According to a source with the Manufactured Housing Institute (MHI), Manufactured Housing Properties Inc (OTC- MHPC) is a member of the Arlington, VA based MHI-National Communities Council (NCC) division. The MHPC investor relations presentation cites MHI numerous times. Before diving in, why examine this firm at this time? MHPC is not currently one of the stocks that MHProNews tracks in its business-daily market reports. Compared to some consolidators, it is relatively modest in size, and thus there is no plan to include them in our market report in the near term. So why examine their recent statements at all?

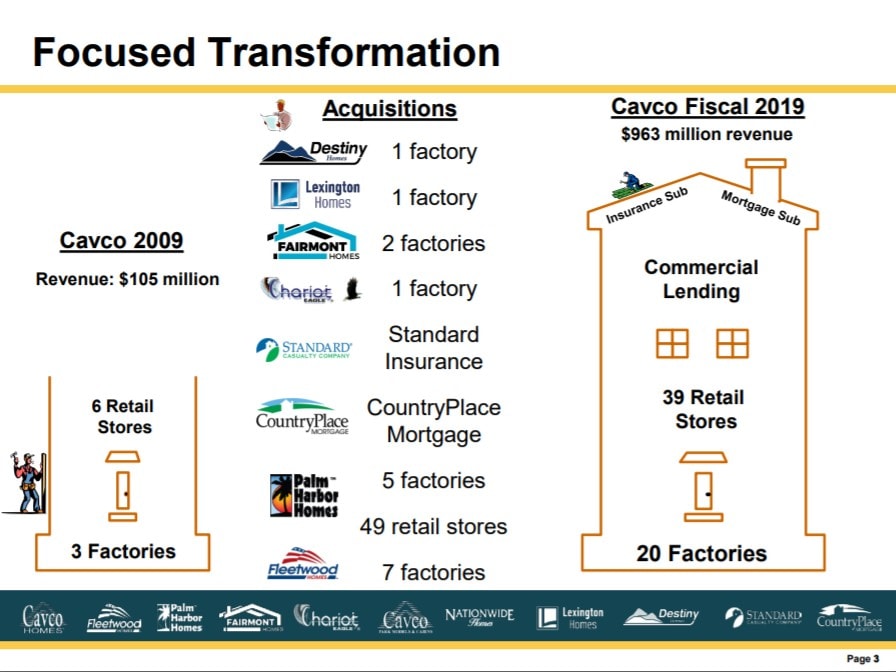

That question sets the stage for what MHI-NCC member Manufactured Housing Properties Inc (MHPC) has arguably done for the manufactured housing independents. It is this. MHPC has documented the themes that the evidence reflects are common among several MHI and NCC members that are focused more on consolidation of independents than they are on manufactured home industry growth.

Let’s provide an executive summary, and then examine the evidence in that MHI member company’s own words.

MHPC statements in bold below are direct quotes from that firm, while the standard-type-face text that follows those MHPC quotes are an analysis-in-brief by MHProNews.

