“The American dream is homeownership, and the unintended effects of new regulation and lack of the secondary market by the GSEs is a path to tragically wipe out the remains of this important housing segment.”

– Kevin Clayton, remarks to Congress on behalf of the Manufactured Housing Institute (MHI) and as CEO of Berkshire Hathaway (BRK) owned Clayton Homes in hearing entitled “THE STATE OF MANUFACTURED HOUSING.”

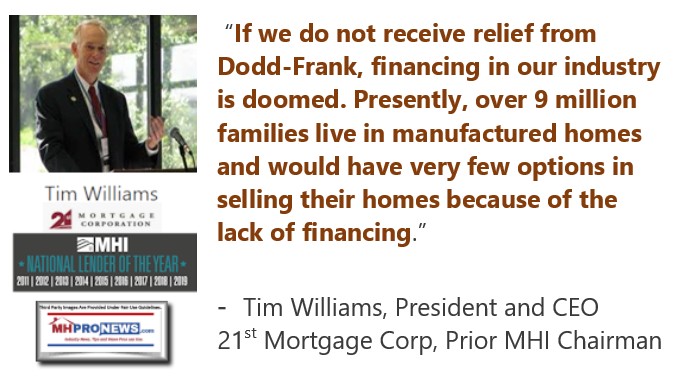

While some of Clayton’s remarks quoted above might be disputed (e.g.: “unintended effects”), the bulk of that statement might have been uttered by Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) in arguing that “new regulation and lack of the secondary market by the GSEs is a path to tragically wipe out the remains of this important housing segment.” The quote is per federal records. The full statement by Clayton to members of Congress will not be the focus of this report, but it does tee up the headline issues that follows.

Given that the environment that the manufactured housing operates in risks ‘tragically wiping out’ the manufactured home industry, Legacy Housing Corporation’s (LEGH) stock and valuation are hardly alone in being impacted by what an analyst for B.Riley described as manufactured home “industry softness.”

