The maxim that ‘Sunshine is the best disinfectant’ is perhaps appropriate for this fact-packed Masthead review of the latest details and insights on the apparently worsening decline in manufactured housing production. New manufactured home production is obviously linked in several ways to sales at both the retail and wholesale levels. Some new homes built by a factory are going for a seller’s inventory while others are ‘retail sold’ or some variation of that term used by retailers (a.k.a. “dealers”) of manufactured homes, developers, and communities. In Part II of this report and expert analysis will be insights on elements virtually no one in manufactured housing, save our MHProNews/MHLivingNews platforms, are publicly addressing in digital print. In brief, the problem may be more serious than what the Manufactured Housing Association for Regulatory Reform (MHARR) is saying about the failures of the post-production sector, which are routinely code-words that mean the Manufactured Housing Institute (MHI).

Part I – the latest news release to MHProNews from MHARR. Note: the hotlinks below are added by MHProNews into the MHARR release for the benefit of researchers, industry newcomers, investors, public officials and others.

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

Continuing Manufactured Home Production Decline Reflects Failure to Address and Correct Deepening Systemic Problems

Washington, D.C., May 3, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production has declined again in March 2023. Just-released statistics indicate that HUD Code manufacturers produced 7,646 homes in March 2023, a 32.2 % decline from the 11,279 new HUD Code homes produced in March 2022. Cumulative production for 2023 is now 21,174 homes, a 28.6% decrease from the 29,670 homes produced over the same period during 2022.

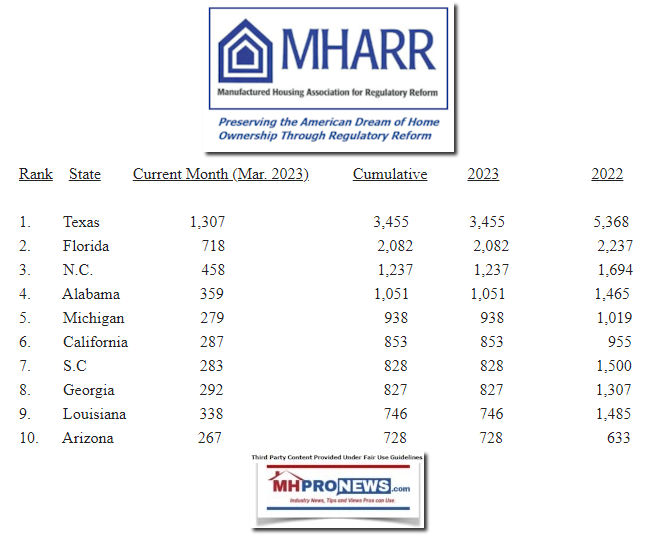

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are:

The production statistics for March 2023 yield one change in the new cumulative index, moving Louisiana into 9th place and Arizona into 10th place on the top-ten shipment list.

At the same time, the March 2023 statistics now show two consecutive quarters of industry production declines, beginning in October 2022. Even worse, these production declines have become steeper every month as the longer-term decline has continued, now reaching a monthly year-over-year decrease in excess of 30%. Again, as MHARR has previously stressed, all of this is occurring at a time of unprecedented demand for affordable housing, thus illustrating once again, not only the long-term destructive impacts of discriminatory zoning and consumer financing on the HUD Code manufactured housing market, but also the failure of federal affordable housing aid and assistance to “reach the ground” for manufactured housing consumers, as illustrated by MHARR’s July 2022 White Paper on that subject. Therefore, decisive industry action to address and resolve these crucial post-production matters (i.e., zoning and consumer financing discrimination) in the nation’s capital is long overdue and a clear indication that the post-production sector’s national representation may not be up to that task.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 –

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: manufacturedhousingassociation.org

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following observations and reflections.

- 1) Arizona is the one state of the top ten that has beat the trend of declining sales. That merits a separate investigation and report. As a placeholder for now, it makes the obvious point that other states that have declining shipments should not necessarily be so.

- 2) This expert writer for MHProNews, at what turned out to be my final MHI Winter Meeting in San Antonio in 2017, raised the following issue one on one with several producers and members. What happens to manufactured housing production as land-lease communities begin to reach capacity in about the next 5 years? A look of surprise was commonplace. None had a good response, save to say, ‘that’s a good question that we’ll have to think about.’ It is an open question if that inquiry, and others like it, played a role in MHI deciding to keep me from attending industry events. More on that later.

