Some 13½ years after the enactment of the Congressionally mandated Duty to Serve (DTS) manufactured housing, rural, and underserved markets for the Government Sponsored Enterprises of Fannie Mae and Freddie Mac, the Federal Housing Finance Agency (FHFA) has stated their respective plans for 2022-2024 will not be accepted for “any of the three underserved markets.” The FHFA release was dated 1.5.2022. The Manufactured Housing Institute (MHI) ‘news and updates’ on that date did not mention this development. Nor did MHI’s email for 1.11.2022. But the Manufactured Housing Association for Regulatory Reform (MHARR) provided some additional insights to the apparently significant development announced by the FHFA. In addition to formal statements by FHFA and MHARR, MHProNews obtained some further comments from two sources at the FHFA. Framed against what Prosperity Now and other affordable housing advocates, those named sources, related further information, facts, and commentary follow in that sequence.

FHFA Objection to Enterprises’ 2022-2024 DTS Plans

FHFA has reviewed Fannie Mae’s and Freddie Mac’s revised Duty to Serve Proposed Underserved Markets Plans (Plans) for 2022-2024 and determined that neither Plan meets the DTS Non-Objection standard for any of the three underserved markets.

The Agency has directed both Enterprises to submit additional revisions to improve the Plans’ impact on all three DTS underserved markets. In the meantime, however, DTS implementation will continue without interruption based on objectives in the Enterprises’ current proposed Plans.

Under the DTS Program, Fannie Mae and Freddie Mac prepare and submit 3-year Plans detailing their activities to serve the manufactured housing, rural housing, and affordable housing preservation markets. FHFA reviews and issues Non-Objections to those Plans, based on the intended impact in each market. The first Plan cycle concluded in 2021 and the Enterprises are developing Plans for the second cycle covering 2022-2024. … ##

The statement above included a comment that follow up on this topic were welcomed.

Welcomed or not, MHProNews did a follow up to several contacts at the FHFA. The following was one of the on-the-recorded responses provided.

The message FHFA communicated yesterday is clear. FHFA has reviewed Fannie Mae’s and Freddie Mac’s revised Duty to Serve Proposed Underserved Markets Plans for 2022-2024. FHFA determined that neither Plan met the DTS Non-Objection standard for any of the three underserved markets. FHFA has directed both Enterprises to submit additional revisions to improve their Plans’ impact on all three DTS underserved markets.

…

Best,

Adam Russell

Senior Communications Specialist

Office of Congressional Affairs and Communications

Federal Housing Finance Agency

##

In a separate communication, another source with the FHFA informed MHProNews that the details were not being made public, at least not at this time.

MHARR’s communique to the industry via email included this release provided to MHProNews. A check of Google on 1.11.2022 at 9.44 AM ET indicated that none of the other manufactured housing ‘trade publishers’ or bloggers in manufactured housing provided this release to their readers.

JANUARY 6, 2022

TO: MHARR MANUFACTURERS

MHARR STATE AFFILIATES

MHARR TECHNICAL REVIEW GROUP (TRG)

FROM: MHARR

RE: FHFA OBJECTS TO PROPOSED 2022-2024 DUTY TO SERVE PLANS

The Federal Housing Finance Agency (FHFA), as the statutory regulator of Fannie Mae and Freddie Mac and the federal agency responsible for implementation of the Duty to Serve Underserved Markets (DTS) directive of the Housing and Economic Recovery Act of 2008 (HERA), announced on January 5, 2022, in a potentially significant action, that it has filed objections to the proposed 2022-2024 DTS implementation plans submitted earlier in 2021 by the two mortgage giants.

In a brief News Release (see, copy attached), FHFA stated that following a review of the proposed plans – the second set to be submitted by Fannie and Freddie under the DTS mandate – it has “determined that neither Plan meets the DTS non-objection standard for any of the three underserved markets” and has “directed both Enterprises to submit additional revisions to improve the Plans’ impact on all three DTS underserved markets.” (Emphasis added).

