Federal and corporate corruption. Sabotaging monopolies. Iron Triangle. “Sock puppet” regulators that bow to the regulated and special interests. Above the law. Thumbing their nose at Congress and millions of Americans seeking affordable housing. The truth is hiding in plain sight. The apparent failure of the Manufactured Housing Institute (MHI) in keeping their word on behalf of independents, much less consumers, is once more arguably being manifest. Fannie Mae and Freddie Mac are blatantly ignoring the law, asserts the latest Manufactured Housing Association for Regulatory Reform (MHARR) analysis of the so-called 2022-2024 “Duty to Serve” plan.

Comments from various experts and MHProNews analysis and commentary will follow.

MAY 19, 2021

MHARR STATE AFFILIATES

MHARR TECHNICAL REVIEW GROUP (TRG)

FROM: MHARR

RE: THE LATEST STEP IN FANNIE MAE AND FREDDIE MAC’S “DUTY TO SERVE” DECEPTION

The latest step in the ongoing deception that constitutes the supposed “implementation” of the Duty to Serve Underserved Markets (DTS) mandate of the Housing and Economic Recovery Act of 2008 (HERA), unfolded on May 18, 2021, when the Federal Housing Finance Agency (FHFA) published the 2022-2024 DTS Plans proposed by mortgage giants Fannie Mae and Freddie Mac. These plans ostensibly address DTS initiatives in relation to the three statutorily-prescribed underserved markets – manufactured housing, rural housing and affordable housing preservation – for the next incremental period following the Enterprises’ initial 2018-2020 DTS Plans and the 2021 Plan supplements filed and approved by FHFA last year.

The most striking aspect of both proposed plans in relation to federally-regulated manufactured housing, is their complete omission of any programs, initiatives, or activities of any kind designed to provide or advance either securitization and/or secondary market support for the manufactured housing personal property (i.e., chattel) loans that constitute nearly 80% of the HUD Code manufactured housing consumer lending market for new home purchases. The latest proposed plans thus include – for their entire coverage period – absolutely no proposed chattel loan purchases, no chattel loan “pilot programs,” no chattel loan data or information gathering, no “education,” no “engagement,” or any other activity of any kind. This will leave the vast majority of mainstream manufactured housing consumers completely unserved, in direct violation of the DTS mandate.

Consequently, after more than a decade (2008-2021) of peddling a complete fiction and phony narrative to FHFA, Congress, consumers and the industry regarding their supposed interest in ultimately serving the manufactured housing personal property market – which is specifically targeted for support by the DTS provision – the 2022-2024 proposed DTS Plans finally expose both Enterprises’ baseless rejection of DTS in relation to the overwhelming majority of the manufactured housing market and manufactured housing consumers.

Indeed, the phenomenal arrogance underlying the Enterprises’ rejection of a direct congressional mandate, is on full display in the Freddie Mac 2022-2024 Plan. In part, that Plan states: “For the 2022-2024 Plan cycle, Freddie Mac will devote our resources to supporting the real property manufactured housing market…. We will not pursue the purchase and securitization of personal property loans on MH. With nearly two-thirds of personal property MH borrowers owning both the land and the home, our focus will continue to be on increasing the industry’s understanding of the beneficial financing and liquidity offered in the real-property space.” (see, Proposed Freddie Mac 2022-024 DTS Plan at p. MH6) (Emphasis added).

As MHARR has explained in previous DTS comments, DTS was designed by Congress to fundamentally change Fannie Mae and Freddie Mac’s approach to mainstream manufactured housing. Put differently, it was adopted to change them – the Enterprises – and their view of, approach to, and policies regarding market-significant support for traditional manufactured housing. Instead, though, Fannie Mae and Freddie Mac (with the blessing of FHFA, which presents yet another issue in itself) have sought to turn DTS on its head, misusing their DTS Plans in an indefensible and inexcusable effort to change the fundamental character of manufactured housing and its use by consumers. This first took the form of providing preferential treatment for “MH Advantage” and “ChoiceHome” manufactured homes which, according to Fannie and Freddie, were “more like” the site-built homes they prefer to deal with. Given the failure of that sop to the industry’s largest corporate conglomerates, which has been – and continues to be – a conspicuous marketplace fiasco, the 2022-2024 proposed DTS plans have simply devolved into an unvarnished campaign to force the industry – and more importantly, the supposedly misinformed and misunderstanding 80% of manufactured housing consumers – into the “real-property space” where Fannie and Freddie would prefer them to be.

This “let them eat cake” approach is not “serving” an existing – and crucial – affordable housing market, so much as it is a bad faith effort to avoid serving that market as it currently exists, while simultaneously seeking to transform it into something entirely different, that consumers have consistently demonstrated they do not want.

