Investors, take note. Manufactured Home ‘Street’ Retailers, your report is coming. But for the next few minutes, we will look at why manufactured home communities (MHCs) – incorrectly still known by too many as ‘mobile home parks’ ([sic] – since no mobile homes have been built in the U.S. since June 15, 1976) ought to have 100% physical occupancy today.

The most recent reports I’ve seen suggest that the occupancy rate for all age MH Communities is hovering around 88%. Senior or 55+ MHCs are around the 93% physical occupancy mark. That number has been slowly rising.

Roughly half of the states in the U.S. don’t maintain a master list of MHCs. So we must use estimates as to how many MHCs there are, based upon estimates from those-in-the-know tell me is in the range of 37,000 to 45,000 MHCs nationally. That’s the more likely total of all land-lease MH communities of all sizes.

About 15% of the MHCs are in the 200+ home site size that the portfolio operators – private and publicly trade – tend to prefer. That means 85% are under that threshold. There are MHCs with under 10 spaces (aka – pads, lots, home sites) or less in jurisdictions that keep such records. Some experts say the typical MHC is around the 100+/- home sites size.

Can you spell Opportunity?

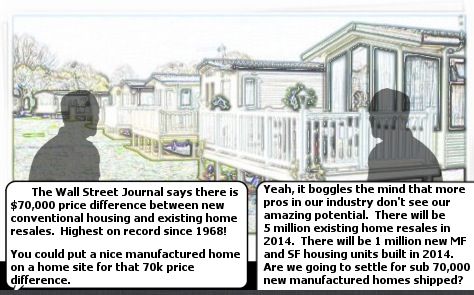

Bottom line, using facts, figures and estimates, the latest reports suggest there could be some 440,000 unoccupied home sites in MHCs across the country. That spells serious potential upside opportunities for investors. It also spells huge opportunities for HUD Code MH manufacturers, chattel lenders, suppliers, vendors, support, insurers and financial services firms of all kinds.

Given the growing need for affordable housing across the U.S., filling those sites is quite doable. What is stopping our industry from those goals?

A variety of factors, of course. For starters, the CFPB certainly isn’t helping, because those willing to risk their own capital aren’t getting to do so without significant regulatory burdens. Those risks from the regulators are far greater than the risk of loss from a repossession, how crazy is that reality?

The public need exists. The pricing of MH vs. rentals or other options is competitive and favorable. But the main issues slowing that 100% physical occupancy goal could be summed up in two words joined by an ‘and.’ Image and Education. Even the regulatory hurdles come down to image and education, though some may not see that connection the same way we do here on the Masthead.

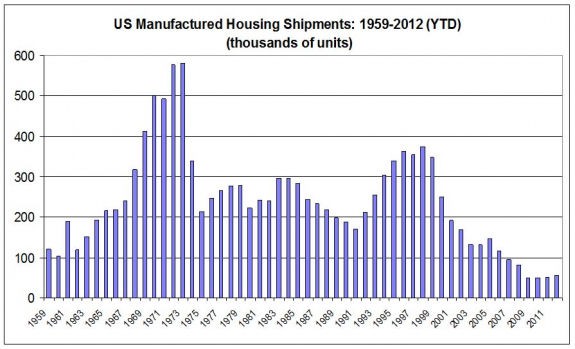

With the right approaches, our expert sources – and own experiences in marketing MH – suggest those MHCs could be filled in under 3 years. That figure suggests that the MH industry could be doing some 200,000 new home sales a year average for the next three years, vs. the mid- 60s level annual shipments we are hovering around now.

Of course, “could” may not mean “does.” That said, IMHO, all facts shared and known suggests this is a great time for investors to target the MH sector for investments in stocks in related MH companies, direct investments in MHCs, etc.. Investors are indeed doing so, but mostly by aiming at the top 15% of the larger communities.

MH Retailers? Your report is coming. As good as the potential for MHCs is, the upside for a good retailer could be even better. That said, there is value to marrying the MHR to an MHC. We’ll look at that topic too in the days ahead.

Closing News Comments

Our Matthew Silver does an amazing job of giving our Daily Business News readers the Industry news briefs that keep those focused on housing in general – and MH/MODs in particular – informed. No one else we know of gives an MH Industry daily business news briefs, plus the daily stock market recap report on MH connected firms and suppliers. You can spend less time and learn more about the industry via a daily scan of the news here, than following online alerts that routinely yield information that wastes precious time.

So is it any surprise that several thousands of pros, investors and researchers follow our news, tips and views daily?

Investors & Owners

The beauty of the MHC or MHR worlds are that you can, with the proper approach, move-the-needle in a reasonable period of time to yield healthy returns. You can have more ‘control’ over the investment. By contrast, there is not much that most can do personally to move a stock on the public markets. But you can do a lot of savvy steps to increase occupancy in an MHC or sales at an MHR.

We’ll look more at that in the days ahead, including our upcoming July Featured Articles in MHProNews. If you have not yet read all of this months issues’ articles, you should! Don’t miss the video related ones, like the red-hot Scott Roberts of Roberts Resort video interview too.

Take a glance today at MHLivingNews.com as well, because a growing number among the public and industry are doing so daily. Millions of visit(ors) there can’t be wrong! See what they’ve found, and see why your peers in MHCs are giving that web site address to their community residents in their newsletters. ##

Manufactured Housing State of the Industry Statistics and related Growth Opportunities Reports

(June 2015)

Realtors ® and Manufactured Housing Growth

SIC defined (Google):

-

used in brackets after a copied or quoted word that appears odd or erroneous to show that the word is quoted exactly as it stands in the original, as in a story must hold a child’s interest and “enrich his [ sic ] life.”.