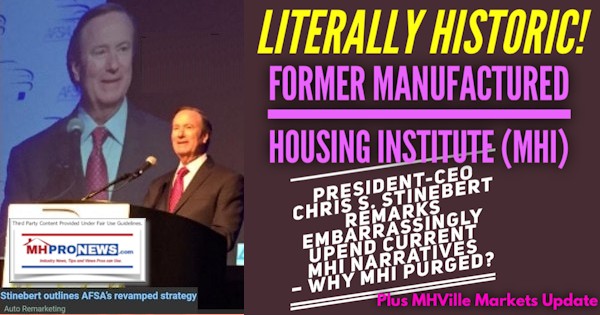

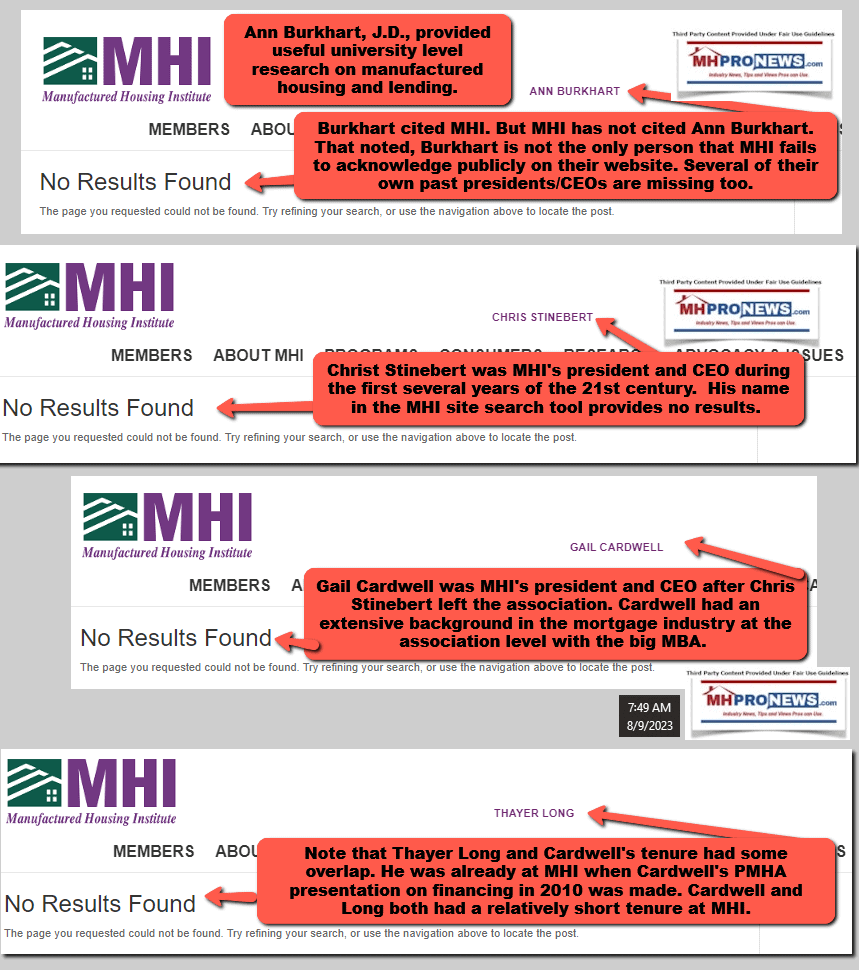

Legacy, per sources, is a member of the Manufactured Housing Institute (MHI). As those words and others by Kevin Clayton, or other MHI leaders clearly indicate, MHI has institutionally known for some 20 years what key issues are ‘holding the manufactured home industry back.’ An example now approaching two decades ago was made by MHI’s own prior president and CEO Chris Stinebert, which is cited below. Furthermore, the results of MHI commissioned and paid for research normally called by industry pros “the Roper Report” is another example approaching 2 decades ago. Isn’t some twenty years more than enough time to do something about these nagging issues? How many high-level sports team, professional or collegiate, would tolerate more than two seasons of similarly ‘tragic’ underperformance?

The impact on Legacy’s stock and projected potential valuation following a release of their quarterly and year-end data is the focus of this and another report linked further below in news report and analysis.

That noted, the B.Riley analysis is Part I of this article, which should be understood by industry readers as not being only about Legacy, but also as considering Legacy as a stand-in for other manufactured housing industry independents, be they publicly traded or not. Why?

Because as Part II will explore, the reality and perception of manufactured home “industry softness” impacts many if not most investors, business owners, employees, potential affordable housing consumers, and taxpayers. The evidence-based case can be made that this isn’t an “unintended consequence,” as Clayton said. Rather, it is arguably a feature desired by those who seeks weaknesses or “imperfections” in markets in order to exploit them. Who said? How about significant Berkshire Hathaway shareholder, William “Bill” Gates III, in remarks to mainstream media about how his buddy Warren Buffett operates?!?

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

MHProNews notes that not all investors risk their capital via publicly traded firms. So, investors in a company (privately or publicly held) are arguably impacted in this “industry softness” manufactured housing has experienced.

During an affordable housing crisis, someone informed about modern manufactured housing might think that the industry’s potential and performance should be robust. But instead, it is described – aptly so, based on the evidence – as “soft.” MHI leadership culpability will be briefly explored in this flash study.

