To frame the financial site Motley Fool’s report on Sun Communities (SUI) and their recent $1.3-billion-dollar deal for Park Holidays UK “mobile home parks” and RV communities in the United Kingdom, the following background is useful. “The central purpose of journalism is to provide citizens with accurate and reliable information they need to function in a free society.” So said the American Press Institute (API), which added the following.

“This purpose also involves other requirements, such as:

- being entertaining,

- serving as watchdog,

- offering voice to the voiceless.”

API’s Principles of Journalism includes this point, that journalism: “must serve as an independent monitor of power

Journalism has an unusual capacity to serve as watchdog over those whose power and position most affect citizens. The [U.S. Founding] Founders recognized this to be a rampart against despotism when they ensured an independent press; courts have affirmed it; citizens rely on it. As journalists, we have an obligation to protect this watchdog freedom by not demeaning it in frivolous use or exploiting it for commercial gain.”

Another API on journalism point: “Seeking out multiple witnesses, disclosing as much as possible about sources, or asking various sides for comment…”

One could go on, but that is sufficient background to dive into one of the possible metrics for a journalistic and factual analysis of how the Motley Fool (Fool) reported on the recent Sun Communities $1.3 billion dollar deal with Park Holidays UK to acquire their British portfolio and lay out plans for expansion. This analysis will also peek at a manufactured housing industry trade source too, and those same metrics for discernment from API apply.

In fairness to the Motley Fool, they routinely do a good job on providing timely transcripts of publicly traded firm’s earnings calls, for example. “The Fool” doesn’t hide the fact that they want to sell readers a premium report, and/or other services, which may be marketed in part via the free reports that they produce. It is from two of those free reports that the following will be cited herein.

That said, some in MHVille are cheerleading about Sun Communities $1.3 billion dollar deal. It is no surprise, perhaps, that the Fool is in some ways too.

But even a few pull quotes from slices of two of their recent reports on Sun’s big international score Park Holidays UK ought to have raised questions for the writers and editors of that stock and equities focused business news site. Setting morality aside, as numbers of publications are apt to do, and looking only at dollars and cents and return on investment for investors, one might ask. Was this international deal the best use of Sun’s resources and leverage ability?

A few pull quotes from the Fool will illustrate several things that MHInsider ignored (meaning, the Fool did a better job on reporting in certain aspects), but which ought to have raised questions for discerning minds in media. Additionally, those questions ought to be raised with investors, regulators, affordable housing advocates, and among Sun’s smaller competitors too.

Each of these three bullets are pull quotes from the Fool.

- “When mobile home parks get shown on television shows and in movies they are generally presented in a rather unflattering light.”

- “The problem is that they aren’t making any more property, and most of the best locations in these two sectors are already locked up.”

- “After the [Park Holidays UK] deal is complete, the [Sun Communities] REIT expects mobile home parks to make up 45% of rents, RV parks 24%, marinas 19%, UK mobile home and RV parks 7%, and combination mobile home and RV parks in North America 5%.”

Not mentioned in either of the Fool’s reports cited herein, nor in fairness by those in MHVille – such as MHInsider – that weighed in on this consolidation trend, are what ought to be obvious issues to explore as API’s principle of journalists acting as watchdogs.

For example.

- When the Fool with a bit of hyperbole observed that “they [manufactured housing community operators] aren’t making any more property” – that should spark further inquiry. Why are so few manufactured home communities being developed? (Facts and linked research shown below will shed light.)

- As a follow up area of inquiry on that, why are more communities being closed than opened? Those factually inspired questions should lead to others. For instance.

- When more costly-per-square foot multifamily housing and single-family housing are both outpacing production by far less costly manufactured homes during an affordable housing crisis, why is manufactured housing struggling to finally cross in 2021 the 100,000 new manufactured home produced for the first time since 2006?

- When legislation was enacted that aimed to support manufactured housing in 2000 and 2008, why did the manufactured home industry nevertheless take a big dip since 1998 from which it has not yet fully recovered during an affordable housing crisis?

- How much, if any, of these manufactured housing trends are tied to Berkshire Hathaway’s entry into manufactured housing?

- How much, if any, of these manufactured home industry trends are connected with Buffett’s Castle and Moat strategy of deploying man eating amphibians in “the moat’s” murky waters?

- Given the deep pockets and financing capacity of some of the largest brands in the Manufactured Housing Institute (MHI), of which Sun Communities and other larger brands are members, why is the industry posturing and paltering about enforcement of laws they claim they want enforced instead of taking the bold legal, publicity, lobbying and other steps necessary to get good existing laws to work as intended?

