Home sales kept rising in October, 2020. They are now reportedly at their highest pace in 14 years, according to data from the National Association of Realtors (NAR).

Record low inventory of available homes and a greater number of luxury homes sold pushed the median home price up to a record $313,000, almost 16% more than a year ago.

Total housing inventory dropped 3% from September and is down nearly 20% from a year ago.

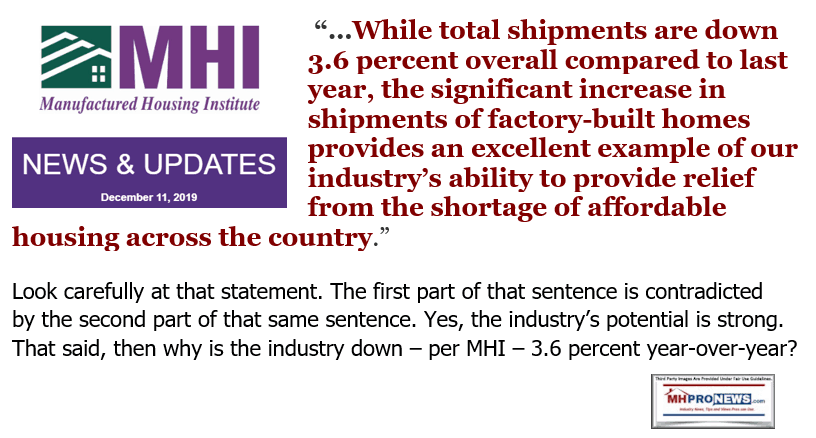

Those data points should be reason for a surge in manufactured housing. But instead of soaring, the industry has stayed at anemic levels.

New readers should know that MHI prior president and CEO, Richard “Dick” Jennison said that the industry could attain 500,000 new home sales.

But years after that comment, which MHI never mentions in their missives to members, the ‘new and improved’ “MHI 2.0” hopes some day to reach 100,000 new home shipments. But they keep much of their data and so-called research under password protection. Instead of growing in 2019, the trade group admitted to having shrunk instead.

The balance of the data from CNN’s report on mainstream housing sales, along with some related analysis will be our featured focus this evening. That follows our quotable quotes, left-right headline bullets, and 2 of the three market graphic summaries for today. The manufactured housing connected equities performance for the day are summarized in a graphic that follows the featured focus and related and recent linked reports.

Quotes That Shed Light – American Social, Industry, National Issues…

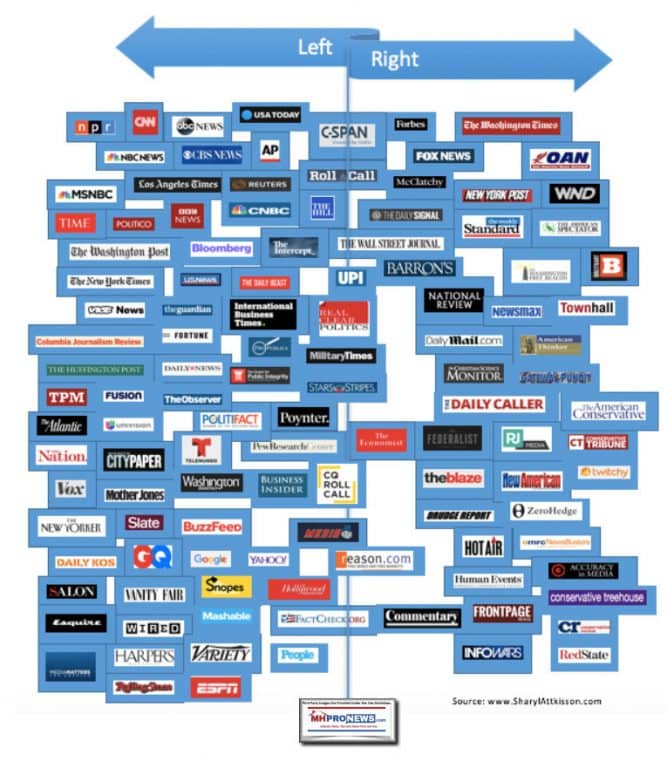

Headlines from left-of-center CNN Business

- A grim winter ahead

- Empty chairs are seen inside a restaurant in New York on November 13, 2020. – Bars and restaurants in New York will shut early on November 13 under fresh curbs designed to slow soaring Covid-19 infections as the number of daily deaths across the globe topped 10,000 for the first time since the pandemic began.

