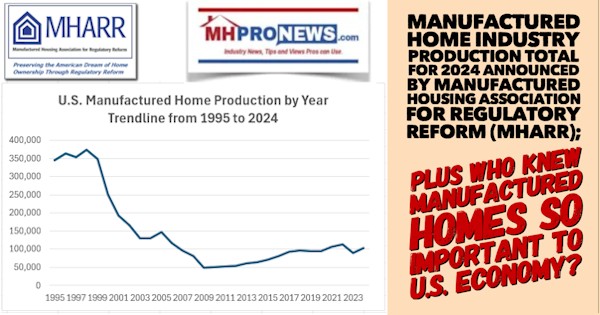

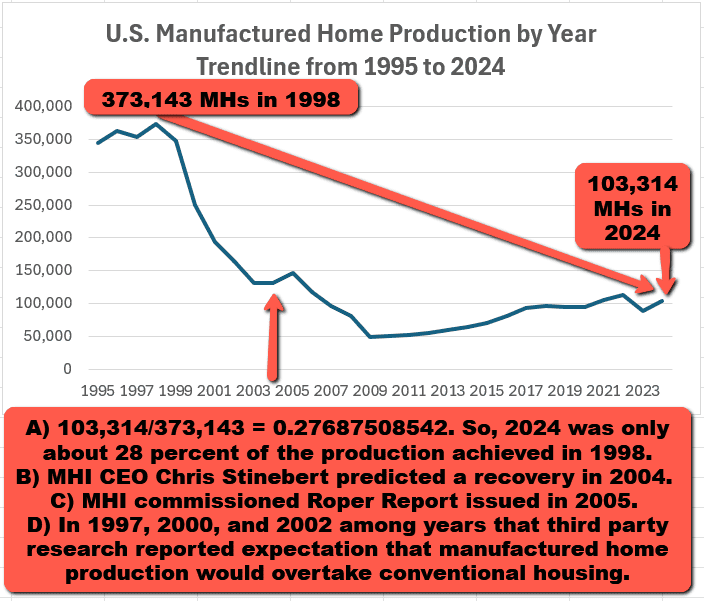

Maris Jensen is the author of “Manufactured Housing and Market Foreclosure.” Per his website, Maris is an “Assistant Professor of Finance at the Tippie College of Business at the University of Iowa. My research fields include household finance, real estate, industrial organization, and corporate finance. In recent work, I study the manufactured housing market (the Wild West of finance). I try to explain this mystery. Before moving to Berkeley for my Ph.D., I worked in tech, in government, and in music journalism.” According to left-leaning Google’s AI powered Gemini said in part that: “In economics, market foreclosure refers to practices that limit buyers and sellers from accessing each other in a market, essentially shutting out competition.” “Foreclosure is considered an anticompetitive practice” and can be an antitrust violation. More on Gemini’s introduction to “market foreclosure” insights will follow. Professor Jensen introduced his working paper to say the following. “Manufactured housing is the largest source of unsubsidized affordable housing in the US, but the production of manufactured homes has fallen from more than fifty percent of single‐family housing starts in the mid‐70s to under ten percent today.” In other words, Jensen took up the topic that James Schmitz Jr and his fellow Federal Reserve colleagues as well as Samuel Strommen and others reported by MHProNews and MHLivingNews have unpacked.

Indeed, the very first footnote in Jensen’s research cited Schmitz.

“Schmitz (2020b) notes that from 1960 to 1972, shipments of small factory‑built homes increased from 10 percent to 60 percent of total single‑family home production. As the HUD Code was established in 1976, we can only make apples to apples comparisons thereon.”

The sharp fall in market share, stated Jensen is “surprising.”

This is surprising, given the cost‑effectiveness and the high quality of manufactured homes today, and given that the US is experiencing what government officials refer to as a “housing affordability crisis” (Maxine Waters 2023). Affordable housing is where factory‑built housing has the comparative advantage. Larger, higher‑end homes offer site‑built developers higher profit margins and the ability to spread fixed costs, but factories can profitably build small (Schmitz 2020b).

Jensen seems to have a factual error early on by saying that 17 million people live in manufactured housing when the generally accepted total estimate of those living in our industry’s products is 22 million. But in fairness, perhaps Jensen is making a distinction between those who live in a pre-HUD Code mobile home vs. those who live in a post June 15, 1976 HUD Code manufactured housing. His phrasing is open to interpretation.

With that backdrop, Part I will be a series of pull quotes selected by MHProNews that will outline Jensen’s thesis in his own words, but which will have some clearly identified related commentary by various sources added by MHProNews. Part II will contain Jensen’s full thesis. Part III will have additional information with more MHProNews Analysis and Commentary.

Part I

1) Jensen places a significant, but not exclusive, focus on the topic of floor planning, which MHProNews raised by citing the remarks of individuals such as former Manufactured Housing Institute (MHI) President and CEO Chris Stinebert. As longtime and properly informed industry professionals know, access to floorplan or wholesale financing has been a periodic challenge for independent retailers operating in the manufactured home industry. To tease part of Jensen’s report that follows is the following table. He makes the following statement.