For the purpose of this analysis and in fairness to the Fool, sufficient information will be provided below from their linked reports to make it clear that MHProNews is not taking information out of context. Some information from MHInsider will also follow.

The highlighting below is added by MHProNews as reflecting the pull quotes cited above. Note terminology errors (i.e. mobile home or mobile home parks in the U.S. when referring to a manufactured home and manufactured home communities) that follow are in the original Fool report.

This $1.3 Billion Deal Opens Up This REIT’s Growth Options

By Reuben Gregg Brewer – Dec 3, 2021 at 8:17AM

Sun Communities’ history is in mobile home and recreational vehicle parks.

It has made two deals over the past year or so that have shifted its business around a little.

Now it has four growth platforms: mobile homes, RV parks, marinas, and UK mobile home and RV parks.

Mobile home parks are pretty reliable assets, but there are just so many of these properties around. Sun Communities has a solution.

Sun Communities (SUI 1.77%) has a niche property type that’s positioned to prosper as baby boomers retire. It’s not a healthcare real estate investment trust (REIT), though it does offer seniors an affordable housing option via its collection of mobile home parks. But recent moves suggest that management is taking the portfolio to the next level.

Maybe not what you think

When mobile home parks get shown on television shows and in movies they are generally presented in a rather unflattering light. Those types of trailer parks undoubtedly exist, but they aren’t exactly representative of the category. Sun Communities’ mobile home assets are more like little resorts, with amenity-filled properties in high-demand markets in coastal regions and retirement havens. Mobile home parks make up around half of the real estate investment trust’s rents today.