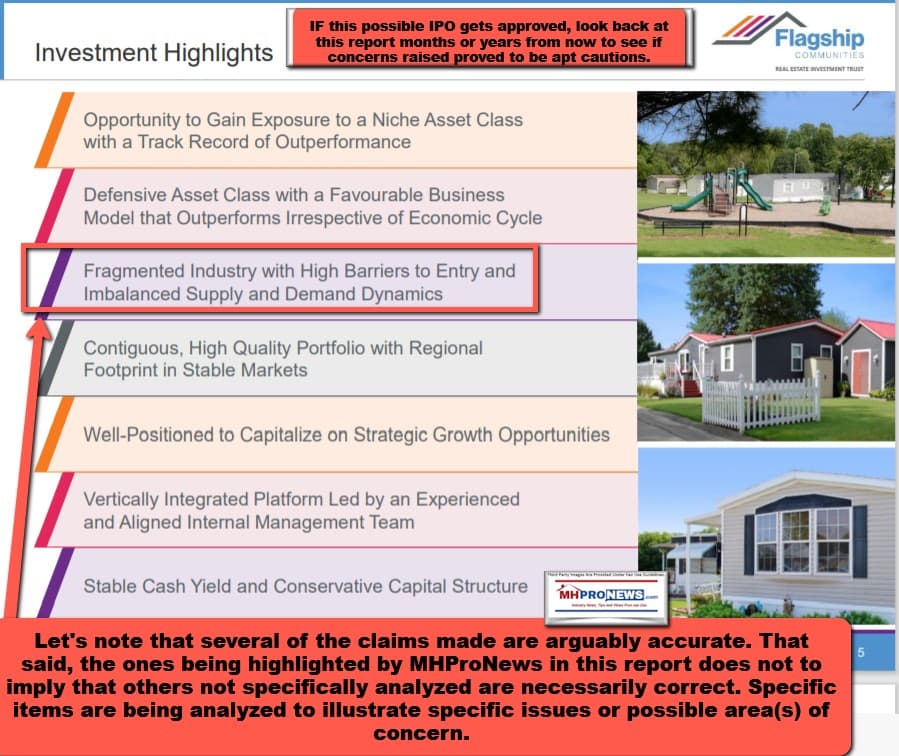

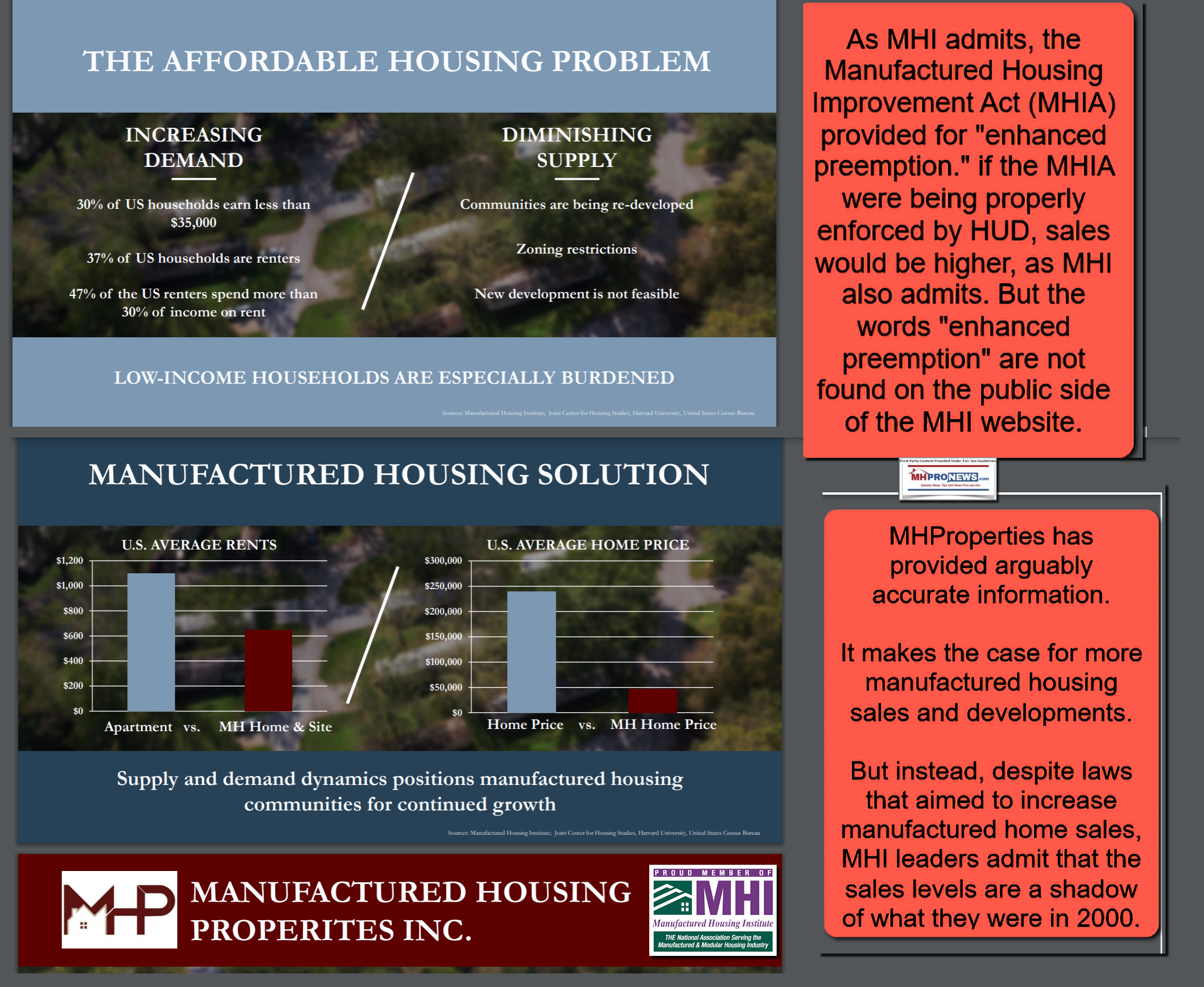

- “Significant Barriers to Entry.” This could be a line out of the Buffett-Clayton Moat mantra, which Warren Buffett, Kevin Clayton, and several pro-Berkshire sources have said is a critical scenario for a “durable competitive advantage.” See the factual evidence linked here, in the words of Buffett, Clayton, and pro-Berkshire voices.

- “Diminishing Supply.” This is a logical consequence of high barriers of entry, combined with the closure of more communities than new ones being opened. It is another evidence-based theme that MHProNews has sounded as an area of concern for some years.

- “Fragmented Ownership of Communities.” While this has become a common theme by MHI NCC members that are busily consolidating the land-lease community sector, it has also been the theme of

There is much more. But those 3 points from MHI member MHPC are enough to set the stage for this MHProNews Masthead report and analysis.

