For years, the industry has struggled with this issue. “How do we explain MH chattel lending rates in a way that people can understand and relate to the facts?”

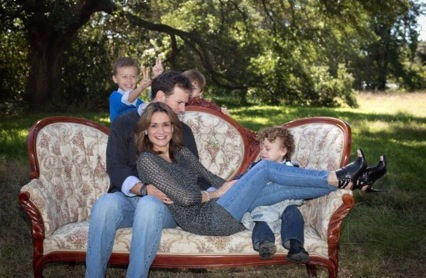

Eric Powell and his family’s dramatic story of trying to finance a

pre-owned MH is told at the link below.

Award winning writer Jan Hollingsworth has given you that tool, by telling the story of Eric Powell and his family, linked below. Positive comments have poured in the last 24 hours on this article. Association leaders are telling us they already have or soon will be using links to the story to rally members. Messages going out to industry pros from associations, urging them to read the article and contact your Senators.

Dodd-Frank and Manufactured Home Financing: The Place Where Good Intentions and Unintended Consequences Collide

By sharing the Powell family narrative – which includes and boldly refutes comments from S 682 opposition leader Doug Ryan at CFED – anyone can see the real world impact of the current CFPB regulations.

If award winning MH Retailer Alan Amy is correct, we are losing an estimated 20,000+/- new MH sales a year, due to the CFPB regulations. That’s equal to 20,000 lost new jobs! That’s 20,000 more people renting or doing some other inferior option than quality, appealing affordable MH! That’s millions of consumers who are limited or cut off from MH lending on their home, should they decide to sell.

My personal thanks to Joe Kelly for his tireless efforts on behalf of MH,

and all those other execs who do the same! A sample of the support for using this article

to pass our bill that will help consumers AND businesses in MH.

The negative impacts go on, so one pathway to address it is to properly tell the story.

Will You Take 3 Steps to Improve access to MH Lending?

Top flight writing like Jan’s takes time, as does the research that precedes it. Please make maximum use of this article. Take the following 3 steps.

1) Send the article linked and your request for support of S 682 to your two U.S. Senators. which is in section 109 of the bill linked here – of larger pending bill to be discussed in committee on May 21st at 10:00 a.m. ET. It is called The Financial Regulatory Improvement Act of 2015. Manufactured housing language is covered in section 108. You can find your two U.S. Senators and email him/her via this link.

Simple suggested message:

Senator,

The negative impact of current CFPB regulations on manufactured home customers is dramatically told by the news story found at this link. It also explains seemingly complex topics in an understandable way.

Dodd-Frank and Manufactured Home Financing: The Place Where Good Intentions and Unintended Consequences Collide

Please support the inclusion of S 682, found in section 109 of the Financial Regulatory Improvement Act of 2015. The companion bill HR 650 has already passed the House by a 100 vote margin. Thank you.

2) After you write your Senators, then you and your circle can share the story via social media and with others and ask them to do the same! Remember, the more links to this story above, the better! I make time to do this myself, please do it too.

3) Many of you know someone in media. Or you can access an email address for news tips to CNN, Fox, Yahoo Business, CNBC, etc. Submit the link, with a note that says this is coming up for a vote this week, and it impacts some 20,000 potential new jobs and millions of home owners.

Closing thought for today

Last year, Doug Ryan at CFED wrote that the CFPB regulations should be tested and given a chance. Ryan and the I’m Home Network got their wish. The policies have been tested for about 18 months now, and stories like Eric Powell’s and Alan Amy’s estimate suggest the test has failed. As the industry predicted, it is harming real people. It harms in many cases, the most vulnerable.

Ryan wrote: “Members of the I’M HOME Network work to increase the role that manufactured housing plays in affordable homeownership. We have a deep interest in advancing policies that provide access to affordable financing for these homes—but not at the expense of consumer protections that help ensure that owners of manufactured homes are able to build and preserve wealth through homeownership.”

If Ryan meant what he said, he would reverse his position! They should now come out in favor of S 682! Will they?

One word heard, if true, has it that Ryan is scrambling for a story, plan or an angle to deflect this Eric Powell story that Jan Hollingsworth has written. That suggests they too see its power.

YOU must be the REAL consumer advocate, AND the business advocate, by sharing the Eric Powell story.

Remember the maxim, “If it is to be, it is up to me.” You be the change. You do this. Then, you can ask others to do it.

Eric Powell would have been far better off had the CFPB given the relief the industry sought. There are thousand like Eric who are being denied or penalized on their access to low cost manufactured homes. Who will speak up for them? If not YOU, then WHO? Take 15, send out the messages, then ask others to do the same. ##

PS: This is one more reason why the MH Alliance is so important!