“The scrutiny [by regulators of Berkshire Hathaway affiliated manufactured home lending practices] has certainly extended to Clayton [Homes], whose mortgage practices have been continuously reviewed and examined in respect to such items as originations, servicing, collections, advertising, compliance, and internal controls. At the federal level, we answer to the Federal Trade Commission, the Department of Housing and Urban Development and the Consumer Financial Protection Bureau. Dozens of states regulate us as well. During the past two years, indeed, various federal and state authorities (from 25 states) examined and reviewed Clayton and its mortgages on 65 occasions. The result? Our total fines during this period were $38,200 and our refunds to customers $704,678. Furthermore, though we had to foreclose on 2.64% of our manufactured-home mortgages last year, 95.4% of our borrowers were current on their payments at year-end, as they moved toward owning a debt-free home.”

– Warren Buffett, who per Reuters in 2015 said he made “no apologies whatsoever” for Clayton Homes and the lending practices of those firms owned by Berkshire Hathaway. In fact, the full sentence in that May 2, 2015 Reuters quote reads: “I make no apologies whatsoever about Clayton’s lending terms.”

Part I.

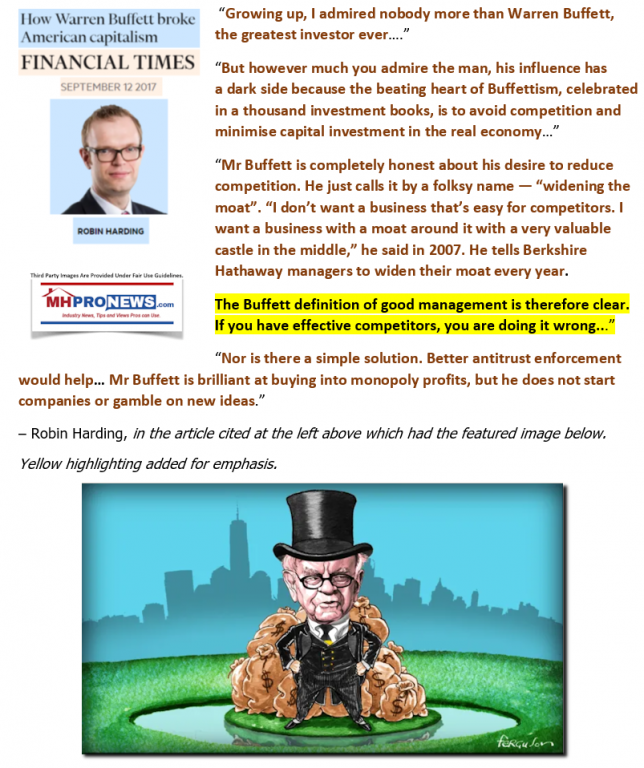

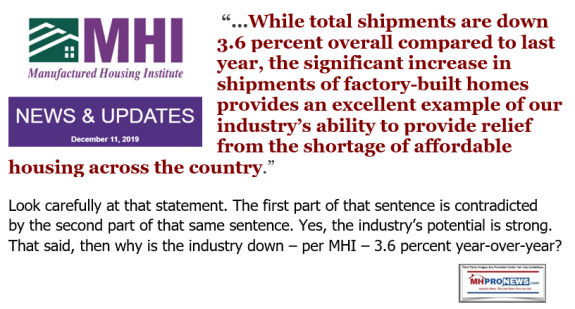

As longtime readers already know, this report will explore every part of the headline. But first this will report will continue quoting at length several more lines below from Warren Buffett’s annual letter at that time in order to fairly frame the discussion. In Buffett’s famous annual letter to shareholders in 2015, he made his formal defense of Clayton Homes and Berkshire owned manufactured housing lending against allegations stirred up by the Seattle Times and the Center for Public Integrity in an article entitled “Warren Buffett’s mobile home empire preys on the poor” published on April 3, 2015. This analysis will also glance at Financial Times writer Robin Harding’s accusation on September 12, 2017 – “How Warren Buffett broke American capitalism,” recent statements from other Manufactured Housing Institute (MHI) members and much more from a variety of third-party quoted sources – all focused on the headline themes.

