“Nobility Homes, Inc. engages in the design, manufacture, and sale of various manufactured and modular homes in Florida,” says a report by financial news site Simply Wall Street on manufactured home producer Nobility Homes (NOBH) that was updated on 22 October, 2023. While the financial news site didn’t give them a total ringing endorsement, they did provide several positive takeaways that ought to cause others in MHVille, or outsiders looking in, to lean in for a closer look. For example, per that same report by Simply Wall Street (SWS): “Earnings grew by 87.1% over the past year.” “Return vs Market: NOBH exceeded the US Market which returned 10.5% over the past year.” Further below, MHProNews will compare what SWS had to say about Nobility with two other MHProNews tracked equities. Namely, Sun Communities (SUI) and Equity LifeStyle Properties (ELS). Yes, that’s an apples and oranges comparison, but the rationale for it should become clear soon.

That said, per SWS is the following information.

Founded Employees CEO Website

1967 145 Terry Trexler https://www.nobilityhomes.com

Nobility Homes, Inc. engages in the design, manufacture, and sale of various manufactured and modular homes in Florida. The company markets its homes under the Kingswood, Richwood, Tropic Isle, Regency Manor, and Tropic Manor trade names. It sells its manufactured homes through a network of its own retail sales centers; and on a wholesale basis to independent manufactured home retail dealers and manufactured home communities.

In addition, the company offers retail insurance services, which involve placing various types of insurance, including property and casualty, automobile, and extended home warranty coverage with insurance underwriters on behalf of its customers in connection with their purchase and financing of manufactured homes, as well as operates as a licensed mortgage loan originator. Nobility Homes, Inc. was incorporated in 1967 and is headquartered in Ocala, Florida.”

In their comparisons, SWS used firms as ‘peer comparisons’ used one manufactured home producer but then used other companies that were mostly site builders. While that could be of general interest to a potential outsider investor looking in, or possibly for a shareholder to see how their earnings compare to an investment in a conventional housing company vs. manufactured housing, that isn’t an apples-to-apples comparison. But then, neither is comparing the performance of stocks in an independent producer (NOBH) to huge, manufactured home community (MHC) operators. But there is a method and purpose to what follows.

What MHProNews will do in this brief snapshot is this. Compare Nobility not to other builders, but to two of the much-ballyhooed manufactured home community (MHC) sector firms of ELS and Sun.

- On April 21, 2023 Equity Lifestyle Properties’ (ELS) shares closed the day at $68.37. Friday’s close on 10.19.2023 was at $64.83. That’s a loss of $3.54 per share, or a drop in the share value of some 0.05178 percent.

- On April 21, 2023 Sun Communities’ (SUI) shares closed that day at $139.62. Friday’s close on 10.19.2023 was at $105.70. That’s a loss of $33.92 per share, or a drop in share value of some 24.3 percent.

- By contrast, on April 21, 2023 Nobility Homes (NOBH) closed that day at $25.45. Friday’s close was at $29.88. That’s an increase of $4.43 per share, or a gain in share value of some 17.4 percent.

What’s going on for Manufactured Housing Institute (MHI) Communities SUI and ELS?

That’s obviously good new for Nobility share holders, but bad news for those who put investment dollars into prominent Manufactured Housing Institute (MHI) members Equity LifeStyle Properties (ELS) and Sun Communities. While there are several possible issues that might be on the minds of investors, it is worth mentioning that Hajek v. Datacomp Appraisal Systems, Inc., et al Case # 1:23-cv-06715 was filed on 8.31.2023. It names ELS and Sun among the defendants. Not only has MHProNews/MHLivingNews reported on that case and the one that followed but so has mainstream media. Sailer-et-al-v-Datacomp et al Case #1.23-cv-14565 was filed on Oct 5, 2023 and it names ELS and Sun among the defendants.

Both MHI members ELS and SUI have watched their respective shares’ value slide before and since that 8.31.2023 court filing in Hajek.

By contrast, the last known information on Nobility Homes is that they are not an MHI member. There are no known concerns about Nobility being involved in possible market manipulation that harms consumers and/or independent firms.

By contrast, MHI connected ELS and SUI each are apparently carrying that baggage of being credibly accused of market manipulation, as was illustrated by concerns raised by Samuel “Sam” Strommen’s legal research and now recently underscored by the Hajek and Sailer cases named herein above. A common feature of the defendants in both of those cases is that they are routinely members of either MHI and/or they are members of a MHI state association “affiliate.” So, concerns raised by Strommen’s research may have taken on new meaning to some investors since the filing of the Hayek and Sailer class action antitrust violations claim cases.

- ELS was at $66.96 at the close of August 31, 2023. That was the date Hajek was filed. Again, Friday’s close on 10.19.2023 was at $64.83.

