The latest statistics for September 2023 were released on 11.3.2023 and are provided herein from the Manufactured Housing Association for Regulatory Reform (MHARR). The data release reveals a month-over-month decline from August 2023 as well as a year-over-year drop since September 2022. New manufactured housing production has now been falling for 11 straight months as measured in year-over-year shipments, per the official data collected for the U.S. Department of Housing and Urban Development (HUD) and as reported by MHARR.

The MHARR reported data was packaged in a mainstream media press release that is provided in Part I of this report below.

Part I

Manufactured Housing Production Decline Persists in September 2023, per Manufactured Housing Association 11.3.2023 Data

During Affordable Housing Crisis Affordable Manufactured Housing Continues to Underperform, by Long-term Historic and Year over Year Trends, says MHARR.

WASHINGTON, D.C., U.S.A., November 3, 2023 /EINPresswire.com/ — The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in September 2023. Just-released statistics indicate that HUD Code manufacturers produced 7,955 new homes in September 2023, a 15.2% decrease from the 9,381 new HUD Code homes produced in September 2022. Cumulative production for 2023 is now 66,647 homes, a 25.7% decrease from the 89,812 homes produced over the same period during 2022.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are (see top ten states graphic).

The statistics for September 2023 produce one change from last month, moving Louisiana into 7th place, ahead of Michigan.

Again, as it has for months now, inherently affordable manufactured housing continues to significantly underperform, with production levels for 2023 remaining far below the industry’s potential and even the diminished annual production averages of the past decade-plus. Reversing this trend will require a laser-like focus and concrete remedial action to combat the discriminatory zoning exclusion and concurrent failure of Fannie Mae and Freddie Mac to implement the Duty to Serve (DTS) mandate with respect to the 80% of the mainstream manufactured housing consumer finance market represented by personal property loans, which have – and continue to – undermine the manufactured housing market.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 –

MHARR Manufactured Housing Production Statistics

The Manufactured Housing Association for Regulatory Reform (MHARR) is the only U.S. trade association serving the manufactured housing industry’s producers which publishes years of monthly statistical reports with a focused analysis. That information is available to the public, investors, public officials, media, educators, nonprofits, affordable housing advocates and others at the link below. The full MHARR statement for the November 3rd, 2023 release of September 2023 data is included below, as are the items quoted from the October 2023 data.

https://manufacturedhousingassociationregulatoryreform.org/category/manufactured-home-shipments/

Per MHARR on October 5, 2023: “HUD Code manufactured housing industry year-over-year production declined again in August 2023. Just-released statistics indicate that HUD Code manufacturers produced 8,670 new homes in August 2023, a 19.1% decrease from the 10,722 new HUD Code homes produced in August 2022. Cumulative production for 2023 is now 58,692 homes, a 27% decrease from the 80,431 homes produced over the same period during 2022.”

So, production in September declined both year-over-year and month-over-month.

The Manufactured Housing Institute (MHI) has acknowledged this sharp and sustained production decline now in its 11th month.

Mobile and Manufactured Home Living News (MHLivingNews.com) and Manufactured Home Pro News (MHProNews.com) both provided the Congressional transcript of the testimony of Cavco Industries (CVCO) William “Bill” Boor to a U.S. House subcommittee on behalf of MHI that also indicates the decline in shipments.

Boor said in part: “Rather than artificially making it more difficult for us to produce quality, affordable housing we believe there are things that Congress and federal agencies can do to facilitate the availability of manufactured housing.”

Boor told Congress the following:

“The manufactured housing industry is at a critical crossroads due to regulatory barriers and market forces. Cumulative shipments from January 1 through April 30, 2023, decreased by 30 percent compared to the same time period of 2022. April 2023 shipments were down 34 percent compared to April 2022 shipments.”

“Across the country, there are countless state and local zoning, planning, and development restrictions that either severely limit or outright prohibit the placement of a manufactured home.”

“HUD has the statutory authority to prevent local jurisdictions from excluding manufactured homes through the “Manufactured Housing Improvement Act of 2000,” which specifically states that when HUD construction and safety standards are in effect, a locality does not have authority to establish different standards. The statute explicitly states that this preemption should be “broadly and liberally construed” to avoid disparate local requirements. HUD has the authority and duty to pursue more vigorous enforcement of this provision, which clearly establishes federal supremacy for manufactured housing construction.”

That from Boor to Congress is arguably a mirror of years of remarks by MHARR leaders on the subject of a lack of enforcement of the “enhanced preemption” under the “Manufactured Housing Improvement Act” of 2000.

Additional Media Updates from MHARR

From the recent report linked below, MHARR said the following.

