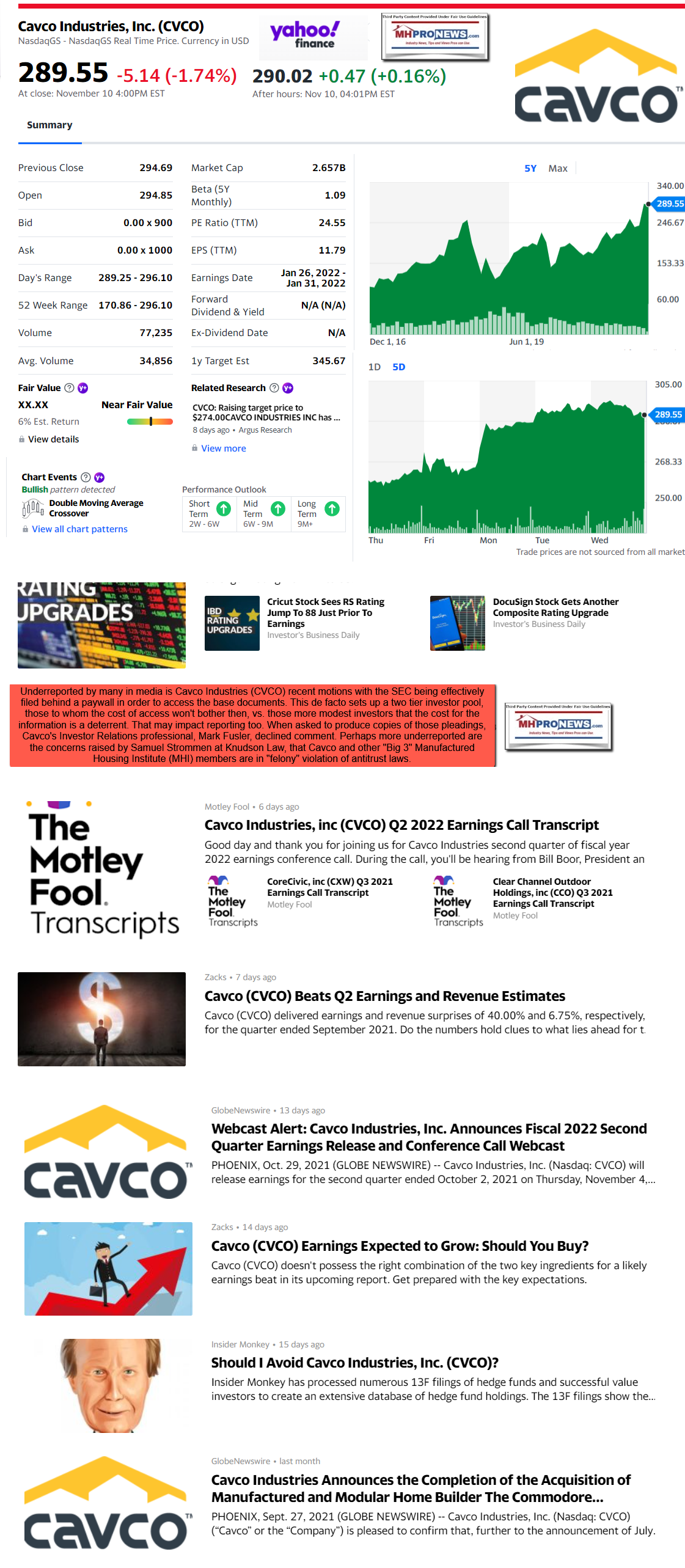

It is axiomatic that ‘The Devil is in the Details.’ Before diving into the transcript and sifting those details from the recent Cavco Industries (CVCO) earnings call, it is useful to look at a related legal development. On November 4, 2021, Cavco Industries filed certain documents with the Securities and Exchanges Commission (SEC) that related to their various motions to dismiss. These, per the SEC site, are scheduled for a hearing on 1.6.2022. Per the transcript shown below from the popular Motley Fool financial website, Daniel Moore, an analyst for CJS Securities, asked “earlier this week you filed a motion to dismiss the SECs most recent action. Any comments there or thoughts around timing of when this might be kind of fully — finally put to rest?” In some ways that is a $64 million (plus or minus) dollar question for Cavco. William C. “Bill” Boor, President and CEO, said in part: “But what we filed earlier this week was really a very legally focused motion to dismiss. And what I mean by that is, we’re not in litigation where we’re arguing what the SEC proposed in their complaint as far as the facts of what happened, but we believe that there are some legal issues with their complaint.” Put differently, Boor has admitted to that the motions are of a technical nature and that these are not related to the substance of the facts that the SEC is charging Cavco and two of their now former officials with.

Is this what Cavco meant by a vigorous defense? See that and more, because it fits with the related part of the previous analysis provided on the Masthead by MHProNews, linked below.

It is one more example of how scrutinizing the facts, evidence, and common sense analysis yielding useful insights that stand the test of time. One might presume that once their corporate legal motions are heard in their case with the SEC, and presuming that those motions fail, a new phase of negotiation to settle the SEC claims will begin in earnest. In the meantime, the motions have bought Cavco some more time before financial and/or other ‘pain’ sets in.

With that in mind, the following email to Mark Fusler and an outside communications consultant that has been used by Cavco, John Lovallo, should be of interest to those tracking not only the brand, their stock, and the related insights as it pertains to more broadly to manufactured housing industry underperformance during an affordable housing crisis. Here is the essence of that inquiry.

from: L. A. “Tony” Kovach @ MHProNews.com

to: Mark Fusler @ Cavco Industries

John Lovallo @ Levick.com

date: Nov 10, 2021, 1:10 PM

subject: Mark or John, media request for comment

Mark and/or John,

Your earnings call transcript encourages review of the latest SEC filings. However, some of those items connected to the SEC suit replies require a payment to access. MHProNews is hereby asking for a copy of all responses, including those, that Cavco has provided to the SEC.

As you should know, not all investors are institutional investors. That means that Cavco essentially requiring a payment that would need to be made in order for current or potential investors to access those pleadings in response to the SEC is de facto establishing a two tiered investor pool. That de facto punishes smaller investors.

Specifically, these items are requested. But all others that fit the description of filings by Cavco and/or its attorneys to the SEC are also requested.

_________________________________________________________________________

| Thursday, November 04, 2021 | ||

| 16 | minute_ord Minute Order ~Util – Set/Reset Motion and R&R Deadlines/Hearings Thu 11/04 2:15 PM MINUTE ORDER: Motion Hearing set for 1/6/2022 at 10:00AM before Senior Judge Susan R Bolton as to13 MOTION to Dismiss and15 MOTION to Dismiss This is a TEXT ENTRY ONLY. There is no PDF document associated with this entry. (MAW) |

|

| Tuesday, November 02, 2021 | ||

| 15 | motion Dismiss for Failure to State a Claim Tue 11/02 8:37 PM AMENDED MOTION to Dismiss for Failure to State a Claim Defendant Daniel Urness’ Motion to Dismiss Plaintiff’s Complaint by Daniel Urness.(Desai, Roopali) |

|

| Att: 1 Exhibit Exhibit Index and Exhibits A-G | ||

| 14 | misc Additional Attachments to Main Document Tue 11/02 5:06 PM Additional Attachments to Main Document re:13 MOTION to Dismiss Case Cavco Industries, Inc.’s Motion to Dismiss (Oral Argument Requested) MOTION to Dismiss for Failure to State a Claim LRCIV 12.1 CERTIFICATION by Defendant Cavco Industries Incorporated. (Rosenbaum, David) |

|

| 13 | motion Dismiss Case Dismiss for Failure to State a Claim Tue 11/02 5:04 PM MOTION to Dismiss Case Cavco Industries, Inc.’s Motion to Dismiss (Oral Argument Requested) , MOTION to Dismiss for Failure to State a Claim by Cavco Industries Incorporated.(Rosenbaum, David) |

|

| Att: 1 Exhibit Index and Exhibits A-F | ||

As your actual or potential investors deserve to know those pleadings, MHProNews hereby requests copies which will be published and made accessible to all who logon.

Please advise, thank you.