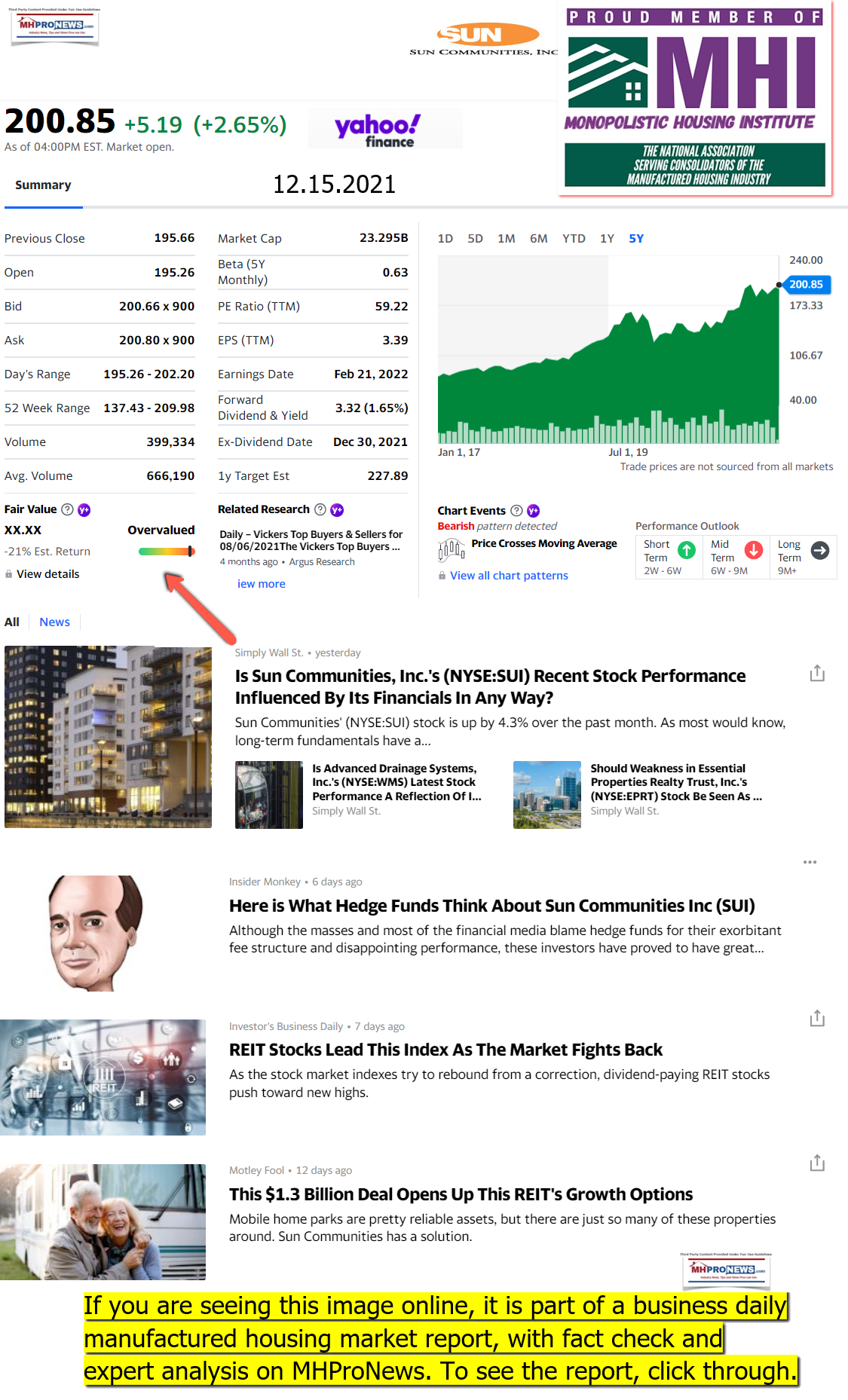

In addition it also generates around 30% of rents from recreational vehicle (RV) parks. These are a lot like the company’s mobile home assets, only the “homes” can be driven to new locations. Again, being in the right places with desirable amenities is a huge benefit. Notably, Sun Communities expects its full-year 2021 same property net operating income (NOI) to increase by roughly 11% over 2020 levels. That’s a sign that demand is high for the properties this REIT owns. And it is helping to power the company’s funds from operations (FFO) growth, which management expects to be a huge 27% at the midpoint of its guidance. In 2022, meanwhile, it expects to be able to increase rents in its mobile home and recreational vehicle properties in the mid-4% range.

The problem is that they aren’t making any more property, and most of the best locations in these two sectors are already locked up. There are still desirable properties that can be bought, but not nearly as many as there were, say, a decade ago. So what’s a REIT to do? Get creative.

Big shifts

The first big strategic change at Sun Communities took place in late 2020 when it agreed to buy Safe Harbor Marinas for $2.1 billion. This expanded the REIT’s portfolio into a new category that had rough similarities to its existing business. With the addition of Safe Harbor’s more than 100 marinas, this business now accounts for around 19% of rents. More important, it gives the company a new avenue for growth.

But Sun Communities isn’t done yet. It recently agreed to buy Park Holidays UK for roughly $1.3 billion. This adds 40 mobile home parks to the REIT’s portfolio. It clearly understands this business, but the key here isn’t what type of property it is buying but where it is doing the buying. Park Holidays is the second largest RV park in the United Kingdom. Notably, the management team that’s currently in place at Park Holidays is staying put, so not only is Sun Communities gaining a foothold in a new market, but it is also adding the expertise needed to operate in that market. Sun Communities expects the deal to be accretive to core FFO in 2022. But, once again, the big draw is that it creates a new avenue for growth, this time a geographic one. After the deal is complete, the REIT expects mobile home parks to make up 45% of rents, RV parks 24%, marinas 19%, UK mobile home and RV parks 7%, and combination mobile home and RV parks in North America 5%.

Notably, in both cases, Sun Communities adds material balance sheet capacity to the business it has taken on. The REIT has an over $20 billion market cap, and the average interest rate on its debt is just 3.3%. That suggests that it can use both of these moves as platforms for further acquisitions, which are a key piece of its long-term growth plan. Only now, instead of just two primary drivers (North American mobile home and RV parks), it has four (North American Mobile, RV parks, UK parks, and marinas).