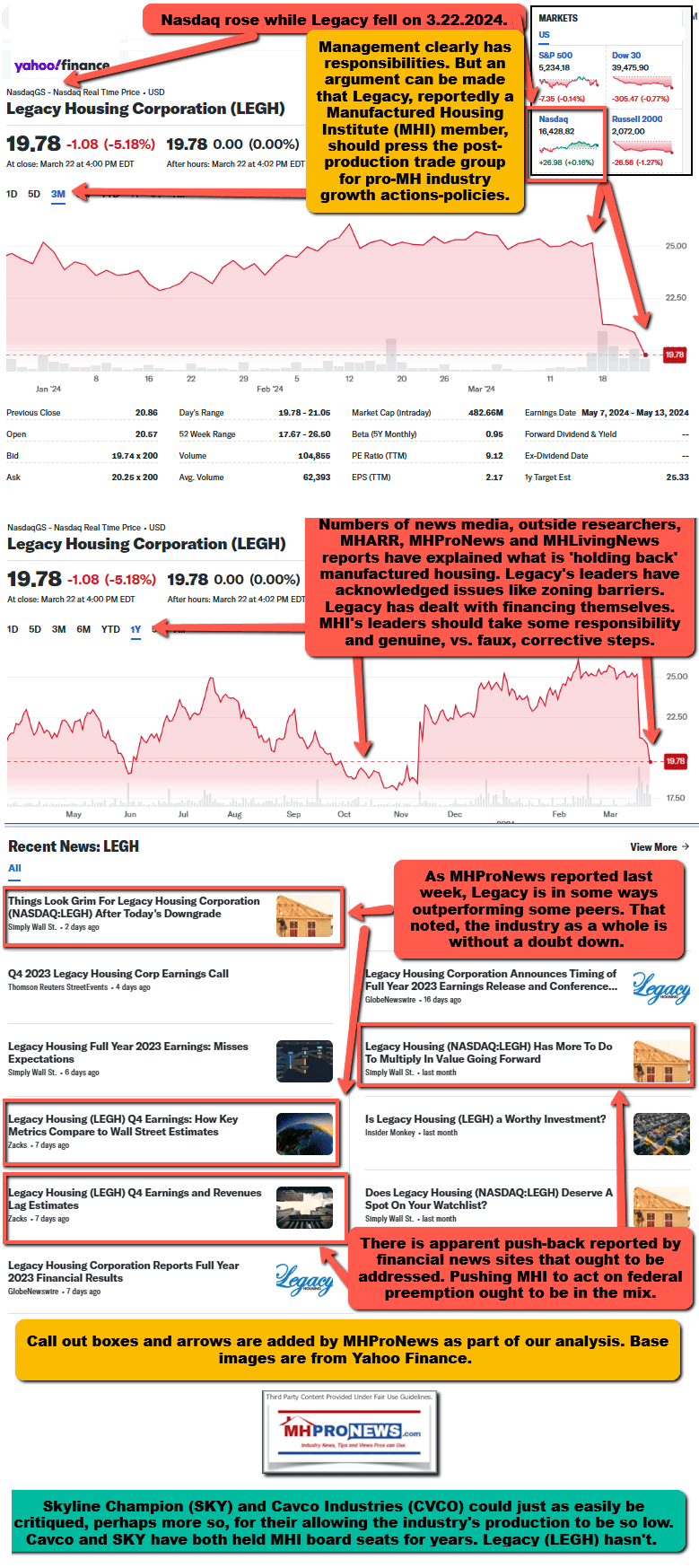

In Part I, MHProNews will next consider the facts from two mainstream financial news reports on Friday 3.21.2024, as well as a composite illustration from Yahoo Finance with MHProNews notes.

Part I

Legacy Housing Stock Price Target at B.Riley Drops on Manufactured Housing “Industry Softness”

According to the financial news site Investing.com on 3.22.2024: “On Friday, B.Riley adjusted its outlook on Legacy Housing Corp. (NASDAQ: NASDAQ:LEGH), reducing the price target to $22 from the previous $24, while keeping a Neutral stance on the stock.” Investing stated that Editor Rachael Rajan was responsible for the report. Note that because manufactured home “industry softness” has implications beyond Legacy Housing, it is a topic that merits a closer look at what B.Riley said.

Per Rajan: “The revision follows the company’s recent conference call on Saturday, March 18, where it reported fourth-quarter and full-year 2023 results, which did not meet the firm’s expectations. The analyst pointed to a significant seasonal impact in the quarter and persistent sluggishness in the manufactured housing sector as the primary reasons for the adjustment.”

According to B.Riley “Following positive commentary in November during its 3Q23 results call and expectations to increase production based on what seemed to be improving demand, the environment for manufactured homes in LEGH’s markets has become less certain,” said the analyst.

Street Insider on 3.22.2024 reported that same analyst’s quote.

“The analyst commented: “On March 18, Legacy Housing hosted a conference call to discuss its 4Q and 2023 results that were below our expectations, given a larger-than-expected seasonal impact in the quarter and the continuation of overall softness in the manufacturing housing industry. Following positive commentary in November during its 3Q23 results call and expectations to increase production based on what seemed to be improving demand, the environment for manufactured homes in LEGH’s markets has become less certain. Management expects to maintain its current production levels and build a backlog of homes in preparation for future sales. The company continues to focus on hiring salespeople, senior-level managers, and teams to focus on land development and workforce housing to accelerate various growth opportunities. The company’s loan portfolios continue to grow and generate strong interest revenue, driving higher overall margins. We are lowering our estimates for 2024, lowering our price target from $24 to $22, and reiterating our Neutral rating.”

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

As MHProNews reported last week, Legacy is in some ways outperforming some peers. That noted, the industry as a whole is without a doubt down.