Tony

## End of main body of inquiry to Cavco’s Fusler. ##

Neither Fusler nor Lovallo have replied as of 12:36 PM ET on 11.11.2021. But an informed source that has been routinely reliable has told MHProNews that the emailed inquiry has been confirmed as received by Cavco. Additionally, there was no bounce message.

Let’s note that Cavco’s stock has hit some of its highest points recently. The markets to that extent like what they see. But should they be seeing more?

With that legal maneuvering backdrop is the following, per the Motley Fool transcription service. Edited out of the following is a pitch by the Fool of ten stocks that they like better than Cavco. Highlighting is by MHProNews, and is not in the original. The highlighting are items that for various reasons merit attention by manufactured home industry professionals, advocates, nonprofits, legal, public officials, and others probing Cavco specifically or manufactured housing industry trends more generally.

This transcript of their November 5, 2021 earnings call will be followed by additional information, some related MHProNews analysis and commentary.

Cavco Industries, inc (CVCO) Q2 2022 Earnings Call Transcript

CVCO earnings call for the period ending October 2, 2021.

(MFTranscribers)

Nov 5, 2021 at 4:31PM

Cavco Industries, inc (NASDAQ:CVCO)

Q2 2022 Earnings Call

Nov 5, 2021, 1:00 p.m. ET

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Good day and thank you for standing by. Welcome to the Second Quarter of Fiscal Year 2022 Cavco Industries Earnings Conference Call. [Operator Instructions]

I would now like to hand the conference over to your speaker today, Mark Fusler, Director of Financial Reporting and Investor Relations. Please go ahead.

Mark Fusler – Director of Financial Reporting and Investor Relations

Good day and thank you for joining us for Cavco Industries second quarter of fiscal year 2022 earnings conference call. During the call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Allison Aden, Executive Vice President and Chief Financial Officer; and Paul Bigbee, Chief Accounting Officer.

Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions. All forward-looking statements involve risks and uncertainties, which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco.

I encourage you to review Cavco’s filings with the Securities and Exchange Commission, including without limitation, the company’s most recent forms 10-K and 10-Q, which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements.

This conference call also contains time-sensitive information that is accurate only as of the date of this live broadcast, Friday, November 5, 2021. Cavco undertakes no obligation to revise or update any forward-looking statement, whether written or oral to reflect actual events or circumstances after the date of this conference call, except as required by law.

Now, I’d like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill?

William C. Boor – President and Chief Executive Officer

Thank you, Mark. Welcome and thank you for joining us today to review our results for the second quarter of fiscal year 2022.

We’re very happy to report another record quarter for revenue and earnings. Revenue increased 39% year-over-year and diluted EPS was up nearly 150%. We also achieved a record housing gross margin of 24.1%. This was partly due to average selling price continuing its upward trajectory with a 13% sequential increase, and partly due to the temporary low we saw in lumber and OSB pricing that flowed through our cost of goods sales – goods sold during the quarter.

Demand for our products remained strong and our backlogs continue to grow. Excluding Commodore, backlogs were $828 million and the acquisition added another $279 million, putting the total at $1.1 billion. This represents about 40 to 42 weeks of production. New home supply has lagged for many years leading to a large housing deficit, particularly for lower cost homes.

Demographics and low interest rates continue to underpin the strong demand we are experiencing. And as the cost for supply and labor inputs increase, the efficiency advantages of factory-built housing relative to site-built are increasing as well. This all results in a very positive and growing opportunity for our industry. By any measure, we’re seeing continued strong demand and can sell every house we can make.

Regarding production, it won’t surprise anyone on the call that supply issues have not let up and they are affecting nearly every material we use to build homes. Not much I can add to the information we’re all hearing about availability of imports, as well as domestically produced supplies. We have no ability to predict how long, but expect the situation will persist for some time. Our teams continue to do a great job managing through it and working to minimize the significant impact this has had on production.

Labor difficulties also continue to negatively impact production. However, because of the holistic approach we’ve been taking to address the root causes with fundamental and lasting solutions, we’re beginning to see signs of improvement in staffing and retention. We’ve implemented increased wages and benefits, but equally as important, we are investing in recruiting, onboarding and training processes.

The labor issues faced by nearly all manufacturers are complex and we’re building systems and approaches that we believe will provide advantages long-term. That kind of fundamental systemic work is how we’re building our team skills.

In addition to this intense focus on labor solutions, our plant teams are continuing to simplify product offerings in order to increase volume for our customers. Strategically, we’ve pushed forward by taking action across the spectrum of our investment priorities. Our recent investment in Fort Worth is a great example of improving process flow to enable increased production. That investment is well on its way to improving throughput by approximately 20%. We’re working to identify and pursue any opportunities to make similar investments across our network of plants.

With regard to our previously announced Glendale project, we have incurred permitting delays that have moved our start-up production to the second quarter of calendar year 2022. The good news is that we’ve now received the necessary permits and are executing on the build-out. This project will both, nearly double our park model production in Arizona, and free up a production line for incremental HUD capacity at our Goodyear plant.

On the acquisition front, we closed on the Commodore transaction during the quarter, a little ahead of the planned third quarter timeline. After just a month and a half since the closing, integration is going well and we could not be happier about joining forces with the people at Commodore. Beyond the geographic expansion and 25% increase in capacity this deal brings, I remain as excited as ever about the manufacturing technologies and the best practices we’ll be applying across the combined company.

The challenges that have limited production have hidden the fact that our plants are improving their efficiencies. For example, our hours per floor produced have improved this year as our plants demonstrate their ability to drive through this period of under-staffing and intermittent high absenteeism.

As we solve these issues and our suppliers become more reliable, we’re poised to see a new level of plant throughput. So strategically we’ve not paused and we’re looking forward to playing an increasing role in addressing the affordable housing issues that are facing prospective homebuyers.

Today, we have our new CFO, Allison Aden, with us on the call. She has been here for just a couple of months now and we’re very happy to have her on board. With that, I’ll turn it over to Alison to discuss the quarterly results in more detail.

Allison K. Aden – Executive Vice President, Chief Financial Officer & Treasurer

Thank you, Bill. We’re pleased to report that Cavco achieved record breaking net revenue results for the second fiscal quarter of 2022. Net revenues for the period were $359.5 million, 39.4% higher than the $258 million posted for the same quarter last year, and up 8.8% sequentially over the first quarter of fiscal 2022.

Within the factory-built housing segment, net revenue increased 42% to $342 million compared to $241 million in the prior year quarter. This increase was primarily due to a 35.3% uplift in average revenue per home sold, driven by product pricing increases to pass through rising material costs, as well as product mix shift to more multi-section homes. In Q2 of fiscal 2022, units sold also increased 5% from the same period a year ago. Included in the Q2 revenue results was one week of activity for Commodore Homes of $4.4 million.

Increases in home production levels continue to be somewhat muted as we face hiring challenges, unpredictable factory employee absenteeism and supply chain disruption. Factory utilization for Q2 2022 was consistent with the Q1 2022 utilization rate of 75%, but was higher than the Q2 2021 utilization rate of 70%.

Financial services segment net revenue increased 2.6% to $17.5 million from $17 million, primarily due to higher home loan sales volume, servicing income and insurance policies in force compared to the prior year. In addition to year-over-year increases in revenue for the quarter, we also expanded our profit margin percentage. Q2 2022 consolidated gross profit as a percentage of net revenue was 25%, up from 20.8% in the same period last year, a 420 basis point improvement. The increase is mainly the result of the factory-built housing segment increasing to 24.1% in Q2 2022 versus 19.2% in Q2 2021.

Most factories have been implementing product price increases at a rate greater than input cost increase resulting in higher total gross margin dollars per home, while also expanding the gross margin percentage. Although lumber and other lumber-related product market prices have declined, those benefits now being realized in cost of sales, these decreases have been mostly offset by other product price increases on many other input costs.

The gross margin from Commodore was not accretive in the period as inventory was written up to the fair value through the application of purchase accounting as required by GAAP resulting in no margin on the associated sales. We expect the remaining inventory at fair value to sell through toward the later half of the third quarter.

Gross margin as a percentage of revenue in financial services increased to 43.7% in Q2 2022 from 43.4% in Q2 2021 and fewer weather-related events in the current period, partially offset by unrealized losses on marketable equity securities compared to unrealized gain in the prior year period.

