Publicly-traded commercial real estate broker and research firm Marcus & Millichap Inc. (MMI) provided MHProNews with their new 2021 mid-year market survey and report. On issues modest to significant, their facts, trends, and the “outlook” on the manufactured home community sector apparently undermine some talking points pushed by the Manufactured Housing Institute (MHI), of which MMHI is a member. While that may not have been MMI’s intent, that reality will be examined following their insightful data.

The MMI report will be followed by additional information, more MHProNews analysis and commentary.

As a teaser, the thrust of what MMI states supports months of research by MHProNews and MHLivingNews in several respects. Among them? MMI underscores the point that the land-lease manufactured home community sector is getting hotter, which numbers of mainstream media outlets have been reporting in recent years too. As a result of more closures than openings and increased demand, site fees are rising as a result.

The risk of regulatory interventions are growing, says MMI.

MMI further notes that much of this is possible because an insufficient number of new sites are coming online which might otherwise dampen or mitigate the increasing stress on residents in consolidating investor-impacted properties. In that sense, it is a bit like the pressure on single family housing prices, where insufficient new supply is causing a rapid growth in existing resale housing prices.

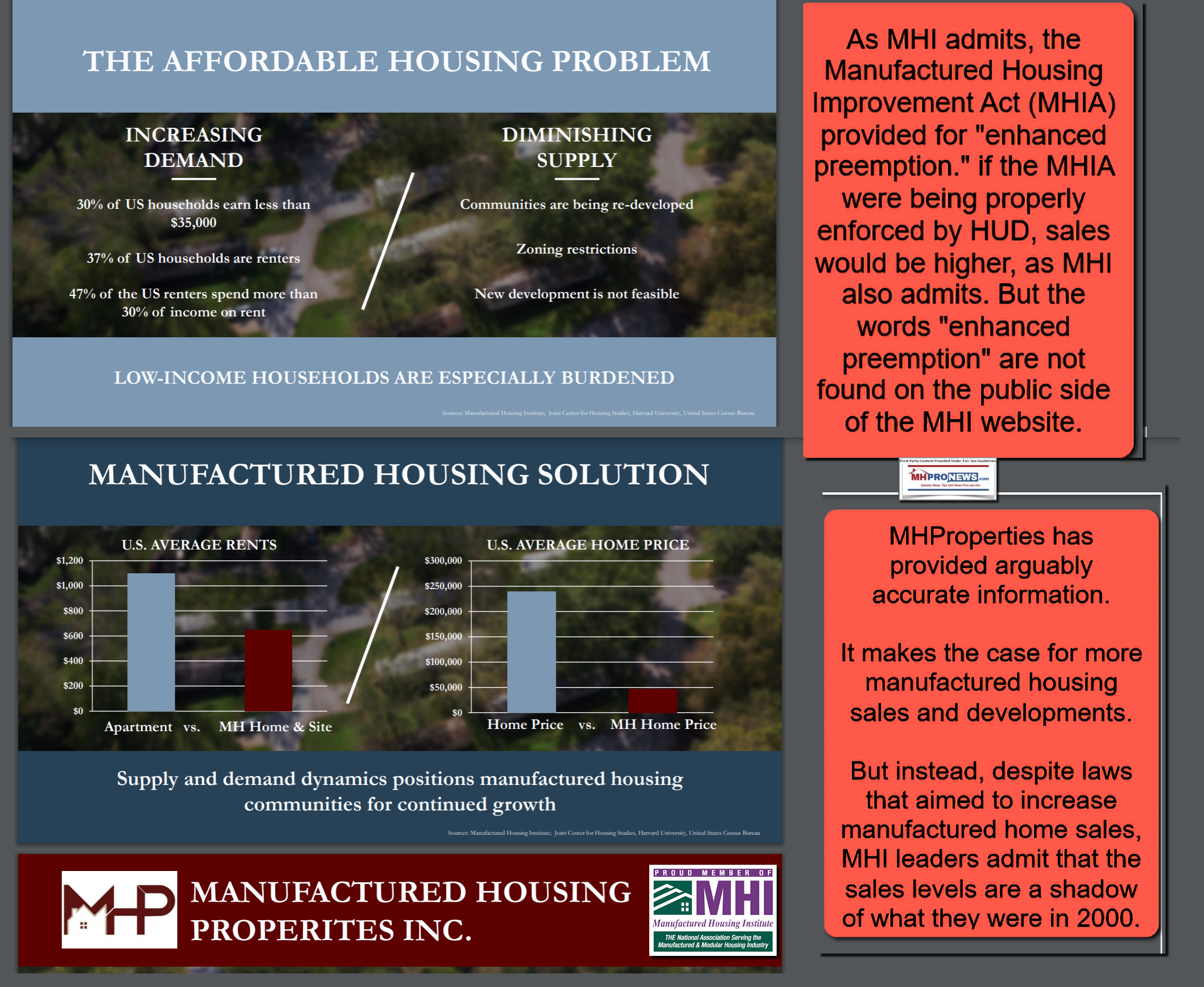

Manufactured home producers, retailers, and affordable housing advocates take note. Because what the MMI data is pointing to will – by the rules of economics – logically and arguably increasingly undermine the potential for robust growth that manufactured homes could and should be enjoying during a worsening affordable housing crisis.

The highlighting below has been added by MHProNews, but the text is as in their original document. To MMI’s credit, it is worth noting that almost every line of their commentary could be highlighted. So, highlighting certain points should not be a reason to skim over the rest of their timely research.

THE OUTLOOK MANUFACTURED HOME COMMUNITIES – MIDYEAR 2021 Marcus & Millichap (MMI)

THE OUTLOOK MANUFACTURED HOME COMMUNITIES – MIDYEAR 2021 Marcus & Millichap (MMI)

Manufactured Home Communities Outperform During Health Crisis;

