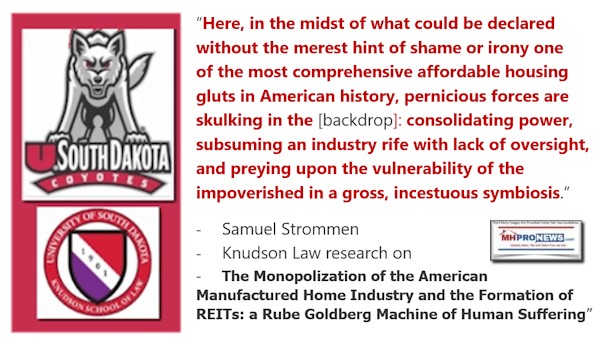

An array of mainstream and other media have for years serious, evidence-based allegations against Warren Buffett led Berkshire Hathaway (BRK) owned Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage & Finance (VMF). A longer list is found further below, but among the sources that span the left-right media and political divide was HBO’s Last Week Tonight with John Oliver. Oliver’s viral smack was down errantly dubbed “Mobile Homes.” Oliver’s video drew millions live, and over 8 million more on one YouTube post alone. Oliver slammed Buffett, Clayton, and exposed other troubling manufactured housing industry practices routinely deemed “predatory” if not illegal. What Oliver – and some others – failed to mention is that the Manufactured Housing Institute (MHI) is often a common thread between these “predatory” brands. With that backdrop, the Consumer Financial Protection Bureau recently published fresh data, disclosures, and statements to the public on industry lending. Additionally, in contacts with MHProNews, the CFPB has provided exclusive new details, some of which is published for the first time. These new facts, evidence, and claims – combined with previous revelations reported here – form a compelling case of what Samuel Strommen with Knudson Law has previously blasted in an evidenced-laced document as “felony” antitrust, RICO, and other possible criminal, illicit and actionable activities. Strommen’s case against Clayton, MHI, and Warren Buffett’s malevolent and purportedly “racist” moat methods just got a boost from no less a source than the CFPB.

The follow up from sources at the CFPB, both on and off the record, once again raises serious questions about how Berkshire Hathaway (BRK) owned Clayton Homes and their affiliated lending – 21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF) – have seemingly gotten away with a range of troubling legal issues for so many years.

Those concerns include complaints of racial bias in the form of higher interest rates to minorities, aggressive sales and loan servicing tactics, and more.

But other concerns that Strommen, critics of MHI and their dominating brands, concerns raised by the the Manufactured Housing Association for Regulatory Reform (MHARR) and others seem to fit a broader thesis by Minneapolis Federal Reserve Senior Economist, James A. “Jim” Schmitz Jr and his colleagues have been hammering on in recent years. Schmitz et al have alleged that “sabotaging monopolies” have undermined HUD Code manufactured housing. They have done so, per Schmitz, by federal regulators colluding with builders and nonprofit trade groups in what they say are ‘subtle ways that are difficult to detect.’ For those familiar with the “Iron Triangle” concept in political science, Schmitz, Strommen, MHARR and others – wittingly or not – are creating supporting evidence for how regulators not only fail to do their jobs, but are purportedly colluding with private interests in ways that are harmful to the public interests, yet benefit a small group capable of manipulating the system. Your Dictionary defines that Iron Triangle as: “The definition of an iron triangle is a three-way political relationship between Congress, an administrative agency and a special interest group to influence Congressional decisions.” It goes on to say about the Iron Triangle that in “(US, politics) The policy-making relationship among the congressional committees, the bureaucracy (executive) (sometimes called “government agencies”), and interest groups.”

William Tucker, writing for Reason in 1991, was already making an “Iron Triangle” case that specifically mentioned manufactured housing akin. Tucker did so stating concerns that Schmitz and other contemporary voices are raising today. Reason’s headline proclaimed, “Housing: The Unwelcome Wagon Rolls On.”

Tucker hits familiar themes for politicos, advocates and others who are frequent readers of MHProNews and/or our MHLivingNews sister-site.

