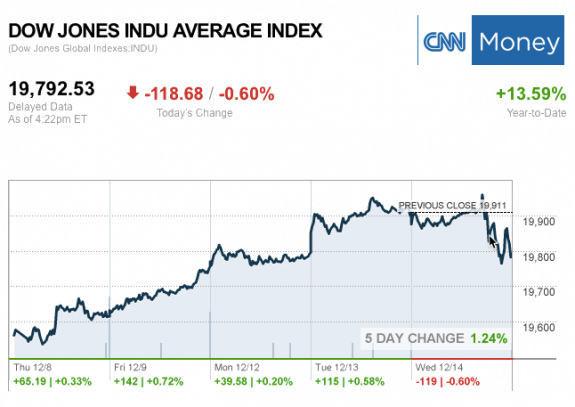

Noteworthy headlines on CNNMoney – Dow falls 119 points after Fed hikes interest rates and says 3 more increases are coming in 2017. Trump meets with top Silicon Valley execs. Japan opens door to $30B casino industry. Wells Fargo faces new trouble for its “living will.”

Some bullets from MarketWatch – Fed no longer expects labor market to get much better. S&P 500 companies would save $87.1 billion if Trump passes his tax plan. The typo that led to the politically damaging hack of Clinton ally Podesta’s emails.

Oil down 3.63%. Gold down 1.55%.

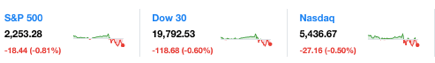

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,253.28 –18.44 (-0.81%)

Dow JIA 19,792.53 –118.68. (-0.60%).

Nasdaq 5,436.67 –27.16 (-0.50%).

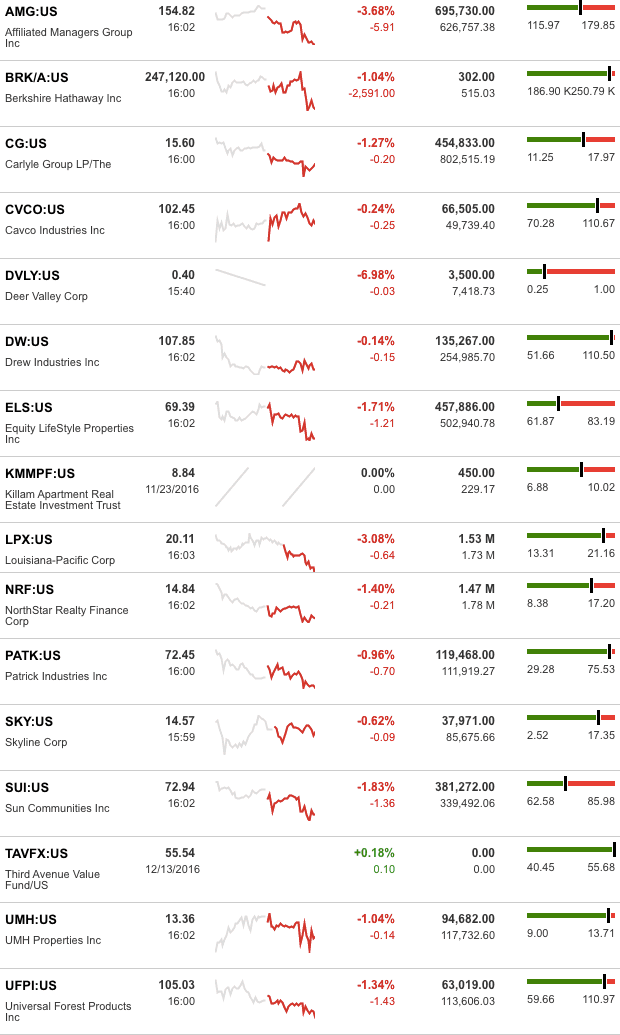

The MH Industry – Today’s Risers and Sliders

There were no gainers for the day. The top sliders for the day were Deer Valley Corp. (DVLY) and Affiliated Managers Group Inc. (AMG). Killam held steady today, as the stock is only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

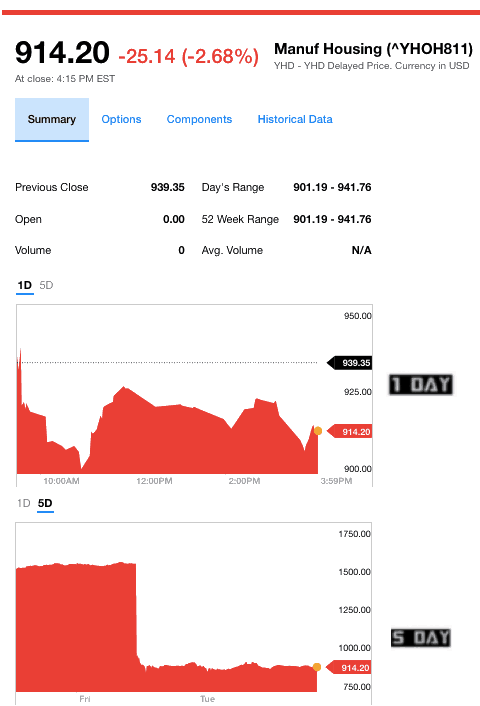

Manufactured Housing Composite Value (MHCV) Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.