Momentum Likely to Carry Into Post-Pandemic Era, Attracting Investors

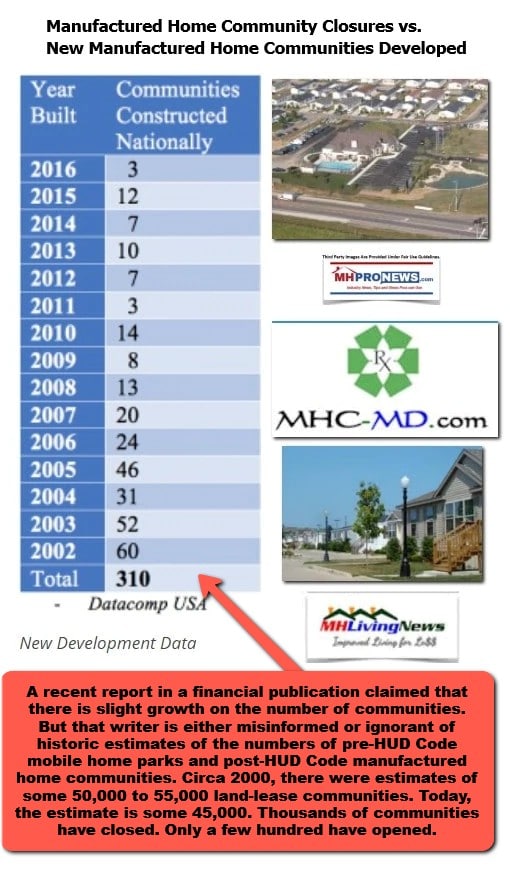

Despite need for economical living options, new inventory is limited. Hardships brought on by the rapid surge of unemployment at the onset of the pandemic highlighted the need for moderately priced housing options. Households seeking larger spaces in less densely populated locations, in addition to more millennials aging into the homebuying phase of life, have bolstered the demand for single-family homes across the nation, which has sent prices soaring. The need for the more economical housing that manufactured home neighborhoods offer has boosted demand for lot rentals, rapidly filling up spaces. A limited number of new communities have been built over the past few decades, however, mainly due to difficulty in obtaining the necessary permits. Increased interest by more local jurisdictions to provide additional lower-cost housing could allow some new communities to be built or existing facilities to be enlarged in the years ahead.

