The truth is a precious commodity, and one shouldn’t expect the truth from cheap, dishonorable, or habitually deceptive and paltering people. That’s a separating the wheat from the chaff paraphrase of a Warren Buffett observation. The truth isn’t always fun to deliver, and it may not be fun to accept. But someone is routinely better off with the truth than without it. Who says? How about Jesus Christ, who told the world that seeking and then following the truth can set us free. With that brief tee up, Michael Snyder via the Economic Collapse and the proper ZeroHedge financial news site provides some of today’s curated insights. Bloomberg and ZeroHedge are providing more evidence-based claims that a collapse that rivals 2008 is already underway. Since the Manufactured Housing Institute (MHI) and their trade journal allies and bloggers won’t tell you the way things actually are on a range of topics, the Masthead editorial blog on Manufactured Home Pro News (MHProNews.com) will. NOTICE. Every crisis is an opportunity in disguise. Who says? Oriental Chinese wisdom as recited by the late assassinated president John F. Kennedy (D).

Here is the plan for this article:

- A). Some pull quotes by Snyder.

- B). More pull quotes from ZeroHedge, which cited Bloomberg, the Mortgage Bankers Association (MBA) and others.

- C). Analysis and commentary with manufactured housing independents and our industry’s actual and potential customer base in mind.

With that outline, let’s dive into some of Snyder’s remarks.

A). What Would You Do If You Had To Go Through The Economic Horrors Of 2008 Again? By Michael Snyder

If you knew for certain that we were about to plunge into another massive economic downturn like we experienced during the “Great Recession”, how would you respond? The events of the second half of 2008 took almost everyone by surprise, and the vast majority of the population was completely unprepared for what happened next. Millions of Americans lost their jobs, and that meant that they were suddenly unable to pay their bills. Countless households got behind on their mortgages and rent payments, and we witnessed a dramatic spike in foreclosures and evictions. I wish that we would never have to see such suffering again, but unfortunately it is already starting to happen right in front of our eyes.

If you knew for certain that we were about to plunge into another massive economic downturn like we experienced during the “Great Recession”, how would you respond? The events of the second half of 2008 took almost everyone by surprise, and the vast majority of the population was completely unprepared for what happened next. Millions of Americans lost their jobs, and that meant that they were suddenly unable to pay their bills. Countless households got behind on their mortgages and rent payments, and we witnessed a dramatic spike in foreclosures and evictions. I wish that we would never have to see such suffering again, but unfortunately it is already starting to happen right in front of our eyes.

The Biden administration keeps insisting that the U.S. economy is in good condition, but if that is the case why are so many large companies now laying off workers?”

A partial list of firms was named, in and out of the tech sector, doing layoffs. Snyder continued.

“…It was also just announced that Bed Bath & Beyond will be permanently closing 150 stories and will be getting rid of about 20 percent of their corporate employees…

“Normally, retailers wait until after the lucrative holiday season before announcing store closings.

So this move seems highly unusual.

Sadly, this is all part of a “layoff tsunami” that has now started. As I discussed the other day, approximately half of all U.S. companies anticipate that they will be eliminating jobs over the next 12 months.

Needless to say, a “tsunami of layoffs” is only going to accelerate the new housing crash that we are now witnessing.

Last week, total mortgage application volume was 63 percent lower than it was during the same week in 2021…”

“…Total mortgage application volume fell 3.7% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume was 63% lower than the same week one year ago.

63 percent!

What a catastrophe.

And many other recent numbers confirm the fact that we are now past the peak of the housing bubble and are now on the way down…

Sales volume of existing homes plunged by 20% from a year ago across the US, and by 31% in California, and by 41% in San Diego. Median prices in the West have begun to drop, and in the San Francisco Bay Area fell below year-ago-levels, including by 8% in San Francisco. Sales of new houses plunged by nearly 30% year-over-year across the US, and in the West by 50%, as the supply of new houses has exploded to 11 months, the highest since the peak of Housing Bust 1. And big institutional buyers have started to pull out of this market because they don’t want to overpay. This has been going on for months.