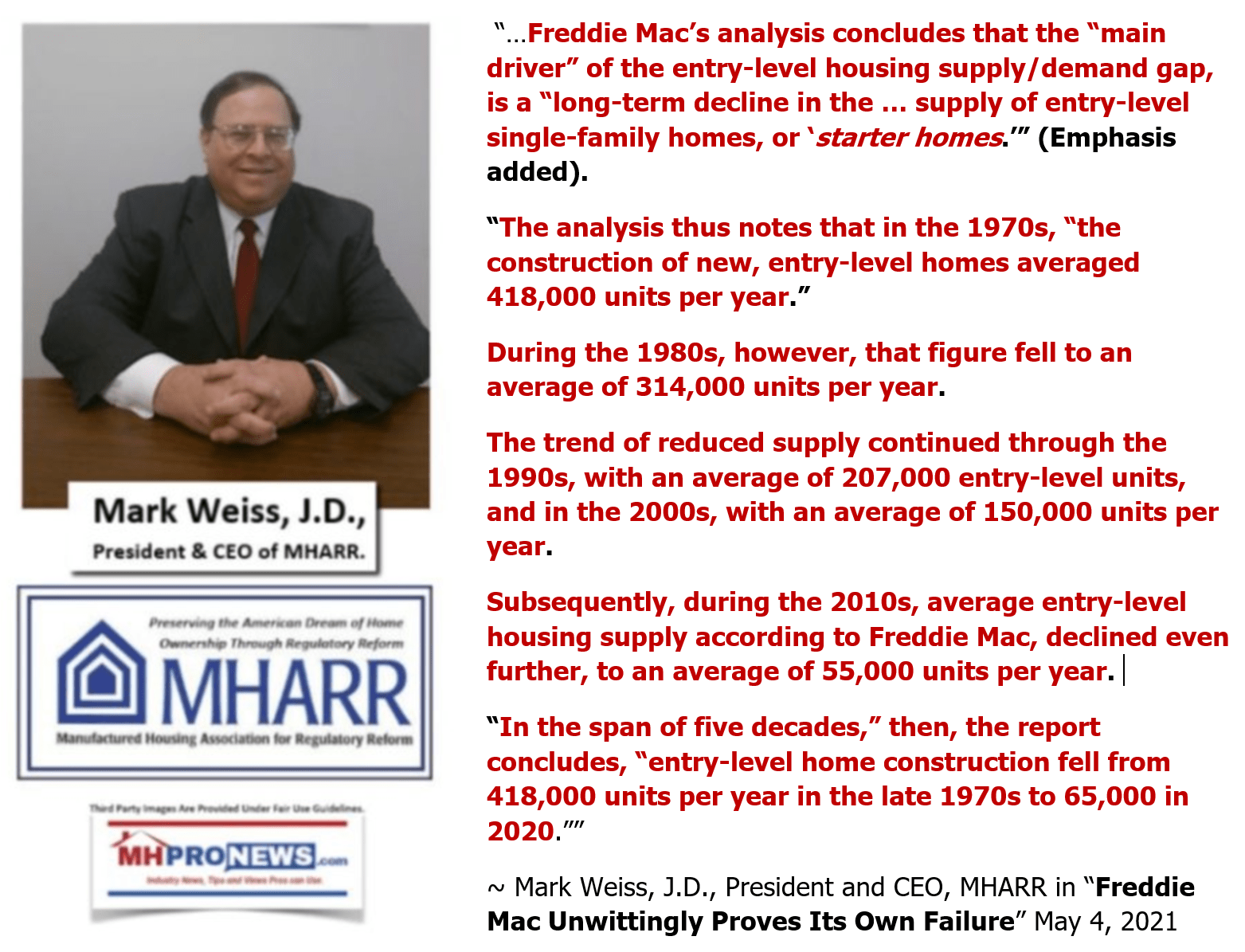

Regulatory barriers are driving up housing costs, while affordable manufactured homes – which Tucker errantly refers to as “mobile homes” are being zoned out. “Housing researchers estimate that zoning delays and building-code requirements add some $15,000 to $30,000 to the price of a new home in many parts of the country. “Starter homes”—simple, no-frills structures that first-time home buyers can afford—are almost impossible to build in exclusive suburbs. Apartments are fought everywhere. Mobile homes (average owner income, $18,000) are restricted to industrial zones—when they are allowed at all. Then people wonder why we have an “affordable housing problem.”

- But it was problems like those that Tucker or others have raised which caused Congress – in a widely bipartisan way – to pass the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform law).

- 8 years later, Congress once more passed in a robustly bipartisan fashion the Duty to Serve Manufactured Housing, Rural and Underserved Markets.

- DTS was part of the regulatory regime that would “mandate” that the Government Sponsored Enterprises of Fannie Mae and Freddie Mac would create a secondary market for manufactured homes.

- Yet, just last year the departing DTS program manager, James “Jim” Gray admitted in his farewell message that they had made little progress toward that goal. While accurate – MHI, MHARR, Prosperity Now and an array of third parties agree to Gray’s contention – it was nevertheless a stunning admission.

- How is it possible that laws passed 13 years to two decades ago are still being thwarted, manipulated, and misdirected? One answer is that special interests, in apparent collusion with members of Congress, regulators and special interests.