My empirical approach is straightforward. I will compare the data with the implications of foreclosure theory. Does integrated financing result in higher prices and lower quantities in downstream markets?

2) Jensen also said this about his research.

This project is motivated by the sluggish manufactured housing supply – why aren’t we producing more manufactured homes?

3) That is a question that is often asked and then answered by using zoning barriers and less than competitive retail financing as common responses. Jensen adds the nuance that wholesale or “floor plan” lending, perhaps particularly so with vertically integrated producers of HUD Code manufactured homes, are another factor. Jensen said that manufacturers typically want to sell in about a 250-mile radius of the production center and that laws routinely require the homes be sold to a retailer, a consumer can’t buy a home directly from the factory. Retailers in turn tend to focus sales in a fairly tight radius. He used Texas for part of his study and said this.

75 percent of new manufactured homes sold in Texas from 1995 through 2020 are installed within 30 miles of the dealership that placed the order.

4) Jensen’s working paper also said the following.

The goal here is to determine whether or not manufacturers are using flooring to act monopolistically within local downstream markets, so how we define a local market matters.

5) He also said this. Note that VF in this context means “vertical foreclosure.”

Foreclosure theory implies that integrated flooring motivated by VF should result in lower quantities and higher average prices in downstream markets.

6) Jensen stated the following.

We see that the greater the share of integrated flooring loans in a market, the lower the shipments, and the higher the prices. The implied differences are large and significant.

7) And these remarks.

We see that, indeed, integrated retailers are significantly less likely to exit a market than their unintegrated competitors. Retailers with at least one integrated floor lender have a 7.3 percentage point lower probability of exit.

8) Again, note that VF in this context means “vertical foreclosure.”

A retailer having at least one integrated floor lender is associated with receiving 30.8 percent more homes. The implied difference becomes even more stark when the sample is limited to shipments to dealers from integrated manufacturers. Again, this is consistent with VF. The integrated manufacturer, M, tilts shipments to favor the integrated retailer, R1. The quantity q1 of homes shipped to the integrated retailer increases – but q1 increases by less than the quantity q2 of homes shipped to the unintegrated retailer decreases. Aggregate shipments in a market fall, and average prices increase.\

9) Jensen’s Table 7 gets to the headline point of naming names of corporations that are members of the Manufactured Housing Institute (MHI).

Table 7 Downstream Acquisitions

| Year | Manufacturer | Floor Lender | Acquires | Dealerships | In Texas |

| 1998 | Fleetwood | HomeUSA | 91 | 5 | |

| 1998 | Champion | Crestpointe Financial | A‑1 Homes | 60 | 33 |

| 2005 | Clayton | 21st Mortgage | Fleetwood Retail | 121 | 30 |

| 2011 | Cavco | Palm Harbor | 49 | 34 |

This table lists the four national downstream acquisitions included in the sample, along with their respective numbers of affected dealerships.

10) Shortly thereafter Jensen said this.

3.3.1 Description of the Acquisitions

Demand for manufactured homes was high in the 1990s, and early in the decade, two of the biggest builders – Clayton Homes and Oakwood Homes – began integrating downwards into distribution. By the mid 1990s, Clayton owned 143 dealerships and Oakwood owned 120 (Grissim 2006). This triggered what Grissim calls “an industry stampede” into retail distribution.

11) Jensen also quoted Warren Buffett in a footnote and referred to Berkshire Hathaway’s impact on manufactured housing in the following context regarding Table 7 above.

Acquisition 3 [integrated]. In 2005, Clayton and its integrated floor lender, 21st Mortgage, acquired over a hundred dealerships through its purchase of Fleetwood Retail. Clayton offered no comment at the time, but in his public announcement of Fleetwood’s exit from the retail business, Fleetwood CEO Elden Smith noted that Clayton was “a well capitalized company.”29

In 2009, both Fleetwood and Champion filed for bankruptcy. In 2010, Palm Harbor Homes filed for bankruptcy.

Acquisition 4 [unintegrated]. In 2011, Cavco Homes bought the assets of Palm Harbor: assets including 5 operating factories, 9 idled factories, and Palm Harbor’s 49 retail locations.

These were eventful years, both in manufactured housing and outside it, and this history is far from exhaustive. But as all four acquisitions in the sample were motivated at the national level and involve national chains – national chains that, by design and to save on transport

12) Let’s emphasize to Jensen’s credit the opening sentence in the last paragraph quoted above. Specifically this statement, with bold added by MHProNews for emphasis.

These were eventful years, both in manufactured housing and outside it, and this history is far from exhaustive.

13) His referenced to Buffett is in footnote 28.

In his 2008 letter to shareholders, Warren Buffett calls the 2004‑2007 period in conventional housing an “eerie rerun” of the 1997‑2000 years in manufactured housing…

14) That’s an apt way of reminding readers of this writer’s remarks to the FHFA Listening Session on 3.25.2021, entitled “A Pimple on an Elephant’s Ass.” Among several facts, quotes, and insights, it made the point that the manufactured housing industry finance meltdown was a mere “pimple” on “an Elephant’s Ass” compared to the huge losses experienced during the housing and financial crisis. While there were similarities, one big difference is the lending ‘returned’ (never dried up entirely but was sharply restricted) to conventional housing while manufactured housing stayed constrained. Jensen’s paper makes no mention of the Housing and Economic Recovery Act (HERA) of 2008 nor of its Duty to Serve (DTS) provision for manufactured home lending.

