We’ve had so many other newsy items lately, we thought it best to hold this pending MHC deal until now.

Apparently, some 50 (+/-) MHCs are in play. Word on the street is that Frank Rolfe and company have a CA with Asset Development Group (ADG/Home Source One), a portfolio that has been hanging there out for some time.

Frank’s operation already acquired a few of the ADG MHCs about 2 years ago.

Sources say the deal may be ‘done’ by mid-December. We’ll keep an eye on it and others worth noting for you.

FYI, “No comment” was the reply from ADG to our inquiry on this topic. Understandable.

There are plenty of MH deals and moves in play, in and beyond the MHC sector. Builders, lenders, investors…

…affordable housing is and will be…

…hot.

Grabbing Nettles

We posted on the Inspiration blog recently a quote from David Ogilvy, branded as the Father of Modern Advertising. While some think Ogilvy is ancient history, there are principles which are timeless. His insight on leaders being those who grasp nettles falls into that category. You can read that brief and its meaning – linked here – in 2 minutes; then jump back to finish.

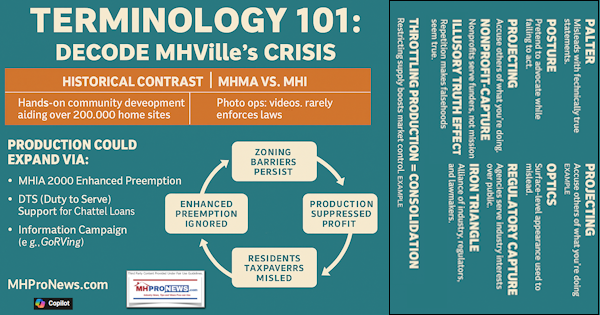

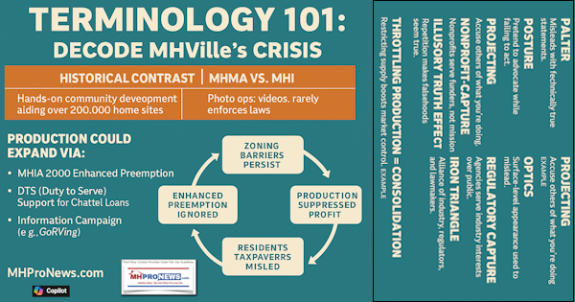

One of the problems generally seen in MH is a reluctance by too many to make changes, even when circumstances are pretty forceful in favor of change.

During the recent MHI meeting, your Masthead scribe publicly raised one of those nettlesome topics. While there was little response in the room, there was in the halls and beyond.

Among those hall and breezeway comments were “thank you” for raising good questions and thoughtful topics designed to advance the MH Industry.

Let’s use the B word…

Let’s raise a nettlesome topic here, now, today. What would it be worth to MH if we could attract billions in new capital for loans, for investments and then billions more from a new stream of credit-worthy buyers?

Answer? Obviously, billion$.

The rub? It’s nettlesome. It requires thoughtful changes from within. The changes require effort, education and work. Let’s dive in.

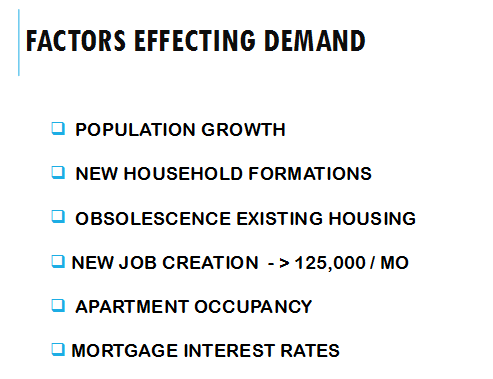

MH is part of a trillion-dollar-a-year housing industry. MH gets less than 5% of that total. Why?

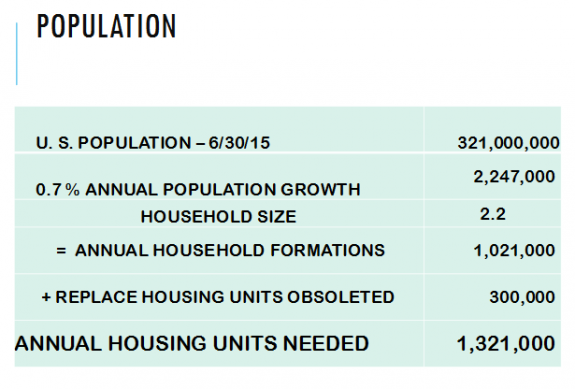

As new MHI Chair Tim Williams gave us permission to share – the power point slides below from his presentation at their annual event – there is a need for some 1.3 million new housing units a year in the U.S..

The Masthead agrees that this is just one of many items that tell pros that MH is poised for growth.