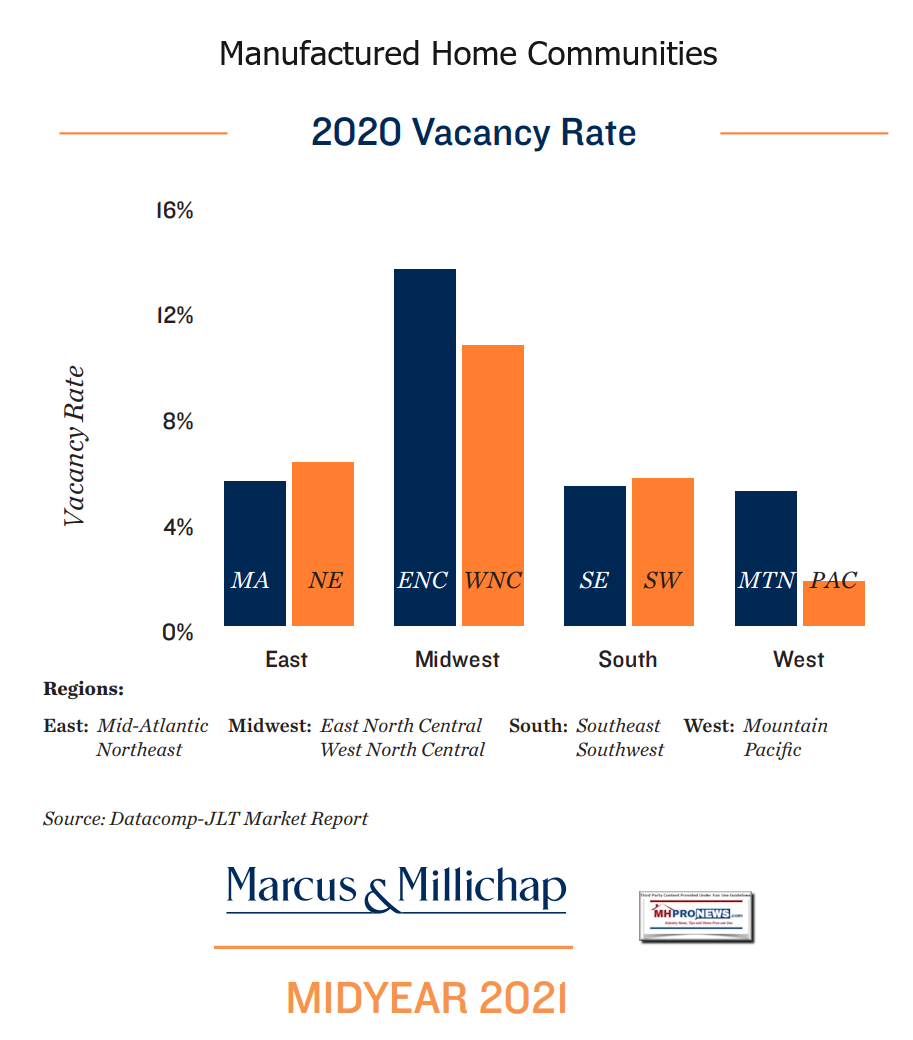

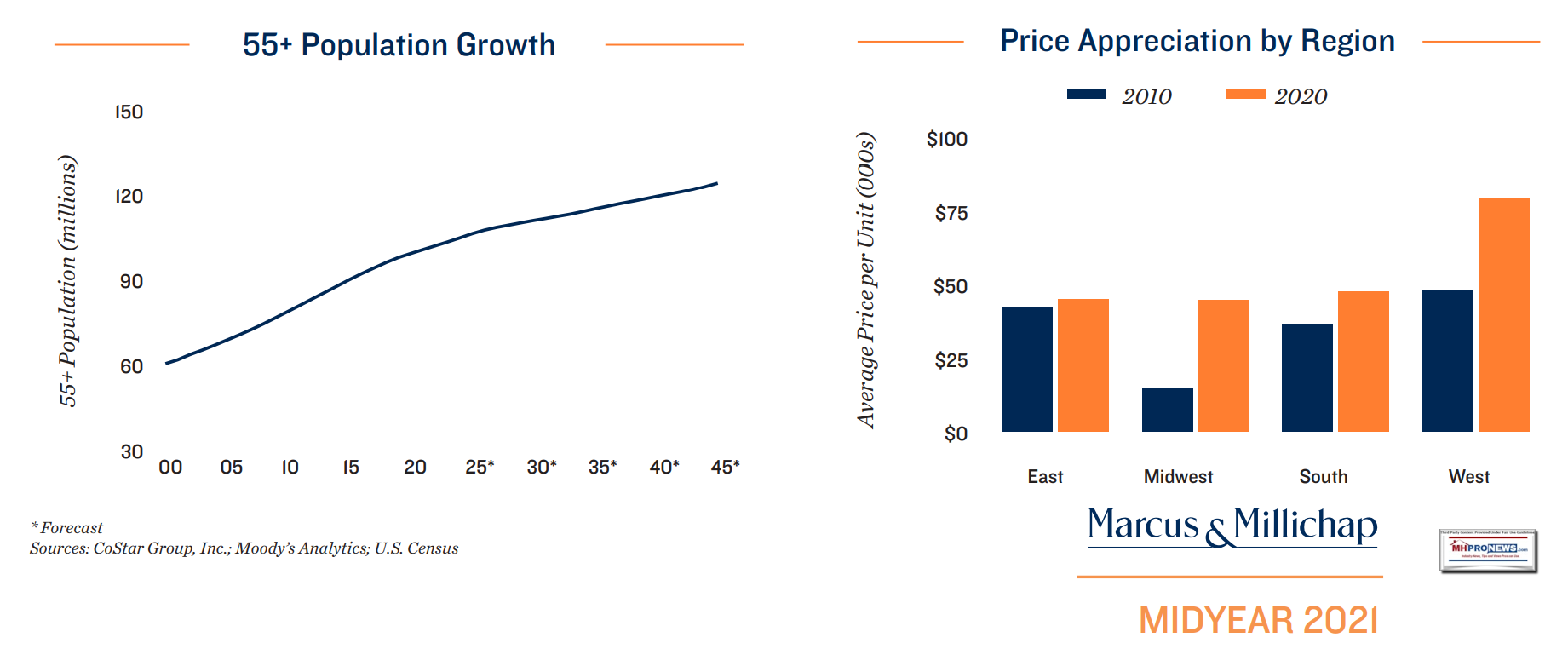

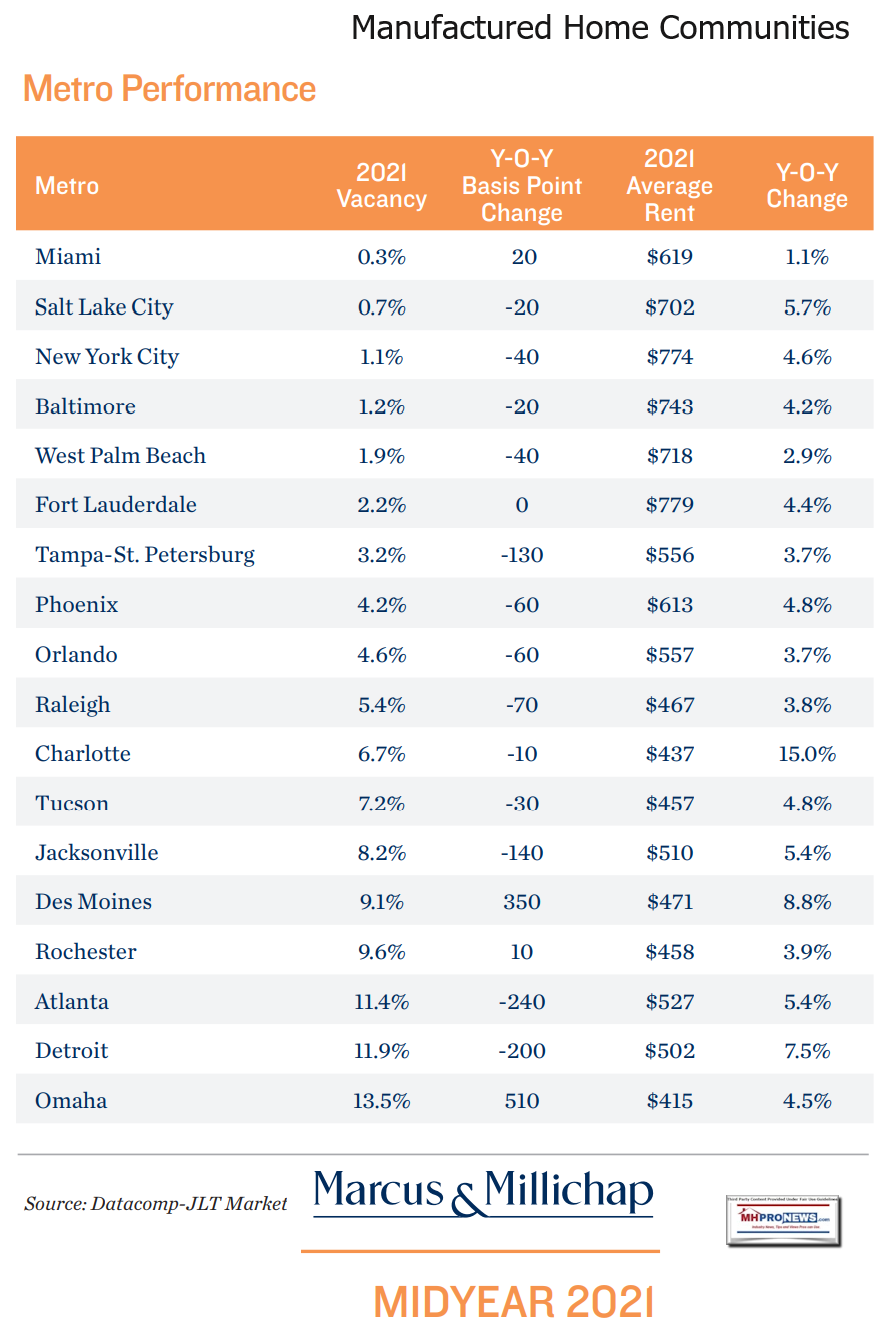

Vacancy continues to tighten across the nation. The lack of new inventory amid an increased need for economical housing options is bolstering demand in manufactured home communities<. Last year, nearly all subregions posted a decline in vacancy as the rate contracted in the majority of the markets surveyed. The rate is especially low in many coastal communities, particularly in California, where there is an increased need for workforce housing. Vacancy rates in age-restricted communities are even lower than all-age parks in most subregions as more than 10,000 people turn 65 years old each day. Households retiring to warmer climates or snowbirds seeking a second residence are boosting demand in the Sunbelt. Looking ahead, high home prices and multifamily rents will continue to generate demand for lots in manufactured home communities while new supply remains limited, benefiting existing owners.

Rent growth maintained traction during health crisis. Rent collections in manufactured home communities outpaced most other property types last year. The cost for a homeowner to move their unit to another park is a contributing factor. As a result of more residents staying in place, rent rose in the majority of metros in 2020. Tightening vacancy and upgraded facilities combined to support the increasing rates. Prospects of future rent growth could be curtailed, however, by rent control proposals that are becoming more prevalent. Outside of these efforts, strong demand for lots and the slow pace of additional inventory growth will likely support continued rent gains over the near term.

Capital flowing into manufactured home community investments. The solid operational performance during the health crisis has drawn a wider range of investors seeking a safer destination for capital. The influx of investments has begun to compress yields. Institutions and REITs remain active, although a lack of higher-quality parks in the best locations has required these buyers to expand their search criteria to include smaller parks or alternative locations. Private investors are also attempting to add to their portfolios, together with numerous buyers new to this property type, but acquisitions have been inhibited by limited listings. Communities rated with at least two stars that have no substantive operational issues frequently receive multiple offers, creating increased price pressure. Looking ahead, strong prices and risks surrounding potential tax law changes have caused some owners to reconsider their long-term strategy. Owners who have held a property for an extended period have little to no depreciation left and some are factoring in the favorable financing climate as they consider their next investment options.

Demand for less-costly housing options, lack of new supply tighten vacancy in manufactured home communities across the nation. As the price of stick-built homes and multifamily rents jump, the need for more economical housing is bolstering the demand in manufactured home parks, diminishing availability. Last year, roughly 75 percent of the metros surveyed posted an annual decline in vacancy. At the same time, some older communities, especially near larger metros, are being redeveloped into higher-density projects, cutting supply. Although some new communities and RV parks have recently been developed or are underway, additional lots typically come from an expansion of an existing park or are located in small metros where land prices are less costly.

