Before submitting the following federal testimony shown below, Kevin Clayton, President and CEO of Clayton Homes had to certify that this met “Truth in Testimony” standards and he signed certain disclosure statements to that effect. Sans the cover page and disclosure page, there are over 8 pages of testimony, or some 3700 words. He entered this testimony into the federal record on behalf of the Manufactured Housing Institute (MHI). The document that follows was obtained thanks to staff working for Democratic lawmakers in Washington, D.C.

A key point in Berkshire Hathaway’s (BRK) general success- and legal-oriented thinking is to think long-term and consider all angles. While Warren Buffett himself has contradicted his claim that his “favorite holding period [for an investment by Berkshire] is forever,” what is less in dispute is their long-term AND detail-minded thinking. That is demonstrated by his often-reported claim of spending 5 hours a day or more reading, with additional time invested in telephone conversations. Meetings are a part of his mix too. But that emphasis in reading for understanding often precedes he and his firm’s action, or inaction.

That means that those who want to survive the slow, steady – or sometimes swift – crush of the Buffett-Berkshire moat and its mechanisms for deploying and expanding a “durable competitive advantage” precisely require attention to details. With competitive advantages in mind, Buffett – said his longtime ally Bill Gates, the Financial Times’ Robin Harding, and others – looks for weaknesses in markets he is in or plans to enter in order to exploit their advantages.

But Buffett does such moat-seeking and expansion process in markets that he thinks are worthy of his time and the potential capital that would be invested by Berkshire. Who says? Berkshire supporters, including Chairman Buffett, Vice Chairman Charlie Munger, and others in the Berkshire orbit. More on that following the Democratically provided document on Clayton.

Once someone grasps these Buffett-mindsets, it ought to be obvious that he invested in manufactured homes for good reasons. Rephrased, manufactured housing is worthy of the investments of Berkshire precisely because the industry and investments are solid. It isn’t just that Clayton has a durable advantage, at least on paper, manufactured housing itself has a durable advantage – per pro-Berkshire sources – when compared to other permeant housing options.

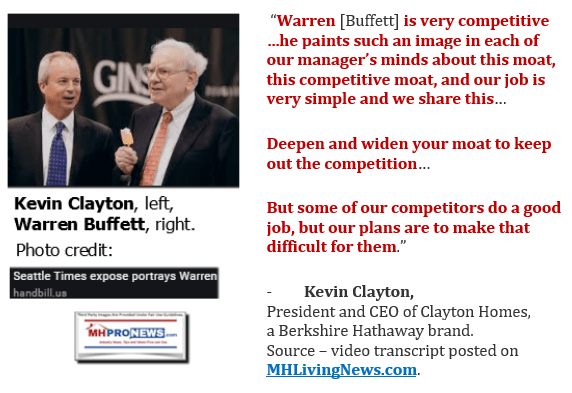

- As Kevin Clayton said in a video interview linked here, Buffett invested about $1.7 billion of Berkshire’s money in buying Clayton Homes.

- Buffett made that investments in Clayton Homes only after what Kevin called an “ugly” legal battle. Clearly, Buffett intended to win.