Observed Tucker 30 years ago, “Modular and manufactured housing, for example, have been a favorite of federal housing reports since HUD Secretary George Romney tried to launch “Operation Breakthrough” in 1968. The iron triangle of union regulations, municipal planning-board skepticism, and homeowners’ unwillingness to countenance such “tacky” stuff in the neighborhood brought a quick end to that. Modular housing is now making some headway, but only because it has become so sophisticated that it is virtually indistinguishable from the “stick-built” variety.”

In his reasonably short article, Tucker – who also has written for Forbes – notes that: “The great irony of the zoning wars is that people who use the power of the government to protect their own investments honestly believe they are doing so in the name of “property rights.” While guarding what they view as their own property rights, they refuse to acknowledge the property rights of others. And therein lies the secret to solving the affordable housing problem—although HUD never quite manages to put its finger on it.”

The point of that quick overview is to set the stage for the fresh revelations from the CFPB and others below. While the names of the various players may have changed since 1991 – or since the 1960s for that matter – the problems remain the same. A few are manipulating, or are “sabotaging” the system, to use Schmitz’s phrasing which dates back to the 1940s. It is a purported “rigged system” that is benefiting a few while harming the many. The case can be made that those so benefiting attempt – often successfully – to get others to think that it is in their best interest to oppose manufactured housing. But much third-party evidence reflects a different reality. To Tucker’s point, research previously noted by MHProNews from university level research by NBER pros Chang-Tai Hsieh and Enrico Moretti revealed that such problematic thinking and behavior is costing the U.S. economy some $2 trillion dollars annually in lost Gross Domestic Product (GDP).

Given that household wealth creation is widely seen as tied to home ownership, Congress recognized in 2000 and again in 2008 that the past patterns had to change. Thus, the MHIA and DTS became law, to make minorities and others with modest means or previously limited opportunities to have a chance at their part of the American Dream.

Nevertheless, however well intended, “sabotaging” “iron triangle” methods have been deployed. Decades later, the same troubling headlines are found as was true in Tucker’s day.

It is therefor time for the posturing and window dressing to end. Because subsidized housing is a cost to taxpayers. A lack of affordable housing is costing some $2 trillion a year in lost GDP. And with HUD Secretary Fudge recent press release stating that there are over a half-a-million homeless, that means tent cities, cardboard boxes and cars housing our fellow Americans. Thus, it is time to stop what MHARR’s President and CEO Mark Weiss, J.D., recently called in a live presentation to the GSEs and FHFA officials the “shell game.” 5 weeks later, Weiss used Freddie Mac’s own data to demonstrate that public officials and the mortgage giants were causing the lack of affordable housing.

Entirely apart from them, the American Enterprise Institute’s AEI Housing Center’s Tobias Peter told Congress that federal policy was causing the lack of affordable housing. In a follow up to those comments, when asked by MHProNews, AEI Housing Center’s Edward Pinto said in an exclusive to that he and Peter believe that manufactured homes are a necessary part of the affordable housing solution mix.

The National Housing Conference (NHC) President and CEO David Dworkin said that manufactured housing are needed in both rural and urban settings. Dworkin, who spent some 2 decades at a GSE and the U.S. Treasury, believes that the GSEs of Fannie Mae and Freddie Mac can do what they have been legislatively mandated to do.

No Title

No Description

This report will focus more on the finance and DTS angle. But the MHIA should not be overlooked, because both the MHIA and DTS were tools that Congress passed to overcome NIMBYism and to allow individual buyers and property owners the right that would not have been questioned by most Americans shortly after the Revolutionary War. Namely, the right to have the home of your choice on your own property.

New Revelations – What Lawmakers Previously and CFPB Recently Said

Current House Financial Services Committee Chair Maxine Waters (CA-D), and three Democratic House colleagues, including now MN Attorney General Keith Ellison, previously said these facts about Clayton and their lending.

No Title

No Description

“As the investigation [by the Seattle Times and Buzzfeed News] makes clear, Clayton is the nation’s largest manufactured housing company and has a “near monopolistic” grip on lending to minority borrowers seeking financing for manufactured housing reaching nearly 72% of African-American borrowers, 56% of Latino borrowers, and 53% of Native American borrowers.[5] Given Clayton’s uniquely broad control of the manufacture, sale, and financing of manufactured homes, it is imperative that their business practices comply with federal law in order to ensure affordable housing for low-and-moderate income buyers. Surely, if news outlets can launch an investigation into potential violations of federal fair lending and consumer protection laws, agencies charged with protecting the nation’s consumers should be able to investigate these allegations, and, to pursue appropriate enforcement actions.”

Those lawmakers’ full letter to Obama-Biden era CFPB Director Richard Cordray and Attorney General Lorretta Lynch dated January 7, 2016 is linked here. The news release to their statement is linked here and is found here as a download.