Rent

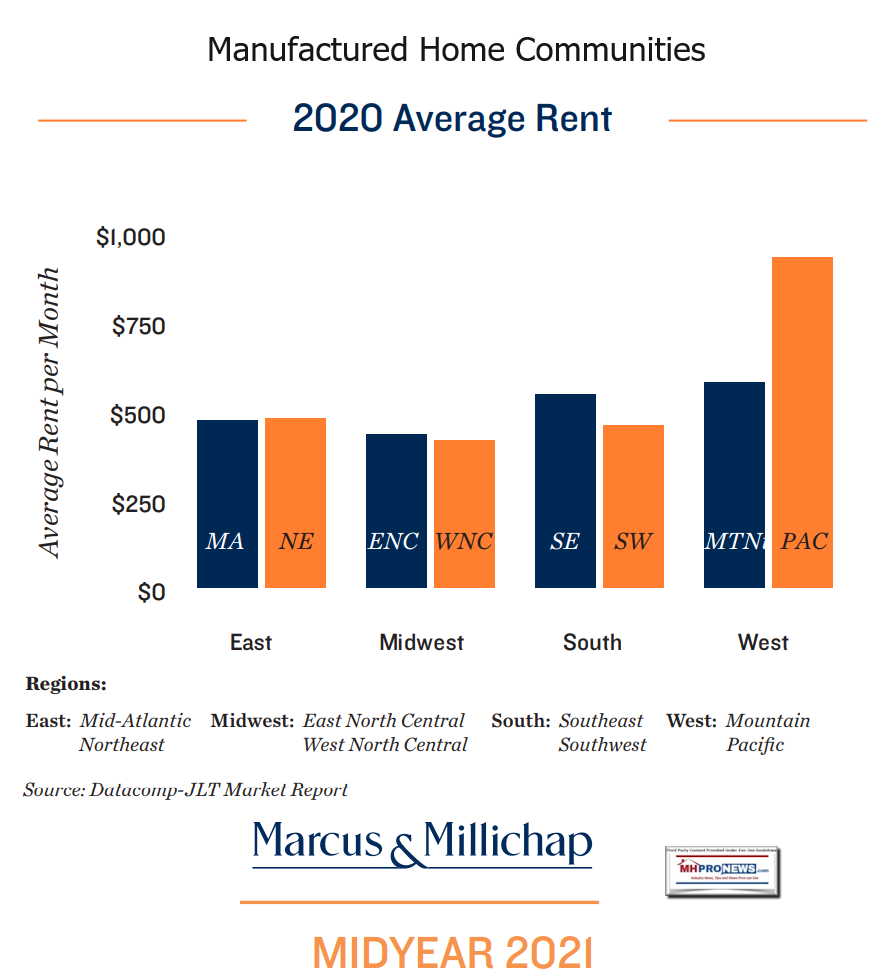

Rents move higher as availability dwindles. The monthly rent payment for a home site in a manufactured housing community held steady or rose in 93 percent of surveyed metros during 2020. The higher rates are bolstered by strong demand, facility improvements and a lack of significant supply growth. The rising rent of sites, however, is drawing the attention of some affordable housing advocates, which is intensifying proposals to place limits on rent gains in some jurisdictions in an effort to preserve economical housing options. If successful, these changes could be challenging for future rent advances. Among subregions, the Northeast led rent growth with a 4.6 percent gain, nudging out the Southwest and Mountain, both registering a 4.5 percent increase.

Vacancy

Rents move higher as availability dwindles. The monthly rent payment for a home site in a manufactured housing community held steady or rose in 93 percent of surveyed metros during 2020. The higher rates are bolstered by strong demand, facility improvements and a lack of significant supply growth. The rising rent of sites, however, is drawing the attention of some affordable housing advocates, which is intensifying proposals to place limits on rent gains in some jurisdictions in an effort to preserve economical housing options. If successful, these changes could be challenging for future rent advances. Among subregions, the Northeast led rent growth with a 4.6 percent gain, nudging out the Southwest and Mountain, both registering a 4.5 percent increase.

Highlights

- The Pacific posts the most costly lot rent among subregions at $932 per month due to multiple California metros where the average rent tops $1,000 per month. San Jose holds the highest average rent in the nation at $1,491 per month in 2020, followed by Orange County at $1,396 per month.

- The lowest average lot rent can be found in the West North Central subregion at $417 per month. More affordable stick-built housing prices and apartment rent compared with other regions of the country hold down rent gains.

- Metros in the Mid-Atlantic and Southeast subregions dominate the list of markets with the lowest lot rent. Average monthly rates below $300 can be found in smaller metros including Columbia and Greenville in South Carolina, as well as Lynchburg and Birmingham.

Investment Sales

Flight to safety boosts demand for manufactured home communities. A surge in investor interest has created a seller’s market, pushing prices higher and compressing yields. Cap rates, on average, have contracted 100 to 150 basis points over the past four quarters. First-year returns for prime, institutional-quality, age-restricted assets can dip into the high-3 percent range, while double-digit rates can occasionally be found in smaller outlying markets, particularly in the Midwest. During 2020, trading activity picked up in the majority of subregions with the Southeast, Pacific and Mountain states maintaining their dominance from the prior year. By state, Florida led transaction activity, accounting for 14 percent of the total. Average yields spanned from a high of 8.2 percent in the South down to 6.6 percent in the West in 2020.

Highlights

- Although prices varied widely depending on a number of factors including quality and location, the Pacific maintained the highest average price per unit during 2020 at $88,100. The subregion also posted the lowest average cap rate at 6.3 percent.

- Light trading volume in the Northeast that was composed of mainly Class C properties with less than 150 units in smaller metros resulted in the lowest average price at $33,100 per lot. Yields ranged from a low of 5 percent and extended into double digits.

- The potential for lower price points and higher yields drew more buyers to the Midwest, increasing deal flow 16 percent in 2020. The average price, meanwhile, rose 17 percent to $44,500 per space. Cap rates averaged 7.7 percent but could dip below 5.5 percent and extend above 12 percent.

| Metro Performance |

Region Definitions

East

- Mid-Atlantic: Delaware, District of Columbia, Kentucky, Maryland, North Carolina, South Carolina, Virginia, West Virginia

- Northeast: Connecticut, Maine, Massachusetts, New Hampshire, New York, New Jersey, Pennsylvania, Rhode Island, Vermont

