“Politics is really about the story you tell and getting the people on your side.”

— Julie Pace – Chief White House Correspondent for the Associated Press

At an MHI meeting in 2015, Lesli Gooch and a room full of industry professionals were introduced to a proposal about how good storytelling could enhance MH lending regulatory relief efforts.

By spotlighting current manufactured homeowners and MH shoppers who have been impacted by the CFPB’s implementation of Dodd-Frank rules, a clearer understanding of the harm caused to real people could be told in a compelling way.

It’s the “poster child” approach many other industries and businesses use successfully.

Why not have a series of MH “poster child” stories, told through video, pictures, graphics and the written word?

Then allow those real-life experiences of MH shoppers, MH homeowners and MH industry professionals convey the issues in a fashion that helps others connect to an otherwise technical and dry regulatory story.

Gooch’s reaction?

Gooch immediately dismissed and shot the “poster child” concept down at that meeting.

As the initial advocate and others outside that meeting room later discussed, the storytelling approach could be useful in countering a negative media narrative promoted by others opposing the Manufactured Housing Institute’s sponsored legislation — HR 650/S 682 (Preserving Access...).

Decades of lobbying experiences by other industries proved that the poster child method could also help elected or appointed officials, policy advocates and their staffs to connect with those in the stories.

So why would Gooch, with her PhD in hand, nix a widely proven method of political engagement?

More Manufactured Home Lending Opportunities Missed, Lost or Buried by MHI?

In 2013, the day prior to the opening of the Louisville Manufactured Housing Show, a national lender was a featured speaker at a semi-private industry educational/promotional event attended by Richard J. “Dick” Jennison, the Manufactured Housing Institute’s (MHI) president.

Jennison issued a statement that praised the event and its content.

But that national lender/speaker has told MHProNews that neither MHI’s Dick Jennison, nor the National Community

Council’s (NCC) Jenny Hodge made any effort to advance an untapped option for more MH lending — that a creative and appealing loan program useful in both land lease and in land/home sales already existed, but was grossly overlooked.

Then, as now, MHI officially said that promoting new lending in manufactured housing was a top priority for MHI.

In an opinion column published by AmericanBanker, Gooch wrote:

“For the record, the Manufactured Housing Institute has been leading the campaign to bring more lenders into the manufactured housing market for years.”

She went on to say that “MHI wants to expand access to financing for manufactured housing and increase the number of lenders that offer such financing. It is time that we all work collaboratively toward constructive and actionable solutions.”

Those solutions, Gooch’s column noted, should include the FHFA encouraging the Government Sponsored Enterprises (GSEs) to do chattel lending.

Gooch is partially correct, in as much as MHProNews confirmed sources closely connected with various non-Berkshire-Hathaway lenders that they were included in Duty to Serve (DTS)-related meetings.

But numerous industry lenders – and lenders not in MHI that sought to advance programs for manufactured housing – have given insights that conflict with the rosy picture Gooch painted in American Banker.

The known facts suggest that for whatever reasons or motives, MHI has missed numerous opportunities to expand manufactured housing home-only and land/home lending. The impact on the factory built housing industry in terms of lost sales could be in the billions of dollars annually.

The Titus Dare

Dare’s first article A Deeper Look at why the GSEs say no to Securitizing Chattel Loans, includes this comment:

“It is MHI’s lack of understanding of the function the GSEs have in providing paper to their core secondary lenders, such as Wells Fargo, Bank of America (BOA) and U.S. Bank.”

If Gooch and MHI were sincere in their desire to work collaboratively to increase lending, then why have Dare’s insights been ignored?

According to a comment we received on Friday (6/24/16) from Dare:

“After my articles in MHProNews were published, I heard from industry and MHI members. But not a word or any follow up from anyone at the Manufactured Housing Institute.”

Other Missed Lending Opportunities? More non-MHI lenders ignored?

This writer has made numerous efforts during the presidency of MHI CEO Jennison to address the need for more lending in manufactured housing.

Meetings open to industry members were held in Tunica and Louisville.