Selling, general and administrative expenses in the second quarter of fiscal 2022 were $45.4 million or 12.6% of net revenue, compared to $35.5 million or 13.7% of net revenue during the same quarter last year. The increase is due to Commodore acquisition deal costs plus higher incentive and commission wages on higher earnings and were partially offset by the additional D&O insurance premium amortization of $2.1 million in the prior year quarter.

Other income this quarter was $4.7 million compared to $1.7 million in the prior year period. This increase was primarily driven by a one-time $3.3 million gain on the consolidation of a non-marketable equity investment that was increased from a 50% ownership level up to a 70% ownership level. Pre-tax profit was up 150.2% this quarter and $49 million from $19.6 million from the prior year. The effective income tax rate was 23.1% for the second fiscal quarter compared to 23.2% in the same period last year.

New this quarter is a line item for net income that is attributable to the remaining 30% non-controlling interest in a non-marketable equity investment that we do not own. After deducting from that component, net income attributable to Cavco shareholders was up 150% to $37.6 million compared to net income of $15 million in the same quarter of the prior year. Net income per diluted share this quarter was $4.06 versus $1.62 in last year’s second quarter.

Now, I’ll turn it over to Paul to discuss the balance sheet.

Paul Bigbee – Chief Accounting Officer

Thanks, Allison. So comparing the October 2, 2021 balance sheet to April 3, 2021, the cash balance was $224.3 million, down $98 million from $322.3 million six months earlier. The decrease is primarily due to the acquisition of Commodore Homes, repurchases of common stock and higher inventory purchases. These uses of cash were partially offset by net income, excluding the impact of non-cash items, changes in working capital, primarily related to higher accrued expenses and other current liability balances, and the sale of consumer loans greater than the loan originations.

And then, in general, across the board, we had increases in accounts receivable, commercial loans receivable, inventories, property, plant and equipment, goodwill and intangibles, accounts payable and accrued liabilities due to the acquisitions during the period. Consumer loans receivable decrease related to principal collections on loans held for investment that were previously securitized. Pre-paid and other assets were lower as the other assets recorded for delinquent loans sold to Ginnie Mae have decreased due to lower forbearance rates. While we are not obligated to repurchase these loans, accounting guidelines requires us to record an asset and liability for the potential of a repurchase at reporting period.

Accrued expenses and other current liability balances increased in addition to acquisition balances as a result of higher wage accruals from the deferral of payroll tax payments under the CARES Act and higher volume rebate accruals and customer deposits received as a result of the greater order rates. Redeemable and non-controlling interest is a new line item that represents the value of the non-controlling shareholders interest due to the consolidation of a non-marketable equity investment previously discussed. Lastly, stockholders’ equity was approximately $733.1 million as of October 2, up $49.5 million from $683.6 million as of April 3, 2021.

And with that, Bill, this completes the financial report.

William C. Boor – President and Chief Executive Officer

Thank you, Paul. Victor, let’s turn it over for questions.

Questions and Answers:

Operator

[Operator Instructions] Our first question will come from the line of Daniel Moore from CJS Securities. You may begin.

Daniel Moore – CJS Securities – Analyst

Thank you, Bill, Allison and Paul. Good morning or good afternoon depending on where you are and thanks for taking the questions. Let me start with gross margin. Obviously, very strong in the quarter even given the raw material and other supply chain headwinds. Just talk about sustainability of that level as we look out into Q3 and Q4. Do you expect any pullback or is that 25%-type level sustainable for the next few quarters anyway?

William C. Boor – President and Chief Executive Officer

I’ll take a quick stab and others here may want to add to what I’ll say. We did kind of catch the temporary drop in lumber and OSB during the quarter. So, while prices increased and I think with long backlogs, there’s every reason to expect that prices will hold. The cost of goods sold had a temporary dip in lumber and OSB, so we’re already seeing that come up. So the cost side is really the wildcard that we can’t predict very well. Maybe it will turn again in our favor. But that’s the thing that I think you really have to look at in the coming quarters and if you’re going to try to predict what the gross margins will be. Anything – you guys have anything to add to that? It’s a little bit hard to predict, though. And I think we’ve explained in the past how the costs have about a 30- to 60-day lag in hitting our cost of goods sold. So if you follow those key commodity inputs, you can kind of get a sense for where their impact will lay in the P&L.

Paul Bigbee – Chief Accounting Officer

[Speech Overlap] were in our P&L in the first two – in really August and September fully.

Daniel Moore – CJS Securities – Analyst

Helpful. Okay, understood. And then what are your expectations for production levels as we look out to Q3 and into Q4, given typical seasonality in some of the northern geographies, as well as lingering supply chain challenges?

William C. Boor – President and Chief Executive Officer

Yeah, I mean that second part is kind of the key. I think we are getting – showing a little bit of progress on stabilizing and growing our workforce. We’ve been understaffed for quite a while, but you hit on the key, which is supplies are the question mark and we don’t really – don’t think we’re any different from anyone else and saying we don’t see that just suddenly clearing up. So that’s really a governor on how high we’ll be able to go with production. Seasonality, I think with the backlogs we’re seeing – we have at the moment, it shouldn’t be a big impact to what we produce.

Daniel Moore – CJS Securities – Analyst

Even in the Northeast, Midwest, those locales, you’ll still kind of produce straight through if you have enough raw materials?

William C. Boor – President and Chief Executive Officer

I think generally. I mean, we’ll see some impact, but in the scheme of our total company production, it shouldn’t be a huge factor.

Daniel Moore – CJS Securities – Analyst

Perfect, And then I really appreciate the comments regarding improvements in throughput, hours per floor. And I know this question is a little theoretical, but if supply chain were not an issue, how many more homes, either in numbers or percentages, do you think you could produce across the portfolio, including Commodore?

William C. Boor – President and Chief Executive Officer

Yeah, we feel really good about what the plants have demonstrated during a number of quarters now where they’ve really been short-handed, both general staffing, number of folks on the payroll, as well as absenteeism, which is hard to predict. And we made a comment last quarter, I’ll kind of reinforce that we’re looking back in a lot of our internal comparisons to two years ago, because it was pre-COVID and more of a stable grounding point for some analysis. And this quarter, we made a few more floors in the quarter, production-wise, than we did in the similar quarter two years ago and we did that with over 10% less production hours. So that – it gives us some optimism as we continue to get on top of labor that we should be able to really kind of blow past pre-COVID levels of production. I’m not giving you the number you’d like to have because I don’t know if I’ll predict it, but we’re looking to try to hold those efficiency gains as we staff up and we should be able to get – we are existing on a plant by plant basis, same plant basis, we should be able to exceed where we were before COVID. And you’ll remember too that even if you go back to 2019, we were in a pretty strong demand market, so we were generally making everything we could make.

Daniel Moore – CJS Securities – Analyst

Understood. I appreciate that. And then given the initiatives, some of the expansions, etc., do you have a target of how fast you can grow capacity, again excluding supply chain challenges? But how fast do you think, annualized, you should be able to sort of grow that capacity with operating efficiencies, greenfields, etc.? Thanks again.

William C. Boor – President and Chief Executive Officer

Yes. Now, I appreciate the question. I apologize that we don’t really have a target because of the supply. I mean, we’re so focused on kind of optimizing what we’re doing from a – well, managing the supply constraint and at the same time getting everything we can control internally focused on being ready to make as much as possible as supply limitations ease up. But with that, I got to just be honest with you and say it’s inside the company with that supply dynamic, it’s very hard for us to say hypothetically what’s our target over the next several quarters for production. It’s just a real challenge every day. So it’s just kind of a peek inside our mindset right now, but we do think we’re doing all the things that are positioning us to not miss a beat. As much as supply will allow us, we’ll be maximizing production.

Daniel Moore – CJS Securities – Analyst

I will jump back in queue with a couple of follow-ups. Thank you.

William C. Boor – President and Chief Executive Officer

Thanks, Dan.

Operator

And our next question will come from the line of Greg Palm from Craig-Hallum. You may begin.

Greg Palm – Craig-Hallum Capital – Analyst

Yeah, thanks. Congrats on the really good results here.

William C. Boor – President and Chief Executive Officer

Thanks, Greg.