There is apparent push-back reported by financial news sites that ought to be addressed. Pushing MHI to act on federal preemption ought to be in the mix.

Skyline Champion (SKY) and Cavco Industries (CVCO) could just as easily be critiqued, perhaps more so, for their allowing the industry’s production to be so low. Cavco and SKY have both held MHI board seats for years. Legacy (LEGH) hasn’t.

Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Part II – Additional Information with More MHProNews Analysis and Commentary

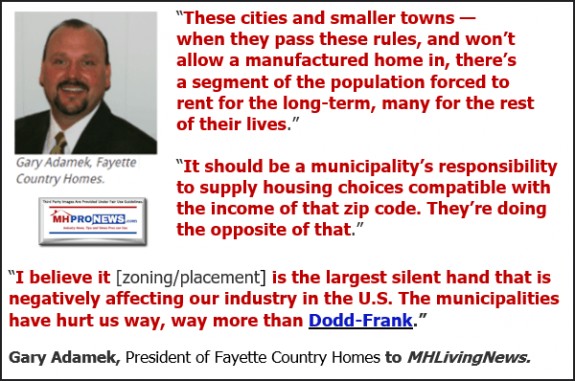

1) Company management clearly has responsibilities. That noted, an evidence-based argument can be made that Legacy, reportedly a Manufactured Housing Institute (MHI) member, should press the post-production trade group for pro-MH industry growth actions-policies.

But with or without Legacy leaders pressing for MHI to”do their d-mn jobs properly” (as one industry inside described it to MHProNews), the evidence-based case can be made that top staff and MHI board leaders legally have a fiduciary responsibility to all of their members.

2) MHI has declared itself, and bills itself, as representing the post-production and the production sectors of the manufactured housing industry. Using MHI’s own terms, they say have said for years that they represent “all segments” of the industry. Thus, that is what they are responsible for in terms of performance metrics.

