“A good compromise, a good piece of legislation, is like a good sentence; or a good piece of music. Everybody can recognize it. They say, ‘Huh. It works. It makes sense.‘” – Barack Obama.

There is momentum behind the common-sense changes sought by the Preserving Access to Manufactured Housing Act (HR 650/S 682). MHProNews has sources that suggest that the bill could clear the Senate when it hits that chamber’s floor for a vote in late summer or this fall.

If that Senate passage happens, then the question will become, what will the president do should the bill hit his desk?

“Still, homeownership is out of reach for too many Americans — families who can afford to buy a home, but find themselves shut out because the lending market is too tight.” – White House website. (January 7, 2015).

One big reason the MH ‘lending market is too tight’ is regulatory. MHProNews and MHLivingNews have documented step-by-step though various reports cited below that demonstrates how the reforms sought by the manufactured housing industry are good for consumers. HR 650/S 682 is also needed by current MH home owners; notably those who have homes that would sell for less than $20,000.

Doug Ryan/CFED and The Seattle Times are both…silent!

On our sister site, the Eric Powell story documented that consumers are being pushed into 36% interest rates when they could get a manufactured home loan for about 1/3 or less of that rate. What kept that lower rate from happening for the Powell’s was the need to reform Dodd-Frank. Because the CFPB – an agency implicated in a conflict of interest with CFED – has failed to respond to the lived realities of their current, clearly-flawed regulatory policies.

Applying President Obama’s quote above to HR 650/S 682, this reform would make good sense for the Powell’s and thousands like them every year who are forced to choose between more renting, or paying an outrageous rate on a non-MH lender’s loan. More, competitive financing would return to the market – originated by firm’s such UMH and others referenced below – and they are only a regulatory or statutory change away. “Huh. It works. It makes sense.” – Barack Obama.

Veteran MH lender Don Glisson Jr.’s on-the-record statement shows how a reasonable modification of the MLO rule, would make it as easy for an MH sales person as it is for a real estate agent to advise a prospective home buyer. Those MH sales professionals aren’t getting paid by the lender. Where is the risk in letting MH sales people do what real estate agents do?

The current state of the CFPB’s regulations umjustly muzzles the free speech rights of professionals, and thus harms the consumers they serve. The proposed law (HR 650/S 682) helps fix that issue. “Huh. It works. It makes sense.” – Barack Obama.

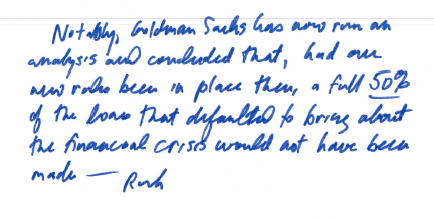

Let’s note too that MH lenders portfolio their loans. They ‘hold their own paper.’ The loans they make are thus very different than those that caused the financial melt down of housing and the mortgage market in 2008 that gave rise to Dodd-Frank.

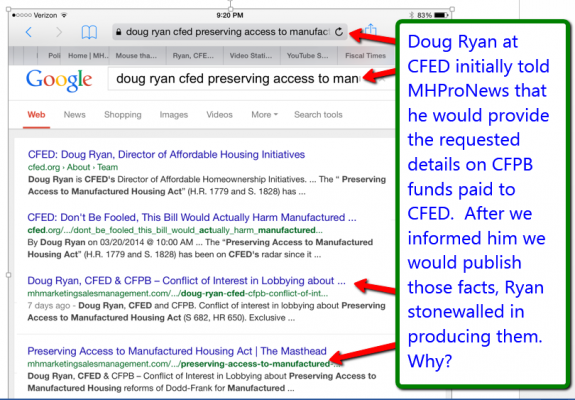

We privately and publicly called out The Seattle Times and Doug Ryan/CFED on such topics. How can they defend the apparent errors in their positions and their own conflicts of interest we spotlighted?