“Kevin Clayton has again delivered an industry-leading performance at Clayton Homes, the second-largest home builder in America. Last year, the company sold 34,397 homes, about 45% of the manufactured homes bought by Americans. In contrast, the company was number three in the field, with a 14% share, when Berkshire purchased it in 2003.

Manufactured homes allow the American dream of home ownership to be achieved by lower-income citizens: Around 70% of new homes costing $150,000 or less come from our industry.  About 46% of Clayton’s homes are sold through the 331 stores we ourselves own and operate. Most of Clayton’s remaining sales are made to 1,395 independent retailers.

About 46% of Clayton’s homes are sold through the 331 stores we ourselves own and operate. Most of Clayton’s remaining sales are made to 1,395 independent retailers.

Key to Clayton’s operation is its $12.8 billion mortgage portfolio. We originate about 35% of all mortgages on manufactured homes. About 37% of our mortgage portfolio emanates from our retail operation, with the balance primarily originated by independent retailers, some of which sell our homes while others market only the homes of our competitors.

Lenders other than Clayton have come and gone. With Berkshire’s backing, however, Clayton steadfastly financed home buyers throughout the panic days of 2008-2009. Indeed, during that period, Clayton used precious capital to finance dealers who did not sell our homes. The funds we supplied to Goldman Sachs and General Electric at that time produced headlines; the funds Berkshire quietly delivered to Clayton both made home ownership possible for thousands of families and kept many non-Clayton dealers alive…”

– Chairman Warren Buffett from his annual letter to Berkshire Hathaway shareholders linked here. The Clayton Homes portion of the letter are on pages 17-19.

Hold those highlighted thoughts, as we return to them later. But next, let’s continue with this from the Financial Times.

Part II

There are any number of instances where people in or out of business make statements that are a mix of what is true, what is incorrect, what is spin, posturing, paltering and so forth. Billionaire Nick Hanauer is subject to the same principle of separating the wheat from the chaff as anyone else is. Manufactured housing finance expert Marty Lavin, J.D. – a Manufactured Housing Institute (MHI) Totaro award winner, who had years of street retail and communities experience too – has made several penetrating statements that can be applied to a variety of instances. “Pay more attention to what people do than what they say” is one of those Lavinisms.

That timely segue noted, Hanauer made the apt point that Henry Ford championed the notion that paying workers well created more customers and more opportunities. Ford wanted his workers to be able to afford the cars that they made.

Rephrased, doing the right thing also happens to be good for business.

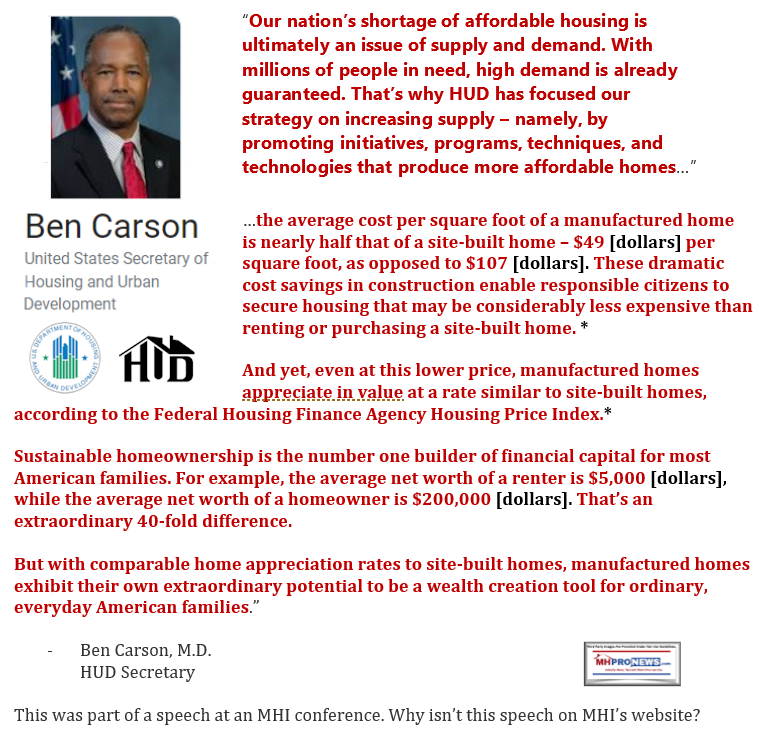

A similar principle applies to affordable housing. When more housing is made that is affordable to the masses of working class, students or retired Americans then equity or wealth is being created. More household wealth, said HUD Secretary Ben Carson, accrues to homeowners than renters by a factor of 40. So, Dr. Carson has promoted the notion of affordable manufactured homes more than any of his 21st century predecessors.