Home prices have only just begun to drop.

They could potentially go down a lot further, because soaring mortgage rates have put home ownership out of reach for a huge chunk of the population at this point.

What we really need is for the Federal Reserve to stop hiking interest rates.

But Fed officials have already told us that they aren’t going to do that.

So the housing crash that we are currently experiencing is only going to get worse.

Meanwhile, an increasing number of renters are getting behind on their rent payments. In fact, it is being reported that 3.8 million renters believe that it is likely that they will be evicted within the next two months…

For the first time ever, the median rent in the U.S. topped $2,000 a month in June — and the increases show no sign of stopping. …”

You now have the picture Snyder’s painted. Links further below to recent reports by MHProNews/MHLivingNews will to various degrees confirm several of those concerns. We don’t have a crystal ball. But when a freight train is heading at a high speed toward a car stalled on the railroad tracks, barring a miracle, you don’t have to be a genius to know what the likely outcome will be.

But there are more reasons to think a economic crash is coming. Consider these next facts and claims.

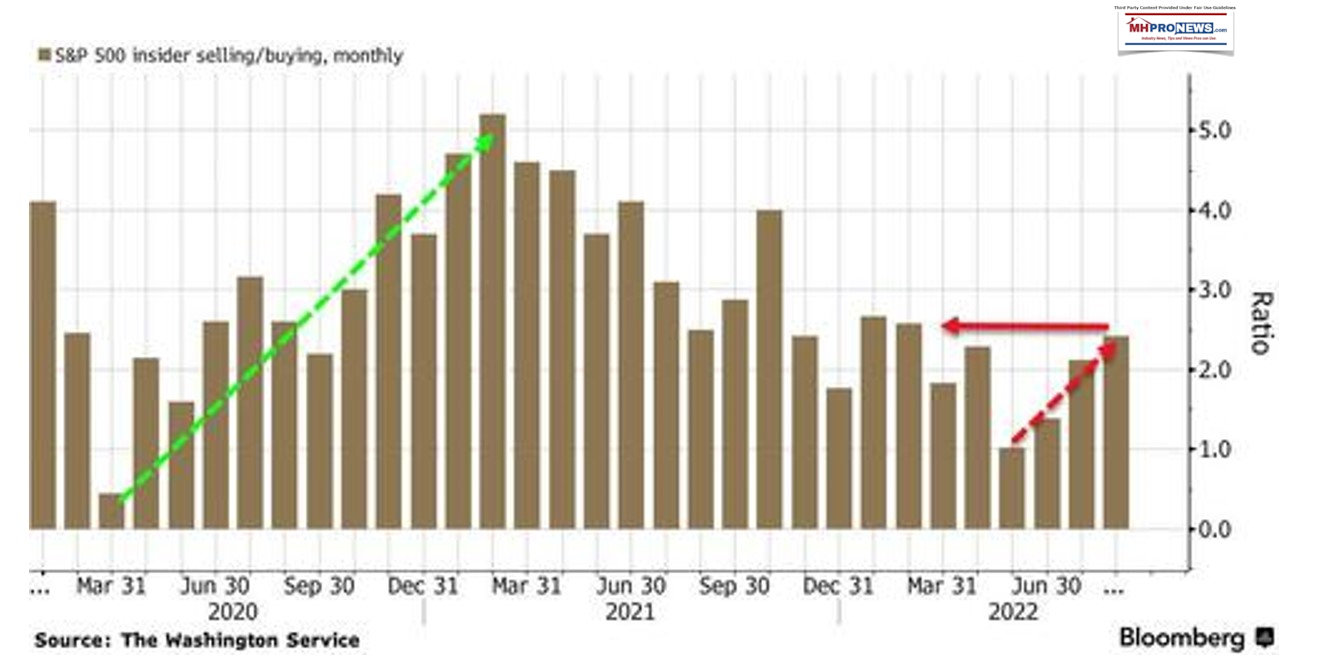

B) Insiders Are Dumping Stocks At The Fastest Pace In Months – ZeroHedge

In a 9.3.2022 report:

Having aggressively bought the f**king dip off the March 2020 lows, supported a tsunami of free money spewing forth from every government orifice, it appears that ‘insiders’ have little interest in catching the falling knife now that The Fed has turned its back.