- 3) 5 years have now elapsed since that inquiry at the MHI Winter Meeting was made. At this time last year, manufactured housing sales were robust and most if not all factories that shared their information publicly reported months of backlogs on production. Starting in the last quarter of 2022 and increasing in the first quarter of 2023, as MHARR broadly indicated above, manufactured housing production has been dropping increasingly sharply.

- 4) It isn’t just MHARR that has made public remarks like the above about systemic failures to address the manufactured housing industry’s problems. Publicly traded Legacy Housing (LEGH) is an MHI member. So far, Legacy has largely eschewed some of the patterns followed by other publicly traded MHI member-producers. Legacy’s co-founder and chairman Curtis “Curt” Hodgson has made during earnings calls remarks that pointed to the industry’s failures to address zoning and placement issues. Part of Legacy’s business model has been to create their own financing, which is at least an indirect commentary on the lack of lending available through sources such as Fannie Mae, Freddie Mac, or from the Federal Housing Administration (FHA) on their FHA Title I loan program (home only, personal property or ‘chattel’ lending).

- 5) MHProNews is the first and only known news source in manufactured housing to highlight the following remarks from MHI’s problematic annual “Quick Facts” series. Emphasis is added by the Masthead on MHProNews.

MHI Quick Facts – Updated August 2022

- 49% of new manufactured homes are placed on private property and 51% are placed in manufactured home communities.

MHI Quick Facts – Updated May 2021

- 69% of new manufactured homes are placed on private property and 31% are placed in manufactured home communities.

MHI Quick Facts – Updated May 2020

- 63% of new manufactured homes are placed on private property and 37% are placed in manufactured home communities.

- 6) To restate and thus underscore the above, for some years, the majority of manufactured home production has been going onto privately owned homesites rather than into land lease communities, according to MHI’s own data. But suddenly, in 2022, a significant shift occurred. Instead of 60-plus percent of new HUD Code manufactured homes going onto private property, now a slight majority are going into land-lease manufactured home communities (MHCs).

- 7) Bullets 5 and 6 above merit their own research and report, but for now, the following insights are useful and significant. Manufactured housing has long been focused on affordable home ownership. The 21st century developments in manufactured housing, as more independents have exited the industry for various reasons and as more “private equity” has moved in, there is a steady transformation of the manufactured housing industry’s various business models, and the MHC sector is one of them. Currently, and perhaps more so in days gone by, thousands of ‘mom and pop’ owned MHCs lacked the capital (and/or the desire) to buy inventory from factories and to become a community-based retailer vs. a so-called “street retailer.” Some of the larger community operators, notably publicly traded ones, have increasingly been in the business of leasing homes vs. selling homes.

‘Trapped’ – NBC Spotlights Fannie Mae-Freddie Mac-Fed Roles in ‘Making Mobile Homes Less Affordable’ Fueling ‘Acquisition Spree’ as ‘New MHC Owners Hike Resident Costs;’ plus MHVille Markets Update

Former Trump Administration official Mark Calabria, Ph.D., posted the tweet below featuring an NBC News report earlier this month terminology-problematically entitled: ‘Trapped’: How federally backed financing is making mobile homes less affordable.” In a flashback, Calabria and then Manufactured Housing Institute (MHI) executive vice president (EVP) Lesli Gooch, Ph.D., met personally as MHI advised their members and readers in an emailed photo op of their Trump era encounter.

- 8) Restating #7, the number of retail sales in manufactured housing may have been in decline prior to the actual decline at the factory level because of MHC wrinkles, but also because there are fewer street retailers by far than there once were.

- 9) If there were an authentic post-production trade group, these facts and observations would be the subject of serious research. But instead of serious research that is worthy of that name, MHI has arguably been producing pablum for years. Oxford Languages insightfully notes the definition of pablum as: “bland or insipid intellectual fare, entertainment, etc.; pap” with “insipid” including the meaning: “lacking vigor or interest,” “many…continued to churn out insipid, shallow works.”

