Preface. This report will end on a hopeful and pragmatic note.

But what will follow initially is a troubling but reality-based collection of documented insights that should be of interest to all those, past and present, who are or where independently owned businesses.

While this may seem at first blush to some to have little to do with consumers and their interests, that would be a mistaken reading of the following information. More competition routinely means that consumers get better served. The reverse is also true. Fewer options means that consumers often get inferior service. Thus, advocates for consumers should be as keen on these insights as professionals and public officials.

Looking at Independents

There are numbers of businesses and well over ten thousand professionals who were once independently owned and operated enterprises in the manufactured housing industry. Many owned businesses that were successful for a decade or more. Some were multi-generational successes.

Anecdotal evidence reflects that independents routinely had good customer relations and fine Better Business Bureau (BBB) ratings, perhaps because that is how a good business stays in business. Whatever color of seasonal or stylish head gear they had or skipped, those businesses and professionals routinely fell into the categorial or proverbial white hats.

That’s as opposed to the so-called black hats who didn’t mind winking at, bending or breaking rules in order to get ahead. Every profession has both, plus those who straddle-the-fence in between.

Those manufactured housing independents included, but were not necessarily limited to, one or more of the categories below.

- Retailers (a.k.a. ‘dealers’) of manufactured homes.

- Land-lease communities (a.k.a. ‘mobile home parks,’ some of which indeed dated back to the mobile home era, pre-June 15, 1976) operators. While there is no exact count, the Manufactured Housing Institute (MHI) for a time was de facto documenting the steady consolidation of the community sector by publishing a list of the top 50 operations by communities and sites. The MHI’s National Communities Council (NCC) list of the top 50 such firms from 2018 is below.

- Producers of HUD Code manufactured homes, who may or may not have produced other forms of factory-built dwellings.

- Suppliers, transport and other service providers to those firms.

