As Manufactured Housing Institute (MHI) member Triad Financial Services (TFS) and the Manufactured Housing Association for Regulatory Reform (MHARR) have documented, manufactured home production is down sharply year-to-date through March 2023. Specifically, MHARR said that manufactured housing has been hit by “a 28.6% decrease from the 29,670 homes produced over the same period during 2022.” By contrast, there are significant findings reported by the National Association of Realtors (NAR) and the National Association of Home Builders (NAHB) which indicates that their more costly side of the U.S. housing business are outperforming manufactured homes on several levels. If that seems odd during an affordable housing crisis, then it should encourage curious minds to want to better understand the facts and seek to understand the apparently underlying factors behind the data. Following this preface will be the facts on new manufactured home production and shipments the 50 states. That data will be followed by key quotes and factual insights from NAR and NAHB. That one-two punch of insights will once yield key items of importance to manufactured housing independents, all employees in manufactured home firms, investors, affordable housing advocates, and public officials.

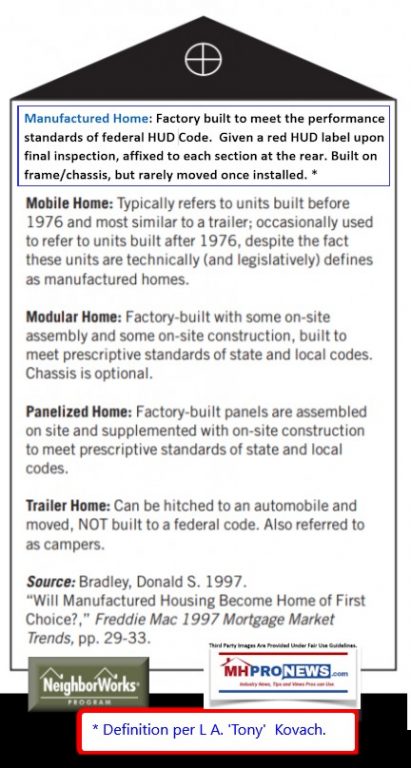

The U.S. Department of Housing and Urban Development (HUD) contracts with the Institute for Building Technology & Safety (IBTS) to gather and report this information. As manufactured home professionals should know, manufactured housing is federally regulated. The primary federal regulator of modern manufactured housing is HUD. Manufactured homes have the only national (federal) set of residential housing construction and safety standards. That’s why manufactured homes are sometimes referred to as HUD Code manufactured homes.

The following represents ‘official’ data from the viewpoint of HUD.

- IBTS’s reference to SW means single section, or “single wide” HUD Code manufactured homes.

- MW below means multi-wide or multiple sections of manufactured homes. Those multi-sectional homes are most typically two (the dated but still heard term of “double wides”) but less commonly may be three or more manufactured home sections.

- In the case of multi-sectional manufactured homes, the units are transported to the homesite where they are assembled and installed permanently on an approved foundation for residential housing use.

- Federal standards require, and research data reflects, that manufactured homes perform dynamically in a similar fashion as conventional “site built” housing does. But due to the savings on time, labor, less wasted materials, and other efficiencies made possible by HUD Code manufactured housing, manufactured homes are about half the cost of conventional “on site” or “stick built” construction. Surprisingly to some, weather or fire safety, and the general appreciation are documented to be similar for manufactured homes as they are for conventional “site built” housing.

With that understanding the following facts reported in May 2023 for March 2023 production and shipments facts on HUD Code manufactured homes are sobering. The insights from NAR and the NAHB which will follow, combined with some expert manufactured housing (MHVille) editorially analysis and commentary will reflect how internal and external obstacles are potentially opportunities in disguise.

Given that preface, here is IBTS’ data on behalf of HUD.

| Institute for Building Technology & Safety | |||||||||

| Shipments and Production Summary Report 3/01/2023 – 3/31/2023 |

| Shipments | ||||

| State | SW | MW | Total | Floors |

| Dest. Pending | 19 | 10 | 29 | 39 |

| Alabama | 178 | 181 | 359 | 542 |

| Alaska | 0 | 3 | 3 | 6 |

| Arizona | 97 | 170 | 267 | 442 |

| Arkansas | 66 | 59 | 125 | 184 |

| California | 43 | 244 | 287 | 541 |

| Colorado | 43 | 20 | 63 | 83 |

| Connecticut | 10 | 7 | 17 | 24 |

| Delaware | 6 | 29 | 35 | 64 |

| District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 195 | 523 | 718 | 1,251 |

| Georgia | 127 | 165 | 292 | 458 |

| Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 9 | 25 | 34 | 61 |

| Illinois | 89 | 33 | 122 | 155 |

| Indiana | 148 | 41 | 189 | 230 |

| Iowa | 12 | 12 | 24 | 36 |

| Kansas | 30 | 8 | 38 | 46 |

| Kentucky | 90 | 161 | 251 | 412 |

| Louisiana | 237 | 101 | 338 | 442 |

| Maine | 12 | 25 | 37 | 62 |

| Maryland | 8 | 4 | 12 | 16 |

| Massachusetts | 4 | 21 | 25 | 46 |

| Michigan | 130 | 149 | 279 | 428 |

| Minnesota | 26 | 22 | 48 | 70 |

| Mississippi | 95 | 121 | 216 | 334 |

| Missouri | 65 | 37 | 102 | 139 |

| Montana | 7 | 12 | 19 | 32 |

| Nebraska | 15 | 0 | 15 | 15 |

| Nevada | 18 | 34 | 52 | 88 |

| New Hampshire | 15 | 9 | 24 | 33 |

| New Jersey | 9 | 21 | 30 | 51 |

| New Mexico | 36 | 59 | 95 | 156 |

| New York | 76 | 60 | 136 | 196 |

| North Carolina | 217 | 241 | 458 | 699 |

| North Dakota | 6 | 3 | 9 | 12 |

| Ohio | 127 | 53 | 180 | 233 |

| Oklahoma | 73 | 91 | 164 | 255 |

| Oregon | 29 | 99 | 128 | 236 |

| Pennsylvania | 77 | 107 | 184 | 292 |

| Rhode Island | 0 | 0 | 0 | 0 |

| South Carolina | 112 | 171 | 283 | 454 |

| South Dakota | 10 | 6 | 16 | 22 |

| Tennessee | 85 | 166 | 251 | 417 |

| Texas | 595 | 712 | 1,307 | 2,024 |

| Utah | 5 | 15 | 20 | 36 |

| Vermont | 8 | 8 | 16 | 24 |

| Virginia | 33 | 46 | 79 | 125 |

| Washington | 27 | 104 | 131 | 237 |

| West Virginia | 18 | 43 | 61 | 104 |

| Wisconsin | 31 | 18 | 49 | 67 |

| Wyoming | 23 | 6 | 29 | 35 |

| Canada | 0 | 0 | 0 | 0 |

| Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 3,391 | 4,255 | 7,646 | 11,954 |