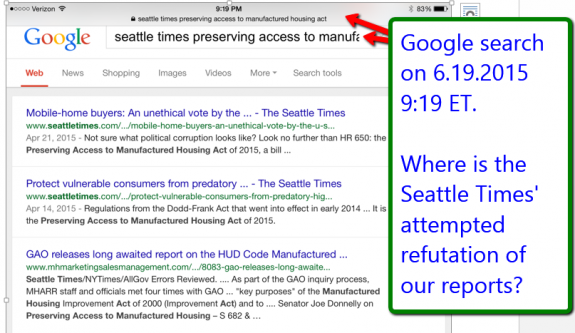

A Google search we did last night on the Seattle Times and CFED revealed…silence. See the screen captures below. Our facts, or those reported by Professor Cunningham (see link below), have to my knowledge gone unanswered. Why? Could it be that both the Seattle Times/Center for Public Integrity and Doug Ryan/CFED are in a conflict of interest? Isn’t it apparent they have no good response to the fact-based reports and common sense we’ve brought to the public discussion of HR 650/S 682?

As the Pledge of Allegiance reminds us, we are a Republic. A nation under laws that are supposed to protect “We, the People.”

The current structure of the CFPB demonstrates that it’s unresponsive to the very body – Congress – that breathed it into regulatory life. As the president once said, he is not the emperor. Nor should the CFPB – or any other regulatory body – be so independent of those representing the American people – Congress – that it is essentially unaccountable for its actions. I’d suggest that the current state of the CFPB regulations of MH financing is un-American, and perhaps un-Constitutional too.

The CFPB must be reigned in. With respect to its current policies regarding MH financing, it is demonstrably harming millions of Americans who own those MHs under $20,000. The CFPB is hampering the access to credit and home ownership which the applied logic of the White House’s previously cited statement wishes to correct; again quoting – “Still, homeownership is out of reach for too many Americans — families who can afford to buy a home, but find themselves shut out because the lending market is too tight.”

We support passage of HR 650/S 682 because it is good for consumers, good for home owners, good for job creation and good for business. That meets all of the criteria President Obama has frequently outlined as being good for America.

We hope President Obama and all Senators who care about the millions currently being harmed by existing regulations will join the strong majority in the House or Representatives and support Preserving Access to Manufactured Housing – the most affordable form of quality, greener, appealing homes available to Americans today. ##

References, Sources and Footnotes

- Dodd-Frank and Manufactured Home Financing – the Place where Good Intentions and Unintended Consequences Collide, linked here. The article demonstrates that MH lenders are about 2/3 lower in interest rate than the kind of financing Eric Powell was forced into, due to policies supported CFED and enforced by the CFPB. The nuances of MH lending are reviewed in terms that make sense, and which undercut the false arguments advanced by Doug Ryan et al. MH lending experts are quoted in this article, as is Doug Ryan.

- Don Glisson Jr., Chairman and CEO of Triad Financial Services, on his company’s experiences and reasons for supporting reforms of the Dodd-Frank Act to correct problems created for manufactured housing lending by current CFPB policies., linked here

- Sam Landy, JD, UMH Properties CEO, and other lenders who have been pushed out of the market by current CFPB policies. It is noteworthy that the facts Landy and others present undercut Doug Ryan led CFED arguments and vividly proves that CFPB polices are costing untold thousands annually access to home ownership. See article and video, linked here. It must be noted that ManufacturedHomeLivingNews has contacted every major and some regional MH lenders. All favor changes to current CFPB regulations, so this is not a Berkshire-Hathaway/Warren Buffett issue.

- A bi-partisan group of Congressional representatives overwhelmingly approved HR 650, two of them are cited at length in their own words as to why. She’s Black, He’s White. They are in Different Parties…

- Alan Amy, a veteran MH retailer, estimates that current regulations are depressing MH sales by about 30% a year. If so, the practical impact is that 20,000 more homes could be sold a year at the current pace and 20,000 new “good-pay jobs” could be created in the construction of manufactured housing. Amy’s comment came as part of a broader video interview, linked here.

- The Integrity of Clayton Homes and the Politics of “Investigative Journalism,” published by Professor Lawrence A. Cunningham, JD. Cunningham’s arguments have yet to refuted by The Seattle Timeset al. Article linked here.

- One must also question why Daniel Wagner and Mike Baker, writing in the Seattle Times articles done in tandem with the Center for Public Integrity, used outdated and inaccurate terminology when referencing modern manufactured homes, improperly calling them ‘mobile homes.’ Was it a tactic on their part? For a better understanding of the terminology and why-it-matters, see the article linked below.

- Evolutionary! From Trailer House to Mobile Home to Today’s Manufactured Home

- Screen captures of Google Searches, shown below, demonstrate that neither CFED nor the Seattle Times have yet to refute the points noted in our MHLivingNews or MHProNews reports on these topics.