An Exclusive Interview with Doug Gorman

1. (Question from www.MHMSM.com by Tony Kovach for Doug Gorman). First, Doug, thanks for taking the time to do this interview. While you are widely known in the industry, please give us a brief background on your many roles and history in this industry, for those who may be new and don’t know you as well as they should yet.

My experience with the industry began in 1971 in the role of a consumer. My wife and I purchased a 12×60 three bedroom front living room which at the time seemed to have plenty of room for us as newlyweds. Shortly after that I went to work for the retailer who sold us our home and have been in the industry continuously since then. My industry work experience has included retail sales, sales center management, multi-location retail management in the Southeast and the Southwest. Field sales for manufacturing covering five sates in the Southeast, multi-outlet retail modular sales management and 22 years of owning a retail sales center in Tulsa, Oklahoma. I have served as the president of our state association in Oklahoma, chairman of MHI’s Federated States Division, chairman of MHEI, the sole retail representative to NFPA for five years prior to the creation of the Manufactured Housing Consensus Committee and for close to ten years now as a member of the Manufactured Housing Consensus Committee.

2. There is a lot of discussion going on in the Industry these days, and we’d like to get your take on some of those timely topics. For example, there is a new initiative out there to launch what is dubbed the MHIDEA, the MH Independent Dealers Association. What are your thoughts on the matter? What can you tell us about R E Crawford, George Allen, Ken Rishel and some of those backing or supporting that initiative?

I believe MHIDEA is a worthy endeavor and its creation is being undertaken by some of the most credible people in the industry. Retailers have numerous issues that can get lost in the broader efforts that are undertaken by MHI. I had hoped for years that the National Retailers Council (NRC) would serve that purpose, but I have not seen it materialize. I don’t fault MHI for that failure. The decline in retailer population has certainly been a factor and for that same reason could limit the success of the efforts around MHIDEA. The total retailer focus of MHIDEA may give it some strengths that are not inherent in NRC.

As a preface to the question that follow, Doug, let me remind our readers that personally and editorially, www.MHMSM.com believes in the strong potential of our industry’s future. I could point to virtually every article, almost every blog post that underscores that fact. But At the same time, we have to look at real world challenges and address them. Many today are scared. So the following are not meant to be ‘doom and gloom questions, but rather to get a feel for how your take on such industry issues as matters currently stand, and to understand what we face in order to address it properly.

3. George Allen is one of those gents that most people in the industry know, especially in the LLC world. Allen has written about what he calls a ‘perfect storm’ or a ‘conspiracy’ to kill HUD Code housing by choking off finance initiatives in Washington, such as implementation of the FHA Title 1 and the “Duty to Serve” passed by Congress in 2008, and what amounts to concerns over leadership from national associations on such issues. How would you respond to that type of concern from a respected and informed industry leader?

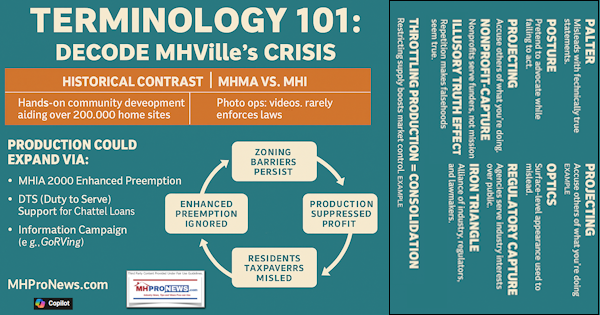

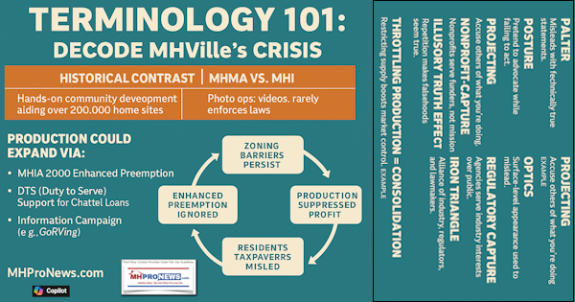

I do not have any specific knowledge of a conspiracy to destroy our industry. At the same time I find many of the actions taken in Washington are in fact resulting in driving up costs for our industry’s clients while reducing the financing options available. If it is a conspiracy, those responsible are being remarkably successful as we look at a 90% drop in industry shipments. I don’t read a lot of news coverage of any other industry taking a hit of that magnitude.