As such, this bad faith action should and must be rejected by FHFA, as MHARR will assert in the comments that it will file in this matter. Those comments, as per MHARR’s usual practice, will be filed in advance of the comment deadline so that they can be referenced by other interested parties. For those who wish to submit written comments in this matter, those comments must be filed by July 16, 2021. In addition, FHFA has announced a further “listening session” with regard to the proposed 2022-2024 DTS Plans, which is currently scheduled for July 14, 2021. Details regarding registration for the “listening session” are contained in the attached notice.

cc: Other Interested HUD Code Manufactured Housing Industry Members

##

FHFA Leadership – Can You Spell “Amazing?” Or Corrupt?

MHProNews has been observing, reporting, and doing analysis on this issues and others connected to it for a decade. There is perhaps no publication in all media, not just manufactured housing trade media, that has done anything close to the type of insights and analysis that MHProNews and our MHLivingNews sister site have. That noted, want proof that is arguably embarrassing to FHFA et al?

Some 2 months before this report, L. A. “Tony” Kovach provided the FHFA with the following experts comments. These comments below are also found on the FHFA website at this link here. The comments that follow – weeks before Fannie and Freddie published their so-called DTS plans that MHARR reported on above still fit the facts now as much as they did the DTS issue two months ago. That is either an amazing bit of better than Nostradamus-like insight; OR it is a sobering example of just how predictably corrupt this process appears to be.

Here are the comments from 3.25.2021. Compare what follows to what MHARR stated and reported, as shown above.

Enterprise Housing Goals FHFA Listening Session Address

Remarks as Prepared by L. A. “Tony” Kovach

3.25.2021

“A Pimple on an Elephant’s Ass.”

That’s how a Manufactured Housing Executives Council (MHEC) member described to MHProNews the comparative losses on manufactured homes to losses incurred in conventional housing during the 2008 housing-financial crisis. He compared those trillions in losses on houses to the far more modest losses experienced by lenders operating in HUD Code Manufactured Homes in the late 1990s into the early 2000s.

Despite that comparative pimple, Fannie Mae, Freddie Mac, and others periodically point back to that problematic so-called “GreenSeco era.” That’s 2 decades in the rearview mirror. How can that be an excuse for treating manufactured homes so differently than conventional housing in access to lending?

The FHFA website says that Enterprise Housing Goals are supposed to “FOSTER competitive, liquid, efficient, and resilient (CLEAR) national housing finance markets that support sustainable homeownership and affordable rental housing…”

Before and after passage of the Housing and Economic Recovery Act (HERA) of 2008 and the Congressional mandate of Duty to Serve (or DTS) for manufactured housing by Fannie Mae, Freddie Mac – FHFA and other regulators have paid lip service to supporting manufactured homes.

That negatively impacts millions. Who says?

HUD Secretary Marcia Fudge spoke recently about the tragedy of increased homelessness in America.

HUD’s sad report is fascinating because James Schmitz Jr. – a researcher for the Minneapolis Fed, and three colleagues – published reports accusing HUD and builders of collusion in deliberately undermining manufactured housing.

Schmitz and those researchers argued that collusion between HUD and builders is a case of “sabotage monopoly.”

They said that sabotaging collusion between HUD and builders increased homelessness, harmed minorities, and cut off the lower income class of all backgrounds from the benefits of affordable manufactured home ownership.

Schmitz and his colleagues wrote positively about the manufactured home option.

Scholastica “Gay” Cororaton’s research for the National Association of Realtors also praised modern manufactured homes.

What makes Schmitz and his colleagues’ charge of HUD’s role in “sabotage monopoly” more compelling are comments from Bill Matchneer. Attorney Matchneer is the former HUD administrator for the Office of Manufactured Housing Programs (OMHP).

Matchneer said HUD’s Office of General Counsel consistently failed to enforce the enhanced preemption clause made law when the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform law) was enacted.

Jim Gray, formerly with the FHFA Duty to Serve program, said in his exit message that FHFA and GSEs – “[W]e have not made as much progress [toward meeting the Duty to Serve mandates] as many of us would have liked; so much remains to be done to reach these [DTS] markets.”

In December 2019, I made two different listening session presentations on the DTS mandates; one virtual and another live in Washington, D.C.

In both presentations, I made the evidence-based case how disgraceful it was that the FHFA and GSEs have ignored the law to the harm of millions.