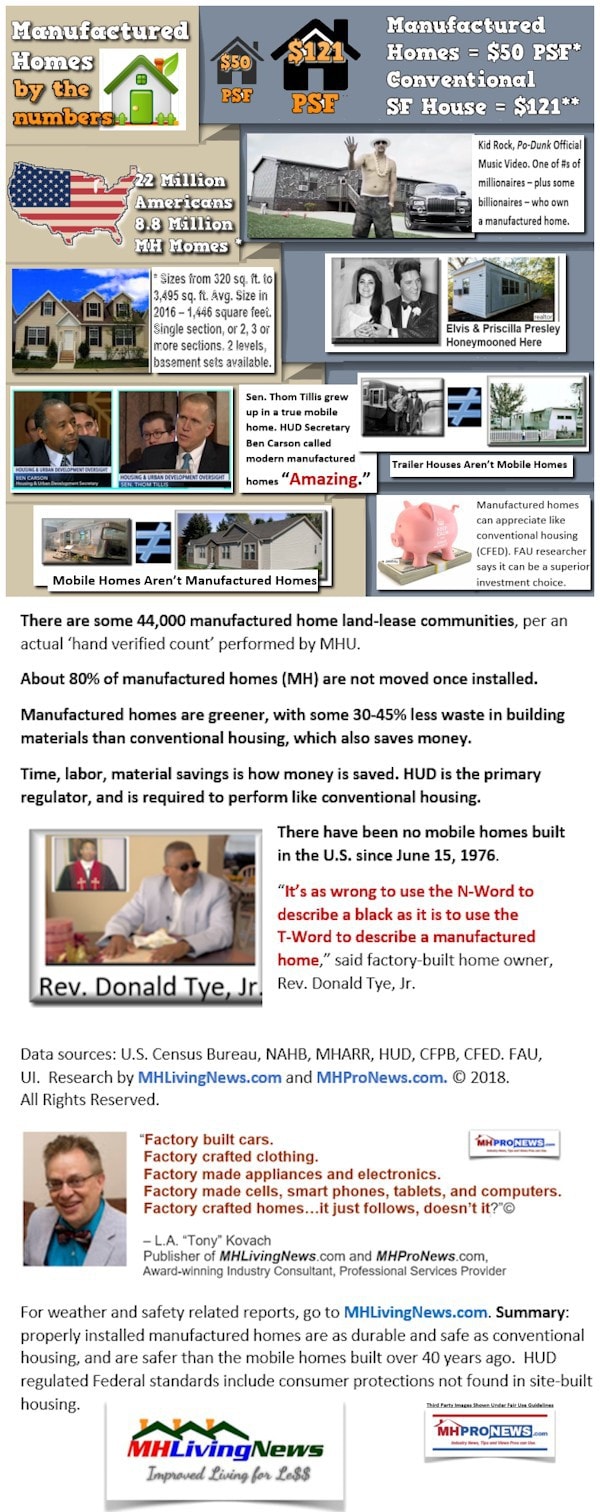

The loss of those independents, by whatever means, has had ripple effect on consumers, public coffers, investors and potential seekers of affordable housing. Congress and other federally commissioned research determined multiple times that pre-HUD Code mobile homes – often described as housing built on a chassis before June 15, 1976 – and post-HUD Code manufactured homes were the most proven form of unsubsidized housing in America.

Flashback Friday

In the heady days of the late 1990s and even into the early 2000s, the ‘old’ Fleetwood and Champion vertically integrated firms produced and retailed via independents and their own company-owned sales centers manufactured homes. Fleetwood and Champion were the two dominant players. While their names exist today, they firms that existed went into bankruptcy.

Per Reuters, on March 10, 2009 – “Fleetwood files for bankruptcy…” ”…will close its travel trailer division, the company said on Tuesday. Fleetwood, which also makes manufactured housing and military barracks…”

That same report said that:

- “As of Oct. 26, the latest data available, Fleetwood had assets of $558.3 million and liabilities of $518 million.”

- “The Riverside, California, company has been trying to restructure for three years.”

- “Fleetwood, which began in 1950 as a maker of manufactured housing, said it believes it has sufficient cash to operate in the immediate term.”

- “In 2007, Fleetwood was the second-largest U.S. maker of manufactured homes, in terms of retail units shipped.”

In a somewhat ironic twist, the RV division of Fleetwood was part of the drag, as the report said that it “has been hurt by high fuel prices and the housing market decline.” But for clarity, RVs have strongly recovered, not so manufactured housing.

The Riverside, CA based firm filed for Chapter 11 protection in 2009.

One possible takeaway from that episode is that vertical integration isn’t an automatic guarantee of financial stability. But there is more.

Wikipedia states: “On July 17, 2009 the private equity firm American Industrial Partners (“AIP”) acquired the motorized recreational vehicle assets from the company. The next month, Cavco Industries acquired the manufactured housing division.”

Per the BizJournals on August 11, 2009 – “Cavco Industries Inc. has been named the highest and best bidder for certain manufactured housing assets of Fleetwood Enterprises Inc.”

That same source said:

Cavco’s investment partner is the Third Avenue Trust Value Fund (through FH Holding Inc., its jointly owned corporation). Third Avenue Management, the investment adviser to Third Avenue Value Fund, is a New York-based company with expertise in value and distressed investing.”

BuilderOnline noted at that time that: “Clayton Homes, a leading manufacturer of modular homes and manufactured HUD homes, bought Fleetwood’s Trendsetter military housing construction assets for $4.5 million last May.”

That same source stated that: “…Fleetwood, which began business as a manufacturer of recreational vehicles and manufactured homes, has attempted to save itself from the slump in demand by diversifying into the modular home business through a subsidiary named Trendsetter Homes. The focus of Trendmaker was two-fold: Capitalize on the need for replacement housing in New Orleans in the aftermath of Katrina and to net military housing contracts.”

Another Fleetwood Takeaway Relevant Today?

It must be noted that the Trendsetter modular housing plan was identified as having another element that sank the firm. As manufactured housing professionals ponder the wisdom, or lack thereof, of the Manufactured Housing Institute backed “CrossModTM homes” so-called “new class of manufactured homes,” Trendsetter should loom large in their calculus. It didn’t work then. Why does MHI, Clayton Homes, Cavco-Industries (CVCO) and Skyline-Champion think this plan will work now?

Another element of concern should be the fact that instead of calling upon “enhanced preemption” made law with respect to HUD Code manufactured homes under the Manufactured Housing Improvement Act (MHIA) of 2000, Fleetwood ‘fled up.’ Once more for emphasis, history says that the plan failed.

Which begs the question: why is it that none of the MHI fanfare and their “new class of manufactured homes” that they’ve registered the name “CrossModTM homes” ever mentions that history? Certainly, at least some MHI leaders must know. Because:

- Joe Stegmayer – MHI’s former chairman, was part of that deal-making over Fleetwood’s assets.

