“MHARR Targets Fannie and Freddie Chattel Failure in DTS “Listening Session” Comments” proclaimed the headline for the media release provided by the Manufactured Housing Association for Regulatory Reform (MHARR). According to a list provided by Federal Housing Finance Agency (FHFA) Weiss was speaker number 5 in their list that follows. The bold and numbering of Weiss’ name and organization are added by MHProNews. The sequence was is from the FHFA and should not be construed as some level or importance for the first, last, or in between speakers.

- Leslie Gooch-Manufactured Housing Institute

- Dave Anderson-National Manufactured Home Owners Association

- Rachel Siegel-The Pew Charitable Trusts

- Adam Rust-National Community Reinvestment Coalition

- Mark Weiss-Manufactured Housing Association for Regulatory Reform

- Mary O’Hara-ROC USA

- Kaitlyn Garfield-Housing Land Trust of Sonoma County

- Amy Bliss-Wisconsin Housing Alliance

- Stacey Epperson-Next Step

- Deb Campbell-MH Action

- Kathleen Paradis-New Hampshire Community Loan Fund

- Kyle Lucas-Resident Action at Western Plaza MHP

- Thomas Heinemann-MH Advisors

- Willie Fleming-Chicago Anti Eviction Campaign

- Jill Borders-Borders Family

- L.A. “Tony” Kovach-MHProNews.com

Part I

Per MHARR’s cover memo is the following.

JULY 20, 2023

TO: MHARR MANUFACTURERS

MHARR STATE AFFILIATES

MHARR TECHNICAL REVIEW GROUP (TRG)

FROM: MHARR

RE: MHARR TARGETS FANNIE AND FREDDIE CHATTEL FAILURE IN DTS “LISTENING SESSION” COMMENTS

MHARR, in comments (copy attached) delivered to a Federal Housing Finance Agency (FHFA) “Listening Session” on July 18, 2023, has called for the immediate “market-significant” support of manufactured home personal property or “chattel” loans under the statutory “Duty to Serve Underserved Markets” (DTS) mandate.

While chattel loans represent (and have consistently represented) nearly 80% of all new manufactured homes financed in the United States – and are specifically authorized by law for inclusion within manufactured housing sector DTS compliance programs – not a single manufactured home personal property loan has been supported by Fannie or Freddie under DTS since its enactment 15 years ago.

As MHARR made clear in its comments, this impasse, which leaves the vast bulk of the manufactured home financing market completely unserved in violation of the DTS mandate, is unacceptable and cannot continue. That is especially the case with the manufactured housing market having entered a severe downturn, beginning with the third quarter of 2022, which has seen the production of new HUD Code homes plummet year-over-year by a factor of more than 30%.

Consistent with its discussion of this matter with FHFA Director Sandra Thompson at a meeting on June 20, 2023, MHARR stated that the time for further alleged “research” and study by Fannie Mae and Freddie Mac is long past, and that both instead must begin now to provide market-significant support for manufactured home chattel loans, consistent with the explicit directive of Congress in DTS.

Otherwise, MHARR emphasized, if Fannie, Freddie and/or FHFA are unclear on what Congress meant by including chattel loans within the DTS mandate, they should be prepared to take this entire matter back to Congress for clarification that DTS means the entire HUD Code market, as well as a specific, close-in deadline for such market-significant chattel support.

As MHARR made quite clear, the time for delay and obfuscation is over. DTS means what it says, and now is the time for Fannie, Freddie and FHFA itself to live up to the obligations imposed upon them by law.

cc: Other Interested HUD Code Manufactured Housing Industry Members

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: www.manufacturedhousingassociation.org

The actual remarks as prepared by Weiss and as provided by MHARR to MHProNews for the DTS Listening Session are as follows. They were also sent via FedEx to the various officials as shown at the end of Weiss’ remarks on behalf of MHARR.

July 20, 2023

VIA FEDERAL EXPRESS

Federal Housing Finance Agency

Duty to Serve Markets

Office of Housing and Community Investments

Constitution Center

400 7th Street, S.W.

Washington, D.C. 20710

Re: July 18, 2023 FHFA Listening Session – Duty to Serve

Underserved Markets – Manufactured Housing Market

Dear Sir or Madam:

The following comments are submitted on behalf of the Manufactured Housing Association for Regulatory Reform (MHARR). MHARR, which is based in Washington, D.C., represents independent producers of manufactured housing regulated under federal law by the U.S. Department of Housing and Urban Development (HUD). MHARR’s member companies are located in and produce homes that are sold in all regions of the United States.

