The Manufactured Housing Institute (MHI) won't say it, because they understandably want to be polite. The state and MHC associations, ditto. So who is going to make the point that an important industry association voice is essentially inaudible on a key financing issue facing manufactured housing?

Before making the point, let me share what a MHARR leader reminded me privately about regarding the subject of working for the passage of HR 1779. "Tony, we've told MHI that we fully support their efforts on this matter."

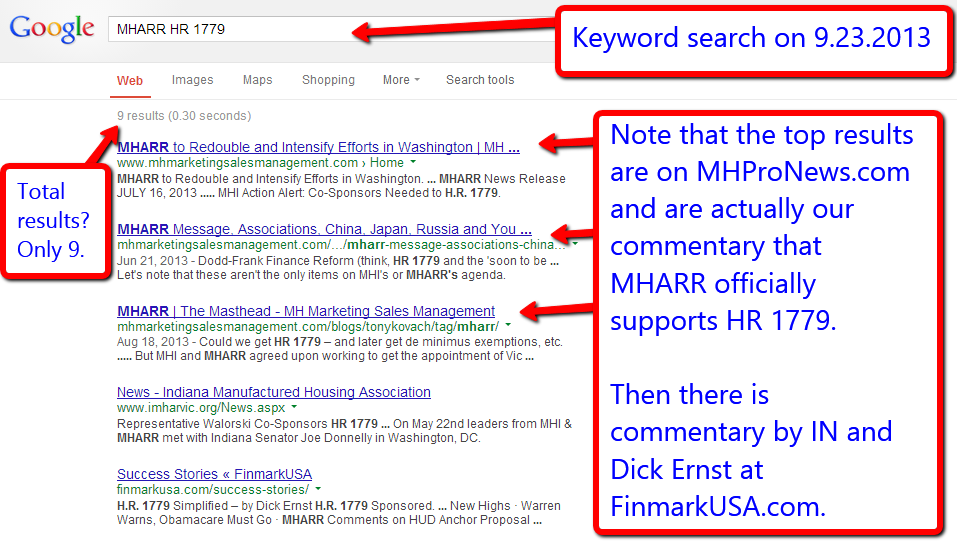

True enough, and we've reported that fact here repeatedly. In fact, that is about the only place you can read about MHARR's support of HR 1779, here…in our words, instead of MHARR's. Here's proof:

That said, when MHARR's office sends out a press release (PR) – often once, or sometimes twice a week – is it too much to hope for to see one PR that is solely focused on a call to action from MHARR followers in support of grass roots action on HR 1779?

In politics, perception is often seen as reality.

With most people reading…almost nothing…from MHARR in its press releases in support HR 1779, we are hereby calling on their office to take the obvious step of clearly supporting in a visible, public fashion what the organization already says they do in fact support.

Missed Opportunity and Error in Fact

The most recent MHARR "Washington Update" PR – seen at the link here – focuses on GSE reform, mentions HR 1779 in passing, missing the opportunity to say that MHARR supports this legislative effort and calls on their followers to robustly support it.

The same MHARR press release then tackles the topic of FHA Title I (home only) lending, which seems to included an error in fact. For the record, there are two manufactured housing lenders who can originate Title 1 loans, Vanderbilt Mortgage AND 21st Mortgage.

Editorially, we agree that there needs to be more Title I lending, and support the position taken by manufactured housing finance expert, Dick Ernst of FinmarkUSA.com, who pointed out in July 2010 in a meeting with industry and federal officials that a smaller reserve level than the so-called "10-10" (10 million dollars and 10%) could accomplish the goal.

For that matter, we agree with a subsequent MHARR statement that it wasn't Manufactured Housing financing that caused the financial meltdown in 2008, yet somehow, the MH Industry has been tarred with a heavier brush than those who were the players in that meltdown! CFPB, how is that fair?

So while we agree with the goal MHARR points to, doesn't it make sense to work robustly to protect the lenders we have and work in closer concert with them to obtain the desired goals; be it HR 1779, or more Title I lending?

A quick spotlight on Title I

A quick series of inquiries from MHProNews to our contacts about each of the industry's primary lender's revealed the following:

-

Vanderbilt and 21st both can originate Title 1 loans,

-

Triad Financial wanted to do Title 1 loans, but the second part of the 10-10 rule kept them from it. Sources say they were prepared to do the 10 million dollar reserve, but their repeated requests to officials for less than the 10% level fell on deaf ears. Given the research done by Dick Ernst on that subject, that reserve requirement is worthy of a deeper look.

-

CU Factory Built Lending, US Bank, Green Hill Financial and Mountainside Financial do not offer Title 1, and for a variety of reasons have no current plans to pursue it.

GSE Reform…Important, But…

An amazing paragraph from the MHARR Washington Update, linked above, will be quoted in its entirety below and will be followed by a quick analysis to make some points.