That doesn’t mean that all that Carson has done is perfect, any more than others cited herein – or this publication or writer for that matter – are perfect. Mistakes are made, or information can be lacking that allows a professional or investor to make a prudent decision. The wheat should ideally be discerned and separated from the chaff. Dr. Carson deserves credit for what’s done well, but should be held to account for what even on its face appears to be problematic.

With useful knowledge in mind, both Warren Buffett and then investor-businessman, now President Donald J. Trump have in their own words stressed the importance of having as much good information as possible about a given subject.

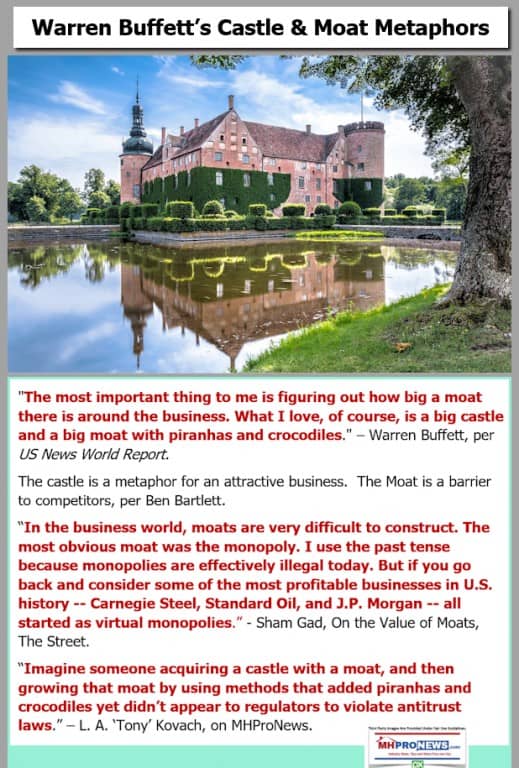

The “Castle and Moat” has several wrinkles that Harding didn’t explore, which is true of any article. There is always more left out than what is included in reports, articles or books. Financing is critical in housing, said Eric Belsky while he was with the Joint Center on Housing Studies at Harvard (JCHS). Specifically, Belsky said that “Credit is the lifeblood of housing.” But accurate and actionable information is useful – one might say, critical – too. What if accurate information about key aspects of manufactured housing could be obscured? How might that impact potential investors? Competitors? Consumers? Hold those thoughts, as we will return to it later.

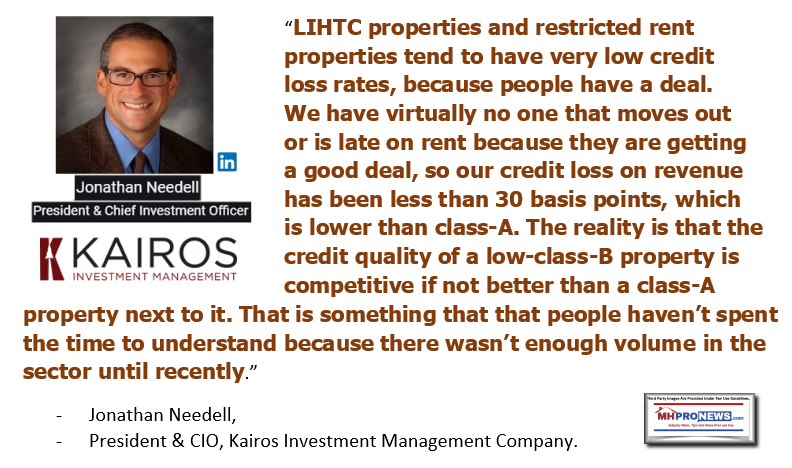

Jonathan Needell, President and Chief Investment Officer of Kairos Investment Management Company (KIMC) was recently interviewed published by Globe St. on February 05, 2020 regarding investing in affordable housing. What follows are some pull quotes from an article entitled “Investors Are Overlooking the Yields in Affordable Housing” with the subheading, “Affordable housing is historically more stable in a downturn, less volatile and often has better credit quality than class-A.”