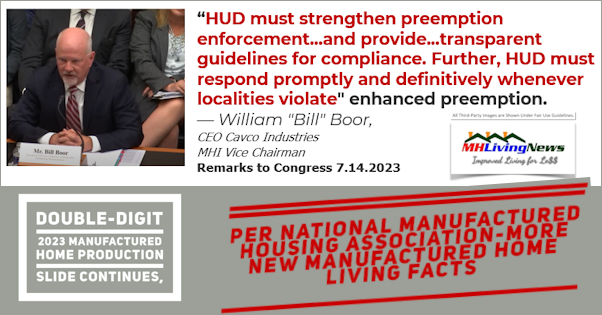

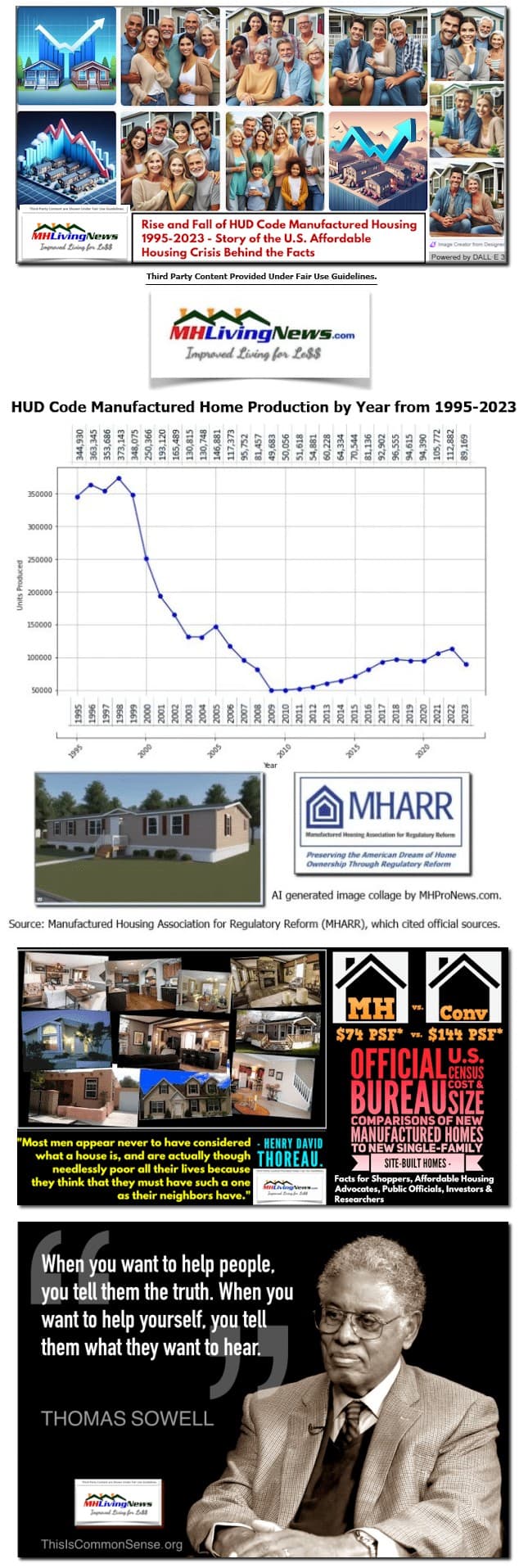

Because the Manufactured Housing Institute has promoted itself for years as representing “all segments” of the manufactured housing industry, what are the fiduciary obligations of their board members and staff leaders to all of their members? For instance, if failing to push for the full and robust enforcement of the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform Law) and its “enhanced preemption” provision is harming industry production, which production data from 1995 to 2023 clearly reflects, doesn’t MHI leadership have some level of responsibility in that scenario, given their own representation claims?

5) This doesn’t take investigative genius. Much of the initial legwork is little more than some common sense, patience, and persistence at reading evidence that MHProNews, MHLivingNews, or for that matter, MHARR have provided. Years of third-party reports have been carefully gathered and examined on our twin platforms (MHProNews/MHLivingNews). Periodic media releases and occasional op-eds submitted to others in the news business have rounded out a steady effort by MHProNews’ leadership to bring these issues to a wider audience. Several public remarks delivered live to federal officials and others round out years of efforts that include subsequently published statements with linked evidence that establishes the facts and some troubling conclusions based on those facts.

7) Given Boor’s on-the-record remarks, or Clayton’s years before, MHI leaders can’t then absurdly forget to press that federal preemption topic in every meeting with HUD officials, in every publicly comments letter, in every donation made to members of Congress via their PAC, and they should press it legally via litigation too. And perhaps most obviously, on their own blankety-blank website. No one with their self-proclaimed degrees, almost-awards for “influence,” and experience could be that stupid or inept, could they? Unless, their occasional mention of federal preemption is their fig leaf to independents who want existing federal laws robustly enforced?

8) Those building apartment buildings are not going to ‘overbuild.’ They are going to build enough units where they fill quickly and stay full. Several reports in the week in review are indicators of why conventional housing cannot and will not be able to close the affordable housing gap. MHProNews has been reporting for the past several years evidence from other media that clearly indicate that conventional housing builders are governing their own production, due in part perhaps for apparently similar reasons as multi-family housing developers.

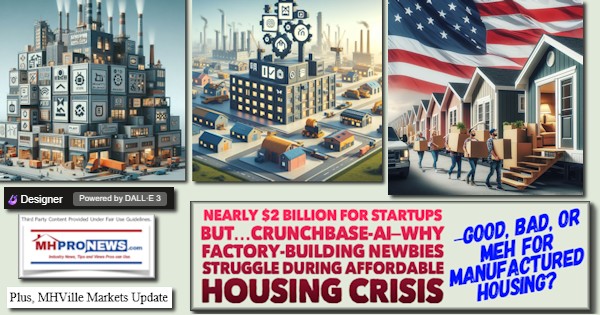

9) That report linked above indicates that despite bold plans, S2A Modular is apparently among those non-HUD Code factory-builders that attracted some $2 billion in investments yet were not able to successfully scale. By contrast, manufactured housing successfully scaled decades ago.

10) There are times when it pays to ask questions directly of the source. There are other times when it may be prudent to let those sources express themselves by their own behavior, their own communiques, and their own outreaches. MHARR members are already paying their association to advocate on production related topics. When MHARR advocates on post-production issues, they are apparently going beyond their own core mandate, while still acting in a manner that benefits their members.

11) In stark contrast to MHARR, MHI is collecting dues from members without obviously delivering on what those dues are supposed to be paying to accomplish. Anyone that is consolidation focused, they may believe (correctly or incorrectly) that they are benefiting. But if MHI is the consolidation association, then they should say so openly. And if they did say openly say they are working for consolidation instead of for the benefit of all members, they may then run afoul of antitrust enforcers. See MHI’s own antitrust statement.

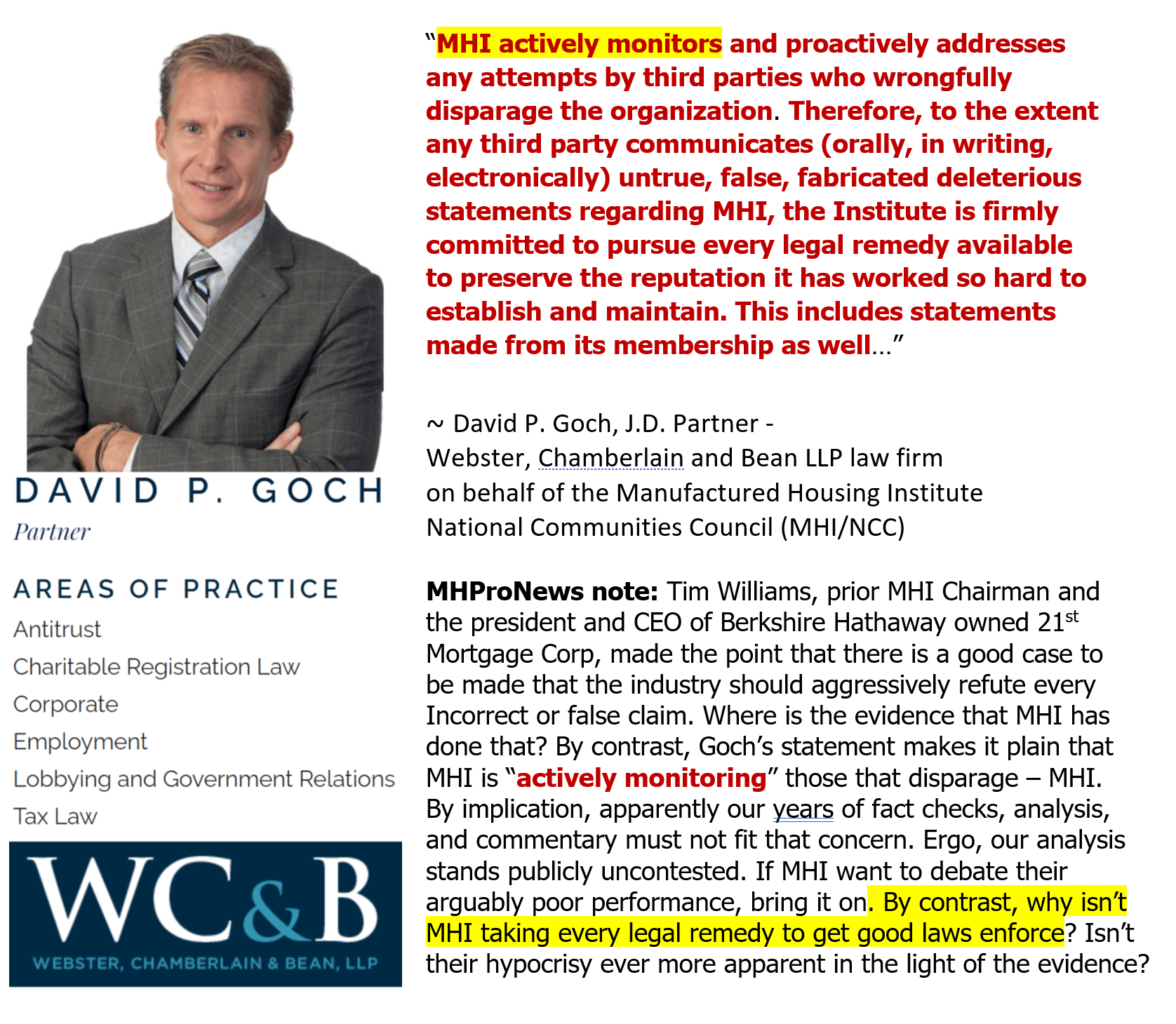

12) MHI’s own attorneys have communicated broadly and specifically to MHProNews that they monitor this publication, and they monitor what others in the industry are saying about “the Institute.” It seems clear that MHI can’t claim that MHProNews, nor MHARR, have ‘disparaged’ them. Or perhaps, suing MHProNews might cause some to wonder why MHI isn’t suing as needed to get enhanced preemption, DTS, or other potentially useful existing laws to be properly enforced?

