The Fannie Mae Home Purchase Sentiment Index® (HPSI) has nearly double over the past year according to the Fannie Mae Economic and Strategic Research Group (a.k.a.: ESR Group) press release provided to MHProNews that will be provided in Part I of this report. Fannie Mae’s news release expressed that differently, as will be evident shortly. The headline is a paraphrase of a remark by Mark Palim, Fannie Mae Senior Vice President and Chief Economist. Their remarks are focused on housing in general, not manufactured housing. Fannie Mae steered away from any mention of politics, but as the news analysis that follows in Part II will reflect, the Trump Effect and other aspects of headline including the MHVille analysis section of this article will be laid out in Part II. It will include a focused update on the Duty to Serve (DTS) manufactured housing, including a letter from the Manufactured Housing Institute (MHI).

Part I

Consumer Housing Sentiment Up Significantly Year over Year

Jump in Confidence Driven Largely by Increased Optimism that Mortgage Rates Will Fall

WASHINGTON, DC – December 9, 2024 – The Fannie Mae Home Purchase Sentiment Index® (HPSI) increased 0.4 points in November to 75.0, continuing its sharp upward trend over the past year as consumers appear to be acclimating to the higher mortgage rate and home price environment. This month, a new record-high share of consumers indicated that they expect mortgage rates to decline over the next 12 months, while fewer respondents said they expect home prices to rise. While only 23% believe it’s a “good time to buy a home,” on net that component continued its upward trend, and is now notably higher than last November’s share of 14%. The share of respondents saying it’s a “good time to sell” remained flat month over month but is also up from last year. Year over year, the HPSI is up 10.7 points.

“Over the past year, we have seen a significant improvement in general consumer sentiment toward the housing market, largely driven by increased optimism that mortgage rates will fall and improved perceptions of both homebuying and home-selling conditions,” said Mark Palim, Fannie Mae Senior Vice President and Chief Economist. “Notably, this improvement in sentiment continues a trend that began about two and a half years ago following the sizeable run-up in home prices during the pandemic, and it is likely due in part to consumers’ slow-but-steady acclimation to current market conditions. Of course, high home prices and high mortgage rates remain the primary reasons why the vast majority of consumers think it’s a ‘bad time to buy’ — trends that we expect to continue into the new year.”

Palim continued: “Fortunately, a sharply growing share of consumers say they expect their personal financial situation to improve over the next year. Additionally, more consumers expect home price growth to slow, a belief recently shared by our expert panelists, as well, which may help ease some of the affordability burden and incentivize some households, especially those who have been waiting in the wings, to finally act on their home purchase decision.”

About the ESR Group

Fannie Mae’s Economic and Strategic Research Group, led by Chief Economist Mark Palim, studies current data, analyzes historical and emerging trends, and conducts surveys of consumer and mortgage lender groups to provide forecasts and analyses on the economy, housing, and mortgage markets.

—

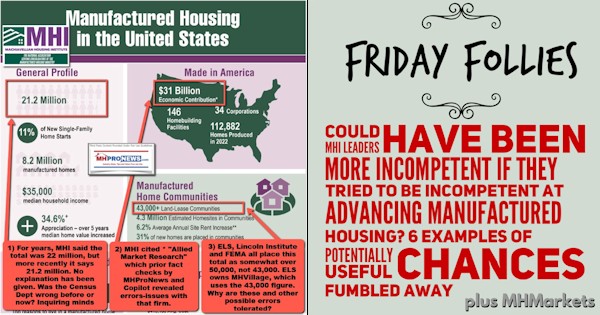

MHProNews note: the illustration below is a composite image from the Fannie Mae website but is not part of their press release above.