MHARR ADDRESSES STATE ASSOCIATIONS ON INDUSTRY DECLINE

At a recent meeting of manufactured housing industry state association executives, MHARR addressed developing industry issues in Washington, D.C., as well as the major causes suppressing long-term industry growth and underlying the double-digit manufactured housing production decline of the past year.

“The enhanced federal preemption provision of the 2000 Reform Law gave HUD the authority to federally preempt any state or local “requirement” that impairs the utilization of federally-regulated manufactured housing.

Exclusionary zoning mandates around the country (in addition to the ongoing failure to fully implement the Duty to Serve mandate) continue to suppress the utilization of affordable manufactured homes at a time when housing costs and monthly mortgage payments are at an all-time high…The enhanced federal preemption provision of the 2000 Reform Law gave HUD the authority to federally preempt any state or local “requirement” that impairs the utilization of federally-regulated manufactured housing. Key congressional proponents of the 2000 Reform Law wrote HUD in 2003 to leave no doubt that the “combined changes [to the law] have given HUD the legal authority to preempt local requirements or restrictions.”

The rest of the Washington Update includes the DOE energy issue, the chassis issue, and financing issues.

About MHARR

Q&As by MHProNews with Danny Ghorbani

MHARR Issues and Perspectives – Mark Weiss

https://manufacturedhousingassociationregulatoryreform.org/category/mharr-issues-and-perspectives/

MHARR-History

MHARR on Proposed MH-Chassis Legislation

###

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Part II – Additional Information with More MHProNews Analysis and Commentary

In roughly 1000 words cited above with illustrations and captions, MHARR’s media release and the related above have summarized a snapshot of the plight of contemporary manufactured housing during an affordable housing crisis.

For example. The column on the left in the second graphic from the top (in Part I above) shows quotes from MHI CEO Lesli Gooch. It also shows relevant quotes from Cavco Industries (CVCO) CEO William “Bill” Boor in his remarks to Congress last July 14, 2023. Boor is now the new chairman of MHI and made his remarks on behalf of MHI. Note that as the above illustrated, on paper, MHI leaders and MHARR may appear to say similar things.

But for some years, MHARR has been making the argument that litigation is needed to force the issues that MHI talks about, and which properly falls in MHI’s ‘jurisdiction’ as post-production issues (zoning and financing are not production issues, but rather they are post-production problems).

A comparison of recent statements from MHI and MHARR covering the same timeframe are found below, along with an analysis of the two.

A careful and detailed look at the DOE energy rule is in the report and analysis linked below. The ‘fingerprints’ of MHI’s responsibility in the DOE energy rule matter ought to be apparent. Indeed, when MHI claims that the represent “all segments” of the industry, that is de facto a tacit ownership of the outcomes.

MHProNews recently unpacked the report by HomeLight on the housing crisis with a look at that issue through the prism of manufactured housing’s interests.

MHI as a trade group is apparently representing the interests of their dominating members. But several of those dominating members at MHI say in their investor relations information that runs counter to what Bill Boor told Congress on the topic of federal preemption, and perhaps other issues as well. Whatever the Arlington, VA based MHI trade group leaders may say to the industry’s independents in emails or otherwise, certain lessons from longtime MHI member Marty Lavin, J.D., are clear.

- Pay more attention to what people do instead of what they say.

- Lavin also said, “follow the money” which has long been an investigator’s method for discerning the truth behind conflicting claims and sometimes masked behaviors.

In response to an inquiry from MHProNews, Bing’s Artificial Intelligence (Bing AI) set on the ‘balanced’ (blue) response said the following recently.

Learn more:

Learn more:

Learn more:

Indeed, the Bing AI system indicated as much when they provided the link to the article below in response #4 immediately above that cited the article by Mandelker linked above.

Among MHVille focused trade media, only MHProNews/MHLivingNews is known to have reported on the prediction by an insider at a well-known MHI member that the industry was facing another downturn. Furthermore, MHProNews also pointed out just a few months before this current downturn started that when MHI previously claimed “momentum” on their apparently market-failed CrossMods scheme, there was a downturn then too. That report and analysis by MHProNews has been vindicated by the evidence of the current 11th month downturn.