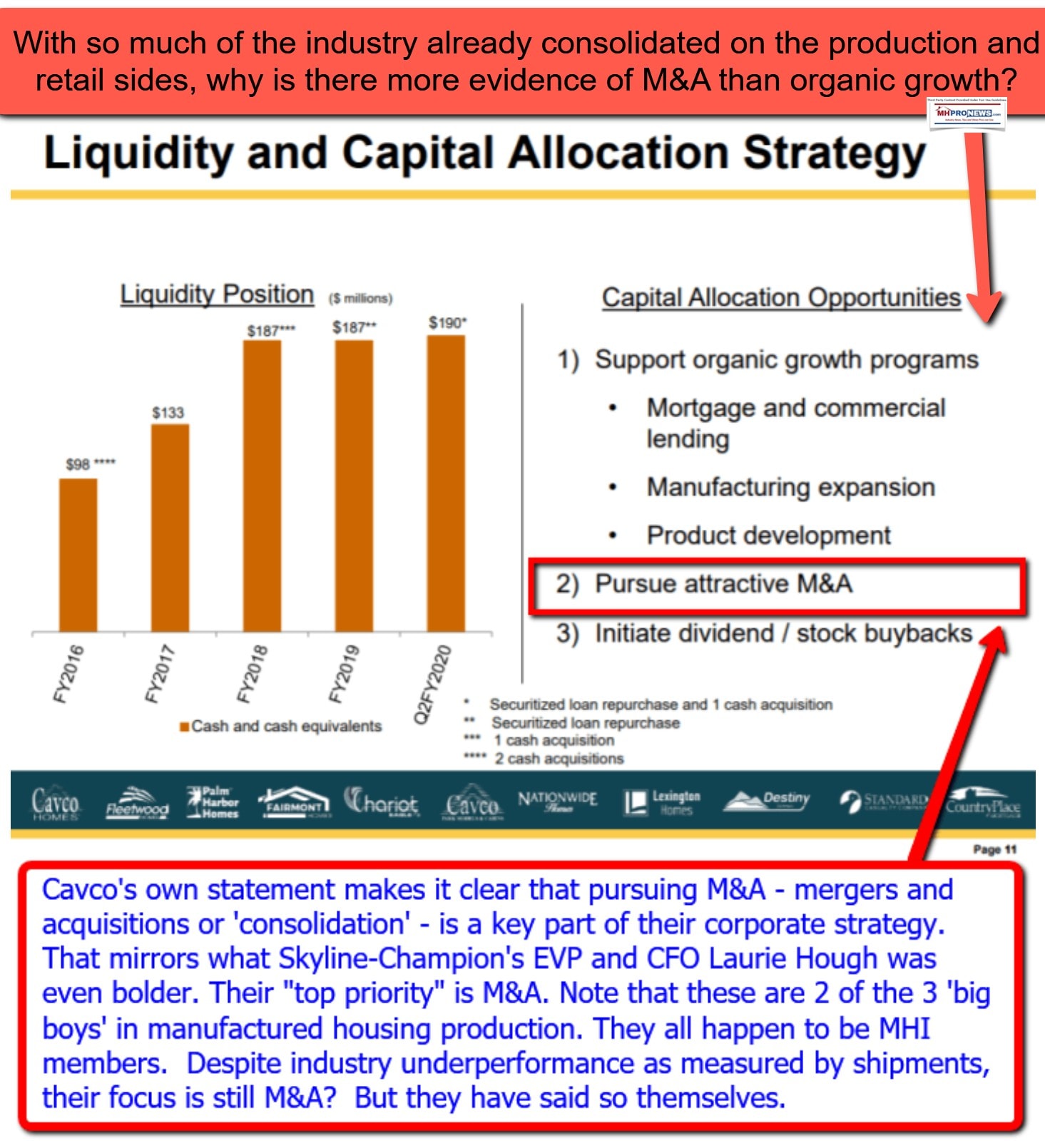

- There are several examples that MHProNews has reported in recent years where MHI member firms, or companies that are members of an MHI state affiliate, are routinely using similar language. Given the common point that they are MHI and/or NCC members, the evidence raises concerns that consolidation is the actual agenda of MHI, rather than the stated one.