Needell’s point above is not so different than one made by Warren Buffett in 2016 in his 2015 annual letter. Buffett said this.

But Needell adds something that is equally significant to the affordable housing crisis challenges and how that impacts on manufactured housing. Often, when new ‘class A’ apartments or other ‘affordable’ multifamily proprieties go in, there is a loss of truly affordable housing in the process. That is playing out several times a year when manufactured home communities are closed for redevelopment. Here’s Needell’s statement.

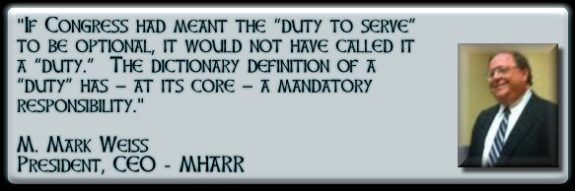

Now ponder the above in the light of the Duty to Serve manufactured housing lending. MHProNews has for years made the point that the excuses made by Fannie Mae, Freddie Mac and apparently accepted by their regulator – the Federal Housing Finance Agency (FHFA) – don’t hold up to scrutiny. There is no denying that bad lending occurred in manufactured housing for years in the roaring 1990s, which tapered off through market forces in the early 2000s. But the industry to some extent cleaned up much of its own act. That occurred without Congressional action. By contrast, the bad lending in conventional housing led the nation into the 2008 housing/financial crisis. Much of those issues which led to that crisis were dealt with – at least theoretically – by Dodd-Frank legislation. Lending to conventional housing has returned. So why is manufactured housing still being punished for ‘sins’ from some 2 decades ago?

Fannie, Freddie and the FHFA know from a variety of sources that manufactured home loans perform. The statement by Buffett is but one example of that reality. Data was reportedly provided by Triad Financial Services and Credit Human federal credit union to the Government Sponsored Enterprises (GSEs).

Other data on manufactured home lending has been available, as CFED turned Prosperity Now pointed out. So even though the Berkshire brands reportedly didn’t provide the GSEs data on their loan performance, Buffett’s annual letters, and several other indicators – like those cited herein above or are linked from this report – are more than enough reasons to take that excuse away from Fannie, Freddie or the FHFA for over a decade of their arguably not implementing federal law.

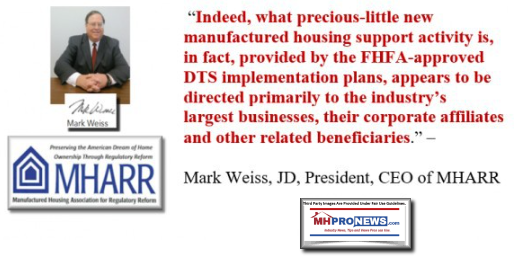

There is also the above blunt point from Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) on the Duty to Serve (DTS) manufactured housing.

