MHProNews highlighted weeks ago that the dirty little secret for land-lease communities in this Biden-era inflationary environment is that various companies’ revenue growth are arguably not keeping up with rising costs. See how that contention plays out in this new report and analysis for Equity LifeStyle Properties’ 2nd quarter 2022 results. ELS is a ‘proud member’ of the Manufactured Housing Institute (MHI). ELS are currently involved in a class action lawsuit. Historically, one of the top two REITs in the manufactured home community sector are Equity LifeStyle Properties (ELS) and Sun Communities (SUI). Several insights can therefore be gleaned from a careful examination of their data combined with the additional information and critical analysis provided by MHProNews.

Press release via Business Wire per Seeking Alpha…

ELS Reports Second Quarter Results

Jul. 18, 2022 4:16 PM ET Equity LifeStyle Properties, Inc. (ELS)

Continued Strong Performance;

Guidance Update

CHICAGO–(BUSINESS WIRE)– Equity LifeStyle Properties, Inc. (ELS) (referred to herein as “we,” “us,” and “our”) today announced results for the quarter and six months ended June 30, 2022. All per share results are reported on a fully diluted basis unless otherwise noted.

Financial Results for the Quarter and Six Months Ended June 30, 2022

For the quarter ended June 30, 2022, total revenues increased $35.2 million, or 10.7%, to $365.3 million, compared to $330.1 million for the same period in 2021. For the quarter ended June 30, 2022, net income available for Common Stockholders increased $0.4 million, to $61.5 million, or $0.33 per Common Share, compared to $61.1 million, or $0.33 per Common Share, for the same period in 2021.

For the six months ended June 30, 2022, total revenues increased $91.7 million, or 14.5%, to $725.5 million, compared to $633.8 million for the same period in 2021. For the six months ended June 30, 2022, net income available for Common Stockholders increased $18.1 million, or $0.09 per Common Share, to $144.4 million, or $0.78 per Common Share, compared to $126.3 million, or $0.69 per Common Share, for the same period in 2021.

Non-GAAP Financial Measures and Portfolio Performance

For the quarter ended June 30, 2022, Funds from Operations (“FFO”) available for Common Stock and OP Unit holders increased $4.0 million, or $0.01 per Common Share, to $121.6 million, or $0.62 per Common Share, compared to $117.6 million, or $0.61 per Common Share, for the same period in 2021. For the six months ended June 30, 2022, Funds from Operations available for Common Stock and OP Unit holders increased $24.4 million, or $0.10 per Common Share, to $262.5 million, or $1.34 per Common Share, compared to $238.1 million, or $1.24 per Common Share, for the same period in 2021.

For the quarter ended June 30, 2022, Normalized Funds from Operations (“Normalized FFO”) available for Common Stock and OP Unit holders increased $7.0 million, or $0.03 per Common Share, to $125.3 million, or $0.64 per Common Share, compared to $118.3 million, or $0.61 per Common Share, for the same period in 2021. For the six months ended June 30, 2022, Normalized Funds from Operations available for Common Stock and OP Unit holders increased $25.8 million, or $0.12 per Common Share, to $266.7 million, or $1.37 per Common Share, compared to $240.9 million, or $1.25 per Common Share, for the same period in 2021.

For the quarter ended June 30, 2022, property operating revenues, excluding deferrals, increased $20.7 million to $315.8 million, compared to $295.1 million for the same period in 2021. For the six months ended June 30, 2022, property operating revenues, excluding deferrals, increased $57.8 million to $638.2 million, compared to $580.4 million for the same period in 2021. For the quarter ended June 30, 2022, income from property operations, excluding deferrals and property management, increased $8.3 million to $174.8 million, compared to $166.5 million for the same period in 2021. For the six months ended June 30, 2022, income from property operations, excluding deferrals and property management, increased $30.5 million to $367.3 million, compared to $336.8 million for the same period in 2021.

For the quarter ended June 30, 2022, Core property operating revenues, excluding deferrals, increased approximately 4.9% and Core income from property operations, excluding deferrals and property management, increased approximately 3.3%, compared to the same period in 2021. For the six months ended June 30, 2022, Core property operating revenues, excluding deferrals, increased approximately 7.2% and Core income from property operations, excluding deferrals and property management, increased approximately 6.2%, compared to the same period in 2021.

Business Updates

Pages 1 and 2 of this Earnings Release and Supplemental Financial Information provide an update on operations and 2022 guidance.

Investment Activity

In June 2022, we completed the acquisition of Holiday Trav-L-Park Resort, a 299-site oceanfront Recreational Vehicle (“RV”) community located in Emerald Isle, North Carolina, Oceanside RV Resort, a 139-site RV community located in Oceanside, California, and one land parcel adjacent to one of our properties for an aggregate purchase price of $97.4 million. Our total year to date acquisition investment is $113 million.

About Equity LifeStyle Properties

We are a self-administered, self-managed real estate investment trust (“REIT”) with headquarters in Chicago. As of July 18, 2022, we own or have an interest in 449 quality properties in 35 states and British Columbia consisting of 170,880 sites.

For additional information, please contact our Investor Relations Department at (800) 247-5279 or at investor_relations@equitylifestyle.com.

Conference Call

A live webcast of our conference call discussing these results will take place tomorrow, Tuesday, July 19, 2022, at 10:00 a.m. Central Time. Please visit the Investor Relations section at www.equitylifestyleproperties.com for the link. A replay of the webcast will be available for two weeks at this site.

Forward-Looking Statements

In addition to historical information, this press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used, words such as “anticipate,” “expect,” “believe,” “project,” “intend,” “may be” and “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements and may include without limitation, information regarding our expectations, goals or intentions regarding the future, and the expected effect of our acquisitions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, including, but not limited to:

- our ability to control costs and real estate market conditions, our ability to retain customers, the actual use of sites by customers and our success in acquiring new customers at our properties (including those that we may acquire);

- our ability to maintain historical or increase future rental rates and occupancy with respect to properties currently owned or that we may acquire;

- our ability to attract and retain customers entering, renewing and upgrading membership subscriptions;

- our assumptions about rental and home sales markets;

- our assumptions and guidance concerning 2022 growth rates and Net Income, FFO and Normalized FFO per share data;

- our ability to manage counterparty risk;

- our ability to renew our insurance policies at existing rates and on consistent terms;

- home sales results could be impacted by the ability of potential homebuyers to sell their existing residences as well as by financial, credit and capital markets volatility;

- results from home sales and occupancy will continue to be impacted by local economic conditions, including an adequate supply of homes at reasonable costs, lack of affordable manufactured home financing and competition from alternative housing options including site-built single-family housing;

- impact of government intervention to stabilize site-built single-family housing and not manufactured housing;

- effective integration of recent acquisitions and our estimates regarding the future performance of recent acquisitions;

- the completion of future transactions in their entirety, if any, and timing and effective integration with respect thereto;

- unanticipated costs or unforeseen liabilities associated with recent acquisitions;

- our ability to obtain financing or refinance existing debt on favorable terms or at all;

- the effect of inflation and interest rates;

- the effect from any breach of our, or any of our vendors’ data management systems;

- the dilutive effects of issuing additional securities;

- the outcome of pending or future lawsuits or actions brought by or against us, including those disclosed in our filings with the Securities and Exchange Commission; and

- other risks indicated from time to time in our filings with the Securities and Exchange Commission.

Our guidance acknowledges the existence of volatile economic conditions, which may impact our current guidance assumptions. Factors impacting 2022 guidance include, but are not limited to the following: (i) the mix of site usage within the portfolio; (ii) yield management on our short-term resort and marina sites; (iii) scheduled or implemented rate increases on community, resort and marina sites; (iv) scheduled or implemented rate increases in annual payments under membership subscriptions; (v) occupancy changes; (vi) our ability to attract and retain membership customers; (vii) change in customer demand regarding travel and outdoor vacation destinations; (viii) our ability to manage expenses in an inflationary environment; (ix) our ability to integrate and operate recent acquisitions in accordance with our estimates; (x) our ability to execute expansion/development opportunities in the face of supply chain delays/shortages; (xi) completion of pending transactions in their entirety and on assumed schedule; (xii) our ability to attract and retain property employees, particularly seasonal employees; (xiii) ongoing legal matters and related fees; and (xiv) costs to restore property operations and potential revenue losses following storms or other unplanned events. In addition, these forward-looking statements, including our 2022 guidance are subject to risks related to the COVID-19 pandemic, many of which are unknown, including the duration of the pandemic, the extent of the adverse health impact on the general population and on our residents, customers and employees in particular, its impact on the employment rate and the economy, the extent and impact of governmental responses and the impact of operational changes we have implemented and may implement in response to the pandemic.

For further information on these and other factors that could impact us and the statements contained herein, refer to our filings with the Securities and Exchange Commission, including the “Risk Factors” section in our most recent Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q.

These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

Supplemental Financial Information

| Operations Update |

Normalized FFO per Common Share

- Second Quarter (“Q2”) 2022: $0.64 or 4.5% growth compared to the same period in 2021.

- June Year to Date (“YTD”) 2022: $1.37 or 9.3% growth compared to the same period in 2021.

Core Income from property operations, excluding deferrals and property management

- Q2 2022: 3.3% growth compared to the same period in 2021.

- June YTD 2022: 6.2% growth compared to the same period in 2021.

MH – 60% of Total Property Operating Revenues

- Q2 2022 Core MH base rental income: 5.7% growth compared to the same period in 2021, which reflects 5.3% growth from rate increases and 0.4% from occupancy gains.

