Ten days from today, the CFPB imposed appraisal rule for manufactured housing goes into effect. There are those who suggest that this is a consumer protection. That reminds me a bit of the Ronald Reagan punch line, “I’m from the government, and I’m here to help you.”

First, for those who aren’t among the thousands who have already accessed one of the three reports we have on manufactured homes and appraisals, let’s share those links below.

21st Mortgage

Triad Financial

This third link is about appraisals, but not per-se about the new appraisal rule. Nevertheless, it is an important topic for all doing MH land/home deals!

Cascade Financial

Making the Bitter, Sweeter

There are those who are working to make, as they put it, lemonade out of lemons on this appraisal rule. That is as it should be. Our team and myself truly do hope it works out for all involved.

That said, let’s briefly explain why this rule was logically unnecessary.

The Market At Work

No lender wants to finance a home for more than it’s reasonably worth. For decades, there has been ways of getting a third party appraisal or estimated value on a manufactured home that was selling either chattel or as part of a land/home package. The new rule is focused on home-only transactions, those not in the CFPB’s QM (see the top two links above).

So because a smart lender wants to make a good loan, there was already consumer protection in place.

Because MH lenders are lending their own dollars – vs. government-backed loan dollars – by MH lenders protecting their interests, they are also protecting those of the consumer buying the home. That’s the natural beauty of the free enterprise system at work. A lender won’t knowingly finance a home for more than its worth, thus the consumer isn’t paying more than a home is worth.

Because government is far from free – every regulation has a cost and impact – the CFPB’s new rule is simply adding a new layer of expenses on businesses. Sooner or later, those government-imposed added costs have to be paid by John Q. Public, or those businesses won’t stay in business.

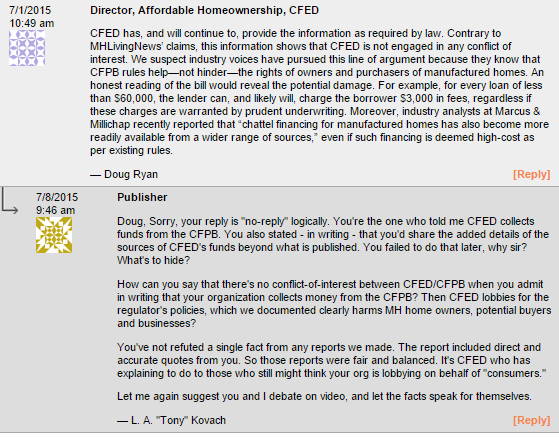

On read-hot MHLivingNews.com, we documented cases of companies that were making MH loans that no longer are doing so because of CFPB’s imposed regulatory burdens and risks. CFED’s Katherine Lucas McKay can cry on their blog all they want to on this topic. But the reality, as we documented in this report, is that there is an apparent conflict-of-interest involving CFED and the CFPB.

Please note that nowhere in her column on the CFED blog has McKay refuted any point made about their alleged conflict-of-interest or our other various reports on the negative impact of CFPB regulations on MH owners or potential customers. Ms. McKay simply recycled the same talking points that Doug Ryan used before her. By the way, Mr. Ryan, what happened to that video debate on the impact of CFPB regulations on manufactured homes you were going to do with me?

One last point for now about Ms. McKay’s column. Stop and think about her title:

I’m Home Fights Back Against Regulations that hurt Owners of Manufactured Homes

We can only hope for that today!

What they published in their headline was a faux pas from their own viewpoint. They aren’t pushing back on regulations. Rather, what they want to do is fend off the proposed reforms to amend CFPB regulations. So not even their headline is logically correct. Should you decide to read Ms. McKay’s column (see link below the comments graphic or click on the comments graphic), do make sure you read the MH Comments posted there.

It’s manufactured housing professionals, businesses and associations that are protecting MH home owners by fighting back against regulations that harm consumers and businesses alike. There is a bi-partisan push for HR 650 – which passed overwhelmingly – and the companion Senate bill, S 682, which has a Democratic sponsor. What CFED and others are doing is fighting to keep the regulations that are proven to harm MH buyers and residents alike.

More National Media Coming Soon…?

We have sources telling us that a national news outlet will be covering this MH finance issue on TV in a few weeks. More on that and other pending MH news in the media, soon.

Thanks to those who see a government solution to almost every imagined problem, consumers now have a new rule that impacts manufactured home retailers and communities just days away. What will the impact of the appraisal rule be? Time will tell, but you don’t have to be a rocket scientist to see why there needs to be a re-balance in how business is done in DC. If you missed the two prior Masthead posts, kindly check them out.

In closing, we empathize with those who want to do right by consumers and the public. I don’t doubt there are many who act with good intentions. We are pleased that CFED and others see the intrinsic value and growing need for manufactured homes. On those levels, we have and continue to applaud them. We’ve given CFED positive digital-ink before, and would gladly do so again, should they change course by correcting their clear errors on this financing topic.

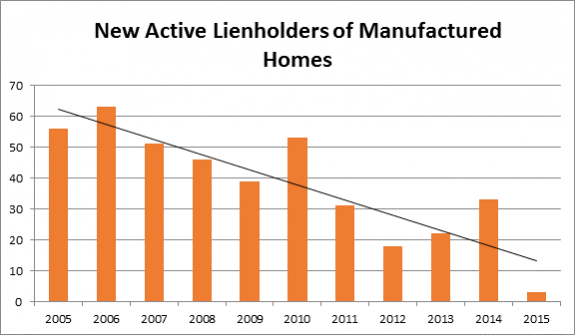

But the time is now to see how those good intentions have actually played out in the real world. We must look at how those CFPB regulations have actually impacted the marketplace! CFED et al can just look at the chart above, courtesy of the Wisconsin Housing Alliance, to see how in their state, the number of lenders making loans on MH dropped like a rock once the CFPB regulations went into effect.

Less lending? How does that help MH consumers and businesses? CFPB/Richard Cordray, are you listening? Seattle Times/Center for Public Integrity, are you seeing the facts linked above that you somehow managed to overlook in your reports?

Our sources tell us that a new anti-HR 650/S 682 push looms. Expect it to be visible anew in the media. The Preserving Access to Manufactured Housing Act is just one battle in a longer struggle against over-regulation. Its a battle that the opposition is fighting hard to win. What are you and your associates doing to make sure that we protect more MH consumers by getting that bill passed in the Senate and signed into law? ##