| THE ABOVE STATISTICS ARE PROVIDED AS A MONTHLY | ||||

| SUBSCRIPTION SERVICE. REPRODUCTION IN PART OR | ||||

| IN TOTAL MUST CARRY AN ATTRIBUTION TO IBTS, INC. | ||||

| Production | ||||||||||||||

| State | SW | MW | Total | Floors | ||||||||||

| States Shown(*) | 248 | 247 | 495 | 745 | ||||||||||

| Alabama | 522 | 639 | 1,161 | 1,805 | ||||||||||

| *Alaska | 0 | 0 | 0 | 0 | ||||||||||

| Arizona | 89 | 186 | 275 | 468 | ||||||||||

| *Arkansas | 0 | 0 | 0 | 0 | ||||||||||

| California | 36 | 234 | 270 | 510 | ||||||||||

| *Colorado | 0 | 0 | 0 | 0 | ||||||||||

| *Connecticut | 0 | 0 | 0 | 0 | ||||||||||

| *Delaware | 0 | 0 | 0 | 0 | ||||||||||

| *District of Columbia | 0 | 0 | 0 | 0 | ||||||||||

| Florida | 67 | 300 | 367 | 674 | ||||||||||

| Georgia | 163 | 288 | 451 | 739 | ||||||||||

| *Hawaii | 0 | 0 | 0 | 0 | ||||||||||

| Idaho | 38 | 77 | 115 | 198 | ||||||||||

| *Illinois | 0 | 0 | 0 | 0 | ||||||||||

| Indiana | 438 | 225 | 663 | 888 | ||||||||||

| *Iowa | 0 | 0 | 0 | 0 | ||||||||||

| *Kansas | 0 | 0 | 0 | 0 | ||||||||||

| *Kentucky | 0 | 0 | 0 | 0 | ||||||||||

| *Louisiana | 0 | 0 | 0 | 0 | ||||||||||

| *Maine | 0 | 0 | 0 | 0 | ||||||||||

| *Maryland | 0 | 0 | 0 | 0 | ||||||||||

| *Massachusetts | 0 | 0 | 0 | 0 | ||||||||||

| *Michigan | 0 | 0 | 0 | 0 | ||||||||||

| Minnesota | 26 | 33 | 59 | 92 | ||||||||||

| *Mississippi | 0 | 0 | 0 | 0 | ||||||||||

| *Missouri | 0 | 0 | 0 | 0 | ||||||||||

| *Montana | 0 | 0 | 0 | 0 | ||||||||||

| *Nebraska | 0 | 0 | 0 | 0 | ||||||||||

| *Nevada | 0 | 0 | 0 | 0 | ||||||||||

| *New Hampshire | 0 | 0 | 0 | 0 | ||||||||||

| *New Jersey | 0 | 0 | 0 | 0 | ||||||||||

| *New Mexico | 0 | 0 | 0 | 0 | ||||||||||

| *New York | 0 | 0 | 0 | 0 | ||||||||||

| North Carolina | 126 | 214 | 340 | 554 | ||||||||||

| *North Dakota | 0 | 0 | 0 | 0 | ||||||||||

| *Ohio | 0 | 0 | 0 | 0 | ||||||||||

| *Oklahoma | 0 | 0 | 0 | 0 | ||||||||||

| Oregon | 57 | 186 | 243 | 441 | ||||||||||

| Pennsylvania | 208 | 281 | 489 | 771 | ||||||||||

| *Rhode Island | 0 | 0 | 0 | 0 | ||||||||||

| *South Carolina | 0 | 0 | 0 | 0 | ||||||||||

| *South Dakota | 0 | 0 | 0 | 0 | ||||||||||

| Tennessee | 517 | 584 | 1,101 | 1,687 | ||||||||||

| Texas | 856 | 761 | 1,617 | 2,382 | ||||||||||

| *Utah | 0 | 0 | 0 | 0 | ||||||||||

| *Vermont | 0 | 0 | 0 | 0 | ||||||||||

| *Virginia | 0 | 0 | 0 | 0 | ||||||||||

| *Washington | 0 | 0 | 0 | 0 | ||||||||||

| *West Virginia | 0 | 0 | 0 | 0 | ||||||||||

| *Wisconsin | 0 | 0 | 0 | 0 | ||||||||||

| *Wyoming | 0 | 0 | 0 | 0 | ||||||||||

| *Canada | 0 | 0 | 0 | 0 | ||||||||||

| *Puerto Rico | 0 | 0 | 0 | 0 | ||||||||||

| Total | 3,391 | 4,255 | 7,646 | 11,954 | ||||||||||

| (*) THESE STATES HAVE FEWER THAN THREE PLANTS. | ||||||||||||||

| FIGURES ARE AGGREGATED ON FIRST LINE ABOVE | ||||||||||||||

| TOTALS TO PROTECT PROPRIETARY INFORMATION. | ||||||||||||||

|

||||||||||||||

Manufactured home industry newcomers and researchers should be aware of the following facts and relevant insights.

- Manufactured homes construction costs are about half the cost of conventional housing.

2. According to LendingTree, the Federal Housing Finance Agency (FHFA), and other sources, manufactured homes have in recent years been appreciating at a similar, and sometimes higher rate, than conventional housing. While the remarks by prior HUD Secretary Ben Carson, M.D., that are linked here would need to be adjusted for Biden era inflation, they nevertheless reflect a useful snapshot of relevant research and applied common-sense.

3. Research in 2022 by mortgage giant Freddie Mac debunked a series of outdated or otherwise misunderstood myths about manufactured homes.

4. Also according to Freddie Mac research, the majority of consumers would consider buying a manufactured home.

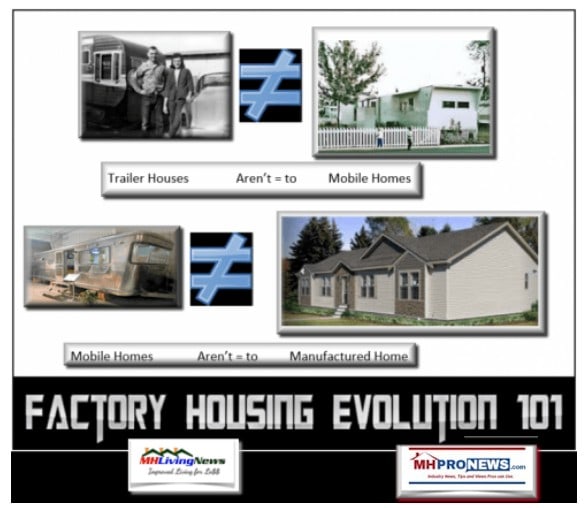

5. Data from the National Weather Service (NWS) ironically debunks the myths that "mobile homes" just blow away at the first big wind. Somewhat like other exaggerations or inaccurate claims that are often repeated which over time appear to become 'true' the facts and video in the report below illustrate the point that only a relatively tiny number of housing units of all kinds of construction (site built or factory built) are lost annually. This is a useful point to mention that there have been no mobile homes built in the U.S. since before June 15, 1976. That is the date when the HUD Code for manufactured housing went into effect and which ended the mobile home era of the largest part of the factory-built housing industry. So, there are pre-HUD Code mobile homes and post-HUD Code manufactured homes. The correct terminology matters because the terminology is properly determined by what building standards a structure was built to achieve.

6. Against that factual backdrop are the following items from the giant National Association of Realtors (NAR) trade association and the National Association of Home Builders (NAHB).

7. According to the NAR, Melissa Dittmann Tracey is a contributing editor for REALTOR® Magazine and is the editor of the Styled, Staged & Sold blog. From a report by Tracey for NAR on May 25, 2023 are the following.

- a) "The spring homebuying season is milder than in recent years, but it’s not being driven by a lack of consumer interest in housing."