Manufactured homes are specifically recognized – and protected – under federal law as a source of inherently-affordable homeownership, and are regulated under a system that is expressly designed to maintain their affordability in a manner that is also consistent with both quality and consumer safety.

Unfortunately, this marks, at least the fifth time that MHARR has addressed one of these Duty to Serve (DTS) “listening sessions.” It is “unfortunate” because DTS should have already been fully implemented within the manufactured housing market by now.

Instead of highlighting the glaring deficiencies and full-blown defiance of Congress and the law by Fannie Mae and Freddie Mac within the HUD Code market, and the Enterprises’ failure to serve, at all, the vast bulk of its consumers, we should instead be here talking about the success of DTS and talking about how DTS-based lending helped to ease the nation’s affordable housing crisis.

Fifteen years later, however, that is not the case and it appears that the entire matter is at an impasse. Whether Fannie and Freddie (or FHFA for that matter) like it or not, the vast bulk of new HUD Code manufactured homes – close to 80% on an ongoing basis per U.S. Census Bureau data– are financed through chattel, or personal property loans.

Financing a manufactured home as chattel may not be the preferred choice of Fannie or Freddie (or even FHFA). But it IS — and has been — the preferred choice of millions of American consumers. And the data is remarkably consistent over time. Going back ten years or more, the census data shows the percentage of chattel loans to all new manufactured home purchase loans fluctuating within a very narrow range, just under 80%.

Why? Chattel loans admittedly carry a higher interest rate than real estate mortgage loans. That is not news, even though its routinely bandied about as if it is. But there is more involved than just the interest rate, obviously. For one, adding the cost of real estate to the purchase transaction makes it far more costly in absolute dollar terms than a home-only chattel loan. That might not seem like a big deal to someone versed only in the site-built market, but in the highly price-sensitive manufactured housing market, it is.

As the nation’s premier source of affordable homeownership – as specifically recognized by federal law – manufactured housing serves a market that is largely comprised of lower and moderate-income Americans. At these lower income levels, the manufactured housing financing market is highly elastic. At such marginal income levels, small differences in the financed price of the home can exclude significant numbers of potential purchasers from the market. As a result, home-only chattel loans that do not include financing for the cost of the land on which the home is sited, are an attractive option for many purchasers.

There is also the issue of loan duration, with chattel loans typically providing for a shorter pay-back period than most mortgages, that may be more consistent with the needs and wishes of younger singles and families, as well as senior citizens.

In any event, though, the reality of the manufactured housing market – whether Fannie and Freddie (or FHFA) like it or not – is that chattel lending predominates and has predominated for many years.

That is the reality and Congress’ directive to Fannie, Freddie and FHFA, through DTS, was to serve that reality – to serve the HUD Code market as it actually exists, not as they or some others would like to see it in some ideal world that has never, in fact, been known to exist.

We are now 15 years down the road since the enactment of DTS and still, nearly 80% of the manufactured housing market remains completely unserved. That is the key fact. Everything else is window dressing and distraction.

This is unacceptable. It is also contrary to the clear objectives of Congress, which expressly included chattel loans with the scope of DTS. The time for excuses and toe-dipping is over. The time for more “research” while the manufactured housing market precipitously declines (over 30% since the 3rd Quarter of 2022) is over.

The time for concrete action – in the near-term – and not years from now, to provide market-significant levels of securitization and secondary market support for manufactured housing consumer chattel loans is here.

Consumers are hurting, the industry is hurting, and the nation is hurting from a lack of truly affordable homeownership. Now is the time for bold leadership from FHFA.

Otherwise, this matter will have to go back to Congress for clarification that DTS means and intends support for manufactured housing chattel loans in market-significant numbers, now.

Sincerely,

Mark Weiss

President/CEO

cc: Hon. Sandra Thompson [FHFA]

Hon. Marcia Fudge [HUD]

Hon. Sherrod Brown [Senator OH-D]

Hon. Tim Scott [Senator SC-R]

Hon. Warren Davidson [Congressman OH-8-R]

Hon. Emanuel Cleaver [Congressman MO-5-D]

Part II Additional Information with More MHProNews Analysis and Commentary in Brief

MHProNews is in the process of requesting remarks by others who addressed the DTS listening session. There is a working plan to provide those remarks by the various organizations and their designated representative for that occasion.