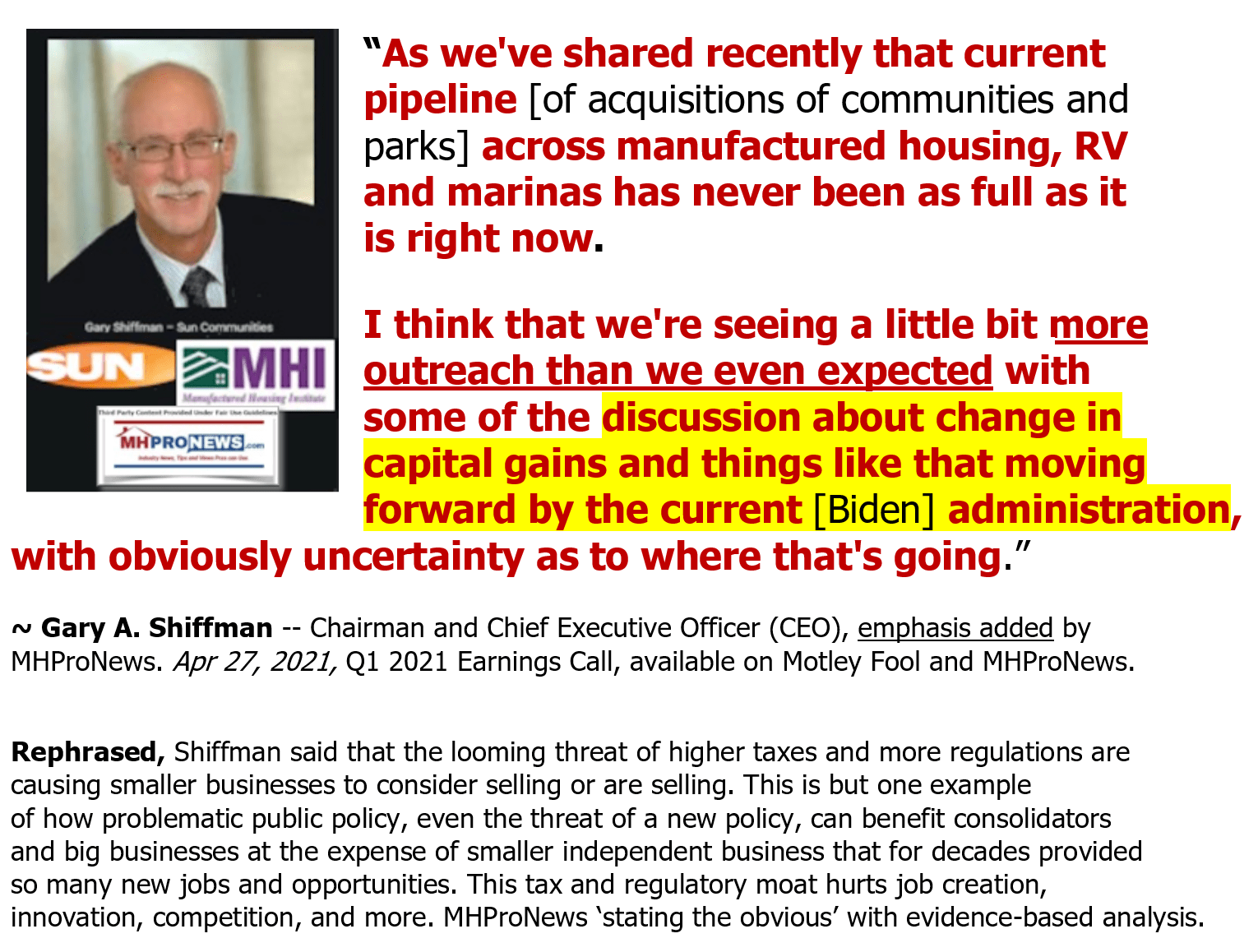

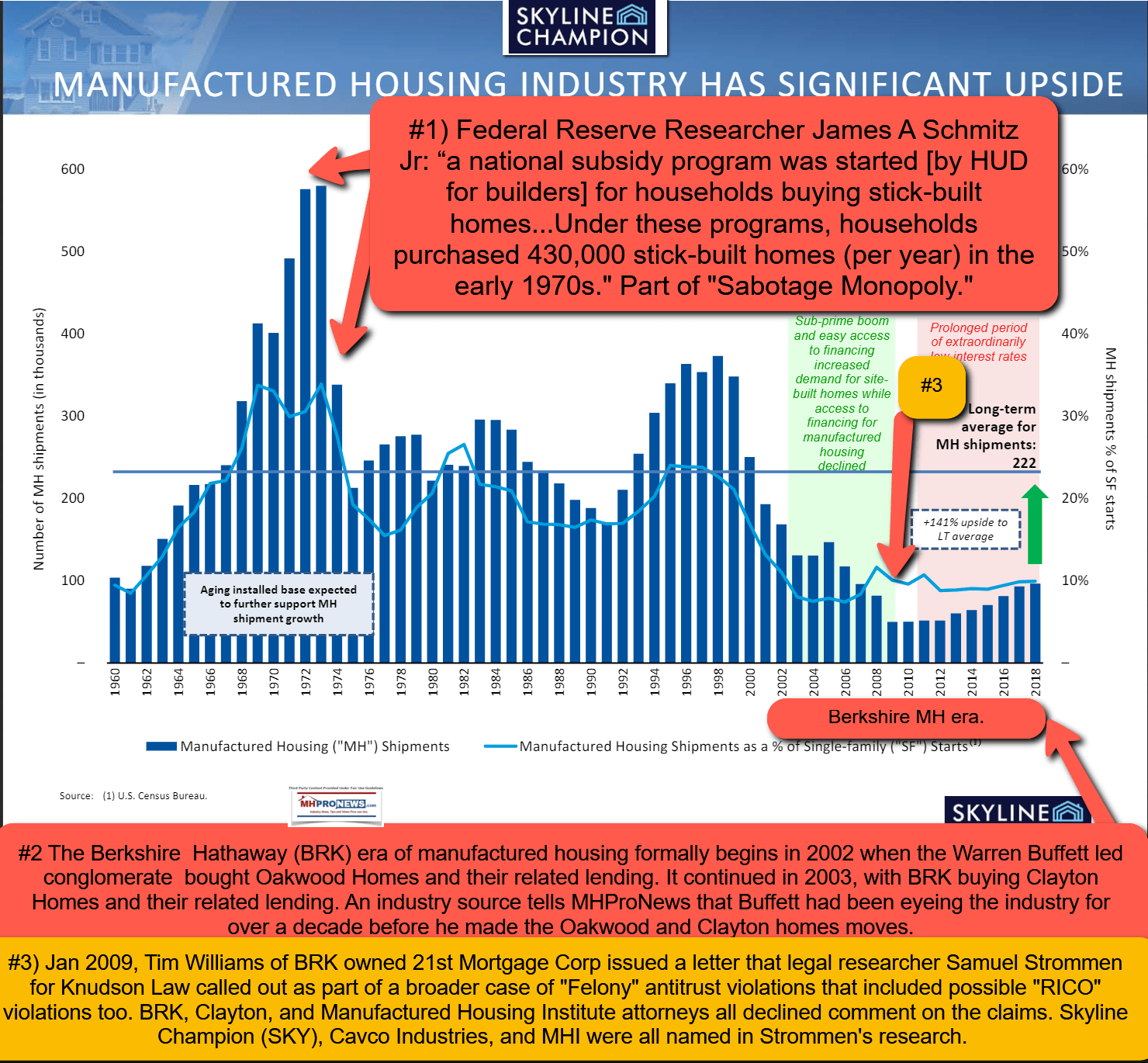

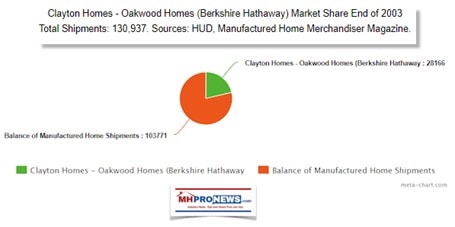

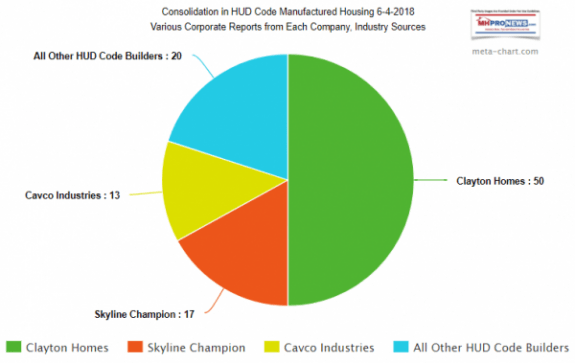

- In order for consolidation to work in volume and profitably, it requires throttling manufactured home production, sales, and new entries. Indeed, prominent MHI member Frank Rolfe openly said as much, when he said that no new communities should be built. It is worth noting that Rolfe and his partner Dave Reynolds community interests are obliquely referred to by MHPC.

- It is Buffett-Berkshire proponent author Bud Labitan and his co-authors in “Moats – The Competitive Advantages Of Buffett & Munger Businesses” who documents and explains how the durable competitive advantage concept works. Barriers of entry are critical in that process, “Moats” states, and they make that point by quoting Buffett and his vice chairman Charlie Munger. Third-party Buffett-watchers, and obliquely Kevin Clayton himself, make it clear that paltering and head-fakes are part of that pattern.