Greg Palm – Craig-Hallum Capital – Analyst

So maybe just starting on demand environment. Just kind of curious if you could walk us through what you’re seeing by channel. And do you think that you’re starting to see some more material, I guess, share gains versus site-built, whether that’s would-be consumers that are now sort of culminated into your space versus traditional home?

William C. Boor – President and Chief Executive Officer

Yeah. Demand channel by channel, I couldn’t even differentiate it because it’s strong across the board. We can’t make enough. Frankly, we can’t keep many of our customers happy right now, they’d all like to add more homes. So they’re are all very strong. And then the second – regarding [Phonetic] the second part of your question?

Greg Palm – Craig-Hallum Capital – Analyst

Yeah, I just – I’m just kind of curious if you’re seeing more share gains from the site-built.

William C. Boor – President and Chief Executive Officer

Yeah, I think you can look at – I mean you can look at how the manufactured housing industry shipments have compared to new home sales and they kind of bottomed out, and I think I’m right about this, they kind of bottomed out during the pandemic at around 10%. And now we’re up kind of in the mid-teens and probably that’s a statement that – of the challenges that the site builders are having. So we’ve seen and over quarter-to-quarter the share increased pretty dramatically and that’s due to a lot of things. We do believe that there is that interface, we talked about a lot, between what manufactured housing does as far as price points and what site-builders do. This point I tried to make in my prepared remarks about, as supply – as input costs, including labor, go up, it’s a challenge for us, but we’re more efficient with those inputs and so they’re moving farther and farther away from being able to supply kind of the upper end of what we traditionally do. So I really do think that we’re capturing some of that space that they just can’t hit at this point and people are buying manufactured housing more and more. So I think we’re taking some share in that regard.

The flip side is, if you flip over to the the folks that are just trying to get into a house at the lower end of what we do, that’s where the story is kind of tough because with price increases like they’ve been, a lot of people are getting priced out at that lower end. But, yeah, I do think that it’s clearly the manufactured housing and we are taking some share away from site-built right now. And the other thing I always recount [Phonetic], Greg, is that – and I know this probably doesn’t need to be said, but I always feel I need to say it, when you look at our industry shipments, it has for a while represented what we can make, not what demand is. So if our industry could make more, we’d be even a higher share of new homes at this point.

Greg Palm – Craig-Hallum Capital – Analyst

Yeah, it’s a good point as well. Looking at backlog, if my math is right, so excluding Commodore, you’re up a little bit sequentially, but a lot less so than your other publicly traded peers. So curious if you’re being more selective in terms of order intake based on capacity levels or if there’s anything else to call out there.

William C. Boor – President and Chief Executive Officer

Yeah, I do think ours has been strong. Kind of a really good question because I know people are trying to think, is there some differentiation across the industry about order pace. What I’ll try to explain here is that our – during – backlogs – the orders we count in backlog compared to our total orders has some judgment in it and we want to manage our backlog to be as conservative as we think is reasonable. Meaning, as we all know, we’re out many months in lead time and so when we get orders that are for really far out, in some cases, on a plant by plant basis, we’ll make the decision to – they’re good orders, but we’ll make the decision not to include them in our backlog as we look at it internally and as we reported to you all.

And long-winded way of saying that during this quarter, we actually took a considerable number of orders and said, hey, let’s – they’re so far out, let’s take them out of our backlog number for now. Doesn’t mean they’re not good orders, doesn’t mean we won’t make them, but it’s a bit of conservatism in case the market does change on us. So it’s kind of a little bit apologetically, we report this backlog, and yet there is some – other than [Phonetic] judgment in it and this quarter, we made a correction that makes it look like it grew a little bit less than if we hadn’t made that correction. So I hope that’s – hope that explains that a bit and you might have some follow-up questions on that for us.

Greg Palm – Craig-Hallum Capital – Analyst

Yeah. I definitely do. That’s interesting. Do you care to quantify exactly how much that amount might be?

William C. Boor – President and Chief Executive Officer

I’m looking because I don’t have the number at the top of my head. Yeah, I don’t think we have a quantification for you right now. It was a meaningful amount that we took out and it’s not real helpful but my guess is that, I would say that I think you should – my answer would be that our backlogs on a – if we hadn’t made that correction, were very much in line with the industry.

Greg Palm – Craig-Hallum Capital – Analyst

And do you not view those – I mean it sounds like those are real orders, but what’s the hesitancy of not putting them in the backlog? I’m just a little bit confused why you won’t include them if you do, in fact, think they’re real orders.

William C. Boor – President and Chief Executive Officer

Yeah, I understand. Well, they’re real orders, we plan to make them. It’s a assessment we make to make sure that what we’re looking at in the backlog is, I guess, a quality backlog, that it really wouldn’t change if the industry did see a little bit of a pullback. So we all know that orders can vanish. And we’re not expecting that, we’re not predicting a pullback in the industry. But we’re constantly evaluating the backlog to make sure that what we’re looking at we feel like is a really conservative high-quality backlog.

Greg Palm – Craig-Hallum Capital – Analyst

Okay, that that makes sense. If I could just spend a couple of minutes on Commodore. I think there were some commentary on purchase accounting and the gross margin impact in the current quarter. Can you quantify what that was to the consolidated and what kind of impact you expect in the current quarter as well?

Allison K. Aden – Executive Vice President, Chief Financial Officer & Treasurer

Yeah, I mean basically, given the timing of the closing date, we had five business days of Commodore operations, which was about $4.4 million in revenue, which we had mentioned. During an acquisition like this, you basically are required to apply purchase accounting and as you know, write up the inventory to the fair value, which negated the – any profitability in this particular quarter. But we do expect to sell through the inventory that we purchased kind of midway through this quarter to through the third quarter, so we’d start seeing their margins uplift to levels that we had shared with you historically.

Greg Palm – Craig-Hallum Capital – Analyst

Okay. And it sounded like there was also some one-time acquisition-related costs that, my guess, was included in opex. Can you quantify how much that was, assuming it was sort of one-time in nature, and I guess trying to figure out if there is any lingering items we need to think about in the current quarter as well?

Allison K. Aden – Executive Vice President, Chief Financial Officer & Treasurer

You’re right, absolutely. In SG&A, there would have been $2.1 million worth of deal costs associated with Commodore which is essentially the large body of the cost associated with the deal.

Greg Palm – Craig-Hallum Capital – Analyst

Great. Okay. All right, I’ll leave it there and thanks for the help.

Operator

And our next question will come from the line of Jay McCanless from Wedbush. You may begin.

Jay McCanless – Wedbush Securities – Analyst

Thanks, good afternoon, everyone. So, I got three questions for you. The first one, in the original Commodore announcement, Cavco indicated that Commodore delivered 3,700 homes in the 12 months ended March 31. I guess, did Commodore have the same jump in the backlog post the initial COVID surge like Cavco and Sky did? And if so, what is Commodore’s quarterly run rate on home sales now, assuming that they’re having to work through a larger backlog and production headwinds like legacy Cavco?

William C. Boor – President and Chief Executive Officer

Yeah. We looked at the quarter increase and it was very consistent with other increases, ours and others. So their backlog growth is very much in line with other numbers you guys are looking at. And from a run rate perspective, they are basically pretty close to where they were pre-COVID. The 3,700 – they’re a little bit off the 3,700 because of some staffing challenges right now. But they’re very much in line with where they were pre-COVID on their run rate.

Jay McCanless – Wedbush Securities – Analyst

Okay. Do you – since they are in the Northeast, is there any seasonality we need to think about and how that 3,700 or below 3,700 falls out during the calendar year?

William C. Boor – President and Chief Executive Officer

Yeah, I think I had mentioned earlier that for ours I think when you spread it over our entire company, it’s not that significant. But, yeah, there are plants that are in the Northeast will have some seasonality. They do have the big backlogs right now so they’ll be running [Technical Issues] they can to try to work those backlogs down. But, sure, a little bit of production seasonality there.

Jay McCanless – Wedbush Securities – Analyst

Okay. And then in terms of the Commodore average price, I think it was roughly $70,000 based on that same release. Is that still the case or have they had a large step-up in price from when the press release came out?