Having aggressively bought the f**king dip off the March 2020 lows, supported a tsunami of free money spewing forth from every government orifice, it appears that ‘insiders’ have little interest in catching the falling knife now that The Fed has turned its back.

As Bloomberg reports, corporate insiders dumped their own shares aggressively in August, with some 2,150 executives hitting the sell button, the most since November 2021 on a net basis.

That’s pushed the ratio of insider selling to buying to the highest since February, data compiled by the Washington Service show. …”

“Finally, we note that it wasn’t just ‘insiders’, global equity funds had outflows of $9.4 billion in the week to Aug. 31, the fourth-largest redemptions this year, according to EPFR Global data cited by BofA. US equities had the biggest exodus in 10 weeks, while $4.2 billion left global bond funds.”

C) Additional Information with More MHProNews Analysis and Commentary

First, one must note that in a tight labor market, big companies laying off workers or closing locations isn’t automatically a recipe for more foreclosures, evictions, or other adverse outcomes. That disclaimer made, there are numerous reasons to think that the claims made in A&B above are genuine risk factors. They appear to be more probable than not, for reasons noted above and that will follow.

Our industry’s independents could be heroes that profit from what lies ahead or just another victim of ‘the coming economic collapse.’ Who says? Warren Buffett, who admonished his fellow plutocrats and oligarchs that they should be greedy when others are fearful and fearful when others are greedy. How an independent position themselves for what lies ahead could make all of the difference between a bigger or smaller bank account.

There are independents in our profession who have grown in size into rather stable and profitable regional powers. They know who they are, and informed industry readers know too, so a list here isn’t needed. Several of those firms achieved what they did precisely by preparing and acting prudently in the face of obstacles as well as opportunities. They stayed cool and made savvy adjustments when others panicked, lost out, sold out, or closed out.

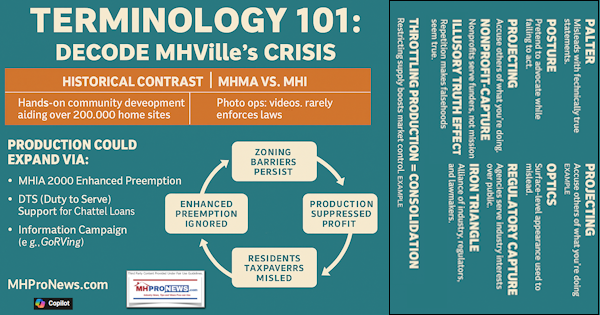

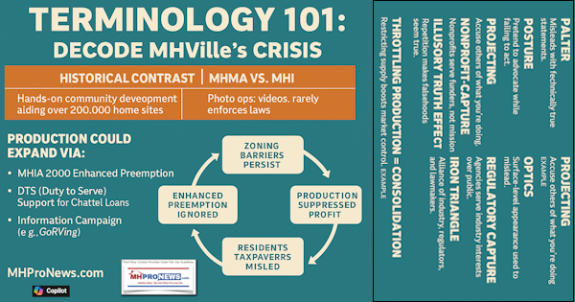

That said, the obvious favoritism of MHI toward their consolidating member firms and their repeated failures at pressing legally and otherwise for a full implementation of good existing federal laws has cost this industry literally billions of dollars annually. Current and former manufactured housing industry independents who aren’t cowering in a corner, waiting to be the next meal for a consolidator, and have the courage to fight back ought to talk to their trusted industry colleagues. They could start a post-production trade group or alliance that would make their individual jobs easier. They can’t be members of the Manufactured Housing Association for Regulatory Reform (MHARR), due to that trade group’s structure and focus. But they could find a ready ally in MHARR. At the state, regional, or national levels, such an effort could pay off handsomely.

