The Manufactured Housing Association for Regulatory Reform (MHARR) report on January 3, 2023 reveals that new HUD Code manufactured home production in November of 2023 continued to decline. Per MHARR, that means that the decline has now hit 13 straight months. MHARR cites official sources on behalf of the U.S. Department of Housing and Urban Development (HUD).

Part II will be additional facts and analysis. Part III will have the MHVille connected markets updates.

Part I. Manufactured Home Production Downturn Hits 13 Straight Months, Data from the Manufactured Housing Association for Regulatory Reform (MHARR) in January 2023 Report

FOR IMMEDIATE RELEASE

Contact: MHARR

(202) 783-4087

PRODUCTION DECLINE PERSISTS IN NOVEMBER 2023

Washington, D.C., January 3, 2024 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in November 2023. Just-released statistics indicate that HUD Code manufacturers produced 7,769 new homes in November 2023, a 2.5% decrease from the 7,970 new HUD Code homes produced in November 2022. Cumulative production for 2023 is now 82,809 homes, a 22.2% decrease from the 106,476 homes produced over the same period during 2022.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current reporting year (2023) and prior year (2022) shipments per category as indicated — are:

The November 2023 statistics result in no changes to the top-ten shipment state list.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Part II – Additional Information with More MHProNews Analysis and Commentary in Brief

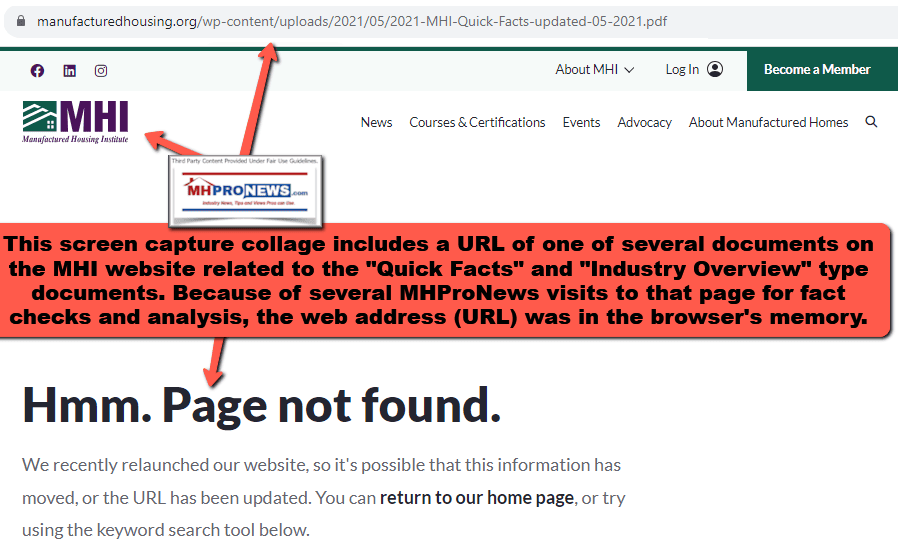

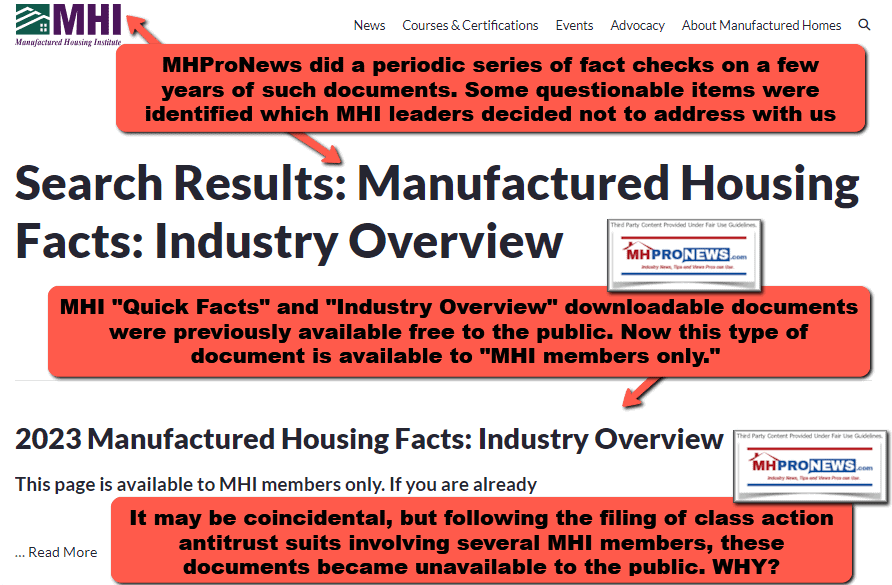

MHProNews has stood almost alone in having warned the industry’s professionals, investors, and others that the industry’s producers have been suffering for a range of causes. Among them that almost no one has been underscoring is this. A big share of manufactured home production has been going into land-lease communities. MHI reported in 2022 that the share was 51 percent. As MHI said in their no longer publicly available “Quick Facts” for 2022:

- 49% of new manufactured homes are placed on private property and 51% are placed in manufactured home communities

That data point ought to have been a klaxon alarm for every independent producer, retailer, suppliers, and others. Why?