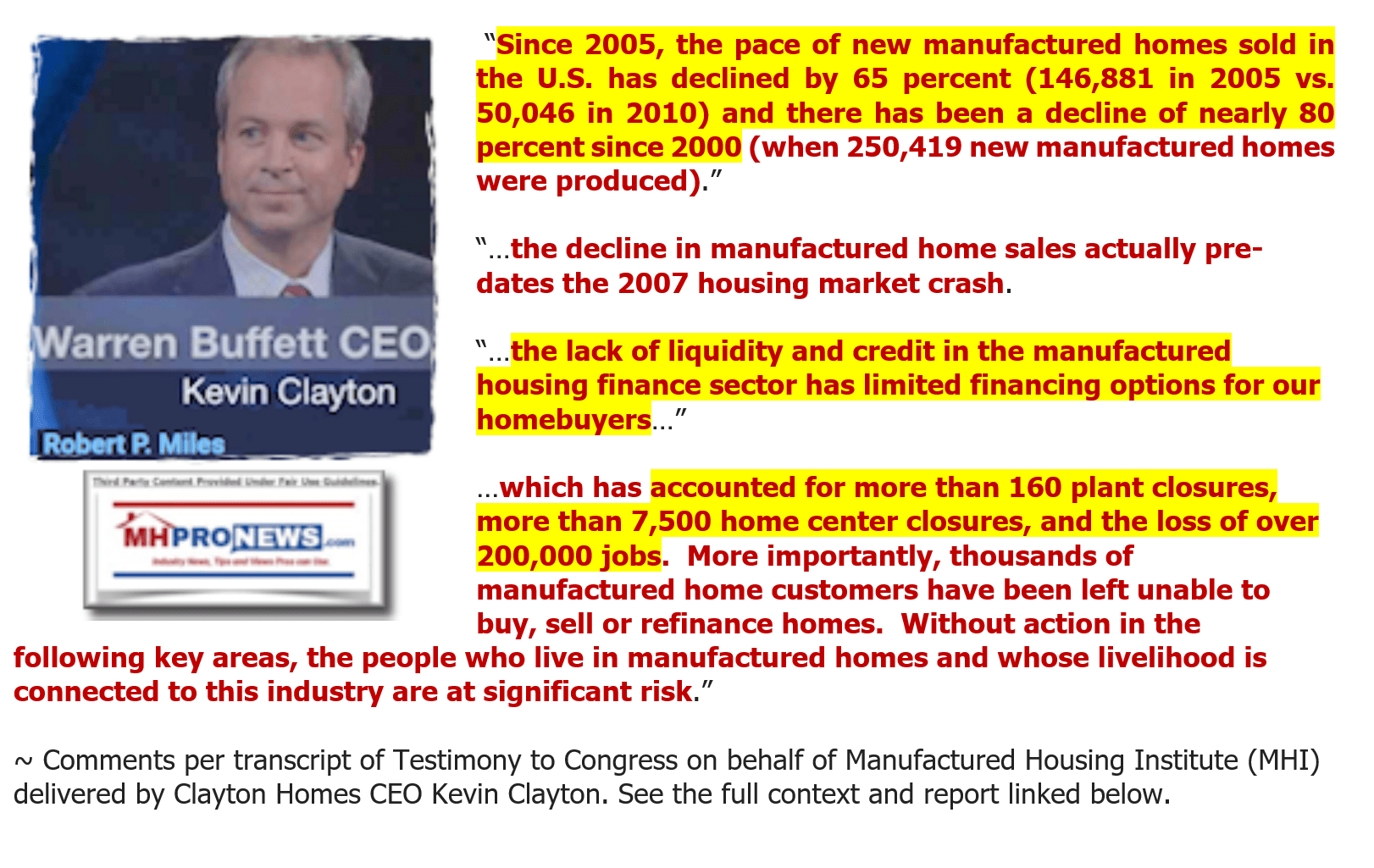

- 10) Much of what MHI has done in the 21st century, perhaps particularly in what is known as the Warren Buffett led Berkshire Hathaway (BRK) era of the manufactured home industry, seems to be focused on posturing, paltering, and sly consolidation that seems to fit the definition of “sabotage monopoly” tactics defined by James A. “Jim” Schmitz Jr. and his research colleagues and the problems described by another third-party researcher Samuel “Sam” Strommen with Knudson Law. More on those quoted and linked further below.

- 11) A longtime MHI linked professional told MHProNews recently that the industry would never recover in our lifetimes to its prior highs. Be that as it may, that sources’ remarks, unpacked below, tells us much of what is occurring behind the scenes in manufactured housing.