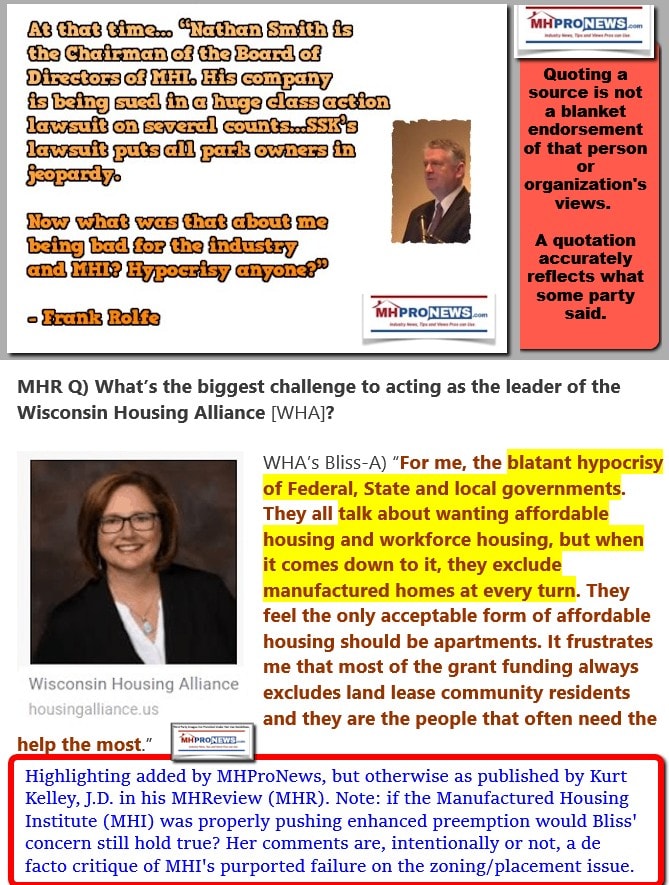

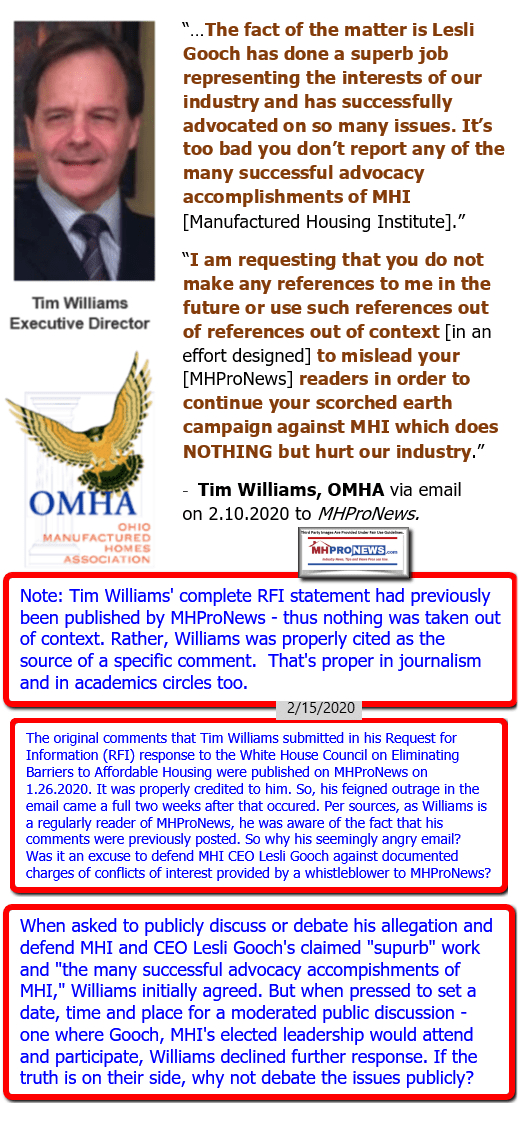

Gaslighting and repetition of what the evidence suggests is arguably deceptive, misleading, and contradictory remarks by MHI-linked leaders doesn’t mean that MHI and their dominating brands get to have it both ways. If MHI CEO Lesli Gooch, for example, is so ‘superb’ as MHI affiliate Ohio Manufactured Home Assocation (OMHA) Tim Williams claimed, then why is the industry in a sustained downturn that Bill Boor himself said is a “critical crossroads?”

But the example of OMHA’s William’s remark begs the question. What successful advocacy? How has MHI helped implement zoning relief, improved rates and terms for manufactured home chattel financing? How many more decades will it take to get “enhanced preemption” enforced, that Boor specifically referenced to Congress? Or how many more years or decades will it take for MHI to get the removal of FHA Title I restrictions in the form of the 10/10 rule removed, which MHI claims they want lifted? Or when will MHI be able to announce that Fannie Mae and Freddie Mac have agreed to provide access to the secondary finance market via robust chattel lending? Or even ANY chattel lending by those two Government Sponsored Enterprises?

Or does OMHA’s Williams think that it is ‘superb’ that Gooch gave FHFA, Fannie Mae, and Freddie Mac a tailor-made excuse not to do chattel lending for manufactured housing? Her remarks were so stunning that MHARR’s Mark Weiss said he has never seen either of the GSEs claim that excuse themselves? Said Weiss, Gooch’s remarks were ‘inexcusable and a major problem.’