- Furthermore, Kevin Clayton with Clayton Homes was part of the process of picking up the pieces of that Trendsetter’s military housing.

Let’s further note that the above occurred after the notorious letter from 21st Mortgage Corporation that was signed by Tim Williams, who is still president and CEO of that firm, and also was a prior MHI Executive Committee chairman.

That’s a fine segue into the report linked below, which should be read after this report has been digested.

But there’s more. Let’s look briefly at some Champion history.

Champion Sinks

On November 15, 2009, Reuters reported that “Champion seeks Chapter 11 for U.S. operations.”

Some pull quotes:

- “The factory-built construction company said it had obtained a $40 million debtor-in-possession credit facility from lenders, a portion of which would be used for operations outside the United States.”

- “The company listed total assets of $576.5 million and total debt of $521.3 million, according to a petition filed in the U.S. Bankruptcy Court for the District of Delaware in Wilmington.”

- “Our company has operated for many years with a significant debt load,” Champion Chief Executive William Griffiths said. “Despite our best efforts to reposition the company for diversified growth, the continued challenging economic conditions…have negatively impacted our capacity for debt.”

- “Our balance sheet is the problem, not our operations,” Griffiths said. “The next step…is to restructure our balance sheet and position our company to capitalize on the anticipated recovery in the residential and commercial construction markets,” he added.

Once more, let’s stress that this occurred after that this filing occurred after that Tim Williams/21st and related drama letter.

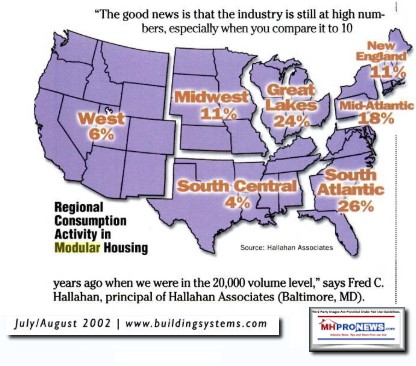

Building Systems said in their July/August 2002 issue that: “Even with terrorist attacks and a faltering economy, the modular system of residential construction remained at historical high in 2001 at 33,500 units nationwide, capturing roughly 2% of all nationwide housing starts.”

Hallahan was cited saying that “…modular volume has remained steady for the past two years, the market has seen an influx of new manufacturers targeting this industry. An example is the publicly traded Champion Enterprises (Auburn Hills, MI). Champion’s launch of its Genesis brand three years ago, and the brands subsequent strong performance, has significantly altered the landscape of the industry and will likely herald the move by other large publicly traded companies into this marketplace.”

So, fast-forward, there was ballyhooing occurring then about modular housing and how that was the coming wave. Think about that as one ponders MHI, Clayton, Cavco and Skyline-Champion promoting “CrossModTM homes.”

Hallahan said that Champion’s Genesis was “making huge gains” but it was “coming at the expense of some more established modular manufacturers.” The market wasn’t growing, it was Genesis that initially grew. “What we are seeing is that a lot of the growth in the South Atlantic market is coming from the HUD-code manufacturers moving into the modular market. In many instances, these companies have the distribution networks already in place and they are very aggressive marketing their efforts to consumers.”

“This is the giant coming over the hill,” stated Hallahan. He thought then that 6 to 8 percent market share was possible of all housing starts.

By November 2009, Champion had filed for bankruptcy protection. That’s not necessarily a slam on Hallahan’s projection, because there were several events that were arguably artificially fostered that numbers of professionals failed to anticipate. How could they, when most normal professionals don’t think in sinister ways?

MHProNews Analysis

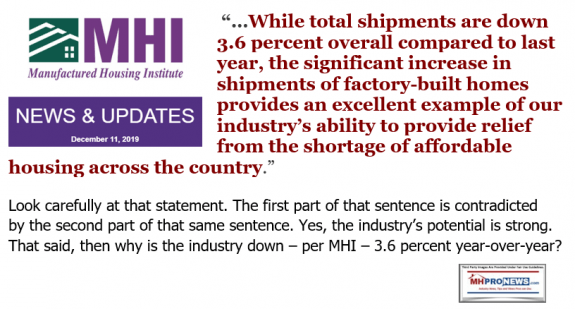

Objectivity and accuracy are part of what we strive to focus upon here at MHProNews. It would be too much to say that “CrossModTM homes” are bound to fail. That said, it is also obviously too much for MHI-Clayton-CVCO-SKY to claim that their razzle dazzle about the ‘new class of manufactured homes’ dubbed “CrossModTM homes” is a sure thing. It’s obviously not. History says otherwise.