Underused or unused programs were examined that, given the proper attention and effort, could have then – and still today – significantly increase MH sales.

Dozens of industry pros who came to each of those sessions and events, and thousands more who read about them wondered: What happened?

Good questions. Some of those took place prior to Lesli Gooch coming on board, but they were known to Jennison, MHI’s president. Why did he fail to engage on those opportunities?

Looking Back at U.S. Bank

This writer signaled in the summer of 2014 The High Cost of Low Volume MH Sales. Within months of that column, U.S. Bank pulled out of the manufactured housing lending market.

Our high-level contacts at U.S. Bank reported, both off-the-record and in official statements, that low volume and regulatory risks caused them to walk away from a home-only lending program that was profitable, but whose volume was too low to continue to fight the long-term regulatory battles.

So it isn’t just MHARR that suggests that MHI has failed to correct the problems with MH industry home lending. Nor is it just sources inside or close to MHARR that accuse MHI of de facto choking off lending with the goal of causing independent businesses to sell off to MHI member companies, or close shop.

In the light of such facts, do concerns raised by MHARR CEO M. Mark Weiss, JD,

asking for the minutes of the closed-door MHI meeting with FHFA about getting the GSE’s to do chattel lending on manufactured homes take on a more urgent look?

View from the Masthead

Management from one of the GSEs met privately with me, at their request, in Las Vegas at the MHI Congress and Expo event. As the Masthead previously reported, we were told, off the record, that there was not much respect at that giant organization for MHI.

MHProNews was also told that the GSEs would not do chattel lending on manufactured housing, unless the FHFA ordered it.

It was that report that caused Titus Dare to reach out and share his insights on how MHI has fumbled this opportunity in recent years.

Dare’s reporting seems balanced, in as much as he reminds the industry that, prior to the current MHI regime, there was progress made with the GSEs, and that some $150 million in lending in land lease manufactured home communities was successfully done.

Dare is currently involved in a non-MH project, so he has no obvious axe to grind, other than his desire to see manufactured housing prosper well beyond its current low levels.

Deliberately Misleading the MH Industry?

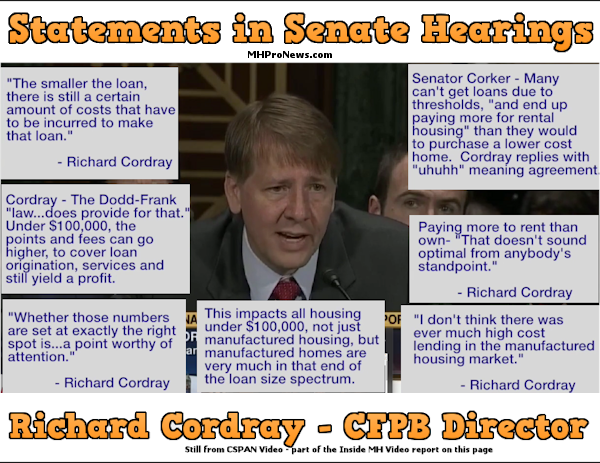

MHProNews has shined a spotlight on the fact that Lesli Gooch, with Dick Jennison’s okay, issued a statement to industry members that was technically accurate, but completely missing the fact that Senator Joe Donnelly’s pro-MH statements were strongly resisted by the CFPB’s Richard Cordray (see the MHI Housing alert, CSPAN video and analysis linked here.)

MHProNews provided MHI repeated opportunities to answer questions on these topics; in each case, they declined or opted not to reply.

When MHProNews formally requested that MHI permit a video and questions for Sen. Donnelly’s upcoming talk to MHI members in Indianapolis, MHI responded with a strongly worded no.

Gooch claimed in her op-ed to American Banker that now is the time “that we all work collaboratively toward constructive and actionable solutions.”

Yet it is Gooch – as noted above – who publicly declined using any supportive video and other poster child -type storytelling efforts by MHLivingNews or MHProNews on behalf of MHI’s bill.

Do they really want it to pass?

It is Gooch and company that have failed to follow up with Titus Dare, to see what they might learn from him on getting the Duty to Serve (DTS) successfully implemented by the GSEs.