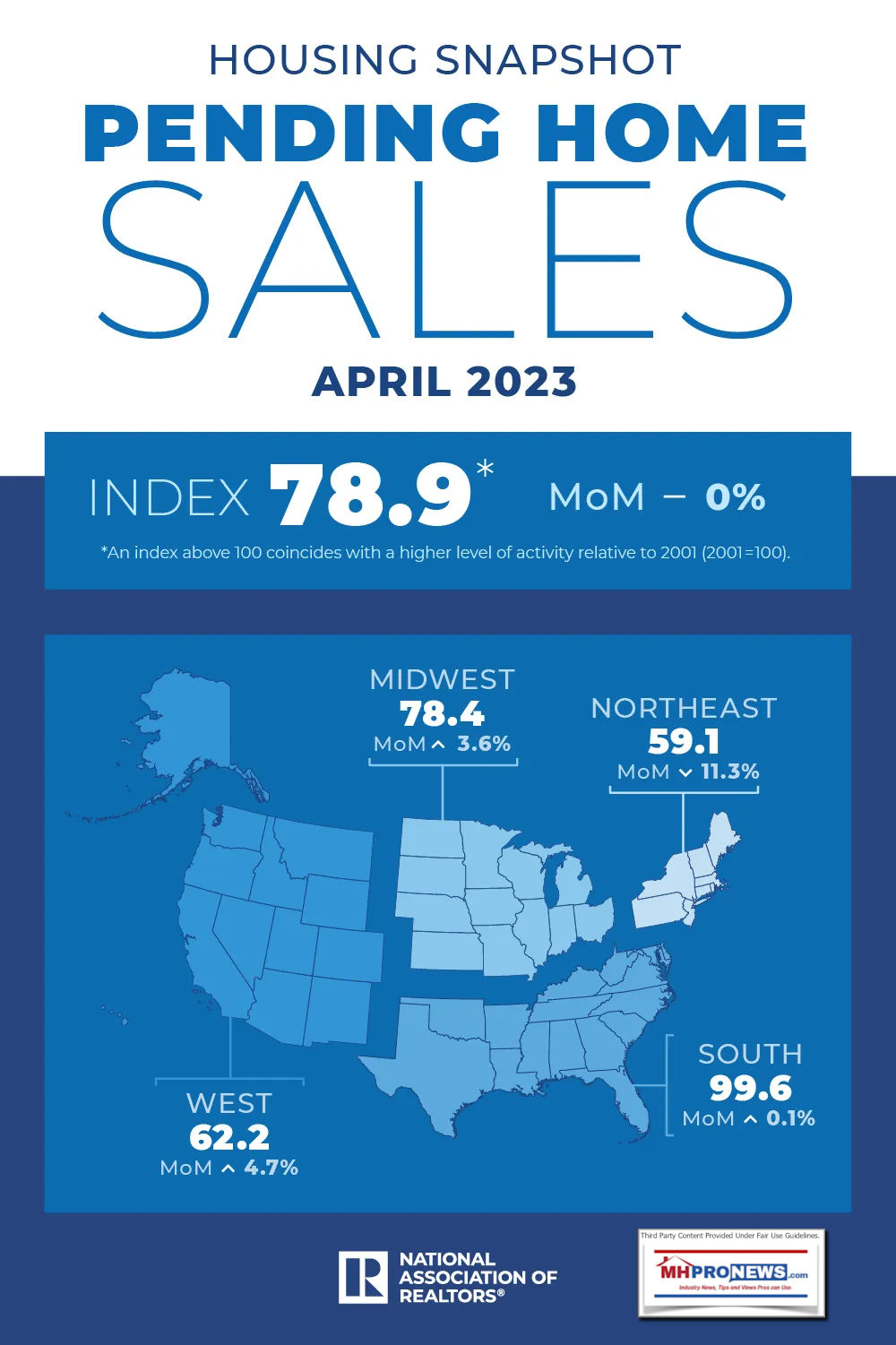

- b) Three of the four regions of the country, per NAR, experienced an increase in pending home sales.

- c) “Not all buying interests are being completed due to limited inventory,” says Lawrence Yun, NAR’s chief economist. “Affordability challenges certainly remain and continue to hold back contract signings, but a sizable increase in housing inventory will be critical to get more Americans moving.”

- d) “Minor monthly variations in regional activity are typical,” Yun says. “However, cumulative results over many years clearly point toward a much greater number of home sales in the South."

8. Tracey's snapshot pointed to new construction as the bright spot in housing. Note that Tracey did not mention manufactured housing at all. Per NAR's Tracey are the following quoted remarks.

a) A bright spot for the housing market lately has been the new-home market, which has been answering the call by providing inventory to buyers starved for greater choices. New-home sales jumped about 4% in April and are now 11.8% above a year ago, the Commerce Department reported this week.

a) A bright spot for the housing market lately has been the new-home market, which has been answering the call by providing inventory to buyers starved for greater choices. New-home sales jumped about 4% in April and are now 11.8% above a year ago, the Commerce Department reported this week.- b) Builders are using incentives to attract buyers to new-home sites. Fifty-four percent of builders offered some type of incentive to help ramp up sales in May, according to the National Association of Home Builders. Those builder incentives often included reducing mortgage payments, like covering closing costs and mortgage rate buydowns.

- c) Twenty-seven percent of builders also said they dropped their prices in May, the builder’s trade group notes. The median new home sale price dropped in April to $420,800, an 8% decrease compared to a year ago.

9. PowerPoints by NAHB and NAR officials in their recent "The Home Front" presentations in Washington, D.C. May 6-11, 2o23 are attached. Those new items reflect the economic, regulatory, home buying interest levels and other headwinds as well as the opportunities.

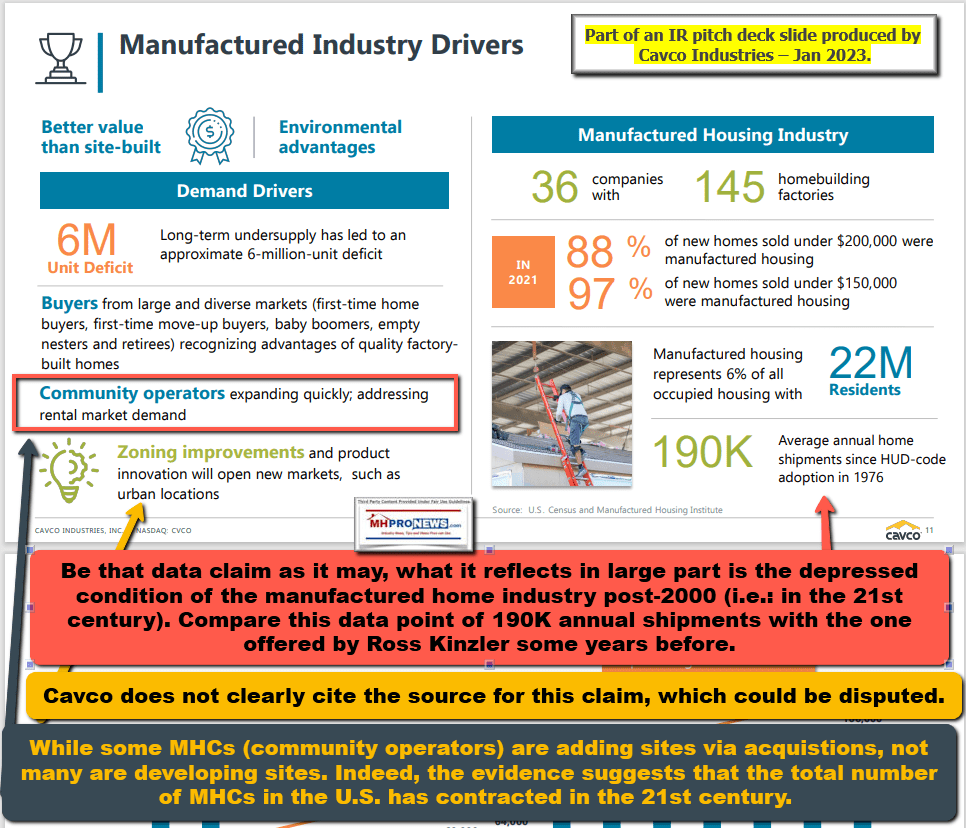

10. For instance. NAR's Yun said there is a need for some 5.5 million homes. That is similar to the 6-million-unit need cited by MHI member Cavco Industries (CVCO). Note, MHProNews has for some time pointed out that there is an odd disconnect in sources on the total number of homes needed, ranging from 3.8 million per Freddie Mac to over 8 million previously cited by NAR's Yun. That wrinkle noted, with the population growing, the southern border porous, the potential new home market is large. For example, sources like the Zebra said: "According to the US Department of Housing and Urban Development, in 2019 there were 43.6 million rent-based households in America." Or iPropertyManagement noted in 2022 that: "35% of American households renting their home."