- June YTD 2022 Core MH base rental income: 5.7% growth compared to the same period in 2021, which reflects 5.2% growth from rate increases and 0.5% from occupancy gains.

- June YTD 2022 Core MH occupancy increased by 97 sites since December 31, 2021.

- June YTD 2022 Core Manufactured homeowners increased by 443 since December 31, 2021.

- Q2 New home sales: 365 which represents the highest volume of new home sales in a quarter in our history.

RV and Marina – 32% of Total Property Operating Revenues

- Q2 2022 Core RV and marina base rental income: 6.6% growth compared to the same period in 2021.

- June YTD 2022 Core RV and marina base rental income: 13.9% growth compared to the same period in 2021.

- Q2 2022 Core RV annual base rental income: 9.2% growth compared to the same period in 2021, which reflects 7.1% growth from rate increases and 2.1% from occupancy gains.

- Q2 2022 combined Core Seasonal and Transient RV base rental income: 2.4% or $0.6 million growth over the same period in 2021. Growth was $0.5 million below the midpoint of our guidance.

- June YTD 2022 combined Core Seasonal and Transient RV base rental income: 22.8% or $13.3 million growth over the same period in 2021.

- Core RV Site Composition

| June 30, 2022 | June 30, 2021 | |||||||

| Annual | 32,000 | 31,300 | ||||||

| Seasonal | 12,100 | 10,700 | ||||||

| Transient | 12,500 | 14,200 | ||||||

| Member | 25,400 | 24,800 | ||||||

- Second quarter total nights camped increased 1.8% and 8.3% compared to the quarter ended June 30, 2021 and June 30, 2019, respectively.

- During the quarter and six months ended June 30, 2022 combined Utility, Payroll and Repair & Maintenance expense, which represent approximately two thirds of property operating expense, were 28.8% and 27.1%, respectively, of total property operating revenue compared to 27.7% and 26.1% for the quarter and six months ended June 30, 2021.

- Added 458 and 514 expansion Sites during the quarter and six months ended June 30, 2022, respectively.

- Core Transient RV base rental income for the 2022 4th of July holiday weekend declined 5.7% over 2021 and increased 14.7% over 2019.

|

2022 Guidance (1) |

| ($ in millions except per share) | ||||

| Third Quarter | Full Year | |||

| Net Income/share | $0.37 to $0.43 | $1.54 to $1.64 | ||

| FFO/share | $0.66 to $0.72 | $2.65 to $2.75 | ||

| Normalized FFO/share | $0.66 to $0.72 | $2.68 to $2.78 | ||

| Core Portfolio: | ||||

| MH rate growth | 5.3% to 5.5% | 5.2% to 5.4% | ||

| RV Annual rate growth | 6.6% to 6.8% | 6.4% to 6.6% | ||

| Combined RV Seasonal and Transient base rental income growth | (2.5)% to (3.5)% | 10.6% to 11.6% | ||

| Property operating revenue growth rate | 4.3% to 4.9% | 5.4% to 6.4% | ||

| Property operating expense growth rate | 3.7% to 4.3% | 5.2% to 6.2% | ||

| Income from property operations, excluding deferrals and property management growth rate(2) | 4.7% to 5.3% | 5.6% to 6.6% |

______________________

| (1) | Third quarter and full year 2022 guidance ranges represent a range of possible outcomes and the midpoint reflects management’s estimate of the most likely outcome. Actual growth rates and per share amounts could vary materially from growth rates and per share amounts presented above if any of our assumptions, including occupancy and rate changes, our ability to manage expenses in an inflationary environment, our ability to integrate and operate recent acquisitions and costs to restore property operations and potential revenue losses following storms or other unplanned events, is incorrect. See Forward-Looking Statements in this release for additional factors impacting our 2022 guidance assumptions. |

| (2) | The expected contribution of our third quarter Core Income from property operations, excluding deferrals and property management is within a range of 24.6% to 25.6% of our expected full year Core Income from property operations, excluding deferrals and property management. |

| Investor Information |

| Equity Research Coverage(1) | ||

| Bank of America Securities | Barclays | Berenberg Bank |

| Jeffrey Spector/ Joshua Dennerlein | Anthony Powell | Keegan Carl |

| BMO Capital Markets | Citi Research | Colliers Securities |

| John Kim | Michael Bilerman/ Nick Joseph | David Toti |

| Evercore ISI | Green Street Advisors | RBC Capital Markets |

| Steve Sakwa/ Samir Khanal | John Pawlowski | Brad Heffern |

| Robert W. Baird & Company | Truist | UBS |

| Wes Golladay | Anthony Hau | Michael Goldsmith |

______________________

| 1. | Any opinions, estimates or forecasts regarding our performance made by these analysts or agencies do not represent our opinions, forecasts or predictions. We do not, by reference to these firms, imply our endorsement of or concurrence with such information, conclusions or recommendations. |

| Financial Highlights |

| (In millions, except Common Shares and OP Units outstanding and per share data, unaudited) | |||||||||||||||

| As of and for the Three Months Ended | |||||||||||||||

| Jun 30, 2022 |

Mar 31, 2022 |

Dec 31, 2021 |

Sept 30, 2021 |

Jun 30, 2021 |

|||||||||||

| Operating Information | |||||||||||||||

| Total revenues | $ | 365.3 | $ | 360.2 | $ | 335.3 | $ | 347.2 | $ | 330.1 | |||||

| Net income | $ | 64.6 | $ | 87.1 | $ | 68.8 | $ | 74.1 | $ | 64.1 | |||||

| Net income available for Common Stockholders | $ | 61.5 | $ | 82.9 | $ | 65.5 | $ | 70.6 | $ | 61.1 | |||||

| Adjusted EBITDAre (1) | $ | 153.3 | $ | 168.4 | $ | 150.7 | $ | 150.8 | $ | 144.6 | |||||

| FFO available for Common Stock and OP Unit holders (1)(2) | $ | 121.6 | $ | 140.9 | $ | 123.0 | $ | 124.5 | $ | 117.6 | |||||

| Normalized FFO available for Common Stock and OP Unit holders (1)(2) | $ | 125.3 | $ | 141.4 | $ | 123.6 | $ | 124.5 | $ | 118.3 | |||||

| Funds Available for Distribution (“FAD”) for Common Stock and OP Unit holders (1)(2) | $ | 103.6 | $ | 125.1 | $ | 102.3 | $ | 106.1 | $ | 99.0 | |||||

| Common Shares and OP Units Outstanding (In thousands) and Per Share Data | |||||||||||||||

| Common Shares and OP Units, end of the period | 195,373 | 195,303 | 194,946 | 192,852 | 192,847 | ||||||||||

| Weighted average Common Shares and OP Units outstanding – Fully Diluted | 195,227 | 195,246 | 193,412 | 192,736 | 192,701 | ||||||||||

| Net income per Common Share – Fully Diluted (3) | $ | 0.33 | $ | 0.45 | $ | 0.36 | $ | 0.38 | $ | 0.33 | |||||

| FFO per Common Share and OP Unit – Fully Diluted | $ | 0.62 | $ | 0.72 | $ | 0.64 | $ | 0.65 | $ | 0.61 | |||||

| Normalized FFO per Common Share and OP Unit – Fully Diluted | $ | 0.64 | $ | 0.72 | $ | 0.64 | $ | 0.65 | $ | 0.61 | |||||

| Dividends per Common Share | $ | 0.4100 | $ | 0.4100 | $ | 0.3625 | $ | 0.3625 | $ | 0.3625 | |||||

| Balance Sheet | |||||||||||||||

| Total assets | $ | 5,400 | $ | 5,265 | $ | 5,308 | $ | 4,982 | $ | 4,824 | |||||

| Total liabilities | $ | 3,878 | $ | 3,734 | $ | 3,822 | $ | 3,673 | $ | 3,522 | |||||

| Market Capitalization | |||||||||||||||

| Total debt (4) | $ | 3,298 | $ | 3,193 | $ | 3,303 | $ | 3,154 | $ | 3,010 | |||||

| Total market capitalization (5) | $ | 17,066 | $ | 18,130 | $ | 20,392 | $ | 18,216 | $ | 17,340 | |||||

| Ratios | |||||||||||||||

| Total debt / total market capitalization | 19.3 | % | 17.6 | % | 16.2 | % | 17.3 | % | 17.4 | % | |||||

| Total debt / Adjusted EBITDAre (6) | 5.3 | 5.2 | 5.6 | 5.5 | 5.4 | ||||||||||

| Interest coverage (7) | 5.7 | 5.7 | 5.5 | 5.5 | 5.4 | ||||||||||

| Fixed charges(8) | 5.6 | 5.6 | 5.5 | 5.4 | 5.3 | ||||||||||

______________________

| 1. | See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for definitions of Adjusted EBITDAre, FFO, Normalized FFO and FAD and a reconciliation of Consolidated net income to Adjusted EBITDAre. |

| 2. | See page 9 for a reconciliation of Net income available for Common Stockholders to Non-GAAP financial measures FFO available for Common Stock and OP Unit holders, Normalized FFO available for Common Stock and OP Unit holders and FAD for Common Stock and OP Unit holders. |

| 3. | Net income per Common Share – Fully Diluted is calculated before Income allocated to non-controlling interest – Common OP Units. |

| 4. | Excludes deferred financing costs of approximately $29.8 million as of June 30, 2022. |