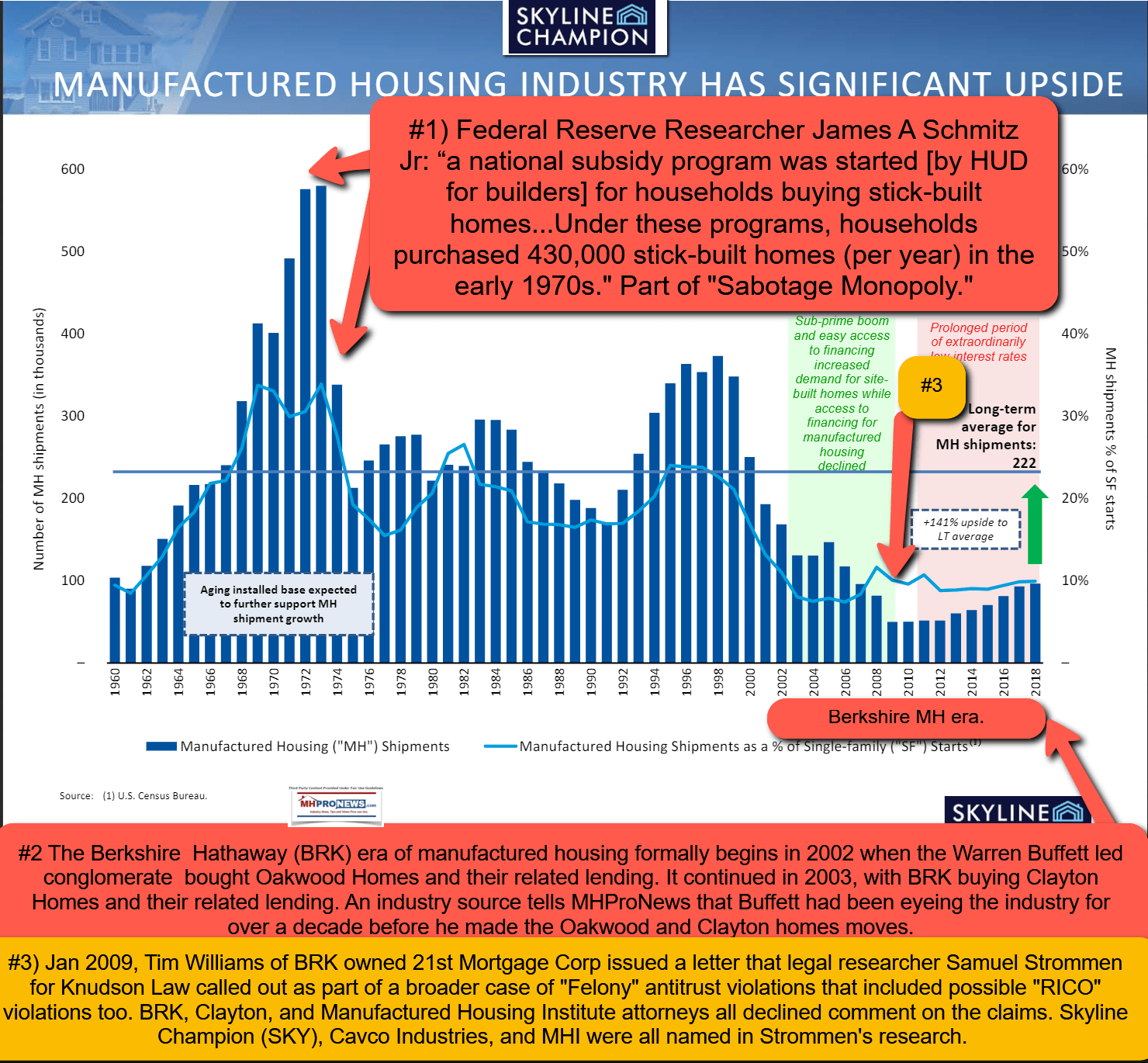

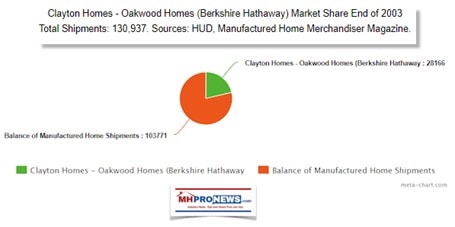

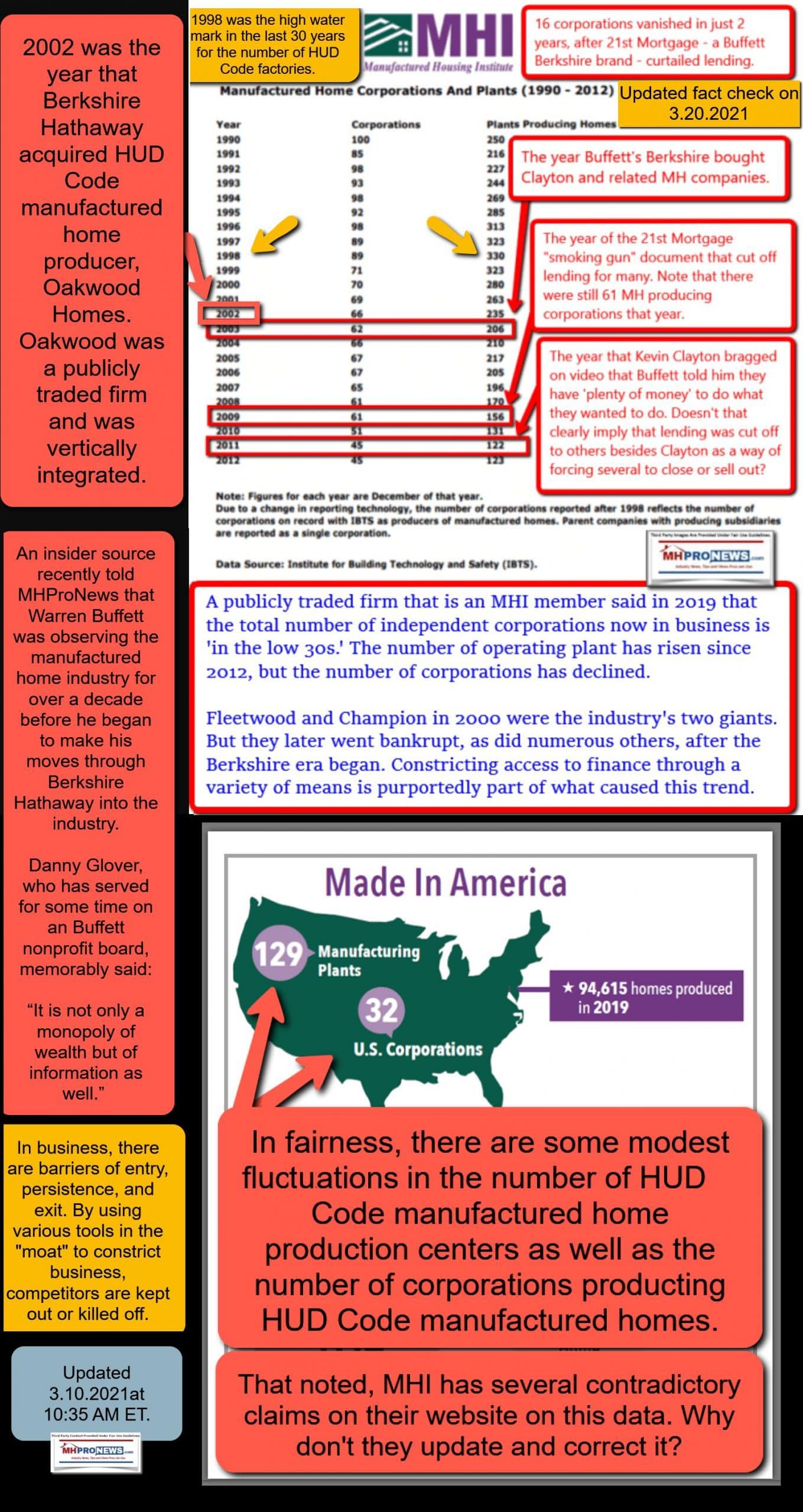

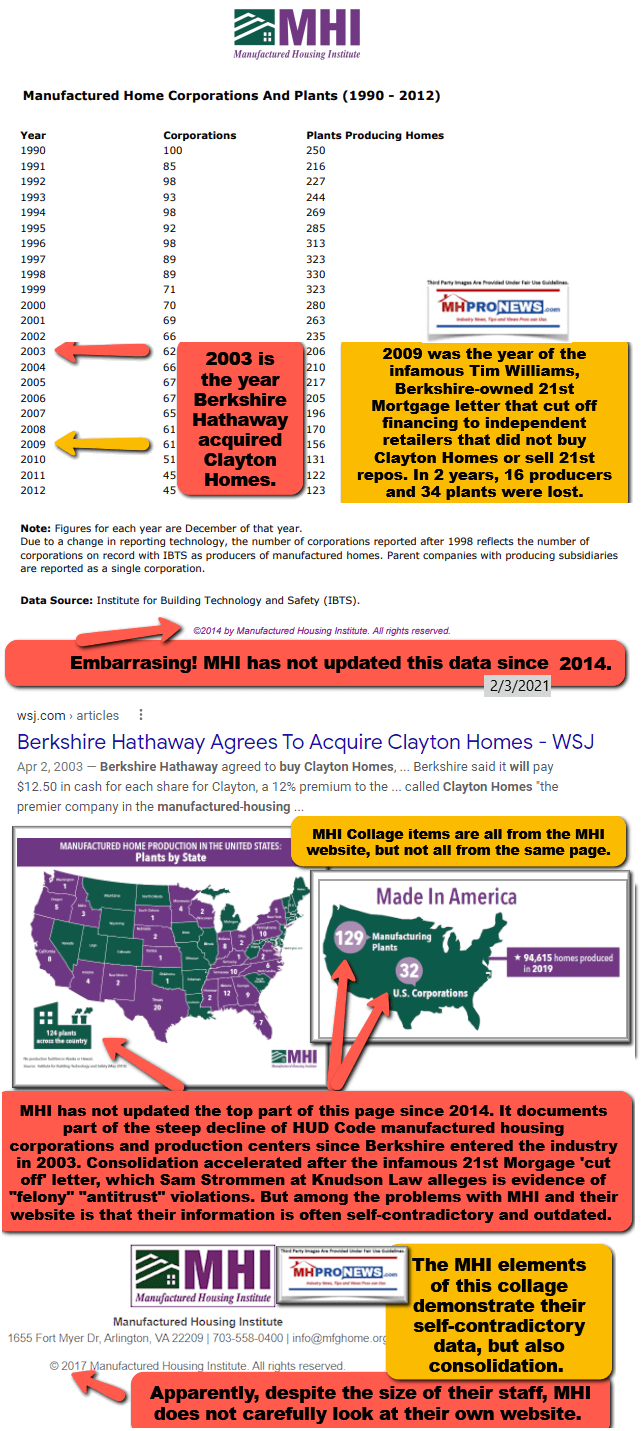

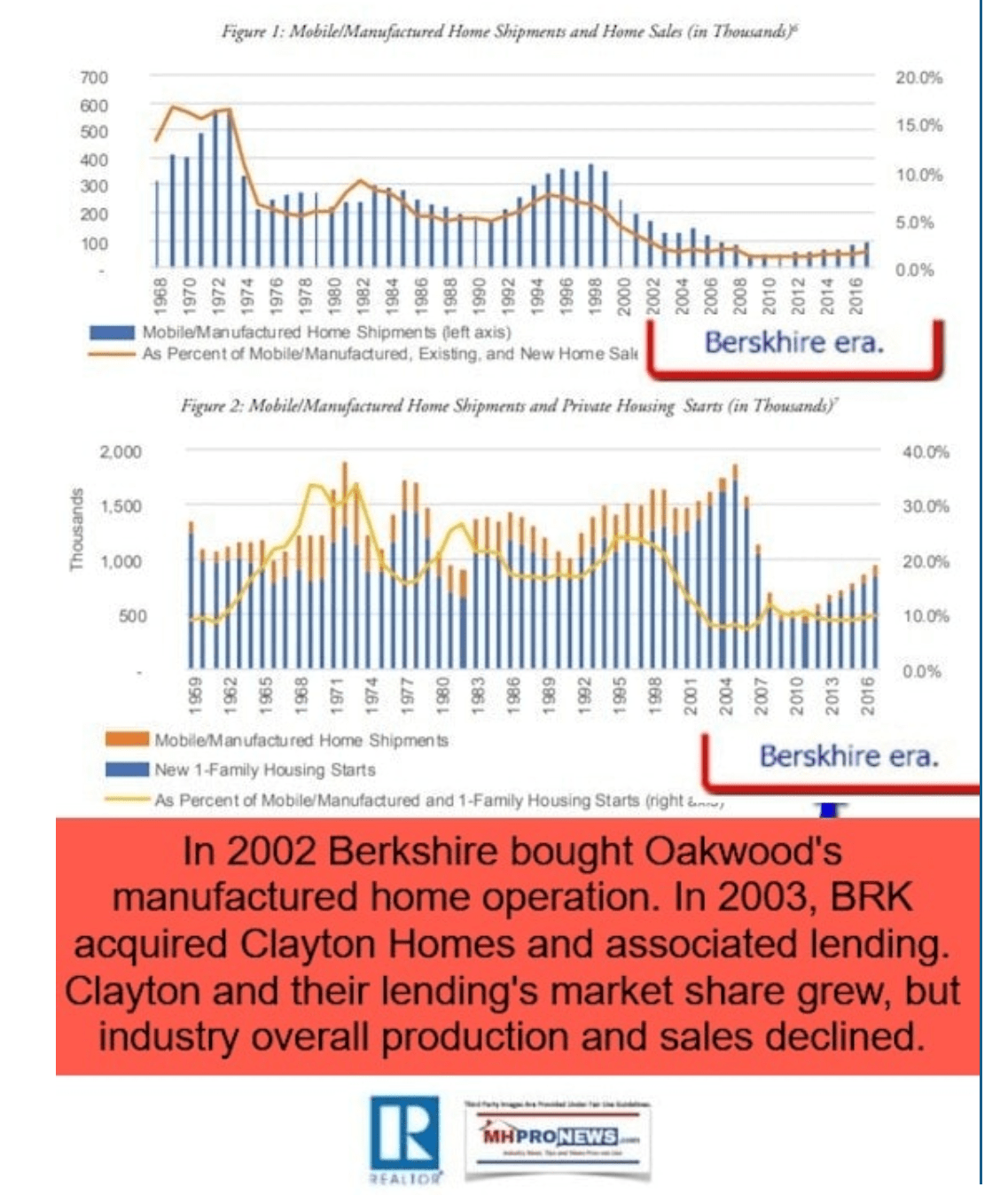

- A well-placed industry source has told MHProNews that Buffett had been eyeing manufactured housing for over a decade before he made those moves. Per that source, Buffett postured for a time about going after a different manufactured home industry firm, before he ended up making the moves that acquired first vertically integrated manufactured housing operator Oakwood Homes Corporation in 2002. Buffett then bought Clayton Homes in 2003. Formerly publicly traded Oakwood Homes Corporation (OKWH) was rolled under the Clayton umbrella, as has been numerous other once proudly independent brands.

- Following his initial $1.7 billion in investments, Kevin said on camera that Buffett has invested billions more in manufactured housing since. Those billions often went into buying loan portfolios as well as acquiring more pieces of the industry.

- Sometimes overlooked, while he was growing his overall holdings in manufactured housing, Buffett had Clayton spin off their manufactured home land-lease communities holdings. That’s a significant fact. Indeed, that merits a separate in-depth analysis for another time. But suffice it to say for now that Buffett purportedly told Clayton that he did not want to be ‘seen as raising the rents on grandma.’ But apparently it is okay in the mind of Buffett, Kevin, and the allies of Clayton at MHI for others ‘raise the rents on grandma.’ Sharp and “predatory” practices often spark resident resistance. That resident pushback in turn often yields public, press, and then political outrage. While the Berkshire brands seem to be at arm’s length from such happenings, upon closer inspection, among Berkshire’s holdings are a firm that brokers manufactured home land-lease communities. Some of those communities listed by Berkshire’s commercial real estate sales outfit were sold to so-called “predatory” firms. Additionally, some lenders that Berkshire has interests in have arranged the financing on manufactured home community lending, refinance, and other transactions too.

There are more points, of course. But that outline is sufficient to begin to set the stage for understanding the full meaning and implications of what Clayton said and its implications.

- Those weaknesses – and strengths – in the manufactured home marketplace must each be understood for a company to survive, or better yet, to thrive. By extension, for a group of companies or the industry at large to expand, there has to be attention to the nuances where the strengths and vulnerabilities of the manufactured home industry are found.

- Public officials that claim to want to solve affordable housing issues in general, or manufactured home industry woes more specifically, cannot hope to do so successfully with incomplete insights.

- Without accurate information and understanding, the GIGO principle applies. GIGO – Garbage In, Garbage Out – was an old computer programming mantra that applies well beyond their discipline. The output of information is no better than the insights that go in.

Kevin Clayton’s Revealing Congressional Testimony

What Kevin Clayton said in this historic written testimony as prepared is revealing on several levels.

In no specific order of importance, the following should be considered.

Clayton’s remarks in several ways confirms the concerns raised by MHProNews, MHLivingNews, MHARR, and other critics of how the Manufactured Housing Institute (MHI) and several federal agencies – including, but not limited to, HUD and the FHFA – have behaved in the past decade plus.

This document and related information that follows should be particularly of interest to ‘loyal’ MHI members who may not yet fully grasp why that trade group has failed to obtain the results that they have promised for years. ICYMI, the report below is useful in gaining the needed insights in the following overview.

That report linked above sheds light on the last 12+ years of MHI performance, during Democratic and Republican Administrations. It is during that broad timeframe that clarity about the current status of manufactured housing is found. It is that history that tells objective thinkers how the status quo has occurred. That said, let’s pivot back to Kevin Clayton’s (KC) revealing remarks.

Kevin Clayton specifically names the following groups and organizations.

- of the Manufactured Housing Institute (MHI),

- the Federal Housing Finance Agency (FHFA),

- the U.S. Department of Housing and Urban Development (HUD),

- the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae and Freddie Mac,

- and federal lawmakers in their oversight capacity, among others.

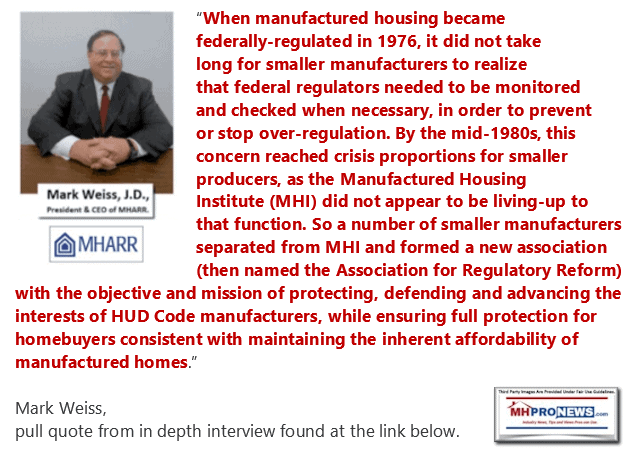

While some of the details shared by Clayton below bear refinement, the thrust of Kevin’s claims are surprisingly similar to what the Manufactured Housing Association for Regulatory Reform (MHARR), this writer in federal testimony such as the statements made in March 25, 2021 linked here, MHProNews, MHLivingNews, and other critics of MHI have reported.