- When asked to defend or otherwise attempt to explain away the growing Buffett-Berkshire-MHI evidence that they are working on behalf of consolidators, those corporate leaders, outside and inside attorneys, and their backers demure engaging the evidence provided by third-parties and as published by MHProNews.

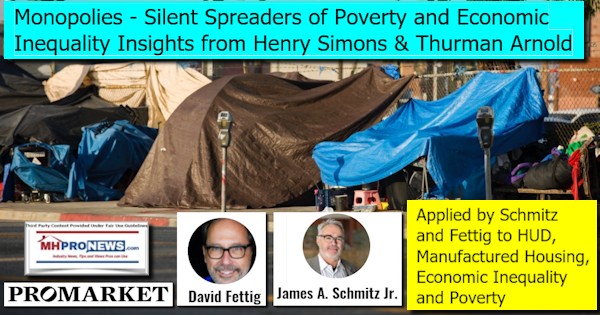

Rephrased, in recent years, the increasingly pressed case that manufactured housing is underperforming due to forces within the industry, often acting in concert with regulators and others, is growing. There is no series response to that factual and evidence-based thesis. Thus, the prima facie case that MHI is working in ways that Samuel Sam Strommen with Knudson Law says indicates “felony” antitrust, “RICO,” and other possible illegal activities is growing and remains publicly unchallenged.