| 5. | See page 16 for the calculation of market capitalization as of June 30, 2022. |

| 6. | Calculated using trailing twelve months Adjusted EBITDAre. |

| 7. | Calculated by dividing trailing twelve months Adjusted EBITDAre by the interest expense incurred during the same period. |

| 8. | See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for a definition of fixed charges. This ratio is calculated by dividing trailing twelve months Adjusted EBITDAre by the sum of fixed charges and preferred stock dividends, if any, during the same period. |

| Consolidated Balance Sheets |

| (In thousands, except share and per share data) | |||||||

| June 30, 2022 | December 31, 2021 | ||||||

| (unaudited) | |||||||

| Assets | |||||||

| Investment in real estate: | |||||||

| Land | $ | 2,073,106 | $ | 2,019,787 | |||

| Land improvements | 4,031,259 | 3,912,062 | |||||

| Buildings and other depreciable property | 1,138,211 | 1,057,215 | |||||

| 7,242,576 | 6,989,064 | ||||||

| Accumulated depreciation | (2,197,013 | ) | (2,103,774 | ) | |||

| Net investment in real estate | 5,045,563 | 4,885,290 | |||||

| Cash and restricted cash | 42,426 | 123,398 | |||||

| Notes receivable, net | 41,925 | 39,955 | |||||

| Investment in unconsolidated joint ventures | 84,113 | 70,312 | |||||

| Deferred commission expense | 48,806 | 47,349 | |||||

| Other assets, net | 136,755 | 141,567 | |||||

| Total Assets | $ | 5,399,588 | $ | 5,307,871 | |||

| Liabilities and Equity | |||||||

| Liabilities: | |||||||

| Mortgage notes payable, net | $ | 2,724,040 | $ | 2,627,783 | |||

| Term loan, net | 496,373 | 297,436 | |||||

| Unsecured line of credit | 47,800 | 349,000 | |||||

| Accounts payable and other liabilities | 185,961 | 172,285 | |||||

| Deferred membership revenue | 188,582 | 176,439 | |||||

| Accrued interest payable | 9,520 | 9,293 | |||||

| Rents and other customer payments received in advance and security deposits | 145,265 | 118,696 | |||||

| Distributions payable | 80,311 | 70,768 | |||||

| Total Liabilities | 3,877,852 | 3,821,700 | |||||

| Equity: | |||||||

| Preferred stock, $0.01 par value, 10,000,000 shares authorized as of June 30, 2022 and December 31, 2021; none issued and outstanding. | — | — | |||||

| Common stock, $0.01 par value, 600,000,000 shares authorized as of June 30, 2022 and December 31, 2021; 186,076,327 and 185,640,379 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively. | 1,916 | 1,913 | |||||

| Paid-in capital | 1,622,876 | 1,593,362 | |||||

| Distributions in excess of accumulated earnings | (191,828 | ) | (183,689 | ) | |||

| Accumulated other comprehensive income | 16,241 | 3,524 | |||||

| Total Stockholders’ Equity | 1,449,205 | 1,415,110 | |||||

| Non-controlling interests – Common OP Units | 72,531 | 71,061 | |||||

| Total Equity | 1,521,736 | 1,486,171 | |||||

| Total Liabilities and Equity | $ | 5,399,588 | $ | 5,307,871 | |||

| Consolidated Statements of Income |

| (In thousands, unaudited) | |||||||||||||||

| Quarters Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Revenues: | |||||||||||||||

| Rental income | $ | 275,330 | $ | 255,698 | $ | 560,395 | $ | 504,720 | |||||||

| Annual membership subscriptions | 15,592 | 14,267 | 30,749 | 27,921 | |||||||||||

| Membership upgrade sales current period, gross | 9,535 | 9,207 | 16,686 | 19,221 | |||||||||||

| Membership upgrade sales upfront payments, deferred, net | (6,367 | ) | (6,454 | ) | (10,451 | ) | (13,881 | ) | |||||||

| Other income | 14,195 | 14,185 | 27,736 | 24,706 | |||||||||||

| Gross revenues from home sales, brokered resales and ancillary services (1) | 52,681 | 40,237 | 92,390 | 65,478 | |||||||||||

| Interest income | 1,722 | 1,742 | 3,481 | 3,509 | |||||||||||

| Income from other investments, net | 2,617 | 1,222 | 4,521 | 2,158 | |||||||||||

| Total revenues | 365,305 | 330,104 | 725,507 | 633,832 | |||||||||||

| Expenses: | |||||||||||||||

| Property operating and maintenance | 114,307 | 102,663 | 218,299 | 191,536 | |||||||||||

| Real estate taxes | 19,182 | 17,896 | 38,639 | 35,746 | |||||||||||

| Sales and marketing, gross | 6,409 | 6,298 | 11,323 | 12,474 | |||||||||||

| Membership sales commissions, deferred, net | (957 | ) | (1,438 | ) | (1,540 | ) | (2,937 | ) | |||||||

| Property management | 19,099 | 16,560 | 36,970 | 31,940 | |||||||||||

| Depreciation and amortization | 50,796 | 48,316 | 100,190 | 93,714 | |||||||||||

| Cost of home sales, brokered resales and ancillary services (1) | 40,971 | 31,793 | 71,670 | 50,710 | |||||||||||

| Home selling expenses and ancillary operating expenses (1) | 7,584 | 6,090 | 14,066 | 11,031 | |||||||||||

| General and administrative | 11,695 | 10,228 | 23,992 | 20,740 | |||||||||||

| Other expenses | 4,189 | 800 | 5,009 | 1,498 | |||||||||||

| Early debt retirement | 640 | 755 | 1,156 | 2,784 | |||||||||||

| Interest and related amortization | 28,053 | 27,131 | 55,517 | 53,406 | |||||||||||

| Total expenses | 301,968 | 267,092 | 575,291 | 502,642 | |||||||||||

| Loss on sale of real estate, net | — | — | — | (59 | ) | ||||||||||

| Income before equity in income of unconsolidated joint ventures | 63,337 | 63,012 | 150,216 | 131,131 | |||||||||||

| Equity in income of unconsolidated joint ventures | 1,253 | 1,068 | 1,424 | 1,936 | |||||||||||

| Consolidated net income | 64,590 | 64,080 | 151,640 | 133,067 | |||||||||||

| Income allocated to non-controlling interests – Common OP Units | (3,073 | ) | (3,021 | ) | (7,217 | ) | (6,768 | ) | |||||||

| Redeemable perpetual preferred stock dividends | (8 | ) | (8 | ) | (8 | ) | (8 | ) | |||||||

| Net income available for Common Stockholders | $ | 61,509 | $ | 61,051 | $ | 144,415 | $ | 126,291 | |||||||

______________________

| 1. | Prior period amounts have been reclassified to conform to the current period presentation. |

Non-GAAP Financial Measures

This document contains certain non-GAAP measures used by management that we believe are helpful to understand our business. We believe investors should review these non-GAAP measures along with GAAP net income and cash flows from operating activities, investing activities and financing activities, when evaluating an equity REIT’s operating performance. Our definitions and calculations of these non-GAAP financial and operating measures and other terms may differ from the definitions and methodologies used by other REITs and, accordingly, may not be comparable. These non-GAAP financial and operating measures do not represent cash generated from operating activities in accordance with GAAP, nor do they represent cash available to pay distributions and should not be considered as an alternative to net income, determined in accordance with GAAP, as an indication of our financial performance, or to cash flows from operating activities, determined in accordance with GAAP, as a measure of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to make cash distributions. For definitions and reconciliations of non-GAAP measures to our financial statements as prepared under GAAP, refer to both Reconciliation of Net Income to Non-GAAP Financial Measures on page 9 and Non-GAAP Financial Measures Definitions and Reconciliations on pages 18 – 20.

| Selected Non-GAAP Financial Measures |

| (In millions, except per share data, unaudited) | |||

| Quarter Ended | |||

| June 30, 2022 | |||

| Income from property operations, excluding deferrals and property management – 2022 Core (1) | $ | 166.6 | |

| Income from property operations, excluding deferrals and property management – Non-Core (1) | 8.2 | ||

| Property management and general and administrative | (30.8 | ) | |

| Other income and expenses (excluding transaction/pursuit costs) | 9.4 | ||

| Interest and related amortization | (28.1 | ) | |

| Normalized FFO available for Common Stock and OP Unit holders (2) | $ | 125.3 | |

| Early debt retirement | (0.6 | ) | |

| Transaction/pursuit costs (3) | (3.1 | ) | |

| FFO available for Common Stock and OP Unit holders (2) | $ | 121.6 | |

| FFO per Common Share and OP Unit – Fully Diluted | $ | 0.62 | |

| Normalized FFO per Common Share and OP Unit – Fully Diluted | $ | 0.64 | |

| Normalized FFO available for Common Stock and OP Unit holders (2) | $ | 125.3 | |

| Non-revenue producing improvements to real estate | (21.7 | ) | |

| FAD for Common Stock and OP Unit holders (2) | $ | 103.6 | |

| Weighted average Common Shares and OP Units – Fully Diluted | 195.2 | ||

______________________

| 1. | See page 11 for details of the Core Income from Property Operations, excluding deferrals and property management. See page 12 for details of the Non-Core Income from Property Operations, excluding deferrals and property management. |

| 2. | See page 9 for a reconciliation of Net income available for Common Stockholders to FFO available for Common Stock and OP Unit holders, Normalized FFO available for Common Stock and OP Unit holders and FAD for Common Stock and OP Unit holders. |