This writer for MHProNews/MHLivingNews pre-posted those remarks in the report linked below. There was only one change made by FHFA officials, and that was to say “bleep” instead of “ass” following the word “elephant” as in “elephant’s ass.” That remark was a direct quote from a Manufactured Housing Executive Committee (MHEC) member to MHProNews.

Were Abe Lincoln and Frank Rolfe Correct?

What’s changed since a Pimple on an Elephant’s Ass was proclaimed at the 3.25.2021 FHFA Listening Session?

Niskanen Center housing policy analyst attorney Andrew Justus’ op-ed for The Hill pointed to zoning barriers and unequal financing options as factors “holding back manufactured homes.”

Harvard’s Joint Center for Housing Studies State of the Nation’s Housing 2023 made similar observations.

Without mentioning the Manufactured Housing Institute (MHI), zoning expert and apparently pro-manufactured home law professor Daniel R. Mandelker said in a working paper for the Lincoln Institute that an ‘Organization is Needed in Manufactured Housing for Litigation and Legislative Support.’

Ouch.

Mandelker echoed the Manufactured Housing Association for Regulatory Reform (MHARR) decade–plus call for a new post–production manufactured housing trade group.

During an earnings call with Cavco Industries CEO and MHI Vice Chairman William “Bill” Boor, analyst Gregory Palm bluntly asked: ‘Why is Manufactured Housing Production so Weak?’

Manufactured housing is in the 8th month of consecutive year–over–year declines in HUD Code manufactured home production and shipments.

MHARR’s warnings on the problematic trend of declining manufactured home production challenge Biden era assurances pre–bunked by HUD researchers.

MHARR said for decades that near the heart of issues restraining more affordable manufactured housing are zoning barriers that could be relieved by an application of the Manufactured Housing Improvement Act (MHIA) of 2000 and its “enhanced preemption” provision.

Despite LendingTree’s research the uneven playing field in manufactured home lending persists.

The Duty to Serve (DTS) remains unenforced on manufactured home chattel lending for approaching 15 years.

On paper, MHI leaders Kevin Clayton and Lesli Gooch seemingly agreed.

In Congressional testimony under oath, Kevin spoke for MHI saying a lack of liquidity hurt manufactured housing.

Warren Buffett said DTS would benefit manufactured housing.

But in practice, why didn’t MHI sue to get DTS and the MHIA’s “enhanced preemption” enforced over a decade ago, as MHI belatedly sued to temporarily halt the harmful DOE energy rule?

Unlike MHARR, MHI leaders arguably palter and posture. MHI suggests manufactured housing production dropped due to retailer inventory overstocking in 2022 and rising interest rates.

Pardon me, but in my expert view as a long–time and successful former retailer in manufactured housing, that’s demonstrably nonsense.

Chattel interest rates in the 1980s hit 20.5 percent, over double current rates.

Yet manufactured home production then was roughly three times the annualized rate of production in manufactured housing per year–to–date data for 2023.

MHI knows that during the same timeframe manufactured housing’s production was falling, more costly conventional housing was increasing their production in 2023.

A well-placed MHI member told MHProNews that Tim Williams, CEO of 21st Mortgage Corporation said he was “happy” that the previously announced chattel pilots failed.

When a coalition of nonprofits asked FHFA Director Sandra Thompson to compel Fannie Mae and Freddie Mac to enforce DTS chattel lending, MHI was oddly missing.

Neither MHI, 21st, nor their attorneys denied these observations when recently and repeatedly asked by MHProNews.

Triad Financial Services is an MHI member with a multi-decade example that chattel lending can be done sustainably at more competitive rates then 21st or Vanderbilt Mortgage and Finance generally offer.

Several smaller lenders proved their ability to do what the law mandates that FHFA should have Fannie and Freddie do.

Is it any wonder that Doug Ryan with Prosperity Now accused MHI of working on Clayton and their affiliated lending’s behalf to tacitly allow Berkshire Hathaway owned brands to dominate manufactured home lending?

Mandate means a compulsory duty.

Obviously not everyone involved at MHI, Fannie, Freddie or FHFA are inept or corrupt.

That said, Crossmods are but one example of how obviously regulated entities have apparently colluded to keep DTS for all HUD Code manufactured homes from becoming a reality.