Not to beat our own chest, but facts are facts. MHProNews predicted almost two years ago that the “new class” scheme was potentially a “Trojan horse.”

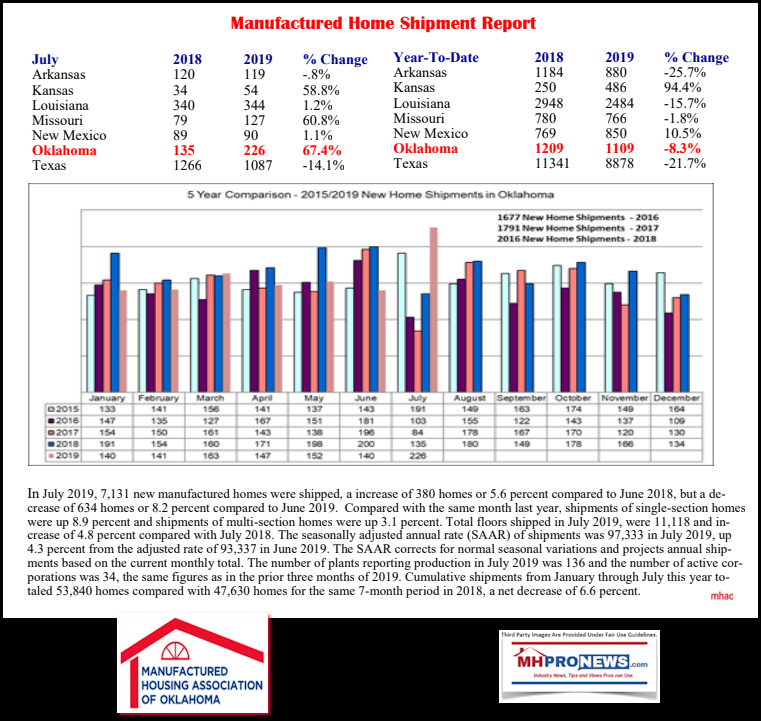

Isn’t that what has begun to occur? Hasn’t manufactured housing slid since the new class of homes was announced? Meanwhile conventional housing is rising. Can you spell disconnect?

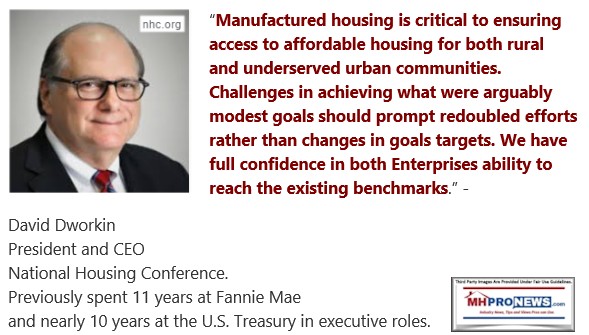

Only 10 such MHI touted ‘new class’ units have had loans closed between both of the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae and Freddie Mac per the St. Louis FHFA Listening session in November, 2019. The GSEs want to back off their projections. Lesli Gooch, then MHI’s Executive Vice President (EVP) but now their CEO in her written comments was okay with the GSEs cutting back on their targets. She only wanted a reduction in the already low targets that they had set.

You simply can’t make this stuff up. It’s outrageous that the National Housing Council President David Dworkin made a stronger case for manufactured housing than MHI did.

Certainly, the difference between the Manufactured Housing Association for Regulatory Reform (MHARR) statements and MHI’s were a stark contrast.

MHI used to claim in writing that they were interested in listening to members and then forging consensus. Apparently, that’s shifted. Their new year greeting was plainspoken. They speak, they want all others to listen. If you don’t like their vision of ‘champion,’ is that just too bad?

Normally businesses don’t double down on failure. But MHI does on this to-date failed new class of homes plan, why? Why do they ignore the history on things similar to this scheme from early in the 2000s?

There are a variety of possible theories. But in our view, the evidence points to this. MHI is focused on consolidation, arguably in ways that are violate the Arlington, VA based trade group’s own antitrust statements.

Curt Hodgson with Legacy Housing made this statement during a conference call with investors.