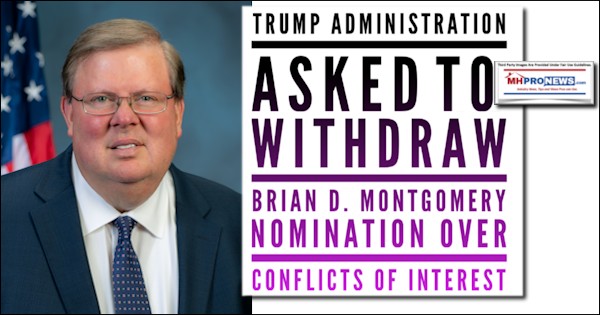

GSEs and FHFA failures arguably included key corporate members of the Manufactured Housing Institute or MHI.

Several scheduled to present today are aware of the issues I’m raising. Because some worked for HUD, FHFA, GSEs, or are otherwise connected to the manufactured housing industry.

For instance. Lesli Gooch, Ph.D., with the Manufactured Housing Institute (MHI) made statements in her filed EHG comments letter that sound supportive of manufactured homes.

But upon closer examination, Ms. Gooch focused on an unproven plan that Berkshire Hathaway (BRK) owned Clayton Homes – which supports MHI – in their push for their branded CrossModTM homes scheme.

Where was Gooch’s similarly robust support for all other mainstream manufactured homes?

- Fannie calls CrossModTMMH Advantage®.

- Freddie calls their version of CrossModTMCHOICEHome®.

- The known data reveals that these programs are market failures.

Supposedly there have been double-digit sales nationally of CrossModTM – under whatever name – in the last few years. That’s in a market producing some 95,000 HUD Code manufactured homes annually.

Attorney and manufactured home finance veteran Marty Lavin – an MHI award winner – did consulting for Fannie Mae. Lavin told MHLivingNews that MHAdvantage ® was likely to be as successful as MH Select®.

Lavin said MH Select® was also a virtual goose egg.

David Dworkin, CEO of the National Housing Conference in federal comments said that manufactured housing was necessary for affordable housing.

Dworkin was fully confident that the GSEs could successful do manufactured home loans.

Dworkin previously worked for a GSE as a Vice President.

Edward Golding worked for HUD and the FHA.

In 2018, Golding and 3 colleagues did a post for the Urban Institute. It was a entitled “Manufactured homes could ease the affordable housing crisis. So why are so few being made?”

Citing FHFA data, Golding and his co-authors in that Urban Institute report said manufactured homes appreciated in value. They said manufactured homes could appreciate even more given access to affordable sustainable GSE loans.

What that Urban Institute post didn’t disclose on that specific page is that Berkshire chairman Warren Buffett is a lifetime trustee of the Urban Institute.

The applied logic of Golding, Dworkin, MHARR’s Mark Weiss, and others should make it plain that the GSEs could and should be doing robust lending in manufactured housing.

Oxford Bank has made personal property loans on manufactured homes for some 2 decades. Oxford reportedly loans with credit scores that mirror those of Berkshire owned 21st Mortgage.

Oxford purportedly does so profitably and sustainably and at lower interest rates than 21st.

Given those facts and legal mandates, what possible excuse can FHFA and the GSEs give for not robustly making mainstream manufactured home loans for both personal property as well as mortgage lending?

- Why did the GSEs and MHI hold closed door meetings some years ago and never released those meeting minutes?

- How did the MHAdvantage ® CHOICEHome® and CrossModTM magically come to be so similar?

- Why is it that MHI postures support, but has backed or tolerated plans that leave Berkshire owned 21stand Vanderbilt Mortgage and Finance as the 2 runaway largest lenders in manufactured housing?

I am consultant L.A. “Tony” Kovach. I’ve worked in the insurance, RV, trade show, and other professions. But all told, I have some 30 years’ experience in manufactured housing retail, communities, with financial service firms, and builders of HUD Code manufactured homes.

Keep in mind that I was an MHI member for years. I was elected by my peers to sit on the MHI Suppliers Division board.

For a time, I was arguably fooled by the purported paltering and posturing of the MHI flim-flam that has undermined manufactured housing.

That paltering pattern harms millions of Americans while thousands of independent retailers, producers, and others went out of business or sold out at discount.

- Is it mere coincidence that this history fits the Warren Buffett “castle and moat” methodology that Kevin Clayton himself bragged about in a video interview?

- Have you viewed or read the transcript of Kevin Clayton saying that Buffett preaches that Moat to make it hard on Clayton’s competitors?

Applying the “Iron Triangle” notion and Schmitz’s “Sabotage Monopoly” principles suggest that insiders rigged the market in ways that undermine the interests of various competitors.

The late Democratic Senator William Proxmire said that in Washington, two things shed light on what occurs.

- There are no coincidences.

- The other is follow the money.

I encourage all to Google each of these topics yourself!

—

For instance, Google “Sam Strommen from Knudson Law” on manufactured housing research.