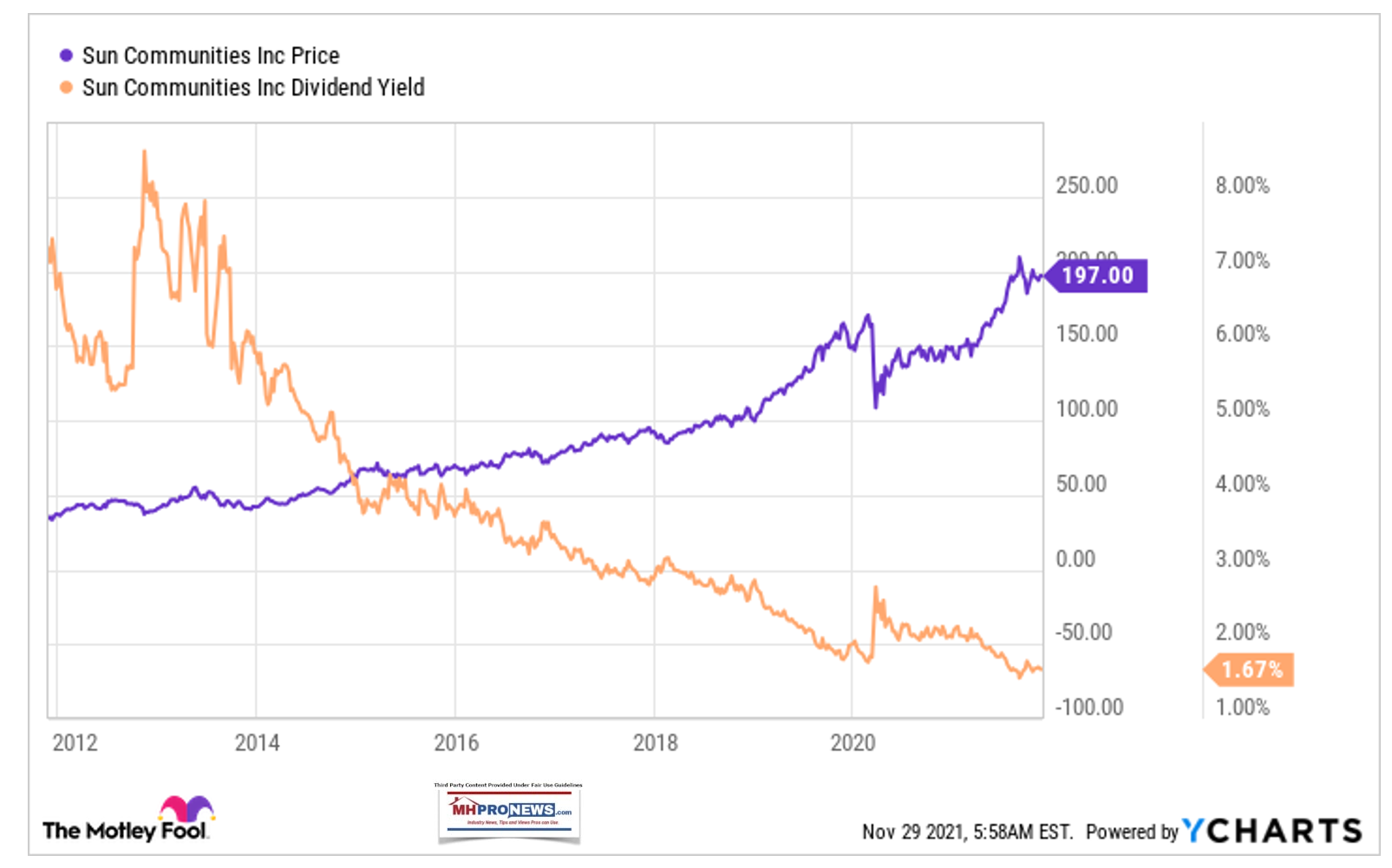

The future’s looking bright

To be fair, the business strength here in the face of the pandemic and the new growth opportunities added over the past year or two have not gone unnoticed. Value-conscious investors probably won’t find Sun Communities’ historically low 1.7% dividend yield all that attractive. However, the dividend has increased 27% over the past five years, or around 5% a year. That’s not bad for a large REIT, and current shareholders should be pleased with the moves management is taking, as they suggest that more solid dividend hikes will be forthcoming in the years ahead. And if there’s a broad and indiscriminate market sell off, Sun Communities could easily become attractive to value types as well.

10 stocks we like better than Sun Communities …” (the Fool report then shifts toward their various pitches). ##

Another Fool report is the shorter one below, which included the video shown.

Sun Communities Just Made a Big International Move

By Matthew Frankel, CFP® and Matthew DiLallo – Dec 9, 2021 at 7:12AM

This unique REIT is expanding its vacation community business across the ocean.

Sun Communities ( SUI 1.77% ) recently announced that it plans to acquire a U.K.-based owner and operator of vacation communities, and the purchase is just the latest in a string of major deals for the REIT. In this Fool Live video clip, recorded on Nov. 16, Fool.com contributors Matt Frankel and Matt DiLallo, along with editors Deidre Woollard and Kayla Schorr, discuss the deal and what it could mean for Sun Communities’ business.

Additional Information, More MHProNews Analysis and Commentary

Objectivity is useful in journalism, reports, and analysis. The Fool brought forth numerous items that so-called MHInsider did not. In fairness, MHInsider included some pull quotes from Gary Shiffman (for instance) that the Motley Fool did not use. Some of this has to do with the business model of the two publications. MHInsider, when closely examined, has clear ties to the Manufactured Housing Institute (MHI). It has been referred to as a kind of house organ or unofficial but clearly tied to MHI mouthpiece for the trade group. The Fool has several revenue drivers working in their background, but they tend to be more dollars, yields, and trends oriented in their reports.