Lawyer Tip$, LCI, PATK, Scholar=Manufactured Housing Institute Insider Says Manufactured Home Industry Sales ‘Will Never Recover to Prior Levels In Our Lifetime;’ plus MHVille Stocks Update

Scholar, Legal Tip$, LCI = Manufactured Housing Institute Insider Says Manufactured Home Industry Sales ‘Will Never Recover to Prior Levels In Our Lifetime;’ plus MHVille Stocks Update, manufactured home community real estate investment trusts (MHC REITs), manufactured housing production, factories, retail, dealers, suppliers, finance, brokers, mobile home park passive investing,

- 12) Another development, which MHProNews presaged and forecast, was the shocking to numbers about the ‘awards’ given by MHI to Flagship Communities REIT. That is unpacked in the report linked below.

- 13) Staying with the Flagship example for now, as the above predicted, Flagship has already deployed their new MHI “awards” in messaging to the public. For those who check the facts, look at the evidence, and then “follow the money” a reasonable thesis to the known facts are that Flagship can behave in a problematic fashion at the granular level while MHI and their amen corner of ‘circular praise’ perform acts of gratification on each other in a manner that may seem at a glance to be authentic vs. ersatz praise. See the reports below and above to learn more.

- 14) This troubling pattern of activity might not have occurred for as long as it has if what passes as the manufactured housing industry’s self-declared ‘trade media’ would do the job that the American Press Institute (API) says is media’s highest calling. “It [journalism, reporting] must serve as an independent monitor of power,” stated API, citing The Elements of Journalism, Bill Kovach and Tom Rosenstiel. The role of modern journalism had to “Rather, it sought to redefine the role of the journalist from a passive stenographer to more a curious observer who would “search out and discover the news.”” “The earliest journalists firmly established as a core principle their responsibility to examine unseen corners of society.” API also noted that “Journalism has an unusual capacity to serve as watchdog over those whose power and position most affect citizens. It may also offer voice to the voiceless. Being an independent monitor of power means “watching over the powerful few in society on behalf of the many to guard against tyranny,” Kovach and Rosenstiel write.” But when trade journalism routinely fails to perform the function of watchdogs that act as an informational check on power and are instead demonstrably more behaving in the role of “passive stenographers” that do cheerleading or even act as a diversion for those who benefit from apparently crony and corrupt practices. Be that pattern of activity by much of the balance of MHVille trade media an accident or design, the effect is much the same. Apparently troubling, immoral and perhaps illegal behavior that seems to involve corruption and cronyism continues with less attention as a result.

- 15) Fortunately, the industry has a national trade group that while modest in size and budget is nevertheless robust in its efforts to expose several aspects of the problems that are holding manufactured housing at low ebb.

Ghorbani Nails Zoning Answers to "How" and "Who"

Danny Ghorbani, Nails, Zoning, Answers, to "How" and "Who", Manufactured Housing, Enhanced Preemption, HUD, HUD Code, Manufactured Housing Improvement Act of 2000, MHIA, 2000 Reform Law, Manufactured Housing Institute, Manufactured Housing Association for Regulatory Reform, enhanced preemption Can Override Local Zoning, requirements, standards, Mark Weiss, Lesli Gooch, Kevin Clayton, Tom Hodges,

- 16) Even far more costly conventional housing has experienced periods of increasing productivity in 2023 despite the headwinds that have developed from problematic policies and higher interest rates, among other obstacles.

'Deception and Misdirection'-MHI Proxy Response to Concerns About "Awards" to BBB D- rated Flagship Communities - 'Facts are Stubborn Things' Commentary; plus Sunday Weekly MHVille Headline Recap

'Deception and Misdirection', MHI Proxy, George F. Allen, Lt. Col George F.

Manufactured Housing Institute Claims 'Effective Branding' for 'Manufactured Housing'-Seriously? Target Rich Satirical Saturday Examines MHI Claims, Messaging, RESULT$; plus MHVille Stocks Update

National Housing Conference, NHC, Solutions for Housing Communications, 3.15.2023, Manufactured Housing Institute Claims 'Effective Branding' for 'Manufactured Housing'-Seriously?