But what will be of particular importance is this. Not just what Kevin said to Congress, but what he did not say. Both are of significance to those who want to get to the root issues about the causes and cures for what has ailed manufactured housing in the 21st century.

Note that since this testimony was provided by Kevin Clayton to Congress in 2011, costs on manufactured homes, and the number of homes in service has changed. So, if this is a decade old document that Democrats provided to MHProNews, why does this still matter?

Because his statements – and avoided statements – are perhaps more relevant now, in hindsight, than when he spoke these words. It is now, through the lens of history, that the importance and implication of his words, statements, and now-apparent omissions will be unpacked following his full testimony below.

The highlighting in several places in his testimony are added by MHProNews, but the text itself remains unchanged. While most if not all of what Clayton said is of interest, those highlighted items point to issues that bear scrutiny now. Several of those highlighted items will be included among the takeaways and analysis following the text of Clayton’s testimony.

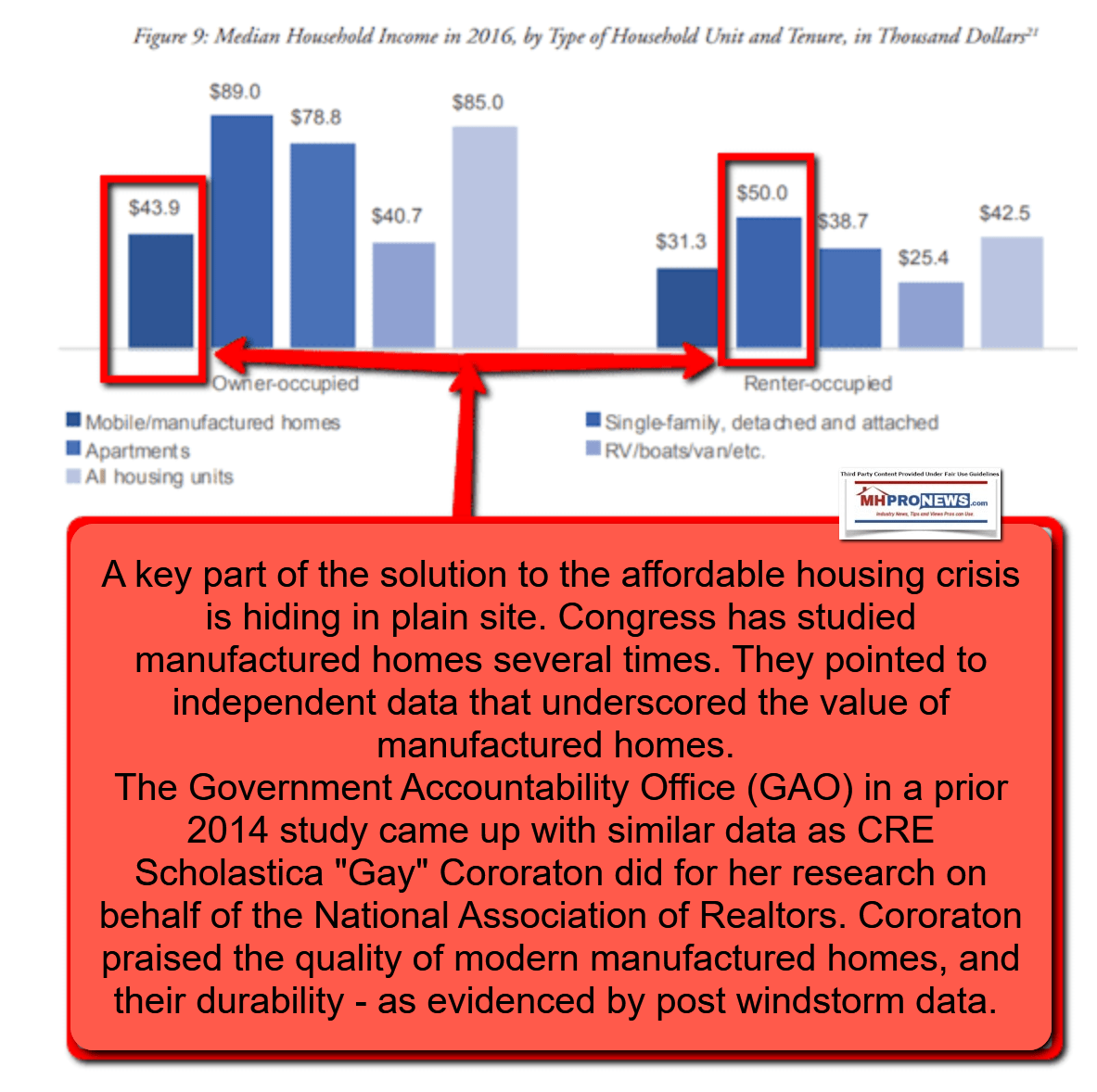

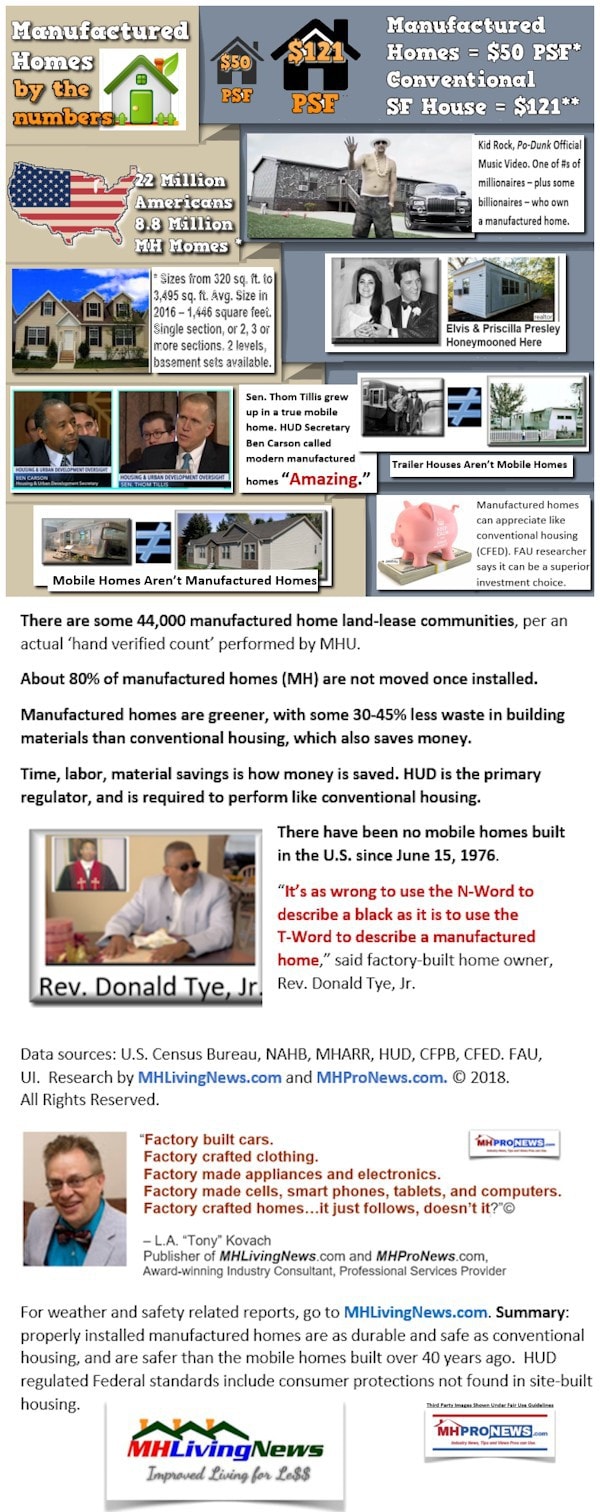

There is a claim Clayton made that is arguably an understatement that is also contradicted by another part of Clayton’s own testimony. The seemingly errant statement and one that points toward that error are both highlighted in pink. It includes this “the manufactured housing industry can produce homes for 10 to 35 percent less than the cost of comparable site‐built construction.” The savings tends to be more in the 35 to 50+ percent range on a cost per square foot basis, as MHI’s own infographic attests. Notably, Kevin Clayton has said as much too. Why Clayton and MHI publishes conflicting claims on that, the number of jobs the industry has created, or other matters are worthy topics for inquiry and reporting another time. But readers should be aware that the savings in the purchase of a manufactured home can be in the tens of thousands to hundreds of thousands of dollars per housing unit, depending on the size of the structure, as MHARR president and CEO Mark Weiss, J.D., recently pointed out by citing U.S. Census Bureau data. Once more, Kevin said something similar below, which further underscores the obvious disconnected and conflicting claims highlighted in pink.

Since his statement, 2 MHI state affiliates dropped out, due to claimed MHI ineffectiveness at delivering upon their promised claims. Those points noted, let’s dive into Clayton’s testimony.

Testimony of Mr. Kevin Clayton

Secretary, Manufactured Housing Institute

Before the

Subcommittee on Housing, Insurance and Community

Opportunity

Committee on Financial Services U.S. House of Representatives

Field Hearing on

“State of the U.S. Manufactured Housing Industry”

November 29, 2011

Danville, Virginia

Thank you, Chairwoman Biggert, Ranking Member Gutierrez and members of the subcommittee for the opportunity to testify this morning on the state of the manufactured housing market.

Thank you, Chairwoman Biggert, Ranking Member Gutierrez and members of the subcommittee for the opportunity to testify this morning on the state of the manufactured housing market.

My name is Kevin Clayton. I am appearing here as the Secretary of the executive committee of the Manufactured Housing Institute. I am also the President and CEO of Clayton Homes headquartered in Maryville, Tennessee. I have a lifetime of experience in the manufactured housing industry dating back to the founding of the company by my father, Jim Clayton in 1966. I have served as President and CEO of Clayton Homes since 1999.

The Manufactured Housing Institute (MHI) is the national trade organization representing all segments of the factory‐built housing industry. MHI members include home builders, lenders, home retailers, community owners, suppliers and others affiliated with the industry. MHI’s membership includes 50 affiliated state organizations.

Since our founding 35 years ago, Clayton Homes has built more than 1.5 million homes and won multiple awards for design and construction. In fact, we are the largest home builder in the country. The Clayton family of companies build, sell, finance, lease and insure manufactured and modular homes as well as re‐locatable commercial and educational buildings. We employ approximately 10,000 team members, and have 33 home building facilities that support more than 1,000 retail home centers. Our financial services companies finance home purchases for more than 325,000 customers and insure approximately 160,000 families. We also own and operate 18 subdivisions. Though we are still family‐led, in 2003, Warren Buffett and Berkshire Hathaway Inc. acquired Clayton Homes.

My testimony this morning will focus on three key financial, policy and regulatory challenges facing the manufactured housing market:

- Improving the flow of capital and access to credit in the manufactured housing market

- Minimizing unintended consequences in the regulatory arena that could potentially eliminate access to affordable manufactured housing

- Promoting innovation and preserving affordability through the promulgation of timely and flexible construction codes and standards

About Manufactured Housing

Manufactured housing is a key source of quality affordable housing for 19 million Americans. During this critical time for our nation’s housing markets, manufactured housing can play an even greater role in providing reliable sustainable housing for current and future homeowners looking to meet a variety of housing and lifestyle needs.