11. NAHB's Chief Economist Robert Dietz, Ph.D. on May 11, 2023 subtitled his presentation as "Home Building Turning Point in View" saying: "Shelter costs continue to rise despite Fed policy tightening --- “Gimmie Shelter.” The NAHB touted the recent Supreme Court ruling as a step ahead in the Biden regime era for housing. Other tweets from the NAHB highlight the opportunities for building new housing. While the NAHB is focused on site-built housing, their points are often relevant for manufactured housing or modular construction too.

More on yesterday's landmark Supreme Court ruling: The current #WOTUS rule is based on the significant nexus analysis the Supreme Court has clearly rejected. Therefore, the administration will have to make extensive changes to the rule. Read more: https://t.co/JfmCM8PlnE

— NAHB 🏠 (@NAHBhome) May 26, 2023

NAHB on the Supreme Court decision redefining the scope of the Waters of the U.S. (#WOTUS) definition: "The decision represents a victory against federal overreach and a win for common-sense regulations and #housingaffordability." Read the full statement: https://t.co/DBJZsm3Sie

— NAHB 🏠 (@NAHBhome) May 25, 2023

NAHB members will meet with their elected officials on June 7 at the 2023 Legislative Conference, urging policymakers to act on key issues impacting housing. NAHB encourages members to watch 3 videos that outline the main messages to convey to lawmakers. https://t.co/gKfFQdFKtS

— NAHB 🏠 (@NAHBhome) May 26, 2023

#NewHomeSales: Sales of new single‐family homes grew 4.1% in April to an annual rate of 683,000, 11.8% higher than in April 2022. Median sales price ($420,800) and average sales price ($501,000) were both down significantly compared to March 2023. #economy #realestate #homesales pic.twitter.com/PFKcU5Cekx

— NAHB 🏠 (@NAHBhome) May 23, 2023

According to the most recent #jobsreport, over the past 12 months, construction sector jobs in the U.S. have increased by 205,000 — a 2.7% increase compared to April 2022. https://t.co/CESmH1oa9n | #CareersinConstruction

— NAHB 🏠 (@NAHBhome) May 22, 2023

Missing middle housing (townhouses, duplexes and similar) is lagging larger multifamily units. Construction of the missing middle fell off during the post-Great Recession period and will continue to without #zoning reform focused on light-touch density. https://t.co/IbzzU0Az7w

— NAHB 🏠 (@NAHBhome) May 24, 2023

Given lack of resales homes, new home sales up 4.1% to 683k annual pace in Apr. Sales still down almost 10% in 2023 on YTD basis. Gains in $200k to $400k price range, with sales $200k to $300k more than double than a year ago. Not started construction sales higher. @NAHBhome

— Robert Dietz (@dietz_econ) May 23, 2023

12. Summing up some of the elements of the above from the larger macro-economic and enormous U.S. housing market picture.

- a) Millions of units of housing are needed.

- b) Realtors biggest challenge is a lack of inventory on resales.

- c) Conventional builders, despite higher costs by far than manufactured homes, are finding ways to boost sales month-over-month, even though the year over year sales have been blunted by rising interest rates.

- d) NAHB builders pointed to the need for the "missing middle" and NAR and others have long pointed to the need for "entry level" housing.

- e) Cavco noted that the lack of affordable housing in the U.S. is a two trillion-dollar annual drag on the U.S. economy. That is a point that MHProNews has periodically referenced for years, based on NBER level research cited here.

- f) Conventional builders have said for years that they simply can't keep up with the demand for new housing. Thus, the need for factory-built housing to fill that gap in demand.

13. Restated, the above bullets (#12 a-f) are factors that should be considered as positive opportunities for the manufactured housing industry and the industry's potential to boost the U.S. economy. Because federally funded university level research has debunked the claim that manufactured homes harm the value of conventional housing when the two construction types are found side-by-side in urban settings, the case for more manufactured homes are strong. Prior and other studies, including more recent research referenced below, each elaborate on that point.

14. That noted, Andrew Justus, J.D., Niskanen Center Housing Policy Analyst, in a The Hill op-ed pointed to their research in asking and answering what is "holding back" manufactured housing in the U.S. Justus' evidence-based contention could be summed up as zoning barriers and a lack of more competitive financing options.

15. MHLivingNews did a 2023 deep dive on the research by Daniel R. Mandelker, J.D., and his remarks on what are the barriers to more manufactured housing. Like Justus, he found that zoning barriers are often 'restrictive.'

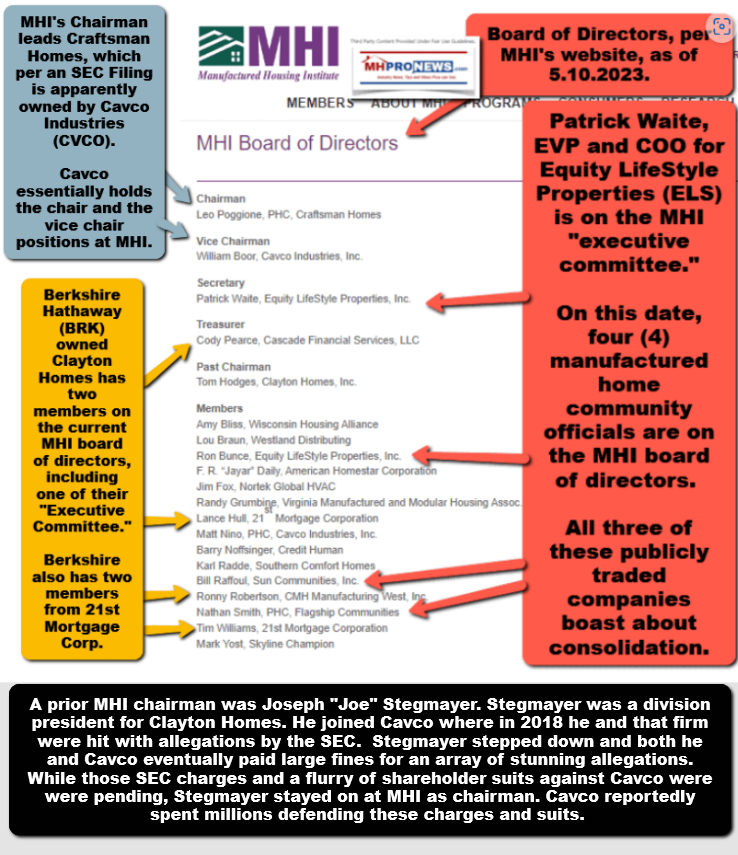

16. Perhaps as or more insightful, Mandelker said that an organization is needed for manufactured housing advocates litigation and legislative support. While apparently unintended, the report linked below outlined how his insightful comment is a de facto slap in the face to the Manufactured Housing Institute (MHI). Why? Because MHI claims to be the organization that is fulfilling that very role of serving "all segments" of manufactured housing.

17. Justus and Mandelker are hardly alone. The Manufactured Housing Association for Regulatory Reform (MHARR), an independent producers trade group (production focused advocacy) has similarly said that there are zoning/placement and financing barriers for the industry. In an exclusive interview with MHProNews, Mark Weiss, J.D., President and CEO of MHARR effectively accused MHI of playing a "shell game" with manufactured housing professionals. That "shell game" "on steroids" impacts affordable housing seekers, independents, investors, taxpayers, and others. Unlike Justus and Mandelker, Weiss takes aim directly at MHI. Note that MHI is an 'umbrella' trade group that claims to represent "all segments" of the interests in the production and post-production sectors of the manufactured home industry. As a useful analogy, NAR would be 'post production' while NAHB would be 'production' focused. So MHARR is 'production' focused and MHI is post-production, but also claims to represent both production and post-production segments of the industry.

18. Note that despite the often-cited problem of manufactured housing placement barriers, which are widely agreed to, Freddie Mac researchers in 2022 said that there are about 25 to 26 million "mortgage ready" Americans renting in areas that are 'manufactured home friendly' jurisdictions.

