CNBC, which was panned for its GOP primary debate moderation in 2015, is now playing the role of cheerleader for Hillary Clinton’s presidential hopes, saying Wall Street expects her to win over Trump in November. Trump ally, Carl Icahn watches Herbalife rise after he grew his stake, and oil is slumping again.

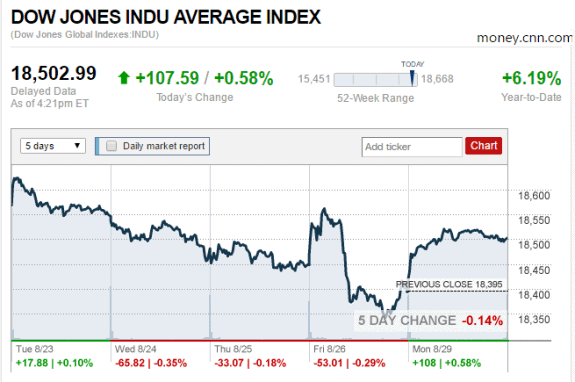

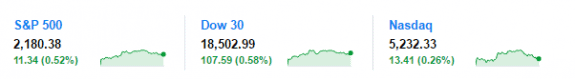

Daily Business News Market Tracker (CNBC):

| Symbol | Price | Change | %Change | |

| DJIA | 18502.99 | 107.59 | 0.58% | |

| NASDAQ | 5232.33 | 13.41 | 0.26% | |

| S&P 500 | 2180.38 | 11.34 | 0.52% |

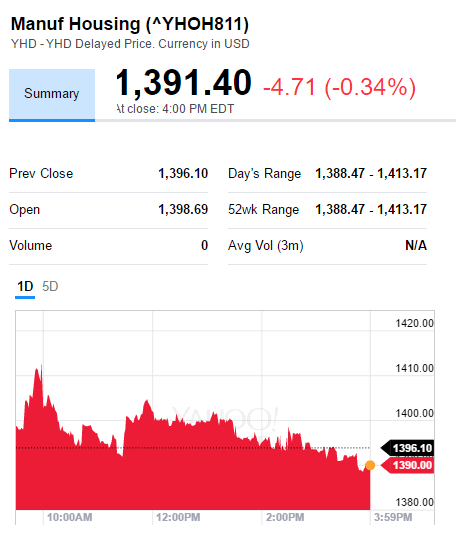

The Yahoo! Finance Manufactured Housing Composite Value (MHCV) gave back -4.71 percentage points, and finally settled at $1,391.40.

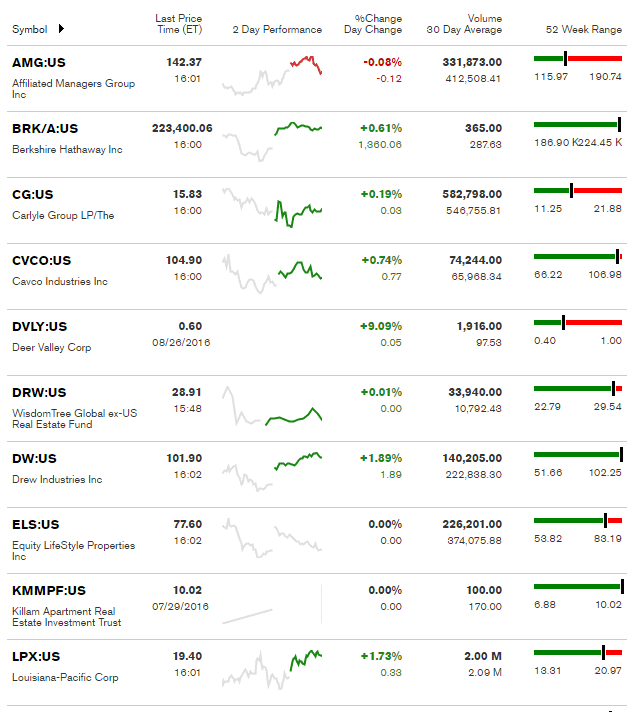

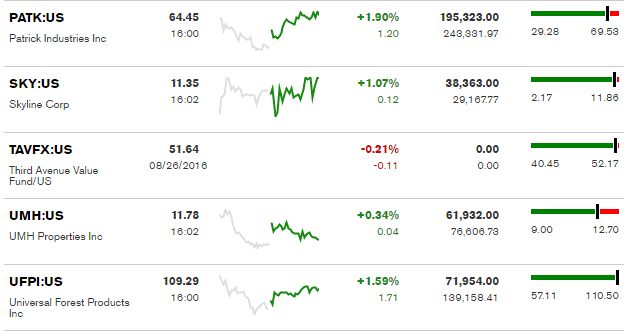

The MH-related tracked stocks biggest loser was Third Ave (TAVFX), and the biggest gainer was Patrick (PATK) with a 1.90 percent climb to close at $64.45. Cavco was featured in a weekend report, linked here, and closed up.

*Note: the chart below includes stocks not included in the MHCV

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown.)

(Editor’s Note: Matthew Silver is taking some much needed and well-earned time off, and L. A. “Tony” Kovach will be helping fill the Daily Business News role in the interim).

MH Industry Market Report by L. A. “Tony” Kovach, to the Daily Business News for MHProNews.