| 3. | Represents transaction/pursuit costs related to unconsummated acquisitions included in Other expenses in the Consolidated Statements of Income on page 6. |

| Reconciliation of Net Income to Non-GAAP Financial Measures |

| (In thousands, except per share data, unaudited) | ||||||||||||||||

| Quarters Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net income available for Common Stockholders | $ | 61,509 | $ | 61,051 | $ | 144,415 | $ | 126,291 | ||||||||

| Income allocated to non-controlling interests – Common OP Units | 3,073 | 3,021 | 7,217 | 6,768 | ||||||||||||

| Membership upgrade sales upfront payments, deferred, net | 6,367 | 6,454 | 10,451 | 13,881 | ||||||||||||

| Membership sales commissions, deferred, net | (957 | ) | (1,438 | ) | (1,540 | ) | (2,937 | ) | ||||||||

| Depreciation and amortization | 50,796 | 48,316 | 100,190 | 93,714 | ||||||||||||

| Depreciation on unconsolidated joint ventures | 835 | 184 | 1,776 | 367 | ||||||||||||

| Loss on sale of real estate, net | — | — | — | 59 | ||||||||||||

| FFO available for Common Stock and OP Unit holders | 121,623 | 117,588 | 262,509 | 238,143 | ||||||||||||

| Early debt retirement | 640 | 755 | 1,156 | 2,784 | ||||||||||||

| Transaction/pursuit costs (1) | 3,082 | — | 3,082 | — | ||||||||||||

| Normalized FFO available for Common Stock and OP Unit holders | 125,345 | 118,343 | 266,747 | 240,927 | ||||||||||||

| Non-revenue producing improvements to real estate | (21,738 | ) | (19,308 | ) | (38,106 | ) | (30,892 | ) | ||||||||

| FAD for Common Stock and OP Unit holders | $ | 103,607 | $ | 99,035 | $ | 228,641 | $ | 210,035 | ||||||||

| Net income available per Common Share – Basic | $ | 0.33 | $ | 0.33 | $ | 0.78 | $ | 0.69 | ||||||||

| Net income available per Common Share – Fully Diluted (2) | $ | 0.33 | $ | 0.33 | $ | 0.78 | $ | 0.69 | ||||||||

| FFO per Common Share and OP Unit – Basic | $ | 0.62 | $ | 0.61 | $ | 1.35 | $ | 1.24 | ||||||||

| FFO per Common Share and OP Unit – Fully Diluted | $ | 0.62 | $ | 0.61 | $ | 1.34 | $ | 1.24 | ||||||||

| Normalized FFO per Common Share and OP Unit – Basic | $ | 0.64 | $ | 0.61 | $ | 1.37 | $ | 1.25 | ||||||||

| Normalized FFO per Common Share and OP Unit – Fully Diluted | $ | 0.64 | $ | 0.61 | $ | 1.37 | $ | 1.25 | ||||||||

| Weighted average Common Shares outstanding – Basic | 185,767 | 182,337 | 185,729 | 182,142 | ||||||||||||

| Weighted average Common Shares and OP Units outstanding – Basic | 195,064 | 192,490 | 195,028 | 192,454 | ||||||||||||

| Weighted average Common Shares and OP Units outstanding – Fully Diluted | 195,227 | 192,701 | 195,253 | 192,668 | ||||||||||||

______________________

| 1. | Represents transaction/pursuit costs related to unconsummated acquisitions included in Other expenses in the Consolidated Statements of Income on page 6. |

| 2. | Net income per fully diluted Common Share is calculated before Income allocated to non-controlling interest – Common OP Units. |

| Consolidated Income from Property Operations (1) |

| (In millions, except home site and occupancy figures, unaudited) | |||||||||||||||

| Quarters Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| MH base rental income (2) | $ | 158.7 | $ | 150.1 | $ | 316.0 | $ | 299.1 | |||||||

| Rental home income (2) | 3.8 | 4.3 | 7.8 | 8.6 | |||||||||||

| RV and marina base rental income (2) | 98.3 | 89.0 | 207.1 | 172.6 | |||||||||||

| Annual membership subscriptions | 15.6 | 14.3 | 30.7 | 27.9 | |||||||||||

| Membership upgrade sales current period, gross | 9.5 | 9.2 | 16.7 | 19.2 | |||||||||||

| Utility and other income (2) | 29.9 | 28.2 | 59.9 | 53.0 | |||||||||||

| Property operating revenues | 315.8 | 295.1 | 638.2 | 580.4 | |||||||||||

| Property operating, maintenance and real estate taxes (2) | 134.6 | 122.3 | 259.6 | 231.1 | |||||||||||

| Sales and marketing, gross | 6.4 | 6.3 | 11.3 | 12.5 | |||||||||||

| Property operating expenses | 141.0 | 128.6 | 270.9 | 243.6 | |||||||||||

| Income from property operations, excluding deferrals and property management (1) | $ | 174.8 | $ | 166.5 | $ | 367.3 | $ | 336.8 | |||||||

| Manufactured home site figures and occupancy averages: | |||||||||||||||

| Total sites | 73,442 | 73,182 | 73,452 | 73,088 | |||||||||||

| Occupied sites | 69,693 | 69,405 | 69,670 | 69,354 | |||||||||||

| Occupancy % | 94.9 | % | 94.8 | % | 94.9 | % | 94.9 | % | |||||||

| Monthly base rent per site | $ | 759 | $ | 721 | $ | 756 | $ | 719 | |||||||

| RV and marina base rental income: | |||||||||||||||

| Annual | $ | 66.6 | $ | 58.8 | $ | 131.0 | $ | 113.3 | |||||||

| Seasonal | 9.5 | 7.4 | 36.1 | 22.8 | |||||||||||

| Transient | 22.2 | 22.8 | 40.0 | 36.5 | |||||||||||

| Total RV and marina base rental income | $ | 98.3 | $ | 89.0 | $ | 207.1 | $ | 172.6 | |||||||

______________________

| 1. | Excludes property management and the GAAP deferral of membership upgrade sales upfront payments and membership sales commissions, net. |

| 2. | MH base rental income, Rental home income, RV and marina base rental income and Utility income, net of bad debt expense, are presented in Rental income in the Consolidated Statements of Income on page 6. Bad debt expense is presented in Property operating, maintenance and real estate taxes in this table. |

| Core Income from Property Operations (1) |

| (In millions, except home site and occupancy figures, unaudited) | |||||||||||||||||||||

| Quarters Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||

| 2022 | 2021 | Change (2) | 2022 | 2021 | Change (2) | ||||||||||||||||

| MH base rental income | $ | 155.8 | $ | 147.4 | 5.7 | % | $ | 310.2 | $ | 293.6 | 5.7 | % | |||||||||

| Rental home income | 3.8 | 4.3 | (10.9 | )% | 7.8 | 8.6 | (9.4 | )% | |||||||||||||

| RV and marina base rental income | 87.4 | 81.9 | 6.6 | % | 183.8 | 161.4 | 13.9 | % | |||||||||||||

| Annual membership subscriptions | 15.4 | 14.3 | 7.9 | % | 30.5 | 27.9 | 9.2 | % | |||||||||||||

| Membership upgrade sales current period, gross | 9.3 | 9.2 | 1.2 | % | 16.4 | 19.2 | (14.5 | )% | |||||||||||||

| Utility and other income | 26.1 | 26.8 | (2.7 | )% | 52.4 | 50.3 | 4.2 | % | |||||||||||||

| Property operating revenues | 297.8 | 283.9 | 4.9 | % | 601.1 | 561.0 | 7.2 | % | |||||||||||||

| Utility expense | 33.7 | 30.9 | 9.0 | % | 67.3 | 59.9 | 12.3 | % | |||||||||||||

| Payroll | 28.5 | 26.7 | 6.8 | % | 53.1 | 49.7 | 6.9 | % | |||||||||||||

| Repair & Maintenance | 23.6 | 21.0 | 12.3 | % | 42.4 | 36.9 | 14.9 | % | |||||||||||||

| Insurance and other (3) | 22.4 | 21.5 | 4.1 | % | 44.5 | 41.2 | 8.0 | % | |||||||||||||

| Real estate taxes | 16.7 | 16.2 | 3.4 | % | 33.9 | 32.4 | 4.7 | % | |||||||||||||

| Sales and marketing, gross | 6.3 | 6.3 | 0.8 | % | 11.2 | 12.5 | (9.8 | )% | |||||||||||||

| Property operating expenses | 131.2 | 122.6 | 7.0 | % | 252.4 | 232.6 | 8.6 | % | |||||||||||||

| Income from property operations, excluding deferrals and property management (1) | $ | 166.6 | $ | 161.3 | 3.3 | % | $ | 348.7 | $ | 328.4 | 6.2 | % | |||||||||

| Occupied sites (4) | 68,992 | 68,711 | |||||||||||||||||||

| Core manufactured home site figures and occupancy averages: | |||||||||||||||||||||

| Total sites | 72,454 | 72,186 | 72,455 | 72,091 | |||||||||||||||||

| Occupied sites | 68,915 | 68,642 | 68,895 | 68,595 | |||||||||||||||||

| Occupancy % (5) | 95.1 | % | 95.1 | % | 95.1 | % | 95.2 | % | |||||||||||||

| Monthly base rent per site | $ | 753 | $ | 716 | $ | 750 | $ | 713 | |||||||||||||