While the underlying FHFA objection letter referenced by the January 5, 2022 News Release has not been made public and an MHARR request for full disclosure of that communication by FHFA has been denied (at least initially), it is significant that FHFA’s objections address “all three” underserved markets, including the HUD Code manufactured housing market.

At the broadest level, FHFA’s announcement confirms the validity of MHARR’s consistent and elemental position that the proposed 2022-2024 DTS plans, as submitted, are fundamentally insufficient with respect to the HUD Code manufactured housing market and, therefore, in violation of the statutory DTS directive. This position has not changed since the submission of the Enterprises’ first DTS plans, and was enunciated unequivocally by MHARR at a July 14, 2021 FHFA “listening session” concerning the proposed 2022-2024 plans, in parallel written comments to FHFA filed on July 15, 2021, and in a subsequent October 5, 2021 meeting with senior FHFA officials.

As MHARR has repeatedly emphasized in all such forums, Fannie Mae and Freddie Mac through multiple DTS proposals and modifications, have shown no change whatsoever in their continuing unacceptable refusal to serve the vast bulk of the manufactured housing market financed through personal property loans and their continuing view of such chattel-financed homes – the industry’s most affordable – as “trailers” rather than legitimate housing. This blatant and baseless discrimination against truly affordable housing and lower and moderate-income homebuyers helps fuel the ongoing housing crisis in the United States.

MHARR will continue to closely monitor this matter as it progresses, will take further action as necessary, and will advise you accordingly.

cc: HUD Code Manufactured Housing Producers, Retailers, Communities and Finance Companies

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: manufacturedhousingassociation.org

##

Additional Information, More MHProNews Insights, Analysis and Commentary

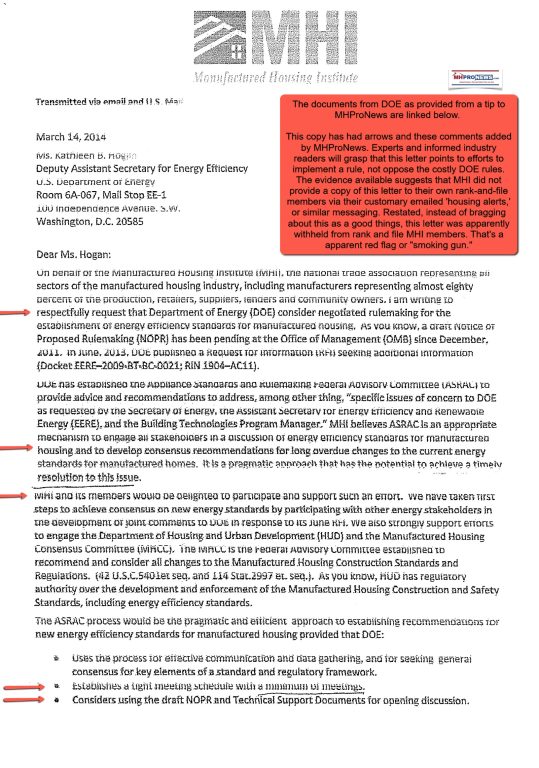

1). On the looming and widely viewed by industry professionals as harmful DOE Energy Rule issue, MHI and MHARR on paper in recent public statements seemingly agree that the rule needs to be stopped before it becomes effective.

2). On the GSE failure to implement the Duty to Serve (DTS) manufactured home lending via chattel lending, MHI and MHARR seemingly agree on paper. Both admit in their own words that manufactured home sales are being limited by the lack of competitive lending.

3). On the long-vexing issue of the failure for HUD to enforce the so-called “enhanced preemption” provision from the Manufactured Housing Improvement Act (MHIA) of 2000 that allows HUD to supersede discriminatory local/state zoning barriers, MHI and MHARR also seem to be on the same page…on paper.

That presumes that the respective statements made by MHI and MHARR are each worthy of being considered at face value. Are they sincere? What does years of evidence from each of the two major trade groups in manufactured housing reveal?

