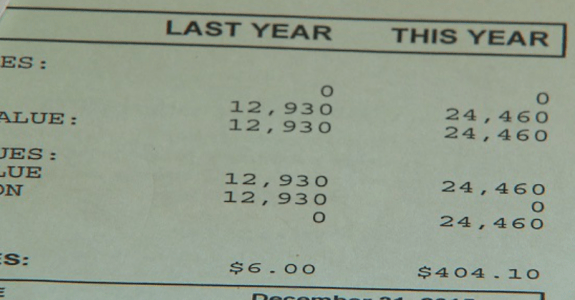

Rich Hobernicht of the Washington County Department of Assessment and Taxation said they studied the county’s manufactured home communities this year and raised the valuations based on the selling price of nearby homes, much like they do in a site-built neighborhood. It is, however, rather unusual for a home to double in value and for the tax bill to increase over 6,000 percent.

Noting everyone’s tax bill in a community like Siller’s would receive a similar increase, Hobernicht said they notified managers in four of the largest communities but did not notify the residents directly. They did not notify Siller’s community of the steep increase.

When asked if the residents received fair waring from the county about the change in valuation, Hobernicht replied,”Well, we give them the tax bill and they have to pay by November 16. So that is their notice.” He said the homeowners have the right to appeal with the property tax board. ##

(Photo credit: koin-tv–tax bill)