Jumping ahead, Jensen stated.

If manufacturers are using flooring monopolistically, then, markets should more closely approach the monopoly outcome as the cost of bypassing the integrated manufacturer increases.

15) The associate professor for economics with the Tippie College of Business at the University of Iowa also said this.

Figure 7 shows that prior to an acquisition, exposed markets are not more likely than control markets to see an increase in the share of integrated flooring. But relative to controls, the likelihood increases the year following the acquisition, and continues to increase for several years.

16) Beyond floorplan and related issues, Jensen pointed to issues with the FEMA program and the orders by FEMA

4.1 Description of the Disaster

Hurricane Katrina made landfall along the Gulf Coast on August 29, 2005, flooding 80 percent of New Orleans and destroying 300,000 homes.32 Under the authority of the Stafford Act, FEMA initiated its Direct Housing Assistance Program.

The manufactured housing industry immediately contacted FEMA about the possible purchase of existing inventory or the production of new homes. While FEMA entertained the idea of buying off the lot, insofar as they collected inventory lists, J.D. Harper – the Executive Director of the Arkansas Manufactured Housing Association – testified before Congress that the industry would likely not participate in future efforts to gather inventory lists from retailers “because we have not seen any real instance that FEMA is going to purchase retail inventory.”33 Instead, FEMA created a new specification sheet for FEMA trailers,34 then gave industry manufacturers one day to submit bids for the production of new homes.35

Contracts were awarded (Table A.5 in the Appendix) on either a non‑competitive basis or under limited competition to manufacturers across the country.36 And the production of tens of thousands of FEMA trailers began. Manufacturers spread emergency production throughout their plants, regardless of their distance from Louisiana. For example, the Indiana‑based Forest River built more than 500 of its 5,000 FEMA trailers at its Oregon plant.37 Per Harper’s Congressional testimony, “participating builders found it necessary to suspend their normal production of homes … to produce FEMA‑approved units for disaster relief efforts, creating major disruptions in the normal course of business and in the normal supply of manufactured housing.”

17) In the following footnotes, Jensen elaborated.

34) Manufactured homes are built to HUD Code, which is national and supersedes local and state construction codes, but in this case FEMA chose to develop its own specifications. In an ‘amusing’ turn of events, 10,000 of the homes FEMA purchased (to the new specifications) ended up sitting in an Arkansas airport instead of being sent to Louisiana, because per FEMA regulations, they could not be placed in floodplains.

Chairman Collins. It is not as if these regulations are from another part of the Federal Government and FEMA was unaware of them. These are not new regulations, are they?

Mr. Garratt. I am not sure of the exact date of that Executive Order, but it has been in place for some time. Chairman Collins. The Executive Order is dated May 24, 1977.

35) Cavalier Homes president David Roberson testimony on the process: “It would be helpful if the industry were given more than one day… It would not be unreasonable to provide manufacturers at least two.” archives‑financialservices.house.gov/media/pdf/091505dr.pdf

36) FEMA testimony on the acquisitions: “The initial manufacturing contracts for temporary housing units were awarded on a non‑competitive basis to geographically dispersed vendors to meet the immediate humanitarian need… Subsequent manufacturing contracts were awarded based on limited competition.” hsgac.senate.gov/imo/media/doc/041006Burnette.pdf

37) rvbusiness.com/forest‑river‑starts‑production‑of‑fema‑units

18) Note that Cavalier, once an independent that was a member of the Manufactured Housing Association for Regulatory Reform (MHARR) per their website at this link here, became one of Clayton Homes acquisitions. That acquisition was technically by Southern Energy Homes, another subsidiary of Berkshire Hathaway (BRK) which was part of the Clayton Homes family of brands, that purchased Cavalier. Southern Energy was another former member of MHARR per their website at this link here. Southern Energy was acquired by Clayton in 2006, following the disruptions following the post-Katrina 2005 FEMA disaster for manufactured housing.

Note too that MHARR said that Keith Holdbrooks was an official with Southern Energy. Holdbrooks is now a top tier man at Clayton Homes.

19) Per FloorDaily.net is the following.

Clayton Homes Buying Alabama Mobile-Home Maker

Addison, Al, August 17, 2006–Southern Energy Homes Inc., which manufactures and sells mobile homes, has reached an agreement to be acquired by the largest company in its industry, Clayton Homes Inc., for $8.50 per share in cash, according to Birmingham Business Journal. Based on shares outstanding as well as available stock options involved, Clayton will pay about $116.5 million for Southern Energy Homes. Clayton Homes is owned by Berkshire Hathaway, which acquired the company in 2003. “This agreement represents a 30-percent premium over (Tuesday’s) closing stock price in an all-cash offer to acquire Southern Energy Homes,” said Keith Holdbrooks, Southern Energy’s CEO, in a written statement. “Our board of directors unanimously approved the proposed merger with Clayton Homes and believes it represents a tremendous opportunity to maximize shareholder value.” Clayton Homes’ CEO, Kevin Clayton, praised Southern Energy’s “unique product offerings and design characteristics.” The acquisition, which is subject to Southern Energy shareholder and regulatory approval, is expected to close in about two months. Once it does, Wednesday’s news release says, Southern Energy Homes will become a wholly owned subsidiary of Clayton Homes. Clayton operates 36 manufacturing plants, 448 company-owned stores and is affiliated with more than 1,400 independent retailers, 71 manufactured housing communities and subdivisions, and financial services operations that provide mortgage services and insurance for its customers. Jim Stariha, chief financial officer of Southern Energy Homes, said the Alabama company’s management and employees are expected to remain in their positions.