19. Despite the fact that some prominent manufactured housing producers took a serious hit on their production in the 6 months for which national data is available (the final quarter of 2022 and the first quarter of 2023), that publicly traded Legacy Housing (LEGH) demonstrated that the trend can be bucked. Their recent earnings call admitted their internal hurdles, but also illustrated how their long-term growth strategy has profitably paid off.

Legacy Housing Financial Results and Earnings Call 1Q 2023-'Sales Slowed but Margins Improved' Duncan Bates Boasts of Manufactured Housing 'Business Tailwinds' Official Data-Analysis

Legacy Housing Financial Results and Earnings Call 1Q 2023, 'Sales Slowed but Margins Improved', Duncan Bates, President and CEO, Max Africk, General Counsel, Co-Founders, Curtis "Curt" Hodgson, Kenneth "Kenny" Shipley, Boasts, Manufactured Housing, 'Business Tailwinds', Official Data-Analysis, investing, mobile home parks, manufactured home communities, production, retail, finance, Manufactured Housing Institute, Manufactured Housing Association for Regulatory Reform, MHARR, MHI, antitrust, Samuel "Sam" Strommen, James A.

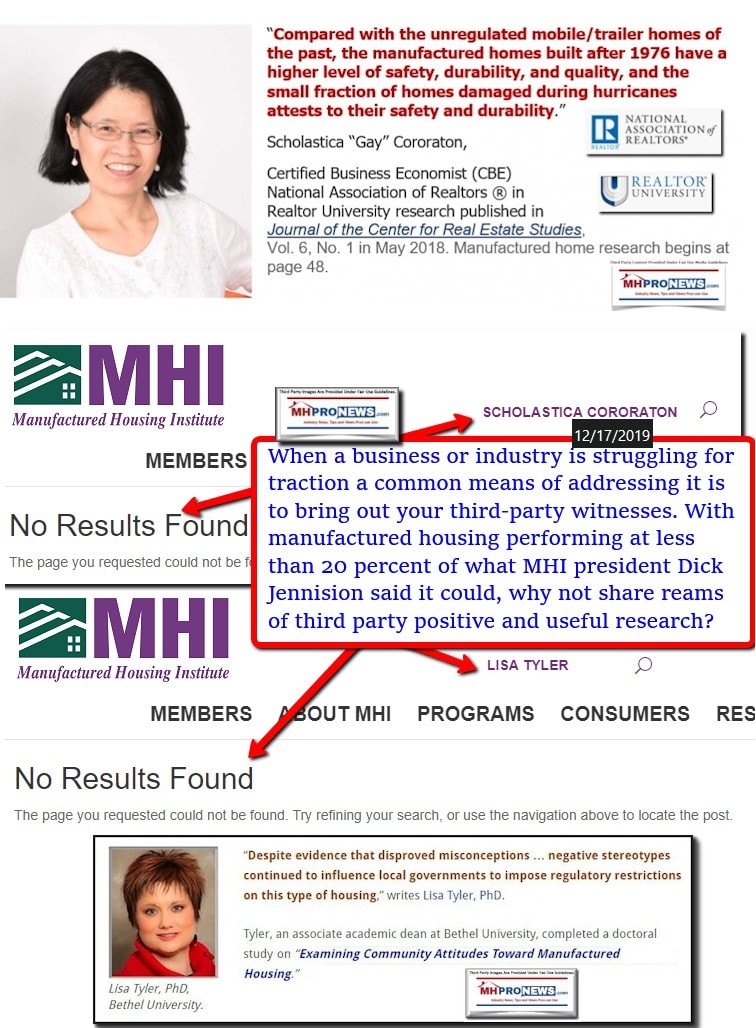

20. Let's pause again to summarize some of the above. There is a widely acknowledged affordable housing crisis. Site builders (NAHB) can't achieve the same price points that manufactured homes do. NAHB and NAR both admit there is a need for entry level housing that could sell for under $200,000. The vast majority of such homes built and sold in America under that threshold are HUD Code manufactured homes. Despite the obvious opportunities to sell literally millions of affordable housing seekers, manufactured homes are often misunderstood. But years of third-party research from credible sources has been gathered on MHLivingNews. That research debunks the concerns about manufactured homes. For instance, the NAR's Scholastica "Gay" Cororaton in research citing this writer and MHARR in footnote 1 of her work pointed to facts that make it clear that millions of renters could qualify for a manufactured home. That 2018 research by NAR's Cororaton is essentially supported by the findings of the Freddie Mac researchers shown and linked above. Oddly, such largely positive research like her's, Freddie Mac's, Lisa Tyler, Ph.D., (who also cited this writer in her acknowledgments) are routinely NOT found on the Manufactured Housing Institute (MHI) website. That summary begs the question. With a budget several times the size of MHARR's is it about MHI that keeps them from taking apparently obviously needed and common-sense steps to advance the interests of the manufactured home profession?

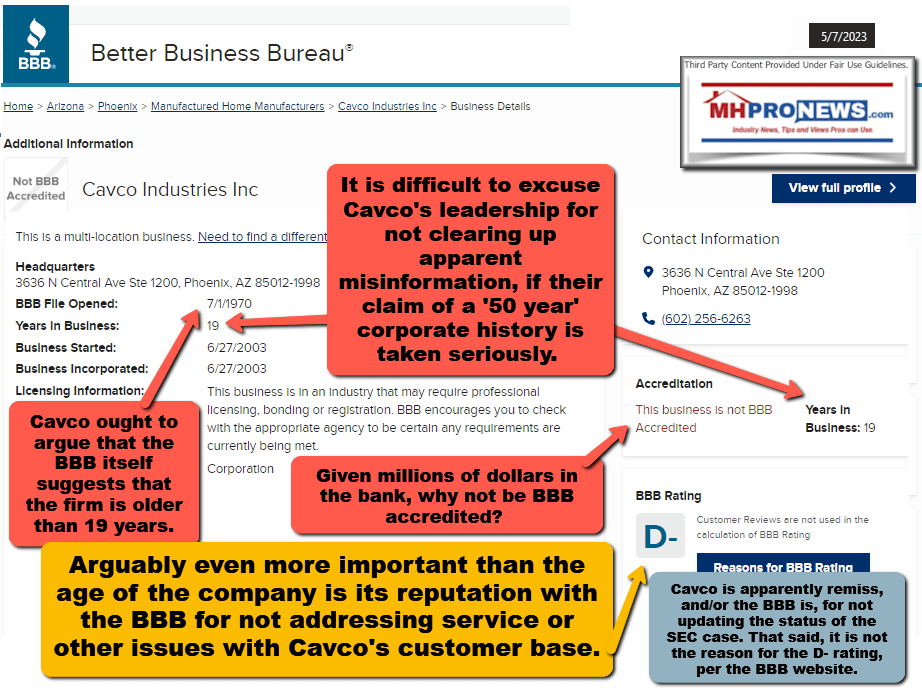

21. Next, let's note that there are legitimate concerns about some of the specific behaviors of manufactured housing firms that have developed a reputation for being what media and public officials have often aptly called "predatory." Even though MHI and their National Communities Council (NCC) has a so-called code of ethical conduct, there are several clear examples of credible mainstream news reports that have documented what appears to be violations of MHI's 'code.' Yet per sources to MHProNews, there are no known examples of MHI taking any corrective steps to enforce their own code of conduct. The evidence-based editorial Masthead blog on MHProNews looked at their so-called code of conduct and several specific examples in depth in the report linked below. When asked about such concerns, MHI leaders have been mute.

