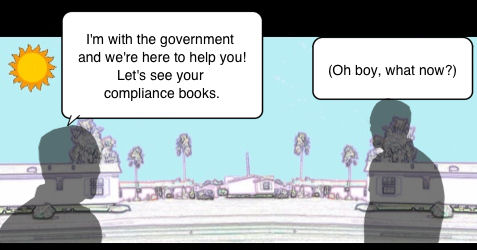

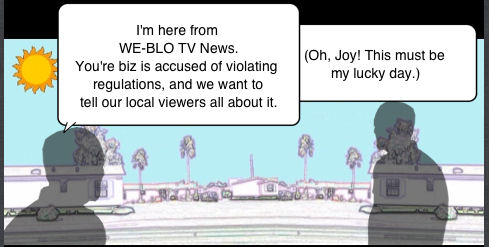

I was talking today with a respected industry leader. Part of the discussion was about fear mongering. There are voices in our great Industry that have and will sound the alarm on a topic, often offering a solution that is profitable to the voice doing the advocacy. While the warning (say for example, on Dodd-Frank and its threats) may be valid, the fact that there is a profit motive may taint the perception by the audience of the voice sounding the alarm. The bottom line for the caller was that until the Consumer Financial Protection Bureau (CFPB) or a state regulatory agency comes out and actually fines someone in our industry, those voices that warn us may not be given full credence.

There are savvy people in our world who use fear as a motivator. Politicians often use fear. Politicos routinely demonize their opponents, naturally while trying to make themselves look like the reasonable party with all the solutions. 'Those are the bad guys! We are here to save you!' You know the drill.

Marketers and sales people may also use fear – such as the fear of loss – to get a person to act now. 'Buy now before prices or interest rates (or prices, etc.) go up.'

We all face fears. Some are real, some imaginary or are mere tools of manipulation. So the first thing one must do is discern; how real is the specter of the fear?

For discussion sake, let's presume we are thinking of a something with a genuine cause for concern.

The question then is, what do we do when faced with a “frightening” challenge? The classic reply is three options: flight, fight or deal with the challenge.

When I raise the topic of fear, what is on my mind today is the following concern (maybe not a fear…). Great, we now see new home shipments thankfully rising. But have enough industry professionals learned the lessons of the last 14 years downturn?

Will we sustain this 9 month upturn, or are we waiting for the next speed bump to hit and slow us down?

How Robust is our Current New Home Shipment Rise?

Our regular readers at MHProNews.com usually know that the industry hit its post HUD code peak production in 1998, when we saw shipments top 372,000 sales. Since then, we watched a steady overall decline until in the past 3 years we have hovered around the 50,000 +/- home shipment (wholesale sales) amount. So the 1998 high was 7 times our current sales levels.

We see the boom taking place in North Dakota housing demand, fueled by oilfield and related activity. Business friendly Texas is seeing a surge, in part due to their oil patch, in part due to a better economy and other factors. You can click here to see a more complete break down of national HUD Code shipment statistics.

The question hereby posed is this. Is our mini-boom from our recent 50,000 +/- annual new home shipment level baseline heading towards yet another bust? Or are we heading towards a new boom, as this retailer/developer's article linked here says is upon us?

Last year, before this 9 month surge in shipments, one association leader mentioned to me that “shipment levels of 46,000 HUD Code homes was the enemy.” At that level, more factories would close. With the shipment trend rising, we now get to report on factories opening, production schedules getting longer and other 'good news.'

Why did we boom in the 90s?

The 1998 peak was reached in part due to the ease of financing – notably chattel financing – but land-home lending was arguably easier then too. A good chunk (some say, 30%) of those mid-to-late 90s MH loans were made to individuals with weak credit and little or no actual down payment.

When our manufactured housing bubble burst, many once large lenders in manufactured housing such as Conseco or GreenPoint vanished from our financing landscape. The remaining MH industry lenders addressed and corrected issues such as weak or flawed document checks and phony down payments. So the remaining personal property lenders tightened credit policies, demanding higher credit scores as necessary for their survival. Arguably those policy changes was necessary for our Industry's survival too.

How is Industry Financing Doing Today?

I hear and see comments about a "lack of financing." Some MH business owners and professionals – often those who enjoyed or heard about the go-go days of the mid-to-late 90s – think that if we can't get a would be home buyer with a 500 range FICO score bought with a modest down, then we must 'lack third party financing.'

Further, some believe that if private lenders can't get that sort of lending done, then we should be asking the federal government to do it and back it.

What attendees saw in Louisville and Tulsa – and what those who are going to the Texas Manufactured Housing Association (TMHA) upcoming annual meeting will see – is that there are many lenders now active in manufactured home financing. Some companies such as First Guarantee Mortgage Corporation (FGMC) are growing rapidly as a result of active efforts to pursue more business in the manufactured housing sector.

That is good news.

So as thWill we Catch the Tsunamiat factory built home retailer/developer argued in his recent Will we Catch the Tsunamiarticle, we could be experiencing a boom that surpasses that of the 1960's.

So why aren't we selling 100,000 -200,000 or 300,000-500,000 homes now? Is it a lack of lending? Or is it something else?

Do we want to be Third Choice Housing?

Some in our industry are correctly proud of the fact that we are able to serve millions of home buyers who would never otherwise be able to buy a new or pre-owned home. Rightly so, and I applaud that sentiment. We are the most affordable housing, and there is no reason for us to abandon those roots.

At the same time, I shake my head when I see or hear those who are 'happy' about or 'okay' with and accept the fact that manufactured homes are "third choice housing."

Pardon me? Not meaning to step on anyone's toes, but how short sighted! As another one well known leader said to me this week, 'We don't have a product problem, we have a great home product!' The problem is one of public perception (Image).

Until we fix our image, we will be less effective in DC, the state house or your local jurisdiction. We either define ourselves or others will define us.

The Industry needs a multi-pronged approach to dealing with its many issues.

-

We need active lobbying efforts such as those of SNR Denton.

-

We need to support the lifestyle decisions of the 19-20 million Americans who live in pre-or-post HUD Code factory built housing. Good retailers in every industry know that you don't 'sell 'em and forget 'em' if you want to be long term in an business. Let's make that ever more true in our Industry.

-

Protect, promote and educate association efforts merit our involvement and support.

-

We must stay informed, involved and invite others to do the same.

Have enough of us learned our lessons during this long downturn? Or do you think there is nothing to fear but fear itself?

We are bullish on the Industry's potential. But optimism needs positive action if we are going to achieve our potential, so we may learn from and avoid the errors of the past. ##

Post by

L. A. 'Tony' Kovach

www.MHProNews.com

www.MHMarketingSalesManagement.com or www.MHMSM.com

Innovation – Information – Inspiration for Industry Professionals

Office – 815-270-0500

latonyk@gmail.com or tony@mhmsm.com

http://LATonyKovach.com

http://www.linkedin.com/in/latonykovach

http://pinterest.com/latonyk/manufactured-home-lifestyle

+++

Whether you think you can or whether you think you can't, you're right. – Henry Ford