13) If MHI’s counsel did so, then they would have to also sue Bing’s AI powered Copilot, which said that MHI’s behavior fits the definition of lie, false, and misleading.

14) So, it isn’t just Legacy’s leaders that should be pressing MHI to take the necessary robust and sincerely needed steps to fix the industry image issues, and zoning/placement issues.

15) Every growth-minded MHI member, every growth-focused MHI linked state association member should be pressing the Arlington, VA based trade association for effective action. The fact that they don’t do so speaks volumes. Those silent MHI members are logically either fearful (and if so, of what?) or perhaps secretly in favor of the status quo. Neither stance is a good look for MHI, nor for their members’ leaders.

Don’t miss today’s postscript.

With no further adieu, here in Part III are the headlines for the week in review, from 3.17 to 3.24.2024.

Part III

What’s New on MHLivingNews

What’s New from Washington, D.C. from MHARR

What’s New on the Masthead

What’s New on the Daily Business News on MHProNews

Saturday 3.23.2024

Friday 3.22.2024

Thursday 3.21.2024

Wednesday 3.20.2024

Tuesday 3.19.2024

Monday 3.18.2024

Sunday 3.17.2024

Part IV – Postscript

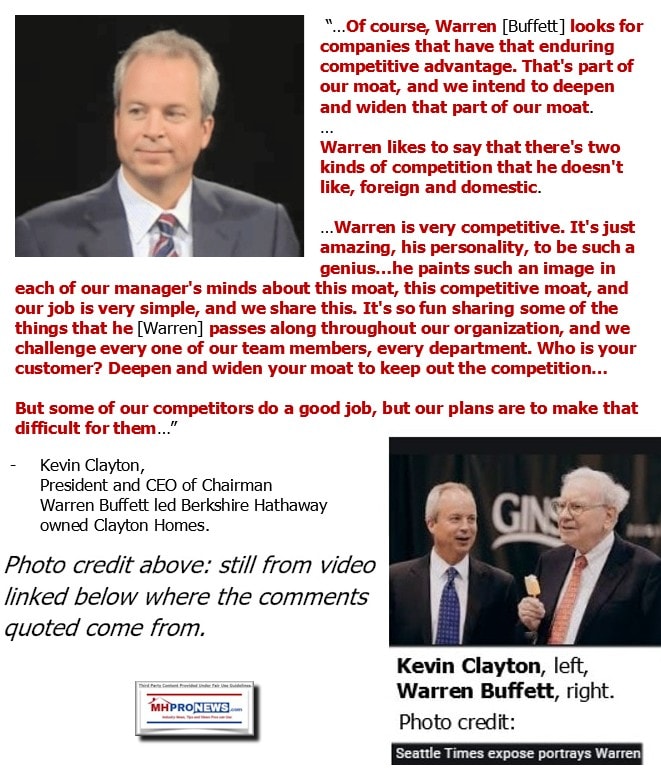

1) Let’s edit down Kevin Clayton’s remarks quoted at the top down to this: “The American dream is homeownership, and the…effects of new regulation and lack of the secondary market by the GSEs is a path to tragically wipe out the remains of this important housing segment.”

When Clayton said the industry is on a “path to tragically wipe out the remains of this important [manufactured] housing segment” it wasn’t the first time that a Berkshire Hathaway connected leader made such an ominous remark.

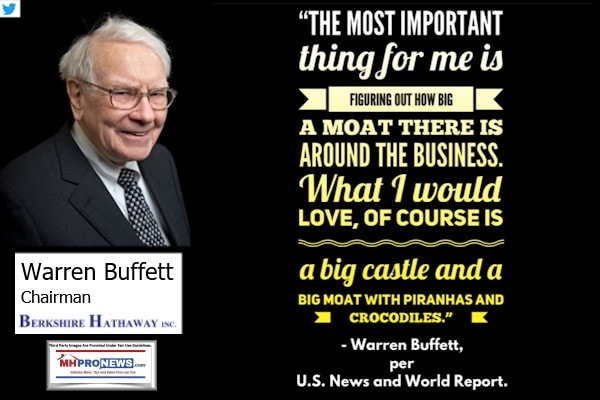

2) It has been said that hindsight is 20/20. With the benefit of hindsight, and reports like this and those shown, it becomes abundantly clear that manufactured housing is underperforming for a variety of reasons. Among them are the efforts of those within the industry who have undermined higher levels of performance, apparently for the purpose of creating barriers of entry, persistence, and exit. Such “barriers” have been called “a moat” by those who follow the Buffett way.

