Financing is routinely a hot topic for pros in MHVille. Recent days are no exception. As we spotlight Titus Dare’s and Ron Thomas Sr.’s respective and popular OpEds, let’s look at a different-yet-related issue.

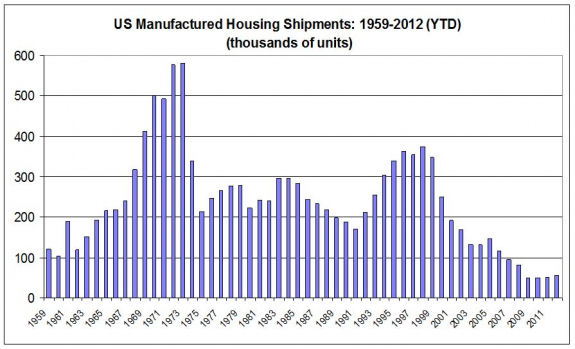

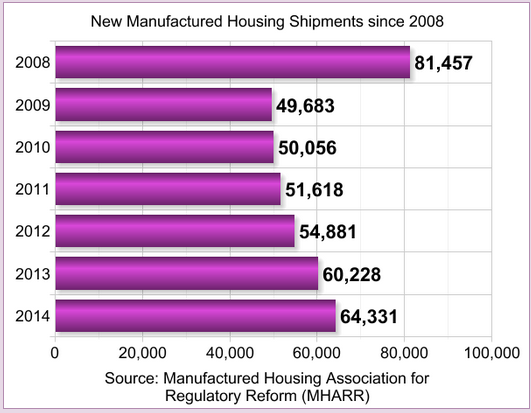

There is a high cost that the MH Industry pays for low volume new home sales. Yes, we are back up to the 70,000+ new home shipment level, but that’s well below where the industry was in 1998, when we peaked out at over 372,000 new home shipments. When Richard Cordray engaged Senator Joe Donnely in a back-and-forth war-of-words, Cordray pointed to a long term overall decline in MH sales. It was akin to the CFPB director saying, ‘For some reason, the public is not buying manufactured homes as they once did.’

That’s technically true, but so is the Indiana Senator’s retort, that access to capital is a big reason for that overall decline.

Clearly, lending – capital access – impacts new and pre-owned MH sales and refinancing. One should note the same principle holds for all forms of housing, or automotive, RV and marine sales too. Constrict lending and sales drop.

But let’s be candid. That’s not the full story.

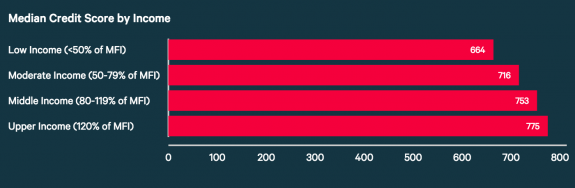

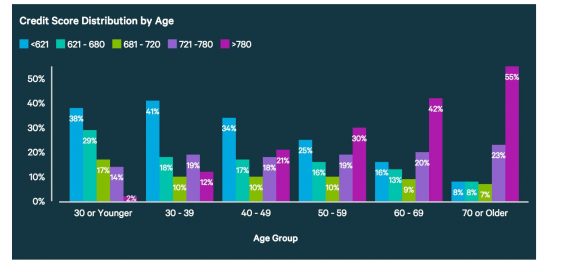

If more better-qualified buyers opted for manufactured homes vs. conventional housing, we’d see sales rise – even if the MH credit sources didn’t change at all.

Dick Ernst asked a panel of MH lenders a few years ago, ‘is there any practical lack of capacity to your firm’s ability to make more MH loans?’ Every major MH lender on that stage answered by saying, ‘with properly qualified customers, yes, we could originate far more MH loans then we currently do. There is no lack of capactity.’

Here are other factors that harm MH sales:

1) Appraisals. Retailers and lenders tell me that on FHA Title II sales, appraisers will get the needed value on a HUD Code manufactured home about 80% of the time. That means that 20% of the time, the appraisal is insufficient. Isn’t that an educational or systemic issue that needs to be addressed with appraisers?

2) Zoning. We could do a book on this topic, so for now, we will only mention it and link to this article on zoning, found here. When over 90% of the nation living in urban and suburban areas, manufactured housing pros better get their arms around the zoning issue, sooner than later.

3) The High Cost of Low Volume Sales. Economies of scale help or harm a business or industry. Part of what Titus Dare’s point in his OpEd is that there is a relatively low number of homes being sold, and that depresses interest in lending on manufactured homes by financial service firms. The more new MH sales rise, the more interest there will be from lenders, investors – and everyone else in the public square. Want more lending? Then we have to generate more sales with the lending that we already have, and those are marketing/image and educational issues.

4) Owner Financing. In the automotive world, owner-carry-financing (buy-here, pay-here loans) is done by hundreds of car dealers in almost every state; many thousands of such locations can be found nationally. For decades, so called ‘Lonnie dealers’ did the same in manufactured home sales, most notably on used homes in land-lease MH Communities. With its heavy regulatory burdens and risks, Dodd-Frank/CFPB has largely crushed that model which for years allowed marginal credit customers to become home owners. While owner-financing is technically doable and is still done, it’s so risky, that many operators will avoid making such loans who previously made them. That’s an avoidable penalty on would be buyers as well as sellers.

5) Resale Values. There is a bit of circular reasoning by some who look at MH lending that is often missed. The law of supply and demand operates for MH the same as it does with conventional housing. When conventional housing credit was choked off in the 2008 housing/mortgage meltdown, values on existing houses dropped like a rock for years. As lending returned, so have existing home’s resale values.

Similarly, when lending on MH is artificially choked off by the CFPB or anyone else, resale values are impacted. That manufactured homes can increase in value is a fact, and some of the reasons why it can and does hold value in the right circumstances are described in the video, linked here. The point? For the GSEs or others who may hesitate on serving MH, there is a degree of self-fulfilling prophecy at work. More lending on new and resale MH would support values, and thus create a lower risk for lenders.

6) Education! Increasing the appeal of manufactured homes among site-built home shoppers. Lindsey Bostick nails it in the video linked here, when she says that it is up to manufactured housing professionals, working together, to inform and attract more good credit and cash buyers.

Note that none of the above takes the CFPB, the GSEs, Congress or anyone else ‘off the hook.’ What it should do is motivate goal-and-solution oriented manufactured housing professionals to do all they can to grow the demand among home seekers who qualify for current lending.

It should also cause MHPros to always be thinking and working at ways to improve the image with local, regional and national media and public figures.

More on these issues in the days ahead. Our rapidly approaching June issue, packed with new featured articles, will give you food for thought and points for profitable pro-active action. Look for them next week on the MHProNews home page. ##

By L. A. “Tony” Kovach,

Office 863-213-4090.

Connect on LinkedIn –

https://www.linkedin.com/in/latonykovach

Publisher – MHLivingNews.com

and MHProNews.com

It’s #1! Get our industry leading, free, Twice Weekly emailed news, tips updates (our emailed Newsletters look like this) – sign up free in seconds at MHProNews.com/Subscribe.