- In the case of MHARR, they have offered to MHI state affiliates to team up and sue to get “enhanced preemption” enforced. There were no takers, stated MHARR. If MHI wanted the law enforced, why haven’t they offered to sue to obtain enforcement of the law too? Or why didn’t MHI encourage their state affiliates to team up with MHARR and sue to enforce the long-delayed law meant to increase affordable housing sales?

- In the case of MHARR on the DOE Energy Rule issue, they previously teamed up with third-parties to the industry and essentially forced MHI to pivot away from what amounted to a capitulation on the DOE rule.

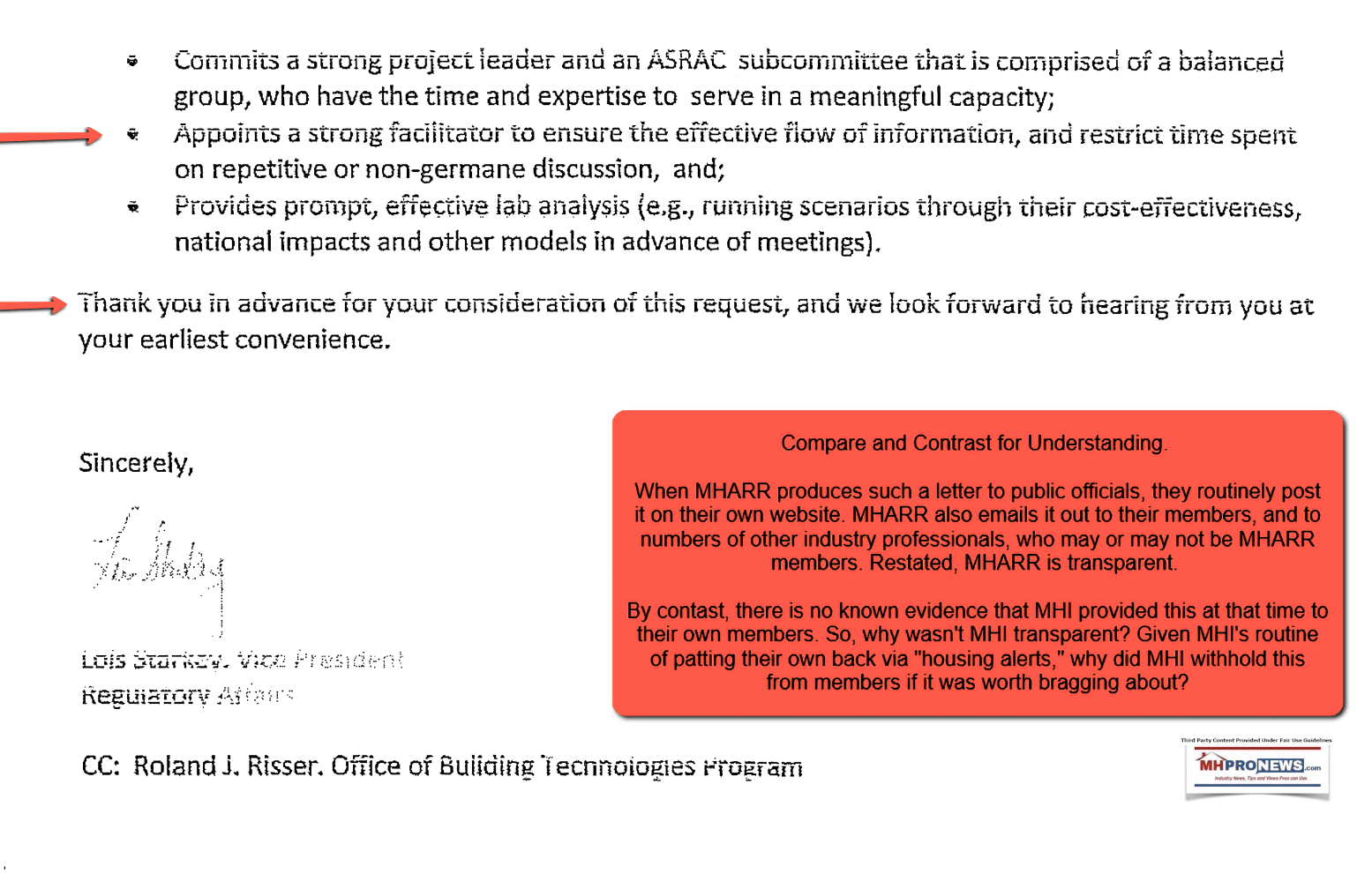

- Additionally, documents obtained/provided by a source at the DOE revealed that MHI has worked behind the scenes to get the energy rule enforced. MHI has not denied the authenticity of the damning evidence – one of which is shown above – that cuts against their ‘official’ posture.

- Then, on DTS, MHARR has met in person with FHFA officials to press for a robust chattel loan program. By contrast, MHI pushed for lending on their apparently market failed CrossModTM homes plan. But why didn’t MHI press for the same level of attention and effort for DTS on all HUD Code manufactured homes? Why has MHI, and the GSEs, never released the meeting minutes from the closed door discussion from which CrossModTM emerged?

- MHARR publicly ripped FHFA’s handing of DTS, asking for internal and Congressional investigations. MHI, by contrast, used politically correct lingo that has produced no results.

- MHI was publicly ripped by Prosperity Now (then CFED) unit leader Doug Ryan for shielding Clayton Homes interests in keeping more costly lending by failing to get DTS enforced.

While MHI’s Lesli Gooch denied that claim by Ryan, the fact that Prosperity Now, some MHI members, and some of MHI’s touted “housing coalition partners” signed onto a letter to FHFA pressing for what has now occurred – while MHI did NOT sign onto that letter – speaks volumes. For the evidence and document, see the report linked below.

What does that brief factual- and evidence-based review reveal?

- Whatever MHI officially says, consider the possibility that they are merely posturing.

- Clear thinkers with discerning minds must consider the possibility that the something quite different than what MHI claims appears to be true.