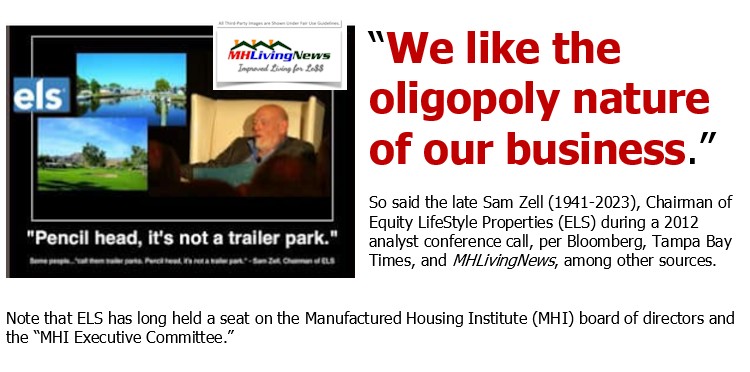

Lincoln Institute’s George McCarthy claimed DTS for communities made manufactured housing less affordable.

Paul Bradley for ROCUSA echoed McCarthy’s concern.

MHI member Andy Gedo said: “Clayton’s finance capability is a barrier to entry (what you like to call a “moat”) that limits competition.”

The Biden Administration and MHI claim they want more minority homeownership.

Then why is affordable homebuying falling? Frank Rolfe and Amy Bliss cried “hypocrisy.”

Wasn’t Abe Lincoln right?

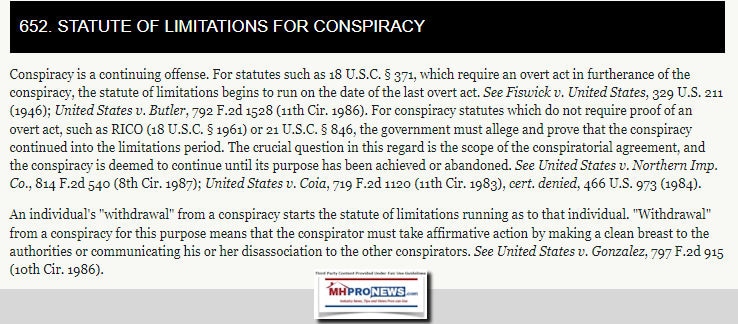

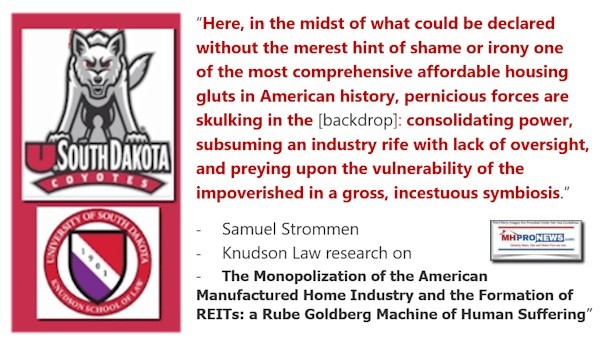

Samuel Strommen’s research asserted MHI and key members violated antitrust laws to limit and consolidate manufactured housing.

I’m L.A. “Tony” Kovach. My thanks to the FHFA for reading and posting my hot-linked facts and observations. These hot-linked documented views will be posted on ManufacturedHomeProNews.com (MHProNews.com) and are on ManufacturedHomeLivingNews.com. ##

Part III – Additional Information with More MHProNews Analysis and Commentary in Brief

MHProNews recent featured reports about three MHI member lenders who are not owned by Berkshire Hathaway. The first two were asked for input and both provided it in a timely manner.

MHProNews provided industry professionals, investors, public officials and others with a powerful takeaway from Cavco Industries’ President and CEO William “Bill” Boor and the document provided by Cavco and/or that was obtained from a source that obtained it from MHI.

Boor was arguably correct when he made the remark below. Namely, that manufactured housing could catch and surpass conventional building. But that remark and those

But Boor, MHI, their staff leaders and corporate ‘masters,’ are not mere observers in manufactured housing. As a pending report from MHARR will detail and evidence, MHI is apparently failing their own membership. So are federal agencies. When Cavco, past and present, blasts federal officials that should be a reason for Cavco, MHI, et al to sue to get good existing laws enforced. Just as MHI finally sued to stop the DOE energy rule, MHI et al should sue to enforce good existing laws that Boor is now on record saying that the appropriate aspects of the federal government should enforce.

Boor is an apparently intelligent fellow. It would be difficult to make an argument that he lacks experience or intelligence. Which means he is for some reason either posturing by saying the right things to Congress, but doesn’t mean them OR he may be signaling that MHI is about to pivot when he takes over as MHI’s chairman. Time will tell which it is. But whatever happens next, there is now a clear, evidence-based argument to be made that Boor has previously withheld what the Securities and Exchanges Commission (SEC) material information in his response to Gregory Palm just a few weeks ago.