- SUI was at $122.42 at the close of August 31, 2023. Once more, Friday’s close on 10.19.2023 was at $105.70.

MHProNews plans to continue to monitor these, and other, manufactured housing linked publicly traded equities. We will report on items that could prove to be of interest to investors, manufactured housing industry stakeholders, public officials, attorneys, and others. To learn more about the issues identified herein, see the linked reports.

Postscript – Manufactured Housing Industry Connected Equities, Stocks, REITs, etc.

| Symbol | Company Name | Manufactured Housing Linked Interests | ||||||||||||||

| APO = Apolo Global Management – bought Inspire Communities | ||||||||||||||

| BAM = Brookfield Asset Management – owns and invests in manufactured home communities (MHCs). | ||||||||||||||

| BLK = BlackRock – conglomerate has investments in firms and operations involved in manufactured housing. | ||||||||||||||

| BRK-A = Berkshire Hathaway – includes outright ownership of Clayton Homes, 21st Mortgage Corp, Vanderbilt Mortgage and Finance, other manufactured home industry linked firms (MHC brokerage, suppliers, etc.). |

||||||||||||||

| BX = Blackstone – Blackstone Group LP has made its first big bet on manufactured housing by buying a portfolio of communities sold by Tricon Capital Group Inc. |

||||||||||||||

| CDPYF = Canadian Apartment Properties Real Estate Investment Trust – also has manufactured home communities (MHCs). |

||||||||||||||

| CIGI = Colliers International Group Inc. – The Manufactured Housing and RV Group “We Assist Owners and Investors

with Disposition, Acquisition, and Financing for Manufactured Housing Communities and RV Parks.” |

||||||||||||||

| CG = The Carlyle Group – has manufactured home communities investments. | ||||||||||||||

| CSGP = CoStar Group – is commercial real estate’s leading provider of information, analytics and online marketplaces. They acquired listing service Homes.com. |

||||||||||||||

| CVCO = Cavco Industries – manufactured home and other factory-built housing production, retail, finance, insurance. | ||||||||||||||

| ECNCF = ECN Capital Group – includes manufactured home lender Triad Financial Services. | ||||||||||||||

| ELS = Equity LifeStyle Properties – includes land lease manufactured home communities (MHCs), but also RV and marine slips holdings. Also has captive manufactured home retail operations, and parent to Datacomp/MHVillage. |

||||||||||||||

| FGF = FG Financial Group – FG Communities “Owns and Operates Growing Portfolio of Manufactured Housing Communities.” |

||||||||||||||

| KMMPF = Killam Apartment REITs- (includes manufactured home communities (MHCs). | ||||||||||||||

| LCII = LCI Industries – components for the manufactured home industry and others (RVs, housing, etc.). | ||||||||||||||

| LEGH = Legacy Housing – produces manufactured homes, tiny houses, retail, and captive finance operations. | ||||||||||||||

| LPX = Louisiana Pacific Corporation – components for the manufactured home industry and others (housing, etc.). | ||||||||||||||

| MHC-UN.TO = Flagship Communities Real Estate Investment Trust (REIT). | ||||||||||||||

| MHPC = Manufactured Housing Properties – land lease manufactured home communities (MHCs). | ||||||||||||||

| MMI = Marcus and Millichap – commercial real estate brokerage services that include land lease manufactured home communities (MHCs). |

||||||||||||||

| NOBH = Nobility Homes – produces and offers captive retail, financing, and insurance services for HUD Code manufactured homes and modular homes. |

||||||||||||||

| PATK = Patrick Industries – components for the manufactured home industry and others (RVs, housing, etc.). | ||||||||||||||

| SKY = Skyline Champion – produces and offers captive retail, financing, and insurance for HUD Code manufactured homes and modular homes. |

||||||||||||||

| SUI = Sun Communities – includes land lease manufactured home communities (MHCs), but also RV and marine slips holdings. Also has captive manufactured home retail operations. |

||||||||||||||

| UMH = UMH Properties – includes land lease manufactured home communities and captive manufactured home retail, leasing, and financing operations. |

||||||||||||||

| UFPI = UFP Industries – components for the manufactured home industry and others (housing, etc.). |

The list above should not be considered exhaustive. Other firms have investments in manufactured housing that for various reasons (size of stake, not yet grabbed headlines for their stakes, etc.) may not be included in the MHProNews listing above. In addition, from time to time, firms that invest in other firms may sell of their stake – MHProNews does not offer any guarantees whatsoever on the list above being completely up-to-date, though we do make a reasonable effort to stay abreast of manufactured home industry connected news and trends. As a ‘free’ news site, MHProNews reserves the right to report or not on issues for any reason deemed appropriate by our parent company whatsoever. That said, our driving interest is to inform and advise readers on issues that relate to manufactured home industry related performance, or the lack thereof. Our reports offer facts and evidence from stated sources. Our reports routinely include Manufactured Home “Industry News, Tips and Views” © that are routinely editorial in nature. We also offer “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide” © and “Intelligence for your MHLife.” © Other terms and conditions of use are linked here.