Strommen’s report called what is happening in manufactured housing a case of “Felony” antitrust violations with possible RICO aspects involved.

Strommen has no axe to grind in our profession.

Strommen concluded that manufactured housing was being subverted from within and mentioned Clayton, MHI, other MHI members, plus the Buffett “castle and moat” method too.

Given the degrees, evidence, and experiences of those involved, I have a hard time making the argument for incompetence causing the status quo.

The Rev. Martin Luther King Jr said:

“He who passively accepts evil is as much involved in it as he who helps to perpetrate it. He who accepts evil without protesting against it is really cooperating with it.”

What comes next should include a full and proper implementation of federal laws that include the

- Manufactured Housing Improvement Act of 2000,

- and the Duty to Serve Manufactured Housing as part of the Enterprise Housing Goals.

- It should also include enforcing antitrust and RICO laws too.

Those good laws need to be fully and properly implemented to restore the free market and liberate millions who want affordable home ownership made possible by mainstream manufactured homes. Pax et bonum.

##

The solution to Big Tech and the oligarchs

Anyone who thinks Big Tech will be reined in by regulations has not been paying close attention. The following cases exposed years of documented corporate, regulatory and accounting failures. They spotlight massive corruption and mainstream media misses.

- Enron

- Theranos

WorldCom

· VW “Diesel-Gate”

· Solyndra

· Bernard “Bernie” Madoff

· WeWork

· Lehman Brothers

· Fannie Mae, Freddie Mac (Government Sponsored Enterprises/GSEs).

Collectively, that list involved hundreds of billions of dollars in losses by investors. Various types of fraud, corruption and deception occurred. Because taxpayers and the broader economy were impacted by Lehman Brothers and GSEs housing-finance scandals, those cost Americans trillions of dollars.

John Kenneth Galbraith said: “Regulatory bodies, like the people who comprise them … become, with some exceptions, either an arm of the industry they are regulating or senile.” Bingo.

Modern robber barons are dominating information and capital. Cold Fusion’s documentary about the Theranos’ scandal observed: “It’s the illusionary effect where if you repeat a lie enough times people start to believe it, especially if you have credible names surrounding the product.”

Problematic products are from corrupt companies.

Theranos’ Elizabeth Holmes is shown with then Vice President Joe Biden and President Barack Obama. In the massive Enron scandal, Ken Lay and Jeff Skilling are shown with then President George W. Bush (R). Those establishment politicians are sufficient to make the point of the “illusionary effect” of “repeating a big lie enough times” when “credible names” are involved.

Harry Markopolos and his colleagues spent years trying to get public officials and mainstream media to expose the massive Bernie Madoff fraud they knew existed. Forbes says Madoff losses may have exceeded $50 billion.

Other regulatory failures are hiding in plain sight. The New York Times quoted Warren Buffett: “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

Buffett’s “class” profited wildly in the 2008 and 2020 economic upheavals. How? CNBC quoted billionaire Bill Gates: “I didn’t even want to meet Warren because I thought, ‘Hey this guy buys and sells things, and so he found imperfections in terms of markets, that’s not value added to society, that’s a zero-sum game that is almost parasitic.'”

The CDC defines parasitic: “A parasite is an organism that lives on or in a host organism and gets its food from or at the expense of its host.”

Buffett said, “The most important thing for me is figuring out how big a moat there is around a business. What I would love, of course, is a big castle and a big moat with piranhas and crocodiles.”

When carefully examined, these oligarchs and their businesses employ “parasitic” “moat” and “sabotage monopoly” methods. They create a slow-motion monopoly of various markets. Experts like James Schmitz say monopolies “inflict great harm on low- and middle-income Americans.”

The solution? Enforce existing laws. Break these pernicious giants up. They cause social, economic and moral harm. Once broken up, watch the economy and America soar. ##

L. A. “Tony” Kovach

###

If the fact that the facts pattern still fits days, weeks, and months later isn’t mortifying to those involved, it is time for cardiac care. When their behavior can be published well in advance in an analysis that fits weeks later, then manner of humanity are these people?

The system is corrupt; not just rigged, but corrupt.

The time to act on each aspect of this, by bringing authoritative investigations by state and federal officials that will use subpoena powers and then act to the fullest extend of the law on what they discover is asap. Because this is either incompetence on such a massive scale as to defy reason, or it is just as corrupt as the above and linked reports makes it appear to be.

As a reminder to first-time or newer readers, MHProNews is #1 for good reason. Industry pros, investors, public officials, and others follow this site because we base our work on facts, evidence, accurately cited sources, and then logically draw conclusions that stand up to scrutiny.

So, either way, be it massive incompetence or corruption of federal, corporate, and other officials, the appropriate heads should legally roll.

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.