William C. Boor – President and Chief Executive Officer

Yeah, they’ve been increasing. I mean their current prices are a bit higher than that, their average selling price, both from increases that they’ve made in line with the rest of the industry and also not to belabor the point, but we’ve mentioned a few times in previous discussions that they pursue a different pricing policy and so they protected price in the backlog more than us and others in the industry. And so they are also getting an average selling price lift from working off that price-protected backlog.

Jay McCanless – Wedbush Securities – Analyst

So where – are they sitting in $75,000, $80,000 on average now or where are they shaking out?

William C. Boor – President and Chief Executive Officer

Yeah, they’re in the upper $70,000s.

Jay McCanless – Wedbush Securities – Analyst

Okay. And then I guess just on the mix for Cavco this quarter, you said there were more multi-section homes in there. But is that price that we saw this quarter, is that a good number to use for the next couple of quarters based on what’s sitting in backlog?

Allison K. Aden – Executive Vice President, Chief Financial Officer & Treasurer

So as we think about the price and the effect of price increases and the effect of the mix, predominantly the increase in price – the increase in ASP was due to pricing, with some uplift coming from mix, they’re probably more minor. As we look forward, our factories – they continue to review pricing. But I think that we were successful in the second quarter of really having all the factories now put in place increases to cover material cost uplift. So I would – currently, without any large changes to material costs that need to be passed through, we consider those somewhat consistent going into the third quarter but may be some drift upward from any shifts to more multi-section homes.

Jay McCanless – Wedbush Securities – Analyst

Okay. Okay, that’s great, thanks for taking my questions.

William C. Boor – President and Chief Executive Officer

Thank you.

Operator

[Operator Instructions] Our next question will be from Daniel Moore from CJS Securities. You may begin.

Daniel Moore – CJS Securities – Analyst

Thanks again. Maybe one macro and one micro. The macro, earlier this week, we heard one of your competitors talk about the duration of land home MH loans materially improving going from the kind of low-20s toward the – more on par with stick-built in the kind of 30-year range, as well as new lenders coming into the MH financing arena. Are those trends consistent with what you’re seeing? And just how significant is that from your perspective?

William C. Boor – President and Chief Executive Officer

Yeah, absolutely consistent. We read the comments as well and we’d just kind of echo them. Extending the duration or the term on both land home and chattel lending is a big deal for affordability and it really kind of helps us set the price increases and modest but kind of threaten rate increases. So our – we’re seeing exactly the same thing. And I think it’s solid lending. We’re still seeing appropriate underwriting standards. I don’t have any concerns in that regard, but these extensions really make a difference for people that generally buy on a monthly basis.

Daniel Moore – CJS Securities – Analyst

Got it. And you’ve talked about this in the past and a little bit earlier, but if you could elaborate on the opportunity to streamline products across facilities to share manufacturing techniques between Cavco and Commodore and I don’t know if there’s an ability to quantify the potential uplift or benefit, but maybe any more detail on that as we look out over the next year or two would be helpful.

William C. Boor – President and Chief Executive Officer

Yeah. On product simplification, when demand’s like this and when our customers really are more – they’re more interested in getting the incremental homes than they are in customization and specialized product, we’re deep into really focusing on product simplification. In some cases with long backlogs, you’ve already got a lot of orders that kind of broaden your product mix that you’ve got to work through so that the benefits kind of come over time. But we’re very focused on product simplification. It’s a big deal for getting more throughput. So we’ll see gains continue from that perspective. And it plays a part in – Dan, in what I talked about earlier as far as getting more homes per employee hour produced. Some of that is very much attributable to product simplification. So we’re getting those gains.

Again, on the Commodore, it’s just – the idea flow had started already. We’ve gotten together, we had companywide general managers meeting a few weeks ago, that just really created a lot of excitement and optimism for me and the information flow of best practices in both directions was meaningful and just thinking about the things that Commodore bring to us, we’ve talked in the past. I think it was when we announced the acquisition, we talked about some of the really good work they do around manufacturing technologies on the floor that increase cycle times and reduce labor intensity. They’re not easy gains, there are things you have to really lay the groundwork for.

I’ve said before, they’re very dependent on having really solid engineering systems because that’s the backbone that allows you to do some of what they’re doing. But we’re going to be able to reapply that stuff across our previous ‘19 [Phonetic] plants. And there’s things like CNC routers and CNC cutting machines to make that process more efficient. They do some great work with laser projection that reduces errors when you have to make cuts, for example, or when fastening floorboards, for example. And there is a really – if they don’t sound significant, they really are. And Commodore has been all over that kind of stuff. So we only have them for a little over a month right now, but I think the attitudes and openness on both sides are encouraging and I really think that we’re going to be able to add value in both directions pretty significantly over time.

Daniel Moore – CJS Securities – Analyst

Great. And then I’ll take a crack, but earlier this week you filed a motion to dismiss the SECs most recent action. Any comments there or thoughts around timing of when this might be kind of fully – finally put to rest?

William C. Boor – President and Chief Executive Officer

You’ll take a crack, and I thought we might actually get through a call without that. I was surprised.

Daniel Moore – CJS Securities – Analyst

I saved it till the end.

William C. Boor – President and Chief Executive Officer

Yeah. Pretty serious subject obviously, and, yeah, I think when we got to – when we talked to folks about the SEC complaint being filed, in an odd way, I would kind of express that, hey, it’s a step toward resolution, and I continue to feel that way. But what we filed earlier this week was really a very legally focused motion to dismiss. And what I mean by that is, we’re not in litigation where we’re arguing what the SEC proposed in their complaint as far as the facts of what happened, but we believe that there are some legal issues with their complaint. And so our first step is what we filed this week to just challenge that and have a motion to dismiss. So, it’s another step in the process. We hope that that would be a successful step. But we’re ready to go to litigation if that’s where we end up and we feel pretty confident in our position once that happens, if it does. So it still continues to be very difficult to project when it’ll be resolved. But I think we can all tell that we’re getting closer and closer to that date.

Daniel Moore – CJS Securities – Analyst

All right, thanks, Bill. And, Allison, welcome and look forward to speaking with you at our conference coming up shortly and I appreciate the color again.

William C. Boor – President and Chief Executive Officer

Thanks, Dan.

Allison K. Aden – Executive Vice President, Chief Financial Officer & Treasurer

Thank you very much.

Operator

Thank you. And I’m not showing any further questions in the queue at this moment.

William C. Boor – President and Chief Executive Officer

Okay. Well, again, very happy to report on our record results in the quarter and also on the progress we continue to make on our strategic actions. So we look forward to keeping everyone updated and certainly thank you for your interest in Cavco.

Operator

[Operator Closing Remarks]

Duration: 42 minutes

Call participants:

Mark Fusler – Director of Financial Reporting and Investor Relations

William C. Boor – President and Chief Executive Officer

Allison K. Aden – Executive Vice President, Chief Financial Officer & Treasurer

Paul Bigbee – Chief Accounting Officer

Daniel Moore – CJS Securities – Analyst

Greg Palm – Craig-Hallum Capital – Analyst

Jay McCanless – Wedbush Securities – Analyst

## End of relevant main body of the Motley Fool Transcript ##

Additional Information, More MHProNews Analysis and Commentary

It is said that the devil is in the details.

1) For the detailed and legally minded, it is a worth asking if filing documents with the SEC that are only accessible via a paywall is a fair or prudent move by Cavco. It also begs the question, why would they use such a methodology, other than to seemingly comply with an SEC mandate, yet without making that data readily accessible to many?

“I encourage you to review Cavco’s filings with the Securities and Exchange Commission, including without limitation, the company’s most recent forms 10-K and 10-Q,” said Mark Fusler, Cavco’s Director of Financial Reporting and Investor Relations, per the transcript above. But as noted above in the preface of this Masthead report to the Cavco earnings call transcript, clicking on the PDF takes someone to the PacerMonitor site where a monthly fee plus “Documents 15¢ / page” for their basic access plan is displayed. This is worthy of a legal inquiry. It also seems to go against the claim by Cavco that in the post Stegmayer “debacle” era at Cavco that the firm is interested in being transparent and fully complaint with the various laws. If this is technically compliant, it would appear to be so in only the narrowest sense of the term. ‘Here is the information, but you have to pay to see it.’