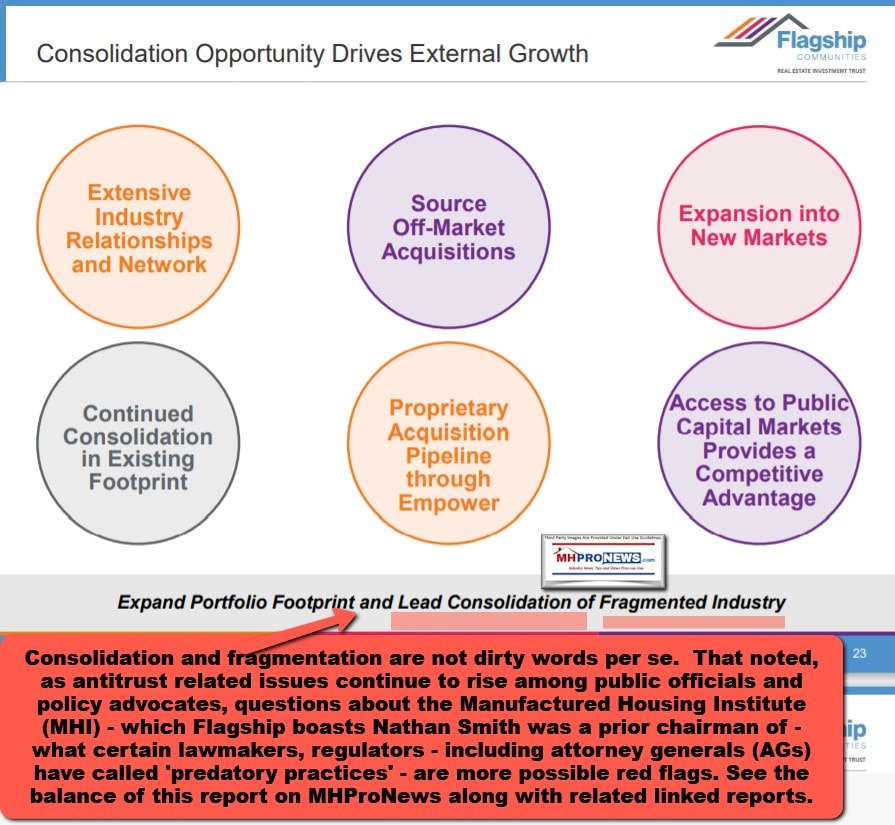

22. Perhaps as troubling is that MHI established "awards" for "excellence" program some years ago. In recent years those awards have been given to firms that appear to have violated the MHI-NCC code of conduct. Furthermore, some of those firms have poor ratings with the Better Business Bureau (BBB). The first MHI member firm which was given an "excellence" award that is linked below has as a co-founder a former Chairman of MHI, Nathan Smith. Smith still sits on the MHI board of directors. The Better Business Bureau (BBB) rates his firm as a D-. As the detailed report below spotlights, the prior name for Flagship Communities was SSK Communities, and they had an F rating with the BBB.

23. The report linked below takes a deep dive look at Cavco Industries. Cavco has a prominent spots on the MHI board (see further below). They also happen to have a BBB rating of D-. How does someone give an "excellence" award to a company that gets a D- BBB rating?

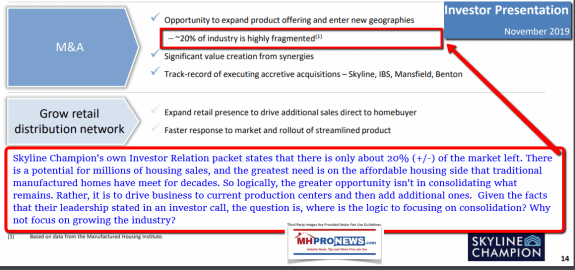

24. In fairness, before proceeding, it should be noted that not every firm at MHI is accused of being predatory. Not every firm at MHI has a poor BBB rating. That said, when several media, public officials, and others hit the organization's members with credible allegations, lawsuits, and/or cases that have settled (which often don't look favorable for the firms involved), a picture begins to emerge. That picture is one of a trade group that has been steadily 'taken over' in the 21st century by a group of firms that have their own agenda. A look at several publicly traded firm's investor presentations reveals that the agenda appears to be the consolidation of the manufactured housing markets various segments.

Whistleblower Payout! Cavco (CVCO) Settle with SEC in Securities and Exchange Commission Case vs. Cavco Former CEO Joseph Stegmayer, Daniel Urness - 21-cv-01507 U.S. District Court of AZ

Whistleblower Payout!, Cavco Industries (CVCO) Settle, SEC Securities and Exchange Commission, Case vs Cavco, Former CEO Joseph Stegmayer, former Cavco Executive Daniel Urness, 21-cv-01507, U.S. District Court of AZ, Information bio history facts on William Bill Boor, SEC Whistleblower Payout Document, record whistleblower payouts,

25. In so-called "red states" and "blue states" manufactured home operations have been hit by cases or probes by state officials, attorneys general, and lawsuits of various kinds. Several of these seem to be tied to MHI members and/or to members of MHI 'state affiliates.' Despite the fact that a Manufactured Housing Executives Commitee (MHEC) member said that state associations should not be in the business of defending 'bad actors' it appears that so-called 'bad actors' are running the show in several states affiliated with MHI and at MHI itself. As a review by MHLivingNews of HBO's Last Week Tonight with John Oliver's satirical and viral hit-piece on manufactured housing revealed, each of those named or shown appear to have clear ties to MHI.

26. Put differently, consolidators who may use predatory tactics appear to have taken control of MHI. When asked to respond to allegations on these concerns, MHI and their attorneys have in recent years chosen to not comment. Examples are linked below.

Longtime MH Retail Sales Manager Asks Manufactured Home Leaders - Why are Manufactured Housing Production Levels Today About Half of 1980s When Interest Rates Hit 20.5% APR on ARM Loans?

Longtime MH Retail Sales Manager Asks Manufactured Home Leaders, Why are Manufactured Housing Production Levels Today About Half of 1980s When Interest Rates Hit 20.5% APR on ARM Loans?, Manufactured Housing Institute, MHI, Clayton Homes, Kevin Clayton, Tom Hodges, Lesli Gooch, Leo Poggione, William Bill Boor, Mark Yost, David Goch, Daniel R.

27. In a heavily footnoted thesis by Samuel "Sam" Strommen, who was then with Knudson Law, Strommen praised the importance of manufactured housing in the affordable housing crisis. But Strommen also blasted what he alleged where obvious antitrust, RICO, and other possible legal violations in an industry whose bad actors appear to be focused on an oligopoly style of monopolization. Strommen asserts these firms, often MHI members, have largely managed to duck accountability. Strommen specifically named MHI as part of what he called a "felony" conspiracy to violate the federal Sherman Antitrust Act. Strommen cited the evidence that pointed out how specific firms in the manufactured home industry have become a "Rube Goldberg Machine of Human Suffering." Note that Strommen repeatedly referenced MHProNews reports like the one linked here.

28. In the face of years of such evidence and challenges, what have others in the manufactured housing industry said? Beyond MHARR, MHProNews/MHLivingNews, there have been few mentions of these topics. It appears that MHI and corporate insiders who dominate MHI have 'weaponized' much of the balance of the industry's trade media in a fashion that appears to give cover for the bad actors.

29. Among those quizzed about these allegations outlined herein, specifically those made by Strommen, are attorneys associated with Berkshire Hathaway. They chose not to answer the allegations of antitrust, RICO, or other possible violations of the law.

30. One may wonder how such a pattern could largely escape the notice of federal officials beyond the SEC suit against Cavco Industries?

a) Per two sources in Washington, D.C. to MHProNews who are deemed reliable, during the Trump Administration, antitrust officials met to discuss evidence of possible violations by Clayton Homes and their affiliated lending. Perhaps due to the change of administrations from President Donald J. Trump to Joe Biden, the deep pocket Democratic supporting donors (think Warren Buffett, Bill Gates, others) that have financial interests in manufactured housing have thus far managed to keep their exposure to a minimum. For balance and in fairness, Democratic lawmakers did refer concerns about prominent MHI member Clayton Homes and their affiliated lending to the Department of Justice and the Consumer Financial Protection Bureau (CFPB). But Biden era federal officials have largely been mute on what has occurred in the wake of those referrals.

