AllGov and the New York Times are among those who have leaned on reports by the Seattle Times and the Center for Public Integrity as they attack the reforms sought by manufactured housing with respect to Dodd-Frank. The form their brand of journalism has taken has been to attack the largest manufactured housing operation in production and lending – Berkshire Hathaway, Clayton Homes, 21st Morgage and Vanderbilt Mortgage and Finance (VMF) – as a way of undermining the entire industry’s efforts to modify the onerous regulations imposed by the Consumer Financial Protection Bureau (CFPB), which are harming millions of manufactured housing owners as well as the MH Industry at large.

The best way to begin to address their many errors is to share three links that directly or indirectly disprove much of what they claim is true.

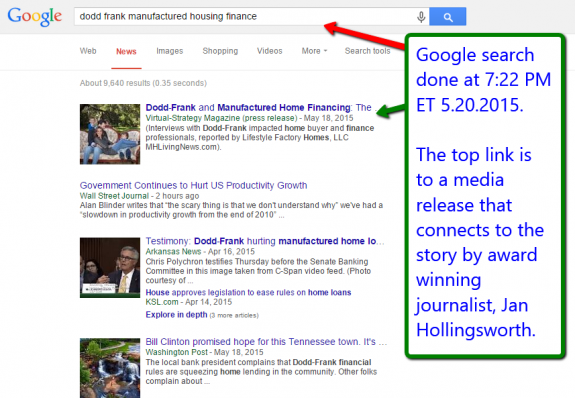

First, the following link under a Google News search this evening is the following.

We’re pleased to say that a number of media outlets have picked this story up, which has nudged the Seattle Times from the top spot on Google for this same search just a week ago. The story that shows that manufactured home lending is NOT predatory, is linked on the image above or at this link here.

Second, the Seattle Times, New York Times, AllGov et al publications have arguably used red hearings and clearly misleading statements. Sam Landy – President and CEO of UMH Properties (NYSE:UMH) video interview on the impact of Dodd-Frank/CFPB regulations on manufactured home lending is linked here. The video and article cause many of the claims made by other media to crumble under closer scrutiny.

Let me wrap up tonight with this comment that was posted on the AllGov article on the upcoming S 682 related vote in the Senate Banking Committee.

To AllGov

This is perhaps a tad worse than the Seattle Times was in terms of accuracy. First, there have been no mobile homes built in the U.S. since June 15, 1976.

Second, even if the authors above had used the correct terminology, Clayton Homes does not control 91% of the manufactured housing market. The combined Berkhsire Hathaway controlled firms are about 45% of the new homes being sold.

Third, Berkshire Hathaway affiliated lenders do dominate manufactured housing lending on the personal property side. But the current regulations under the CFPB has been driving lenders out of the space, please see the article linked below, which includes an interview with a firm that withdrew due to CFPB regs.

Fourth, if conventional housing was as restricted as manufactured housing, there would be serious problems in resales of houses or condos too! Due to the choking regulations, fewer loans available, harms the values of those in the lowest cost manufactured homes, specifically those under $20,000.

I’d invite the authors to contact me for more insights that could set these and other errors straight. Thank you.

Conclusion

All of this points to the need for manufactured housing to continue to rally around the effort to define ourselves. We in MH have a great story to tell. We ought to be proud of the opportunities offered to the full spectrum of customers – from those with credit challenges to those who can finance or pay cash for whatever they want, and they decide on the value of modern manufactured homes.

FYI – the outlook for tomorrow’s vote in the Senate Banking Committee is for passage, with some Democrats voting in favor too. The challenge is the next hurdles…

We either define ourselves or others will define us, often to our detriment. When our story is better understood, even our political efforts will benefit.

We each have a role to play in this effort, with time, talent or treasure. We must be the true advocates for millions of current and future manufactured home owners harmed by Dodd-Frank. Protecting our customers also protects and promotes our business.

Enough said for tonight. ##