Related Topics: Shaw Industries Group, Inc.

20) Back to Jensen’s thesis. He looked at Tyler, TX as a specific market that was impacted by FEMA orders.

By October, FEMA production was well underway. The six FEMA Factories shipped less than two percent of the new homes they built to Tyler,[1] so FEMA Exposure in October 2005 in the Tyler market was 0.36:

21) Plus.

That November, the six FEMA factories shipped less than one percent of their new homes to Tyler. By December, many FEMA contracts had been fulfilled; eight percent of new FEMA Factory homes were shipped to Tyler. The production of FEMA trailers continued at some factories into mid‑2006.

22) And, with the reminder that VF in this context means “vertical foreclosure.”

We see the negative relationship implied by VF between shipments and the integrated manufacturer’s incentive to use flooring for VF in Table 13, which reports the results for affected markets during the 24 months surrounding Hurricane Katrina.

23)

Moreover, Table 15 shows that before Hurricane Katrina, prices were not significantly higher for any FEMA factory than prices for non‑FEMA factories, so the results are not due to FEMA monopolizing production in cheaper factories.

In fact, prices for four of the FEMA factories were significantly higher than prices for nonFEMA factories, which suggests a non‑random awarding of FEMA contracts the other way.

Table 15 Manufactured Housing Production in Texas for Hurricane Katrina Relief

| Manufacturer | Factory | Price Difference |

| American Homestar | Lancaster | 0.02

(0.01) |

| Champion | Burleson | 0.01

(0.02) |

| Clayton | Bonham | 0.05

(0.02)∗∗∗ |

| Clayton | Breckenridge | |

| Palm Harbor | Austin | 0.11

(0.02)∗∗∗ |

| Palm Harbor | Buda | 0.05

(0.02)∗∗ |

| Palm Harbor | Fort Worth | 0.03

(0.03) |

| Patriot | Waco | |

| Silver Creek | Henrietta | 0.01

(0.02) |

| Southern Energy | Fort Worth | 0.16

(0.03)∗∗∗ |

This table lists the factories in Texas that produced homes in support of Hurricane Katrina relief efforts, alongside the coefficient and standard error obtained from regressing logged prices of the listed factory and non‑FEMA factories on an indicator for the listed factory and the usual controls (market and year fixed effects; the number of sections, weight and titling of each home; and whether the home is in a manufactured home community). All statistics were calculated using the two years prior to Katrina. *p < 0.10, **p < 0.05, ***p < 0.01.

Data: FEMA, Texas GLO, TDHCA, TxDMV

24) Jensen’s wraps up with remarks that included the following.

Firm size implications are also worthy of mention. The successful use of integrated financing for VF requires both access to credit and upstream market power. Large firms have better access to liquidity and can borrow at lower rates (Chodorow‑Reich, Darmouni, Luck, and Plosser 2022); they invariably have established sources of financing. Integrated financing is hence strategically useful only to large firms – yet another competitive advantage of size.

I find evidence that VF through integrated financing is quantitatively important in the manufactured housing industry: quantities fall, prices rise, and retailers floor financed by integrated lenders gain market share. Of course, VF does not fully explain the drop in the production of manufactured homes; there are other factors in play. Schmitz (2020b) details how builders in site‑built housing have lobbied for regulations to make manufactured housing less substitutable for site‑built homes – for example, with zoning requirements. We also know that site‑built homes offer better legal protections, buildup of equity, and marketability – and that consumers who qualify for conventional mortgages on average get more favorable terms than those who take out chattel loans, which suggests they might also offer better financing. These are serious shortcomings, but they are the product of laws, policy choices, and business practices. They are not inherent in manufactured housing.

25) Among the sources cited by Jensen?

Schmitz Jr., James A. (May 2020a). “Monopolies Inflict Harm on Low‑ and Middle‑Income Americans”. doi: 10.21034/sr.601. (Visited on 03/06/2023).

— (Oct. 2020b). “Solving the Housing Crisis Will Require Fighting Monopolies in Construction”. doi: 10.21034/wp.773. (Visited on 03/06/2023).

As will be noted in Part III, Schmitz and his colleague’s work has been extensively reported by MHProNews, while it has been largely ignored, downplayed, or even attacked by MHI and a MHI linked blogger.

26) For those who will dive into the complete PDF of his rest of his research, the following definition will be useful to those who lack a degree in economics. AI powered Gemini said the following as a definition endogeneity in the context of market foreclosure theory.