Do they really want DTS to become reality? If not, why not?

When Gooch, writing on the association’s behalf, says that MHI “has been leading the campaign to bring more lenders into the manufactured housing market for years” — doesn’t the evidence suggest otherwise?

How does one explain the repeated failures by MHI staff to embrace options and opportunities or new lenders into the MHI space that could lead the industry into more competitive lending and more new manufactured home sales?

Respected and High-Profile Members Who Won’t be at the MHI meeting in Indy

There are numerous voices that are telling MHProNews, off the record, that they won’t be in Indianapolis for MHI’s Summer Meeting. Others are saying they will go, but still expect more of the same.

One pro stated they were shocked that MHI was indirectly admitting they were once more being blind-sided on the “anti-MHI rider” that a message from Jennison urgently called on industry professionals to oppose.

As some are quietly asking: Is it all a show?

If the staff was serious about getting more lending and passage of their bill, how to explain the numerous obvious, yet missed, opportunities outlined in this article? Theories and allegations on these issues abound.

In our rapidly approaching July issue, we will feature on the record comments from well-known and respected operations that say:

-

they support MHI, but suggest that nothing much is getting done

-

that MHI may benefit a select few, but has failed the industry at large and are calling for a new association to be formed

-

We may have more details on a source that says he has spoken with industry professionals prepared to put over a million dollars into funding a new post-production association and promotional effort.

The Masthead has been sounding the klaxon that if MHI is to avoid more embarrassment or further internal divisions, changes — including some level of house cleaning — must take place.

There have been rumors that one or more MHI staff members — seeing the coverage and the growing revelations — are polishing resumes and looking for new opportunities outside of manufactured housing.

Pulling the Threads Together…

The AP’s Julie Pace is correct. “Politics is really about the story you tell and getting the people on your side.”

MHI’s communications to industry, and to those they claim to want to influence, could be termed lackluster, dry and — given that Preserving Access is stalled — ineffective.

They failed to get the GSE’s or FHFA to say yes to chattel lending.

There are many bright spots in MHVille, but how many are directly attributable to MHI?

As a dues-paying, elected MHI board member, this writer has as recently as this week written Congress on behalf of the Preserving Access to Manufactured Housing Act. Not many in the industry could claim to have created more educational storytelling than MHLivingNews.com has, all accomplished with the support and involvement of a range of MH companies and our team members.

We believe in the industry. We believe, too, that the facts show that something dramatic has to happen at MHI, because it clearly is ineffective as it is currently operating.

Gooch wrote about “numerous articles about MHI’s strong support for the inclusion of chattel lending in the rule.” A recent MHI message told their members that MHI “urged” HUD to make changes in their regulatory regimen.

If writing and urging were the only things needed to get implementation or regulations to change, or bills to pass, they would have succeeded long ago.

But the opposite is clearly evidenced by Gooch’s own letters to American Banker, when she says they’ve been working on these issues for years. Isn’t that like saying, they’ve failed to move the ball for years? How long does one keep a coach or player that doesn’t score points for the home team?

Yes, D.C. is in gridlock, as MHI defenders say. But if they can’t get something done, why does the MHI staff continue to grow? What are they all doing now to successfully address issues, rather than “urge” and “strongly support” a change?

It is MHI members who are quietly telling the Masthead that MHI had the opportunity to get the MLO rule changed. Those same voices tell us that achieving that success could have led to others on points and fee thresholds, the twin goals of Preserving Access.

If MHI’s leadership wants to move the ball down the field and score points that sell more homes, a serious series of changes must take place at MHI.

As strong supporters of MH industry professionals and homeowners, only success should be accepted.

We have too good a story to tell! Why isn’t MHI effectively telling it? How many lost sales will we accept before change is demanded, or a new association is formed? ##

Footnotes

1) The following two MHARR Washington Updates each include references to the handling by MHI of the Duty-to-Serve rule, and MHARR’s allegations that this is being done to favor the largest lenders; i.e. the Berkshire-Hathaway owned lenders.

http://www.mhpronews.com/images/stories/uploads/MHARR_APRIL_21_2016_WASHINGTON_UPDATE.pdf

http://www.mhpronews.com/latest-news-from-mharr/11445-mharr-washington-update-report-and-analysis

2) For updates on queries and comments regarding this message from industry members, please see below. (6.26 and 6.27.2017)

Managing Member of LifeStyle Factory Homes, LLC.