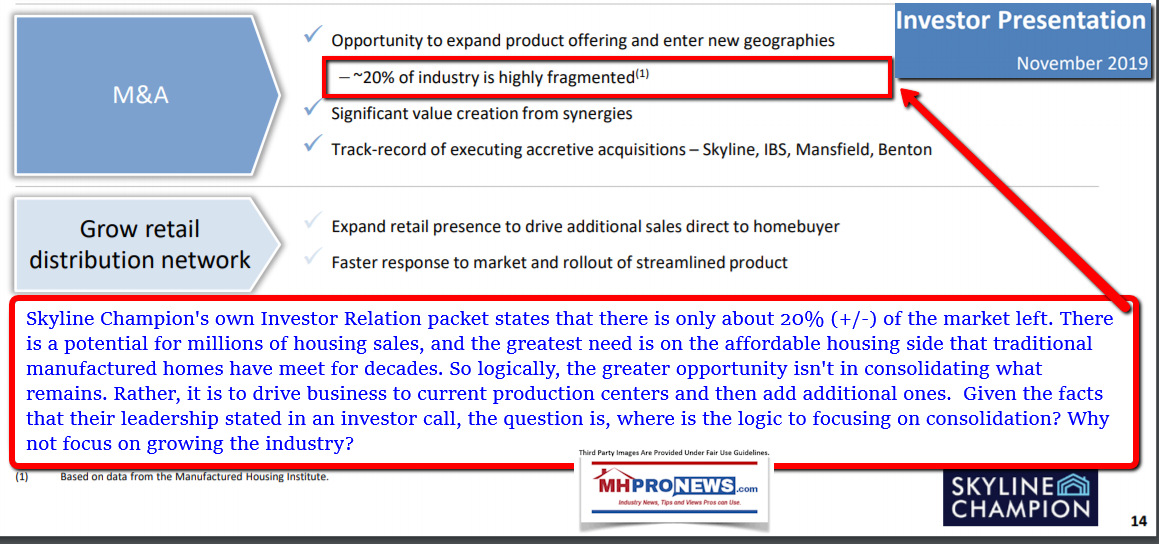

That’s a pivot point to the following from Skyline Champion Corporation (NYSE:SKY) quotes that follow.

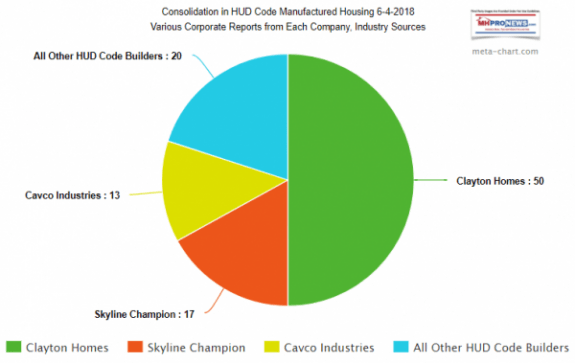

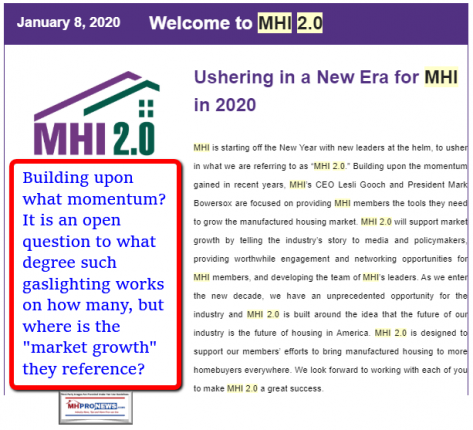

The quotation above and those that follow can be read in context from the report linked here. MHProNews and MHLivingNews have previously reported that as of late 2019 at the St. Louis FHFA listening session, only 10 of those ‘new class’ of “CrossModTM homes.” in 2018 to that point in 2019. Given two years of rah-rah from MHI, Clayton Homes, Skyline Champion, Cavco Industries and their surrogates – not to mention the investments made by Fannie Mae and Freddie Mac – the result is poor. Think about it, less than one home a month closed on the new class of home loans? If MHI’s research was accurate, how can they explain the clear failure in the marketplace?

Nevertheless, even the publicly traded companies in MHI – in this case below, Skyline Champion (NYSE:SKY) continues to push this, despite the weak performance. Why? Yost himself said in an investor call that the growth is coming from single-section manufactured homes, not MHAdvantage/“CrossModTM homes.”

There are many things that have been said by Yost and the firm’s Executive Vice President and CFO, Laurie Hough. Perhaps this statement by Hough should get 5 stars placed next to it, in terms of importance.

Notice that Hough stated herself that this is “definitely…our top priority.”

Their top priority – even more industry consolidation. That’s from the lips of the EVP of a top MHI member firm. Note how each of these quotes and facts support the allegations, case and trends we’ve been documenting for years?

Part III.

Follow this logic.

- Needell’s explained that oftentimes new housing means the replacement or loss of actually more affordable housing.