MHProNews has carefully documented for the past several years the mounting evidence that MHI appears to be acting as part of an ongoing effort to consolidate the industry into a relatively small number of firms who are all MHI members.

Manufactured housing ought to be soaring.

But instead, manufactured housing production and shipments are sliding.

Misinformation, past and present, and head fakes of various kinds appear to abound.

By making their own path on financing, a fair reading of their respective public information reveals that Legacy Housing (LEGH) and Nobility Homes (NOBH) are two brands that have not only survived but have grown during often difficult times for other firms. It shows the importance of financing.

MHARR has made their case that public officials need to investigate what has gone wrong at the regulatory and industry advocacy levels.

While distinctive, MHProNews/MHLivingNews has for several years made the that antitrust and other apparent violations of federal laws seem to be occurring. Will Boor lead Cavco and MHI in a pivot? If not, why not? What will he tell investors in his firm’s stock if he fails to either deploy Cavco’s resources as needed and/or leads MHI into appropriate and robust litigation to get favorable to manufactured housing laws enforced?

After all, it isn’t as if Cavco has been a squeakily clean company, right?

It isn’t just HUD, or the FHFA and the DOE, that has failed the industry and its consumers. It is MHI and companies like Cavco. Even if Cavco had to act solo, it would arguably be in their own best interest to do so. They have the cash or cash equivalents to deploy successful litigation to get existing laws enforced. Failure to do so would only tend to confirm the detailed evidence-based allegations of Samuel “Sam” Strommen and others who have criticized MHI and their leadership based on good, old fashioned, solid evidence and applied common sense.