Manufactured housing is a highly regulated industry, with three distinct qualities: manufactured homes are safe, they are energy efficient, and they are affordable.

Manufactured homes are built almost entirely in a controlled environment, transported to the building site, and completed at the home‐site in accordance with federal building codes and enforcement regulations administered by the Department of Housing and Urban Development (HUD). These governing rules are commonly referred to as the “HUD Code”.

As the only federally‐regulated national building code, the HUD Code regulates home design and construction, installation requirements for strength and durability, resistance to natural hazards, fire safety, electrical systems, energy efficiency, and all other aspects of the home. Homes are inspected every step of the way and our industry adheres to a robust quality assurance program which offers far greater controls than anyone else in the home building industry.

Affordability

Our greatest attribute is delivering quality and value to consumers. Through cost savings and technological advancements in the factory‐building processes, the manufactured housing industry can produce homes for 10 to 35 percent less than the cost of comparable site‐built construction.

The affordability of manufactured housing can be attributed directly to the efficiencies emanating from the factory‐building process. The controlled environment and assembly‐line techniques remove many of the challenges encountered during traditional home construction, such as poor weather, theft, vandalism, damage to building products and materials and unskilled labor. Factory employees are trained and managed more effectively and efficiently than the system of contracted labor employed by the site‐built home construction industry.

Manufactured housing’s affordability means it has long been the housing choice for many low‐ and moderate‐income families, including retirees on fixed incomes and first‐time homebuyers. When compared to all homeowners, the median annual income of manufactured homeowners is nearly 50 percent less—$60,000 vs. $32,000 (Source: 2009 American Housing Survey).

Manufactured housing‘s importance as a sustainable source of affordable housing is reinforced by data indicating that in 2010 it accounted for:

- 72 percent of all new homes sold under $125,000;

- 47 percent of all new homes sold under $150,000; and

- 27 percent of all new homes sold under $200,000.

Manufactured homes serves many housing needs in a wide range of communities—from rural areas where housing alternatives (rental or purchase) are few and construction labor is scarce and/or costly (nearly two of three manufactured homes are located in rural areas), to higher cost metropolitan areas as in‐fill applications. Without land, the average purchase price of a new manufactured home is $62,800 versus $272,900 for a new site‐built home (Source: U.S. Census Bureau), which is affordable by almost any measure.

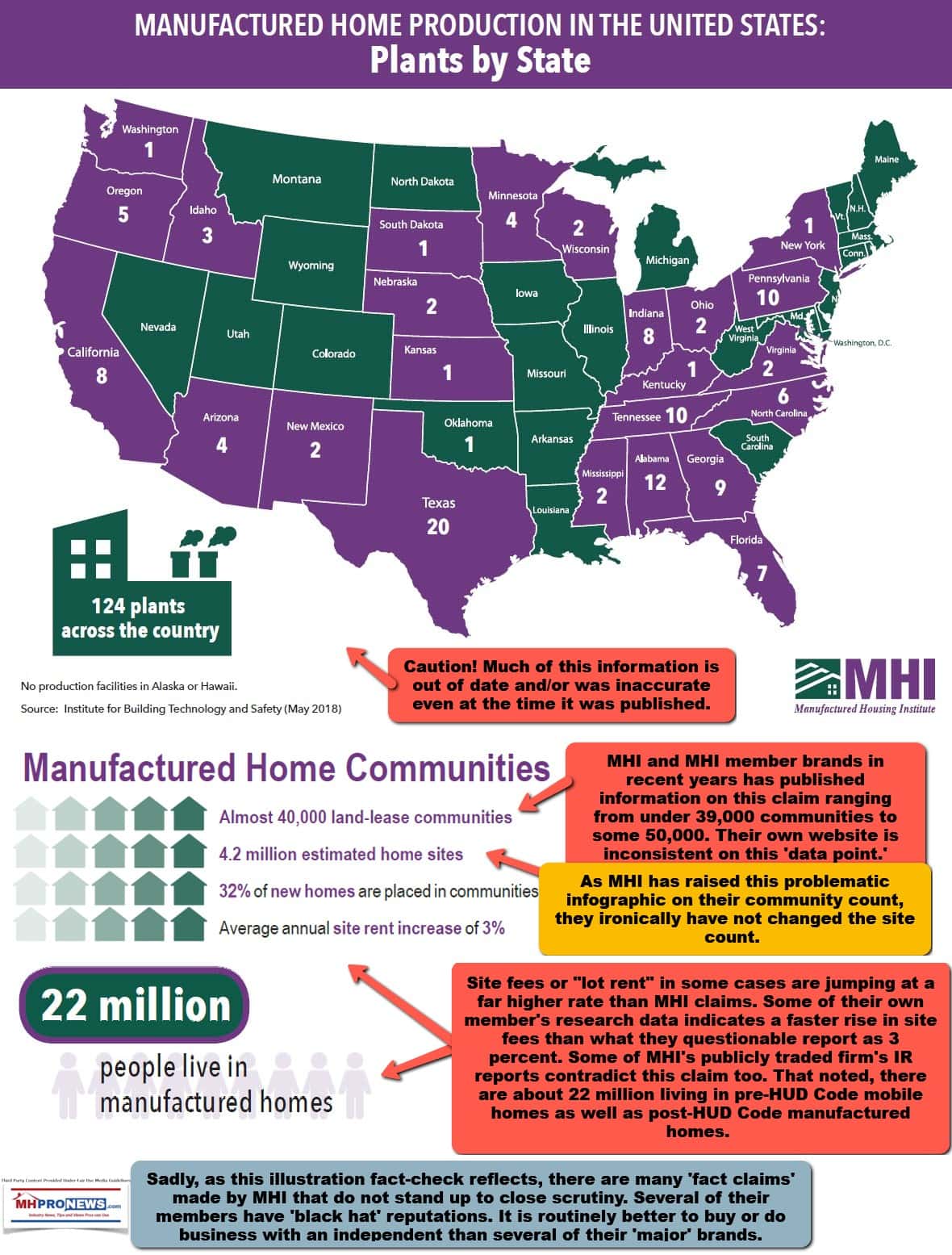

In addition to the valuable role it plays in providing reliable, efficient and affordable housing for 19 million Americans, the manufactured housing industry is an important economic engine. In 2010, the industry produced 50,000 new homes, which were produced in more than 120 home building facilities, operated by 45 different companies, and sold in 4,000 retail home sales centers across the U.S.—generating 75,000 full‐time, good‐paying, jobs.

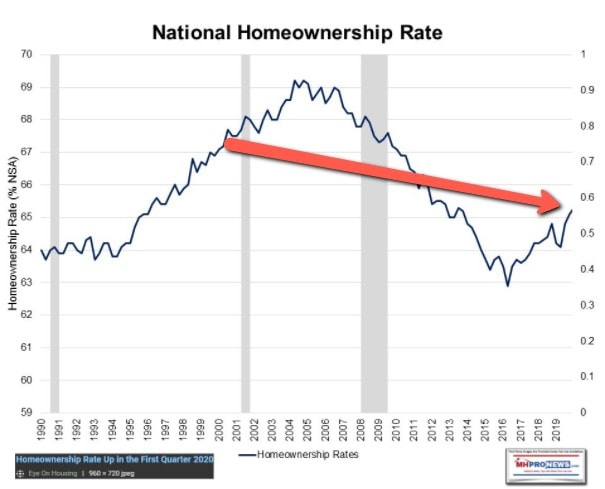

The Economic and Regulatory Challenges

Despite its role as a valuable source of affordable housing; a driver of the U.S. economy; and a model of efficiency and sustainability in the larger housing industry, the manufactured housing industry has had ongoing challenges over the past decade. Since 2005, the pace of new manufactured homes sold in the U.S. has declined by 65 percent (146,881 in 2005 vs. 50,046 in 2010) and there has been a decline of nearly 80 percent since 2000 (when 250,419 new manufactured homes were produced).

While the pace of sales for new single‐family site‐built housing has also declined by roughly 75 percent since its peak in March 2005, the decline in manufactured home sales actually pre‐dates the 2007 housing market crash.

The decline in home sales and activity within the manufactured housing market coincides with a number of challenges:

- the growth of subprime lending in the traditional site‐built lending market diminished the affordability advantage of manufactured housing;

- the lack of liquidity and credit in the manufactured housing finance sector has limited financing options for our homebuyers;

- the uncertainty and impact of new financial services and mortgage finance regulations has hindered growth; and,

- slow pace of adoption for new standards within the HUD Code has prevented the manufactured housing industry from remaining on the cutting‐edge of design and construction.

Like the site‐built housing market, the manufactured housing industry can appreciate the difficulty and uncertainty of operating in a stressed environment. New manufactured home construction has fallen roughly 80 percent over the past decade, which has accounted for more than 160 plant closures, more than 7,500 home center closures, and the loss of over 200,000 jobs. More importantly, thousands of manufactured home customers have been left unable to buy, sell or refinance homes. Without action in the following key areas, the people who live in manufactured homes and whose livelihood is connected to this industry are at significant risk.

Improving the flow of capital and access to credit in the manufactured housing market

Over 60 percent of manufactured homebuyers finance their purchase using a personal property loan where the dwelling alone is financed. The ability for lenders to securitize manufactured home loans in the secondary market, particularly those secured by personal property, has been very limited.

MHI and its members have long demonstrated to rating agencies, investors, Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA), Ginnie Mae and others that manufactured housing lenders operate within a disciplined lending environment.

Despite this performance, the government‐sponsored enterprises (GSEs) have had little involvement and displayed little interest in financing and securitizing manufactured home loans. Less than one percent of GSE business comes from manufactured housing and none of that comes from manufactured home personal property loans. This is in spite of data indicating that since 1989 manufactured housing has accounted for 21 percent of all new single family homes sold in America.

This barrier has effectively shut off the development of a viable secondary market for manufactured home loans leading to higher financing costs. The development of a viable secondary market would dramatically improve liquidity in the credit‐constrained manufactured housing market and provide potential buyers with more ready access to loans to purchase affordable manufactured housing.

As federal policymakers debate the form, shape and structure of a new housing finance system and secondary market mechanism, MHI agrees with many in Congress and other housing stakeholders that any secondary market housing finance structure should be supported by private capital. In addition, MHI believes that any secondary market –particularly if it is supported by a government backstop –should provide equal and open access to manufactured home loans secured by either real or personal property.

As part of the Housing and Economic Recovery Act of 2008 (HERA; P.L. 110‐289), Congress directed Fannie Mae and Freddie Mac to establish a secondary market for manufactured home loans, including those secured by personal property. However, given the conservatorship status of the GSEs, the continued sluggishness of the housing market, the uncertain regulatory environment, and concern over taxpayer exposure this mandate has remained unimplemented by GSE’s regulator and conservator —the Federal Housing Finance Agency (FHFA).

In moving forward, we encourage Congress to support the creation of a secondary market that allows for loan products, including all manufactured home loans, to compete on a level playing field absent barriers and prejudicial treatment. Improving the prudent flow of capital to the manufactured housing financing sector will lower lenders’ cost of capital. This will draw more lenders to the market, increasing competition, lowering financing prices, and enabling more consumers to choose manufactured housing.

Correct the Regulatory Threats to Affordable Manufactured Housing

The manufactured housing industry has always been fully committed to protecting consumers throughout the home buying process. MHI recognizes the importance of responsible lending and improving the consumer experience. MHI has also consistently urged Congress to consider the unique nature of manufactured housing lending and to avoid measures that would inadvertently curtail lenders’ ability to make manufactured housing loans.

Over the past year, MHI has been working on a bipartisan basis to educate Members of Congress and the Administration of some of the unforeseen impacts recently enacted legislation would have on limiting access to credit for the purchase of affordable manufactured housing.

Specifically, provisions of the Dodd‐Frank Wall Street Reform and Consumer Protection Act (Dodd Frank Act; P.L. 111‐203) and the Secure and Fair Enforcement of Mortgage Licensing Act (SAFE Act; P.L. 110‐289) would have the unintended consequence of limiting the availability of and access to credit for the purchase of low‐cost affordable manufactured housing.

First, the manufactured housing industry is concerned that the significant revisions to mortgage finance and anti‐predatory lending laws outlined in the Dodd‐Frank Act will disparately impact manufactured home lending. The Act adds significant new requirements on residential mortgage loans, including limitations on mortgage origination activities and high‐cost mortgages, which will make it more difficult for manufactured home buyers to obtain affordable financing.

Many of the new regulations that would be imposed on mortgage lenders by the Dodd‐Frank Act are designed to curtail questionable lending practices such as zero down payment loans, balloon notes, and stated income loans, which helped bring about the recent decline in the housing market. While the manufactured housing industry and manufactured homeowners played no role in this decline and for the most part maintained prudent underwriting standards, the Act would unfairly lump small balance loans used to purchase affordable manufactured housing into the same category as subprime predatory site‐built mortgages.

Section 1431 of the Dodd‐Frank Act expands the range of loan products that could now be classified as “high‐cost mortgages” under the Home Ownership and Equity Protection Act (HOEPA). A loan would be considered “high‐cost” if the Annual Percentage Rate (APR) or “points and fees” exceeds certain thresholds. Unfortunately, the limits established in the Dodd Frank Act were set without a full understanding of the economics of originating and servicing small balance manufactured home loans.

While drafters of the Dodd‐Frank Act recognized that large multi‐national banks and small community banks could not be regulated in identical ways; the same realization was not reached for manufactured housing loans. Specifically, statutory thresholds for a $200,000 loan and a $20,000 loan cannot be set and evaluated in the same fashion, which is the effect of Section 1431 as it is now written. The cost of originating and servicing these two different size loans is essentially the same in terms of real dollars. However, the cost, as a percentage of each loan’s size, is significantly different. It is this difference that causes the smaller‐sized manufactured home loan to potentially exceed the thresholds in the Act and be categorized as “high‐cost” or predatory under HOEPA, even though there is nothing predatory about the features of the loan.

In addition, the lack of a secondary market means lenders are typically forced to hold manufactured home loans in their portfolios, which makes cost of capital associated with originating manufactured home loans higher for these lenders versus those which are able to securitize real property mortgages through the GSEs or through asset‐backed securities.

Under this new provision, the propensity for a loan to be classified as “high‐cost” greatly increases as the loan size diminishes. According to the American Housing Survey (AHS), the median purchase price of a manufactured home (including new and existing home sales) is $27,000 (versus $107,500 for all occupied units according to 2009 American Housing Survey data). Potentially half of all loans to purchase manufactured homes, or more than four million (out of 8.7 million nationwide), could be at risk of being categorized as “high‐cost mortgages.”

An internal analysis of our company’s lending activities yields similar results. Of all loans made year‐to‐date, more then 50 percent would be classified as “high‐cost mortgages” under the HOEPA revisions outlined in the Dodd‐Frank Act.

Due to the increased liabilities, responsibilities and stigma associated with making and obtaining a HOEPA “high‐cost mortgage,” it is likely that a majority of these loans would not be made. Potentially millions of families could see the ability to sell their homes effectively wiped out because lenders would be unwilling to provide the financing needed to sell them.

While a significant percentage of manufactured home loans may have rates higher than traditional site‐built mortgages, the terms typically associated with manufactured home loans— namely fixed interest rates, full amortization, and the absence of alternative features (such as balloon payments, negative amortization, etc.)—allow them to satisfy the requirements of what the Dodd‐Frank Act would consider conservative and prudent underwriting standards as outlined under the “qualified mortgage” definition in Sec. 1412.

In addition, based on existing regulatory requirements and additional statutory guidelines outlined in the Dodd Frank Act, provide significant consumer protections and disclosures while prohibiting many predatory loan features. These provisions ensure substantial protections are available to consumers without having to subject a majority of manufactured home loans to the onerous HOEPA “high‐cost mortgage” designation.

Fortunately, MHI has been working with majority and minority leaders of the House Financial Services Committee to develop a bipartisan solution to this issue that will provide technical correction and relief while maintaining adequate consumer protections.

The manufactured housing industry also has concerns over the lack of clarity provided in implementing the SAFE Act. The SAFE Act was designed to enhance consumer protection and reduce fraud by requiring states to establish minimum standards for licensing mortgage loan originators.

There has been substantial confusion among states in applying the SAFE Act to manufactured home retailers and their salespersons; those financing the sale of their own manufactured homes; and, those engaging in a minimal level of loan origination.

Prior to enactment of the SAFE Act (or issuance of final federal regulations), states began adopting versions of a model/uniform act. HUD issued a final rule in July 2011 that provides some regulatory clarification in recognizing the delineation between the treatment of individuals who undertake the sale of manufactured homes and individuals who engage in the loan origination business, but uncertainty in application of the rule still exists.

Specifically, additional statutory guidance is necessary to ensure that individuals who assist and aid customers in the manufactured home buying process are not categorized as loan originators for purposes of the SAFE Act.

The process of purchasing a manufactured home has some substantial differences from purchasing a site‐built home. The ability of a manufactured home retail salesperson to provide key technical assistance in the home buying process absent the risk of being arbitrarily classified as a mortgage loan originator for purposes of the SAFE Act is critical.

Similar to real estate brokers whose activities Congress specifically exempted from SAFE Act licensing requirements, manufactured home retailers are fundamentally in the business of selling homes; they are not in the loan origination business. However, like real estate brokers, manufactured home retailers and sales personnel are fundamentally engaged in providing technical assistance throughout the home buying process. Their core mission is to help a customer through the home buying process. It is not to originate mortgage loans.

In addition, due to the limited financing options available to manufactured home buyers, the ability of retailers and sellers of manufactured homes to provide buyers with adequate information regarding lending options available or to allow manufactured homeowners to finance the sale of their own homes is critical to preserving the availability of manufactured homes as an affordable housing source.

MHI has been working to educate Members of Congress and the Administration, including the new Consumer Financial Protection Bureau (CFPB), which has now assumed jurisdiction over the SAFE Act from HUD, on the need for enhanced clarity and certainty in the SAFE Act implementation process.

MHI is grateful for the diligent support Chairman Bachus and Ranking Member Frank have provided on this issue over the years. Last year, during HUD’s rulemaking process, Reps. Bachus and Frank formally requested that HUD provide clearer guidance to states on the treatment of manufactured home retailers and that HUD clarify that states have the ability to provide exemptions to those engaging in minimal levels of loan origination or activity that is occurring outside of a commercial context. The manufactured housing industry and MHI hope to build on this guidance so that both the statute and regulation can provide clearer guidance and relief to manufactured home sellers.

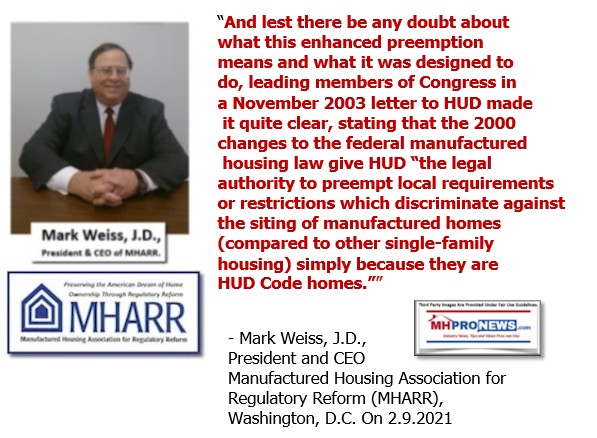

Promote Innovation and Affordability with Timely Construction Codes and Standards

A fundamental reason manufactured housing can serve as a viable source of affordable housing is because of its uniform preemptive building code (The HUD Code) and efficient procedural and enforcement regulatory system, which was established by the Manufactured Housing Construction and Safety Standards (MHCSS) Act of 1974 (42 U.S.C. 5401 et seq.). Federal preemption is essential to the manufactured housing industry’s reliance on interstate commerce to produce and distribute housing. A clear advantage for keeping homes affordable is to utilize a single building code and enforcement system.

As with all things, the industry believes the HUD‐Code is a “living” code, which needs constant attention and updates in a timely and logical manner.

Subsequent changes to the law with the enactment of the Manufactured Improvement Act of 2000 (P.L. 106‐569) made significant enhancement to the MHCSS Act by:

- establishing a balanced consensus process for the development, revision and interpretation of construction standards;

- creating a ‘Non‐Career’ position within HUD to oversee the manufactured housing program

- establishing model manufactured home installation standards; and

- establishing a program to enforce standards in states that choose not to implement their own programs and enhancing the federal preemption of the HUD‐Code.

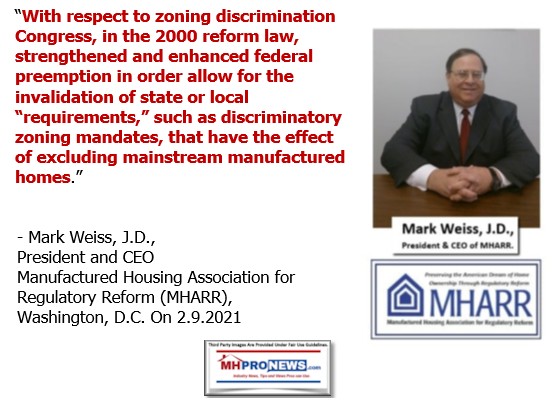

Despite these improvements, HUD has been unable to keep the HUD Code updated in a manner consistent with other building codes. This has made it difficult, if not impossible, for the industry to utilize state‐of‐the‐art building products and technologies. In addition, outdated building codes have left the industry vulnerable to discriminatory zoning and local regulatory restrictions.

Even with Congressional action to significantly strengthen preemption of the HUD Code and its enforcement regulations, HUD has failed to change its outdated 1997 policy guidance on preemption. More importantly, HUD has been unwilling to intervene when state and local regulators attempt to mandate requirements above and beyond the HUD Code or when communities use local zoning to unlawfully prohibit or restrict the placement of manufactured housing.

Next, despite the industry’s importance to millions of Americas, HUD has lagged in establishing manufactured housing as a key component of its overall housing mission. For example, HUD’s FY 2010‐2015 Strategic Plan fails to mention the manufactured housing program as one of the tools for meeting HUD’s mission and goals. In the plan, HUD has identified 5 major goals and 18 sub‐goals to fulfill its mission, yet the manufactured housing program is mentioned only once— “to protect and educate consumers when they buy, refinance or rent a home.”

The manufactured housing program has been without a ‘Non‐Career’ Administrator for several years. Congress intended the Administrator to oversee the development of codes and standards to ensure that the program is managed in accordance with the law, and to act as an advocate for manufactured housing in HUD’s overall mission, policies and programs. Appointment of a Non‐Career Administrator would serve to enhance the role manufactured housing plays within HUD’s overall mission.

Finally, since 2009, HUD has not appointed collective industry representatives to the Manufactured Housing Consensus Committee (MHCC), even though other program stakeholders continue to be represented by appointees from collective organizations. This has severely impaired representation of the industry on the MHCC, depriving it of the benefit of the knowledge, know‐how, expertise and institutional memory that the industry’s national trade organizations uniquely possess. Appointment of these industry representatives is essential to the maintenance of standards that will properly balance safety, workability and affordability.

Chairman Biggert, Ranking Member Gutierrez and members of the subcommittee I thank you for the opportunity to testify and welcome any questions you may have.

##

Clayton’s testimony with the so-called ‘Truth in Testimony’ certification is found at this link here.

As was noted above, the highlighting was added by MHProNews,

but the text was as in the original document.

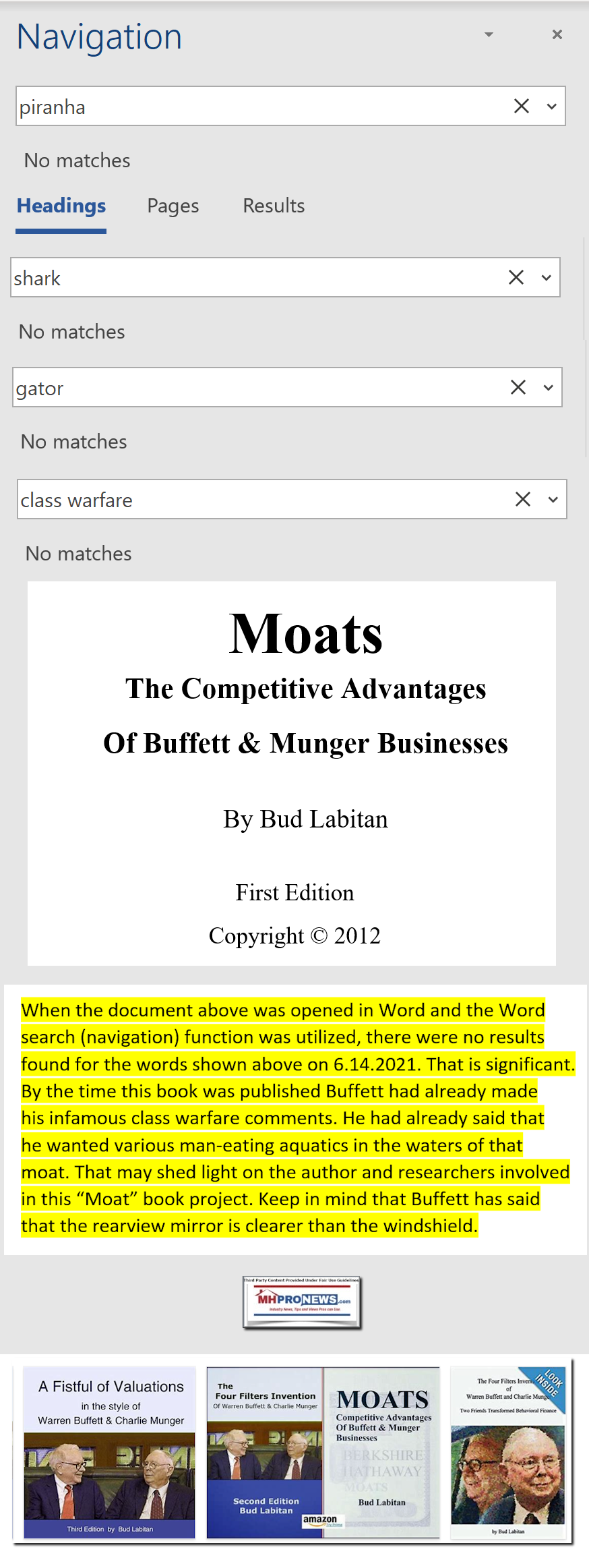

Unpacking Kevin Clayton’s Comments to Congress – First Through the Lens of “Moats” by Bud Labitan, et al.

– The Paltering Connection

“Said Buffett, “I made an offer for the business [Clayton Homes] based solely on Jim’s book, my evaluation of Kevin, the public financials of Clayton and what it had learned from the Oakwood experience.” – Bud Labitan et al in “Moats – The Competitive Advantages Of Buffett & Munger Businesses” (First Edition 2012),

There are some statements made by Labitan and his co-authors in “Moats” that are apparently contradicted by other sources, such as Jennifer Reingold’s Fast Company take on how the deal for Clayton came to be. While it may seem like ancient history, there was as Kevin Clayton put it, “ugly” litigation around the deal. That litigation by Berkshire to insure the acquisition of Clayton Homes may be more of interest today than when it occurred, but that is another story for another time. That disclosure noted, there are at this time no reasons to distrust several of Labitan’s direct quotes by Buffett.

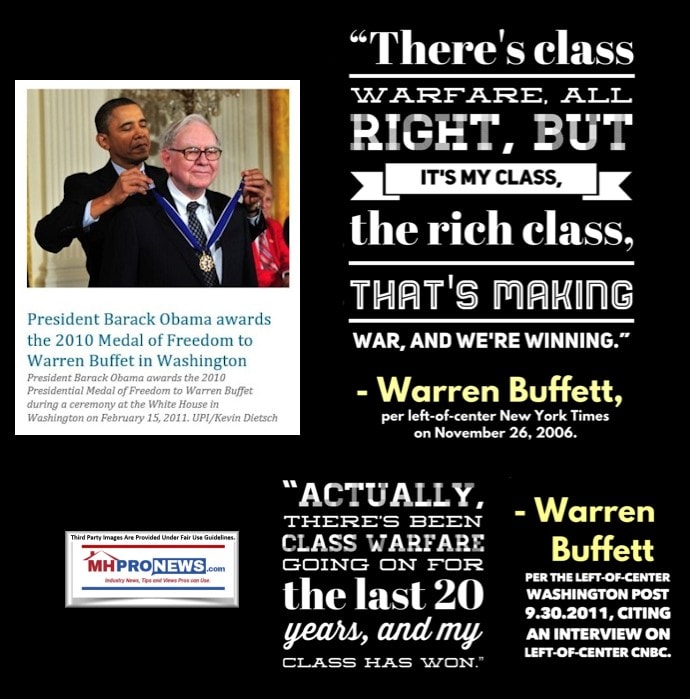

“Misleading by “telling the truth” is so pervasive in daily life that a new term has recently been employed by psychologists to describe it: paltering.” So said a 2017 report by the BBC, entitled “The devious art of lying by telling the truth – BBC Future.” That article includes this fascinating observation, “despite the fact that it costs us considerably more mental effort to lie than to tell the truth. US president Abraham Lincoln once said that “no man has a good enough memory to be a successful liar“.”

Let’s rephrase that insight on paltering from the BBC and honest Abe Lincoln and apply it to Clayton and manufactured housing.

When a significant or big lie, paltering, spin, or other forms of deception are attempted, with the passage of time, it is more likely that the disconnects in that deceptive statements will be revealed. Why? Because it is difficult to keep the past lies, paltering, spin, etc. straight enough in the mind to keep the ruse from being exposed. The more time, the more deceptive statements, the more disjointed and discernable the claims become, IF they are laid out in relation to other evidence.

That if in that thumbnail of the risks of exposure for those engaged in paltering, spin, or other devious forms of deception requires considerable effort, attention to details, and a certain level of expertise needed by those trying to expose the ruse.

On the surface, that gives an apparent advantage to the clever deceiver. Time is on their side. That is especially so if such a liar has an apparent aura of respectability. That was the observation by Cold Fusion cited here in what they called the “It’s the illusionary effect where if you repeat a lie enough times people start to believe it especially if you have credible names surrounding the product.” Lincoln was right on that notion. You can fool people – even many – for a time, but you can’t fool everyone forever. The longer a deception has to be kept up, the more likely disconnects will be revealed that undermine the purpose that motivated the deception in the first place.

The above certified “Truth in Testimony” certified statements by Kevin Clayton – with the passage of time and new insights – have more exposure now than when these words were spoken. The clues that would have been available at the time he said the above were not seriously reported. Thus, the comments could be taken at face value with relatively little risk. Buffett was correct when he said that the rearview mirror is clearer than the windshield.

Without a knowledge of such history, there is no sound way to discern how the industry came to this vexing status quo in this point in time.

But now, with obviously unstated evidence in what Clayton aid above available, much that he said is useful as a way of illustrating the various reports linked below. Why? Because Clayton himself – by telling the truth in an apparently deceptive manner – has made more clear than ever just how manipulated the manufactured housing market has been for years. It may well be unfair to say that it has only occurred during the Buffett-Berkshire era of manufactured housing. That would be an exaggeration. But it would be fair to say, because the evidence for the case is found in the various reports linked below, that the crash of manufactured housing to historically low levels was precisely possible because of active (or inactive) efforts on the part of people in certain: businesses, nonprofits, public officials, and elected officials that caused/allowed these 21st century events to occur.

In no particular order of importance, research/reports by the following have allowed the stunningly bold manipulation of the manufactured housing industry to occur, despite what in hindsight should have been obvious clues. Those clues to market manipulation are disclosed by Kevin himself in the above. They could be boiled down broadly to the federal government:

- failing to enforce the clear meaning of the Duty to Serve Manufactured Housing mandated by HERA 2008,

- and the failure to properly implement the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform Law).

There is more, but those two major elements Clayton’s testimony cited above, with some tweaks, might have been written by Mark Weiss, J.D., President and CEO of MHARR. Weiss’ comments on such issues are tighter and more specific. But Clayton hit several of the same notes that Weiss and his predecessor CEO, Danny Ghorbani, have been saying for well over a decade.

Samuel “Sam” Strommen with Knudson Law said that what his well documented research uncovered was a pattern. That pattern revealed a lack of oversight and collusion by various players that were causing harm millions of Americans. He darkly described that as “Rube Goldberg Machine of Human Suffering.” Given repeated opportunities to respond to Strommen’s scathing evidence-based critique of Clayton, MHI, and others involved in the mix, attorneys and officials for Berkshire Hathaway, Clayton Homes, 21st Mortgage Corporation, MHI, inside and outside counsels declined. Put differently, Strommen’s fact- and evidence-based thesis stands publicly unchallenged.