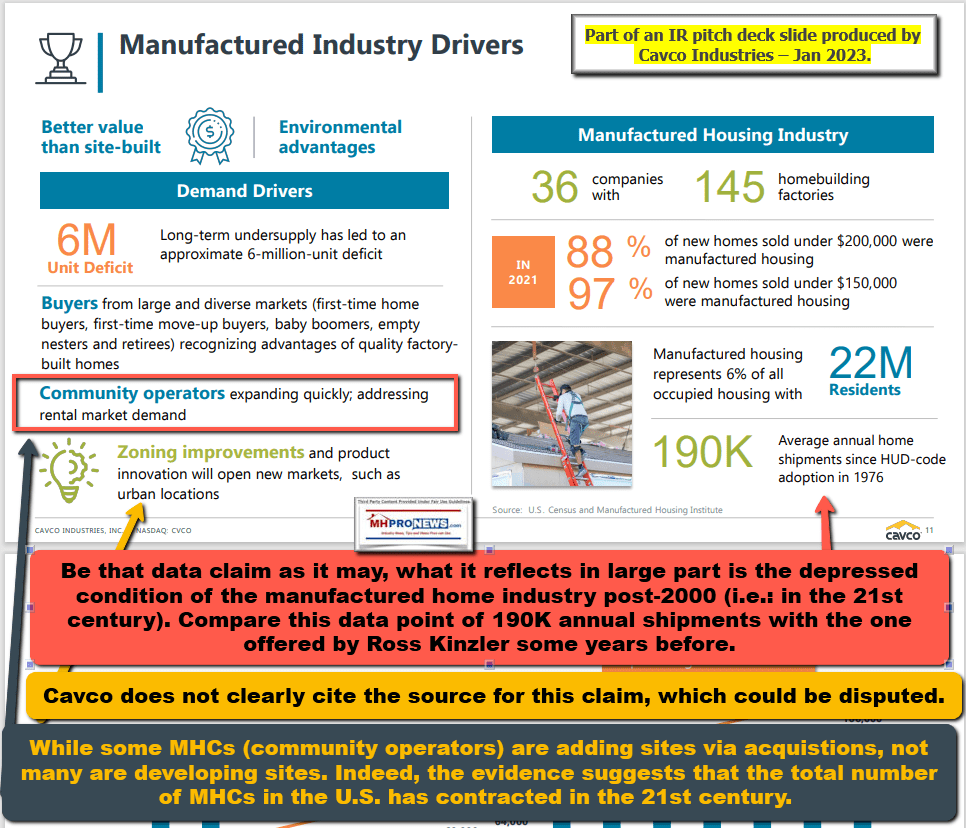

- 17) Cavco Industries, a prominent MHI member, ironically demonstrated that point by admitting that some 6 million homes are needed. The case can be made that their estimate may low, but accepting that 6-million-housing-units needed figure helps us understand the sheer potential for the industry. But also because there are tens of millions of renters, Freddie Mac research last year asserted in a report that manufactured home friendly zones could support the sale of some 25 to 26 million units. Those facts and more are found in the two reports linked below.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Manufactured Housing Institute (MHI) Claims Contradicted by Cavco Industries IR Statements, 'Shortage of Affordable Housing Costs Economy $2Trillion Annually;' plus MHVille Markets Update

Manufactured Housing Institute (MHI) Claims Contradicted by Cavco Industries IR Statements, 'Shortage of Affordable Housing Costs Economy $2Trillion Annually;' plus MHVille Markets Update, William Bill Boor, Eleanor Griffiths, manufactured housing production, manufactured home communities, Real Estate Investment Trusts, MHC REITs, dealers, retail, suppliers, finance, finance,

- 18) MHI member ROC USA, led by Paul Bradley, provided some relevant remarks to the pace of consolidation in the manufactured home community sector.

“From what I have read from JLL, it looks like just short of 800,000 sites purchased by REITs and private equity since 2015. The pace has slowed in the last 6 – 12 months, with interest rates rising.

My not unique take: Private equity (small, medium and large) – with low cost debt from GSEs (but reflective of overall interest rate market for much of the last decade) – has driven up prices of MHCs and put immense pressure on site rents.

It was inevitable – consolidators consolidate industry segments. But, I do fear the loss of local developer/owners to consolidators bc [because] the more that it’s just an income producing asset for far-away number crunchers, the more unaffordable it will become for working and retiree households.”

When asked if the JLL 800,00 site figure seemed supported by the evidence he had seen, Bradley answered in the affirmative. He also said that ROC USA aims to be part of the solution. Such facts are “…leading me to work through how we [ROC USA} will deconsolidate portfolios through resident ownership. We’re on it!” Bradley confirmed his remarks were on the record for MHProNews.