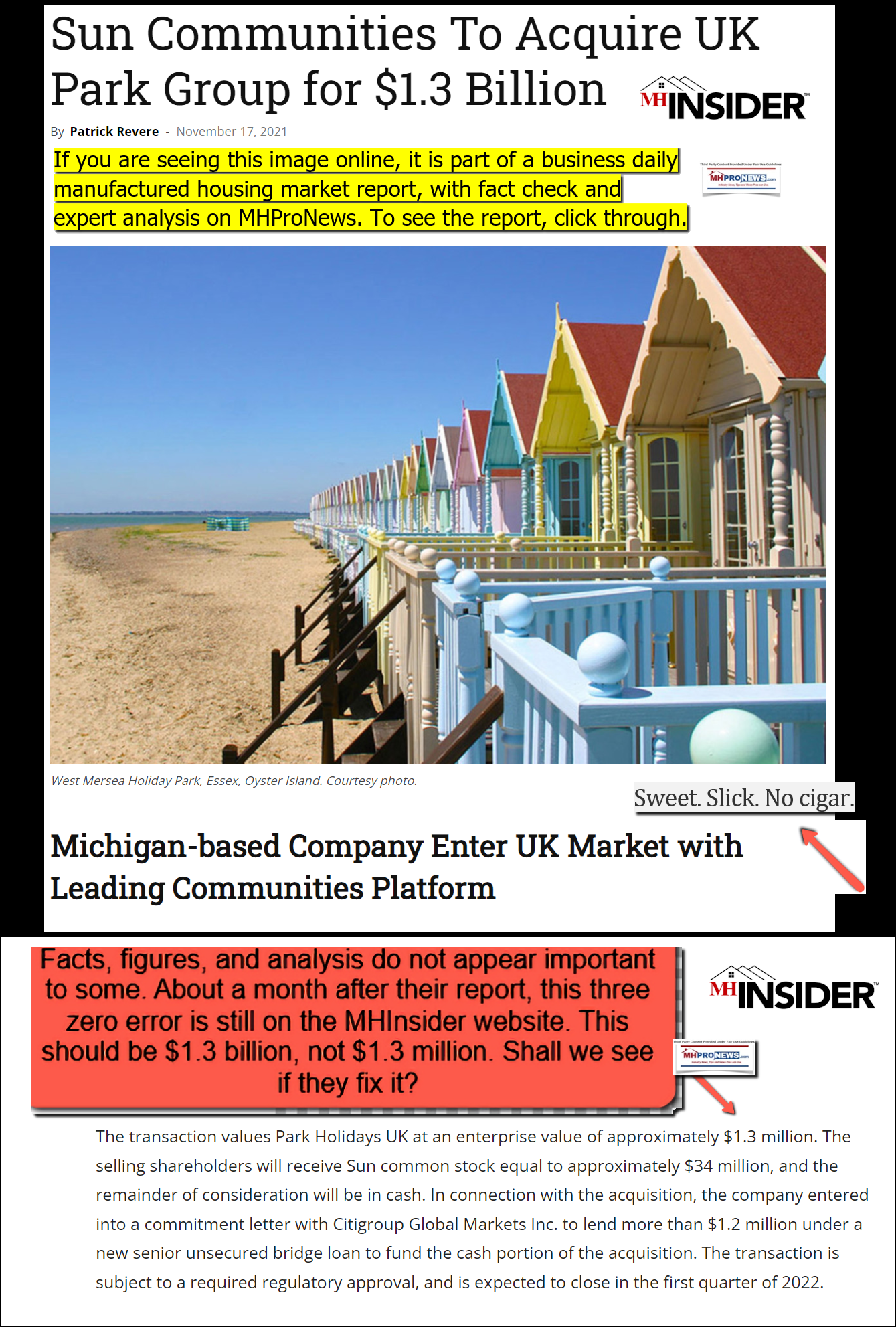

Despite their braggadocio claims, MHInsider is a smaller competitor to MHProNews (in fairness, every professional manufactured home trade media is smaller than our site’s size, scope, and traffic). In fairness, they look slick, but you can’t judge a book by its cover. Candy often tastes sweet, but a diet of candy will lead to health problems – and there are obvious analogies that can be drawn between a diet of candy and a diet of sugary ‘trade journalism.’ Rely on pure sweets at your own risk.