And as MHARR has also observed, if MHI indeed has believed Gooch’s 2023 remarks Weiss slammed as reported in the article linked above, then why hasn’t MHI gone to Congress with a legislative remedy? Whatever MHI wants to say or do, they are faced by a maze of their own self-contradictory stances and often years of self-contradictory behaviors. As MHARR said on 1o.26.2023: “MHARR believes it would be much more beneficial to use this legislative vehicle to put increased pressure on the Federal Housing Finance Agency (FHFA), Fannie Mae and Freddie Mac, under the Duty to Serve mandate, to actually begin serving the bulk of the manufactured housing market financed via personal property loans.” That “legislative vehicle” is the draft by Senator Tim Scott of the ROAD to Housing Act.

MHI has been posturing for some weeks about the possibility of Congress de-funding DOE’s MHI’s energy rule. While that may be a valid method which should be part of the ‘all of the above’ strategy that MHI at times has claimed, then why haven’t they asked Congress to defund HUD, FHA, or FHFA unless they immediately reform their errant practices with respect to a lack of enforcement on “enhanced preemption, a dearth of loans via FHA Title I, and the void in the 21st century since Fannie Mae and Freddie Mac effectively pulled their support for manufactured home chattel lending?

When MHI deployed attorneys in conjunction with the TMHA on the DOE issue, it apparently served to cement the case that MHProNews has editorially argued that MHI needs to litigate enhanced preemption and apparently the manufactured home lending issues too.

And if MHI’s advocacy is so superb, then why doesn’t MHI join forces with MHARR to get these issues done? Why have MHI instead allied themselves with the associations that represent multifamily, single family, or conventional housing?

Between MHARR, Bing AI, outsiders looking into manufactured housing who have often critiqued the industry’s handling of lobbying, or lack of litigation, and the often self-contradictory remarks of MHI’s association remarks and those of some of their leading brands, a nearly complete case exists that the growth-minded industry’s independents, earnest advocates, and others now have in hand. That case is bolstered by facts, evidence, and behaviors. It is further buttressed by fresh litigation aimed against multiple MHI members in class action lawsuits. Those class action lawsuits below routinely named MHI members and/or members of MHI connected state affiliates.

Programming Notices. Two fresh reports are being prepared that are just over the horizon. A third new report will reflect new developments in manufactured housing financing not named herein, but which MHProNews has some exclusive statements on from a highly placed and on the record source. Stay tuned for those and more on your most accurate, apparently most read, and trustworthy source for manufactured housing “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.” ©

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.3.2023

- The latest on markets, the jobs report and the economy

- Mark Levin, host of ‘Life, Liberty & Levin’ on Fox News, speaks during the Republican Jewish Coalition (RJC) Annual Leadership Meeting in Las Vegas, Nevada, U.S., on Saturday, Nov. 6, 2021.

- White House condemns Fox News for ‘standing up on behalf of hate’ after host attacks CNN anchors’ Jewish heritage

- US banks hit by deposit delays

- Taylor Swift and Beyoncé concerts deliver record-breaking earnings for Live Nation

- UK officials close antitrust probes into Amazon’s and Meta’s retail platforms

- Who is Sam Bankman-Fried, the crypto king who had a stunning downfall?

- An employee at the Khurais Processing Department in the Khurais oil field in Khurais, Saudi Arabia, on Monday, June 28, 2021.

- Saudi Arabia’s oil production cuts have tipped its economy into reverse

- The US economy added 150,000 jobs last month. Here’s what that means

- 24-inch iMac

- Apple’s ‘scary fast’ upgrades hint at its vision for the AI era

- Signage is seen on the exterior of the building where law firm Cravath, Swaine & Moore LLP is located in Manhattan, New York City, U.S., August 17, 2020.

- Top law firms signal they won’t recruit from college campuses that tolerate antisemitism

- Jeff Bezos is leaving Seattle for Miami

- Shipping giant laying off 10,000 as pandemic boom turns to bust

- The 5 wildest moments from the Sam Bankman-Fried trial

- November is typically the best month for stocks. So far, it’s looking promising

- ‘It all feels like a nightmare.’ This mom and former Israeli tank commander is leading her tech startup from a war zone

- Elon Musk sees an AI future where ‘no job is needed’

- Sam Bankman-Fried found guilty of seven counts of fraud in stunning fall for former crypto billionaire

- China’s fright night: Halloween protests and cash crunch send distress signals about the economy

- 35,000 workers across 18 casinos will strike on Nov 10 if deal isn’t reached

- Walgreens is cancelling corporate bonuses as big pharmacies face increasing difficulties

- India regains its economic swagger as China stumbles

- White House calls on Fox News to apologize after top host’s ‘sickening’ Islamophobic rant

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.