Midwest

- East North Central: Illinois, Indiana, Michigan, Ohio, Wisconsin

- West North Central: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota

South

- Southeast: Alabama, Florida, Georgia, Mississippi, Tennessee

- Southwest: Arkansas, Louisiana, Texas, Oklahoma

West

- Mountain: Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming

- Pacific: Alaska, California, Hawaii, Oregon, Washington

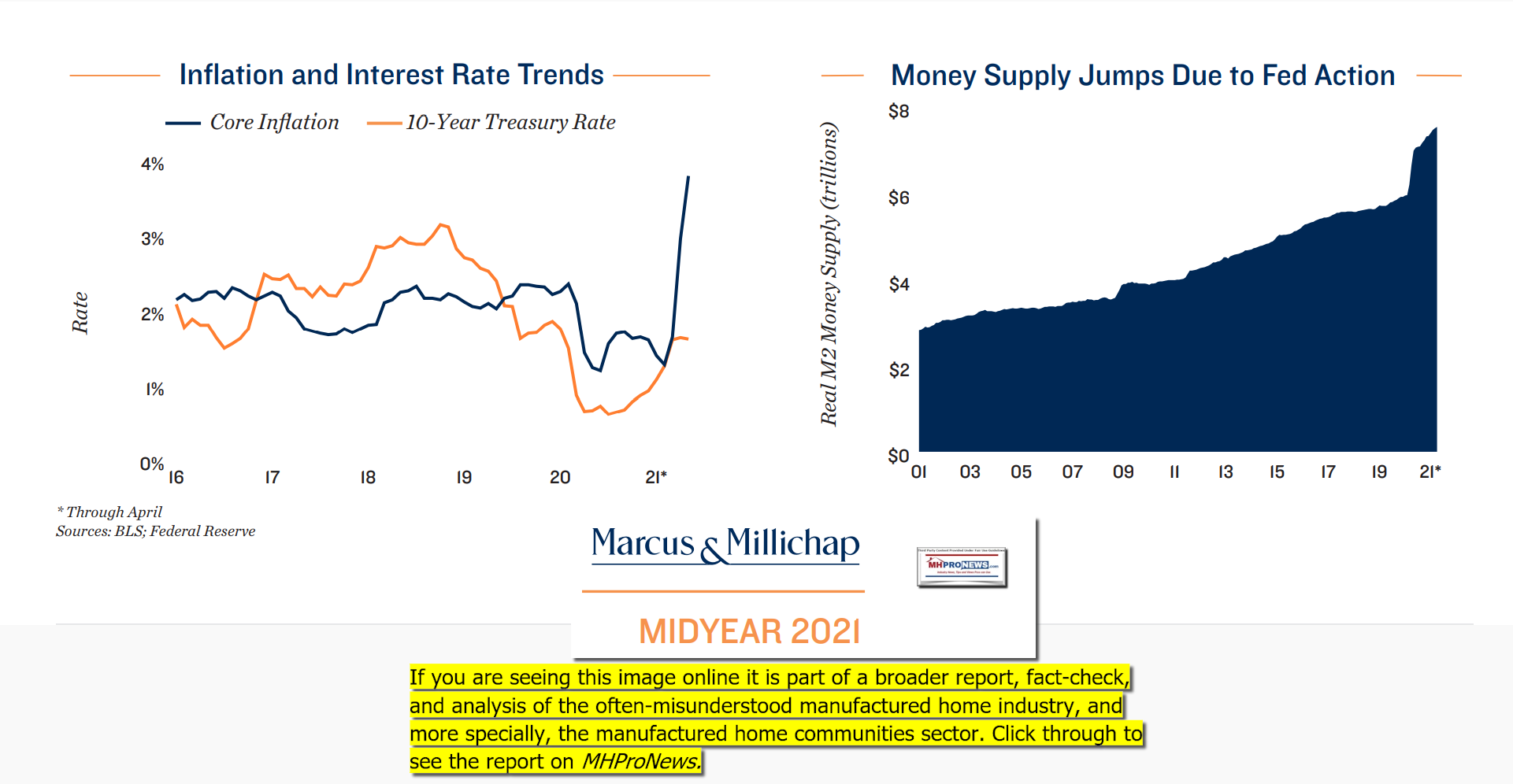

Capital Market Operations Largely Resume; Inflation Concerns on the Horizon

Fed positions for temporary higher inflation period. Applying lessons learned from the global financial crisis, Congress and the Federal Reserve reacted boldly and swiftly to the coronavirus pandemic last year. A cut in the overnight lending rate to the zero lower bound and implementation of multiple quantitative easing programs have successfully maintained market liquidity and supported borrowers. As U.S. infections recede and the economy reopens, attention is shifting to the potential longer-term ramifications. The rapid increase in money supply paired with low interest rates and disrupted supply chains raises the risk of inflation. The Federal Open Market Committee considers this a temporary concern and has stated its intention to allow inflation to stay above the traditional 2 percent target for longer than it has in the past. The Fed has also clarified its intention to keep the overnight lending rate low for the near future but may begin to wind down some of its pandemic-period support measures, several of which have already ended. A change in the health situation, new legislation, or other unexpected factors that shift the direction of the current economic recovery may prompt additional actions from the FOMC.

Lenders, like the economy, are opening back up, with financing available for quality properties. Following significant disruptions last year, the majority of lenders are now active and anticipating larger volume after 2020’s slowdown. Sentiment is improving, aided by a 10-year Treasury rate above 1.5 percent and greater population mobility, which will help properties in commercial and travel hubs that were disproportionately affected by lockdowns. Lenders are nevertheless favoring borrowers with whom they have an established and positive relationship. A borrower’s credit worthiness and track record bear considerable weight when acquiring capital, as does the recent financial performance of the residential community. Capital for manufactured housing communities remains generally available from local banks as well as government sponsored agencies. High-quality properties may be considered for a CMBS securitization or by a life-insurance company. Overall, while lending volume is not anticipated to recover to 2019 levels, the impact of the health crisis on capital availability is expected to be less severe than that of the global financial crisis. The external nature of the health problem and critical efforts taken by Congress and the Federal Reserve have maintained and are improving liquidity in the market.

Manufactured Home Communities Division

Michael L. Glass Senior Vice President | National Director,

Manufactured Home Communities Division

Prepared and edited by

Nancy Olmsted Senior Market Analyst |

Research Services For information on national manufactured housing

communities trends, contact:

John Chang Senior Vice President | National Director, Research Services

The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guarantee, express or implied, may be made as to the accuracy or reliability of the information contained herein. Sales data includes transactions sold for $1 million or greater unless otherwise noted. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not intended to provide specific investment advice and should not be considered as investment advice.

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Datacomp-JLT; Federal Reserve; Institute for Building Technology and Safety; Manufactured Housing Institute;

Moody’s Analytics; U.S. Census Bureau

Additional Information, More MHProNews Analysis and Commentary

First, in fairness, MMI’s report by Michael Glass, John Chang, and editor Nancy Olmsted is on its face one of the finer research documents produced annually by any organization in manufactured housing. They rely on data, cite their sources, and provide an array of useful insights. While there are data points that might have been included, and perhaps should be for their next edition – such as the trends on the count of newly opened vs. closed communities, overall there work merits serious attention.

That well earned tip of the hat to MMI said, what they produce arguably contradicts several claims made by the Manufactured Housing Institute (MHI), of which they are a member. MHI’s claims, along side seemingly timeless statements by a former MHI president and CEO, ought to be mentioned for the sake of new readers, as well as long-term ones. Here is what former MHI staff leader Chris Stinebert said on his way out the door.