Part II – Additional Information with More MHProNews Analysis and Commentary

1) Fannie Mae’s Chief Economist Mark Palim said the improvement in consumer sentiment is: “is likely due in part to consumers’ slow-but-steady acclimation to current market conditions.” That may be, but the above obviously ignored the widely reported facts that Kamala Harris (D) and her running mate, Governor Tim Walz (MN-D) were not seen by most voters as better at handling the economy than the winner of the 2024 presidential election, former and future President Donald J. Trump (R) and his running mate, Senator J.D. Vance (OH-R). MHProNews and our MHLivingNews sister-site reported on trends using Election Time and other sources that provided an evidence-based analysis that showed Trump would win, even as some pollsters claimed Harris was ahead.

Put differently, through discernment our publication did a good job of accurately reporting items that some multibillion-dollar news organizations missed.

2) For those who are closely following our broader series on The Patch of economic, political, spiritual, cultural, and “infotainment” articles know, Democratic Party insiders revealed after the election on during a left-leaning Pod Save America episode that their campaign’s internal polls never showed Kamala Harris (D) ahead of Trump-Vance (R). That was a surprising admission that some in media downplayed or ignored to the detriment of their audiences. The remarks by former Obama-Biden era adviser David Plouffe were reported by left-leaning USA Today.

3) Our Patch series also reported that Democratic mega-donor and wealthy attorney John Morgan recently ripped the Kamala Harris campaign via numerous news interviews. Morgan thought Kamala Harris’ (D) campaign was poorly run. Morgan supported Obama-Biden and among other remarks indicated he thought Harris had no “damn business” being president. The right-leaning New York Post said on November 27, 2024 that “Kamala Harris’ failure to win the presidential election despite a war chest of $1.5 billion “disqualifies” her from ever running for office again,” per Morgan. Some reports claim that Harris had twice the money that the Trump campaign had, a detail that MHProNews may look at as part of a future post-election article on The Patch. Forbes said 4 days ago that “John Morgan, The Billionaire Lawyer Behind $350 Million A Year In Ads.” Part of the significance is that Morgan understands marketing and understands Democratic politics. It is worth mentioning that estimates of Morgan’s net worth range from $700 million to $1.5 billion in “family” net worth.

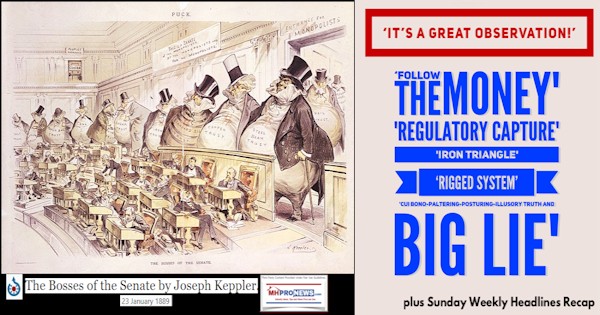

4) Those two post-election articles on The Patch provide a unique look from the vantagepoint of Democratic Party insiders. In contrast to factual and evidence-based reporting with analysis by MHProNews, MHLivingNews and this featured contributing writer for The Patch, the Manufactured Housing Institute (MHI), which certainly has access to well-placed sources for information, seemed to put their thumb on the scales in favor of Democrats. Examples are linked in the first two articles linked below.

5) Restated, MHI may be likened to some Democratic Party insiders in the sense that they withheld certain information that undermined their desire narrative. Remarks made by Plouffe unpacked on The Patch by this writer for MHProNews revealed challenges Democrats face in so-called swing or battleground states. With that in mind, according to left-leaning NBC News, Meet the Press is the longest running show on television featuring in depth political discussions and interviews. President-Elect Trump’s recent interview with them is posted below.

🚨FULL INTERVIEW: President Trump details his plans for Day 1 in the White House on Meet the Press

00:01:33 – Nominations and Military Focus

00:04:34 – Discussion on Tariffs

00:12:32 – Minimum Wage Discussion

00:14:49 – Plans for Mass Deportation

00:18:15 – Addressing DACA… pic.twitter.com/E24ukpJIyu— AJ Huber (@Huberton) December 9, 2024

The interview with Trump includes a segment on his plans for deportation of people in the U.S. illegally. It is a subject that MHProNews hit in May 2024 as a potential way of improving the housing crisis that could be faster than a massive ramping up of manufactured housing.

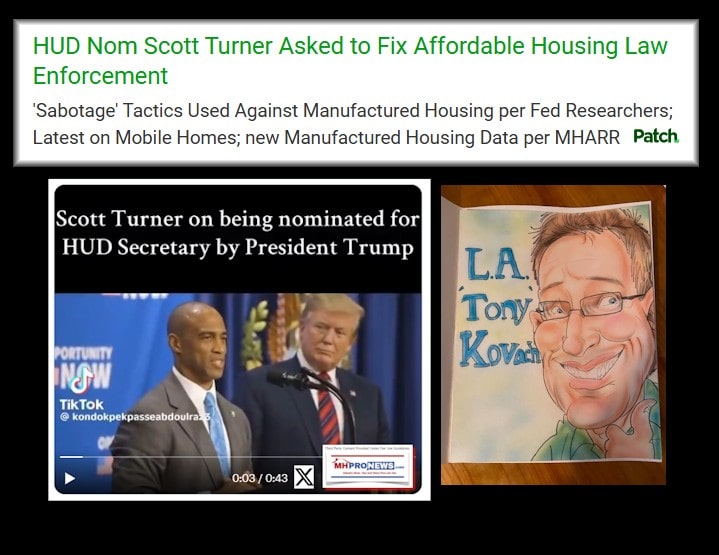

6) MHProNews updated readers here and on our pre- and post-election series on The Patch about relevant economic and political developments that may impact manufactured housing. For example, the report linked below indicates the problematic reporting by Alice Carter for The Northern Forum which quoted the Manufactured Housing Institute’s CEO Lesli Gooch specifically on the impact of deportations on the manufactured home industry. Gooch’s response was interesting.

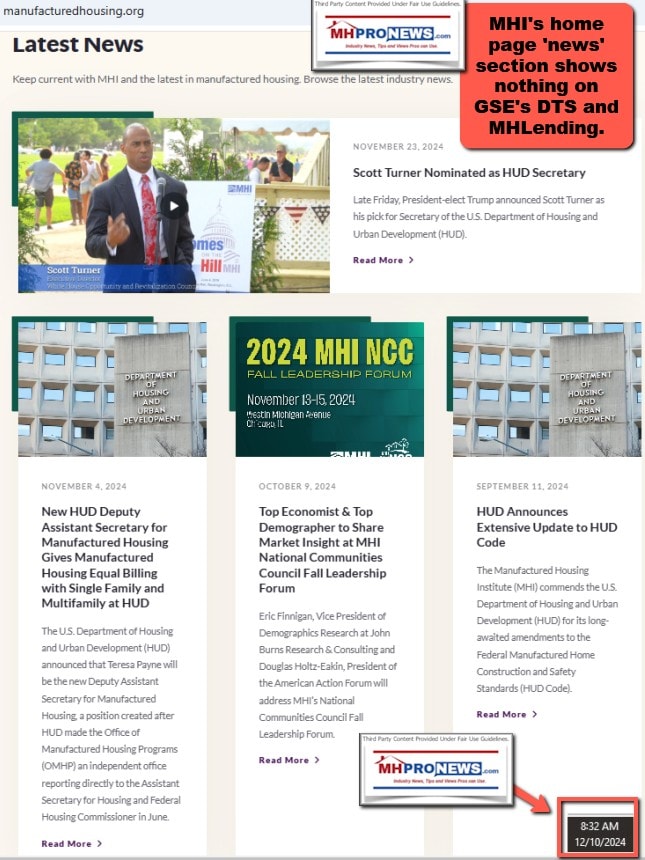

7) Pivoting back to mortgage giant Fannie Mae. MHProNews notes that on 12.9.2024 there was no visible content on the MHI website’s news segment that points out the newsworthy fact that neither Fannie Mae nor Freddie Mac have included manufactured housing chattel lending as part of their Duty to Serve plans for their respective upcoming plan cycles.

8) A more careful search of their website reveals a letter from MHI submitted as regulatory comments dated August 12, 2024 on DTS. That MHI letter is linked here. It said in part the following.

Manufactured housing is the most affordable homeownership option for American families. Last year, the price for an average manufactured home was $124,300, while the average site-built home was around $409,000 (excluding land). The average income for a manufactured home buyer was about $61,000 while the average income for a site-built home buyer was over $136,000.

9) That letter also noted that on land-home loans, Fannie and Freddie both charge an extra 50 basis points interest rate fee bump.

For real property manufactured loans, Fannie and Freddie both charge a 50 basis point LLPA.

10) MHI’s pet CrossMod® homes project is naturally mentioned and in a way that indicated that the GSEs ‘removed appraisal hurdles.’ It is one of several subtle admissions that MHI has apparently mishandled their own project from the start and for several years. As has been repeatedly noted by MHProNews, MHI has yet to put a total figure on how many such CrossMods have been built and sold in the years since the flawed and failing project was launched.

For example, both Enterprises have developed programs that provide conventional financing for CrossMod homes. Last year, the Enterprises affirmed the potential for CrossMod homes by removing appraisal hurdles, which was a critical step.

To further the impact of CrossMod homes across the country, we urge the Enterprises’ programs to be modified to include eligibility for single-section CrossMod homes, not just multi-section CrossMod homes.

11) MHI’s entire remarks on personal property loans are worth sharing.

Personal Property Loans

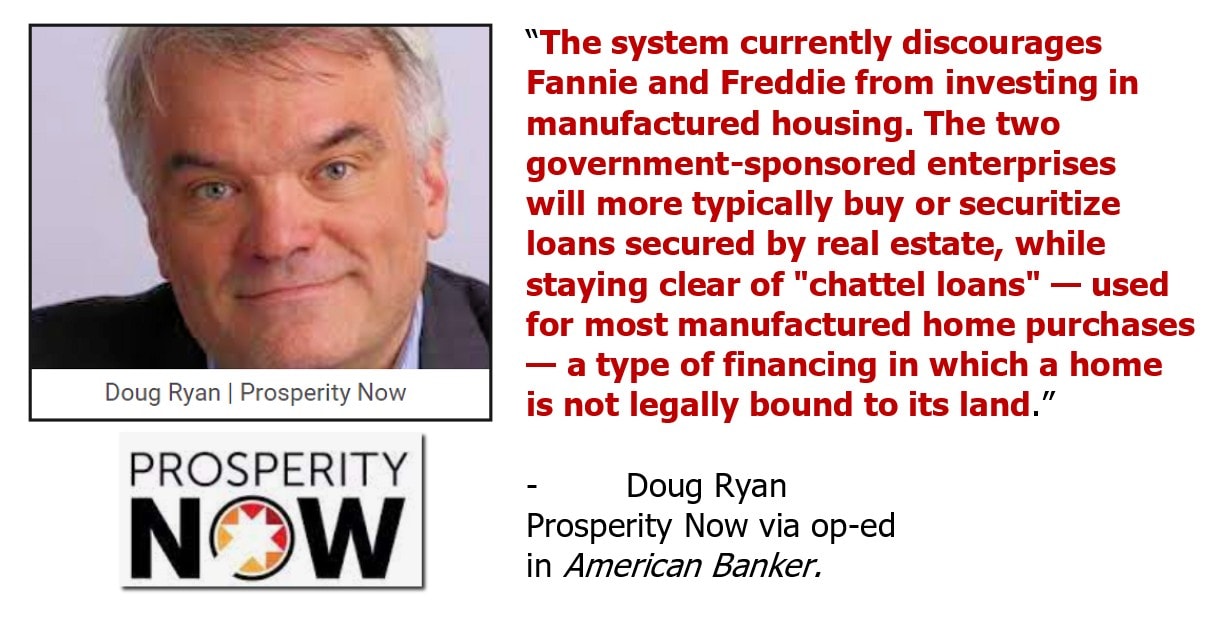

Despite the HERA statute requiring Fannie and Freddie to “consider” personal property manufactured loans as part of its statutory Duty to Serve requirements, neither GSE has made a single personal property loan since HERA was adopted 16 years ago.