2) Boor and Cavco have made several interesting statements. Some are arguably self-contradictory.

For instance.

- Boor said: “supply issues have not let up and they are affecting nearly every material we use to build homes.”

- “Labor difficulties also continue to negatively impact production. However, because of the holistic approach we’ve been taking to address the root causes with fundamental and lasting solutions, we’re beginning to see signs of improvement in staffing and retention. We’ve implemented increased wages and benefits, but equally as important, we are investing in recruiting, onboarding and training processes.”

- But then: “We’ve been understaffed for quite a while, but you hit on the key, which is supplies are the question mark and we don’t really – don’t think we’re any different from anyone else and saying we don’t see that just suddenly clearing up. So that’s really a governor on how high we’ll be able to go with production.”

- By saying they have taken a “holistic approach” to address “root causes” with “fundamental and lasting solutions” and then saying that they “don’t think we are any different than anyone else” in dealing with supply and labor issues, they appear to be on both sides of the fence.

- Perhaps as important is the “governor on” “production” statement. It is akin to what conventional builders have said that building is being ‘throttled’ or ‘metered’ instead of apparently doing all that might be done.

- The facts, evidence, relevant quoted statements, and analysis found in the report above sheds added light on this topic.

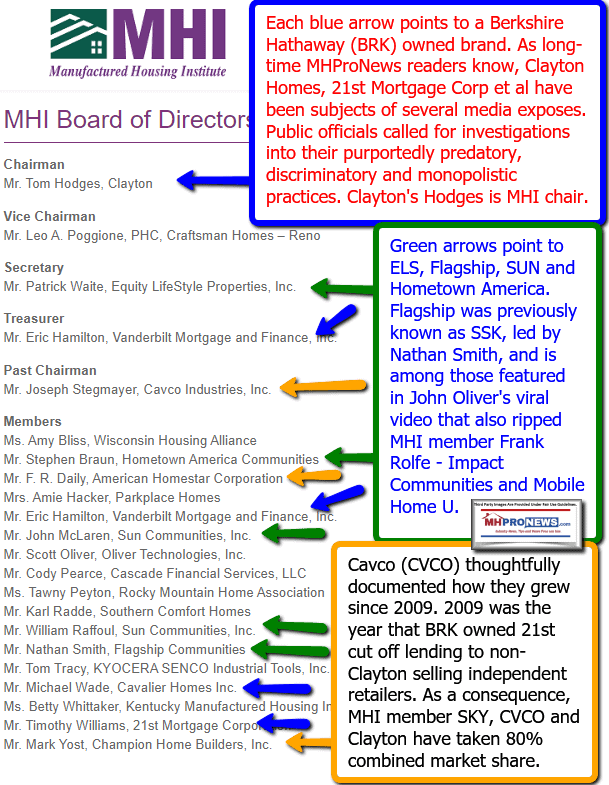

3) While Cavco themselves may not have the clout that would be necessary to get a governor of a state to take the steps needed to address the arguably artificial causes of the labor issues, for instance, much less of international or domestic supply chain issues with the Biden White House, that doesn’t mean that in concert with others, Cavco couldn’t achieve the claimed desire to fix the underlying or “root causes” of these issues. While the Manufactured Housing Institute (MHI) moans or makes occasional noise about such matters, they have obviously not fixed it. Yet Cavco’s former chairman and CEO, Joseph “Joe” Stegmayer remained MHI’s chair even after stepping down at Cavco. Furthermore, Stegmayer is still reportedly on the main MHI board.

No Title

No Description

When the MHI board of Directors and membership lists are examined, what emerges are ties to some of the most powerful investment groups and uber-billionaires in the U.S. So, while Cavco can’t claim the necessary ‘clout’ solo, MHI could in theory wield significant access and clout, as the Biden-Harris campaign website previously referenced reflects. Put differently, there are several issues that MHI claims to be working on that they could arguably have achieved in the current as well as prior administrations, because the level of access is so great. This points to the notion that the status quo, for whatever reasons, serves the interests of MHI’s leading brands and billionaires. https://www.manufacturedhomepronews.com/3bs-bill-buffett-biden-what-if-warren-buffett-bill-gates-joe-biden-affordable-manufactured-homes-potential-analysis-ugly-plus-sunday-weekly-headlines/ and https://www.manufacturedhomepronews.com/civic-alliance-amazon-facebook-buffett-berkshire-backed-kraft-arabella-advisors-cbs-disney-twitter-bill-gates1000-corporate-nonprofit-plot-brags-ousting-president-trump-sunday-weekly-head

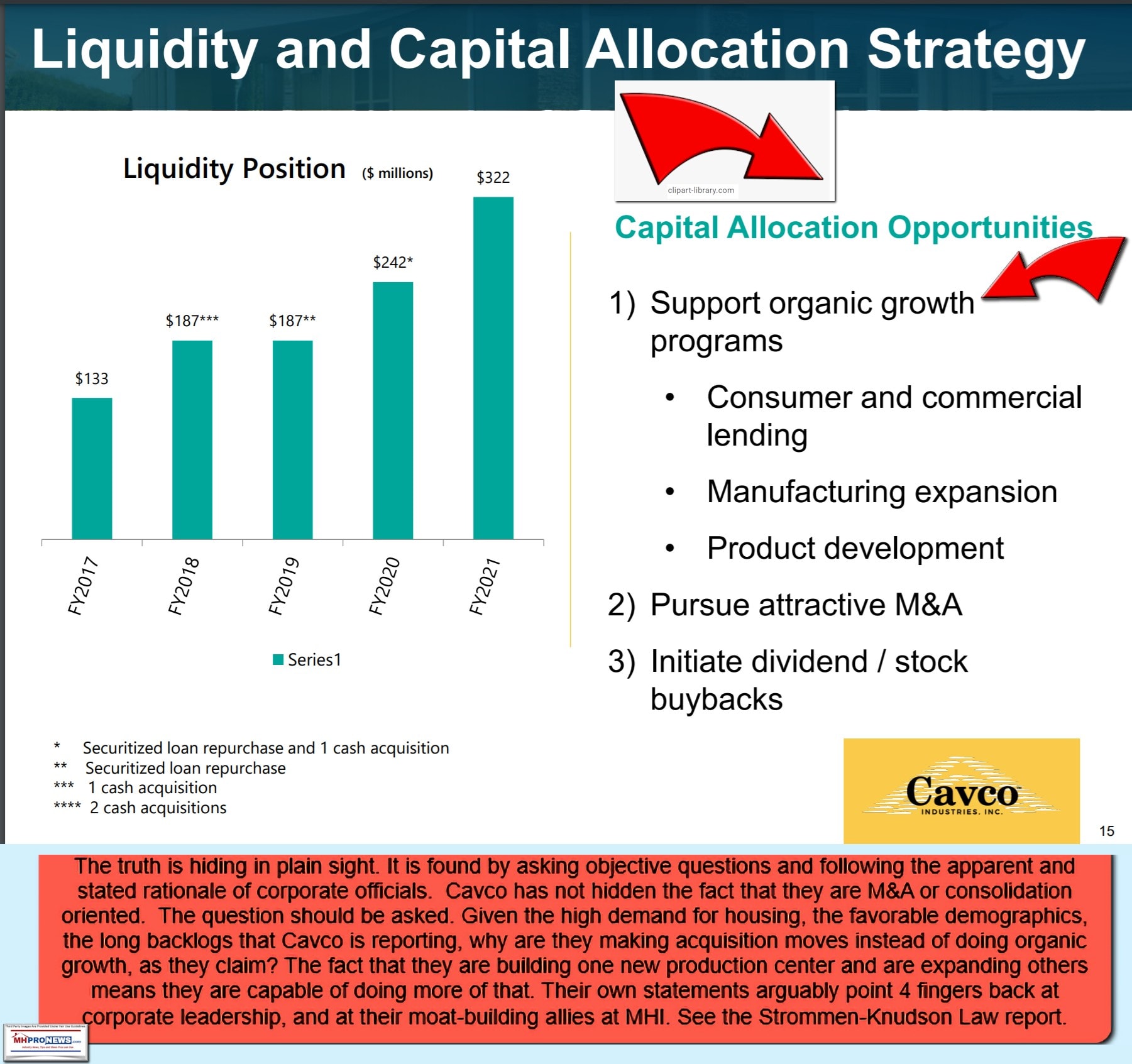

- One must keep in mind that Stegmayer is ex-Clayton Homes. Clayton Homes has been a Berkshire brand for approaching 2 decades. Kevin Clayton is a professed acolyte to the Warren Buffett “moat” method that looks to utilize man eating amphibians to increase a firm’s “durable competitive advantage.” Samuel Strommen at Knudson Law has flatly accused, with evidence and seemingly sound legal reasoning, MHI and their “Big Three” manufacturers of “felony” monopolization. Cavco and Skyline Champion (SKY), plus Clayton are the so-called ‘big 3.’

4) Given that the Cornell University Law School Legal Information Institute (LII) website says that the penalty for such felonies can be stiff, it is hardly likely that Cavco will roll over and confess to them. Per Cornell Law: “Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony, and, on conviction thereof, shall be punished by fine not exceeding $100,000,000 if a corporation, or, if any other person, $1,000,000, or by imprisonment not exceeding 10 years, or by both said punishments, in the discretion of the court.”

5) Cavco’s admitting that lending terms can impact affordability is stating the obvious. That said, what they didn’t state is that MHI stand accused of posturing support for more lending while failing to do the common-sense steps that would yield more lending.

Sgt Schultz, Perry Mason Allusions-Prominent Manufactured Housing Institute (MHI) Members, Allies Reveal Apparent MHI Ruse – Manufactured Housing Institute Facts About More, Better MHLoan$

Underserved Mortgage Markets Coalition, Letter, FHFA Acting Director Sandra Thompson, Prosperity Now, ROCUSA, NextStep, National Housing Conference, MHARR, Hogan’s Heroes Sargent Schultz, Perry Mason Allusions, Prominent, Manufactured Housing Institute (MHI) Members, Housing Coalition Allies, Reveal, Apparent, MHI, Ruse, fraud, confidence game, con game, David Goch, Lesli Gooch, Kevin Clayton, Tim Williams, 21st Mortgage Corp, Clayton Homes, Vanderbilt Mortgage and Finance, VMF, Manufactured Housing Institute, Facts, Evidence, more competitive, Better, manufactured home loans, single family loans, personal property loans, chattel loans, home only manufactured home loans,

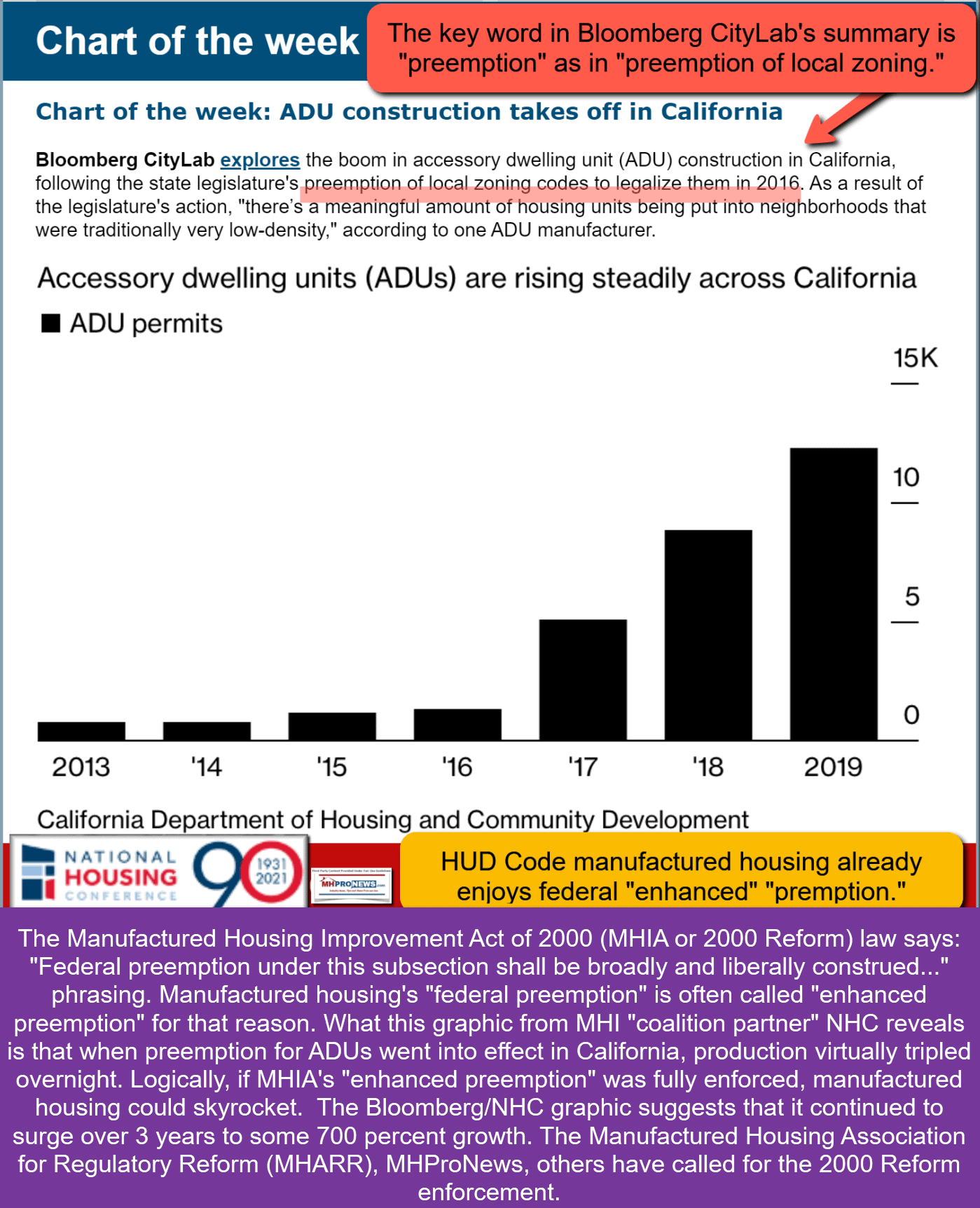

5) Similar comments could be made about zoning and placement issues. This wasn’t even addressed by the analysists or management, per the call transcript above. Nor was the Tiny House Hands Up/Institute for Justice (THHU/IJ) suit. That case has implications for Cavco Industries and all other HUD Code manufactured housing producers.

National Spotlight-Tiny House Calhoun Suit-Nonprofit, Attorneys-Institute of Justice Sue-Where’s Manufactured Housing Institute, Plant A Home, Manufactured Housing Improvement Act, Enhanced Preemption Case?

” The only reason to ban smaller homes is to artificially inflate housing costs and exclude hardworking residents who do not make enough money to afford a larger home, which are not legitimate government interests.” So says part of the pleadings by the Institute of Justice (IJ) which along with another attorney acting pro-bono, has filed suit against officials in Calhoun, Georgia.

6) Who says? By statement and logical implication, Cavco’s Manuel “Manny” Santana, on behalf of MHI.

7) Note that Cavco is simply accepting the notion that pricing is leaving behind the lower end of the industry’s historic ‘base.’

- From the transcript above: “a lot of people are getting priced out at that lower end.”

- They are simplifying product, said Boor. “But we’re very focused on product simplification. It’s a big deal for getting more throughput.” That appears to be a euphemism for less customization options.

- They admit that they are not keeping customers happy. “Frankly, we can’t keep many of our customers happy right now, they’d all like to add more homes.”

- Then, they say that they are capturing “gains from the site-built.” Per Boor, “So I really do think that we’re capturing some of that space that they just can’t hit at this point and people are buying manufactured housing more and more. So I think we’re taking some share in that regard.”

But more specifically:

- “I know this probably doesn’t need to be said, but I always feel I need to say it, when you look at our industry shipments, it has for a while represented what we can make, not what demand is. So if our industry could make more, we’d be even a higher share of new homes at this point.”

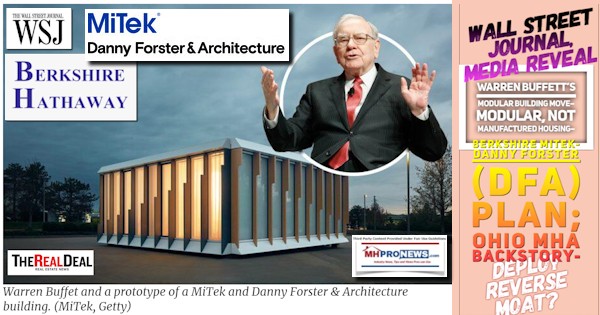

- That seemingly pretends that developments like Warren Buffett’s move into more modular construction, or S2A’s plan to build dozens of production centers doesn’t exist.

- Those marketplace examples cited above clearly seem to contradict Cavco’s executive claims that they want ‘organic’ growth.

- All of that and more appears to support concerns that Strommen and others have raised about MHI’s leading members, which certainly includes Cavco.

No Title

No Description

Summing Up and Conclusions

Once MHProNews and MHLivingNews was steadily awakened, step by step, in recent years to the disconnects and contradictions that shed light on why manufactured housing was underperforming, the evidence for those claims began to appear quite readily. The SEC suit is just a piece of the puzzle in that regard. Cavco is not alone in having a problem with past comments contradicting current realities, as Manny Santana exemplifies. That might seem innocent to some, given that it was said years ago. But when the realities that sparked those comments has not changed, it begs the question. Why didn’t Cavco, MHI, and others act to change that dynamic? Why didn’t they act legally, as Tim Williams with 21st Mortgage Corporation admitted might be necessary in a meeting roughly a decade ago?

Speaking of Williams and lending, when MHI’s leadership postures efforts, touts their supposed advances, but then produces little or no positive measurable results, how is it that their dominating brands tolerate such ineffective staff work? That is, unless they actually like the status quo?

Manufactured Housing Institute Touts FHA Title I Loan “Access” HUD’s Lopa Kolluri- “Manufactured Homes Comparable to Site-Built Homes,” “Stasis” Section 8 MH Voucher Redux, plus MH Markets Updates

Manufactured Housing Institute, Touts, FHA Title I Loan, “Access”, HUD’s Lopa Kolluri, “Manufactured Homes Comparable to Site-Built Homes”, “Stasis”, Section 8 MH Voucher Redux, Housing Opportunity Through Modernization Act, “MHI Applauds New Law Allowing Use of Section 8 Vouchers to Purchase Manufactured Home”, plus MH Markets Updates, 11.9.2021, stocks, REITs, communities, mobile home parks, manufactured home production, factories, suppliers, retail, finance, brokers, Lesli Gooch, Lucy, Charlie Brown, Football, MHI Meme,

Therein lies the truth that is arguably hiding in plain sight.

The formal complaint lodged against Thomas “Tom” Hodges has drawn no official response from MHI, nor Clayton Homes or other major brands involved at MHI. One must keep in mind that several of these same personalities, and their companies, previously praised MHProNews for factually accurate, objective reports and analysis. They previously gladly responded to inquiries, until such thorny issues became too common a question. That’s when their ‘silence’ – or worse – in response began to emerge.

Clayton Homes GC Thomas “Tom” Hodges, Manufactured Housing Institute Chairman, Slapped by BPR Complaint – Facts, Claims – Why It Matters to Affordable Housing Seekers

On paper, much of what Clayton Homes General Counsel, Thomas “Tom” Hodges, J.D., has said or written over the years may seem fine from the viewpoints of certain quarters involved in the battle for more affordable housing in general, and more manufactured homes in particular.

While MHI claims to be working to mitigate zoning and placement headaches, Rev. Ivory Mewborn’s accounts from Ayden, NC puts those claims into a very different light.

Baptist News Global – “Manufactured Homes and Just Zoning Laws Can Transform Working Poor” Rev Ivory L. Mewborn, Mayor Pro-Tem of Ayden, NC

Baptist News Global, “Manufactured Homes and Just Zoning Laws Can Transform Working Poor”, Rev Ivory L. Mewborn, Mayor Pro-Tem of Ayden NC, Vice chair of the Pitt County (N.C.) Human Relations Council. Manufactured Housing Improvement Act, Enhanced preemption for HUD Code manufactured homes, enhanced preemption,

HUD’s Own Report Confirm Alarms – HUD Officials, Manufactured Housing Institute Leaders Duck Charges of Racial Bias, Dereliction, Thwarting Racial Equity, More in “Plant A Home” Program

HUD PD&R, Pam Blumenthal, Regina Gray, Research Confirm Alarms, HUD Officials, Manufactured Housing Institute, Lesli Gooch, Tom Hodges, David Goch, John Greiner, Duck Charges, Racial Bias, Dereliction, Thwarting Racial Equity, More, “Plant A Home” Program, Ayden NC Commissioner Mayor Pro-Tem Ivory Mewborn, Tyrone and Jaime Taft, MHARR, Mark Weiss, Teresa Payne, Office Manufactured Housing Programs, HUD Secretary Marcia Fudge,

When attorney David Goch, acting on behalf of MHI, complained to HUD about their hiring Lois Starkey, he copied the Office of the Inspector General and the General Counsel’s office. That begs the question. Why hasn’t MHI used any of the millions that they have in their annual operating budget, plus millions more in reserve, to sue to get good laws enforced? The logical outcome of getting the Manufactured Housing Improvement Act and “enhanced preemption” enforced would be a surge of sales.

Meaning, it would be an investment to press such claims, with billions a year in potential upside. But the fact that MHI, whose board is dominated by brands such as Cavco, does not and has not done more than dance, prance, and romance independents while consolidating the industry in steady stages, makes it clear that consolidation is primary.

This is arguably a disservice to stockholders. It is evidence of collusion, as any one of these brands could blow the whistle publicly on MHI and legally bring this charade to a rapid halt.

The actions speak louder than words. The words are noteworthy to the extend that they are compared to actions, past and present, to see how words and deeds align. Or, all too often, to see how words and deeds do not align.

Abraham Lincoln has arguably been proven to be correct. No one has a good enough memory to be a successful liar long-term. Sooner or later, the lies and deceptions become apparent.

Public, Official Concerns Caused by Monopolization Grow Says Matt Stoller – 10 Years Prison, $100M Fines Possible – What are Manufactured Housing Institute Leaders Saying? – Plus, Sunday Weekly Headlines Review

Public, Official Concerns, Monopolization Rising, Says Matt Stoller, 10 Years Prison, $100M Fines Possible, Manufactured Housing Institute, Leaders Saying, Plus, Sunday Weekly Headlines Review, Thomas “Tom” Hodges, Kevin Clayton, antitrust violation, suborning perjury, penalties, Baptist Global News, Ivory Mewborn, Manufactured homes and just zoning laws can transform working poor,

Polling suggests that the majority of the public is favoring antitrust action. Given that politicians talking about it is in part a finger in the wind and playing to those political forces that are blowing, there is now a struggle for what shape that anti-monopolistic behavior might take.

Given human nature and the history of Cavco in recent years – as told through the lens of the SEC pleadings, Strommen, and others – it is no surprise that paltering, mendacity, deception and misdirection seem to be engrained in the leadership roles there. The question is, will sufficient numbers press the correct buttons to get Cavco and others in top roles at MHI to genuinely change course? Time will tell.

This Masthead report and analysis on MHProNews opened with the maxim – “The Devil is in the Details.” Stay tuned for a planned follow up on Cavco Industries and related topics. MHProNews will shine a light on the evidence, report the facts, raise the concerns, and press the issues that directly or indirectly causes the powers that be to sweat just a little more than they may want to admit. After all, 10 years in prison plus potentially millions in fines would not be a picnic. And that is not the only legal risks that they have apparently taken.

When someone looks at the version of Cavco’s ‘refreshed’ logo used in the featured image at the top, note that it has a drop shadow under the logo? Perhaps that shadow is more aptly cast over the corporate leaders there? That noted, there are honorable and talented people there too. Not every MHI member is problematic or tainted by behavior that merits regulatory or legal scrutiny. But for those who do, they should be pressed to the full extent of the law. It will be interesting to see how the SEC case plays out. And will there be other legal actions in MHVille, or at Cavco itself, in the wake of that litigation? Time will tell, and yes, the devil is in the details. ###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.