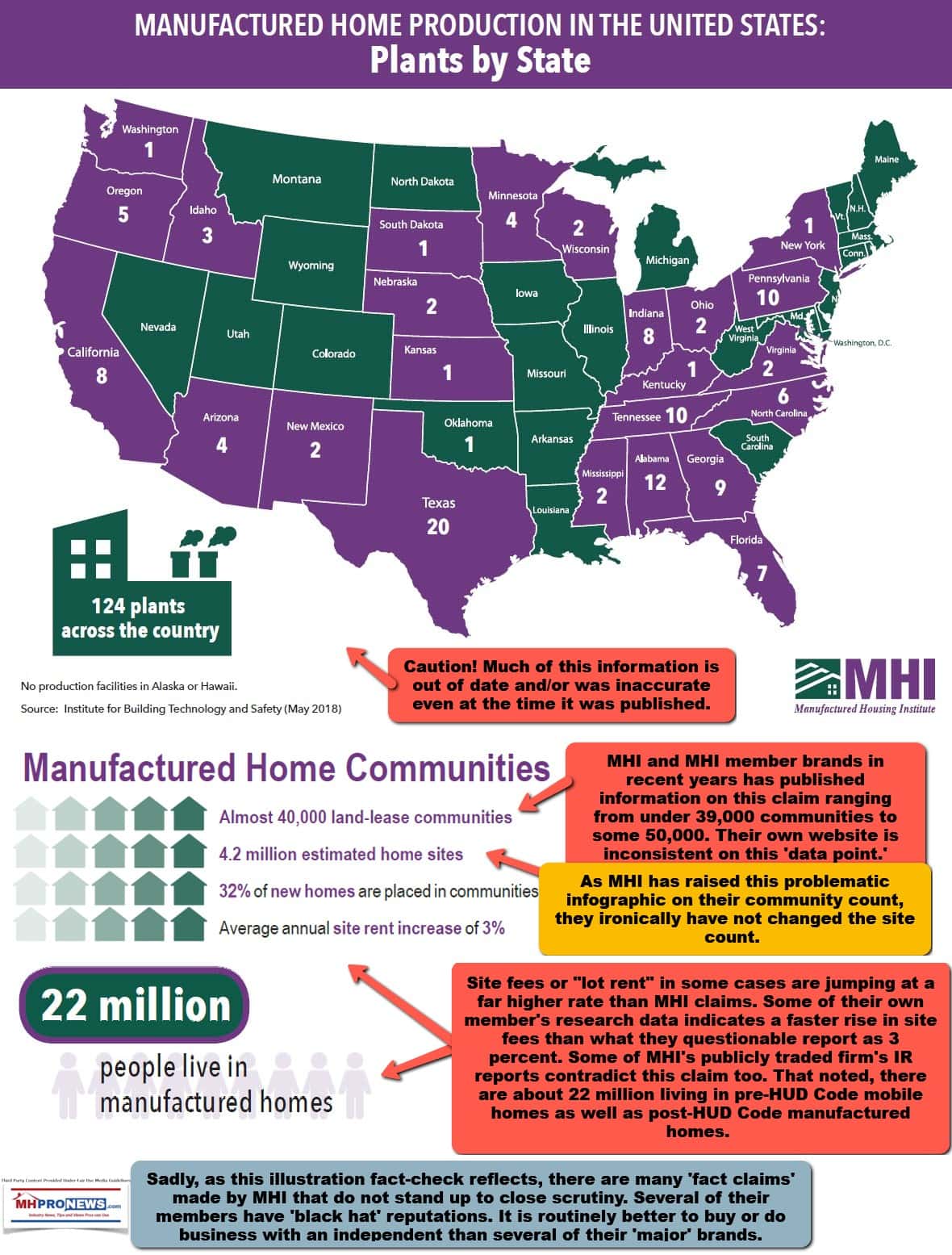

To provide thoughtful illustrations of apparent disconnects between MHI claims and behavior, evidence is warranted. For example. Reports like the above by MMI, and those by MHProNews/MHLivingNews that has cited publicly-traded firm and other evidence, belied the claim by MHI that the average rate of site fee (lot rent) increase was 3 percent. An example of that misleading MHI claim is shown below. Under pressure by our trade media sources and a few of their own members, MHI has since revised that up to 3.5 percent, which is perhaps still too low, based upon a range of evidence — like MMI’s, above.

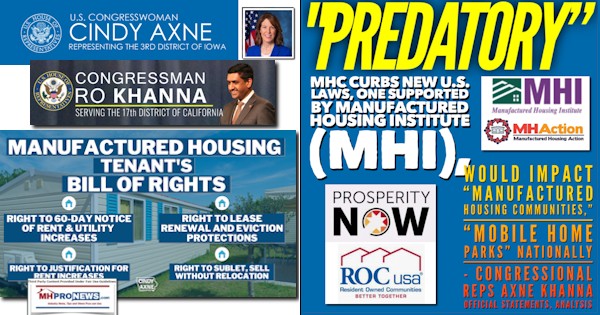

Then there are voices that have raised concerns about the business practices of some of MHI’s more notorious and “predatory” brands. MMI’s research lightly refers to the pressure for rent control in their report above. They do so without straying into the politically charged waters of pointing out the apparent connection between many of those brands that are causing that call for rent control or other regulations, and MHI. Some of the “predatory” brands are members of MHI state affiliates, while several are a mix of both. MMI’s position in producing a report like the one above is not an easy one. They, like several others, attempt to navigate the sources of their revenue – which may include fellow MHI members that are purported ‘black hats.’ While MHI has repeatedly declined to comment about the question if they have ever taken any significant action under their so-called “Code of Ethical Conduct,” an MHI state affiliate and an MHI board member have told MHProNews that they are not aware of any such action. The affiliate went a step further, and said they do not expect MHI to act on their own Code of Ethical Conduct. If so, that makes that so-called MHI code mere window dressing.

A careful look at the steady stream of negative headlines sparked by member brands such as Havenpark Capital/Havenpark Communities, RHP Properties, Frank Rolfe and Dave Reynolds owned Impact Communities, former MHI chair Nathan Smith and his colleagues Flagship Communities history reveals a stunning array of apparent violations of the MHI/NCC code. That makes it little more than a purported fig-leaf of a code that MHI deceptively has put forth. To unpack examples of those allegations, see the linked reports below.

In terms of MMI’s cited sources. The CoStar Group includes LoopNet, which MHProNews recently profiled apparent and demonstrably inaccurate information. That is not meant as a slam on the research from MMI, which may or may not have accounted for the misstatements from LoopNet’s writer, as is evidenced by the communications between Daniel Schmergel and MHProNews in the report linked below and the companion report linked here.

The press of capital into the manufactured housing community sector has been reported numerous times on MHProNews and/or MHLivingNews. One of the statements made by Sun Communities Inc (SUI) leader Gary Shiffman explains the impact of Biden-proposed tax hikes and tax changes as a driver of sales.