| Core RV and marina base rental income: | |||||||||||||||||||||

| Annual (6) | $ | 57.4 | $ | 52.6 | 9.1 | % | $ | 112.8 | $ | 103.6 | 8.9 | % | |||||||||

| Seasonal | 9.0 | 6.9 | 30.6 | % | 34.0 | 22.1 | 54.1 | % | |||||||||||||

| Transient | 21.0 | 22.4 | (6.6 | )% | 37.0 | 35.7 | 3.7 | % | |||||||||||||

| Total Seasonal and Transient | $ | 30.0 | $ | 29.3 | 2.4 | % | $ | 71.0 | $ | 57.8 | 22.8 | % | |||||||||

| Total RV and marina base rental income | $ | 87.4 | $ | 81.9 | 6.6 | % | $ | 183.8 | $ | 161.4 | 13.9 | % | |||||||||

| Core utility information: | |||||||||||||||||||||

| Income | $ | 14.7 | $ | 13.4 | 9.7 | % | $ | 30.2 | $ | 26.9 | 12.3 | % | |||||||||

| Expense | 33.7 | 30.9 | 9.1 | % | 67.3 | 59.9 | 12.4 | % | |||||||||||||

| Expense, net | $ | 19.0 | $ | 17.5 | 8.6 | % | $ | 37.1 | $ | 33.0 | 12.4 | % | |||||||||

| Utility Recovery Rate (7) | 43.6 | % | 43.4 | % | 44.9 | % | 44.9 | % | |||||||||||||

_____________________

| 1. | Excludes property management and the GAAP deferral of membership upgrades sales upfront payments and membership sales commissions, net. |

| 2. | Calculations prepared using actual results without rounding. |

| 3. | Includes bad debt expense for the periods presented. |

| 4. | Occupied sites are presented as of the end of the period. Occupied sites have increased by 97 from 68,895 at December 31, 2021. |

| 5. | The decrease in the occupancy rate for the six months ended June 30, 2022 is due to the addition of expansion sites. |

| 6. | Core Annual marina base rental income represents approximately 99% of the total Core marina base rental income for all periods presented. |

| 7. | Calculated by dividing the utility income by utility expense. |

| Non-Core Income from Property Operations (1) |

| (In millions, unaudited) | |||||||

| Quarter Ended | Six Months Ended | ||||||

| June 30, 2022 | June 30, 2022 | ||||||

| MH base rental income | $ | 2.9 | $ | 5.8 | |||

| RV and marina base rental income | 10.9 | 23.3 | |||||

| Annual membership subscriptions | 0.2 | 0.3 | |||||

| Utility and other income | 3.7 | 7.4 | |||||

| Membership upgrade sales current period, gross | 0.3 | 0.3 | |||||

| Property operating revenues | 18.0 | 37.1 | |||||

| Property operating expenses (2) | 9.8 | 18.5 | |||||

| Income from property operations, excluding deferrals and property management (1) | $ | 8.2 | $ | 18.6 | |||

______________________

| 1. | Excludes property management and the GAAP deferral of membership upgrade sales upfront payments and membership sales commissions, net. |

| 2. | Includes bad debt expense for the period presented. |

| Income from Rental Home Operations |

| (In millions, except occupied rentals, unaudited) | |||||||||||||||

| Quarters Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Manufactured homes: | |||||||||||||||

| Rental operations revenues (1) | $ | 10.9 | $ | 12.4 | $ | 22.2 | $ | 24.8 | |||||||

| Rental home operations expense (2) | 1.2 | 1.3 | 2.6 | 2.5 | |||||||||||

| Income from rental home operations | 9.7 | 11.1 | 19.6 | 22.3 | |||||||||||

| Depreciation on rental homes (3) | 2.5 | 2.7 | 5.0 | 5.3 | |||||||||||

| Income from rental operations, net of depreciation | $ | 7.2 | $ | 8.4 | $ | 14.6 | $ | 17.0 | |||||||

| Occupied rentals: (4) | |||||||||||||||

| New | 2,742 | 3,305 | |||||||||||||

| Used | 375 | 491 | |||||||||||||

| Total occupied rental sites | 3,117 | 3,796 | |||||||||||||

| As of June 30, 2022 | As of June 30, 2021 | ||||||||||||||

| Cost basis in rental homes: (5) | Gross | Net of Depreciation |

Gross | Net of Depreciation |

|||||||||||

| New | $ | 221.3 | $ | 184.1 | $ | 230.8 | $ | 196.5 | |||||||

| Used | 14.6 | 6.1 | 17.8 | 11.7 | |||||||||||

| Total rental homes | $ | 235.9 | $ | 190.2 | $ | 248.6 | $ | 208.2 | |||||||

______________________

| 1. | For the quarters ended June 30, 2022 and 2021, approximately $7.1 million and $8.1 million, respectively, of the rental operations revenue is included in the MH base rental income in the Core Income from Property Operations on page 11. The remainder of the rental operations revenue is included in Rental home income for the quarters ended June 30, 2022 and 2021 in the Core Income from Property Operations on page 11. |

| 2. | Rental home operations expense is included in Property operating, maintenance and real estate taxes in the Consolidated Income from Property Operations on page 10. Rental home operations expense is included in Insurance and other in the Core Income from Property Operations on page 11. |

| 3. | Depreciation on rental homes in our Core portfolio is presented in Depreciation and amortization in the Consolidated Statements of Income on page 6. |

| 4. | Occupied rentals as of the end of the period in our Core portfolio. Included in the quarters ended June 30, 2022 and 2021 were 185 and 282 homes rented through ECHO Financing LLC (“ECHO joint venture”), respectively. As of June 30, 2022 and 2021, the rental home investment associated with the ECHO joint venture totaled approximately $7.1 million and $11.1 million, respectively. |

| 5. | Includes both occupied and unoccupied rental homes in our Core portfolio. New home cost basis does not include the costs associated with our ECHO joint venture. As of June 30, 2022 and 2021, our investment in the ECHO joint venture was approximately $18.7 million and $17.7 million, respectively. |

| Total Sites and Home Sales |

| (In thousands, except sites and home sale volumes, unaudited) | ||

| Summary of Total Sites as of June 30, 2022 | ||

| Sites (1) | ||

| MH sites | 73,400 | |

| RV sites: | ||

| Annual | 34,200 | |

| Seasonal | 12,700 | |

| Transient | 14,900 | |

| Marina slips | 6,900 | |

| Membership (2) | 25,800 | |

| Joint Ventures (3) | 3,000 | |

| Total | 170,900 | |

| Home Sales – Select Data | |||||||||||||||

| Quarters Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Total New Home Sales Volume (4) | 365 | 295 | 626 | 487 | |||||||||||

| New Home Sales Volume – ECHO joint venture | 29 | 16 | 51 | 24 | |||||||||||

| New Home Sales Gross Revenues (4) | $ | 33,848 | $ | 23,320 | $ | 59,378 | $ | 37,658 | |||||||

| Total Used Home Sales Volume | 97 | 108 | 169 | 210 | |||||||||||

| Used Home Sales Gross Revenues | $ | 1,367 | $ | 1,107 | $ | 2,365 | $ | 1,989 | |||||||

| Brokered Home Resales Volume | 263 | 212 | 451 | 372 | |||||||||||

| Brokered Home Resales Gross Revenues | $ | 1,049 | $ | 588 | $ | 1,660 | $ | 1,020 | |||||||

______________________

| 1. | MH sites are generally leased on an annual basis to residents who own or lease factory-built homes, including manufactured homes. Annual RV and marina sites are leased on an annual basis to customers who generally have an RV, factory-built cottage, boat or other unit placed on the site, including those Northern properties that are open for the summer season. Seasonal RV and marina sites are leased to customers generally for one to six months. Transient RV and marina sites are leased to customers on a short-term basis. |

| 2. | Sites primarily utilized by approximately 131,000 members. Includes approximately 6,300 sites rented on an annual basis. |

| 3. | Joint ventures have approximately 1,800 annual Sites and 1,200 transient Sites. |

| 4. | Total new home sales volume includes home sales from our ECHO joint venture. New home sales gross revenues does not include the revenues associated with the ECHO joint venture. |

| Memberships – Select Data |

| (Unaudited) | ||||||||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | Six Months Ended June 30, 2022 (1) |

||||||||||||||||

| Member Count (2) | 111,094 | 115,680 | 116,169 | 125,149 | 131,049 | |||||||||||||||

| Thousand Trails Camping Pass (TTC) Origination | 37,528 | 41,484 | 44,129 | 50,523 | 27,157 | |||||||||||||||

| TTC Sales | 17,194 | 19,267 | 20,587 | 23,923 | 12,284 | |||||||||||||||

| RV Dealer TTC Activations | 20,334 | 22,217 | 23,542 | 26,600 | 14,873 | |||||||||||||||

| Number of annuals (3) | 5,888 | 5,938 | 5,986 | 6,320 | 6,341 | |||||||||||||||

| Number of upgrade sales (4) | 2,500 | 2,919 | 3,373 | 4,863 | 1,969 | |||||||||||||||

| (In thousands, unaudited) | ||||||||||||||||||||

| Annual membership subscriptions | $ | 47,778 | $ | 51,015 | $ | 53,085 | $ | 58,251 | $ | 30,749 | ||||||||||

| RV base rental income from annuals | $ | 18,363 | $ | 19,634 | $ | 20,761 | $ | 23,127 | $ | 12,388 | ||||||||||

| RV base rental income from seasonals/transients | $ | 19,840 | $ | 20,181 | $ | 18,126 | $ | 25,562 | $ | 10,867 | ||||||||||

| Membership upgrade sales current period, gross | $ | 15,191 | $ | 19,111 | $ | 21,739 | $ | 36,270 | $ | 16,686 | ||||||||||

| Utility and other income | $ | 2,410 | $ | 2,422 | $ | 2,426 | $ | 2,735 | $ | 1,093 | ||||||||||