31. Summing up this segment of the report, there is an array of evidence of wrongdoing by specific firms that are prominent MHI members. Fines have been handed down or accepted by federal and state officials against some MHI member companies. But those fines and settlements appear to be more of a slap on the wrist instead of serious punishment meant to deter or end illegal and immortal practices. While mainstream media does report on this or that troubling incident, what is routinely lacking in mainstream reports are the apparent ties to brands that dominate MHI and MHI itself. When problems are broadly mentioned, sometimes the ethical operators in manufactured housing are inadvertently lumped in with the predatory brands. There are reports that may accurately depict some of the problems but may not as accurately point to the best possible solutions, which can include free enterprise opportunities that are supported by the rule of law.

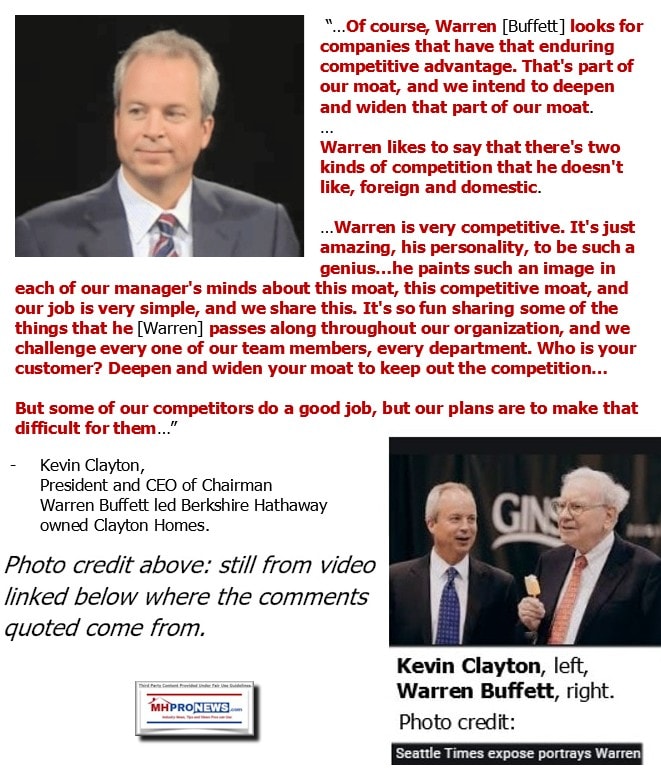

32. So, there appears to be a pattern of problematic and apparently illegal behaviors by firms that are routinely tied to MHI. Those firms which are publicly traded have often stated in their investor relations packages that they are focused on "acquisitions" in "a largely fragmented industry" (their terms). They appear to support the notion that deliberate antitrust behaviors may be involved, see Strommen above and further evidence that will be linked herein.

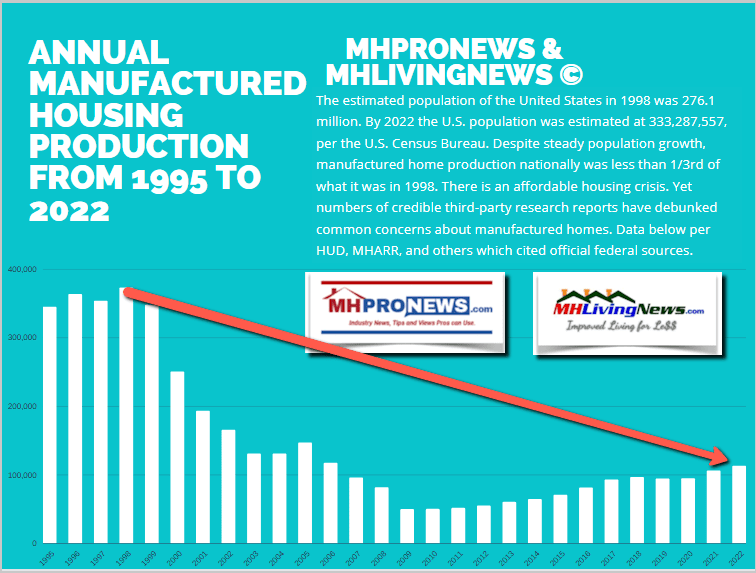

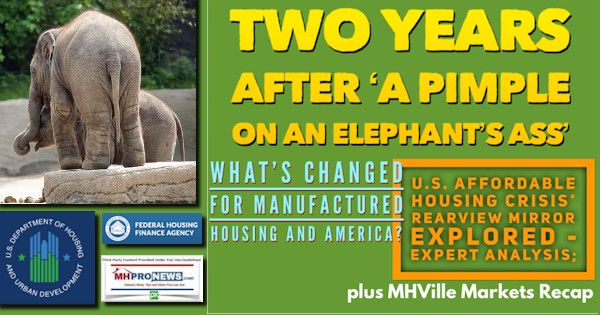

33. That said, underperformance in manufactured housing - from the perspective of some of these predatory consolidators - is seemingly seen as an often unstated but implied advantage. By sullying the image of their own industry, and by keeping the industry at a fraction of the level that it operated in the late 20th century, companies can be forced to close and/or sell out at reduced valuations. Note that the data below reflects that in 1998, with a smaller U.S. population, that manufactured housing sold far more homes nearly a quarter of a century ago than it did in 2022. The industry is at about 30 percent of its last highwater mark. And this is occurring during an affordable housing crisis, after years of research has demonstrated that manufactured homes are a proven solution. While MHI's website does have token examples of positive remarks about their own industry's products, they routinely fail to have the kind of third-party generated research that one might expect for a profession which has been struggling for traction for over 2 decades.

34. The problems are both better and worse than what they may appear to be. On the one hand, there are obvious internal and external challenges which are mentioned and linked from this outline. On the other hand, there are possible solutions in place that for those with the vision, moxie, and resources needed, could see manufactured housing as a giant opportunity in disguise.

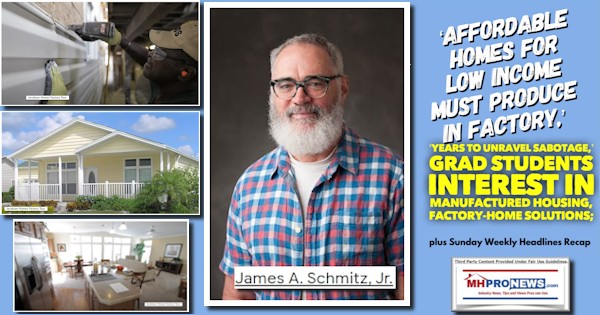

35. Much of this can be connected to the anti-competitive practices deployed that Warren Buffett and Kevin Clayton have referred to as "the moat." A book has literally been written about the Buffett moat methods, and a chapter of that book is devoted to Clayton Homes and their lending. As the second evidence packed report linked below details, Clayton has bragged that Buffett has pledged to him that he can have access to whatever capital needs he may want. In the light of the evidence outlined and linked herein above, that clearly points to a sobering conclusion. Giant firms like Berkshire Hathaway, BlackRock, and people like Buffett ally Bill Gates, and others that have a large stake in manufactured housing have tens of billions of dollars at their disposal. They could readily do the lobbying, marketing, legislation, and educational work needed to reverse the issues that are "holding" manufactured housing "back" to borrow Justus' term linked above and here. Put differently, once the facts of the housing market are understood, and the realities of manufactured housing are grasped, it is obvious that manufactured housing is being 'sabotaged' by forces outside and within. That's the view of Strommen, Minneapolis Federal Reserve researchers that include James A. "Jim" Schmitz Jr., MHARR, and this writer for MHProNews/MHLivingNews.