Warren Buffett has said that what people learn from history is that people don’t learn from history. Do you think that the Oracle of Omaha counts on that as part of his “Castle and Moat” stratagem?

Independents had every reason to believe that manufactured housing would bounce back in 2003-2004. Fast Company reported as much at that time.

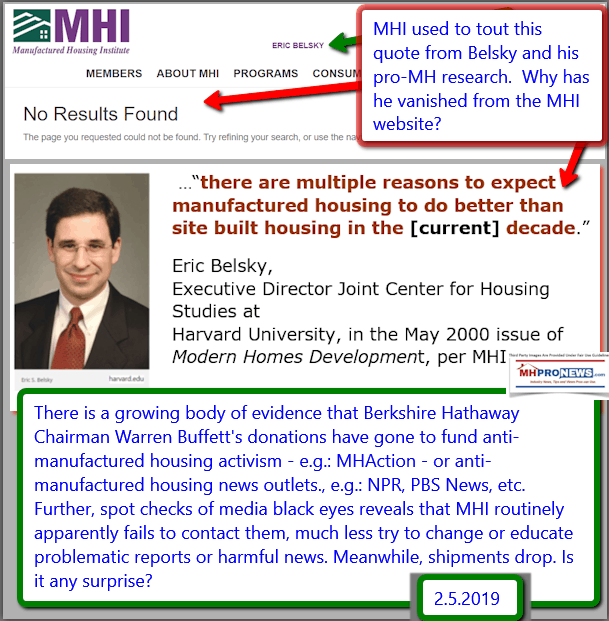

Erik Belsky, then at Harvard’s respected Joint Center for Housing Studies (JCHS), knowing about the repossession glut and the financing issues that faced the industry, nevertheless projected that manufactured housing would dominate over conventional housing by 2010. Belsky and others were proven wrong. Why?

The simple answer is the one that MHProNews and our MHLivingNews sister site has increasingly documented and stated in recent years. Their is documentary evidence that the industry has been subverted from within.

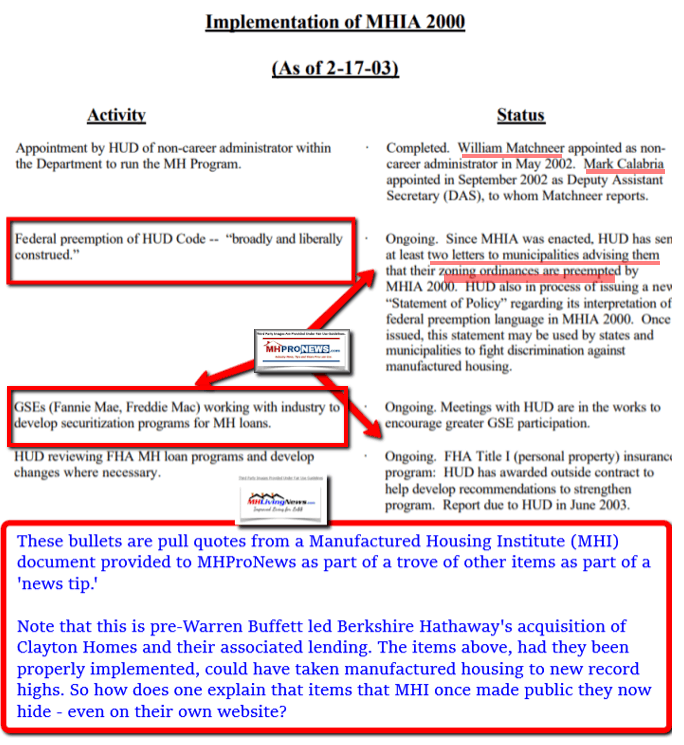

The industry’s independents could debate the variables that occurred prior to Tim William’s 2009 letters. We will unpack that period between 2003 and 2009 in a future report. But there is evidence that MHI knew what to do pre-Berkshire owned Clayton became a reality. They used to tout third party scholarship, like Belsky’s and MHI used to have “enhanced preemption” on their website, per a recent insider tip. See that evidence linked below.

Since that time, as Berkshire’s influence at MHI increased, and since the periodic problematic news reports that have been attached to Clayton during that timeframe and since, there is a case to be made that the strongest horses in manufactured housing subverted the industry from within.

What would be the purpose? Questions like that should be put to Kevin Clayton, Tim Williams, Tom Hodges, Warren Buffett and MHI’s presidents and top executives. That’s been put to Mark Yost at Skyline Champion (SKY) and also to Joe Stegmayer and others at Cavco Industries (CVCO. Their reply? Silence.

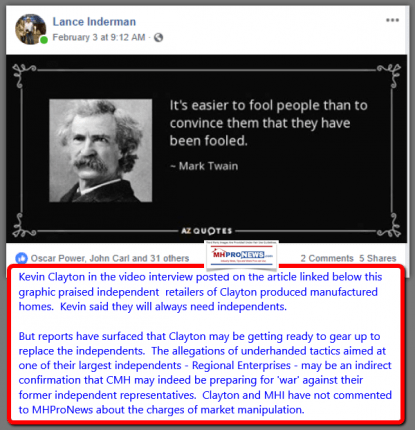

What seems certain is that given the laws that were in place, only an idiot could have fumbled those legal advantages. We believe that the Berkshire leaders are intelligent, not lacking in mental prowess. We also believe that without thoroughly understanding the report linked below and that video interview of Kevin Clayton near the end of that report, no one can possibly have a clear understanding of the woes that dog manufactured housing today.

Independents, Arise…

There are a variety of schemes that have arguably been deployed to slowly but steadily monopolize manufactured housing and consolidate the industry into a relatively small group of firms.

Independents can’t afford to bury their heads in the sand. Reality is what it is, whether we like it or not. Given repeated opportunities to respond to reports like the one linked here, neither MHI, nor the Berkshire brand leaders, nor their outside or inside attorneys have opted to even try to explain away those concerns. New readers must keep in mind that at this time in 2017 and before, MHProNews could send an email to those same people and get a prompt response. No longer.

What to they have to hide? Perhaps plenty. Once more, we believe that public officials have ample evidence to make formal inquiries. Let’s note anew that we know that there are investigations from mainstream media sources as well as our own sources and research. The example below is from mainstream media found in Clayton/21st own home town. But there have been years of reports much like the one below from a range of regional and national mainstream media.

Independents need to think ahead. Failure to plan ahead with such concerns in mind is akin to surrendering to the trends of consolidation. While some may want to sell out, doesn’t everyone that does so want to get a fair valuation instead of a discounted one? Yet, what several sources have told us is that when Clayton buys a retailer, for example, they do so at a lower figure than if the industry was roaring. The same could be said when a production center is sold.

As the examples above reflected, acquisitions and consolidations have routinely occurred for over a decade at discounted valuations. Rephrased, if this is the result of market manipulation – and we believe there is good evidence that such is the case – then thousands have arguably been defrauded of a just valuation. There are investors implications too.

Some statements made to MHProNews are memorable in positive or troubling ways. The independent who said that statement quoted below is something that current independents ought to ponder.

How Many MH Independents, Retailers Have Been Lost Recently? “They Think They Own Us”

But it is our strong belief that independents can fight back in legitimate, lawful and profitable ways. For those interested in learning more in confidence, you can send a message via the comments system below. In your subject line, write: “Confidential Inquiry by Independent DBN.”

The first linked report below is a new item on the Masthead. It dives deeply into purported corruption that has serious impacts on our industry and thus the struggle for affordable housing. It ties into the concerns and allegations raised above.

https://www.manufacturedhomepronews.com/masthead/mobile-home-militia-clayton-homes-wants-your-cornbread-too-join-the-revolution-you-gotta-have-swagger/

We promised that this would wrap on a positive note. Here it is. The opportunities in the industry are perhaps greater than at any time in the industry’s history.

But as with any opportunity, it comes dressed in overalls. It will have to be worked for, it won’t fall in your lap. There are numbers doing what they can to fight back. But there is more possible.

There is more ahead. But at this dawn of a new year and decade, industry independents and investors must ask themselves. Will you keep doing the same things in the same ways? Or will you look at the lessons of history and take savvy, lawful steps to protect your interests? If you have already been harmed, don’t forget this reality. You may still be able to get justice lawfully.

It isn’t over until someone quits.

If you thought it was over, think again. Read, think, then do. The first report following the byline and notices is the runaway most-read in manufactured housing this month. See why. More below and ahead. “News through the lens of manufactured homes and factory-built housing,” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.)

(See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Does Monopoly Power Impact Workers’ Stagnant Wages? MH Industry Impact$

President Raises the M-Word, “Monopoly,” Plus Manufactured Housing Industry Market Update$