______________________

| 1. | Activity through June 30, 2022. |

| 2. | Members have entered into annual subscriptions with us that entitle them to use certain properties on a continuous basis for up to 21 days. |

| 3. | Members who rent a specific site for an entire year in connection with their membership subscriptions. |

| 4. | Existing members who have upgraded memberships are eligible for enhanced benefits, including but not limited to longer stays, the ability to make earlier reservations, potential discounts on rental units, and potential access to additional properties. Upgrades require a non-refundable upfront payment. |

| Market Capitalization |

| (In millions, except share and OP Unit data, unaudited) | |||||||||||||||||

| Capital Structure as of June 30, 2022 | |||||||||||||||||

| Total Common Shares/Units |

% of Total Common Shares/Units |

Total | % of Total | % of Total Market Capitalization |

|||||||||||||

| Secured Debt | $ | 2,750 | 83.4 | % | |||||||||||||

| Unsecured Debt | 548 | 16.6 | % | ||||||||||||||

| Total Debt (1) | $ | 3,298 | 100.0 | % | 19.3 | % | |||||||||||

| Common Shares | 186,076,327 | 95.2 | % | ||||||||||||||

| OP Units | 9,297,011 | 4.8 | % | ||||||||||||||

| Total Common Shares and OP Units | 195,373,338 | 100.0 | % | ||||||||||||||

| Common Stock price at June 30, 2022 | $ | 70.47 | |||||||||||||||

| Fair Value of Common Shares and OP Units | $ | 13,768 | 100.0 | % | |||||||||||||

| Total Equity | $ | 13,768 | 100.0 | % | 80.7 | % | |||||||||||

| Total Market Capitalization | $ | 17,066 | 100.0 | % | |||||||||||||

______________________

| 1. | Excludes deferred financing costs of approximately $29.8 million. |

| Debt Maturity Schedule |

| Debt Maturity Schedule as of June 30, 2022 (In thousands, unaudited) |

|||||||||||||||||||||||||

| Year | Secured Debt |

Weighted Average Interest Rate |

Unsecured Debt (1) |

Weighted Average Interest Rate |

Total Debt | % of Total Debt |

Weighted Average Interest Rate |

||||||||||||||||||

| 2022 | $ | — | — | % | $ | — | — | % | $ | — | — | % | — | % | |||||||||||

| 2023 | 94,355 | 4.94 | % | — | — | % | 94,355 | 2.90 | % | 4.94 | % | ||||||||||||||

| 2024 | 10,116 | 5.49 | % | — | — | % | 10,116 | 0.31 | % | 5.49 | % | ||||||||||||||

| 2025 | 94,538 | 3.45 | % | — | — | % | 94,538 | 2.91 | % | 3.45 | % | ||||||||||||||

| 2026 | — | — | % | 300,000 | 1.79 | % | 300,000 | 9.23 | % | 1.79 | % | ||||||||||||||

| 2027 | — | — | % | 200,000 | 2.01 | % | 200,000 | 6.15 | % | 2.01 | % | ||||||||||||||

| 2028 | 209,675 | 4.19 | % | — | — | % | 209,675 | 6.45 | % | 4.19 | % | ||||||||||||||

| 2029 | 39,727 | 4.10 | % | — | — | % | 39,727 | 1.22 | % | 4.10 | % | ||||||||||||||

| 2030 | 275,385 | 2.69 | % | — | — | % | 275,385 | 8.47 | % | 2.69 | % | ||||||||||||||

| 2031 | 263,642 | 2.46 | % | — | — | % | 263,642 | 8.11 | % | 2.46 | % | ||||||||||||||

| Thereafter | 1,762,573 | 3.77 | % | — | — | % | 1,762,573 | 54.23 | % | 3.77 | % | ||||||||||||||

| Total | $ | 2,750,011 | 3.61 | % | $ | 500,000 | 1.88 | % | $ | 3,250,011 | 100.0 | % | 3.34 | % | |||||||||||

| Unsecured Line of Credit | — | 47,800 | 47,800 | ||||||||||||||||||||||

| Note Premiums | 213 | — | 213 | ||||||||||||||||||||||

| Total Debt | 2,750,224 | 547,800 | 3,298,024 | ||||||||||||||||||||||

| Deferred Financing Costs | (26,185 | ) | (3,627 | ) | (29,812 | ) | |||||||||||||||||||

| Total Debt, net | $ | 2,724,039 | $ | 544,173 | $ | 3,268,212 | 3.48 | % | (1) | ||||||||||||||||

| Average Years to Maturity | 11.7 | 4.1 | 10.4 | ||||||||||||||||||||||

______________________

| 1. | Reflects effective interest rate for the quarter ended June 30, 2022, including interest associated with the line of credit and amortization of note premiums and deferred financing costs. |

| Non-GAAP Financial Measures Definitions and Reconciliations |

FUNDS FROM OPERATIONS (FFO). We define FFO as net income, computed in accordance with GAAP, excluding gains or losses from sales of properties, depreciation and amortization related to real estate, impairment charges and adjustments to reflect our share of FFO of unconsolidated joint ventures. Adjustments for unconsolidated joint ventures are calculated to reflect FFO on the same basis. We compute FFO in accordance with our interpretation of standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. We receive non-refundable upfront payments from membership upgrade contracts. In accordance with GAAP, the non-refundable upfront payments and related commissions are deferred and amortized over the estimated membership upgrade contract term. Although the NAREIT definition of FFO does not address the treatment of non-refundable upfront payments, we believe that it is appropriate to adjust for the impact of the deferral activity in our calculation of FFO.

We believe FFO, as defined by the Board of Governors of NAREIT, is generally a measure of performance for an equity REIT. While FFO is a relevant and widely used measure of operating performance for equity REITs, it does not represent cash flow from operations or net income as defined by GAAP, and it should not be considered as an alternative to these indicators in evaluating liquidity or operating performance.

NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO). We define Normalized FFO as FFO excluding non-operating income and expense items, such as gains and losses from early debt extinguishment, including prepayment penalties and defeasance costs, transaction/pursuit costs, and other miscellaneous non-comparable items. Normalized FFO presented herein is not necessarily comparable to Normalized FFO presented by other real estate companies due to the fact that not all real estate companies use the same methodology for computing this amount.

FUNDS AVAILABLE FOR DISTRIBUTION (FAD). We define FAD as Normalized FFO less non-revenue producing capital expenditures.

We believe that FFO, Normalized FFO and FAD are helpful to investors as supplemental measures of the performance of an equity REIT. We believe that by excluding the effect of gains or losses from sales of properties, depreciation and amortization related to real estate and impairment charges, which are based on historical costs and may be of limited relevance in evaluating current performance, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. We further believe that Normalized FFO provides useful information to investors, analysts and our management because it allows them to compare our operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences not related to our operations. For example, we believe that excluding the early extinguishment of debt and other miscellaneous non-comparable items from FFO allows investors, analysts and our management to assess the sustainability of operating performance in future periods because these costs do not affect the future operations of the properties. In some cases, we provide information about identified non-cash components of FFO and Normalized FFO because it allows investors, analysts and our management to assess the impact of those items.

INCOME FROM PROPERTY OPERATIONS, EXCLUDING DEFERRALS AND PROPERTY MANAGEMENT. We define Income from property operations, excluding deferrals and property management as rental income, membership subscriptions and upgrade sales, utility and other income less property and rental home operating and maintenance expenses, real estate taxes, sales and marketing expenses, excluding property management and the GAAP deferral of membership upgrade sales upfront payments and membership sales commissions, net. For comparative purposes, we present bad debt expense within Property operating, maintenance and real estate taxes in the current and prior periods. We believe that this Non-GAAP financial measure is helpful to investors and analysts as a measure of the operating results of our properties.