- Hough has said they at Skyline Champion are focused on consolidation. Why? The big three already have about 80 percent of the market share. Why do they need more of that remaining 20 percent of the pie? Where is the logic?

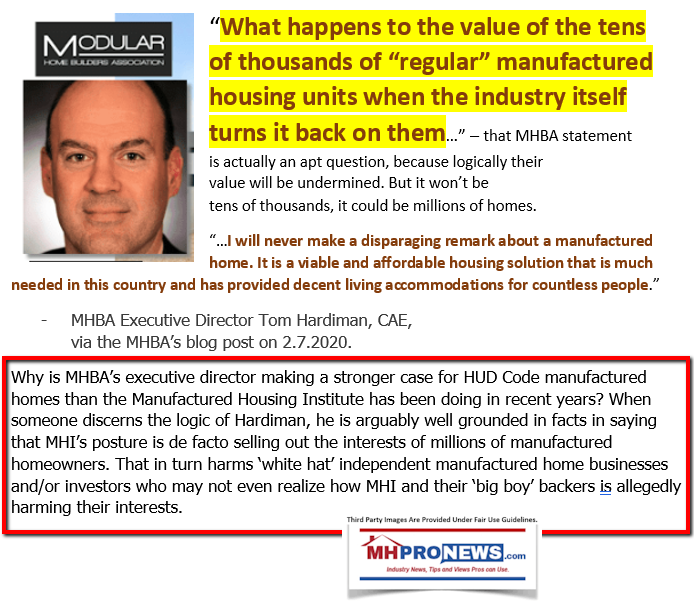

- 3. MHI’s key members are pushing for lending by the GSEs on a class of homes that is undermining the interests of potentially millions of consumers. Who says? That’s the well-reasoned logic of MHBA’s Executive Director Tom Hardiman. There is no similar push for lending on all other manufactured housing, even though they periodically posture that stance. In fact, Yost has downplayed more chattel lending by the GSEs.

- 4. Yost can’t be held responsible for something that was said after their SKY investor conference call. That said, he absolutely should have known about MHI’s position on the GSE’s cutting back on their lending targets for the new class of manufactured homes. Additionally, MHBA has publicly called for MHI to stop using the terminology of “CrossModTM” as being “deceptive.”

- 5. MHI affiliate Mary Gaiski of the Pennsylvania Manufactured Housing Association told mainstream media that the problem of zoning and placement are getting worse, not better.

- 6. MHProNews considers Tim Williams of the Ohio Manufactured Home Association (OMHA) to be a multi-year friend. Per our sources, despite Williams having previously told MHI leadership that he doesn’t want to be put ‘in the middle’ between MHProNews’ reports/analysis and MHI, Williams was ‘pushed’ recently into doing just that in an email purportedly designed to support Gooch from a person known to support this platform. We’ve been told by MHEC members how the game is played by the Omaha-Knoxville-Arlington axis and their allies behind the scenes. See the prior report on that topic linked here. That said, this quote below is part of the defense offered by Williams in the face of Gaiski and Hardiman’s recent statements.

[cp_popup display=”inline” style_id=”146657″ step_id = “1”][/cp_popup]

Summing up. MHProNews has made the case that MHI and the key members of the Omaha-Knoxville-Arlington axis have been focused on consolidation more than industry growth. The quotes above underscore that claim.

Additionally, despite Buffett’s claim that they kept non-Clayton retailers open during the post 2008 meltdown, he failed to mention how they pulled the financing from thousands of industry retailers. See that documentation and evidence at this link here. That’s arguably an antitrust violation. It could include RICO charges too, depending on how their various steps to make that collapse of retailers occur.

MHProNews can raise the issues, provide the documentary evidence, propose the rationale and logical questions. But it is up to public officials and others who are impacted by these issues who must then step up and act upon that evidence. “We Provide, You Decide.” © ## See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them. Any third-party images and content are provided under fair use guidelines.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and was recognized with the prestigious Lottinville Award in history from the University of Oklahoma, where he also studied business management with a perfect 4.0 and made the Dean’s List. Tony has earned multiple awards in manufactured housing and in history. He’s a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

Office 863-213-4090 |Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Sign Up Today!

Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates.

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.