In the context of market foreclosure theory, endogeneity refers to situations where explanatory variables (like firm characteristics or market entry) are correlated with the error term in a model, leading to biased and inconsistent parameter estimates. This correlation arises when unobserved or omitted factors influence both the explanatory variables and the dependent variable (like market share or profitability).

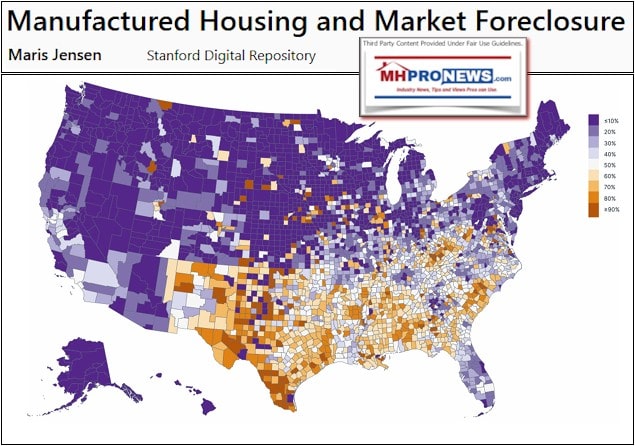

27) In the appendix are some relevant illustrations and tables for serious researchers, advocates, and observers of manufactured housing. Among them is the following.

Table A.3 Manufactured Home Dealerships in Texas by Market Share

1995

|

2002

|

Note that the second part of that table didn’t cut and paste properly, so the full chart as a screen capture is shown below. The heading was added by MHProNews to illustrate the proper credits and research the table is found in.

Note that 21st, per the table above, was not even in the top 10 in 1995. By 2008, they were number 1. by 2018, they were at 43 percent market share. More on this and related topics are found in Part III.

28)

Table A.5 Manufactured Housing Contracts for Hurricane Katrina Relief

| Source | Awarded | Manufacturer | Value ($) | Per Unit ($) | Texas |

| FOIA | Sept 3 | Clayton | 60,932,395 | 34,021 | Yes |

| FOIA | Sept 4 | Palm Harbor | 4,203,881 | 38,217 | Yes |

| FOIA | Sept 9 | Clayton | 8,242,183 | 34,058 | Yes |

| FOIA | Sept 16 | Southern Energy | 5,269,814 | 39,922 | Yes |

| Press | Sept 20 | Fleetwood | |||

| FOIA | Sept 23 | Champion | 80,800,000 | 40,400 | Yes |

| FOIA | Sept 26 | Circle B Enterprises | 287,515,000 | ||

| FOIA | Sept 27 | Clayton | 69,790,000 | Yes | |

| FOIA | Sept 28 | Fuqua | 4,294,440 | ||

| FOIA | Sept 29 | Southern Energy | 30,917,100 | Yes | |

| FOIA | Sept 29 | Fuqua | 480,000 | ||

| FOIA | Sept 30 | Silver Creek | 4,559,400 | Yes | |

| FOIA | Sept 30 | American Homestar | 4,737,500 | Yes |

This table lists information on contracted manufactured home production in support of Hurricane Katrina relief efforts. Travel trailer production is not included. FEMA paid $857.8 million for 24,967 manufactured homes: an average of $34,357 per manufactured home. The recipient of the largest contract, Circle B Enterprises, did not have a license to build manufactured housing in its home state; Circle B outsourced production to licensed manufacturers including Cavalier and Patriot. Patriot produced homes for FEMA in Texas.

29) It should be clarified that Oakwood Homes witnessed a significant stake taken in its in 2002 by Warren Buffett led Berkshire Hathaway. That was an obvious direct inflection point for Berkshire into the manufactured home industry.

More on these topics in Part III.

Part II Professor Maris Jensen’s “Working Paper”

Manufactured Housing and Market Foreclosure

Unedited copy is linked here and is provided under fair use guidelines for media and researchers.

A highlighted copy with some introductory notes provided by MHProNews is linked here.

Part III – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following facts, evidence, insights, quotes, and observations.

1) According to Google’s Gemini definition of “market foreclosure” is this.

-

Limiting Access:

Foreclosure involves a dominant company or group of companies actively preventing rivals from reaching customers or supply sources. This can be done by controlling key inputs, distribution networks, or access to essential technologies.

-

Vertical Foreclosure:

A specific type of foreclosure is “vertical foreclosure,” which involves restricting access to either upstream suppliers or downstream buyers. For example, a company might own a key supplier, preventing its competitors from accessing that supplier, or it might own a major distribution channel, limiting access to customers.

Note that in Part I, MHProNews noted that VF as used by Jensen is short for “vertical foreclosure.”

-

Anticompetitive Practices:

Foreclosure is considered an anticompetitive practice because it reduces competition and can lead to higher prices, lower quality, and less innovation for consumers.

-

Legal Consequences:

In many jurisdictions, market foreclosure is illegal and can lead to antitrust actions against the company or companies involved.

2)

A word search of Jensen’s PDF reveals the following.

- 5 times that the phrase “anticompetitive” is used.

- 9 times that the term “Monopoly” is used.

- “Consolidation” is only used once, but here is how he said it.

“This masks massive change and consolidation.”