With that backdrop, let’s dive into the fresh details, how that marries up with other statements from MHI members, all of which substantiates those claims.

About Manufactured Housing Properties

As of 6.16.2021, a brief online check of news items using the search of the firm’s name – Manufactured Housing Properties – reveals no apparent resident pushback issues. If so, that is a plus. That said, the company operates under several location names. Per their own documentation, they have used a number of company names previously.

On the reasons for concern side, a simple request to two company leaders to ask about their association ties, if any, to the Manufactured Housing Institute and/or state associations by MHProNews did not receive a reply. While there are possibly valid reasons a firm may not respond in a timely matter to such a bland inquiry, it could also have some significance.

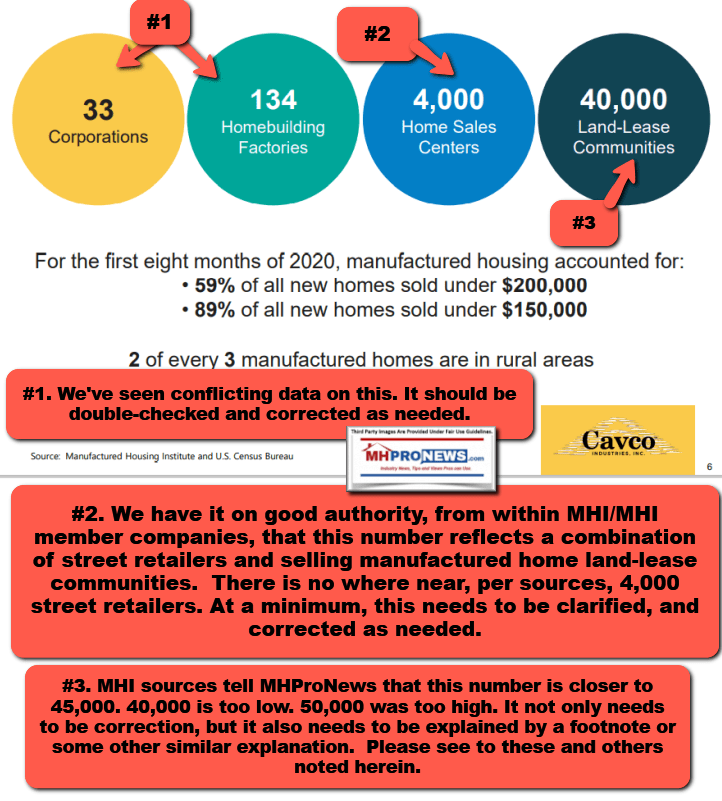

This MHProNews fact-check, report, and analysis is not a plug for the firm. Rather, this is an examination of some of their statements which bear a level of scrutiny. On the mildly inaccurate side of the information is this example. There is arguably at least one incorrect statement in MHPC’s investor relations information. MHPC states that there are four publicly traded firms in the manufactured home community space, counting themselves. The other three would be Sun Communities (SUI), Equity LifeStyle Properties (ELS), and UMH Properties (UMH). However, MHPC does not apparently count Flagship Communities, perhaps because that firm is traded in Canada on the TSX.

Let’s look at several examples of MHI member firms which have pressed similar themes to MHPCs.

![]()

That noted, and of greater interest to independents, consumers, public officials, and others is this point that takes up a significant part of their IR pitch. MHPC, along with several such firms, declare themselves rather openly to be consolidators of the ‘highly fragmented’ manufactured home community sector in some form or fashion.

In fairness, let’s consolidation might be done legitimately, and in a manner that is beneficial to consumers.

That said, there is a growing body of evidence that an examination of several members of the MHI, NCC, and/or an MHI connected state association affiliate reflects are using similar themes. Those themes arguably reflect areas of regulatory, legal, consumer, and other professional interest that may in time prove to be problematic for more consumers and also to investors.

The following is from MHPC, and once more for emphasis, it is provided not as an endorsement of the firm. Rather, it is published as direct evidence of the commonality of consolidation among MHI members who are openly and publicly doing the consolidation.

The illustration that follows is from the MHP investor relations pitch-deck, but was not part of the quoted items from their recent press release.

Per MHPC…

“We believe that manufactured housing communities have several characteristics that make them an attractive investment when compared to certain other types of real estate, particularly multifamily, including:

“We believe that manufactured housing communities have several characteristics that make them an attractive investment when compared to certain other types of real estate, particularly multifamily, including:

| ● | Significant Barriers to Entry. We believe that the supply of new manufactured housing communities will be constrained due to significant barriers to entry in the industry, including: (i) various zoning restrictions and negative zoning biases against manufactured housing communities; (ii) substantial upfront costs associated with the development of infrastructure, amenities and other offsite improvements required by various governmental agencies, and (iii) a significant length of time before lease-up and revenues can commence. |

| ● | Diminishing Supply. Supply is decreasing due to redevelopment of older parks. |

| ● | Large Demographic Group of Potential Customers. We consider households earning between $25,000 and $50,000 per year to be our core customer base. In 2019, this demographic group represented about 34.9% of all full-time workers, according to 2019 U.S. Census data estimates. |

| ● | Stable Resident Base. We believe that manufactured housing communities tend to achieve and maintain a stable rate of occupancy, due to the following factors: (i) residents generally own their own homes; moving a manufactured home from one community to another involves substantial cost and effort and often results in the abandonment of on-site improvements made by the resident such as decks, garages, carports, and landscaping; and (iii) residents enjoy a sense of community inherent in manufactured housing communities similar to residential subdivisions. |

| ● | Fragmented Ownership of Communities. Manufactured housing community ownership in the United States is highly fragmented, with a majority of manufactured housing communities owned by individuals. We estimate that the top five manufactured housing community owners control approximately 9% of manufactured housing community home sites. |

| ● | Low Recurring Capital Requirements. Although manufactured housing community owners are responsible for maintaining the infrastructure of the community, each homeowner is responsible for the upkeep of his or her own home and home site, thereby reducing the manufactured housing community owner’s ongoing maintenance expenses and capital requirements. |

| ● | Affordable Homeowner Lifestyle. Manufactured housing communities offer an affordable lifestyle typically unavailable in apartments, including lack of common walls, a yard for each resident, the ability to park by the front door, and a sense of community. |

Competition

There are numerous private companies, but only three publicly traded REITs that compete in the manufactured housing industry. Many of the private companies and one of the REITs, UMH Properties, Inc., may compete with us for acquisitions of manufactured housing communities. Many of these companies have larger operations and greater financial resources than we do. The number of competitors, however, is increasing as new entrants discover the benefits of the manufactured housing asset class. We believe that due to the fragmented nature of ownership within the manufactured housing sector, the level of competition is less than that in other commercial real estate sectors.

Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively:

| ● | Deal Sourcing. Our deal sourcing consists of marketed deals, pocket listings, and off market deals. Marketed deals are properties that are listed with a broker who exposes the property to the largest pool of buyers possible. Pocket listings are properties that are presented by brokers to a limited pool of buyers. Off market deals are ones that are not actively marketed. As a result of our network of relationships in our industry, only two properties in our portfolio were marketed deals, the rest were off-market or pocket listings. |

| ● | Centralized Operations. We have centralized many operational tasks, including accounting, marketing, lease administration, and accounts payable. The use of professional staff and technology allows us to scale efficiently and operate properties profitably by reducing tasks otherwise completed at the property level. |

| ● | Deal Size. We believe that our small capitalization size with non-institutional deals of less than 150 sites are accretive to our balance sheet. These sized properties typically have less bidders at lower prices than larger properties. We can profitably operate these smaller properties through our centralized operations. |

| ● | Creating Value. Our underwriting expertise enables us to identify acquisition prospects to provide attractive risk adjusted returns. Our operational team has the experience, skill and resources to create this value through physical and/or operational property improvements. |

Our Growth Strategy

Our growth strategy is to acquire both stable and undervalued and underperforming manufactured housing properties that have current income. We believe that we can enhance value through our professional asset and property management. Our property management services are mainly comprised of tenant contracts and leasing, marketing vacancies, community maintenance, enforcement of community policies, establishment and collection rent, and payment of vendors. Our lot and manufactured home leases are generally for one month and auto renew monthly for an additional month.

Our investment mission on behalf of our stockholders is to deliver an attractive risk-adjusted return with a focus on value creation, capital preservation, and growth. In our ongoing search for acquisition opportunities we target and evaluate manufactured housing communities nationwide.

We may invest in improved and unimproved real property and may develop unimproved real property. These property investments may be located throughout the United States, but to date we have concentrated in the Southeast portion of the United States. We are focused on acquiring communities with significant upside potential and leveraging our expertise to build long-term capital appreciation.

We are one of four public companies in the manufactured housing sector, but we are the only one not organized as a REIT, thereby giving us flexibility to focus on growth through reinvestment of income and employing higher leverage upon acquisition than the REITs traditionally utilize due to market held norms around 50-60%. This can give us a competitive advantage when bidding for assets. Additionally, due to our small size, non-institutional sized deals of less than 150 sites, which have less bidders and lower prices, are accretive to our balance sheet.

…

## Their pitch deck and the full media release the above is cited from are linked as shown. ##

Summing Up and Conclusions

1.) MHI can offer as a defense of their behavior the fact that they have an antitrust statement. But upon closer examination, that antitrust statement itself is almost a road-map to the types of behavior that are apparently occurring.

