same leaders are doing and/or not doing, at some point it could well result in the kinds of legal actions that have already erupted in the land-lease communities sector.

While MHI member emeritus blogger, and other MHI-linked publishers were busily ignoring and/or pooh-poohing the obviously growing risks pointed out by Strommen’s legal research reported by MHLivingNews and MHProNews, the legal liability shoes have apparently begun to drop in MHVille. Not even MHI linked cheerleaders for consolidation, like Frank Rolfe and a de facto writing ally Cody Dees can distract from the apparent reality that high profile litigation is no longer looming. It is here. It is a reality.

Gaslighting, paltering, and propaganda are not news.

Abe Lincoln said it well. You can fool some of the people some of the time, you can fool all of the people some of the time. But you can’t fool all of the people all of the time.

Lance Inderman and Mark Twain have a point, don’t they?

What this review of the latest data, NAR, NAHB, MHARR, and other information reveals is that manufactured housing is demonstrably underperforming during an affordable housing crisis. Ironically, several MHI members have essentially helped document that point via the base images shown in this and the linked reports, which have annotated insights by MHProNews.

There are a range of issues that MHARR leaders have said that MHI needs to be held accountable for, and MHI has only reluctantly it seems been pushed into litigating one of them.

This scheme might work longer if there were no MHARR, no MHLivingNews, or no MHProNews. But just as other hiding-in-plain-sight schemes have been brought down in the 21st century after years of operating, so too the time may be nigh that something similar will occur in MHVille among MHI’s higher profile members. Stay tuned, as we will continue to monitor, unpack, analyze and report. That’s what it means to provide manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” ©

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

MHProNews Notice: while this article features the Christmas season image that MHI had posted, the contents of this report and analysis are significant for anyone who goes to MHI linked trade show, event, or meeting. See what they and their attorneys have cooked up now…its a hoot. A year round one for anyone who attends virtually any manufactured housing industry event.

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 1.17.2024

- Apple Watch imports banned in America – again

- Samsung Electronics Co. Galaxy S24 smartphones during a media preview event in Seoul, South Korea, on Monday, Jan. 15, 2024. Samsung, the world’s most prolific smartphone maker, is leaning into artificial intelligence as the key to unlocking greater sales this year.

- Samsung’s Galaxy S24 lineup goes all in on AI

- Spirit AeroSystems offices in Farmers Branch, Texas, US, on Monday, Jan. 8, 2024. Spirit AeroSystems Holdings Inc. fell the most in more than four months as the supplier to Boeing Co. faces scrutiny over an incident in which a panel tore loose from a passenger jet mid-flight.

- Federal investigator hasn’t determined whether bolts were installed on the 737 Max part that blew off an Alaska flight

- Secretary of State Antony Blinken gets off his plane after his arrival to the Cheddi Jagan International Airport for an official visit to Georgetown, Guyana, in July 2023.

- Secretary Antony Blinken’s Boeing 737 out of Davos had a critical failure. He had to switch planes

- President of Argentina Javier Milei delivering a speech at the World Economic Forum in Davos, Switzerland on January 17, 2024.

- Argentina’s Milei tells Davos ‘heroes’ how it should be done

- A contractor works on a house under construction at the Toll Brothers Regency at Folsom Ranch community in Folsom, California, US, on Thursday, May 18, 2023.

- Homebuilder sentiment surges as mortgage rates trend down

- Biden administration proposes rule that could save consumers $3.5 billion a year in bank fees

- Shoppers carry bags in Walnut Creek, California, US, on Wednesday, Dec. 20, 2023. US retail sales unexpectedly picked up in November as lower gasoline prices allowed consumers to spend more to kick off the holiday shopping season.

- US retail sales rose at a faster pace in December

- A dangerous undercurrent is pulling Americans toward the political extreme. The media is turning a blind eye to it

- UK inflation posts first rise in almost a year

- China’s population declines for second straight year as economy stumbles

- Why Wall Street should worry about retail

- ‘Truly sorry.’ Fujitsu says it will compensate UK postal workers who were ruined by its software

- Uniqlo sues Shein for allegedly copying its viral shoulder bag

- Bob Iger made $31.6 million as Disney’s CEO last year

- Costco is testing out a new system for entering stores

- Poultry processor hit with proposed $212,646 fine after second worker, a teen, killed by machine

- Boeing’s stock tumbles after report warns investigation will open ‘a whole new can of worms’

- Microsoft CEO Satya Nadella says he’s ‘optimistic’ about the future of AI

- Spirit Airlines shares plunge after judge blocks JetBlue merger

- Here’s why electric cars don’t go as far in the cold

- Washington state wants to block the Kroger-Albertsons merger

- US airlines cancel more than 1,700 flights today