Duty to Serve (DTS), the GSEs and MH Lending

Duty to Serve (DTS), the GSEs and MH Lending

Both MHARR and MHI state they want DTS implemented. Arguably, MHARR backers say, they have more invested in that effort; certainly they believe they’re more responsible for the needle moving. MHI says, not so fast. We wanted and worked for DTS too. Hmmm…

That aside, existing MH lenders and finance experts tell MHProNews privately that they don’t expect a tidal shift as a result. Good? Yes. Helpful? Yes.

DTS…a…Game Changer?

Maybe not. More than one informed source told us they expect roughly the kind of impact on new MH sales from DTS that FHA Title I yields. That’s about 1000 homes a year. Nice! But for an industry producing about 70,000 MH on a SAAR basis in 2015, it’s hardly a tidal shift.

Some so-called non-profit consumer groups think the DTS will be the MH finance break through. They want to horse trade support for DTS via GSEs for dropping HR 650/S 682. That’s a swap we’re told isn’t happening.

Pro-Consumer non-profits, please read this link.

The View from Fannie and Freddie

The GSEs are cool to DTS. They’re making numbers of loans on MHCs, see example linked here, hoping the Feds will let that count towards their DTS.

We’re told, that won’t cut it.

So the GSEs are likely to do some form of MH lending that includes home only loans. Details are being hashed out, with the industry getting a chance to comment before it’s made final.

Also being pursued by one (or more…) groups in MH lending is an effort to create a secondary market, one that is apart from a need for DTS and the GSEs. So far, no brass ring, but those efforts/education of capital markets

continues.

Now, Let’s Swing at that Teed-up Ball…

The true game changer is both simple and profound. Yes, it requires work. It demands that scary-to-some word, ‘change.’ It may tax and strain the various turf struggles we see all too often in MHVille.

But the results from the proper effort could be the MH breakout…and that ‘out’ means UP.

The road to billion$ of more revenue flowing into MHVille could lead us to –

- 100,000 new home shipments, then

- 200,000 HUDs annually,

- 300,000 MHs sold a year, onto

- 400,000 or

- 500,000+ new HUD Code home shipments achieved over the next few years.

The way that happens is to make the exit strategy of home owners and lenders alike more akin to conventional real estate.

What does that mean?

That MH could and should in most cases (save in certain private property installations, meaning those not in MHCs), be sold with a real-estate style outcome.

Make it easy for home owners to sell, and recoup and/or profit.

Make it easy for lenders to net recover closer to break even on a loan balance. After all, one of the biggest costs that add to the rate on an MH loan is the high cost incurred for almost any repossession.

Making the MH exit strategy for buyers and lenders more like real estate, that would change the MH game, for the good.

Properly done, it changes the MHVille game forever (or for as long as the planet and the MH industry lasts).

Why?

The biggest deterrent to GSEs or anyone else is historic! Marty Lavin said it; there’s an overhang from the boom of MH that hit bust in the late 1990s.

- Change the exit,

- make MH recovery for lenders better,

- make selling with a positive outcome easier for MH lenders and home owners alike,

and then MH changes for good.

How is that done?

> By creating more demand for MH. Supply and demand is powerful.

> By making sales at a good price for the title holder a routine, vs. more of an exception.

How is that done?

> Via education,

> best practices,

> training,

> good PR and marketing.

It’s a job. It’s carefully grasping nettles. But as herbalists know, nettles and nettle teas are reputed to have positive health benefits.

FYI, we’ve seen this done in MHCs. We’ve been part of projects that raised resale values, and thus also boosted new home sales in the process. Happier buyers, sellers, home owners. Loan performance and collections all improved too.

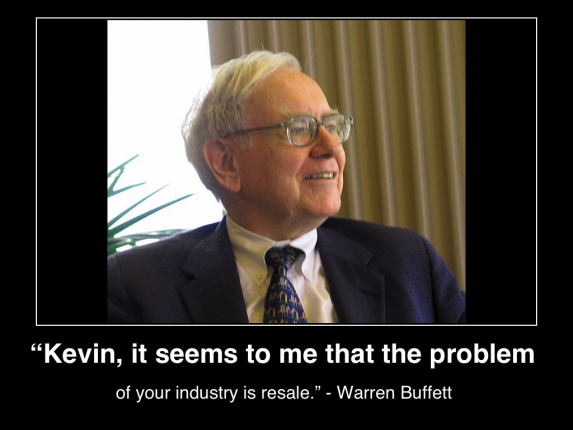

Properly grasping the nettles of the resale market is the way to go. No less a person that Warren Buffett indirectly suggested it a few years back, when he said: “Kevin (Clayton), it seems to me that the problem of your industry is resale.”

While we may disagree with Mr. Buffett’s publicly stated political stances, the Masthead take on this resale issue is that the Sage of Omaha is spot on. ##