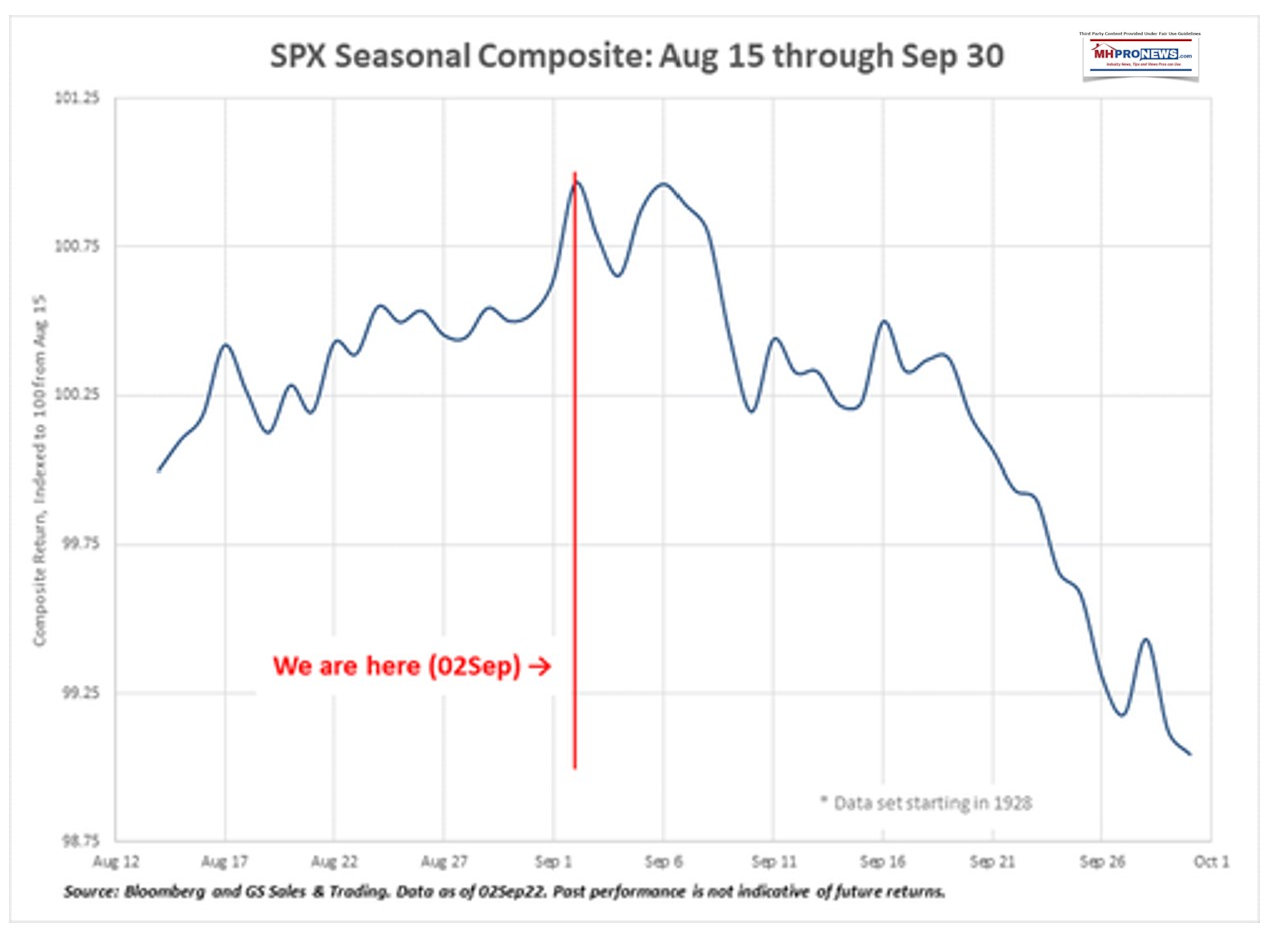

A possible wave election is forming. With primaries largely over, and the general midterm election ahead on Tuesday, 11.8.2022, there is time to get up to speed and involved in election integrity and ‘throw the bums’ out efforts that could sweep possibly dozens of seats away from Democrats who are following a big corporate agenda that is enriching a few while making the rest of us generally poorer or more in debt. As a data point to support that claim, LendingTree said: “Since the second quarter of 2021, credit card balances have risen by $100 billion. That’s a 13% increase, the largest year-over-year jump in more than 20 years.” Yes, equity in housing may be up…for now. But if a collapse comes, will that same level of equity remain? While some states such as Florida may be in a better position than others, a range of housing experts expect a drop in home values to start soon, perhaps as soon as September 2022.

The PINO Biden Junta’s party and backers know that ‘it’s the economy, stupid’ will kill them in the midterms. What is their game plan? Apparently, it is to demonize Trump and MAGA supporters. Hey, Trump wasn’t elected to be high priest of the U.S.A. He doesn’t have to be a saint to be a good president. Classic biblical examples are David and Solomon. Neither one of those turned out to be sexually virtuous leaders. But both made ancient Israel ‘greater’ than it was before they took over.

The ancients had a piece of wisdom summed up in 3 words. Ora et Labora. That’s Latin for “Prayer and Work.”

Some mistakenly think that prayer alone, or work alone, are enough in troubled times. Nonsense. Just as there are no atheists in foxholes or in airplanes that are crashing towards earth, so too there should be no atheists and agnostics in these troubled times in American and global history. We must pray as if it all depends on God. We must also work as if it all depends on us. Ora et Labora. Prayer and Work.

We must also learn to prudently push back.

Our industry’s leadership is arguably largely corrupted. That claim and case has been here on MHProNews and MHLivingNews for several years. There is no serious pushback against it. Oh, there are noise makers and posturing aplenty. But the evidence when properly examined and understood speaks for itself.