The following table reconciles Net income available for Common Stockholders to Income from property operations:

| Quarters Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (amounts in thousands) | 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Net income available for Common Stockholders | $ | 61,509 | $ | 61,051 | $ | 144,415 | $ | 126,291 | ||||||||

| Redeemable perpetual preferred stock dividends | 8 | 8 | 8 | 8 | ||||||||||||

| Income allocated to non-controlling interests – Common OP Units | 3,073 | 3,021 | 7,217 | 6,768 | ||||||||||||

| Equity in income of unconsolidated joint ventures | (1,253 | ) | (1,068 | ) | (1,424 | ) | (1,936 | ) | ||||||||

| Income before equity in income of unconsolidated joint ventures | 63,337 | 63,012 | 150,216 | 131,131 | ||||||||||||

| Loss on sale of real estate, net | — | — | — | 59 | ||||||||||||

| Membership upgrade sales upfront payments, deferred, net | 6,367 | 6,454 | 10,451 | 13,881 | ||||||||||||

| Gross revenues from home sales, brokered resales and ancillary services (1) | (52,681 | ) | (40,237 | ) | (92,390 | ) | (65,478 | ) | ||||||||

| Interest income | (1,722 | ) | (1,742 | ) | (3,481 | ) | (3,509 | ) | ||||||||

| Income from other investments, net | (2,617 | ) | (1,222 | ) | (4,521 | ) | (2,158 | ) | ||||||||

| Membership sales commissions, deferred, net | (957 | ) | (1,438 | ) | (1,540 | ) | (2,937 | ) | ||||||||

| Property management | 19,099 | 16,560 | 36,970 | 31,940 | ||||||||||||

| Depreciation and amortization | 50,796 | 48,316 | 100,190 | 93,714 | ||||||||||||

| Cost of home sales, brokered resales and ancillary services (1) | 40,971 | 31,793 | 71,670 | 50,710 | ||||||||||||

| Home selling expenses and ancillary operating expenses | 7,584 | 6,090 | 14,066 | 11,031 | ||||||||||||

| General and administrative | 11,695 | 10,228 | 23,992 | 20,740 | ||||||||||||

| Other expenses | 4,189 | 800 | 5,009 | 1,498 | ||||||||||||

| Early debt retirement | 640 | 755 | 1,156 | 2,784 | ||||||||||||

| Interest and related amortization | 28,053 | 27,131 | 55,517 | 53,406 | ||||||||||||

| Income from property operations, excluding deferrals and property management | 174,754 | 166,500 | 367,305 | 336,812 | ||||||||||||

| Membership upgrade sales upfront payments, and membership sales commissions, deferred, net | (5,410 | ) | (5,016 | ) | (8,911 | ) | (10,944 | ) | ||||||||

| Property management | (19,099 | ) | (16,560 | ) | (36,970 | ) | (31,940 | ) | ||||||||

| Income from property operations | $ | 150,245 | $ | 144,924 | $ | 321,424 | $ | 293,928 | ||||||||

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE (EBITDAre) AND ADJUSTED EBITDAre. We define EBITDAre as net income or loss excluding interest income and expense, income taxes, depreciation and amortization, gains or losses from sales of properties, impairments charges, and adjustments to reflect our share of EBITDAre of unconsolidated joint ventures. We compute EBITDAre in accordance with our interpretation of the standards established by NAREIT, which may not be comparable to EBITDAre reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. We receive non-refundable upfront payments from membership upgrade contracts. In accordance with GAAP, the non-refundable upfront payments and related commissions are deferred and amortized over the estimated customer life. Although the NAREIT definition of EBITDAre does not address the treatment of non-refundable upfront payments, we believe that it is appropriate to adjust for the impact of the deferral activity in our calculation of EBITDAre.

We define Adjusted EBITDAre as EBITDAre excluding non-operating income and expense items, such as gains and losses from early debt extinguishment, including prepayment penalties and defeasance costs, transaction/pursuit costs and other miscellaneous non-comparable items.

We believe that EBITDAre and Adjusted EBITDAre may be useful to an investor in evaluating our operating performance and liquidity because the measures are widely used to measure the operating performance of an equity REIT.

______________________

| 1. | Prior period amounts have been reclassified to conform to the current period presentation. |

The following table reconciles Consolidated net income to EBITDAre and Adjusted EBITDAre:

| Quarters Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (amounts in thousands) | 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Consolidated net income | $ | 64,590 | $ | 64,080 | $ | 151,640 | $ | 133,067 | ||||||||

| Interest income | (1,722 | ) | (1,742 | ) | (3,481 | ) | (3,509 | ) | ||||||||

| Membership upgrade sales upfront payments, deferred, net | 6,367 | 6,454 | 10,451 | 13,881 | ||||||||||||

| Membership sales commissions, deferred, net | (957 | ) | (1,438 | ) | (1,540 | ) | (2,937 | ) | ||||||||

| Real estate depreciation and amortization | 50,796 | 48,316 | 100,190 | 93,714 | ||||||||||||

| Other depreciation and amortization | 1,119 | 740 | 1,946 | 1,444 | ||||||||||||

| Interest and related amortization | 28,053 | 27,131 | 55,517 | 53,406 | ||||||||||||

| Loss on sale of real estate, net | — | — | — | 59 | ||||||||||||

| Adjustments to our share of EBITDAre of unconsolidated joint ventures | 1,361 | 273 | 2,817 | 519 | ||||||||||||

| EBITDAre | 149,607 | 143,814 | 317,540 | 289,644 | ||||||||||||

| Early debt retirement | 640 | 755 | 1,156 | 2,784 | ||||||||||||

| Transaction/pursuit costs (1) | 3,082 | — | 3,082 | — | ||||||||||||

| Adjusted EBITDAre | $ | 153,329 | $ | 144,569 | $ | 321,778 | $ | 292,428 | ||||||||

CORE. The Core properties include properties we owned and operated during all of 2021 and 2022. We believe Core is a measure that is useful to investors for annual comparison as it removes the fluctuations associated with acquisitions, dispositions and significant transactions or unique situations.

NON-CORE. The Non-Core properties include properties that were not owned and operated during all of 2021 and 2022. This includes, but is not limited to, six RV communities and eleven marinas acquired during 2021, one membership RV community and three RV communities acquired during 2022 and our Westwinds MH community and Nicholson Plaza.

INCOME FROM RENTAL OPERATIONS, NET OF DEPRECIATION. We use Income from rental operations, net of depreciation as an alternative measure to evaluate the operating results of our home rental program. Income from rental operations, net of depreciation, represents income from rental operations less depreciation expense on rental homes. We believe this measure is meaningful for investors as it provides a complete picture of the home rental program operating results, including the impact of depreciation, which affects our home rental program investment decisions.

NON-REVENUE PRODUCING IMPROVEMENTS. Represents capital expenditures that do not directly result in increased revenue or expense savings and are primarily comprised of common area improvements, furniture and mechanical improvements.

FIXED CHARGES. Fixed charges consist of interest expense, amortization of note premiums and debt issuance costs.

______________________

| 1. | Represents transaction/pursuit costs related to unconsummated acquisitions included in Other expenses in the Consolidated Statements of Income on page 6. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220717005073/en/

Paul Seavey

(800) 247-5279

Source: Equity LifeStyle Properties, Inc. ##

The transcript via Seeking Alpha for the ELS earnings call is posted below, and the audio recording of that call with transcript is found at this link here. Typos are in the original, but the highlighting is added by MHProNews for emphasis on specific topics of interest.

Equity LifeStyle Properties, Inc.’s (ELS) CEO Marguerite Nader on Q2 2022 Results – Earnings Call Transcript

Jul. 19, 2022 5:51 PM ET Equity LifeStyle Properties, Inc. (ELS)

Company Participants

Marguerite Nader – President & Chief Executive Officer

Paul Seavey – Executive Vice President & Chief Financial Officer

Patrick Waite – Executive Vice President & Chief Operating Officer

Conference Call Participants

Keegan Carl – Berenberg

Lizzy Doykan – Bank of America

Samir Khanal – Evercore ISI

David Toti – Colliers

Brad Heffern – RBC

Wes Golladay – Baird

John Pawlowski – Green Street

Anthony Hau – Truist

Anthony Powell – Barclays

Nick Joseph – Citi

Michael Bilerman – Citi

Michael Goldsmith – UBS

Operator

Good day, everyone, and thank you for joining us to discuss Equity LifeStyle Properties’ Second Quarter 2022 Results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO. In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the company’s earnings release. [Operator Instructions] As a reminder, this call is being recorded.

Certain matters discussed during this conference call may contain forward-looking statements in the meanings of the federal securities laws. Our forward-looking statements are subject to certain economic risks and uncertainties. The company assumes no obligation to update or supplement any statements that become untrue because of subsequent events. In addition, during today’s call, we will discuss non-GAAP financial measures as defined by the SEC Regulation G. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are included in our earnings release, our supplement information and our historical SEC filings.

At this time, I’d like to turn the call over to Marguerite Nader, our President and CEO.

Marguerite Nader

Good morning and thank you for joining us today. I am pleased to report the results for the second quarter of 2022.

We continued our record of strong core operations and FFO growth with a 4.5% growth in normalized FFO per share in the quarter and a 9.3% growth year-to-date. We have often discussed the quality of our portfolio and our cash flow. Over the years, our acquisition strategy has been focused on the quality of cash flow from property operations and buying in locations with long-term positive demographic trends. We see high demand for our key locations with our customers expressing a desire to stay with us on a longer-term basis.

Our residents and customers see the benefit of an increased commitment to us from a quality of life standpoint. We are well-positioned and benefited from an influx of resident and customer interest into our key states of Florida, Arizona and California. Our strong top line performance, coupled with disciplined operating practices, resulted in continued strength and growth in normalized FFO per share.

The revenue from our MH communities represents 60% of our revenue. We have seen a heightened increase in leads and interest in our locations over the past two years. Over the last two years, Florida has seen outsized population growth. Our customers are attracted to the Sun Belt climates. They are taking advantage of the added flexibility in their schedules as well as technology to accelerate the move from their northern location.

Our portfolio is well-positioned to take advantage of this key demographic movement. Continued evidence of the demand for our product offerings is seen in our new home sales results. During the quarter, our new home sales increased 24%. We sold 365 new homes in the quarter, which was a high watermark for ELS. The primary driver of the new home sales volume increase was our Florida MH sales program, where we saw an increase in the volume of 60%.

Over 95% of these new homebuyers were cash buyers. This investment is consistent with our entire portfolio as the vast majority of our residents have made a capital commitment to live in our community. That commitment from our homeowners results in a pride of ownership and a long-term resident base.