- The pandemic is intensifying and the US economy is about to shrink, JPMorgan warns

- Bitcoin soars again after BlackRock says it could replace gold

- Unemployment rates in most states dropped last month — but the Covid-19 spike could reverse that

- Trump picks a fight with Powell. The economy loses

- Trump administration cuts off emergency Fed programs

- Ex-Federal Reserve chair Alan Greenspan: I’ve never seen anything like this

- Alan Greenspan weighs in on the Fed’s latest moves

- MISINFO WATCH Trump claims of dead voters continue to fall apart

- A Biden tax hike could give utility stocks a boost

- China borrows at negative interest rates for the first time

- Mortgage rates have never been this low

- Home sales are off the charts

- The Legend of Zelda prequel is here

- Tofurkys are selling like hotcakes

- Virgin Hyperloop test site.

- Hyperloop wants to change the world. Not everyone’s convinced

- The Tesla Inc. Model Y crossover electric vehicle sits on display during an unveiling event in Hawthorne, California, U.S., on Friday, March 15, 2019. Tesla Chief Executive Officer Elon Musk said the cheaper electric crossover sports utility vehicle (SUV) will be available from the spring of 2021. The vehicle’s price will start at $39,000, a longer-range version will cost $47,000. Photographer: Patrick T. Fallon/Bloomberg via Getty Images

- Model Y reliability woes put Tesla near bottom of Consumer Reports rating

- MARKETS

- AT WORK

- This May 4, 2020, file photo provided by the University of Maryland School of Medicine, shows the first patient enrolled in Pfizer's COVID-19 coronavirus vaccine clinical trial at the University of Maryland School of Medicine in Baltimore. On Monday, Nov. 9, 2020, Pfizer said an early peek at its vaccine data suggests the shots may be 90% effective at preventing COVID-19.

- What to know if your employer wants you to get vaccinated for Covid

- How to advance your career when you’re WFH

- What to consider before relocating

- The rules of talking politics at work

- Burnout is a big deal. Here’s how managers can spot it

Headlines from right-of-center Newsmax

- Mnuchin Denies Trying to Sabotage Biden on Economy

- Election 2020

- Pelosi: Trump a ‘Psychopathic Nut’

- GOP Gov. Hogan Rips Trump for ‘Ridiculous Challenges’ to Election Results

- Pence Campaigns in Ga. Ahead of Senate Runoffs

- Georgia Secretary of State to Certify Election for Biden

- Sidney Powell: Will Prove Case ‘Within Next Two Weeks’ in Court

- Cotton: Time for Evidence of Fraud, Not Press Conferences

- CNN: Trump Discussing WH Invite to Pennsylvania GOP Legislators

- Fox News Calls Giuliani Liar After News Conference

- More Election 2020

- The Trump Presidency

- Trump Makes Late-Term Bid to Lower Prescription Drug Costs

- Rudy Giuliani’s Son Tests Positive for Coronavirus

- Pentagon’s Tata Tests Positive for COVID After Lithuanian Visit

- Rick Scott Tests Positive for COVID-19

- Ivanka Trump Dismisses New York Probes as ‘Harassment’

- Critics Say Pompeo Auditioning For 2024 With West Bank Trip

- Mnuchin Wants Congress to Unlock $580B of Unused Stimulus

- Census Officials Doubt They’ll Reach Trump Deadline

- Newsfront

- China Promotes Study Claiming Coronavirus Started in Italy

- China Promotes Study Claiming Coronavirus Started in Italy

- Chinese officials have been promoting a new study that claims the coronavirus could have been spreading undetected in Italy months before it was first found in Wuhan, The New York Post reports……

- Related Stories

- Vaccine Shipping Needs Pose Problem for Rural Areas

- CDC Director: Schools Are Safe Places for Kids During Pandemic

- Religious Leaders Fighting COVID-19 Restrictions

- Operation Warp Speed Official: Vaccine Distribution May Start Next Month

- WHO Rejects Gilead Remdesivir Drug Trump Took to Treat COVID-19

- Tyson Suspends Officials Over Betting Pool on COVID-19 Infected Workers

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

The National Association of Realtors (NAR) in their 11.19.2020 release said “Existing-Home Sales Jump 4.3% to 6.85 Million in October.”

NAR’s media release to MHProNews said in part the following.

, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 4.3% from September to a seasonally-adjusted annual rate of 6.85 million in October. Overall, sales rose year-over-year, up 26.6% from a year ago (5.41 million in October 2019).

“Considering that we remain in a period of stubbornly high unemployment relative to pre-pandemic levels, the housing sector has performed remarkably well this year,” said Lawrence Yun, NAR’s chief economist.

While coronavirus-induced shutdowns hindered virtually all markets, Yun says the housing industry has mounted an impressive rebound.

“The surge in sales in recent months has now offset the spring market losses,” Yun said. “With news that a COVID-19 vaccine will soon be available, and with mortgage rates projected to hover around 3% in 2021, I expect the market’s growth to continue into 2021.” Yun forecasts existing-home sales to rise by 10% to 6 million in 2021.

The median existing-home price2 for all housing types in October was $313,000, up 15.5% from October 2019 ($271,100), as prices increased in every region. October’s national price increase marks 104 straight months of year-over-year gains.

Total housing inventory3 at the end of October totaled 1.42 million units, down 2.7% from September and down 19.8% from one year ago (1.77 million). Unsold inventory sits at an all-time low 2.5-month supply at the current sales pace, down from 2.7 months in September and down from the 3.9-month figure recorded in October 2019.

Conventional “Homebuilders’ confidence has soared even though the actual production has not,” Yun said. “All measures, such as reduction to lumber tariffs and expansion of vocational training, need to be considered to significantly boost supply and construct new housing.”

CNN’s analysis of the NAR data made the following points, some of which duplicates the above.

- Homes sold at a swift pace in October, with more than 7 in 10 homes sold on the market for less than a month. At the current pace of sales, it would take just 2.5 months to clear the existing inventory — a record low.

- Sales of existing homes — which include single-family homes, townhomes, condominiums and co-ops — were up 4.3% from September and 26.6% from a year ago, to a seasonally adjusted annual rate of 6.85 million in October.

- While coronavirus-induced shutdowns hindered virtually all markets, Yun says the housing industry has mounted an impressive rebound.

“We see home sales continuing to grow at a strong pace through the remainder of 2020 and into 2021,” said Ruben Gonzalez, chief economist at real estate firm Keller Williams. “Record-low interest rates have continued to bolster demand, however, supply shortages remain a limiting factor and are continuing to put pressure on home prices.”

While fewer homes have sold this year over last year at the lowest end of the market because of lack of inventory, sales at the high end are significantly above a year ago, pushing the median price of all homes up.

Nationally, homes sold between $750,000 and $1 million are up 80% from a year ago and those $1 million and over have more than doubled.

“The continued surge in home buying shows not only catch-up sales from earlier in the year when shutdowns dampened real estate activity, but the strength of interest from buyers combined with the opportunity afforded by still record-low mortgage rates,” said Danielle Hale, Realtor.com chief economist.

“With news that a Covid-19 vaccine will soon be available, and with mortgage rates projected to hover around 3% in 2021, I expect the market’s growth to continue into 2021.”

However, AEI’s Housing Center provided a somewhat different wrinkle to the above. While they agree that sales may stay strong for 6 to 12 months, they see the threat of the housing bubble.

Instead of touting a similar surge in manufactured housing sales, which could be filling the gap, MHI instead trumpets their coalition with mainstream housing groups that arguable often have a different agenda that manufactured housing.

See the various linked, related, and recent reports for more.