Based on this fluid but steadily evolving situation, MHARR has developed alternative strategies and approaches that it has already shared with its working group partners at the Manufactured Housing Institute (MHI). While focusing primarily on the development and advancement of language that would clearly, definitively and, on a mandatory basis, include all types of manufactured home loans in any final GSE reform bill, it is apparent that even with the passage of such legislation, the current GSEs will continue to exist for at least five more years – and possibly longer. Indeed, if a stalemate ultimately develops over the final shape of GSE reform legislation, the continued existence of the GSEs could be indefinite, and must be factored into the industry’s efforts to expand the securitization of private sector chattel loans, contrary to the assertions of some within the industry who have already declared (and promoted) the demise of the industry’s hard-won “duty to serve” underserved markets provision (DTS) including manufactured housing.

-See more at: http://www.MHProNews.com/latest-news-from-mharr/6290-mharr-september-23-2013-washington-update

Analysis:

-

MHARR's own words indicate that the GSE reform is potentially going no-where.

-

We'd agree that early engagement by the Industry is a good idea on the GSE reform topic, a lesson we hopefully learned from the SAFE Act and Dodd-Frank's 'unintended consequences.'

-

But why spend all this time and 'digital ink' on a topic that is likely NOT advancing soon, when there IS advancement on HR 1779! It is HR 1779 that needs the push, NOW! We have over 70 co-sponsors, that's better than last year at this time, but need more co-sponsors…when? Now!

-

As an aside, we'd agree with MHARR that the DTS in HERA 2008 should not be forgotten. Here is an example of a topic that MHI seems unwilling to invest in at present, and yet it may become more important than ever in the aftermath of what happens – or fails to happen – between now and mid-January 2014, when CFPB regs will go into effect.

There is a crying need for the parties based in and near DC to work more efficiently together. MHARR's paid staff and MHI's paid staff are each advocating for their respective constituencies, and those interests are closely aligned.

Jim Ayotte's commentary in his fine interview, A Cup of Coffee with...Jim Ayotte makes the key point. Our industry routinely fails to advance when all hands on deck are pulling in any direction save the same one! Since Jim has been a part of MHI and also has the state (“grass roots”) perspective, it seems that his thoughts on this subject are highly relevant indeed.

Let me draw to a close with yet another key set of insights from another exclusive interview we did.

In our A Cup of Coffee with…Leigh Abrams, Drew' highly successful chairman makes the point over and over of how important image building is for our industry. He points out that RVs are way outselling manufactured housing. One key reason why? Their image campaign!

Image building is NOT just about selling more homes, as important as that obviously ought to be! Until the public and public officials generally 'get it' that manufactured homes are quality, durable, affordable and appealing homes, we will be kept at a low ebb in production and respect.

So long as this or that player is more concerned with the size of their slice of a small pie, we could be suppressing the great potential of our own future.

So can we all get focused, please? Yes, we need to pull together on HR 1779. Not someday, now!

While claiming no expertise, having spoken with experts and having seen significant levels of data, in my mind there is no doubt that failure to pass HR 1779 will negatively impact the Industry but perhaps more important, it will thus impact the home values of millions of people who have low-cost pre-HUD Code mobile or post HUD Code manufactured homes.

Beyond HR 1779, we also need to move rapidly to improve our image, because the two go hand in hand. We can't hope to win on defense alone.

The victory will come if and when:

-

Industry professionals and their businesses

-

Associations

-

Consumers

all have a clear win-win-win. Win-lose often ends up being a lose-lose. In fact, the argument should be made that the list above should be reversed. If consumers are harmed, we are harmed!

Dr. Stephen Covey was spot on in his brilliant volume, The 7 Habits of Highly Successful People. “Seek first to understand, then be understood.”

Let MHARR seek to better understand MHI, and vice-versa. As just one example, without MHARR manufacturers, would the come back of the Louisville Show happened? I doubt it.

As the big boys sort all of this stuff out…

Let's all seek to truly see why the industry is not embraced by the public at large as widely and robustly as it ought to be.

When we start seeking win-wins and management by objective (MBO), we may yet obtain the desired outcomes that will benefit all involved. Can enough of us get focused and make that happen? Please?

Shall we? ##

PS: Check our many Exclusive and Red Hot Featured Articles for September and see the other new stories at MHLivingNews.com too.

L. A. 'Tony' Kovach

L. A. 'Tony' Kovach

ManufacturedHomeLivingNews.com | MHProNews.com |

Business and Public Marketing & Ads: B2B | B2C

Websites, Contract Marketing & Sales Training, Consulting, Speaking:

MHC-MD.com | LATonyKovach.com | Office 863-213-4090

Connect on LinkedIN:

http://www.linkedin.com/in/latonykovach

.png)