The definition of affordable housing used by the U.S. Department of Housing and Urban Development (HUD): “Affordable housing is generally defined as housing on which the occupant is paying no more than 30 percent of gross income for housing costs, including utilities.”

According to the U.S. Census Bureau in: “2022, show that before taxes, median household income declined 2.3% to $74,580…”

Per BankRate which cited data the National Association of Realtors (NAR), existing homes (not new construction) stood at “$387,600 as of November 2023.”

The Census Bureau said: “The median sales price of new houses sold in January 2024 was $420,700.”

Doing some basic math, 30 percent of $74,580 = $22,374.

Forbes reported that: “Nationwide Americans spend an average of $429.33 per month on utilities.”

Basic math tells us that $429.33 x 12 equals $5,151.96 annually.

22,374 – $5,151.96 = $17,222.04. That $17,222 and change is what the mortgage or rent payment should be for “affordable” housing. Good luck with that in March 2024. Here’s why. That is $1,435.16 monthly.

Rent Cafe said a 1-bedroom apartment is $1,470 and is an average of about 890 square feet, depending on the state. So, if you need two or three bedrooms, you have exceeded that 30 percent ratio for housing to be affordable.

The above clarifies why the NAHB President and CEO Jerry Howard said in 2022 to Fox Business that: “Right now, in almost no market in this country, can a homebuilder build a house that is affordable for a first-time homebuyer.” Howard added: “We can’t do it. The costs that are on us make it impossible.”

The very next paragraph said: Howard’s “comments come as new data from Redfin revealed that a homebuyer has to earn at least $107,281 to afford the $2,682 monthly mortgage payment on a typical U.S. home, representing a 45.6% jump from last year, when annual income to afford a home was $73,000.” Yes, Bidenomics and the inflation of the past 3 years is a significant part of it, but not all of it.

So, what can a typical family or household afford today?

Millions could qualify for a new or pre-owned manufactured home. The St Louis Fed, citing Census Bureau data said that a new single section manufactured home was “in October 2023 it was $83,300.” That was down from the price of $85,400 in June 2023. Lot cost varies, as do taxes and insurance rates. But let’s imagine $100,000 in land and improvements for that new manufactured home. BankRate said: “Saturday, March 09, 2024, the national average 30-year FHA mortgage interest rate is 6.61%.” Keep in mind that while some lenders want to do an ‘overlay’ and only want to finance multi-section manufactured homes on land, the FHA guidelines allow both single or multi-section home on land loans, and some lenders have historically done both. The math below reveals this is “affordable.”

That’s about 500 words or 2½ minutes reading. That must be too simple for some in politics, government, or the manufactured housing industry trade media to do such quick research and math.

We’ve tested Bing’s AI, rebranded as Copilot, since May 2023. The initial response was incomplete, which explains the Q&A quoted below.

> “Sorry, Copilot you missed a step. You have to add the home and land before doing the math. A new single section manufactured home on land. The home is $83,300. The land and improvements are $100,000. So, $183,300 total land-home package. Then calculate an FHA 30-year fixed rate loan with a minimum down payment at 6.61 percent. What is the monthly payment, principal, and interest?”

My apologies for the oversight! Let’s recalculate the FHA loan details, considering the total land-home package cost of $183,300.

My apologies for the oversight! Let’s recalculate the FHA loan details, considering the total land-home package cost of $183,300.

- Down Payment:

-

- The minimum down payment for an FHA loan depends on your credit score:

- If your credit score is 580 or higher, the down payment is 3.5% of the home’s purchase price.

- If your credit score is between 500 and 579, the down payment increases to 10%1.

- Given the total cost of $183,300, we’ll calculate both scenarios:

- For a credit score of 580 or higher: Down payment = 3.5% of $183,300 = $6,416.05

- For a credit score between 500 and 579: Down payment = 10% of $183,300 = $18,330.00

- The minimum down payment for an FHA loan depends on your credit score:

- Loan Amount:

-

- Subtract the down payment from the total cost:

- For a credit score of 580 or higher: Loan amount = $183,300 – $6,416.05 = $176,883.95

- For a credit score between 500 and 579: Loan amount = $183,300 – $18,330.00 = $164,970.00

- Subtract the down payment from the total cost:

- Interest Rate:

-

- You mentioned a fixed rate loan. Let’s assume the interest rate is 6.61%.

- Monthly Payment Calculation:

-

- We’ll use the formula for the monthly payment on a fixed-rate mortgage:

- Monthly Payment = Loan Amount × (Monthly Interest Rate) / (1 – (1 + Monthly Interest Rate)^(-Number of Payments))

- Number of Payments = 30 years × 12 months/year = 360 payments

- We’ll use the formula for the monthly payment on a fixed-rate mortgage:

- Monthly Interest Rate:

-

- Convert the annual interest rate to a monthly rate:

- Monthly Interest Rate = (6.61% / 100) / 12 = 0.0055083

- Convert the annual interest rate to a monthly rate:

- Calculate Monthly Payment:

-

- For a credit score of 580 or higher:

- Monthly Payment = $176,883.95 × 0.0055083 / (1 – (1 + 0.0055083)^(-360)) = $1,117.97

- For a credit score between 500 and 579:

- Monthly Payment = $164,970.00 × 0.0055083 / (1 – (1 + 0.0055083)^(-360)) = $1,042.86

- For a credit score of 580 or higher:

Therefore, the estimated monthly payment for the FHA loan would be approximately $1,117.97 (for credit score 580+) or $1,042.86 (for credit score 500-579). This includes both principal and interest. Keep in mind that additional costs such as mortgage insurance premiums (MIPs) and closing costs may apply1.”

