I’m picturing a manufactured home community owner who was standing at the entry door in the back of an association meeting. He looked stunned, bewildered and lost. When asked, he tried to express to me his frustration, and sense of helplessness, over federal finance regulations that hit his business. He’d served MH owners and buyers for decades. Now, it was all changing so rapidly, his head was spinning.

Next image was another MHC owner, in different state and another association’s meeting. That man explained how his family business jumped-the-hoops to get an MLO on staff. However, that MLO left him after a few months. Their volume of loans was too low, he said, to keep someone. This MHC owner was trying to comply with rules that did not help buyer or seller, as they made no money on financing of a home. “Angry” is how I would describe him.

Retailers and others have approached me at trade shows like Louisville and Tunica, often to vent. Sometimes, they wanted to explain that they were trying, but afraid that all these changes would drive them from the business they’d worked in for x number of years.

Odds are good you know stories like these. Maybe you have one of your own?

The other stories going untold

Then there are the MH home owners who can’t sell his under $20,000 home for what it was worth, because once the CFPB regulations hit, lenders that made those loans pulled out from that segment of the MH market. It was no longer possible to make those loans without more risk than their was chance for profit. Yes, we’ve spoken or heard from consumers impacted too.

If you love all the ways that the Consumer Financial Protection Bureau (CFPB) is implementing regulations relating to on manufactured home financing, brought on by 5 year old Dodd-Frank legislation, save sometime and stop here.

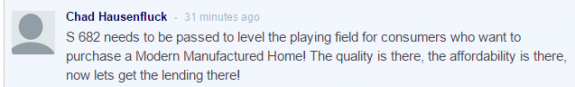

On the other hand, if you feel that the regulations should change, that MH homeowners and businesses need to speak up NOW…then please do two things, right now today. Both are easy, 10 minutes and you’re done.

- Please read this article linked on The Hill’s Congressional Blog, Congress and their staffs, Policy Advocates, the CFPB, the media and others read this blog.

http://thehill.com/blogs/congress-blog/economy-budget/248665-regulations-for-manufactured-home-loans

- Briefly tell your own story in their comments section. Congressional staff, House and Senate Members, regulators and even the WH reads The Hill

Here are 4 MH Industry examples…

...please join them. Perhaps 5, 10 minutes and you’re done.

Don’t curse the darkness, light the candle. Yours. Don’t wait for someone else to do it, you be the one. Let’s let DC know that this issue matters to manufactured home owners and businesses. HR 650 passed the House by a wide margin. The Senate vote looms. Send a messge. ##