While MHI is handwringing and making excuses as to why they can't get the GSEs or the FHFA to make the Duty to Serve Manufactured Housing - a Congressional mandate - a reality, Bradley previously reported progress on that very point for financing inside ROCs.

- 19) Is it any wonder that Doug Ryan, a de facto colleague and periodic ally for ROC at Prosperity Now (previously known as CFED), called out MHI as undermining the DTS process in an effort that benefits Clayton Homes and their affiliated lending.

McCarthy: 'Missions of Fannie Mae and Freddie Mac to Help Preserve Affordable Housing-They're Doing Exactly the Opposite'-Updated 2023 MH Communities Total, New Manufactured Housing Infographics

New factual and evidence-based manufactured housing focused infographics are provided in this report. Fresh insights as to the actual numbers of land-lease manufactured home communities are in this article as well. The data challenges previous estimates and claims in significant ways.

- 2o) All of these facts and pieces of evidence are like a jigsaw puzzle. When pieces of the puzzle are missing, someone might guess what the true picture is, but that presumption could be correct or incorrect. It is only when the maximum number of pieces are found, checked to see if they are an easy (true) fit or if they are forced and in reality don’t fit that an honest picture begins to emerge. The fact that MHI’s leaders, and those of the corporations and their trade media allies duck and decline to answer questions about these concerns is also a point of interest. In years gone by, MHI and their leaders not only answered inquiries, they at various time paid to have their content posted on MHProNews, perhaps counting on the impact of having their notions made available to the industry’s largest professional audience.

'The Rules Are Simple. They Lie to Us, They Know We Know They Are Lying;' MHVillage/MHInsider Darren Krolewski Unveils Sobering Claim - 'How to Waste Good Money on Marketing' - plus MHVille Stock$

'The Rules Are Simple. They Lie to Us, They Know We Know They Are Lying'.

Summary and Conclusion

Manufactured housing is demonstrably underperforming during an affordable housing crisis. MHProNews/MHLivingNews has repeatedly made the point that the corporate powers that be at MHI have made self-contradictory and superficially implausible behaviors for years. MHI and their leaders appear to say similar things that MHARR does, tout their superior access to public officials, but then fail to do the common-sense things that their superior access ought to be utilized to accomplish. That thesis remains unchallenged by MHI, but they do at times appear to have one George Allen who attempts to distract from that clear, fact- and evidence-based, and commonsense analysis. Deception and misdirection is a tactic for the sabotage monopolists who are building their respective moats. When asked to respond directly to these concerns, they stand mute. Meanwhile, the industry is consolidating. That is the ironically a stated goal of those involved, as Flagship, Cavco, and others have made clear in their own words. Given that evidence and logical presentation, is it any wonder that they duck making remarks that may later bite them yet again? This calls out for serious legal probes by public officials and should be prosecuted to the fullest extent of the law, because it is a pattern that harms millions who need and want affordable housing. ##

New U.S. Conventional Housing Nears 450K Average as Sales Up in March 2023 vs Manufactured Housing's Reported Dive - Added Facts, Opportunities, Obstacles, MHMedia Views - plus MHVille Market Update

New U.S. Conventional Housing Nears 450K Average as Sales Up in March 2023 vs Manufactured Housing's Reported Dive-Added Facts Opportunities Obstacles Views-plus MHVille Market Update, ManufacturedHomes.com, MHInsider, MHVillage, Manufactured Housing Institute, MHI, Manufactured Housing Association for Regulatory Reform, MHARR, Kurt Kelley, MHReview, George F.

[cp_popup display="inline" style_id="139941" step_id = "1"][/cp_popup]

Stay tuned for more of what is 'behind the curtains' as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. "Tony" Kovach - for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He's a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC's and/or the writer's position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Manufactured Housing Association Presses HUD for Specific Inclusion of HUD-Regulated Manufactured Homes in New Affirmatively Furthering Fair Housing (AFFH) Rule; plus MHVille Markets Update

Manufactured Housing Association, Manufactured Housing Association for Regulatory Reform, Presses HUD, Specific Inclusion, HUD-Regulated, Manufactured Homes, New, Affirmatively Furthering Fair Housing, AFFH Rule; plus MHVille Markets Update 4.26.2023, Manufactured housing, production, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs,