Warning: This blog post is not for the faint of heart or for those who think they can skim and get it all. As an Industry Pro, directly or indirectly, this impacts YOU every day.

In a recent conversation with George F. Allen, I mentioned a discussion topic that Finmark’s Dick Ernst and I shared in preparation for our INdustry in Focus interview with Dick about manufactured home financing. During that conversation, Mr. Ernst used the memorable phrase, “elephants in the room.” Specifically, we spoke about the challenges that lenders and home owners face when resale time comes. “That’s the elephant in the room, Tony, that we as an industry need to deal with.” was the gist of Dick’s revealing statement.

The president of a manufactured housing finance company and the senior VP of yet another lender I’ve recently spoken with concur.

As George and I spoke, he commented on the customer or secondary (resale) market side with, “I was going to say, you’re right, that is the second elephant in the room. This is an important topic, Tony. Maybe you should consider doing a Linkedin or blog post on it.” GFA being correct, I agreed. As a result of that advice, a lively Linkedin MHC group discussion has begun…

So here I am suggesting to an Industry pro like yourself that we need to take a long, hard look at how to change this avoidable and troubling dynamic. We need a process that allows an MH customer or finance company to exit at least as easily from their manufactured home asset as someone might from a conventional stick built house.

Why?

Because as long as we have elephants in the room, those pachyderms will be pushing out of the room customers, investors, lenders, public officials and a whole host of opportunities that we otherwise would deserve! We can be:

- Selling more homes.

- Have happier manufactured home owners.

- Get more MH referrals.

- Enjoy more, better, happier…these are some of the rewards for solving the ‘problem pachyderms’ issue!

The bottom line is you can make more money long term, and so can the Industry, once we face and fix this plaguing problem.

Yet some – perhaps many – who will read this may knee jerk in opposition. Why?

Let’s take a look…

VMF and 21st stated in the MHI Summer Meeting with FHA officials that when they take in a repossession, they wholesale that repo 65% of the time. Other lenders in the room were nodding or made sounds that indicated that Berkshire Hathaway affiliates are not alone. Now they may make this ‘work,’ but at what cost? Higher rates on manufactured homes than conventional housing are certainly among the sad consequences.

Less lending availability is another avoidable consequence!

Why has the FHA set such a high bar on finance companies who will be doing FHA Title I loans? Because of past industry losses in financing.

Why do the GSEs hesitate to lend on MH chattel, in spite of the Duty to Serve mandate from Congress? Because of past industry losses in financing.

Why are so many MH communities doing in house financing? To the tune of billions of dollars? Because it is almost a necessity, due to past industry losses in financing.

Why does Ken Rishel and company teach community operators and retailers how to raise the capital and do legally compliant ‘captive chattel financing?’ Because there aren’t enough MH chattel lenders available without doing it in house. I’d bet that Ken would also ad that because doing it in house is a profit center of it’s own…when it is done right!

Now, please don’t shoot the messenger for reporting what you already know.

The only way to deal with the elephant in the room that no one wants to touch is to look closely at the various dynamics and then do what it takes. If we as a manufactured housing professional, company or as an Industry want to climb out of the Industry’s financing limiting doldrums, we better deal with the issues head on!

When a MHIndustry lender is wholesaling off repo inventory 2 times out of 3, that means that some out there are ‘getting a good deal.’ But the ‘good deal’ to a community, retailer or wholesaler means a lender took a beating. When the lender takes enough beatings, they may say, ENOUGH! That leads to the skittish behavior of FHA and The GSEs on this subject. Those losses on repos cause other financial institutions and potential lenders to look warily at the manufactured housing product, because Conseco/Greentree is not ancient history to them.

Now please don’t misread this.

For example, the government agencies have Congressional mandates. They should serve manufactured housing as the law requires, period, end of story! In my world and yours, if Congress passes a law, we obey. If you don’t like it, you work to change it. But if you and I simply fail to obey a law, then we get fined, prosecuted, jailed, or strung up. I say, the GSEs and FHA should do as Congress mandated. They should do so broadly, rapidly and effectively. These agencies should find the solution to the elephants in the room issue as part of the implementation of the legislation that Congress created and the president signed into law.

This means that the FHA and the GSEs should find a way to make the programs sustainable and work long term.

We in the Industry, if we are smart, should help them.

That is what MHI and those Industry leaders were trying to do in DC a few weeks ago, trying to shed light with Vicki Bott and other FHA and HUD officials on ways to make their program work. Because a sustainable program is a win for everyone!

But let’s go back to those who can’t resist doing that wholesale deal on a repo.

And let’s go back to those lenders who shed their inventory at bargain basement rates.

Knowingly or not, each are contributing to the long term history in the financing/resale realm that has plagued our Industry, those elephants in the room.

Before writing this, I also spoke with a wholesale repo buyer, who effectively said:

“If they are going to sell me a home at these prices, why would I say no?”

I admit, that has to be tempting. But a number of points come up in analyzing this long term, and you can think of them as well or better than I.

Now, please note, the wholesale buyer has learned how to move that inventory. So why can’t the lender do the same?

I spoke with a long term MH lender, who effectively said:

“I have x homes and x millions tied up in inventory in just the x market. The regulators are checking our files right now. We want to continue to do MH lending. But every time a ‘park’ (his term) bills me for lot rent, every time a park fails to help resell a home at retail, every time a home sits and sits instead of resells for a good price, every time I have to move a home in order to get it sold, it puts that much more pressure on our manufactured home financing program.”

Do we need to lose another lender(s) before we learn our lesson? Hello? If we are the ‘survivors’ of the Great MH Lending Meltdown that started around the turn of the century, who needs coffee?

Now all of these are actual or paraphrased comments from real people who didn’t ask to be named for obvious reasons, and each one is revealing.

To the future potential of the MHIndustry, these viewpoints and their implications are chilling.

Let’s imagine for a moment, that FHFA, in the aftermath of the tidal wave of comments they received last month, relented. Let’s say they put a program in place that really met the intent of Congress in the Duty to Serve legislative provisions. Let’s further imagine that FHA modified their threshold for Title I lenders, lowering the amount and making more capital thereby available to the Industry.

Then let’s image that nothing has changed about the resale/remarketing issue. What would eventually happen?

They’d take their lumps for a while, then go back to Congress and understandably say, “we told you so!”

So now ladies and gents, we better tackle this once and for all. We should not only work on Congress and these agencies to get the financing we need, but also work with them to make sure that repos don’t result in big losses.

That is just long term, common sense.

That said, one gent told me recently that in our Industry long term may be 10 minutes to 10 days. “I’ve got the end of the month coming up, and have to get this deal done!” Oye, vez. We have to think 10 weeks, 10 months and 10 years ahead too. A dozen years have gone by since we sank from nearly 373,000 shipments to under 50,000 last year. We are inching up this year, and that is good. It reminds us that we can grow again. But if we don’t buckle down and do ALL that it takes, we will have a shorter and shallower bubble than we had in the roaring 90s.

Or, we can have the best years the Industry has ever had. The choice is in our hands.

Let us shift gears and briefly look at an example that may lead to a solution.

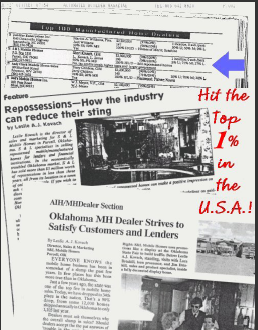

Back in the late 80s (and again in the early 2000s), I was in a leadership role of a successful resale programs for various manufactured housing lenders. We:

- set up a structured approach that reduced their losses, accelerated their resale time line and got assets back on the books at prices that were close to new ‘repo fighter’ home prices then.

- There were legal and systemic limits that kept us from selling repos for even more, but I am here to say, we could have sold those homes for more money had the financing system allowed for it.

- We didn’t buy repos ourselves, meaning we didn’t compete against the lenders repos with our own inventory, as to me that seemed like a conflict of interest.

- Our team did repo sales for lenders, period! We got paid commissions, and we earned a lot of those. We also received got paid some spiffs and other incentives, all above board, that were part of our agreement.

- We looked at issues and we dealt with them in the best fashion possible to control costs for lenders and limit their losses.

It wasn’t perfect, but it worked a lot better for those MH lender clients than they had elsewhere in that state. We know this because they said so, and backed it up by bringing us ever increasing levels of inventory, and then asked us to expand into different markets in other states.

That was then. Maybe there are similar efforts out there now, but:

- where are they now?

- If they are out there, why are key MHIndustry lenders still wholesaling 65% of the time?

- If they aren’t out there, why aren’t MHIndustry lenders creating a program that works for all long term?

Ladies and gents, this isn’t rocket science. This is about discipline, solution orientation and will power. Other industries face this issue and make it work.

We…

Can…

Too!

I don’t quote sources unless they wish or agree to be quoted or have spoken in public. So privately to me or via posted comments, I am hereby inviting industry members to comment on the elephants in the room.

Please share your experiences and viewpoints. Please agree or disagree.

Heck, let’s have a debate here if you want to, that is what posted comments are for too.

We as MH professionals, companies and as an Industry have to move the resale/re-marketing subject ahead.

We don’t need endless meetings and another task force that later disbands, for whatever reasons. I am not criticizing anyone, but I am challenging every stake holder to think this through and resolve it for the long term benefit of all involved.

Some MHCommunity operators do a good job at this. If they can, others can too.

How do you solve a big problem? You face it squarely and deal with it honestly.

How do you eat an elephant? One proverbial bite at a time. # #

_________

End Note:

A few The Masthead blog posts ago, I touched on this topic lightly. It was part of the broader subject of what are our Industry’s strengths and weaknesses are. That post referenced how we could be doing 200,000 to 800,000+ new annual manufactured home shipments a year! Not someday, right now. If you missed that prior post due to vacations or whatever, you might want to read or re-read it.

I was thinking back to the repo glut of the late 90’s and early 2000’s.

- Do we miss selling 372,000+ homes a year?

- Do we miss having full communities?

- Do we miss building new MHCs or fee simple developments?

- Do we want factories that are at or near capacity?

- Do we miss having more retailers?

- Do we miss more lenders, vendors…

Please read, or re-read this blog post linked below. It outlines the path for MHIndustry business growth today.

_________

L.A. ‘Tony’ Kovach, MHM

Publisher, MH Marketer and The Masthead blogger

Manufactured Home Marketing Sales Management trade journal at www.MHMarketingSalesManagement.com aka www.MHMSM.com

tony@mhmsm.com

847-730-3692