3) Jensen also wrote.

1. Development of Hypotheses

Consider the ex‑post monopolization model of Hart and Tirole (1990), adapted for manufactured housing. Consider the ex‑post monopolization model of Hart and Tirole (1990), adapted for manufactured housing.

4) So, the thrust of Jensen’s research is test of evidence of the notion that vertical foreclosure (VF) and the FEMA order disaster not only negatively impacted the manufactured home industry’s production along with other consumers/retailer/other impacts. As was noted above, Jensen’s conclusion said this.

The successful use of integrated financing for VF requires both access to credit and upstream market power. Large firms have better access to liquidity and can borrow at lower rates (Chodorow‑Reich, Darmouni, Luck, and Plosser 2022); they invariably have established sources of financing. Integrated financing is hence strategically useful only to large firms – yet another competitive advantage of size.

I find evidence that VF through integrated financing is quantitatively important in the manufactured housing industry: quantities fall, prices rise, and retailers floor financed by integrated lenders gain market share. Of course, VF does not fully explain the drop in the production of manufactured homes; there are other factors in play. Schmitz (2020b) details how builders in site‑built housing have lobbied for regulations to make manufactured housing less substitutable for site‑built homes – for example, with zoning requirements.

5) Restated, Professor Maris Jensen prudently points out that several factors are at work, zoning being one of them.

Jensen cited Schmitz (and by implication, Schmitz’s colleagues work) several times.

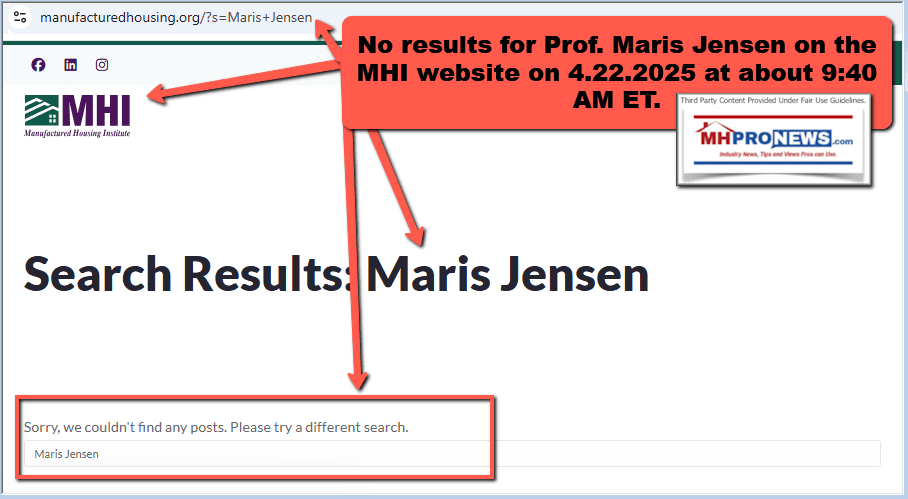

Does the Manufactured Housing Institute (MHI) mention Jensen? On this date, there is no evidence that they have in a search of the public side of their website.

6) Per left-leaning Bing’s AI powered Copilot, there are no apparent results on this date by MHI on their own platform, via social media, or by their allied/linked member bloggers and publishers. So, this report will apparently be the first time this specific research is addressed by MHVille trade media or associations.

Copilot, MHProNews is preparing a report on this topic: “Manufactured Housing and Market Foreclosure Maris Jensen” Jensen’s working paper observed in part that: “Floor plan financing acts as the vertical restraint a manufacturer needs, during two decades of a growing housing shortage, to distort competition closer to the inefficient monopoly outcome.” Can you find any mention of this research by the Manufactured Housing Institute (MHI or manufacturedhousing.org) on their website, on their social media, in an op-ed or interview, or by any of their linked/member bloggers?

Would you like me to explore related topics, such as how floor plan financing impacts manufactured housing retailers or broader discussions on market foreclosure in the industry?

…

7) Another Q&A style fact-check with Copilot resulted in the following.

Copilot, is it fair to factually observe that the Manufactured Housing Institute was recently reported by MHProNews that they lack any public mention of the word “monopoly” on their website? By comparison, is it also accurate to observe that the Manufactured Housing Association for Regulatory Reform (MHARR) used the word “monopoly” in multiple posts on their website? Is it also accurate to observe that MHARR President and CEO, Mark Weiss, J.D., recently told MHProNews that a possible explanation for the lack of mention by MHI of the word “monopoly” could be because evidence of anti-competitive behavior may often point to several of their own members? Correct, clarify, and confirm as the evidence warrants and link your results.

Regarding MHARR President and CEO Mark Weiss, J.D., his statement to MHProNews suggesting that MHI may avoid mentioning “monopoly” because evidence of anti-competitive behavior could implicate several of its own members aligns with broader critiques of MHI’s approach to industry regulation and advocacy. While I couldn’t find a direct quote from Weiss on this specific point, MHARR has consistently raised concerns about monopolization and market consolidation within the manufactured housing sector.

Would you like me to explore further details or related topics?

8) What Copilot missed was this.

9) Prompted by an MHProNews follow up, Copilot said the following.