Because part of the story for 2023 has been that manufactured home communities (MHCs) cut back on their orders. It isn’t the only factor. But it is a significant one. Read it for yourself in any, or all of the reports linked below. Read what those publicly traded companies that are MHI members themselves have said.

MHProNews raised this market share concern at the last MHI meeting we attended. That was the MHI winter meeting in 2017. Despite periodic praise, blogger George Allen hasn’t been a cheerleader for our platform for years, as regular and detail-minded readers here know. But on 2.17.2017, Allen said the following. Note his reference to this writer “Mr. Kovach” for MHProNews was the first of the “news notes” he provided.

• MHI’s Winter meeting in San Antonio attracted more than 100 participants! 24 of whom were owners/operators of land lease communities; 18 HUD-Code home manufacturing firm representatives, 18 state MHAssociation executives, 14 lenders from ‘both sides of the aisle’, seven suppliers, six MHRetailers, and a smattering of attorneys, insurance agents, and several new friends from FHFA and both GSEs. Central message? ‘New administration in Washington, DC., likely business-friendly; and hopefully, a relaxed regulatory climate for all!’ But guess which HUD staffer no one would talk about, despite prodding from Mr. Kovach. …”

But another item that was prodded by this writer – beyond the questions about Pam Danner that Allen referenced, was about the community sector and manufactured home production. Why didn’t Allen mention those points too?

Namely, what this writer asked, and there were no specific answers, was this. What will happen to manufactured housing production when the land-lease communities begin to fill up and reach capacity? The question often asked of producers, at the current pace, perhaps 5 years from now, communities will be near capacity. What will happen to production when the existing land-lease communities are effectively filled?

It’s not that Allen’s observations weren’t of interest. But perhaps not how he meant it.

- Out of 5o states, only 18 were state association executives and state association team members attended?

- Only 6 retailers out of “more than 100 participants” attended.

- But 24 owner/operators of land-lease communities came.

- 18 people from the production sector came.

The attendance, in short, was pathetic. Out of ‘hundreds’ of MHI members, who employed tens of thousands of professionals, only about 100 people come, and some of those worked for MHI? It is often not what is said, it is also what is NOT said from other sources that should raise the eyebrows. And what is said should also be carefully examined to see not only the writer’s point, but what it may logically imply. If every MHI state association attended with one staffer, and 4 members with them, the attendance for that event could have been over 250 people. That year, also in the winter, some 3,000 people attended Louisville. See the comparisons? MHI’s winter meeting attendance was apparently pathetic. Allen was arguably and apparently just doing what Allen does: part time cheerleader, part time critic, whatever he thinks will benefit…Allen and/or someone paying Allen.

That said, back to the main point.

- If Integra Realty Resources, Inc. (IRR) is correct, “The national occupancy rate [for manufactured home communities] rose 10 basis points in 2021, reaching 93.8%.”

- Per MMI (both in reports in 2023): “The national lot vacancy rate held below 6 percent through the end of 2022.”

MHI in 2023 apparently began to hide some of their previously publicly available data on what the market share of manufactured home production going into land lease was. That occurred after MHProNews began calling attention to the issue. It also occurred after national class action antitrust suits were filed. Coincidences? The content MHI began to remove from the public side of their website included, but was not limited to, those MHI “Industry Overviews” and/or MHI “Quick Facts.”

- The manufactured home industry has a place to put problem. MHI member Legacy has said it is the number one issue.

- The manufactured housing industry has a lack of competitive financing problem. As the prior and above links reveals, it isn’t only MHARR that has hit MHI over these woes.

- The industry has a serious, and perhaps increasing risk from the DOE energy rule, which MHARR can be described as having pointedly accused MHI as having fostered in several respects. The report linked below ought to provide one more bright line distinction between what other trade groups, beyond MHARR, have done, and what MHI hs done on the energy rule woes.

- Manufactured Housing Institute research has repeatedly and for approaching 2 decades pointed out the ‘image/education’ issue. Yet, what MHI has done to address that issue is almost mindbogglingly ineffective as measured by the prime measurement. Namely, production!