So, those four lawmakers publicly noted their call for the CFPB and the DOJ to investigate Clayton Homes and their affiliated lending.

When officials at the CFPB were asked last week about what happened to those requests for from Democratic lawmakers for CFPB and DOJ investigations, the off the record “on background” comment was sent. On background, after presenting significant data, a CFPB official said the following.

“Thank you for this additional information and feedback. We appreciate you reaching out, but we decline to comment further, other than to say that we received the congressional letter, and we will remain in dialogue with Congress regarding the matter.”

“Thank you for this additional information and feedback. We appreciate you reaching out, but we decline to comment further, other than to say that we received the congressional letter, and we will remain in dialogue with Congress regarding the matter.”

So, over 5 years later…nothing? No apparent public action taken? Just more dialogue with Congress is planned? What happened to the Joe Biden campaign website pledge for transparency by federal officials and agencies?

But there is more. But for the next few moments, pause and ponder how issues raised 30 and 53 years ago are still getting the same type of handling. This is how the slow roll, make promises, and let the pressure pass can occur in Washington, D.C. The Rev. Dr. Martin Luther King Jr recognized that pattern. Rev. King and others kept the heat on until actual changes were put into law.

Also from the CFPB, they formally said regarding the new data they published on May 27, 2021 the following.

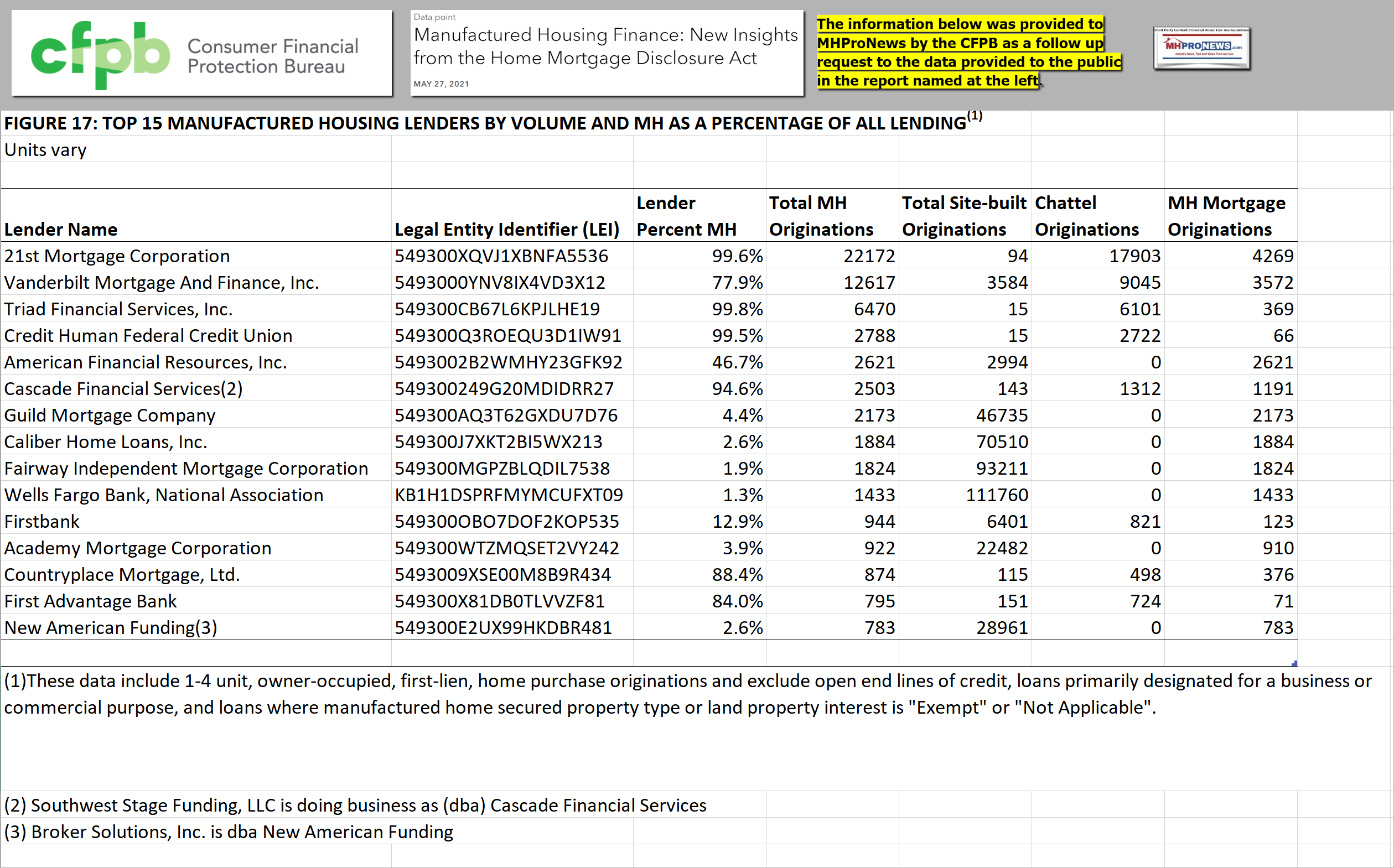

Per the data above, 21st and VMF loans are some total 26,848. All manufactured home loans from all 15 of the top lenders total some 39,126. That yields 68.619332413% of all manufactured home chattel loans are financed by Berkshire Hathaway owned 21st & VMF.

What Clayton Homes Tom Hodges Said to Congress

With that in mind, let’s flash back to federal testimony by Tom Hodges, J.D., General Counsel for Clayton Homes. Hodges, it should be noted, is currently MHI’s chairman. In a hearing on July 11, 2012, Hodges said the following.

“New manufactured home construction has fallen roughly 80 percent over the past decade, which has accounted for more than 150 plant closures, more than 7,500 retail home center closures, and the loss of over 200,000 jobs. More importantly, thousands of manufactured home customers have been left unable to buy, sell or refinance homes. Without Congressional and regulatory action, the people who live in manufactured homes and whose livelihood is connected to this industry are at significant risk.”

Hodges elaborated. “It is estimated that more than 60 percent of manufactured homebuyers finance their purchase using a personal property loan product where the dwelling alone is financed (i.e., no real estate securing the loan). The ability for lenders to securitize manufactured home loans in the secondary market, particularly those secured by personal property, has been very limited.”