An example of how the compression in cap rates and the sometimes steep increases in site fees/lot rents at several communities is possible precisely because MHI is posturing one thing, but doing another. While claiming to want to mitigate zoning/placement barriers, failure to do so is what is creating the imbalance in supply-demand that MMI aptly described.

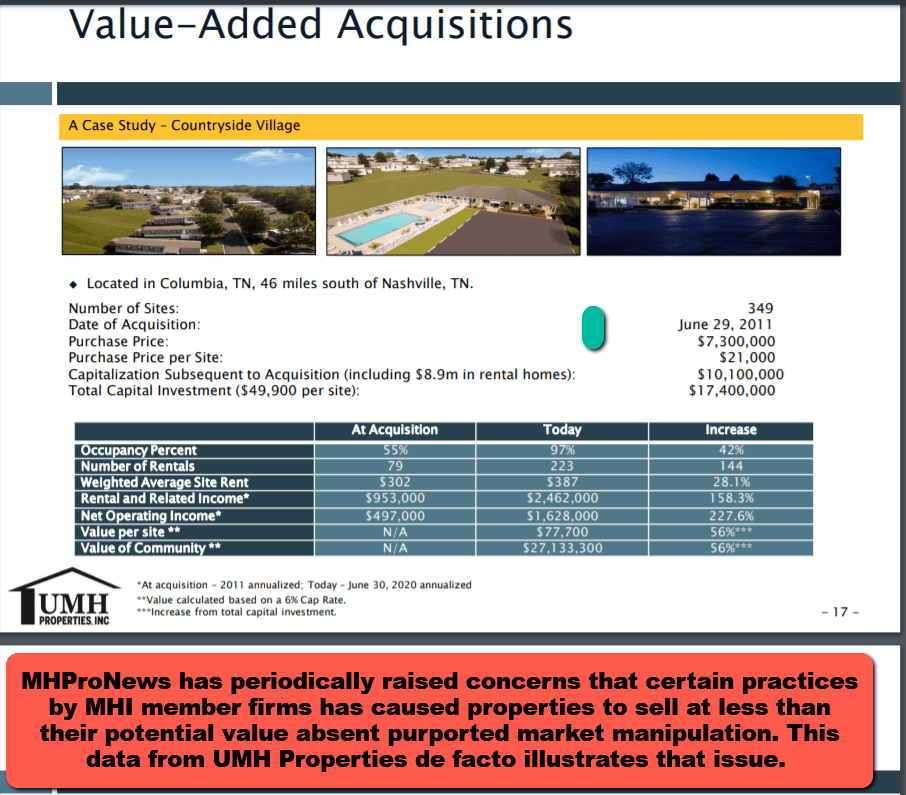

Larger community operators are better able to access capital. That means that smaller ‘mom and pop’ operators are selling out for less than the potential value of their manufactured home community properties. While it may be true that they can get more today than a few years ago, that does not mean that they are getting the true value of their property. The UMH case study slide, one of several that they have produced, illustrates that point.

Larger communities are better able to navigate rent control and other issues, as Equity LifeStyle Properties CEO Marguerite Nader has thoughtfully made clear during and earnings call.

Rephrased, MHI is apparently engaged in an elaborate scheme that benefits consolidators while harming independents, existing, and potential manufactured homeowners. This can not be emphasized enough.