Publisher of MHLivingNews.com, MHProNews.com and Inside MH storytelling video series.

MHI member, elected MHI Suppliers Division board member.

Consultant and service provider to the MH industry.

Office 863-213-4090.

Connect on LinkedIn –

https://www.linkedin.com/in/latonykovach

It’s #1! Get our industry leading, free, Twice Weekly emailed news, tips updates (our emailed Newsletters look like this) – sign up free in seconds at MHProNews.com/Subscribe.

(Editor’s notes: we’ve had numerous messages and calls about this column, and previously about others that cited Titus Dare’s writing and work. Among the messages were those who have worked with Dare on these home-only GSE loans in the manufactured home community market, or did committee work with him, etc.

Among those messages that came in on 6.25.2016, two questioned the total amount of those GSE originated loans. We’ve therefor asked Titus Dare to double check his records, and we will update that if/as needed for accuracy. MHProNews has been and will always seek to be for getting the facts correctly. Dare has texted back saying he’s happy to double check on those figures next week and will advise as needed, so that too suggests a desire for accuracy.

A comment from a high level MHI member used words to the effect that MHI can’t keep a lender out of the manufactured housing market, regardless if such a lender was encouraged or discouraged by MHI. While that’s technically true, it misses two broader realities.

First, The low volume of MH loans – combined with other factors such as the CFPB’s onerous regulatory regime – is what drove US Bank out. Low volume is a piece of the puzzle for new MH sales growth, which is why that factor was noted in the original column, above.

Opening up new lending, especially on a national scale, requires significant time, talent and financial resources. So anything a prospective lender can do to bring those up-front costs down before going to market will make it easier for a new lender to say – yes, we want to make loans on manufactured housing.

That also means the reverse is true. If a prospective lender finds they aren’t getting interest or support from a national association (in this case, MHI) that repeatedly states that new lending is high priority for them, isn’t that a reason to question the wisdom of entering into making loans in MHVille?

So logically – yes, failure for MHI to encourage lenders can be costly to the industry at large.

The second point is that Gooch’s article in American Banker, was it entirely accurate when it says that MHI wants to encourage new lenders, or not? Doesn’t the evidence indicate otherwise? Didn’t key MHI staff members – at a minimum – fail to encourage lenders and options that were presented to them in a meeting? And that meeting had dozens in attendance, including me.

The objective reader can see that Gooch, with Jennison’s okay, sent out a MHI Housing Alert message to members that distorted what acctually took place in the hearing with Senator Joe Donnelly and CFPB’s Richard Cordray. Typos or honest mistakes can happen to anyone, and most people understand those for what they are. But once someone has deliberately decieved, it can be hard to regain trust.

Organizations are obviously made up of people, and an association has staff that does its work. This pro-Industry trade publication has questioned the allegations, facts and concerns raised about members of the MHI staff. These concerns are routinely brought to us by third parties. So MHProNews spotlighting staff at an organization isn’t the same as condemning the organization, of which this writer is a member.

So what needs no update is that whatever the precise amount of the loans involved, or how many lenders MHI staff members may have failed to encourage to lend in the MH market, the principles noted above all still apply. Why did MHI not contact Dare? Why did Dick Jennison or Jenny Hodge not encourage other lending in the MH space when, they met personally with a lender interested in doing work in the manufactured housing market? Was Lesli Gooch incorrect in saying that MHI encourages more lenders?

MH has a good story to tell, and we are busy telling it.

MH should be doing far better than it is, and part of the puzzle requires that collectively we must identify the roadblocks inside and outside of our industry that keep manufactured housing from advancing to its true potential, which Dick Jennison suggested in Louisville in 2015 should be 500,000 new homes per year. Are you for 600% growth for your business, anyone?)