MHProNews, per Bing AI, and other third-party sources, appears to be by far the largest and most-read trade media source focused on the manufactured home industry. The Daily Business News on MHProNews offers ‘business daily’ headline news several days weekly that include a headline recap of macro-markets and other news items. Regular readers of that feature can save time and have a decent sense in just a few minutes of what is occurring in the world around us.

By comparison, our would-be competitors in manufactured housing focused trade media and bloggers lack reports on topics and companies like those that follow.

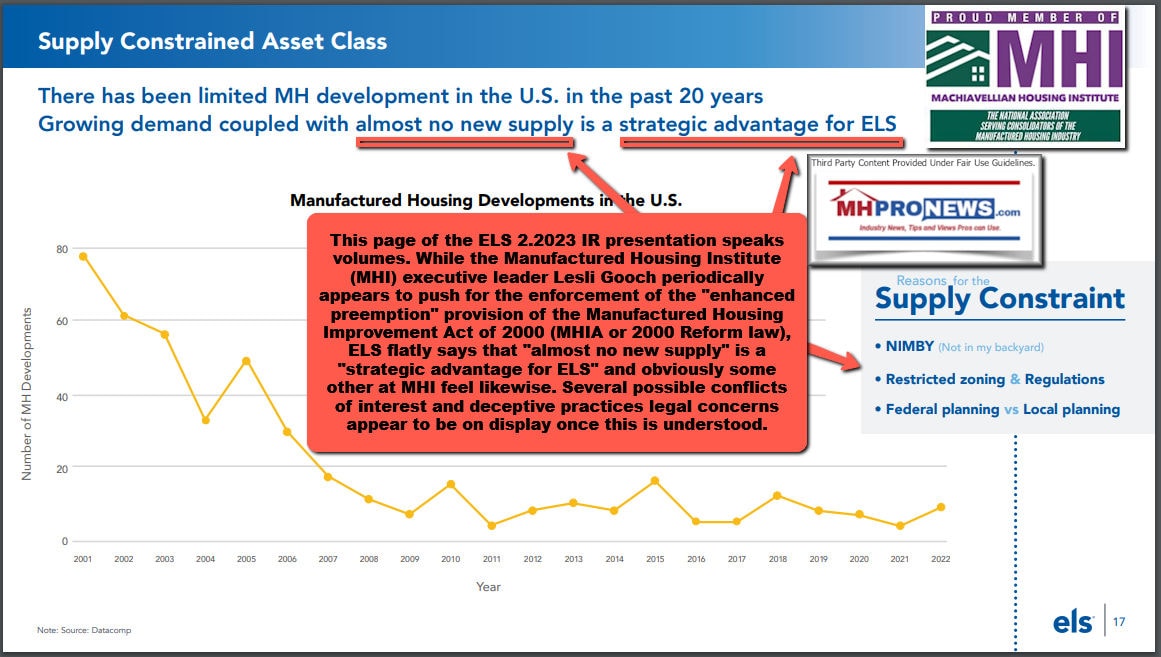

The following is a page or slide from an ELS investor pitch deck. It is followed by some ELS and Sun related articles.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

The following are articles that include or focus on independent manufactured home producer Nobility Homes.

The following are articles that focus on various controversies involving the Manufactured Housing Institute (MHI). Note that Nobility (NOBH), per the known information available, is not an MHI member.

Given the evidence of apparent conflicts of interest within MHI, and the unwillingness of their leadership to clear these issues up through direct engagement with MHProNews on these and other issues, the concerns raised by Strommen and the litigation filed and cited above arguably take on a new relevance. There is an evidence-based prima facie case of MHI engaging in pattern of behavior that benefits a few insiders’ firms while creating harmful issues for consumers as well as industry independents. See the linked and related reports to learn more. See the production related reports to learn more. Surf the site or use the search tool.

Things aren’t always as they are portrayed by insiders…

There is an affordable housing crisis that has been well documented. Yet, manufactured housing is struggling. Reports like those shown pull back the veil on why much (not all) of the industry is snoring instead of soaring.

MHProNews and MHLivingNews published reports in advance of the Hayek and Sailer cases being filed that sounded the alarm for those who were paying close attention. Some examples are among those noted above and below.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

As in any profession, there are good firms, problematic ones, and those that are meh. Doing the homework protects or pays. And while manufactured housing ought to be soaring, the case can be made that until the industry is cleaned up, or obviously in the process of being cleaned up and its root issues are addressed, the industry will underperform. Are there exceptions to that rule of thumb? Obviously. Are there ways that the process could be speeded up? Yes. See the linked and related reports to learn more.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’