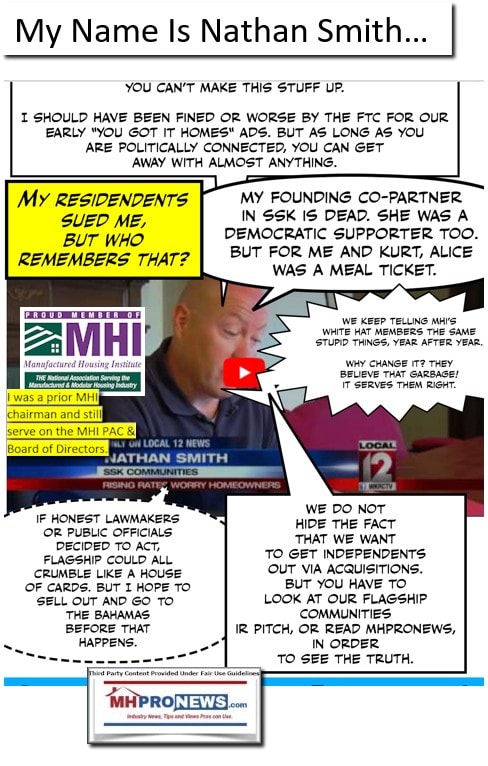

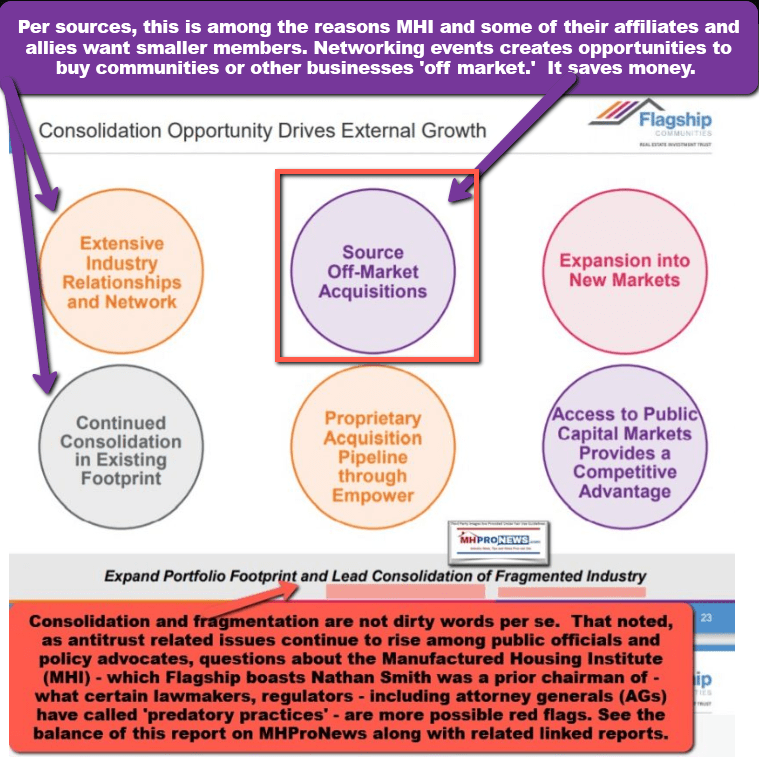

But that thesis begs a question. Why would MHI posture instead of performing the steps necessary to accomplish what they claim they want, some might ask? Because several of MHI’s own members indicate in writing and repeatedly that they are aiming to consolidate the manufactured home industry. You can’t make this up, nor is there a need to — because the evidence is found in publicly traded MHI member company investor relations pitches.

When asked to respond to such fact-, evidence- and years-of-trends based concerns, MHI leaders and their attorneys stays mute (see first linked report below). So too has Berkshire Hathaway connected attorneys (see second linked report below).

It is their respective constitutional right not to incriminate themselves from a range of possible federal and/or state crimes. Several of MHI’s own ‘elected chairmen’ have been caught up in controversial legal and media issues. MHI ‘razzle dazzle’ act is to behave as if it never happened.

See the related reports to learn more. But the bottom line is increasingly clear. For whatever motivations, MHI says one thing, but routinely does or does not do the very commonsense steps necessary to effect their claimed posture.

Former MHI vice president and MHARR’s founding president and CEO, Danny Ghorbani – as well as current CEO Mark Weiss, J.D, – have effectively pressed MHI on the question: will MHI sue to defend the industry from the DOE energy rule if needed? Will MHI sue to get DTS or the Manufactured Housing Improvement Act “enhanced preemption” enforced?

Time will tell. But failure by MHI’s leaders to do so may leave several board members and others legally vulnerable. They have a fiduciary responsibility and other duties to their members. By contrast, MHARR has made the efforts, which instances linked above, include successful efforts to foil MHI at their own posturing game.

MARK WEISS Addresses the Manufactured Housing Industry’s Twin Crises -an MHProNews Interview With MHARR President and CEO, Mark Weiss, J.D. – Manufactured Housing Association for Regulatory Reform

The following is a exclusive new interview with attorney, manufactured housing industry veteran, Manufactured Housing Association for…

Day by day, the concerns raised by Samuel Strommen from Knudson Law, and others within the industry appear to be proven soberingly accurate.

No Title

No Description

In summary, in about an 8-minute read, this article outlines and links the troubling evidence that MHI is posturing without preforming. They have attorneys. They have millions of dollars in reserve. They have big corporate members with deep pockets that could sue to stop DOE or sue to enforce the MHIA’s “enhanced preemption, or the Housing and Economic Recovery Act of 2008 Duty to Serve (DTS) mandate. But instead, MHI writes letters that say one thing, but then time and again demonstrably do something different. It may soon be time to engage Congress, the FTC, and the DOJ to investigate, expose, and sue/prosecute as needed MHI and their dominating brands. Failing that, there are other fall-back options too.

To lighten up the mood on often sobering problems you’ll also get reports like the one below. Stay tuned to the only trade source that provides the insights that pro-MHI publishers and bloggers decline to expose. It is this thesis that explains why manufactured housing has been underperforming for so long during an affordable housing crisis. ##

###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.