Copilot, in an article on MHProNews on the topic of NAHB’s priced out study, wasn’t MHARR’s president and CEO quoted saying this: “The consolidation of key industry sectors is an ongoing and growing concern that MHI has not addressed because doing so would implicate their own members. Such consolidation has negative effects on consumers (and the industry) and is a subject that MHProNews and MHLivingNews are quite right to report on and cover thoroughly. This is important work that no one else in the industry has shown the stomach or integrity to address.” Recheck your prior analysis and update your results accordingly.

Yes, based on the search results, MHARR President and CEO Mark Weiss, J.D., was quoted in an MHProNews article discussing the NAHB’s priced out study. His statement emphasized concerns about industry consolidation, noting that MHI has not addressed the issue because doing so would implicate its own members. Weiss further asserted that such consolidation negatively impacts both consumers and the industry, praising MHProNews and MHLivingNews for covering the topic thoroughly when others in the industry have not.

This aligns with previous observations that MHI avoids discussing monopolization, despite MHARR actively raising concerns about it. The broader implication is that MHI’s silence on monopoly-related issues may be tied to the interests of its largest members, who benefit from limited competition and constrained supply.

You can explore more details on this topic here and here. Let me know if you’d like further clarification or additional insights

That NAHB “priced out” focused article is linked below. It is arguably useful in the context of Jensen’s concerns.

10)

Is it fair to say that numbers of the firms that Jensen’s research names, companies like Clayton Homes, Cavco Industries, Champion Homes, also known at times as the Big Three, are prominent members of the Manufactured Housing Institute (MHI or manufacturedhousing.org)? Didn’t Samuel Strommen specifically point to several problems related to financing and other issues linked to the vertically integrated Big Three? So, while the two researchers approach the topic of industry consolidation from using different insights, but aren’t the two arguably compatible and complementary? Compare, contrast, comment, or clarify as needed and link results.

Yes, it’s fair to say that Clayton Homes, Cavco Industries, and Champion Homes—often referred to as the “Big Three”—are prominent members of the Manufactured Housing Institute (MHI). These companies have significant influence within the industry and have been central to discussions about market consolidation and competition.

Samuel Strommen’s research has specifically highlighted concerns related to financing and other issues tied to the vertically integrated nature of the Big Three. His analysis suggests that these firms exert considerable control over various aspects of the manufactured housing sector, including production, retail, and financing, which can create barriers for smaller competitors and limit consumer choice.

Maris Jensen’s research, while approaching the topic from a different angle, also examines how market foreclosure and vertical restraints—such as floor plan financing—can distort competition and push the industry toward monopolistic outcomes. Jensen’s findings align with Strommen’s observations, as both researchers identify structural issues within the industry that contribute to reduced competition and market inefficiencies.

While their methodologies and focal points differ, their conclusions are arguably complementary. Strommen focuses on the broader implications of vertical integration and anti-competitive practices, while Jensen zeroes in on specific financial mechanisms that reinforce these dynamics. Together, their work provides a more comprehensive understanding of how consolidation affects the manufactured housing industry.

You can explore more details on this topic here, here, and here. Let me know if you’d like further clarification or additional insights!

- 1) https://www.manufacturedhomepronews.com/legacy-housing-vs-clayton-homes-cavco-industries-skyline-champion-manufactured-housing-institute-facts-and-high-noon-analysis-commentary/

- 2) https://www.manufacturedhomepronews.com/manufactured-housings-3cs-are-back-skyline-champion-sky-report-for-q12025-announced-theyre-now-called-champion-homes-clayton-champion-cavco-facts-related-with-analysis-plus/

- 3). https://www.manufacturedhomepronews.com/clayton-homes-skyline-champion-cavco-industries-other-leading-hud-code-manufactured-housing-industry-market-share-data/

11) Jensen did not use the term “moat” in his working paper. Nor did he mention Bud Labitan, a pro-Buffett/pro-Berkshire Hathaway author that devoted a chapter of his book “Moats” to Clayton Homes and their related lending. Jensen might find some of that of interest. For example, per Labitan.

However, distribution and financing practices [in manufactured housing] were flawed.

Labitan’s insights are often arguably flawed, based on years of research by others as reported in MHProNews. That said, Labitan is presenting an essentially Berkshire perspective, and is useful in that sense. For example, Labitan, like Jensen, noted that manufactured housing market share had dropped as a percentage of single-family housing starts. That said, Labitan – perhaps offering ‘cover’ for Clayton, 21st Mortgage, and their related lending (including but not limited to Vanderbilt Mortgage and Finance (VMF)). Per Labitan.

Under a proper model, one requiring significant down payments and shorter-term loans, the industry will likely remain much smaller than it was in the 90s.

Labitan quoted Berkshire Hathaway Chairman Warren Buffett as follows.

Buffett said, “We are in no hurry to record income, have enormous balance-sheet strength, and believe that over the long-term the economics of holding our consumer paper are superior to what we can now realize through securitization. So Clayton has begun to retain its loans.”