With the add-ons, that’s close to the 30 percent AGI HUD suggests for affordability. Images shown are not included in the word counts. That’s under 1,000 words to this point.

It takes about 4 minutes 20 seconds to read 1,000 words. The balance that follows will take the typical reader over the 5-minute mark.

Part II

That begs a series of questions, which won’t be directly addressed in depth with this MHProNews Masthead editorial – facts with analysis. But we will indirectly address those topics by providing links to reports that provided more details on various related issues.

Every permanent kind of housing that can be produced and preserved is necessary for the affordable housing crisis to be solved.

Manufactured homes can technically be built as small as 320 square feet, per HUD Guidelines. So, ‘tiny houses’ of 320 square feet or above could be built to the HUD Code.

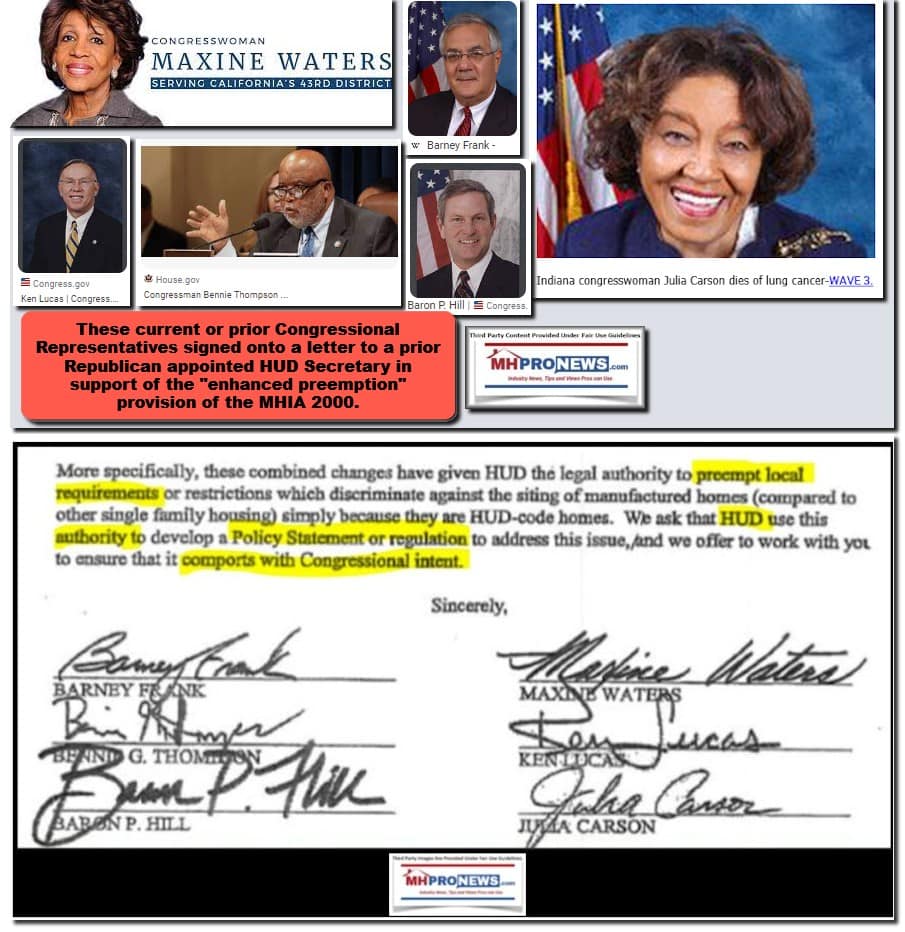

According to the Manufactured Housing Improvement Act of 2000 (MHIA, 2000 Reform Law, or 2000 Reform Act), manufactured housing is supposed to enjoy “enhanced preemption.” Unfortunately, HUD has rarely invoked that authority.

But if that authority was invoked, then the affordable housing crisis could truly be solved in a matter of a few years and largely without federal subsidies. Meaning, the private sector could solve the housing crisis, so long as the public sector enforces good existing laws. See the related reports to better understand the popularity as measured by surveys of such a solution, the related politics, apparent corruption, and other failures to implement the solution that a bipartisan Congress made federal law nearly a quarter of a century ago. The beauty in this solution are many, including the point that people would be allowed to select the type of housing and lifestyle that makes sense for them. Normalizing #HousingChoice is how #AffordableHousing gets done.

In about 1200 words or about 9 minutes of initial reading, there you have the solution to the affordable housing crisis hiding in plain sight. Conventional builders can’t do it alone. Manufactured home builders are needed. Congress studied this in 2000 when it passed the MHIA (2000 Reform Law). They held hearings in 2011 and 2012 to see why HUD had not yet properly implemented the 2000 Reform Act. Congress could make it simple. Until HUD routinely implement federal law, cut HUD’s funding off. Until the FHFA properly enforces the Duty to Serve (DTS) on Fannie Mae and Freddie Mac to do chattel lending for manufactured homes, Congress could cut them off too. Simple. Enforce existing laws, period. ##

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.