The MHInsider report on the deal for Park Holidays UK might as well have been a press release for Sun Communities. None of the questions or concerns raised here were addressed there. Instead, they focused on – wait for it – more consolidation that is planned by Sun in the United Kingdom just as they have been consolidating land-lease communities in the U.S.

Sun Communities Chairman and CEO Gary A. Shiffman was quoted as saying: “We are incredibly excited to expand Sun’s footprint into the UK by acquiring Park Holidays, which allows us to leverage our land lease community expertise in a growing market. This transaction provides Sun with immediate scale in the UK as well as a platform for future growth in a fragmented landscape.” What is Shiffman going to say? That they just made a $1.3 billion dollar blunder?

Not mentioned in that report was the following point made by Shiffman previously. This statement from Sun’s leader was made during an earnings call. Shiffman flatly stated that new manufactured home communities can often be developed for a better rate of return than they can by buying an existing community.

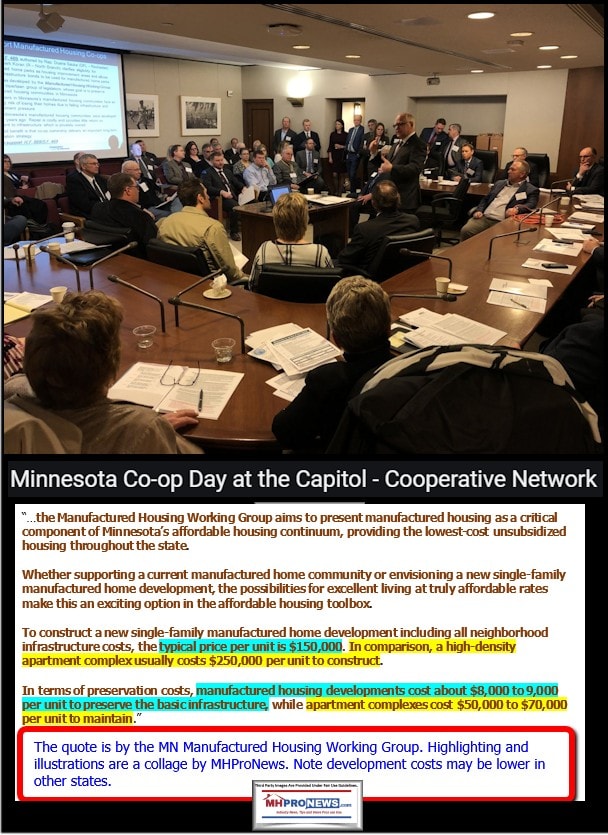

Democratic and Republican lawmakers in a working group did research that revealed that manufacutred homes can be developed and/or redeveloped at significantly lower costs than multifamily housing.

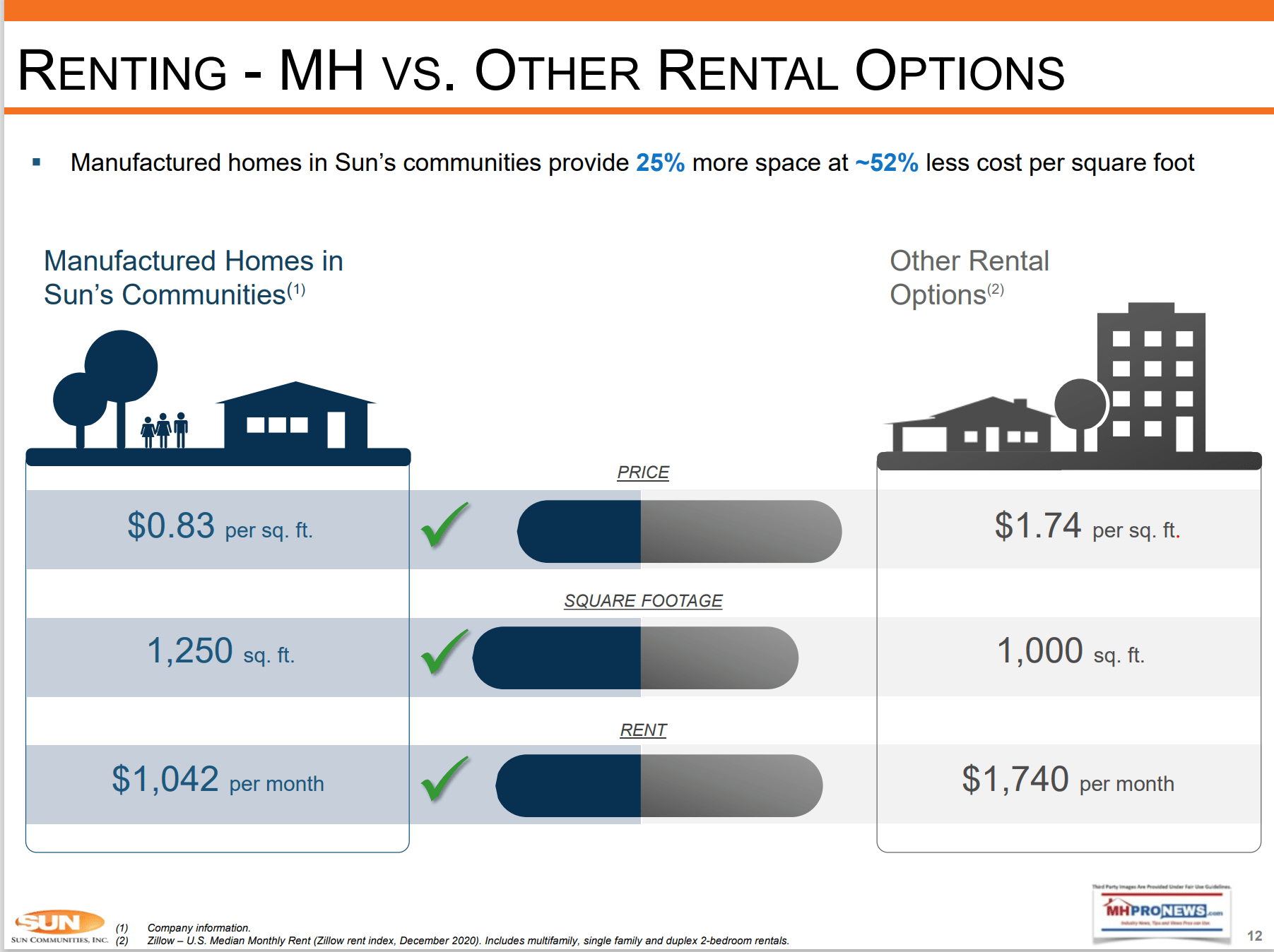

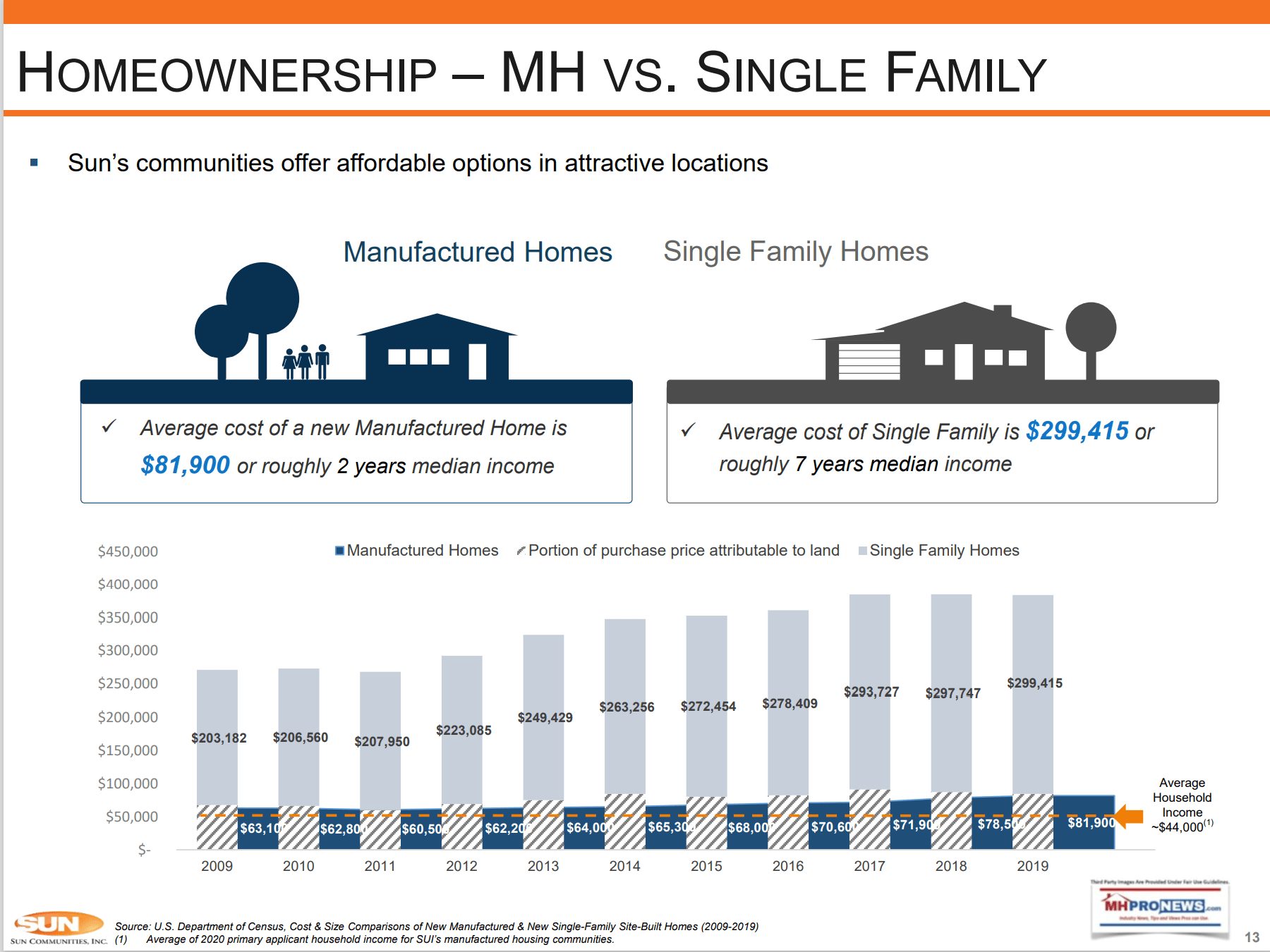

Or what about the lack of internal logic when Sun’s own investor pitch deck is touting their better value over multifamily and single family housing options, and then they go international to make a deal that is consolidation focused?

These are the among the questions that neither MHInsider, nor the Fool, bothered to raise much less seek to answer. In the MHInsider’s case, it should be apparent than focusing on eye candy and sweet stuff is their business model. Otherwise, the financial support they get from MHI connected brands – and their already meager professional audience – vanishes. The odds are excellent that far more people will read about MHInsider’s report on Sun’s British deal here than they did on their own website.

Harvard Health warns: “The effects of added sugar intake — higher blood pressure, inflammation, weight gain, diabetes, and fatty liver disease — are all linked to an increased risk for heart attack and stroke,” says Dr. Hu. Healthline’s report “11 Reasons Why Too Much Sugar Is Bad for You” warns “Excess sugar consumption has been associated with obesity, type 2 diabetes, heart disease, certain cancers, tooth decay,” and more. There is an argument by analogy that something similar occurs with sugary reports by ‘trade publishers’ that only have sweet things to say about manufactured housing industry trends, especially when it comes to naming names with respect to MHI’s top brands.

If public polling about Joe Biden is to be believed, most of his own party don’t want him to be their man in 2024. The New York Times and CNN – generally pro-Democratic news organs – are already exploring alternatives to Biden. That said, you don’t have to be a Biden fan (disclosure: we are not, nor have we been) to realize that even if it was posturing, Biden’s statements about the dangers of market consolidation and monopolizations are often accurate descriptions of the harms caused to the free market by monopolistic forces.

It is an entirely different question if Biden means it as anything more than window dressing. That said, it is conceivable that what was laid out as window dressing could morph into the real deal.

Regrettably, in our era, much of the media has to be taken with a separation of the wheat from the chaff approach. This is part of the reason why the public trust in news media has plummeted. MHProNews can’t fix that, certainly not alone. But we can do our part by shining a light on issues that others downplay, ignore, or miss entirely.

Sun Communities is arguably doing their investors a disservice by not directly addressing the key issues that face manufactured housing’s 20 plus years of underperformance. Sun Communities does not need MHI, if they wanted to use their financial clout to produce more ground up properties, use the Manufactured Housing Improvement Act (MHIA) of 2000, and other possible legal, lobbying, and marketing tools to make that process easier than it otherwise would be.

But for whatever reasons, it appears that once a consolidators mindset takes hold, it is not easy to shift from that course. The recent Securities and Exchange Commission (SEC) suit against Cavco Industries might be a cautionary tale.

But will the SEC suit and its revelations actually be a caution flag for investors, industry professionals, and others?

That aside, Yahoo is saying post-Park Holidays UK deal that the Sun stock is overpriced (see collage illustration above). In an era when all too often media, corporate, and other entities fail to tell a completely accurate picture, it becomes necessary to do authentic (vs. ersatz) fact checks and analysis that fits the facts and statements, past and present from a range of sources. Sun Communities (SUI)? It can and should do much better. ##

###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Several of the illustrations shown in this report can be opened in many browsers to reveal a larger size. To open this picture below into a larger image, click the image once and follow the prompts. Use your browsers back key or escape to return to the article.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.