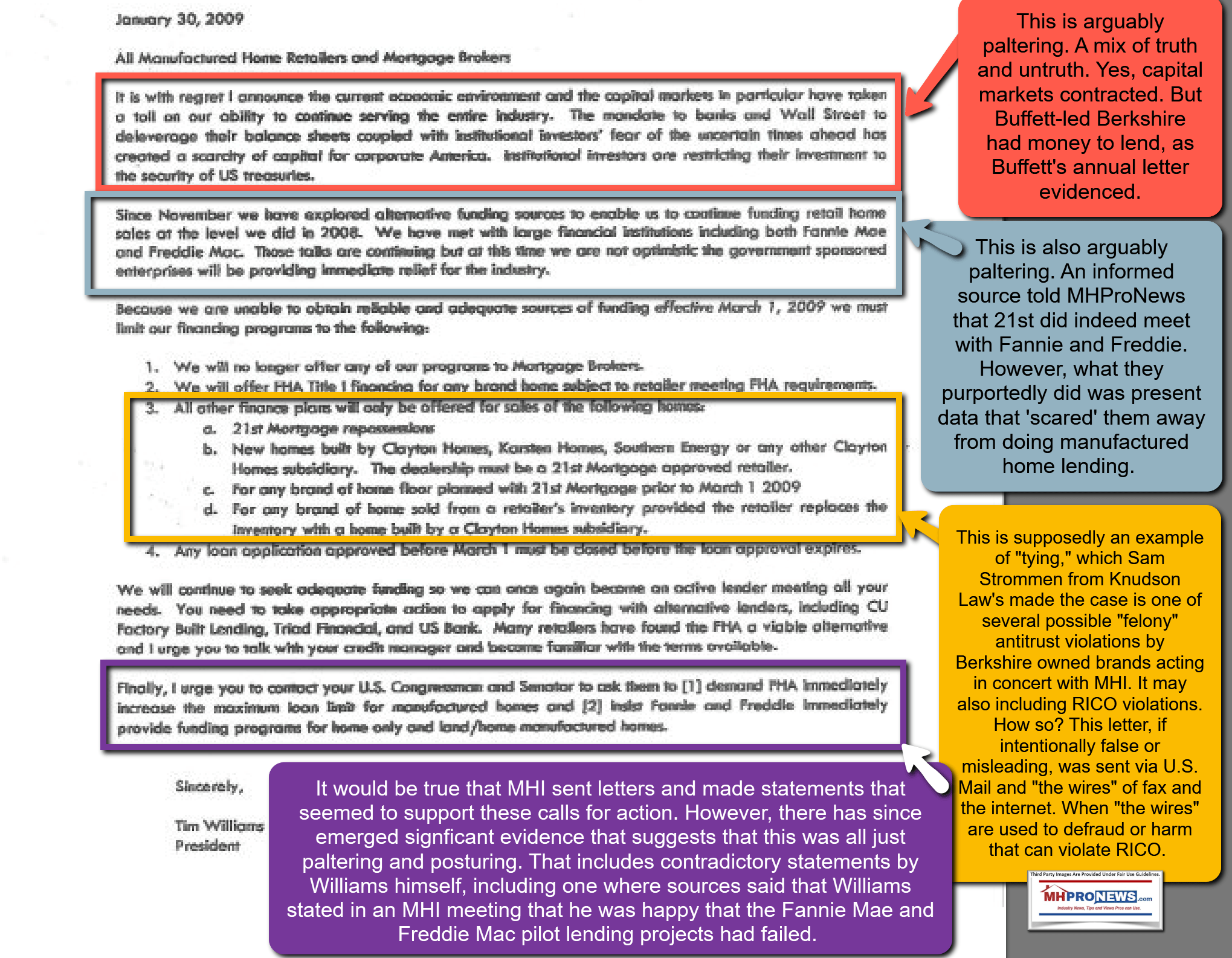

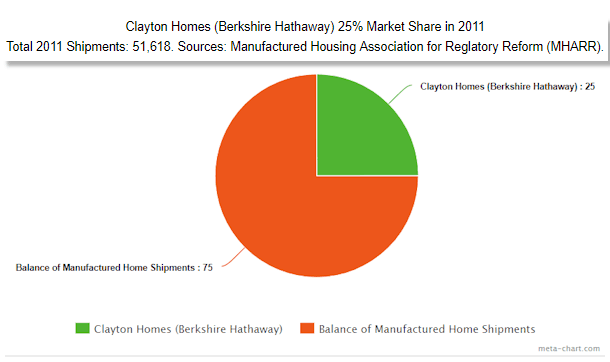

A) One of the significant items Strommen cited – and one that Kevin Clayton conveniently neglected to mention to Congress – is that Clayton’s sister company, 21st Mortgage Corporation can be pointed to by specific documentary evidence as having sparked the loss of those 7,500 independent retailers that Kevin mentioned in that field hearing.

B) Additionally, as Labitan noted in the chapter of his book on Clayton Homes, Buffett specifically said he wanted to hold the loans that Clayton and their manufactured housing lenders generated in portfolio. Per Labitan, “Buffett said, “We are in no hurry to record income, have enormous balance-sheet strength, and believe that over the long-term the economics of holding our consumer paper are superior to what we can now realize through securitization. So Clayton has begun to retain its loans.””

Rephrased, while Kevin seemed to be making the pitch to Congress that they and MHI wanted to see DTS or other lending securitization to be realized, Clayton’s boss – Buffett himself – was on record saying something quite different.

- Not only does the quote from Buffett above make that point, but the factual record of the Berkshire era of manufactured housing does too.

C) It cannot be missed that the Buffett-Berkshire-Clayton moat would not have worked in manufactured housing as it has IF federally supported or encouraged lending was no marginalized or eliminated. An explanation is warranted to make this significant point clear.

- Securitized lending via DTS or Ginnie Mae (Government National Mortgage Association), etc. – as Clayton admits would be at lower interest rates than Berkshire owned 21st or Vanderbilt Mortgage and Finance (VMF) could make. Securitized lending reduces risks to lenders, and thus would encourage more lenders to enter into the market. Lower rates from such lending would be good for consumers and sellers alike.

- However, that would not be good for the Buffett-moat that they expected from Clayton. As a close look at Berkshire’s annual letter reveals, a sizable chunk of Clayton’s profits are precisely from financial services, much of which are loans. How many loans would have been made at higher rates by Clayton if others could sell homes with less costly lending?

- Put differently, the moat for Clayton would only work if they had a high degree of confidence that Fannie Mae, Freddie Mac, FHA Title I loans, et al, would not be a significant factor in the industry.

D) Said Labitan in Moats on the chapter about Clayton Homes:

“Buffett and Munger believe it is appropriate to finance a soundly selected book of interest-bearing receivables almost entirely with debt, just as a bank would. Therefore, Berkshire borrowed money to finance Clayton’s portfolio and re-lent these funds to Clayton at their cost plus one percentage point. This markup fairly compensates Berkshire for putting its exceptional creditworthiness to work. And, it delivered money to Clayton at an attractive price.

How did Clayton build up its economic moat? In 2003, Berkshire did $2 billion of such borrowing and re-lending, with Clayton using much of this money to fund several large purchases of portfolios from lenders exiting the business.” It must be stressed that Kevin said as much himself in the video interview with transcript that is found on MHLivingNews at this link here.

E) While Clayton and MHI have arguably advanced an impression via posturing (i.e. paltering) that they wanted to see more lending, key facts make the opposite far more likely. But paradoxically, Clayton has revealed to a significant degree that they have inflicted billions of dollars of economic harm on rivals. While Clayton played nice in his largely accurate statements to Congress, he said something quite different to another apparently pro-Berkshire interviewer, Robert Miles. While Clayton never used the word the “moat” in Congressional testimony, he did so repeatedly to Miles.

F) Did Labitan palter too? That is an open question. It may prove useful for federal and/or state investigators to use subpoena powers and get testimony under oath that might begin with asking Miles and Labitan about specific communications with Berkshire people outside of an interview. To the question about Labitan, there are seemingly odd misses and apparent factual concerns in his telling of the Clayton moat story. It may have been innocent. But if not, that may be one more nail being hammered by investigations into the diabolical cunning ways that the moat operates. That noted, Labitan makes point that are useful and seem to be supported by other evidence. Rephrased, the factual wheat can be separated from the chaff.

H) To sum this segment up, there are numerous examples available of how the malevolent “moat” stratagem has destructively played out in manufactured housing. That harm has impacted current and potential manufactured home owners, as Clayton’s testimony above ironically illustrated. It has also undermined thousands of independents. Who said? Once more, Clayton provided the factual dots that are connected by simply laying the puzzle pieces out until the picture is framed. With the insights above in mind, it is now even more useful consider/reexamine different, but arguably related, terminology and descriptions of harm used by others that may or may not have used the phrase “the moat” themselves.

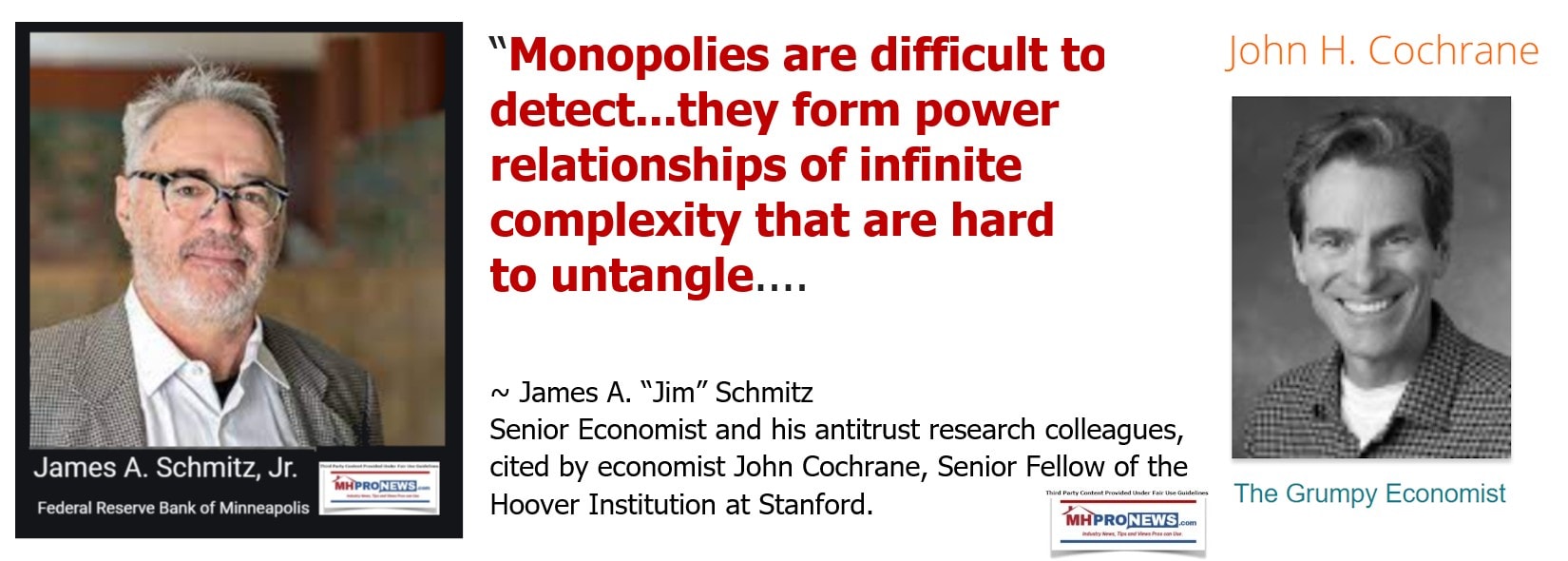

- So, for instance, Minneapolis Federal Reserve senior economic researchers and others have spoken about “sabotaging monopolies.” Note that in each of these examples, facts and evidence has been spotlighted by MHProNews, MHLivingNews, or others that illustrate the validity of their broad claims.