On the agenda of the remainder of independent producers, retailers, investors, and community owners in 2024 ought to be an authentic probe of MHI and/or a legal action against MHI. No one could be that incompetent for that long unless it was desired by the insiders at MHI. ICYMI, or need a refresher, grab your favorite beverages and snacks, and sit down to unpack the report linked below.

Manufactured housing is underperforming during an affordable housing crisis. The challenges are known. MHI claims that they want to deal with the issues that are outlined herein. They say they want more lending that is more competitive. MHI leaders say they want to remove zoning barriers. MHI leaders say they want to improve the industries image. MHI filed suit on the DOE issue.

But then why hasn’t MHI sued to finance and zoning barriers? Isn’t 23+ years long enough to wait to try to get enhanced preemption enforced?

Why hasn’t MHI sued on FHA and GSE related issues?

On almost every front, the industry is suffering. Production is down to a level not seen since circa 2017. The number of land-lease communities isn’t growing, the count is shrinking. There is one area where the industry’s metrics reveals ‘growth’ and that is the area of growing consolidation. The consolidators are MHI are benefiting. Employees and investors? Not so much.

See the linked reports to learn more. Additional facts on the declining production and shipment of manufactured housing will be published in an upcoming report later this month (January 2024). Stay tuned.

Under different, but related to the bigger picture…

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 1.2.2024

- Harvard President Claudine Gay resigns after plagiarism and campus antisemitism accusations

- A screen displays a chart with the evolution on index IBEX 35 at Madrid’s Stock Exchange Market, Spain, 02 January 2024. The Spanish stock market started the year up 0.65 percent and approaches 10,200 points.

- Stocks, bitcoin, oil: What you need to know as markets kick off 2024

- People walk past the Apple store in the Americana at Brand shopping center on the day after Christmas on December 26, 2023 in Glendale, California.

- Apple shares slide following Barclays downgrade, dragging down markets

- The picture on the packaging of the Reese’s Peanut Butter Pumpkins product that

- Plaintiff purchased when compared to the actual product that she received looked as follows:

- Hershey is sued for selling Reese’s Peanut Butter cups without ‘cute pumpkin faces’

- A screenshot from the trailer of “Mickey’s Mouse Trap”.

- Multiple Mickey Mouse horror movies announced as Steamboat Willie enters public domain

- Harvard University President Claudine Gay attends a House Education and The Workforce Committee hearing titled “Holding Campus Leaders Accountable and Confronting Antisemitism” on Capitol Hill in Washington, U.S., December 5, 2023.

- READ: Harvard President Claudine Gay’s resignation letter

- MIAMI, FLORIDA – OCTOBER 04: Forms to pick numbers for Powerball are on display in a store on October 04, 2023 in Miami, Florida. Wednesday’s Powerball drawing will be an approximately $1.2 billion jackpot.

- Ticket sold in Michigan wins estimated $842.2 million Powerball jackpot in New Year’s Day drawing

- Jerome Powell, Chairman of the U.S. Federal Reserve, speaks during the conference celebrating the Centennial of the Division of Research and Statistics, Board of Governors of the Federal Reserve System in Washington D.C., United States on November 08, 2023.

- Rate cuts and a soft landing: This will be a critical year for the Fed

- Vehicles at a Tesla store in Colma, California, US, on Wednesday, Dec. 13, 2023. Tesla Inc. will fix more than 2 million vehicles, its biggest recall ever, after the top US auto-safety regulator determined its driver-assistance system Autopilot doesn’t do enough to guard against misuse.

- Tesla reports record sales but growth slows in face of growing EV competition

- Container vessel Maersk Hangzhou sails in the Wielingen channel, Westerschelde, Netherlands July 15, 2018.

- Maersk suspends shipping through key maritime route Red Sea ‘until further notice’

- Fidelity fund again trims Elon Musk’s X valuation

- China’s BYD is selling more electric cars than Tesla

- What to expect at work in 2024

- ASML forced to suspend some China exports after US escalates tech battle

- An early version of Mickey Mouse is now in the public domain

- 5 reasons to be optimistic about the 2024 economy

- Baidu’s live streaming plans suffer as it calls off $3.6 billion Joyy deal

- Here’s where the minimum wage is increasing this year

- Maersk pauses shipping through Red Sea after Houthi boats attack vessel

- Xi Jinping rings in 2024 with rare admission that China’s economy is in trouble

- Reckitt/Mead Johnson voluntarily recalls specialty infant formula due to possible bacterial infection

- Four key retail moments in 2023

- Microsoft’s Satya Nadella is CNN Business’ CEO of the Year