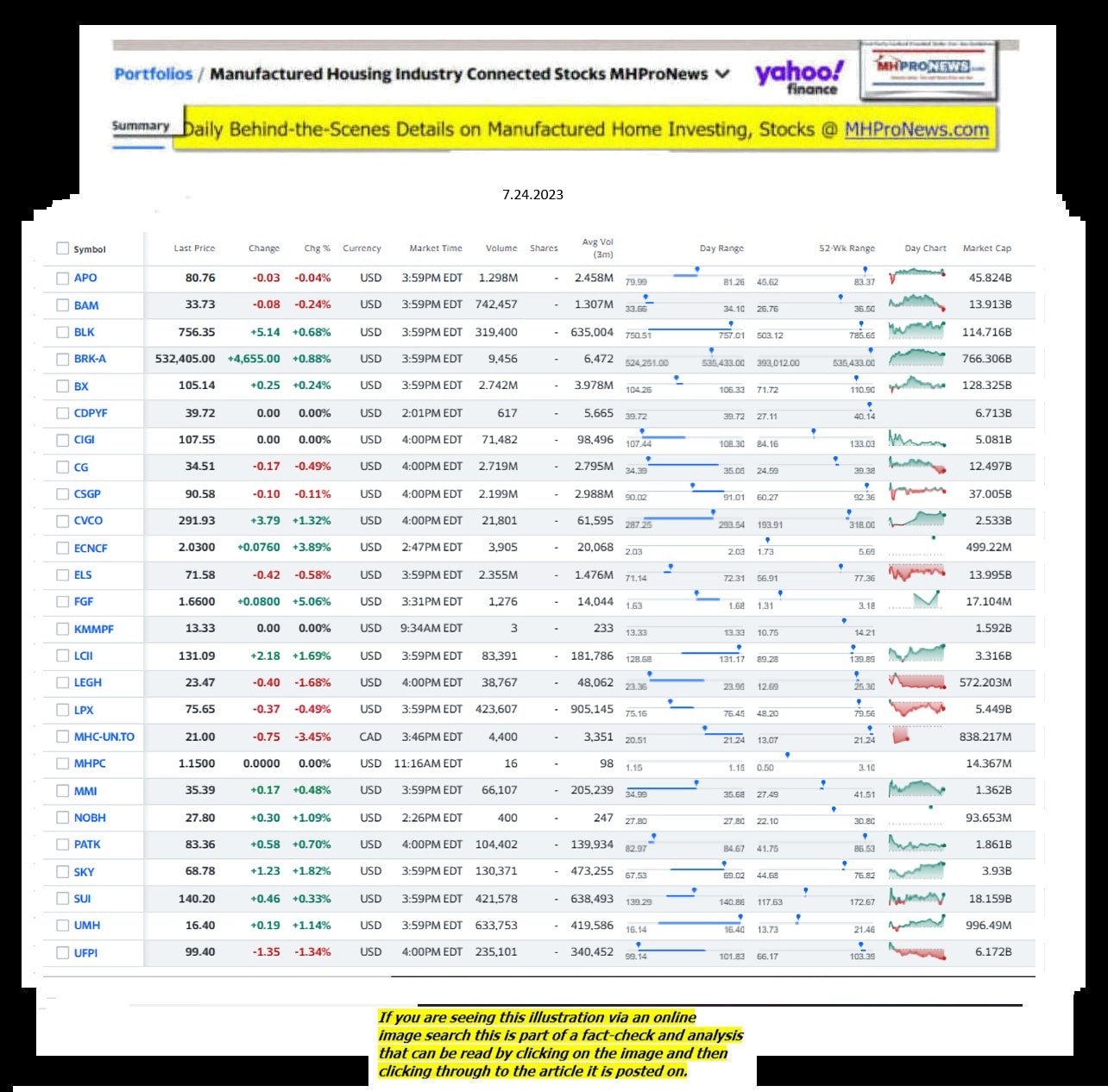

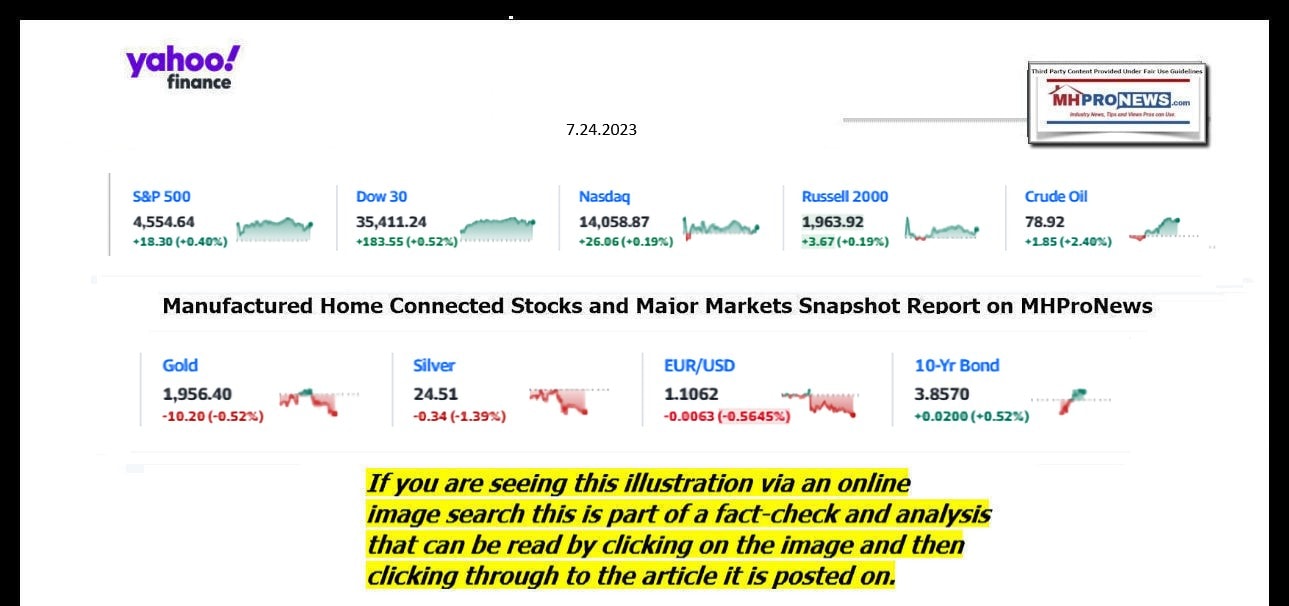

Part IV. Daily Business News on MHProNews Markets and Headline News Segment

Headlines from left-of-center CNN Business – from the evening of 7.24.2023

- Rise of the gig workers

- More Americans are freelancing through apps like Uber, Lyft and Doordash. And that’s changing the face of the US economy

- New EV battery plant fuels labor tensions as UAW strike looms

- Domino’s is still struggling with delivery. One solution? More cars

- Here’s what inflation’s slowdown has meant for US businesses

- Trader Joe’s recalls two types of cookies because they may contain rocks

- Wheat prices rise after Ukrainian Danube port hit

- ‘Barbenheimer’ box office debut sparks hopes that cinema is back

- Why America stopped building public pools

- Europe’s largest airline just sounded the alarm on travel demand

- How stock market expectations have changed this year

- Spotify is hiking its prices

- Sex scene with Cillian Murphy and Florence Pugh in ‘Oppenheimer’ becomes latest target of India’s Hindu nationalists