“MHI and its members have long demonstrated to rating agencies, investors, Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA), Ginnie Mae and others that manufactured housing lenders operate using strong underwriting and regulatory standards. Despite this performance, the government-sponsored enterprises (GSEs) have had little involvement and displayed little interest in financing and securitizing manufactured home loans. Less than one percent of GSE business comes from manufactured housing and none of that comes from manufactured home personal property loans,” said Hodges in the written copy of the testimony that is linked here.

Skipping ahead but still on page 4 of that testimony, Hodges stated that: “This barrier [caused by GSEs and FHA not creating a securitized path for more manufactured home lending] has effectively shut off the development of a viable secondary market for manufactured home loans leading to higher financing costs. The development of a viable secondary market would dramatically improve liquidity in the credit-constrained manufactured housing market and provide potential buyers with more ready access to loans to purchase affordable manufactured housing.”

Much of that is demonstrably true, but the number of lost retailers in manufactured housing was perhaps understated by Hodges in his quoted comments. But what Hodges doesn’t say is as important as what he did express in his testimony.

Said Hodges, “As federal policymakers debate the form, shape and structure of a new housing finance system and secondary market mechanism, MHI agrees with many in Congress and other housing stakeholders that any secondary market housing finance structure should be supported by private capital. In addition, MHI believes that any secondary market – particularly if it is supported by a government backstop – should provide equal and open access to manufactured home loans secured by either real or personal property.”

What Hodges Did Not Say…Embarrassing Realities That Beg for Federal, State Investigations

After acquiring Clayton Homes, Warren Buffett said, “We are in no hurry to record income, have enormous balance-sheet strength, and believe that over the long-term the economics of holding our consumer paper are superior to what we can now realize through securitization. So Clayton has begun to retain its loans.” That is cited in “Moats – The Competitive Advantages Of Buffett & Munger Businesses,” by Bud Labitan.

Put differently, while Hodges is posturing to Congress that MHI – and the Buffett-led Berkshire Hathaway brands – ‘want’ securitized lending, they themselves were holding their loans in portfolio. Who said? Warren Buffett.

“The government wants high quality, low cost housing and manufactured housing provides that product.” – Warren Buffett. Source: Manufactured Housing Institute (MHI).

“If home buyers throughout the country had behaved like our [manufactured] buyers, America would not have had the [2008 housing-financial] crisis that it did.” – Warren Buffett, Chairman of Berkshire Hathaway, which owns Clayton Homes, 21st Mortgage Corp and Vanderbilt Mortgage and Finance (VMF), and other conventional and manufactured housing interests. Source: Manufactured Housing Institute (MHI).

The Color of Change activist nonprofit previously said this in an undated post.

What many do not realize is that Buffett has apparently, by accident or design, taken to heart this mantra of the Bolshevik leader, Vladimir Lenin who said that “The best way to control the opposition is to lead it ourselves.” As reports linked here reflects, there is a documented dark money trail back to Warren Buffett from the Color of Change nonprofit, as well as to MHAction, among other activist nonprofits. As will be reflected in an upcoming report, Color of Change and MHAction do not deny the ties. But they also do not state to what level of coordination might exist, or what kind of strings are attached to those donor dollars. That will be the subject of a planned upcoming report.

Years before Sam Strommen from Knudson Law said were apparently “felony” antitrust and RICO actions, MHARR and this publication have carefully documented numerous concerns to the “usual usual suspects in manufactured housing. This claimed pattern has benefited a few, including Berkshire brands, but also other big boys in the manufactured housing industry that routinely seem to be Manufactured Housing Institute (MHI) members.

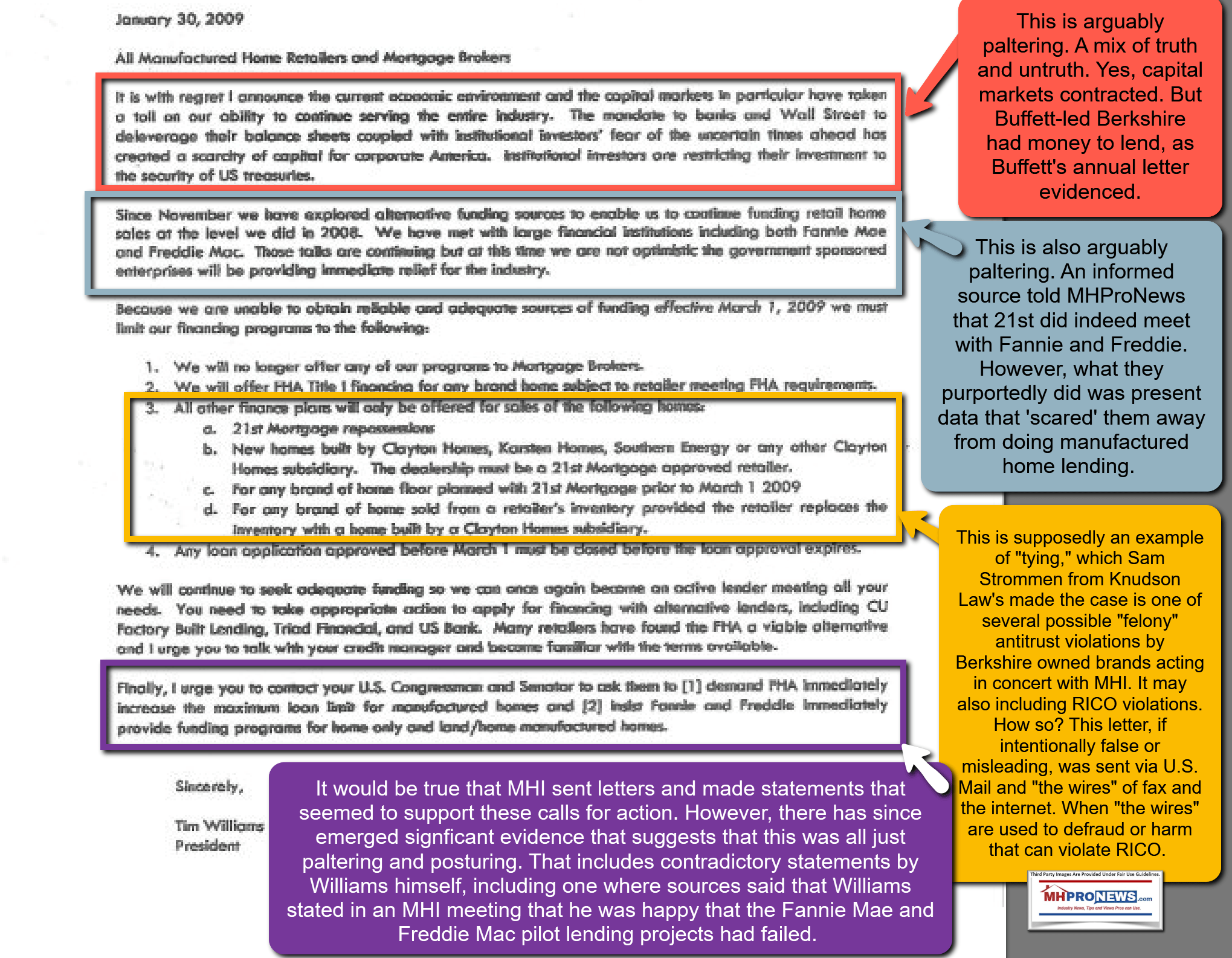

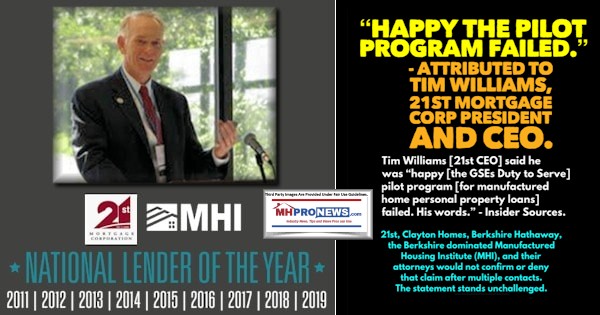

Strommen and others have opined that the document below from 21st Mortgage Corporation and signed by Tim Williams, their President and CEO, is a prima facie example of tying, an antitrust violation. Note that Hodges, in his comments to Congress, conveniently failed to mention the role that this “moat” ploy played in causing thousands of manufactured home retailers to fail.

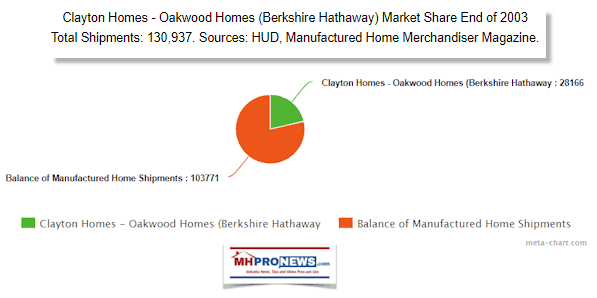

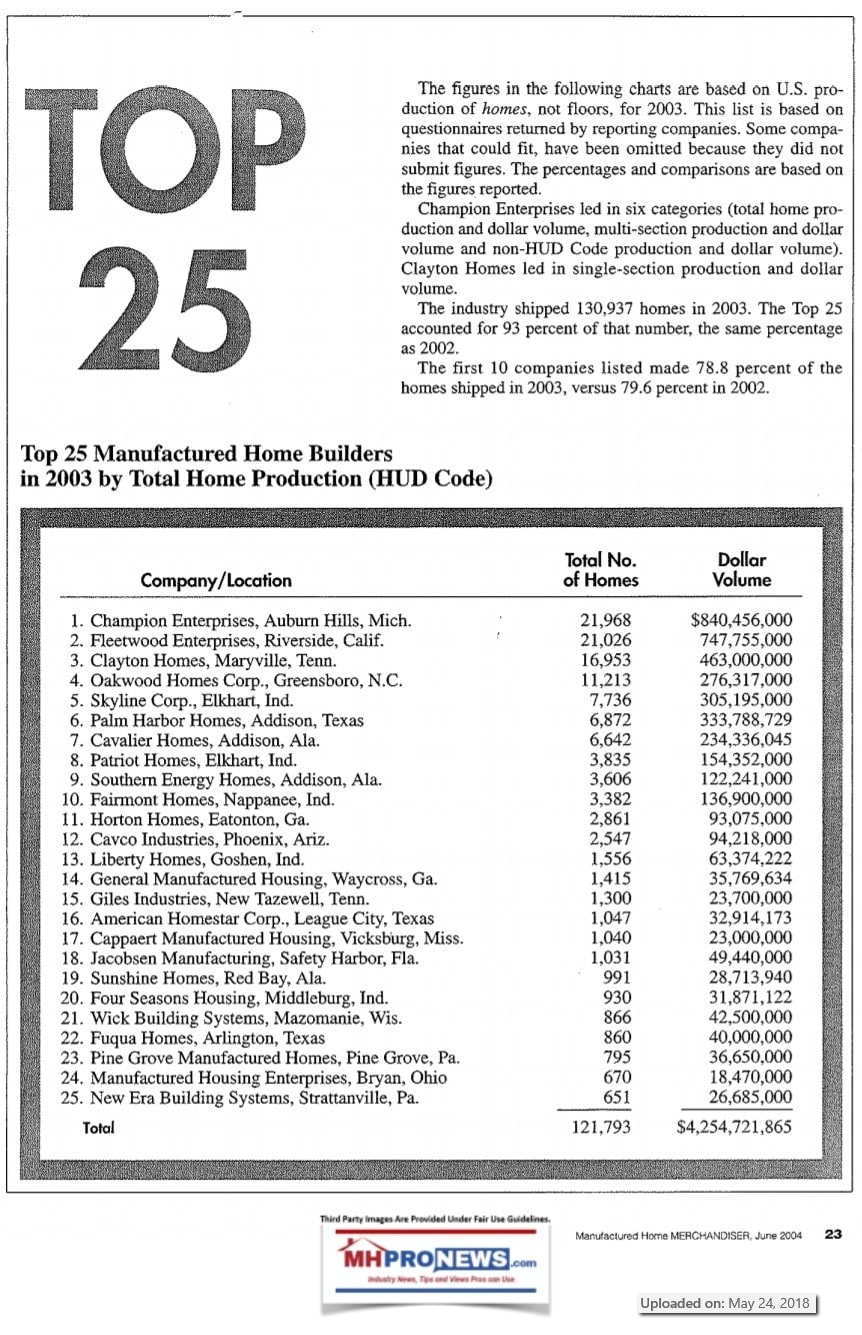

There are public officials who say they are exploring this, plus those lawmakers and others that have called for federal investigations into Clayton Homes and their affiliated lending practices. Because in the wake of the document above, the shift in the market share of Clayton Homes has been dramatic. The screen capture from the now defunct MH Merchandiser Magazine showed that in 2003, Clayton and Oakwood, both acquired by Berkshire Hathaway, were number 3 and 4 in total production at the end of that year.

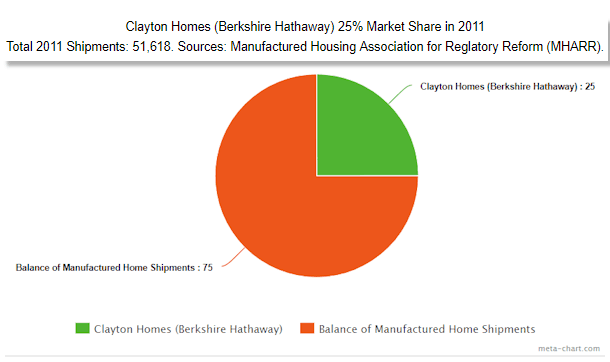

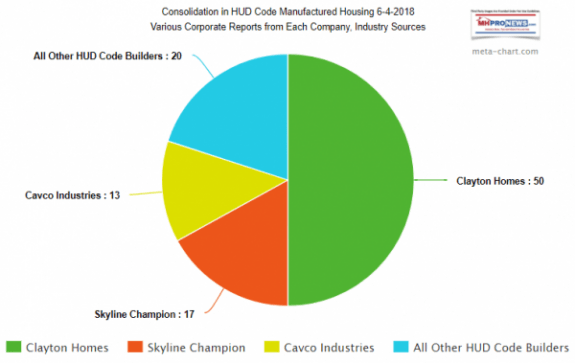

Not long after the 2009 cutoff of lending by 21st, reflected in the letter above, the market share for Clayton Homes had shifted to the following.

Kevin Clayton, in a video interview with transcript shown below, said in 2011 that “Warren” told him not to worry, because they had plenty of money to do whatever Clayton and their lending might need or want. That directly contradicts what Williams claimed in his letter to retailers. That alone merits a federal and/or state investigations.

Through a series of ongoing “moat” ploys, Clayton became the #1 producer as well as the number 1 lender in manufactured housing.

Yet, there are federal laws that if enforced would have potentially kept much of this from occurring. Ironically, the CFPB report spotlights in an indirect fashion how failure to implement DTS that was made law in HERA 2008 has hurt untold numbers of consumers. The series of quotes below sheds light on that claim.

While MHI CEO Lesli Gooch, Ph.D., denied Ryan’s claim that MHI was not properly pushing for DTS enforcement, she has to admit that the law has in fact not been implemented.

No Title

No Description

Strommen’s research comes to a similar conclusion as the report linked below, which demonstrates in a prima facie fashion that MHI claims to be working for industry growth, but in fact has postured efforts without performing.

Summing Up and Conclusion

- Buffett said after he acquired Clayton Homes that he Berkshire Hathaway holding the loans that Clayton, 21st, and VMF generated. That would only be a strategy that could work IF there was no DTS or other competitive industry lending.

- Fast forward to the tip by an MHI insider, reflected in the quote above from Tim Williams, CEO of 21st Mortgage Corp. He said he was happy that the DTS program had failed. But how could he know that it had failed? Williams said that weeks before both GSE recently announced that they had no plan to continue a pursuit of DTS pilots for chattel lending.

- This could only have logically occurred with insider information that is coupled with apparent collusion on the part of federal officials at the FHFA.

- The other information above reflects that this slow motion method of throttling lending and good existing laws steadily made Berkshire owned brands and their MHI allies dominating forces in an industry that early in the 21st century had far more producers, retailers, lenders, etc.

- These facts and the evidence beg for federal and state level investigations.

- The CFPB’s statement to MHProNews reflects no specific actions at all of enforcement by the federal agency against Clayton Homes and their lending, despite evidence based requests to do something by Democratic lawmakers addressed to the CFPB and DOJ some 5 years before.

- See the related reports linked from herein for more details and evidence.

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.