4. It seems obvious that manufacturers and retailers – and these days, retailers often means land lease communities (LLCs) operators – have a natural need for each other. What concerns do you feel as a respected retailer who has years of manufacturing experience over the steady decline in new home shipments? What do you see as the needs to turn that 12 year decline in shipments around?

Clients want what we build. They are denied the ability to purchase our homes in many cases because of zoning issues and because of the inability to obtain financing. The zoning concern has to be addressed at the state level to achieve significant success. Improvement of financing will most likely only be achieved through increased pressure from our representatives in Congress to improve the application of existing programs.

5. Some have speculated that we are looking at the end of the HUD Code industry by 2020, others have said 2016. I spoke with a senior executive in the manufacturing world very recently who told me there is maybe 24 months to turn the industry around or many/most of the factories will be gone. What are your thoughts on the time line, and why don’t we see more being done to impact ‘saving our industry’ now?

I would not dispute either of the forecasts mentioned. Our program is the only Federal building code for and is administered by HUD. As an industry we certainly have a very real danger of national shipments continuing to be so low that we become irrelevant in the scheme of the Federal budget. If that were to happen manufacturers would lose the preemptive benefit of the federal code. They could possibly continue production meeting various individual state codes that might exist, but the federal umbrella would be lost.

6. You have expressed in the past your viewpoint on Danny Ghorbani’s importance at MHARR, saying “The industry needs Danny.” Can you elaborate on that, please?

For many of the same reasons that retailers may feel a need for a dedicated retailer trade association, many manufacturers feel a need for MHARR. I have no problem with MHARR’s position that their exclusive objective is to monitor regulatory events as they may affect our industry’s manufacturers and ultimately the cost of the home to our clients. Danny Ghorbani has worked tirelessly in this regard for many years. I do not always support or agree with a particular tact or undertaking by Danny, but the industry does not have anyone else who so fervently monitors the effects of proposed undertakings by our federal government.

As retailers, we do not understand to any significant degree the possible impact for instance of the current efforts by HUD to increase monitoring costs through an effort intended to improve quality control. While I believe the effort by HUD is well intended, I am also aware from conversations with manufacturers that many unintended consequences will drive up costs with no corresponding benefit to our client. MHARR will seek to route these efforts through the Consensus Committee. In HUD’s defense, a proposal on this subject was worked on by the MHCC, but was not moved forward due to lack of information regarding costs.

7. We did an exclusive interview posted on my blog with Eddie Hick’s recently about his initiative to promote product placement as an image building tool. During that interview, Hick’s said, and I’m quoting: “Well, I don’t think we need to wait and get a group like MHI involved. In some ways, they’ve failed to move this sort of thinking ahead on the image building issue.” As someone active with MHI and on the national scene, how would you respond to that comment and concern?

I would support any effort that Eddie can take in that regard. His idea makes sense and he sounds like he knows people that can help him accomplish his proposal. I don’t fault MHI and I don’t think Eddie does either. It is a statement of fact that MHI has not gotten involved in the RV type image building campaign. MHI was confronted by an industry made up of companies facing enormous cash demands in the face of the previously mentioned 90% decline in shipments. Major industry players such as Fleetwood, Patriot, Wick and Champion would ultimately face bankruptcy. That scenario is a difficult setting for raising millions in cash for a national image campaign.

8. Doug, any other thoughts you’d like to share about needs and issues facing the HUD Code and factory built housing industry today? What are your reasons for being optimistic about the industry potential and future?

As an industry we face many challenges. The SAFE Act will drive up costs for our clients while reducing the number of lending options. New FHA guidelines will also increase the costs of financing and increase the amount of cash needed to purchase a home. The new appraisal guidelines that went in to effect on February 16th will make appraisals more difficult especially with those appraisers that do not understand our product or do not understand the difference between an entry level home and a high specification home.

The Duty to Serve issue needs to be pursued as it holds huge potential for our industry. The government needs to move forward to fully implement the FHA Title I program and in light of 3285 retire the current permanent foundation requirements of the FHA Title II program.

Many of the concerns noted affect all housing while others are specific to our industry. I remain optimistic because the consumers want what we are offering. No other housing segment can touch what we offer. I can sell a three bedroom, two bath home for less than $30,000 and I can offer a two story modular for under $200,000. Isn’t life grand? Now if we could just have a good drought.