2.) MHI claims to have a code of ethics policy. However, a MHEC state affiliate and an MHI board member are among those who have stated the obvious. There is no apparent evidence that the MHI Code of Ethical Conduct has ever been invoked. So both I and II appear to be window dressing for those who do not closely examine the facts.

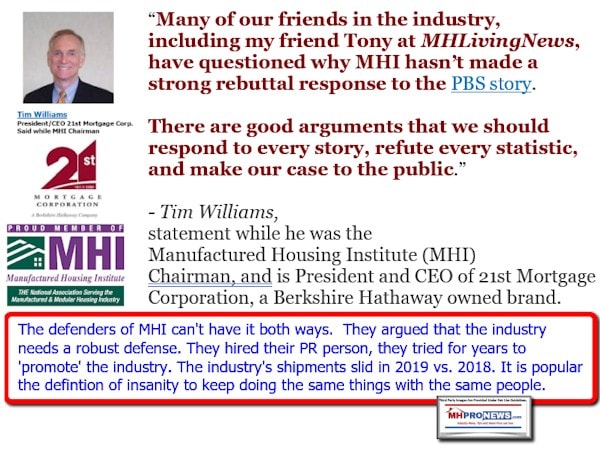

3.) During an affordable housing crisis obviously being made worse by the post-Trump administration policies on the southern border, there are indications that more people are coming into U.S. legally and illegally than housing is being built to meet the needs. Manufactured homes could, in principle, be the best poised to meet those needs. However, despite lip service from Biden-Harris officials such as HUD Secretary Marcia Fudge, there are no indications that Buffett, Bill Gates, or other billionaire-titans plan to use their clout to open the spigot on building much larger volumes of HUD Code manufactured homes. Additionally, despite MHI’s self-documented access to officials in both Democratic and Republican administrations, they have demonstrably not achieved their claimed objectives. Who says? Ironically, MHI and their key members. So it is not just MHI or Berkshire critics, it is MHI itself which documents their own failures.

4.) While MHI – much less the Berkshire brands, et al – are unlikely to publicly say that they have been deluding independents in order to foster consolidators aims, that’s what the evidence reflects.

5.) As MHI supporters and Kevin Clayton himself has said, the prima facia case against Clayton, Berkshire, MHI and their allied brands are confirmed, rather than challenged in any meaningful way.

6.) There is a distinct difference between posturing and performance. MHI, and their dominating brands, can not have it both ways.

Forget what they told you. If you want the truth, follow the money, said author Roxanne Bland, who’se pity statement is anything but bland. What does that mean? See who is profiting or benefiting from the status quo, vs. who is being harmed.

Her comments align with what MHI award-winner Marty Lavin has said.

Lavin has also said that MHI is working for their ‘big boy’ brands.

When those facts, and years of third-party research is examined, it should be clear. MHI has been turned into a tool for consolidators. That sheds light on why Equity LifeStyle Properties (ELS) president and CEO Marguerite Nader called MHI ‘“their” trade association.

Nathan Smith, signaled the same thing years ago. Smith simply did so by laughing as he made the statement.

If this was up for serious debate, then MHI would enter into such a debate. But in fact, they and their corporate masters – after years of praising this publication for our objective pro-growth, pro-consumer journalism – has oddly gone silent or turned on MHProNews. Like it or not, it is what it is.

An recent exception has been MHI backer, George Allen. But Allen, who periodically weaves between MHARR and MHI, has occasionally made similar observations, but then he backs away.

The evidence is there for anyone who dares look for the truth, as opposed to clever spin, paltering, mendacity, etc.

Them what should be the next steps?

A) There ought to be a thorough audit of all MHI communications and records that date back through the evolution of the Berkshire era. Testimony under oath should be procured. Where there is evidence of wrongdoing, it should be prosecuted/acted upon.

B) Just launching such a probe may result in a change of behavior at MHI and their apparently market manipulative brands. But if MHI suddenly pivoted, or if major brands did so too, that should not be a reason not to do a through legal probe.

C) Because tens of billions of taxpayers’ dollars are involved, state and federal agencies should be part of a transparent investigation. Such transparency will also put to the test Biden 2020 campaign “guarantees” that transparency will occur at all federal bureaucracies if he gained office, which right or wrong, he has accomplished.

MHProNews has asked several industry leaders that are MHI defenders, to respond to such allegations. So far, silence. These outreaches, as recent as this week, are documented. That may explain why after several direct and/or thinly veiled threats by various ‘powers that be’ in manufactured housing, that they have never sued. One, the evidence is supplied to readers. Two, a suit opens up the discovery process that could follow from a countersuit.

Silence is not always golden. The bottom line is that the pattern outlined above will not change until the band aids are ripped off, the ugly truths exposed, and then the appropriate legal actions are acted upon.

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.