- Elon Musk rebrands Twitter as X

- US-Taiwan trade pact key to countering diplomatic isolation, Taipei’s top trade negotiator says

- Elon Musk says Twitter logo to change, birds to be gradually abandoned

- ‘It comes up on you fast:’ Scorching heat is crushing American businesses

- ‘Barbie’ dominates the box office, raking in a $155 million opening weekend

- What’s ahead this week for Wall Street and the economy

- AI investment is booming. How much is hype?

- ‘We’ve organized, strategized, now it’s time to pulverize,’ says Teamsters union president ahead of looming UPS strike

- Not every version of Barbie and her friends was a hit. Check out these flops

- American Airlines pilot contract offer increases to $9 billion following United agreement

- ‘It almost doubled our workload’: AI is supposed to make jobs easier. These workers disagree

Headlines from right-of-center Newsmax 7.24.2023

- Trump Classified Documents Trial to Start in May

- Trump Motion to Get Ga. Election Case Tossed Has New Life

- Attorneys for former President Donald Trump have pushed an emergency motion to disqualify Democrat Fulton County District Attorney Fani T. Willis and her office, and a top state judge ruled to have the motion heard outside of Willis’ jurisdiction. [Full Story]

- Related Stories

- Report: Ga. Eyes Racketeering in Trump Case

- Reports: Trump Aide Testifies Before Jan. 6 Grand Jury

- Trump Classified Documents Trial Scheduled for May

- Rick Scott: ‘Clearly Two Standards of Law’

- Florida AG: Mayorkas a Threat to This Country | video

- Y. Sheriff: Suspect ‘in Mind’ One Month Into Gilgo Task Force | video

- Whitaker: FBI in ‘Purposeful Cover-up’ on Biden Document | video

- Trump on Participation: ‘Newsmax Should Get a Debate’ | video

- Trump: ‘Absolute Shame’ Buried Laptop Story Swayed Election | video

- Roy: Dems Trying to Silence RFK Jr. | video

- Matt Taibbi: Dems Don’t Understand First Amendment | video

- DeSantis: ‘Nobody Is Entitled,’ Trump Should Debate | video

- Hunter Atty Files Ethics Complaint for MTG Showing Sex Pics

- The attorney for Hunter Biden is filing an ethics complaint against Rep. Marjorie Taylor Greene, R-Ga., for making House hearing placards of their client’s sex pictures…. [Full Story] | video

- Trump: Trial Date a ‘Major Setback’ for Biden DOJ

- Former President Donald Trump issued a statement Friday to hail a [Full Story] | video

- Related

- Trump Classified Documents Trial Scheduled for May

- Jaguars Strength Coach Maxen Comes Out as Gay

- Jacksonville Jaguars assistant strength and conditioning coach Kevin [Full Story] | video

- Jason Aldean’s Wife Defends Song Amid Backlash

- Country music star Jason Aldean’s wife Brittany, has fired back at [Full Story]

- Comer: Hunter Faces 10 Criminal Referrals

- House Oversight Committee Chairman James Comer says he expects to [Full Story]

- Related

- Devine: Special Prosecutor for Biden Bribe Allegations

- FBI Fires Back: ‘Safety of a Confidential Source’ at Risk

- Trump to Newsmax: ‘Absolute Shame’ Buried Laptop Story Swayed Election |video

- WH: Biden Bribery ‘Debunked’; Tactics ‘Shameless’ |video

- Grassley Releases FBI Doc on Biden Bribery Allegation

- Putin to Poland: Hostility on Belarus an Attack on Russia

- Russian President Vladimir Putin on Friday accused NATO member Poland [Full Story]

- Related

- Russia Turns Missiles on Ukraine’s Farm Storage

- Zelenskyy Calls for Spending Restraint; Minister Offers to Resign

- Ukraine Unleashes US Cluster Munitions Against Russia

- Senate Defeats Effort to Limit US Aid to Ukraine

- Wheat Prices Up in US After Russia Exits Deal |video

- Israeli Military Assessing Reservists’ Protest Letter Over Judicial Overhaul

- Israel’s military said on Friday it was examining the impact of a [Full Story]

- Call Congress to Stop Trump Political Prosecutions

- We cannot tolerate the continued election interference of the Biden [Full Story]

