“Potential for Higher Returns Lures New Buyers, Generating Competition; Supply of For-Sale Listings Remains Tight, Boosting Prices,”

– Marcus & Millichap (M&M) National Report, First Half of 2018

A new research report has been provided by brokerage firm Marcus & Millichap to the Daily Business News.

For those in MHVille who don’t know Marcus & Millichap Inc (MMI), the following description is from their website.

“Powered by Culture: George M. Marcus and William A. Millichap revolutionized the real estate brokerage industry. Marcus & Millichap was designed to go far beyond simply facilitating real estate transactions. It was developed as an entire system dedicated to maximizing value for real estate investors.”

As part of our ongoing periodic series on the true state of the manufactured housing industry, the following summary provided to MHProNews by MMI. How good are they? Here’s what a market snapshot tells you investors think of MMI. Money talks.

Investment Highlights

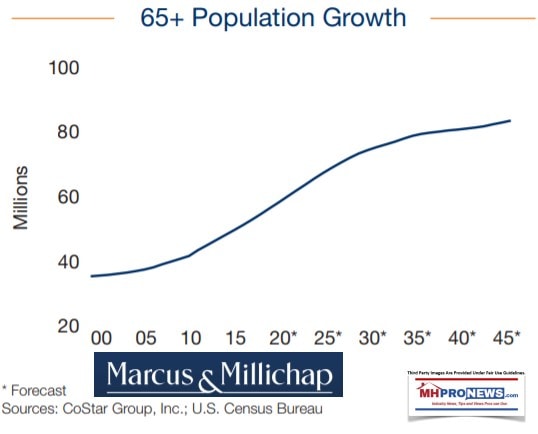

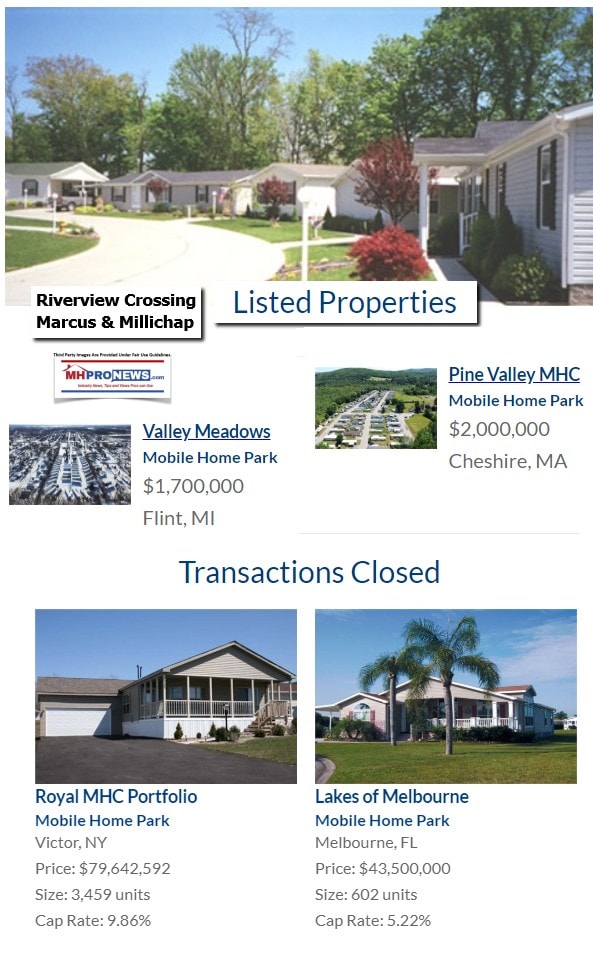

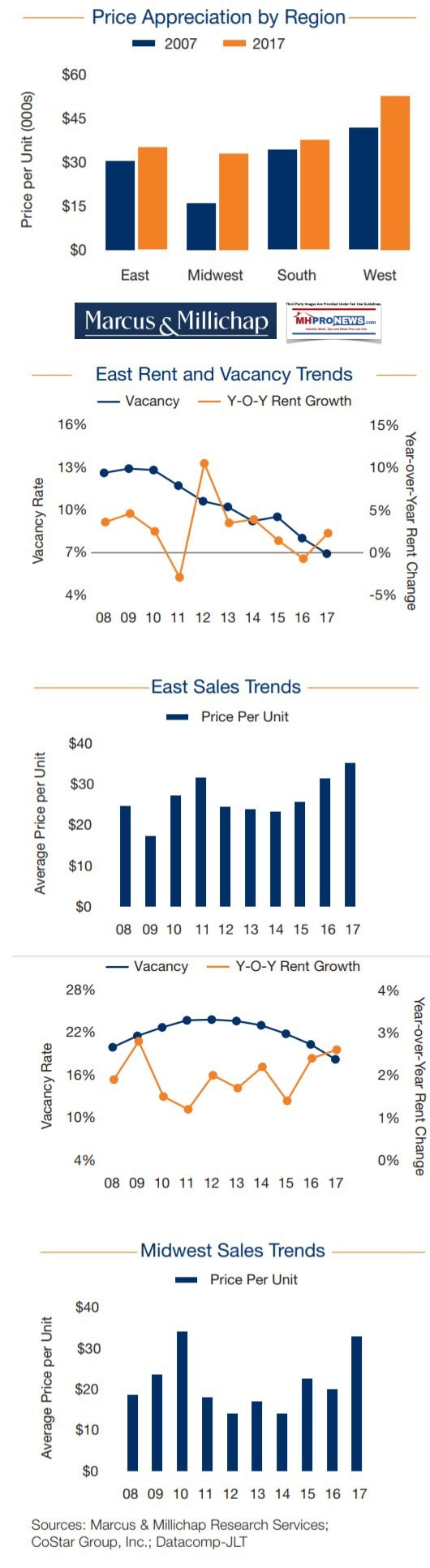

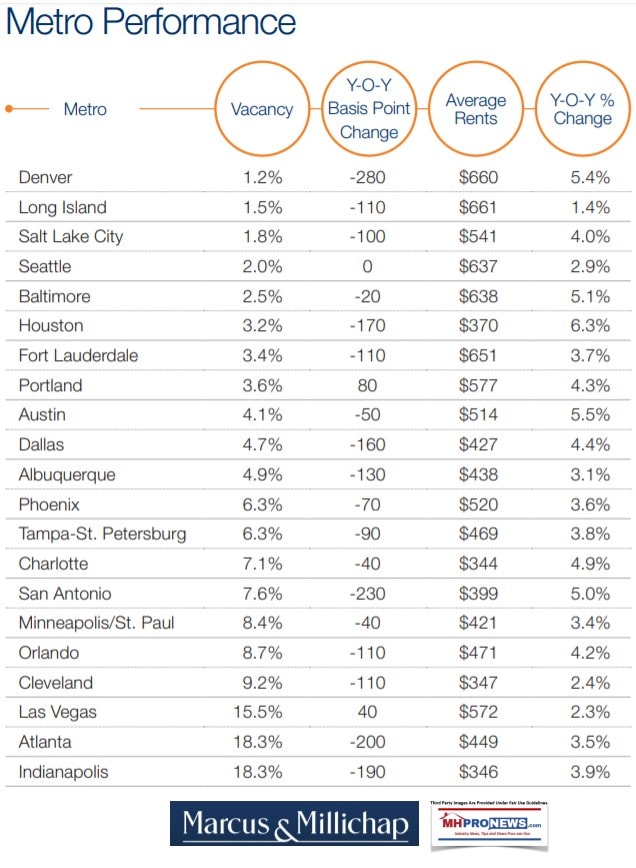

“Buyers are flush with capital amid a scarce supply of available listings throughout most areas of the nation, which has resulted in more off-market transactions. Heightened demand is producing aggressive pricing that keeps cap rates steady despite the rise in interest rates.

In some areas of the country, for-sale listings are further reduced by resident groups in manufactured home communities exercising their right of first refusal and making offers to purchase the park.

Exchange buyers remain active. Many of these investors are trading out of other commercial real estate product types, such as apartments, and are unfamiliar with owning a manufactured home community. In many instances the potential for higher returns is luring them to consider park ownership and they are willing to pay a premium to own, helping to drive prices higher.