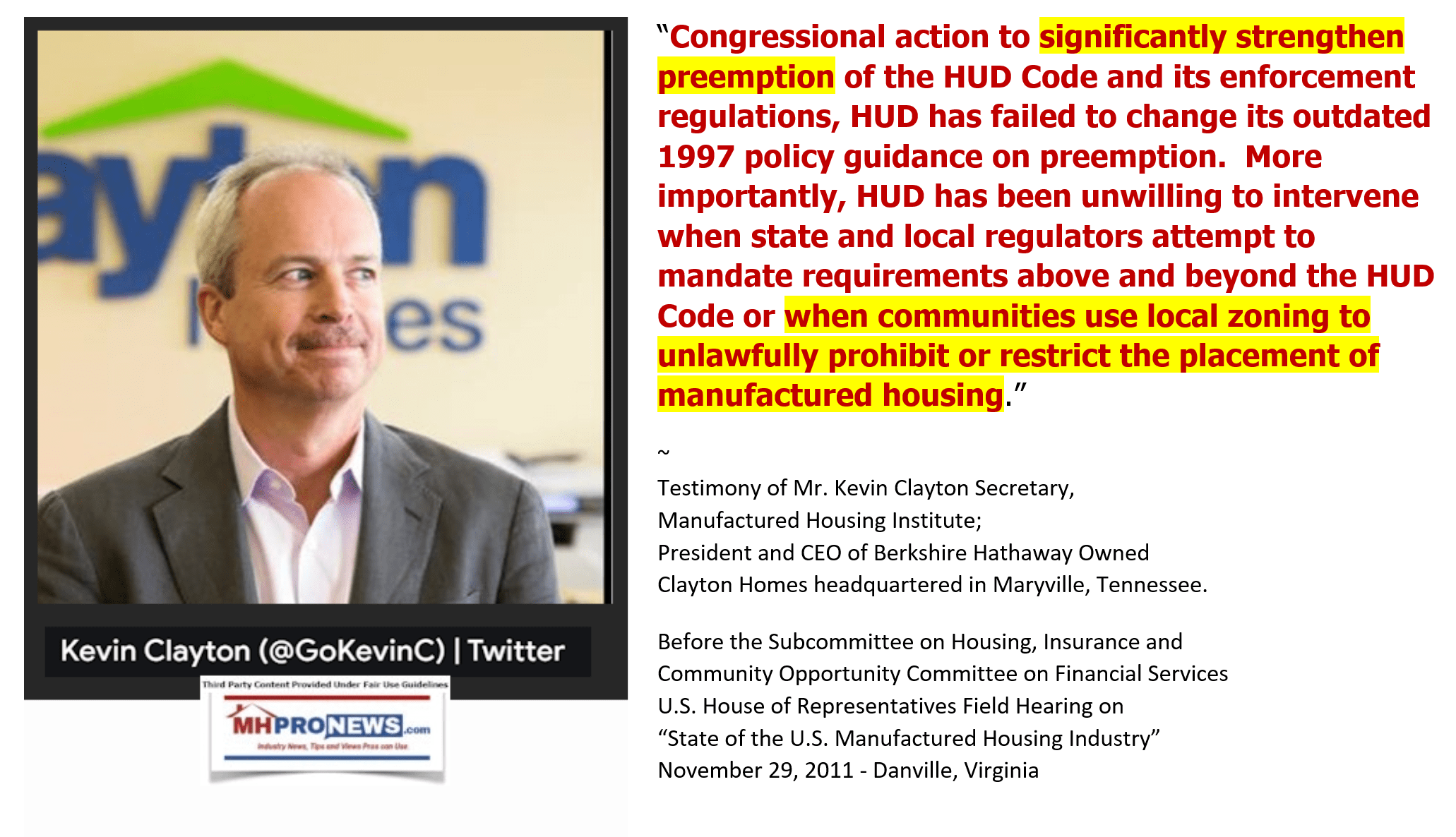

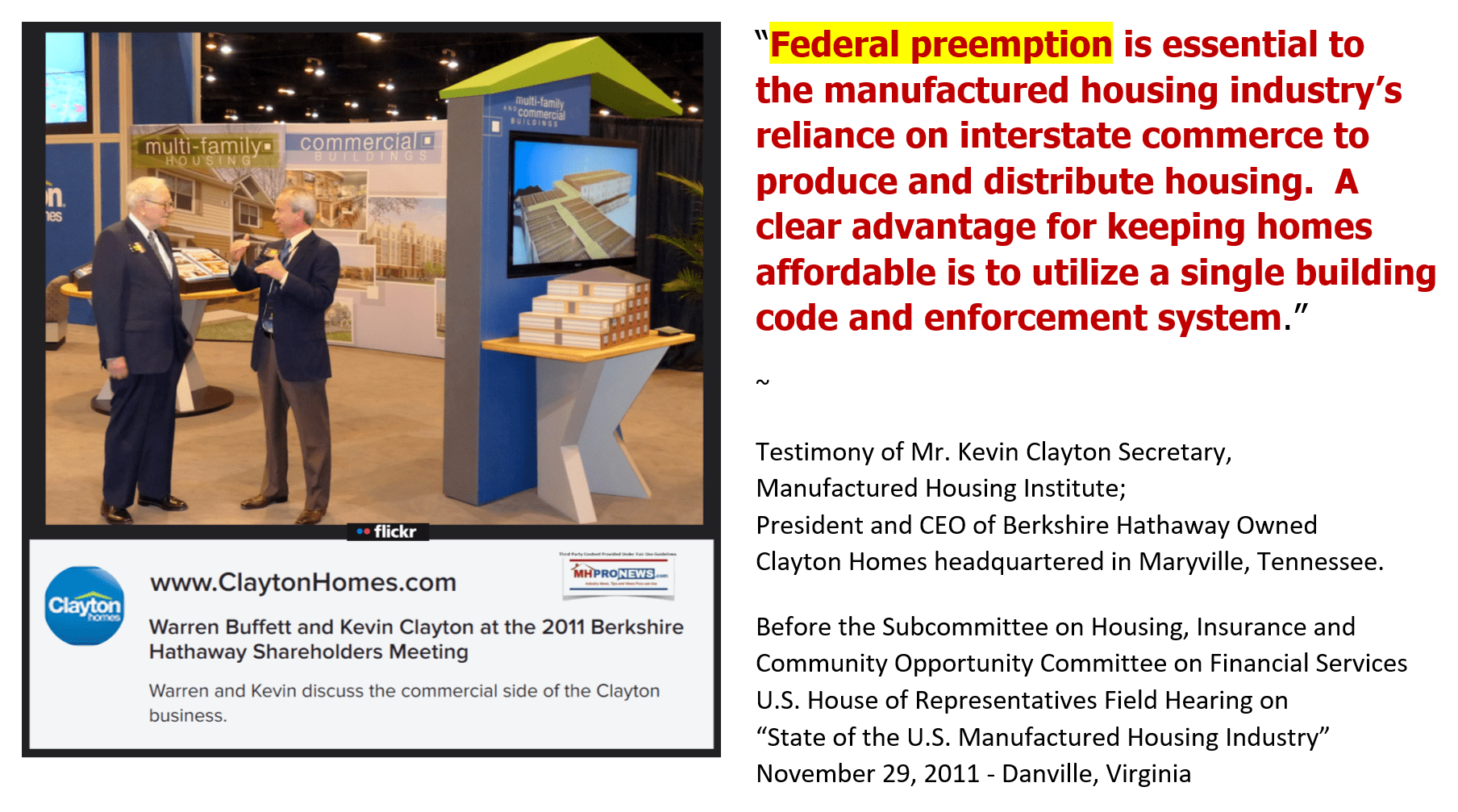

Ironically, the harm caused by this pattern is explained by Kevin Clayton. See the report linked above and the one about Buffett linked below.

Numerous possible examples of third-party research that sheds light on some aspect of these problems can be pointed out, as the reports above and below make clear.

The bottom line? The state of the manufactured home community sector is in a sense like the production sector before it began to be rapidly consolidated over a decade ago.

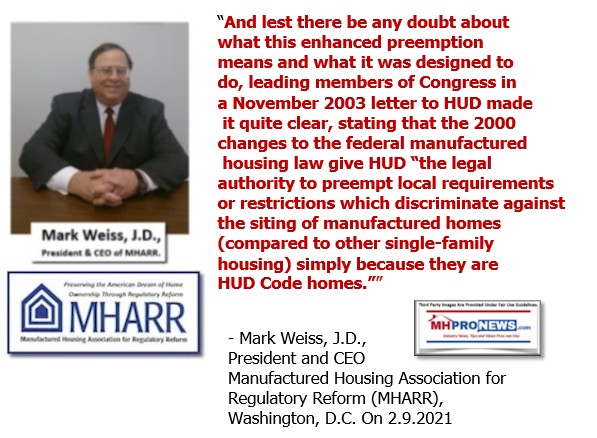

The consolidators seem ascendant. Thoughtful voices inside or once affiliated with MHI, on or off the record, along with MHARR and others have shed light on this pattern.

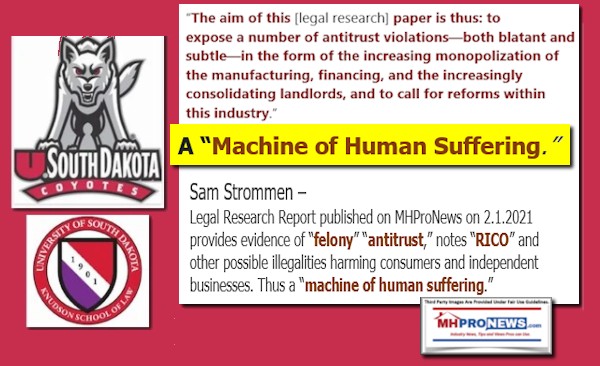

What has not yet happened is a serious investigation by public officials of this pattern of what Samuel Strommen from Knudson Law has called a Rube Goldberg Machine of Human Suffering. The fact that it has not yet happened should not be reason to believe that it won’t occur. Keep in mind that over a dozen well documented major scams has occurred in the 21st century alone. Those various violations of state/federal laws took place over a period of years. It wasn’t until critical mass was achieved that mainstream media/public officials finally paid those serious attention. What happened before can happen again. The time may be approaching when the brazen nature of the manipulation of modern manufactured housing by a relatively few players that use MHI and other nonprofits as cover could be upon us.

Time will tell. Stay tuned for what’s next. Watch for a special report planned on MHLivingNews in the days ahead. ###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

UPDATE and Notice to MHI members. Follow up emails to several MHI linked attorneys – not one disputed the claim by the law firm cited in the report below.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.