Manufactured housing should be soaring instead of mildly rising.

- Either the powers that be are inept (unlikely, given experience, education, etc.),

- or they are fumbling away great opportunities for reasons that are generally understated or unstated.

- What is necessary is simple P.E.P. principles to be applied. Protect. Educate. Promote. That MHI fails at that so often and for so many years can’t be a coincidence.

- Several of the publicly traded firms have made it clear that they want to consolidate manufactured housing. That means that every manufactured home independent is a potential target for consolidation or elimination. Those same firms have stated their support for MHI. That closes the logical circle.

When an economic downturn or collapse comes, affordable housing is more needed that before.

When times are good, there is still a need for affordable housing, because millions will never qualify for conventional housing on a modest salary.

No matter how impressive a publicly traded firm’s financial performance may seem to be, they are not as good as they ought to be. Fresh evidence for that will be presented in a planned report on an emerging factory-built housing firm that claims that have 130,000 potential buyers on their waiting list. They plan over a billion dollars in investments to produce the factories that will produce those homes.

That could be, should be and ought to be manufactured housing’s story. Not much more need be said, so the links and quotes that follow are just to dot the i’s and cross the t’s on the points already made. Read them. Understand them. Act on them. Don’t be fearful. Team up with others. Vote wisely.

After the election, whatever the outcome, organize and approach your state’s attorney general and ask them to probe the apparent corruption in manufactured housing. Some will, some won’t. But most won’t unless asked or pressed. If they don’t do it when asked directly, go to your state lawmakers and ask them to press the state AG to investigate and then act. There are laws that are apparently being ignored and violated. They cost states, taxpayers and harm consumers. Count on digital support from your pro-trust busting and anti-racketeering friends at MHProNews.