Communities on well and septic are still slower to trade. Some buyers are searching for a value-add opportunity in parks that have the potential to be hooked up to these city services.”

The MMI research and data reflects the growing demand for manufactured home communities that industry professionals have been reporting for several years, as was noted in last night’s snapshot report on RHP Properties.

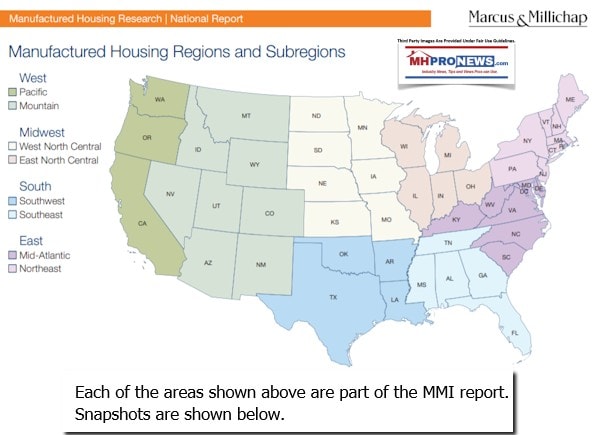

East Region Mid-Atlantic Trends Vacancy:

“Strong demand for affordable housing produced a 70-basis-point reduction in vacancy to an average of 6.6 percent during 2017. Vacancy was especially tight in Baltimore at 2.5 percent. Rents: The average rent rose 3.8 percent in 2017 to $381 per month, bolstered by a 5.1 percent surge in Baltimore. Rents have climbed 14 percent over the last five years.”

The above gives you the flavor of the document, which is a free download.

You can sign up for their full national report at this link, here.

The Takeaways?

The facts speak for themselves. But there are many takeaways, including that manufactured home communities – and the industry at large – could be doing significantly better than they already are.

But we’ll drill that down in an upcoming summary report on manufactured home communities, that should be ready by next week. Investors, industry professionals and advocates, stay tuned. Newcomer? Sign up for our industry leading emailed update headline news, below. ## (News, analysis and commentary.)

(Third party images are provided under fair use guidelines.)

Related Reports:

https://www.manufacturedhomelivingnews.com/affordable-housing-focus-group-comparing-housing-options-conventional-houses-condo-rentals-and-manufactured-homes-up-for-growth-national-association-of-realtor-studies/

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.