October Jobs + AEI Housing Center Nowcast Data, plus Manufactured Home Investing, Stock Updates

Related, Recent, and Read Hot Reports

“Mob Rules” – 2020 and Manufactured Housing Updates; plus, Sunday Weekly Headlines in Review

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

Fall 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

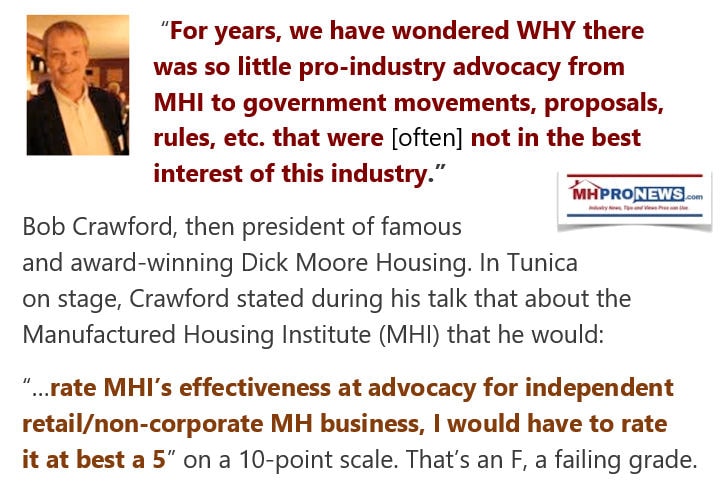

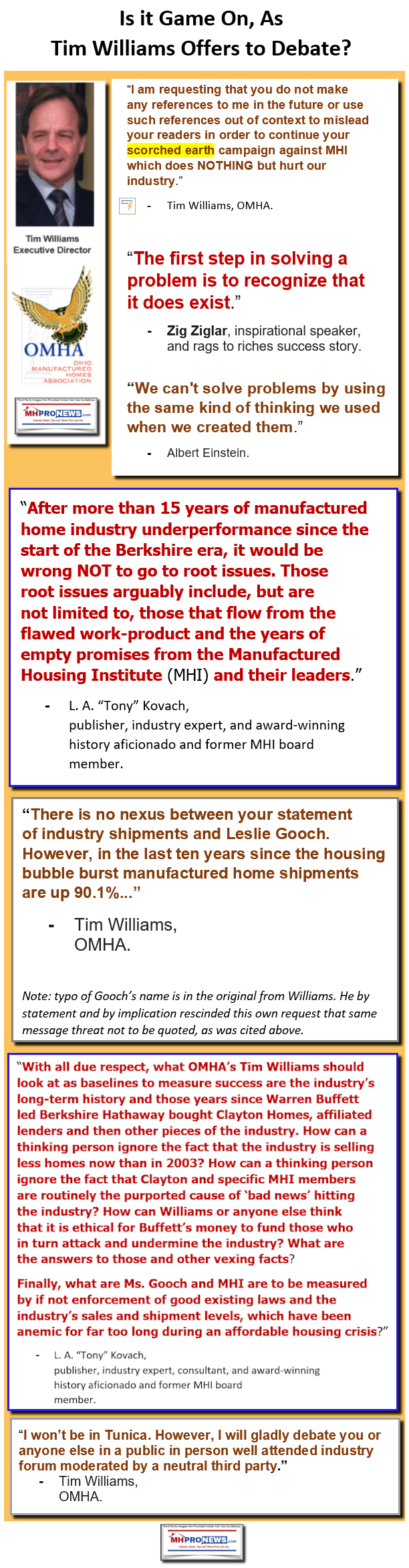

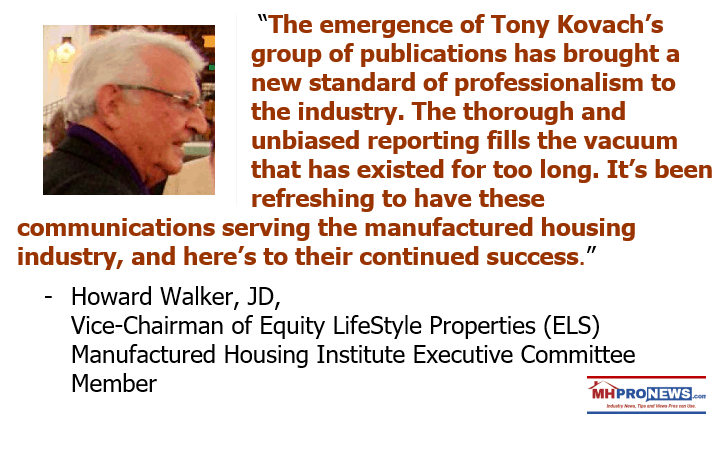

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.