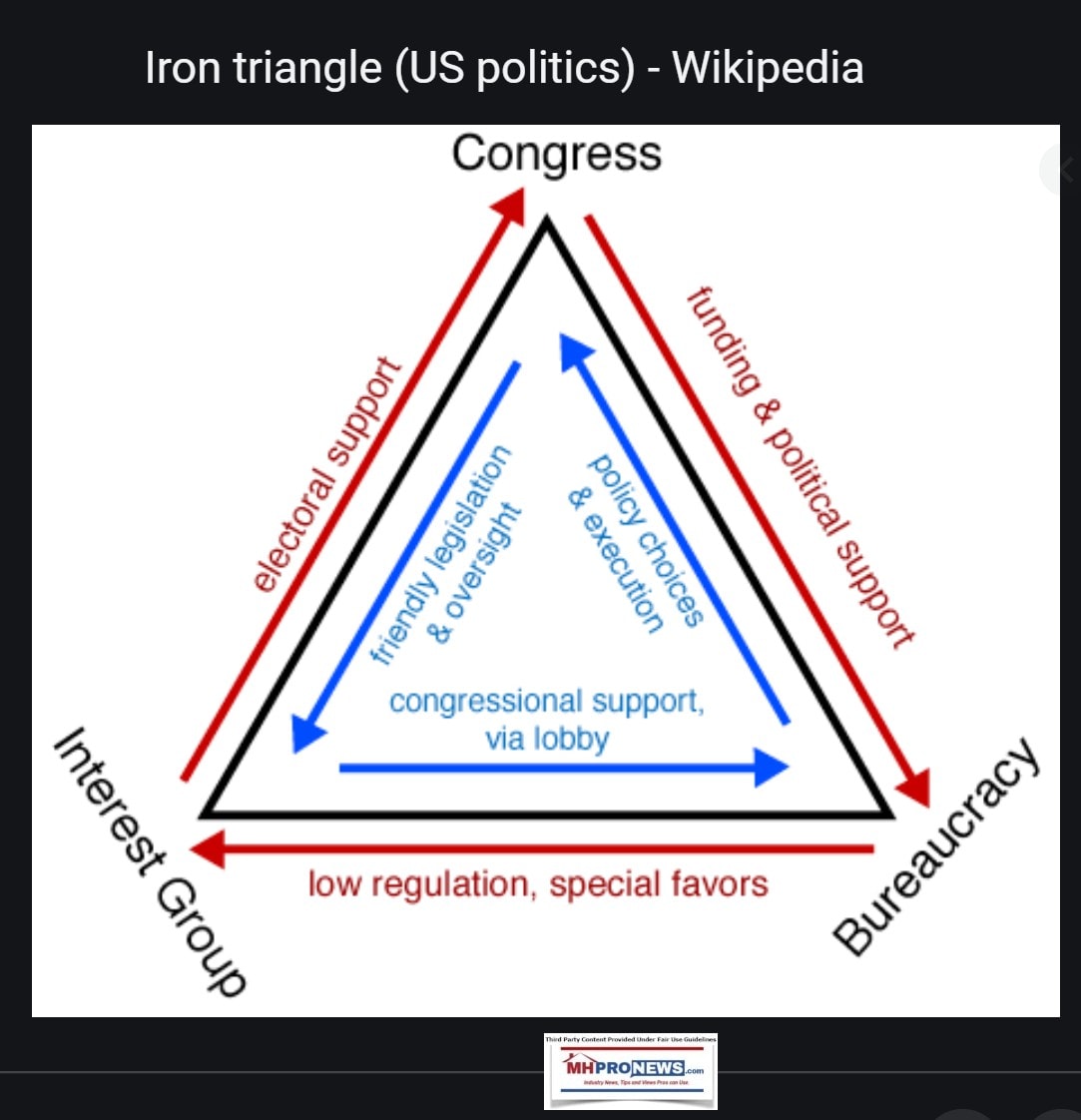

- Some have written about “the Iron Triangle.”

- All of these have the common point that harm is being inflicted on the many by the collusion of the few. Given the credentials and growing number of examples of those making such claims, it is stunning to see that thus far, under Democratic and Republican Administrations, beyond a few relative modest fines by Berkshire standards, so little has been done.

I) The loss of thousands of manufactured home businesses, hundreds of thousands of jobs that Clayton said is true, and perhaps, understated. While the decline began before Buffett entered the business, there were third-party research experts – like then Harvard’s Joint Center for Housing Studies (JCHS) fellow Eric Belsky who thought that the industry would not only recover, but who gave the factual evidence why manufactured homes could or should surpass conventional housing. Why didn’t that occur? In a phrase, the pernicious moat that destroys markets for the benefit of Buffett’s brands and a few at great harm to the many, including taxpayers.

J) What the above reveals and underscores are several affordable housing and manufactured home industry connected issues. For instance. With Kevin Clayton saying such positive things that seemed to be holding HUD and the FHFA accountable to members of Congress, it likely tended to mollify some concerns of independents that trusted MHI, and by extension, their affiliated stated associations. By doing so, the moat building consolidators were able to continue to posture effort on ‘behalf’ of independents without actually delivering actual performance. It is an issue and pattern that MHARR leaders have called out for years. The irony is that the testimony above helps drive home MHARR leadership’s points. Note, that this find and others are occurring quite apart from MHARR. As a disclosure, MHProNews provides certain services to MHARR, but we did so to Clayton, 21st, MHI and other related brands too. It has cost us money to expose these challenges, but doing so the only way to root out the corruption that for too long was dismissed as agenda driven. Those who have been making these claims are within MHI, besides MHARR, or groups outside of manufactured housing altogether.

Epic Need for Affordable Housing and Manufactured Homes – Navigating Challenges to Achieve Rare Opportunities

The ability of the industry to grow rapidly has been proven several times over the years. Yet until the last 2 months, there have been 2.5 years of declines instead. What happens next depends upon what authorities of competent jurisdiction do or fail to do. If they do nothing or sweep it under the rug, then there is no reason to believe in their desire to act on behalf of the American people rather than deep pocketed special interests.

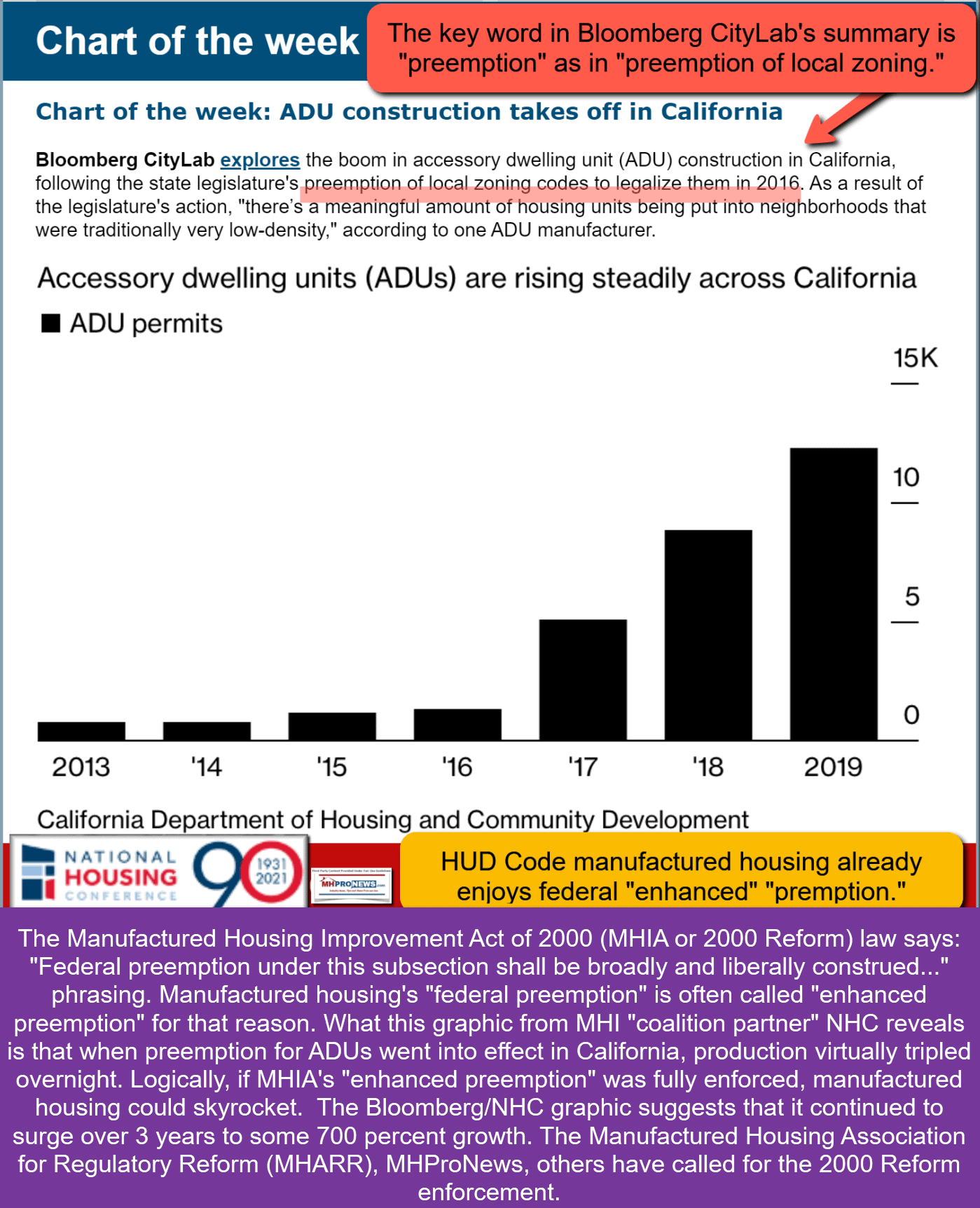

Rather than belabor more various quotes and experts’ points, this is the point where a few illustrations will now fill in some important blanks.

The MHIA of 2000 was supposed to insure that ever more Americans, particularly those of low to modest incomes, could have access to their part of the American Dream of homeownership. Note that this is not aiming at some politically correct politeness. The time for that has long passed. There are people of good and ill will in a range of organizations, political, professional, or otherwise.

The facts speak loudly, once the history of the facts are understood.

But due to the types of Machiavellian Moat Maneuvers – a.k.a., Iron Triangle and Sabotaging Monopolies, et al – the percentage of home ownership mysteriously declined instead.

But when Clayton’s words to Congress in that testimony cited above are examined, most of it is quite correct. Summing up, existing laws were not being properly implemented. That was true then and now.

What he left out was that Clayton, Berkshire, MHI et al were part of the ruse that made that deflection of good existing laws possible. While Kevin Clayton was mouthing nice words – routinely, accurate words – at that Congressional field hearing, his parent company’s sister firm, 21st Mortgage Corporation had struck a death blow to thousands of companies. That purportedly paltering mortal blow was signed by Tim Williams, President and CEO of 21st. To underscore just how deceptive this pattern appears to be, Tim Williams told an MHI group that he was glad that the DTS ‘pilot project’ had failed. That statement, in conjunction with so much other evidence, should eliminate all doubt that MHI and their big boy brands had any serious desire to see DTS enforced – until and how that they might want it enforced.

It is possible that far more harm has occurred than Clayton said, but even that level of lost businesses and harms to consumers is more than enough to cause serious souls interested in true justice to press for unbiased investigations that are as transparent as possible. Not some Warren Commission style effort where evidence that doesn’t fit a narrative is ignored and swept aside. Rather, what is necessary are hearings that include documents produced under subpoena, and testimony is compelled under oath. Once facts like those shown are confirmed, public officials should act swiftly to enforce market-rigging, antitrust, RICO, Hobbs Act, SEC, FTC, and/or any other federal or state laws that appear to have been violated.

###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.