- Record-Breaking Heat Baking Southern US to Expand

- A record-breaking heat wave stretching across the southern United [Full Story]

- Activist Judges May Force Supreme Court to Take Gun Rights Case

- Gun owners and pro-Second Amendment groups have filed a notice to [Full Story] | Platinum Article

- Expat Russian Politician: Putin’s Downfall ‘Months Away’

- Ilya Ponomarev, a former member of the Russian parliament and a [Full Story]

- US ‘Nowhere Near’ Chinese Hypersonic Capabilities

- A Chinese-developed state-of-the-art wind tunnel – that purportedly [Full Story] | Platinum Article

- Pro-RFK Jr. Super PAC Raises $5M During Testimony

- American Values 2024, a super PAC representing Democrat presidential [Full Story]

- District Votes to Alert Parents on Transgender Kids

- A California school district this week voted to approve a policy that [Full Story]

- Liberal Justices Issue Harsh Dissent in Alabama Execution

- The Supreme Court allowed the execution of 64-year-old James Barber, [Full Story]

- Report: Georgia Eyes Racketeering in Trump Case

- A Fulton County, Georgia, prosecutor is reportedly preparing to [Full Story]

- DeSantis Adds 13 Utah Endorsements, Total at 274

- Florida Gov. Ron DeSantis continues to work the grassroots to [Full Story] | video

- Trump: Would Be ‘Very Dangerous’ to Jail Me

- There is wild speculation special counsel Jack Smith’s next coming [Full Story]

- Related

- Donald Trump: ‘By Destroying Me, They Destroy You’

- Trump Vows Death Penalty for Human Traffickers

- Admitting he would face pushback even from allies for expanding the [Full Story] | video

- SEC Charges Digital World SPAC for ‘Misrepresentations’

- The U.S. Securities and Exchange Commission said Thursday that [Full Story]

- Threads User Engagement Continues to Drop

- User engagement on Threads has continued to fall, The Wall Street [Full Story]

- Michael Cohen Settles With Trump Org Over Unpaid Legal Bills

- Donald Trump’s company and his former longtime lawyer Michael Cohen [Full Story]

- Texas A&M President Resigns Amid DEI Backlash

- Texas A&M University announced Friday that its president has resigned [Full Story]

- Trump Motion to Disqualify Georgia Case Gets New Life

- Attorneys for former President Donald Trump have pushed an emergency [Full Story]

- New Jersey Sues Feds Over NYC Congestion Pricing Plan

- The state of New Jersey has filed a federal lawsuit against the U.S. [Full Story]

- Ford Keeps AM Radios as Congress Weighs Legislation

- As more car manufacturers announce plans to eliminate AM receivers [Full Story]

- US Chamber Coalition Urges Biden to Help Avoid UPS Strike

- The U.S. Chamber of Commerce is leading a coalition of over [Full Story]

- Thousands of Muslims Protest Quran Desecration in Sweden

- Thousands of people took to the streets in a handful of [Full Story]

- White House, DHS Communicated on School Board Letter

- A White House official offered “to explore options” with Department [Full Story]

- Prosecutors Accuse FTX ex-CEO of Witness Tampering

- U.S. prosecutors have accused FTX founder Sam Bankman-Fried of [Full Story]

- Trump Classified Documents Trial Scheduled for May

- A federal judge in Florida has set a trial date for next May for [Full Story]

- Finance

- David Phelps: How to Protect Your Retirement Lifestyle in an Uncertain Economy

- Navigating the complexities of our economy can often feel like trying to predict the weather, and we’ve all seen how often even the so-called “experts” get that wrong…. [Full Story]

- Lauren Fix, The Car Coach: Used Car Prices Are Down 10%!

- The Rise & Fall of the Chief Diversity Officer

- Affirmative Action Leviathan Finished, Let’s Go for DEI Next

- Mark Schulte: Changes in Med Student Demographics Historic

- More Finance

- Health

- Twice a Year Shot Could Replace Hypertension Pills

- Every day, millions of people must take one or more pills to control their blood pressure and reduce their risk for heart attack or stroke, but if new research pans out, some may be able to scrap their pills for a twice-yearly shot with the same benefits.Given as a shot…… [Full Story]

- Take the Guesswork Out of Applying Sunscreen

- Study: Eating Omega-3-Rich Foods Boosts Lung Health

- Study: Breast Cancer Survivors Age Faster

- Seniors Who Volunteer May Reduce Risk for Dementia