False impressions occur.

Few professions understand those statements better than a seasoned manufactured housing (MH) professional.

For whatever valid reasons one cares to cite, the false impressions about the MH Industry are legion.

All those false impressions are why the parent company to MHProNews.com created our sister site, MHLivingNews. There the public and professionals alike have a resource of reliable, and ongoing series of fact-based reports, videos, and interviews exists that debunk myths and misconceptions.

Misunderstandings Exist Within the Industry, Not Just Outside of MH

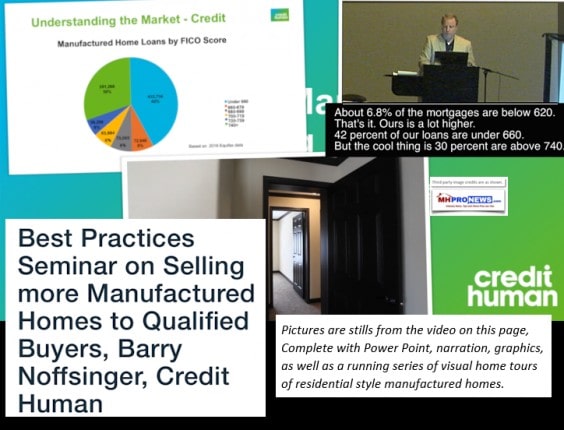

The video that follows is a presentation by award-winning Barry Noffsinger of award-winning Credit Human (formerly San Antonio Credit Union, CU Factory Built Lending, and Mountainside Financial). Federal HMDA data reveals that Credit Human is one of the industry’s largest lenders.

Just as Triad Financial focuses on better qualified buyers, Credit Human Federal Credit Union tends to do so too. The fact that multiple lenders can thrive when focused on more qualified buyers sends a message to those retailers and communities that send messages to MHProNews that say things like, ‘the only customers we get are around 600 FICO score or lower.’

Noffsinger’s and other’s experiences prove that with the proper business development and training practices, that could become the exception, rather than the rule.

When a location is struggling now with poor credit quality, that doesn’t have to stay that way. That’s a key point of Noffsinger’s presentation.

The RV industry routinely attracts higher credit scores and large numbers of cash buyers too. The RV industry does better routinely in the same markets that manufactured home professionals operate in too.

State of the Manufactured Home Industry, Comparing RV vs. MH Data

As Noffsinger mentions, site builders and real estate agents attract and sell about 99 times more better credit customers than manufactured home retailers and communities do. You can read the latest national housing statistics, and compare them to MH, at the link below. All of these facts and more underscore the validity of Noffsinger’s points.

A Broad Range of Facts and Experience Go Into the Best Practices Noffsinger Presents

Noffsinger has been in the trenches of manufactured home lending for many years. He’s seen better times, as well as the worst times in the industry’s history.

As many lender’s reps do, Noffsinger and his associates visit sales centers, developments, and manufactured home communities from across the country.

So, the facts and ‘best practices’ he shares via this video captured in front of a live MH audience ought to be compelling consideration for owners, managers and those on the front lines that aspire to do more and perform better with their career.

Credit Scores Rising…

Credit scores nationally have risen slightly since this video was first captured, but the broad-brush facts Noffsinger states are all the same.

Noffsinger stresses why the industry’s greatest opportunities for growth aren’t with the lower credit scores.

Not only are the facts on his side, but the points he makes are underscored by field-tested results, which Sunshine Homes, or New Durham Estates have been willing to share their own experiences in spotlighting how best practices pay off.

In the case of Sunshine Homes – which only sells more upscales, residential style manufactured homes – they’ve grown at more than double the pace of the industry at large, per their own video statements.

New Durham Estates, by using the kinds of best practices Noffsinger describes and others, has not only dramatically increased sales, but also attracted more good credit and cash buyers that spend more on the homes they buy.

As MHProNews continues its November 2017 State of the Manufactured Housing Industry series, it is as important to show what works as what doesn’t. Noffsinger stressed many facts in this video, among them, that more companies need to do a better job in sales training. As he jokes, he wasn’t paid to say that in front of the live 2017 audience this video was recorded.

Update Will Follow This Week

This article will be updated and cross linked later to more related information.

But for those looking for their Monday or Tuesday morning sales meeting material, this 15-minute video is packed with proven information on how to fish in the pond where the best fishing and most growth for manufactured housing is to be found. ## (Research, business development, news, reports, data, analysis, commentary),

Note: to learn more about some of the training related opportunities Noffsinger is referring to, click here. It should be noted that while Noffsinger has sat in on some of Tony Kovach’s training, his kind comments to this live audience shouldn’t be construed as a specific endorsement. To see how other respond to that training and related business development strategies, see the video comments by Sunshine Homes and other third parties, on the second video on the page linked here.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)