Make the best of your Labor Day weekend. Knowledge is potential power.

As Conventional Housing Slides, Manufactured Housing Sales Continue Mo – State-by-State and National Data June 2022 – Facts, Forecast, and Analysis; plus MHVille REITs, Stock Market Update

As interest rates have risen and conventional housing costs have soared in 2022, sales have slowed to the point that the National Association of Realtors Chief Economist Lawrence Yun said that the U.S. is now in a housing recession. Moody’s Analytics Chief Economist Mark Zandi said that housing is overvalued in dozens of markets.

‘Housing Overvalued’ ‘We are in a Housing Recession’ – Reports by Moody’s Mark Zandi, NAR’s Lawrence Yun Conventional Housing Manufactured Home Concerns Probed; plus MHVille REITs, Stocks Update

‘Housing Overvalued’ ‘We are in a Housing Recession’ – Reports by Moody’s Mark Zandi, NAR’s Lawrence Yun Conventional Housing Manufactured Home Concerns Probed; plus MHVille REITs, Stocks Update, 8.26.2022, manufactured housing, manufactured homes, REITs, production, factories, retail, finance, suppliers, dealers, brokers, mobile home park investing, reports, facts, analysis,

National Home Price Appreciation (HPA) Index Drops Sharply, May Go Negative by September in Various States, Says AEI Housing Center’s Ed Pinto, J.D.; plus Manufactured Home REITs, Stocks Update

National Home Price Appreciation (HPA) Index Drops Sharply, May Go Negative by September in Various States, Says AEI Housing Center’s Ed Pinto, J.D., Tobias Peter, plus Manufactured Home REITs, Stocks Update 8.22.2022, Manufactured home communities, mobile home park investing, manufactured housing, production, factories, retail, suppliers, finance, brokers,

‘Biden Administration has Obviously Taken Small Business Owners and the American People for a Ride’ JCN’s Alfredo Ortiz, ‘Hey Joe,’ ‘Stop Lying;’ plus Manufactured Home REITs, Stocks Update

Biden Administration, Obviously Taken Small Business Owners and the American People for a Ride’, Job Creators Network, JCN, Alfredo Ortiz, ‘Hey Joe’, ‘Stop Lying’, plus 9.2.2022, Manufactured Home REITs, manufactured housing stocks, 9.2.2022, production, factories, retail, suppliers, finance, brokers, mobile home park investing,

Urban Institute - 'The Role of Manufactured Housing in Increasing the Supply of Affordable Housing' in the U.S.A., Unpacking UI's Deep Dive into Manufactured Homes Research in July 2022

Urban Institute, Kaul and Pang, "The Role of Manufactured Housing in Increasing the Supply of Affordable Housing", U.S.A., affordable housing, single family homes, manufactured homes, mobile home, research report, Unpacking, Karan Kaul and Daniel Pang, UI's Deep Dive, Manufactured Homes Research in July 2022, Manufactured Housing Institute, MHI, Manufactured Housing Association for Regulatory Reform, MHARR, MHLivingNews, L A Tony Kovach,

'Sprawling Federal Censorship' New Civil Liberties Alliance Lawsuit Revelations 'Shock Americans,' State Attorneys General Involved in Legal Battle v Corrupt Feds; plus MHVille Market Updates

A headline from the National Federal of Independent Business (NFIB) to MHProNews on 9.1.2022 said: "Federal Legislation Seeks to Provide Fairness for Small Business Owners using Big Tech Services." It may not seem to be the hottest issue in the minds of tens of millions of voters who are tired of the economic toll to their personal finances.

Truth is a precious commodity, so don't expect it from cheap, repeatedly dishonest, and demonstrably dishonorable people. Enough said for today. ##

[cp_popup display="inline" style_id="139941" step_id = "1"][/cp_popup]

Stay tuned for more of what is 'behind the curtains' as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. "Tony" Kovach - for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He's a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC's and/or the writer's position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.