Core RV and marina revenue produced strong results with an increase of 6.6% in the quarter. The primary driver of this increase was the strength of our annual revenue stream which increased by over 9%. Our market surveys provide support for an increase in market rates and we saw an increase in conversions from transient and seasonal guests.

Our transient and seasonal revenue grew by 2.4%. We saw a strong pickup in seasonal revenue demand. Roughly half of the increase in seasonal demand was from our Florida customers who extended their stays in April due to the continued difficult weather conditions in the north. The transient revenue decline was impacted as well by the difficult weather in April and May in key locations. Strong demand for longer-term stays has reduced the number of available transient sites across our portfolio. We were able to increase the rate on the transient sites to combat some of the weather-related declines.

Our operating teams have done a great job keeping up with a high demand for our properties. In June, TripAdvisor announced that 63 of our properties received Travelers’ Choice Awards and 23 of those properties are in the Hall of Fame since they have received the award for five or more consecutive years. Our ELS team members are dedicated to exceeding the needs of our customers. They have done a great job delivering excellent customer service and have continued to focus on safety for our customers, guests and employees.

I will now turn it over to Paul to walk through the numbers in detail.

Paul Seavey

Thank you, Marguerite. Good morning, everyone. I will review our results for the second quarter and June year-to-date, highlight our guidance assumptions for the third quarter and full year 2022 and discuss debt market conditions as well as our balance sheet.

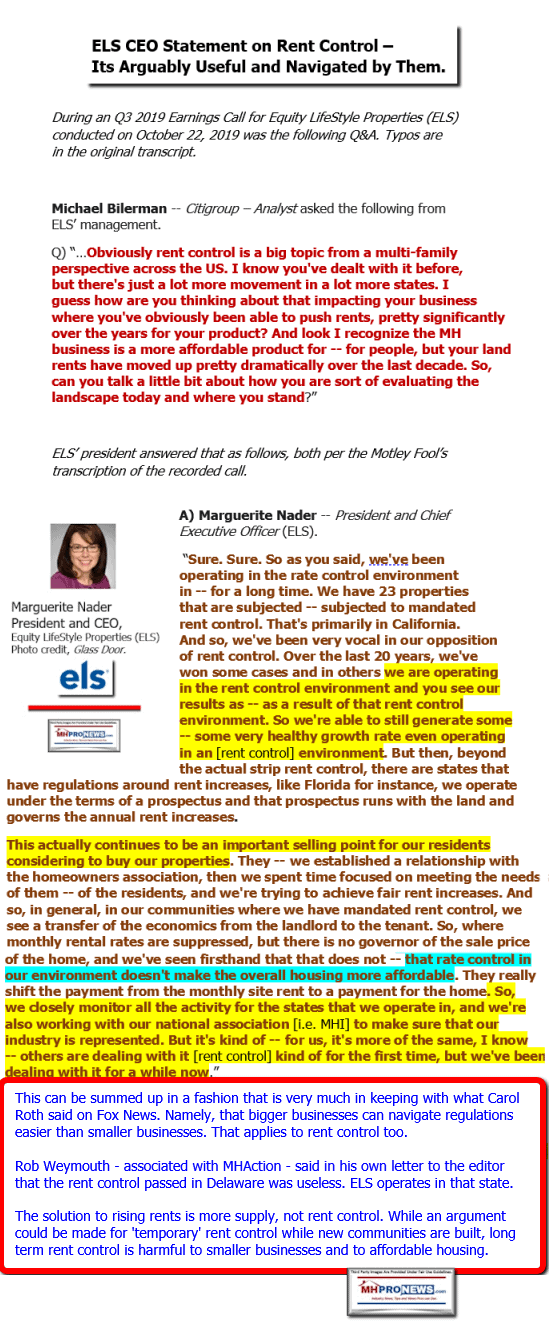

For the second quarter, we reported $0.64 normalized FFO per share. Core and noncore property operations delivered the strong results we expected, while home sales volumes and profits exceeded our expectations in the quarter. Our second quarter core MH rent growth of 5.7% consists of approximately 5.3% rate growth and 40 basis points related to occupancy gains when compared to the same period last year. We have increased occupancy in 97 sites since December with an increase in owners of 443 while renters decreased by 346.

Core RV and marina base rental income increased 6.6% in the second quarter and 13.9% year-to-date compared to prior year. Base rental income from annuals represents more than 60% of total RV and marina based rental income and it increased approximately 9% for the second quarter and year-to-date periods compared to last year. Annual RV rate increases generated approximately 6.4% growth in the year-to-date period, with occupancy contributing close to 300 basis points of growth.

Our guidance for the second quarter included a range of growth rates for combined seasonal and transient rents was 4% at the midpoint of the range. The actual results for the second quarter was 2.4% growth, a variance of approximately $500,000. Demand for extended stays resulted in better-than-expected seasonal rental income during the quarter and offset to lower-than-expected transient income. Year-to-date, combined seasonal and transient rent increased almost 23% compared to prior year, following recovery of our seasonal RV business during the first quarter of 2022.

Membership dues revenue increased 9.3% and 10.1% for the quarter and year-to-date, respectively, compared to the prior year. Year-to-date, we’ve sold approximately 12,300 Thousand Trails Camping pass memberships. While this represents a 9% decrease over the same period in 2021, it represents a 20% increase over membership sales in second quarter of 2019. At the end of the second quarter 2022, our member count, excluding our RV dealer free trials, was 3.6% higher than the same time last year. Also, during the quarter, members purchased approximately 1,100 upgrades at an average price of approximately $8,700.

Core utility and other income was higher than expected during the quarter as a result of utility income that offset higher-than-expected utility expense. Year-to-date, our utility recovery rate is approximately 45%, the same rate we experienced in the first six months of last year. The decrease in utility and other income in the second quarter compared to prior year is the result of $2.3 million of hurricane-related insurance proceeds that we recognized in 2021. Core property operating expense growth was 7% in the second quarter and 8.6% year-to-date. The second quarter growth rate was 60 basis points higher than the midpoint of our guidance range, a variance of approximately $800,000.

In the second quarter, utility expense, specifically electric expense, was the largest contributor to core property operating expense growth. Rate driven increases in Florida and California caused electric expense to be more than $1 million higher than last year and our guidance. The increase in repair and maintenance expense compared to last year is attributed to inflationary effects on the services of third-party contractors we engage for property maintenance and landscaping. Property payroll reflects a modest increase in the number of employees across our portfolio. The percentage growth is mainly the result of wage rate changes with some additional expense for overtime to cover open positions.

In summary, second quarter core property operating revenues increased 4.9% and core NOI before property management increased 3.3%. For the year-to-date period, core property operating revenues increased 7.2% and core NOI before property management increased 6.2%.

Income from property operations generated by our noncore portfolio was $8.2 million in the quarter and $18.6 million year-to-date. These results were in line with our expectations. Revenues generated by our recently acquired assets reflect our strategic focus on long-term revenue streams. During the year-to-date period, only 8% of our noncore property operating revenues were generated from transient rent. Property management and corporate G&A expenses were $30.8 million for the second quarter of 2022 and $61 million for the year-to-date period. Other income and expenses, excluding transaction and pursuit costs generated a net contribution of $9.4 million for the quarter.

New home sales profits, along with our ancillary retail and restaurant operations, generated approximately $4.1 million in the second quarter and $6.7 million year-to-date. Interest and related amortization expense was $28.1 million for the quarter and $55.5 million for the year-to-date period.

The press release provides an overview of third quarter and full year 2022 earnings guidance. As I provide some context for the information we’ve provided, keep in mind, my remarks are intended to provide our current estimates of future results. All growth rates and revenue and expense projections represent midpoints in our guidance range and are qualified by the risk factors included in our press release and supplemental financial information. A significant factor in our guidance assumptions for the remainder of 2022 is the level of demand for shorter-term stays in our RV communities. We have developed guidance based on current customer reservation trends. We provide no assurance that our actual results will be consistent with our guidance and we assume no obligation to update guidance as conditions change.

Our full year 2022 normalized FFO guidance is $2.73 per share at the midpoint of our range of $2.68 to $2.78. Full year normalized FFO per share at the midpoint represents an estimated 7.5% growth rate compared to 2021. We expect third quarter normalized FFO per share in the range of $0.66 to $0.72. Full year core NOI is projected to increase 6.1% at the midpoint of our guidance range of 5.6% to 6.6%. We project a core NOI growth rate range of 4.7% to 5.3% for the third quarter and expect NOI for the quarter to represent 25% of full year core NOI. Full year guidance assumes core rent rate growth in the ranges of 5.2% to 5.4% for MH and 6.2% to 6.4% for annual RV rents. Our guidance assumptions for the third and fourth quarters include MH occupancy gained in the second quarter with no assumed occupancy increase in the second half of the year. Our assumptions for expense growth reflects current expectations based on year-to-date activity and our review of property level and consolidated expense projections for the remainder of the year.

As a reminder, we make no assumptions for storm events or other uninsured property losses we may incur. The midpoints of our guidance assumptions for combined seasonal and transient show a decline of 3% in the third quarter and growth of 11.1% for the full year compared to the respective periods last year. Our guidance for the full year and third quarter includes the impact of the acquisition activity we’ve closed in the first and second quarters, with no assumptions for additional acquisitions during the year. We have repaid all debt with maturity dates in 2022. The full year guidance model makes no assumptions regarding other capital events or the use of free cash flow we expect to generate in the remainder of 2022.