In their Duty to Serve Plans, both Fannie Mae and Freddie Mac are focused on efforts around titling barriers to converting land ownership so there are more real property manufactured home loans – and on efforts to purchase personal property home loans in Resident Owned Communities.

MHI believes this is the wrong focus. Personal property loans make up around 70% of the manufactured home loan market. The simple truth is that personal property loans continue to be made safely by portfolio lenders, and MHI has submitted detailed loan performance data to FHFA, Fannie Mae, and Freddie Mac to document the strong loan performance of these loans – even through COVID, a time of mortgage loan stress.

Therefore, as MHI has been calling for years, Fannie and Freddie should develop a flow program for such loans, purchasing all loans that meet underwriting criteria – for securitization into secondary markets. After 16 years of delay we see it a significant shortcoming of Fannie Mae and Freddie Mac with respect to their compliance with Duty to Serve requirements.

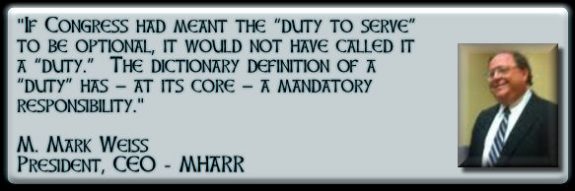

12) Note that MHI’s letter by CEO Lesli Gooch once more offers the GSEs of Fannie and Freddie an apparent pass by putting the word “consider” in quotes, instead of emphasizing, as the Manufactured Housing Association for Regulatory Reform (MHARR) has done for years, the word “Duty” as meaning a mandatory responsibility. MHARR’s President, CEO, and attorney Mark Weiss said that MHI’s terminology was ‘inexcusable and a major problem’ last year. Given CEO Gooch’s problematic blend of posturing while giving the GSEs an apparent ‘wink and a nod’ pass in the above, is it any surprise that the GSEs failed again to act in favor of personal property lending?

13) So, MHI continues to fail the dwindling numbers of independents of the industry on an ongoing basis. They do so from something as relatively simple as sharing honest, accurate, and timely news, to being effective at advocacy, to offering de facto cover for the insiders who are busy consolidating the industry. When MHI’s CEO Gooch said “After 16 years of delay we see it a significant shortcoming of Fannie Mae and Freddie Mac with respect to their compliance with Duty to Serve requirements,” she was ironically pointing a finger at herself and her colleagues at MHI while confirming what MHARR, Doug Ryan, and other critics have said for some time. Namely, that MHI’s lack of performance in that area clearly benefits Berkshire Hathaway lenders associated in manufactured housing with Clayton Homes (i.e.: 21st Mortgage Corporation and Vanderbilt Mortgage and Finance).

More on that in depth in the report linked below. Buffett himself said that it would benefit manufactured housing sales for DTS chattel lending to be made available.

MHProNews’ analysis of the DTS scenario presented to the FHFA remains valid.

14) Summing up. Housing is apparently poised for a potential rebound. The Trump Effect may be ignored by Fannie and MHI may be posturing for the sake of Scott Turner and others, but the reality is that notorious MHI member Frank Rolfe’s remarks seem to be born out once again. There is no serious effort to solve the affordable housing crisis by many stakeholders, including but not limited to, MHI and Freddie Mac. It remains to be seen how the Trump 2.0 administration will address the problems that have been “bottlenecks” for manufactured housing. See the related reports that follow to learn more.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’