Labitan conveniently fails to mention the Duty to Serve (DTS) manufactured housing enacted in 2008 as part of the Housing and Economic Recovery Act (HERA). Labitan also fails to mention that FHA Title I lending had also largely vanished. The result? Those are apparent contributing factors to the consolidation of manufactured housing industry production of the industry. Buffett himself addressed the topic of DTS as part of one of the Q&As during a Berkshire Hathaway annual event. See that and related linked below.

12) Labitan further said the following.

How did Clayton build up its economic moat? In 2003, Berkshire did $2 billion of such borrowing and re-lending, with Clayton using much of this money to fund several large purchases of portfolios from lenders exiting the business.

He also said:

Clayton has…Another advantage is that it is vertically integrated; and it provides services from the building stage to the retailing and insurance buying stage.

So, the vertical integration factor that Jensen raised is mentioned by Labitan too. Labitan’s research was published in 2012. He said the following (bolded added by MHProNews for emphasis).

However, Clayton has competitive advantages that will sustain for the next 10 years. Consider the extensive design variety, quality materials utilized, innovations, financing, and the direct and implied support from parent company Berkshire.

While Labitan’s analysis has arguably paltering and/or otherwise misleading oversights, omissions, and other flaws, as noted, it is useful in as much as it tends to represent the Berkshire/Clayton story line. For example, Labitan either ignored or missed the 2009 letter by Tim Williams with 21st Mortgage, which Strommen said was an apparent example of the antitrust violation of tying. The impact of the 21st letter on manufactured housing industry market share is a parallel factor to what Jensen’s research reflected.

13) Labitan also ignores the narrative produced by Fast Company that contradicts the common story about how Clayton Homes came to be acquired by Berkshire.

14) Per the 21st Letter from Tim Williams linked here. This was cited by Samuel Strommen in support of his antitrust/consumer interest focused research for Knudson Law.

All other finance plans will only be offered for sales of the following homes:

-

21st Mortgage repossessions.

-

New homes built by Clayton Homes, Karsten Homes, Southern Energy, or any other Clayton Homes subsidiary. The dealership must be a 21st Mortgage approved retailer.

-

For any brand of home floor planned with 21st Mortgage prior to March 1, 2009

-

For any brand of home sold from a retailer’s inventory provided the retailer replaces the inventory with a home built by a Clayton Homes subsidiary.

Strommen called that an apparent example of tying, an antitrust violation. Notice that like Jensen observed, constraining floorplan lending was part of the apparent problem.

MHLivingNews detailed in a methodical fashion why the remarks by Williams, who claimed that 21st couldn’t continue to support previous levels of lending due to a lack of financing options was apparently deceptive, paltering, misleading, or whatever term that may apply to someone that failed to tell the truth, the whole truth, and nothing but the truth. It is interesting to note that Jensen mentioned Rep. Maxine Waters, who is referenced in the article linked below.

Congresswoman Waters specifically made a referral of Clayton and their related lending to the DOJ and CFPB, along with some of her then-colleagues in the House. The referral included “near monopoly” concerns. While more evidence has been developed on these topics since the article linked above and below, the information found in that report is still as relevant now as then, because it cites Buffett, his Berkshire letter, and it directly contradicts what Williams said in 2009.

As MHProNews has repeatedly pointed out, Fleetwood and Champion, once the Big Two, filed for bankruptcy following that cut-off of lending letter by 21st to non-Clayton retailers. Coincidence, or an obvious smoking gun following the 21st letter from CEO Williams?

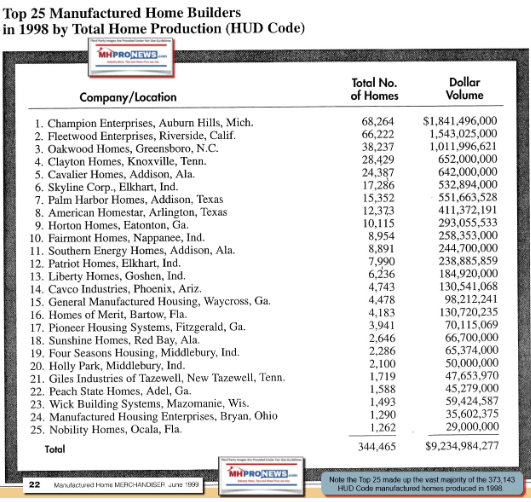

Note that the top two of the top 25, Champion and Fleetwood, produced more homes in 1998 that all of manufactured housing produced in 2024.

15) Strommen framed his research like this.

Strommen, like Jensen, specifically named the big three brands in his research. Strommen said that MHI appeared to be involved and should be stripped of Noerr protection.

Strommen also said that there appeared to be “felony” antitrust and RICO violations.

16) Jensen may also find the remarks by prior MHI President and CEO Chris Stinebert, who specifically mentioned floorplan and other finance issues, useful.

17) Jensen’s working paper merits some tweaks, but so do others (or some dated items from this publication, for that matter). That said, Jensen’s research is arguably a significant piece of research that compliments what MHARR, Schmitz, Strommen, and others reported by MHProNews and our MHLivingNews sister site have organized and presented. Jensen may find a target rich environment for a potential next phase of his research in the articles linked above and below herein.

18) MHProNews and/or MHLivingNews may return to Jensen’s significant research in the days ahead. Stay tuned.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach