CoStar Group (CSGP) was recently featured on MHProNews as a firm that arguably misrepresented aspects of manufactured housing and related investing. See that report linked below.

In a press release to MHProNews, Pomerantz Law has announced a probe of CoStar Group for possible violations of Securities and Exchanges Commission (SEC) and other laws in connection with information that is shown below. recently announced a probe of Home Point Capital which has a division that states its involvement with manufactured home lending.

From the Home Point Capital website are these insights.

About Home Point Capital

About Home Point Capital

Home Point Capital is evolving the homebuying and home ownership experience. Home Point Capital’s primary business entity, Home Point Financial Corporation, is a leading mortgage originator and servicer focused on driving financially healthy and successful homeownership. Through additional wholly owned subsidiaries Home Point Mortgage Acceptance Corporation and Home Point Asset Management, the company supports sustainable homeownership as a crucial element of each consumer’s broader journey towards financial security and well-being, delivering a seamless and less stressful homebuying experience.

…

- One-unit, single family, primary residences, including condos, PUDs, townhomes, and manufactured homes

- 65% maximum DTI

- LTV up to 97% and a minimum 620 FICO score (minimum 660 FICO score for manufactured homes)…”

Against that backdrop is the following from Pomerantz Law

Home Point Capital Faces Class-Action Lawsuit From Pomerantz Law Firm

Home Point Capital Faces Class-Action Lawsuit From Pomerantz Law Firm

Katie Jensen

June 22, 2021

While the rest of the nation prepared for margin compressions, Home Point continued to expand, allegedly overestimating its business and financial prospects.

Home Point Capital Inc, a residential mortgage originator and service provider, is faced with a class-action lawsuit from Pomerantz Law Firm for allegedly making false and misleading statements within the Offering Documents, causing damage to investors.

This lawsuit is filed on behalf of all persons and entities that purchased Home Point common stock pursuant and/or traceable to the Company’s January 29, 2021, initial public offering (the “IPO” or “Offering”), seeking to recover compensable damages caused by the defendants’ violations of the federal securities laws.

Allegedly, the Offering Documents misstated Home Point’s aggressive expansion of brokers, which significantly increased the company’s expenses. From late 2018 to mid-2020, Home Point increased the network of 1,623 brokers to nearly 5,000 brokers, representing an annualized growth rate of 88%. While the rest of the nation prepared for margin compressions due to rising interest rates in 2021, Home Point continued to expand, allegedly overestimating its business and financial prospects.

In the fourth quarter of 2020, lenders industry-wide began to expect decreased gain-on-sale margins. Only 19% of lenders foresaw a spike in profit margins, according to the Fannie Mae Q4 2020 Mortgage Lender Sentiment Survey. In the prior quarter, 48% of lenders expected an increase in profit.

In early 2021, Home Point issued 7.25 million shares of common stock to the public at the Offering price of $13.00 per share for proceeds of $88,123,750 to the selling stockholders. This is calculated before expenses and after applicable underwriting discounts and commissions.

On May 6, 2021, Home Point announced the company’s financial results for the first quarter of 2021. It reported revenue of $324.2 million, missing consensus estimates by $41.72 million. On the same day, Home Point’s stock price fell 17.7% per share to close at $7.72 per share.

Ever since the complaint was filed Home Point’s stock price has been floating below $13 per share, damaging investors.

Over the years, Pomerantz Law Firm has recovered numerous multimillion-dollar damages awards on behalf of class members. For more information visit www.pomerantzlaw.com. ##

In a separate press release that also has manufactured housing industry ties is the following.

SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of CoStar Group, Inc. – CSGP

SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of CoStar Group, Inc. – CSGP

Fri, July 30, 2021, 8:50 PM

NEW YORK, NY / ACCESSWIRE / July 30, 2021 / Pomerantz LLP is investigating claims on behalf of investors of CoStar Group, Inc. (“CoStar” or the “Company”) (NASDAQ:CSGP). Such investors are advised to contact Robert S. Willoughby at newaction@pomlaw.comor 888-476-6529, ext. 7980.

The investigation concerns whether CoStar and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

[Click here for information about joining the class action]

On July 27, 2021, CoStar issued a press release announcing its financial and operating results for the second quarter of 2021. Among other results, CoStar disclosed that “[t]he Company is lowering its adjusted EBITDA guidance for the full year of 2021 to a new range of $605 million to $615 million to reflect the expected negative EBITDA results of Homes.com”, a residential marketplace acquired by CoStar in May 2021, “and planned investments to integrate and develop the residential marketplace.” On this news, CoStar’s stock price fell sharply during intraday trading on July 28, 2021.

The Pomerantz Firm, with offices in New York, Chicago, Los Angeles, and Paris is acknowledged as one of the premier firms in the areas of corporate, securities, and antitrust class litigation. Founded by the late Abraham L. Pomerantz, known as the dean of the class action bar, the Pomerantz Firm pioneered the field of securities class actions. Today, more than 80 years later, the Pomerantz Firm continues in the tradition he established, fighting for the rights of the victims of securities fraud, breaches of fiduciary duty, and corporate misconduct. The Firm has recovered numerous multimillion-dollar damages awards on behalf of class members. See www.pomerantzlaw.com.

SOURCE: Pomerantz LLP

##

The Pomerantz LLP website includes the following. Highlighting is added by MHProNews.

Protecting Our Free-Market System

Protecting Our Free-Market System

Pomerantz has earned a reputation for prosecuting complex antitrust and consumer class actions with vigor, innovation, and success. The Firm’s Antitrust practice group has recovered billions of dollars for shareholders. Time and again, Pomerantz has protected the free-market system from anticompetitive conduct such as price fixing, monopolization, exclusive territorial division, pernicious pharmaceutical conduct, and false advertising.

Through advocacy that has spanned across diverse product markets, the Pomerantz Antitrust practice group has demonstrated the versatility to prosecute class actions on any terrain. The Firm has spearheaded efforts to challenge harmful anticompetitive conduct by pharmaceutical companies, financial institutions, major league sports and other industries.

From fighting antitrust behavior by NASDAQ market-makers to challenging artificially inflated prescription drug prices and scoring victories over Major League Baseball and the National Hockey League on behalf of fans over geographic blackouts. Pomerantz’s cases illustrate the expertise and commitment that the Firm’s Antitrust practice group devotes to prosecuting egregious anticompetitive conduct, no matter where it is found.”

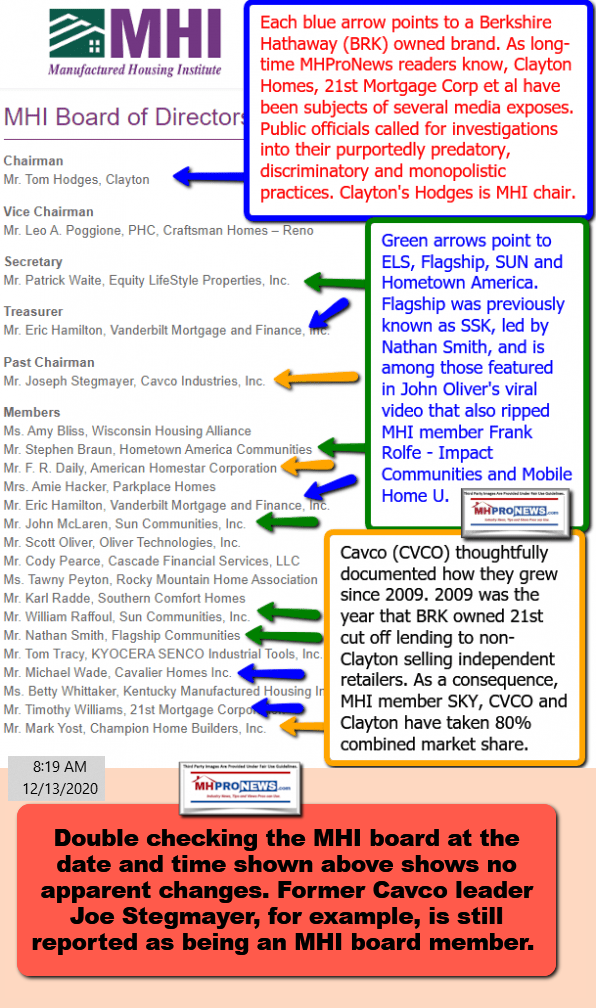

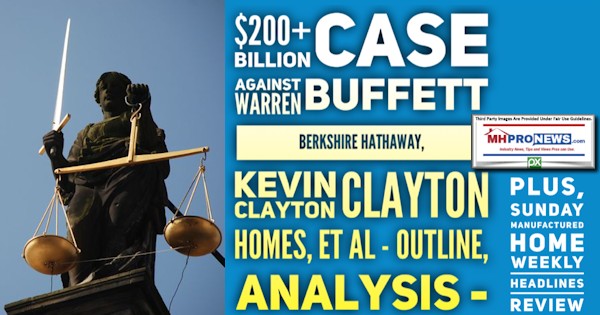

Another significant recent legal action, this one involving members of the Manufactured Housing Institute (MHI) and their National Communities Council (NCC) is shown below.

Cavco Industries faced a flurry of such suits and probes. That case with the SEC is apparently still pending.

Yet another probe is pointed at Apollo and the Carlyle Group, as the report above specifies. These are just some of the pending and/or settled cases involving manufactured housing, and more specifically, involving in several instances to members of the Manufactured Housing Institute (MHI)>

Which leads to the following.

Additional Information, more MHProNews Analysis and Commentary

In an obliquely related issue is this. Several brands involved in the Manufactured Housing Institute (MHI) have been involved in actions that have been described as predatory, illegal, or other problematic business practices. This is despite MHI’s so-called Code of Ethical Conduct, an MHI state affiliate and an MHI board member have confirmed to MHProNews that no known action has been taken by the Arlington, VA based trade group based on that code.

While bloggers and trade publications that are members or closely aligned with MHI routinely ignore negative news, that includes litigation. By contrast, MHProNews and MHLivingNews have for some years spotlighted the distinction between so-called ‘black hat brands,’ that are often members of MHI and/or an MHI state affiliate. Why? Because there is no point in having the entire industry tarnished due to the actions of a few. Further, even if some of those few happen to be larger brands, it is all the more useful to white hats and independents to have a point of reference that paints the bright line distinction between the black hats and the white hats.

In doing so, it should be noted that MHI for some years had their member directory open to the public. Perhaps due to our reporting, that is no longer so. MHI has revealingly – or paradoxically – hidden their member list as well as their staff directory list. While it may be true that some trade associations do not publish their member list, what trade association hides their staff names? Go to the National Association of Home Builders (NAHB), the National Association of Realtors (NAR), or the Manufactured Housing Association for Regulatory Reform (MHARR) and those staff names are publicly available.

The MHI members directory for 2019 is linked here as a download. Sharing that or any other information about MHI should not be construed as an endorsement of that trade group. The MHI board of directors is demonstrably dominated by major brands, not independents.

MHProNews monitors mainstream and other news for items that shed light on litigation and other issues that impacts or may have some other reflection – good or bad – on manufactured housing. Given the issues raised in the report linked below, it would not be a surprise if major litigation could occur. While it is would certainly require a law firm with chutzpah, savvy, and staying power to go up against brands like Berkshire Hathaway, that was once true of the tobacco industry too.

The single hottest report on either of our platforms for some months has been the one linked below.

While it may not happen today or tomorrow, the report linked below merits understanding.

MHProNews plans to continue to monitor and report on these and other issues that relate to allegations of problematic and possibly illegal behavior in the manufactured housing industry.

###

Our thanks to you, our sources, and sponsors for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.