3) Kevin Clayton made it clear that Buffett’s various units are taught that moat. Buffett has said so himself.

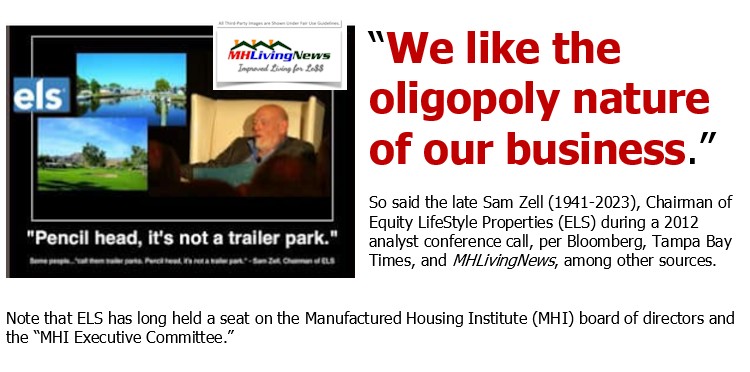

4) But that moat would not operate as designed if all of those in MHVille were blowing the whistle to state and federal officials. So, perhaps a bit like what Bernie Madoff did in his scheme, the ‘insiders’ at MHI have colluded to consolidate the industry in a manner that benefits some increasingly apparent firms who openly state(d) that they are consolidation focused. As the late Sam Zell put it a dozen years ago, he liked the oligopoly nature of the industry.

5) That oligopoly nature has been documented to have obliterated the business models that were common 25 years ago, when the manufactured housing industry was at its late 20th century zenith. Many of the former leaders in the industry no longer exist as independent business entities.

6) There are those inside and outside of manufactured housing who share in some measure of culpability for this state of affairs. But rather than point fingers of blame today, let’s focus for a few moments on what is obviously needed in order to solve the affordable housing crisis. Manufactured housing has to be ‘unleashed.’ Past experiences make is clear that in a few short years, a million or more new manufactured homes could be coming off of assembly lines from production centers existing or new from across the country.

7) It would be easier if multiple leaders of businesses the size of Legacy and smaller joined together to openly press for the enforcement of good existing laws. That could be done through existing and/or new trade bodies.

8) The alternative is to continue to accept the ‘sabotage monopoly’ ploys that have kept manufactured housing underperforming for essentially all of the 21st century. The facts are clear. Had manufactured housing grown following the enactment of the MHIA of 2000, odds are excellent that much of the tribulations of the affordable housing crisis could have been avoided.

9) While it seems unlikely that Clayton’s and their related lenders leadership is likely to change course, it is plausible that board members, shareholders, and others involved at ‘insider’ firms such as Cavco (CVCO) and Skyline Champion (SKY) could cause a pivot at their companies. But with or without such larger firms (i.e.: SKY and CVCO) being involved, the law is arguably on the side of the industry’s independents. Untold billions of dollars could be potentially recovered, over time, from larger firms that apparently schemed using MHI as part of their cover.

10) The alternative is to watch and hope that someone will be the last person eaten by the proverbial lions preying on the industry. In the meantime, even reasonably durable firms like Legacy will suffer with lower valuations and performance than they might otherwise enjoy. The industry’s independents need not look beyond their own books, their own comments, and then look around at the industry’s landscape to recognize that the truth might be challenging, but it is true, nonetheless. MHARR has made a critical start. But MHARR itself has been saying for years that more needs to be done. The time to organize and fight back is surely long overdue. The RV Industry showed us their superior performance in the 21st century, after years of RV production lagging behind manufactured housing. No one else in MHVille has invested more time documenting the various reasons why the industry should learn to fight back. The most profitable way ahead for most industry pros arguably is to learn from these facts, research, and experiences, to fight smart and win. The alternative is for outsiders like B.Riley analyst to say, the manufactured home industry is soft. Which it demonstrably has been for far too long.

“The American dream is homeownership, and the unintended effects of new regulation and lack of the secondary market by the GSEs is a path to tragically wipe out the remains of this important housing segment.” – Kevin Clayton, remarks to Congress (modestly edited 😉 ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)