36. What this three-dozen bullet point outline reveals is a stunning tale of affordable housing that has been sabotaged from outside and within. If it still may seem to amazing to be true, HUD has two researchers who published a report that frankly admitted in September 2021 that the causes and cures for the affordable housing crisis have been known for 50 years. Ironically, or perhaps in a corrupt fashion if Schmitz, MHARR, and others are correct, HUD has the solution under their jurisdiction. Nevertheless, the affordable housing crisis persists.

Two Big Problems Facing Manufactured Housing Have Technically Already Been Solved by Congress, But...

37. Note that Justus and MHARR's Mark Weiss both cited financing and zoning/placement issues are keeping manufactured housing from reaching its potential. So has the Urban Institute and other researchers.

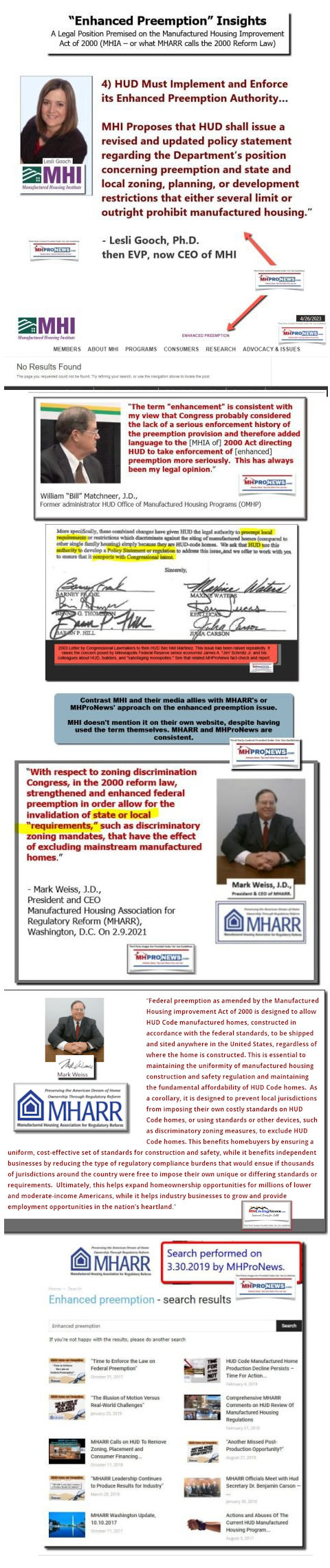

38. Legislation involving manufactured housing 2000 was enacted in 2000 and 2008. There was the Manufactured Housing Improvement Act (MHIA) of 2000, what MHARR sometimes refers to as the 2000 Reform Law or 2000 Reform Act. Both MHI and MHARR agree on a key meaning of the law. That meaning is that Congress gave HUD the authority to overcoming zoning barriers to HUD code manufactured housing. The legal phrase used is that the MHIA gave HUD "enhanced preemption" authority.

39. What the above illustrates are examples of how MHI admits to the power, but they have not used that very phrase on their own website. By contrast, MHARR has used that phrase and have numerous examples of articles that point to "enhanced preemption" being asked for full enforcement. Put differently, MHI is posturing and paltering. As Danny Ghorbani - former MHI VP turned MHARR's founding president and CEO, and now MHARR senior advisor - put it, MHI has engaged in photo ops but has failed to act. The action needed at this point is to sue to get the law enforced. What Justus, Mandelker and others have said is needed, is already federal law.

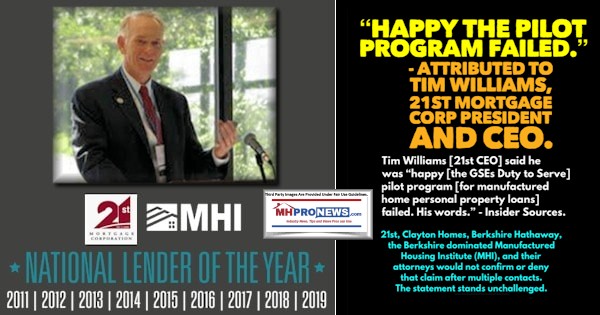

40. Something similar has occurred with the competitive financing issue. The Housing and Economic Recovery Act of 2008 has mandated that Fannie Mae and Freddie Mac have a "Duty to Serve" manufactured housing. Oddly, MHI's Tim Williams - President and CEO of Berkshire Hathaway owned 21st Mortgage Corporation, former MHI chair, and current MHI board member - bluntly said in an MHI meeting with dozens present that he was glad that Fannie and Freddie's pilot program has failed.

41. While that occurred after Doug Ryan of Prosperity Now's remarks linked below, it makes the point he claimed reflect about the monopolization of manufactured housing.

42. There is a case to be made that key aspects involving manufactured housing have been corrupted. That corruption includes association and at least some public officials who are not doing their jobs. As a disclosure, this publication's writer has personally provided federal and state officials with evidence. State officials have acknowledged the compelling nature of the evidence for illegal actions, similar (but not as detailed) as what is linked herein. That said, if investigations were opened, no one has said so. Complaints to federal officials have been acknowledged, but have not apparently been acted upon. Two examples are linked below.

No Title

No Description

DOE

No Title

No Description

43. There is much more, but that sums up much of could be described as the true state of the affordable housing crisis in America and the troubling scenario that manufactured housing is caught up in. MHARR said approaching 6 years ago that manufactured housing needs a new post-production trade group.

44. MHARR has since released a white paper that explains how the years of promises made to manufactured housing fails to "reach the ground," a kind of reference to weather events when whisps of rain or hail evaporate before it reaches the earth.

Manufactured Housing Association for Regulatory Reform MHARR - Issues and Perspectives HUD's Failure on Zoning Equity Hurts Manufactured Housing Industry and Consumers - Manufactured Housing Association for Regulatory Reform

White Paper, entitled "The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions,"...

Summary and Conclusion

It has been said by the late Zig Ziglar that the first step in problem solving is to understand that a problem exists.

The classic movie Charade humorously reveals the age old problem of why liars lie in stealthy ways.

While there is evidence that several MHI member firms have engaged in paltering, as has MHI, there is also evidence that the remarks uncovered as a result of some of those acts - when carefully examined - reveals the true nature of the problems that have held manufactured housing back. For instance, the SEC case reads in part like a corporate spy novel, complete with code names for what Cavco (CVCO) has finally settled with a 7 figure fine.

The affordable housing crisis is real. It could be solved by using HUD Code manufactured housing. If MHI were using its legal resources, as MHI was finally compelled by the steady spotlight from MHARR and MHProNews to do in the DOE case, then manufactured housing could be unleashed to a new era of high-level performance. Tiny houses have sued for their rights on zoning issues, so why hasn't MHI done the same thing, when they already have a federal law to support their case?

Cavco may apparently palter, as does MHI, but they are correct in some points. They are right that the lack of affordable housing costs the U.S. economy some $2 trillion dollars annually in lost GDP. The lack of affordable housing could be an opportunity in disguise for those who have the moxie to stand up to the vexing pattern evidenced herein. While it is an April Fool's post, the following made several key points. Thousands of professionals and investors, and millions of Americans could benefit simply by doing what's right, profitable, and by compelling the enforcement of existing laws. ###

[cp_popup display="inline" style_id="139941" step_id = "1"][/cp_popup]

Stay tuned for more of what is 'behind the curtains' as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. "Tony" Kovach - for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He's a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC's and/or the writer's position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Manufactured Housing Association Presses HUD for Specific Inclusion of HUD-Regulated Manufactured Homes in New Affirmatively Furthering Fair Housing (AFFH) Rule; plus MHVille Markets Update

Manufactured Housing Association, Manufactured Housing Association for Regulatory Reform, Presses HUD, Specific Inclusion, HUD-Regulated, Manufactured Homes, New, Affirmatively Furthering Fair Housing, AFFH Rule; plus MHVille Markets Update 4.26.2023, Manufactured housing, production, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs,