Stating the obvious can bring clarity to a subject. There are a variety of pressures routinely placed on those in public service. Some of those pressures come from special interests. Some of the pressures are time, workload and other demands.

In practical terms that means that the broader public interest must periodically be brought to the attention of officials. There is the mantra, if you see something, say something. Officials have to be told a problem exists.

If they fail to respond appropriately, then voters and taxpayers have a proven ability to influence the system whenever some might falter in their duties for whatever reason. Media, including specialized trade media, can play a useful role in that process.

A prima facie case will be laid out below of wrongdoing within the manufactured housing industry that directly or indirectly impacts almost everyone in the United States because of the vital nature of affordable housing.

But initially, a brief list of some data and research follows that will underscore why the allegations of lawbreaking are worthy of robust pursuit and enforcement by various public officials.

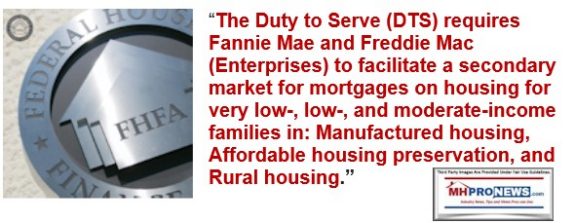

- For the 111 million renters, the estimate per the Apartment List in 2019, various surveys indicate that some 75 percent of those want to be homeowners someday. It would be hard to find anyone of sound mind that would argue for less-affordable housing among those 111 million souls.

- The National Low Income Housing Coalition (NLIHC) March 18, 2019 said that some “7 million affordable and available” housing units were needed.

- HUD recently released their 2019 data summary that said 567,715 persons experienced homelessness in 2019, which has increased overall nationally, thought numbers of states have had a modest dip.

- Value Penguin published on June 7, 2018 a summary of research “Fear, Manufactured Homes and a Solution to the Affordable Housing Crisis.” That research should make budget and cost-conscious public officials – as well as investors and others – sit up and take note, because the third-party research they cited indicates that a lack of affordable housing near where it is needed costs the U.S. Gross Domestic Product (GDP) some $2 trillion dollars annually. Other researchers have come to similar conclusions. More GDP would mean more revenue for governments at the local, state and federal levels.

Rephrased, not solving the affordable housing crisis is harmful to those Americans directly impacted and costly to government and the nation at large.

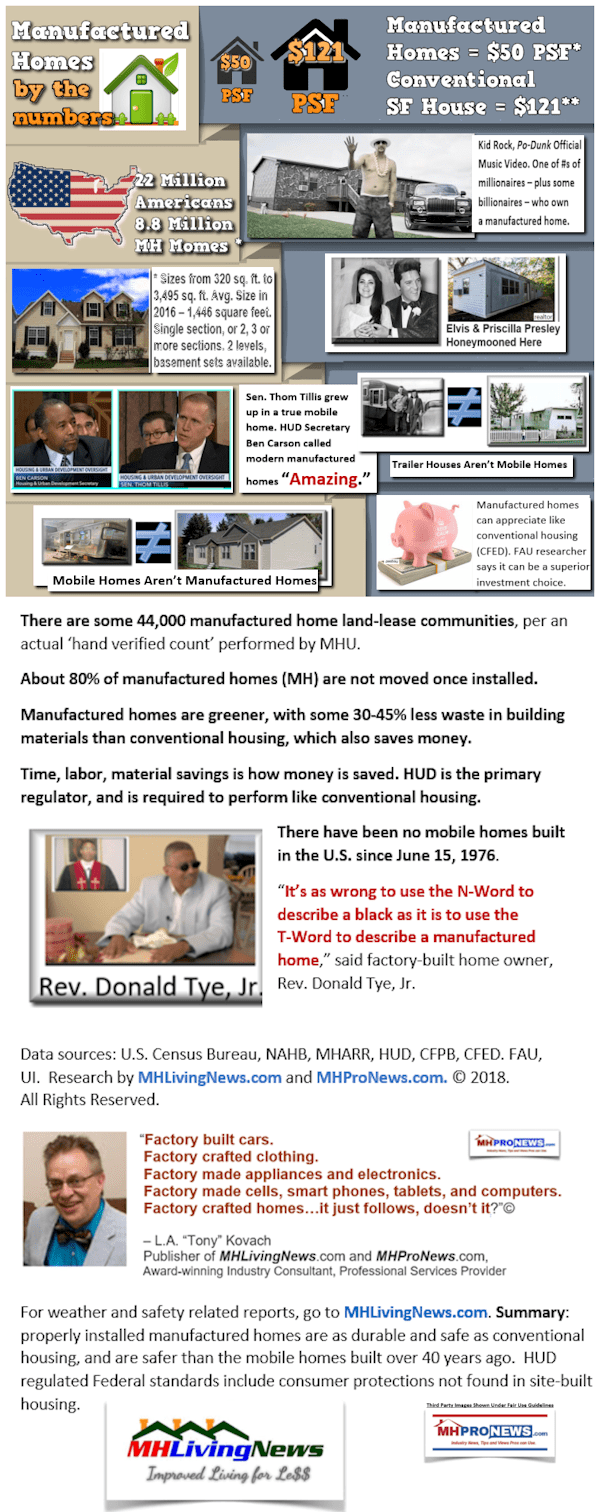

Mobile and manufactured home (MH) residents are routinely homeowners and are in the documented most proven form of affordable housing in the U.S. Some research results are as follows.

- On January 25, 2019, a bipartisan panel of lawmakers stated their findings under the title “Manufactured homes can play a vital role in easing the [affordable housing] shortage” that was first published in the Star Tribune.

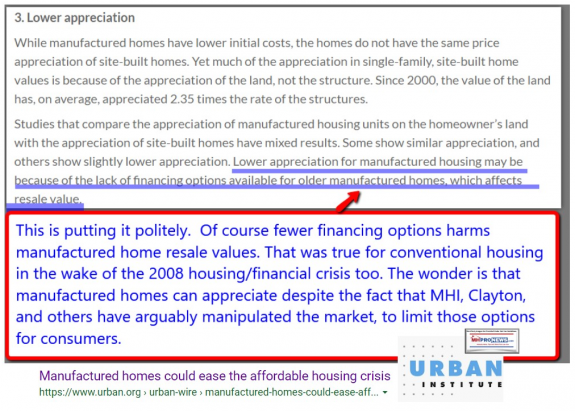

- The Urban Institute and the National Association of Realtors’ Certified Business Economist Scholastica ‘Gay’ Cororaton each published in 2018 their research that came to very similar findings about the quality, durability, affordability and need for manufactured homes.

- Cororaton’s NAR research coupled with the statement of the National Housing Conference President and CEO David Dworkin in 2019 are relevant, as alongside the Urban Institute and the Federal Housing Finance Agency (FHFA) study of data revealed that manufactured housing appreciates much like conventional housing. They are among several third-party research findings that spans more than 2 decades of independent studies which challenge mistaken stereotypes about manufactured homes.

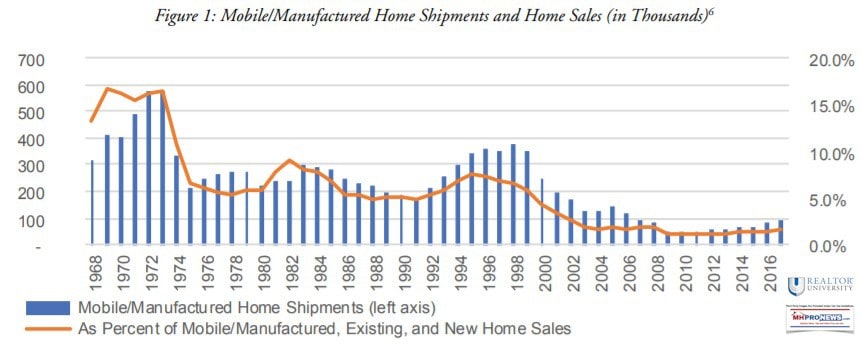

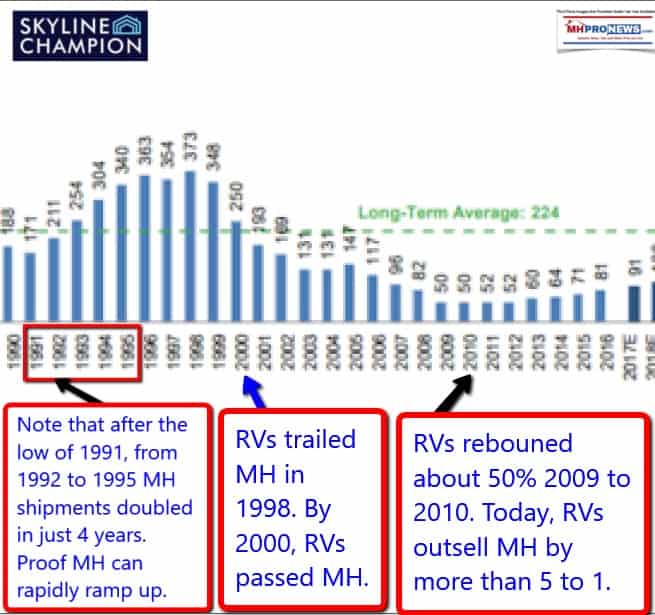

Even that brief survey begs a question. As the Urban Institute aptly asked in their reports headline question on January 29, 2018 – “Manufactured homes could ease the affordable housing crisis. So why are so few being made?”

That question and its troubling answer are near the heart of what follows.

Reading those key findings will illuminate why the following ought to matter to public officials who will be asked to investigate and prosecute as needed the allegations set forth below and linked from reports found herein. The allegations found below shed logical light on the true answer to the Urban Institute’s timely question.

For non-attorneys, the definition of a prima facie case is as follows.

With that backdrop, let’s examine prima facie examples of specific laws that were broken. Note that these prima facie allegations are not necessarily the most serious legal issues that will be raised in this report. But by beginning with these obvious or prima facie examples, it should then logically cause public officials and other investigators to dig beyond the apparent into the other allegations that are arguably harming the interests of tens of millions of Americans.

- First, (I)we will look at a prima facie case of perjury.

- Second, (II) we will look at far more serious prima facie case for an antitrust violation that caused untold billions of dollars in harm to the interests of literally thousands of privately held businesses in a deviously timed manner that masked the truth at the time it occurred.

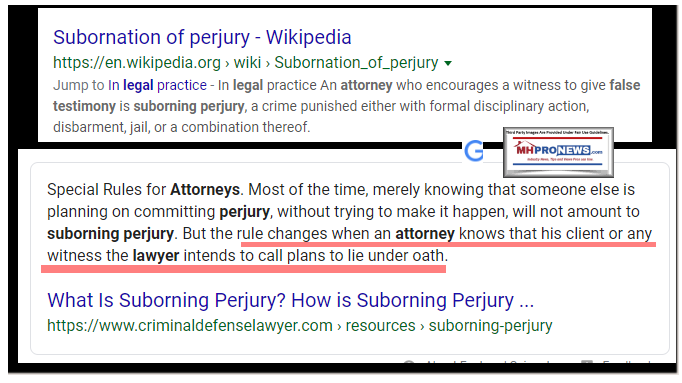

- Third, (III) in pondering the cases above, there are attorneys involved that reviewed those purportedly false and perjurious filings. Arguably with knowledge, those attorneys nevertheless allowed various filings to occur, which raises the issue of subornation of perjury. That is a disbarrable offense and can carry other penalties too.

Those items ought to raise questions for investigators. For example.

- Why would someone perjury themselves or why would an attorney risk disbarment?

- What is so important that would cause someone to risk making a false statement under oath?

That will be followed by additional evidence of several arguably illegal, harmful and costly actions that merit prompt regulatory and law enforcement attention.

Lawmakers in their oversight capacities should be keen on these matters too.

Then, some biographical insights, disclaimers and notices about this writer will be included. The professional expertise, credibility and some biographical history of this writer will be examined.

Finally, during the course of this proposed case described in the headline a mention of possible rebuttals that might be advanced by those accused will be considered. Arguably several steps they’ve taken are in preparation for such a legal defense. That will be revealed below as well.

With that step-by-step presentation plan, let’s begin.

I. Prima Facie Case of Perjury

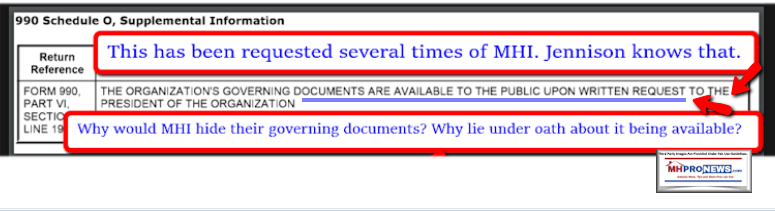

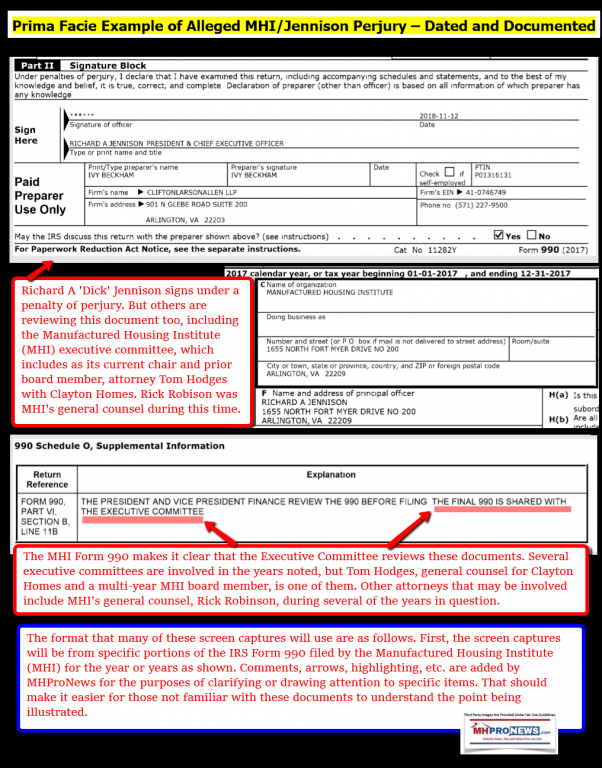

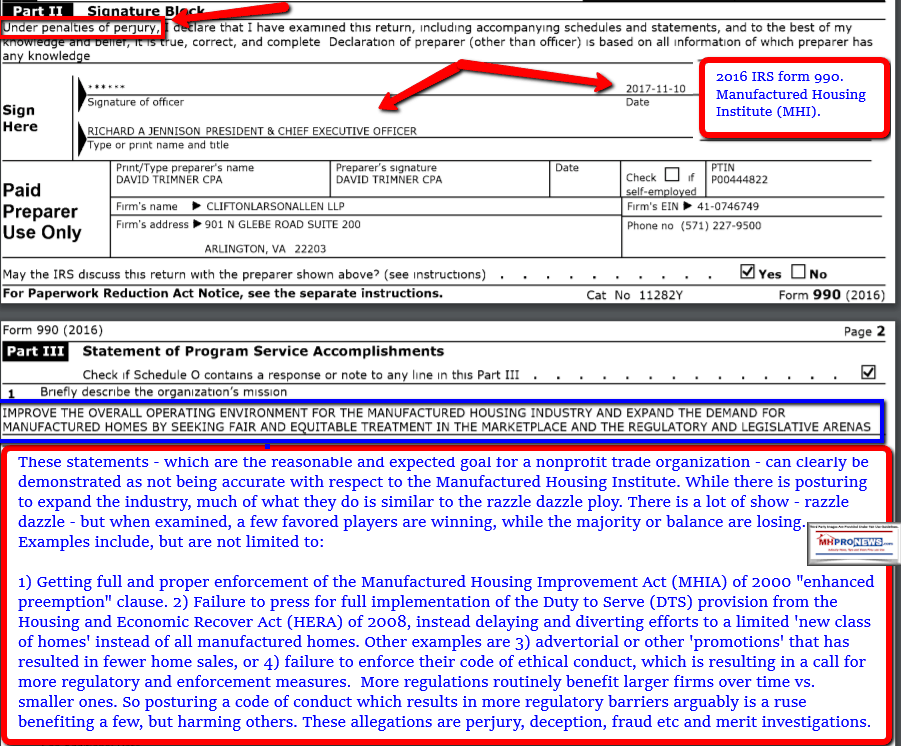

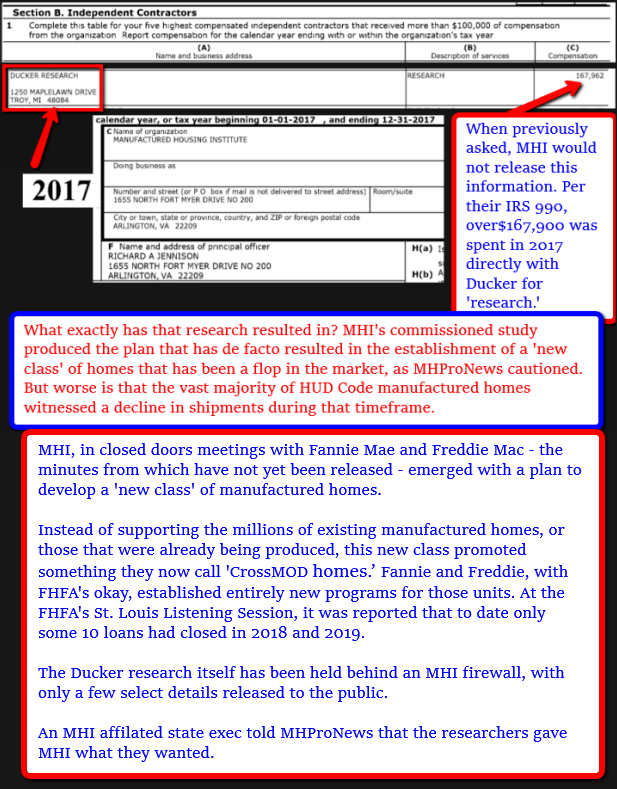

The Manufactured Housing Institute (MHI) is a nonprofit organization. As such it files an IRS Form 990 annually. That form is signed by MHI’s president, who during the timeframe in question was Richard A. ‘Dick’ Jennison. It is also, per their own 990 filing, reviewed by an MHI vice president and by the MHI Executive Committee.

The screen capture below is a collage of items from MHI’s 990 that includes commentary in red, arrows, and a title that were added by MHProNews. That image illustrates the first element of the matter of perjury. Namely, that statements are being made to the IRS under oath.

Note that not only Jennison but also MHI’s Executive Committee reviews this document, per their own statement, which is also shown. Depending on the time frame in question, one or more of those MHI Executive Committee members are attorneys. For reasons that will be apparent further below, it is also reasonable to believe that MHI’s then general counsel, Rick Robinson, was involved in the review and/or preparation of these documents.

With the above in mind, the following will now establish the first – but not only – example of a prima facie case for perjury.

I. A) Prima Facie Example of Alleged MHI/Jennison Perjury – Dated and Documented

Indeed, by law MHI is required to provide such information. So the IRS Form 990 is merely restating what’s required. But in fact, MHI’s president and leadership have been asked several times over the course of more than 2 years and didn’t provide those records which they said under penalty of perjury they would provide. MHProNews first made such a request while our parent company was still an MHI member. At no time have those documents been provided.

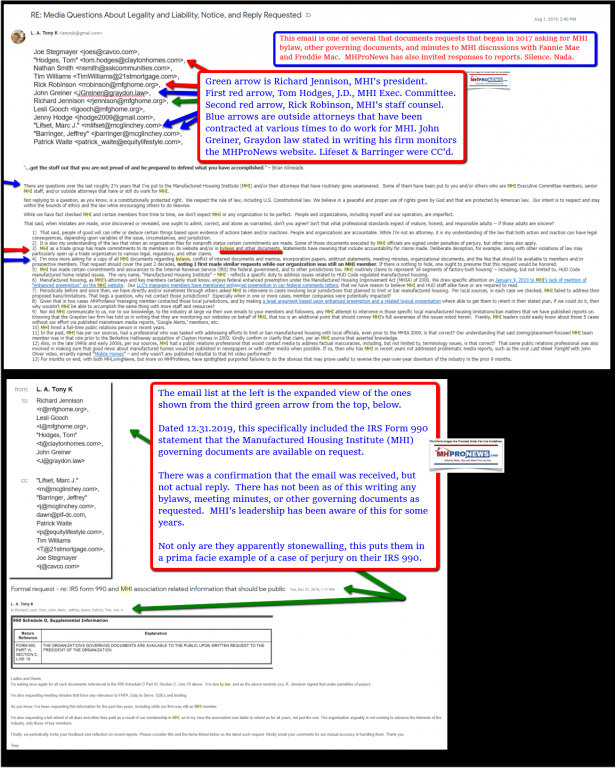

The screen capture below are two of several examples of such requests, but other examples are available.

Beyond documenting a purported prima facie case for perjury, in as much as MHI admits they are supposed to provide such documents but in fact have not done so, that should beg a simple and obvious question. What does MHI and their leaders have to hide by not providing their bylaws and other governing documents and records?

Bear in mind that such documents would routinely be kept by a nonprofit in a PDF format, and could be provided in a matter of a few minutes. Click on the PDF, attach it to an email, add a simple cover message and send it. MHProNews went beyond the step of asking just the president, others involved in the organization were asked too. Furthermore, there were BCC’s of that request, to further document the ask.

I. B) Prima Facie Example of an Antitrust Violation by 21st Mortgage Corp, Involving Clayton Homes and others at Publicly Traded Berkshire Hathaway, Inc. (BRK)

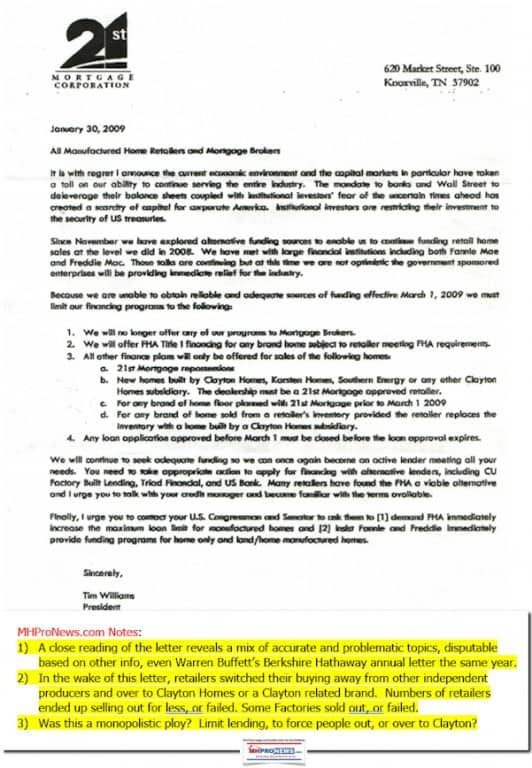

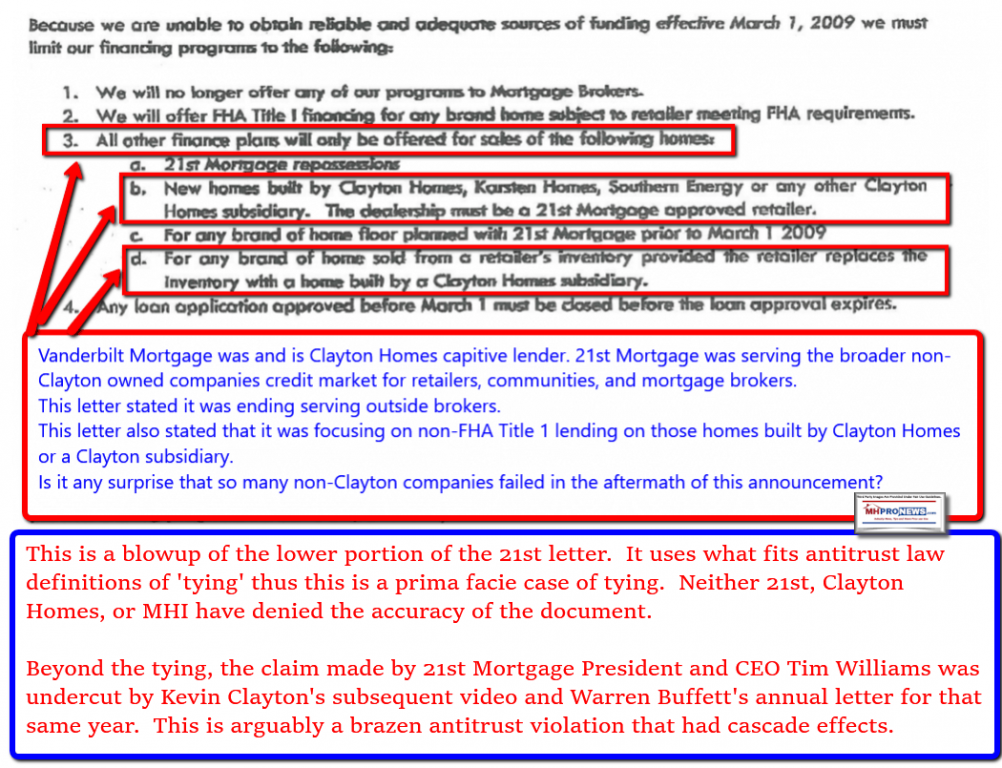

There are several demonstrable false and misleading statements mixed in with more accurate ones in the document that follows that I’d hereby allege involves a prime facie case for an antitrust violation. The initial focus in this involves the matter of “tying.” While we are not attorneys, some have been asked about this and there is also this definition.

“Tying falls under the wider legal umbrella of illegal competition that was originally censured by the Sherman Antitrust Act and refined in later acts.” So said Investopedia on April 14, 2018. Tying – as the name implies – involves a requirement that in order to get a product or service one the customer is being required or ‘tied to’ getting another product or service.

From the FTC website:

“If the seller offering the tied products has sufficient market power in the “tying” product, these arrangements can violate the antitrust laws. … tying products raises antitrust questions when it restricts competition without providing benefits…”

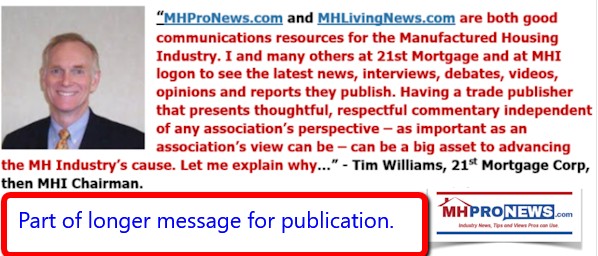

The letter reproduced below is from 21st Mortgage Corporation and was authorized/signed by Tim Williams, President and CEO of the company. Williams, it should be noted, has served on the Manufactured Housing Institute board of directors and for several years was the Chairman of the MHI Executive Committee.

What the letter does is establish that Williams and 21st set a condition for getting their lending (a product or service) based upon their selling Clayton Homes and/or 21st Mortgage repossessions.

Let’s first note that the paltering – the mixture of truth and purported lying – plus the timing of the letter in the wake of the 2008 housing/mortgage/credit meltdown made it sound plausible. The fact that the letter was sent out via U.S. Mail and via what federal law refers to as “the wires” raises other legal concerns, because the document could be construed as fraud and thus triggers RICO, U.S. Postal and other legal and regulatory (e.g.: SEC) issues.

That letter has a far wider impact than people outside of manufactured housing might realize. As a result of that letter, several thousand independent manufactured home retailers went out of business. Some had been successful for many years, even decades.

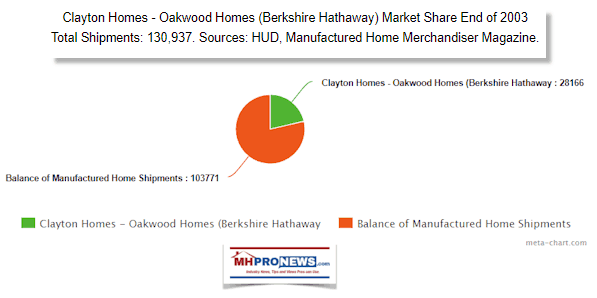

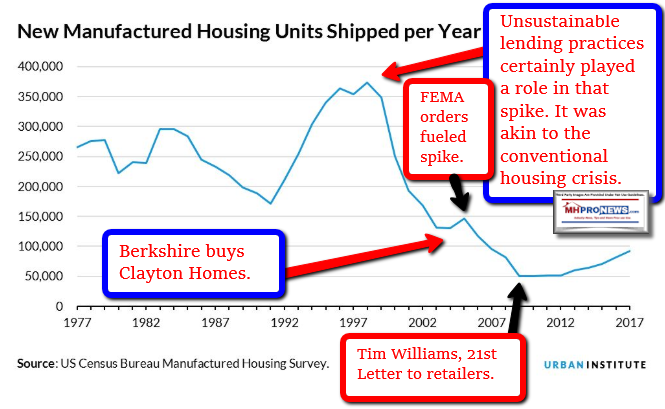

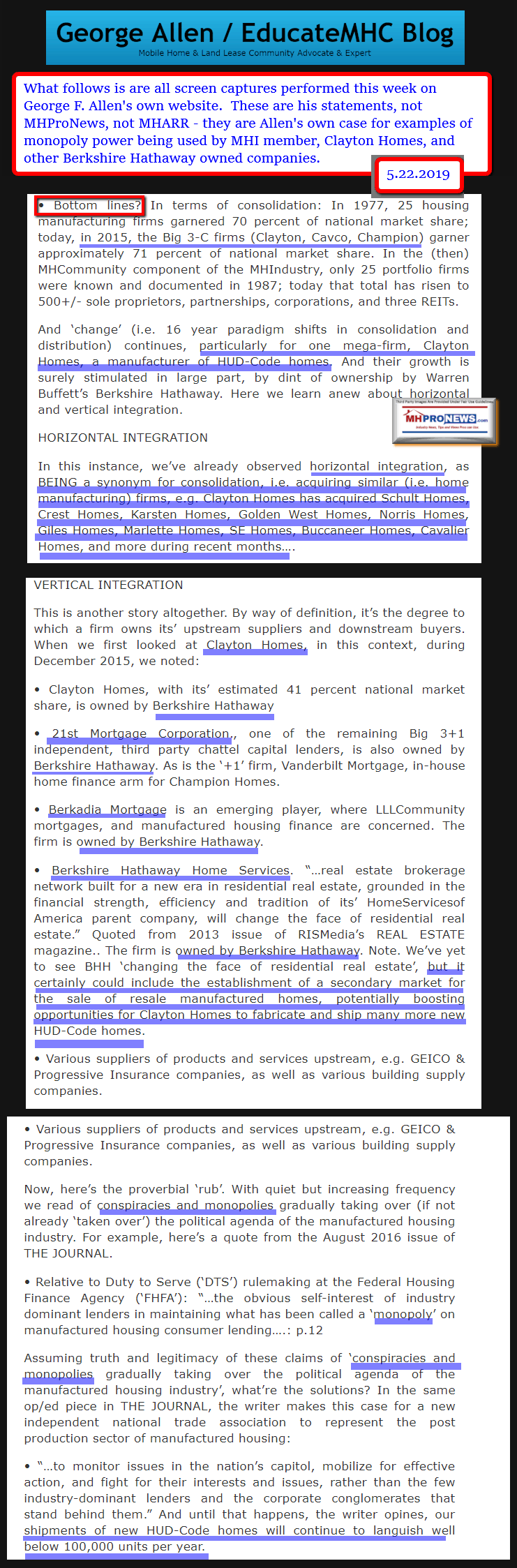

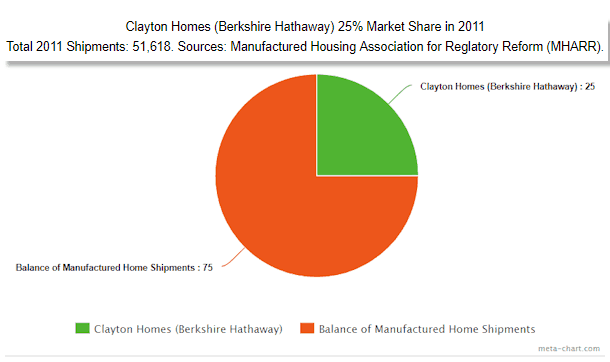

Furthermore, those retailers bought homes from independent producers of HUD Code manufactured homes. At the time, Clayton Homes had a significant, but far smaller market share, of manufactured housing production and sales.

So there were several other broad impacts that flowed from this prima facie example of purported tying and other legal and antitrust violations. In no particular order of importance:

- Several independent HUD Code manufactured home producers ultimately failed and/or sold out at discounted valuations.

- For decades, independent community owner/operators routinely depended upon retailers (a.k.a. “dealers”) of HUD Code manufactured homes to sell homes that filled their vacant home sites. With the loss of those independent retailers, the business model of thousands of communities was disturbed. While vacancies in communities normally take time to occur, as time advanced the vacancy rates in those communities rose as a result. That meant that the valuation of those properties was reduced. The profitability that allowed for repair or maintenance of infrastructure was impacted. When communities were sold or in some cases foreclosed upon, they were routinely sold at a far lower price than if the same property had been at full occupancy. Not last, those getting into or staying in the community sector routinely had to adapt and buy manufactured homes themselves, which required additional capital. More on how this ultimately impacted hundreds of thousands of consumers will follow further below.

- With fewer retailers, sales volumes diminished and that contributed to other lenders either not entering or not staying in the manufactured housing lending space. U.S. Bank is but one of several lenders that pulled out of manufactured home lending, specifically citing low volume and regulatory barriers as issues. Both that low sales volume and increased regulations will be viewed in more depth later in this report.

- Suppliers, transporters and installers were among those negatively impacted.

- Because affordable housing that was previously being provided by manufactured home retailers without public subsidies was suddenly diminished, the demand for providing publicly supported – de facto subsidized by taxpayers – increased.

- All of this undermined the values of existing manufactured homes, which would amount to economic harm to millions easily totaling billions of dollars.

- That in turn undermined the wealth creation of those individual manufactured homeowners.

- Last point under this category for now. Because competition in the manufactured home community sector was radically impaired by this purported antitrust violating scheme, it also created a cascade of harms to hundreds of thousands who live in manufactured home land-lease communities (also but errantly known as ‘mobile home parks’). How so? Consolidators with deeper pockets have moved into sector to replace those ‘mom and pop’ operators that routinely had closer relationships to their residents. While often on site or nearby owners of manufactured home communities (MHC) would be gentle in site fee hikes, by contrast, that’s often not the case with those who sweep in, buy MHCs at a discounted valuation, start filling vacant sites with their own inventory of homes, and raise site fees at often nose bleed rates.

That pattern has been often reported. Some examples will be shown in mainstream news and other video reports below. But the underlying causes of that pattern have not been widely understood, other than on our MHProNews and MHLivingNews trade media.

There are other examples like the above from numerous states from coast-to-coast.

Summed up, by 21st essentially pulling critical lending away from an estimated 10,000 (+/-) independent retailers in states across the country, a series of consequences occurred. The manufactured home industry has still not recovered from that calamity.

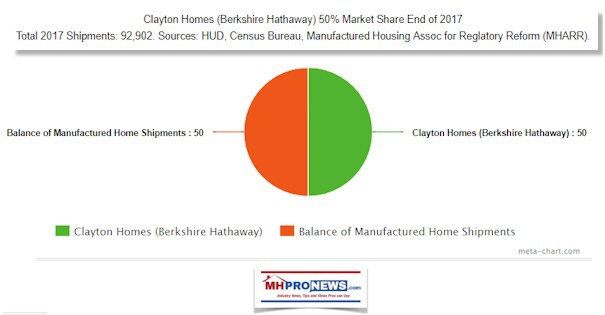

By contrast, Berkshire Hathaway owned brands – including, but not limited to, Clayton Homes, 21st Mortgage and Vanderbilt Mortgage and Finance (VMF) – have grown at a steady clip, because they had the deep pockets necessary to fill the void that was created. Indeed, they in several cases purchased distressed businesses at a discounted valuation.

From 2003, the growth of their market share accelerated following that 21st letter shown above. Operations like Fleetwood’s military division were absorbed by Clayton Homes, as was reported in June 2009. Other retail, production and supplier business entities followed.

More on this will follow below. But this brings us to prima facie allegation number three.

I. c) Prima Facie Evidence of Attorneys Connected With This Purported Scheme Suborning Perjury

These items have been increasingly covered by MHProNews and MHLivingNews over the course of the last few years. MHI’s Rick Robinson, J.D., Clayton Homes’ General Counsel Tom Hodges, J.D., and others who are inside and outside counsels for MHI and/or operations connected to Berkshire Hathaway of MHI have read about these concerns. This is known from a variety of means, but we will note for now that they were directly contacted about them, as the screen capture above under the first prima facie allegation reflected. Numerous such contacts occurred. It is therefore highly unlikely that those leaders or attorneys would say otherwise under oath if so questioned, as it would readily be disproven.

That screen capture will be reproduced again at this link here crystal clarity. Some of the attorneys are named by pointing them out with red arrows. While suborning perjury may be one bar association and/or legally related concern, depending on the jurisdiction, other legal issues may arise that also ought to be considered.

As that message and numerous others like it make clear, MHProNews has repeatedly offered MHI, Clayton Homes, 21st Mortgage, VMF and other firms involved in this alleged market rigging scheme the opportunity to refute, react, disprove or otherwise rebut or explain away the claims. They have repeatedly not done so, as the example in the email above demonstrates. Thus, another element in a prima facie claim is established.

Part II. A Deeper Look at More Granular Issues That Also Involve Perjury By Jennison/MHI, Plus Other Legal Concerns

MHI’s 990 claims to be working to “Improve the operating environment for the manufactured housing industry and expand the demand for manufactured homes…” or similar language for several years. See the screen capture below where that phrasing is found bordered in blue added by MHProNews for emphasis.

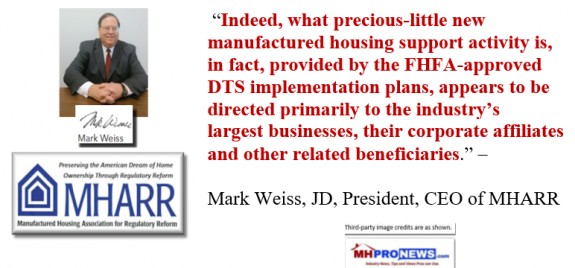

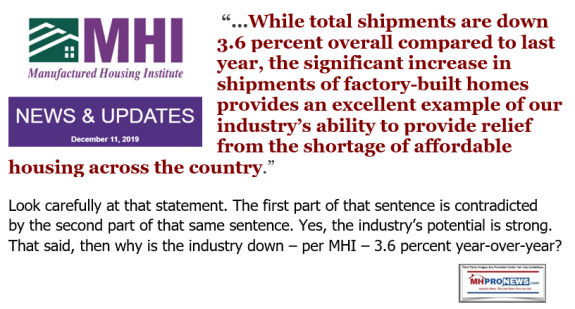

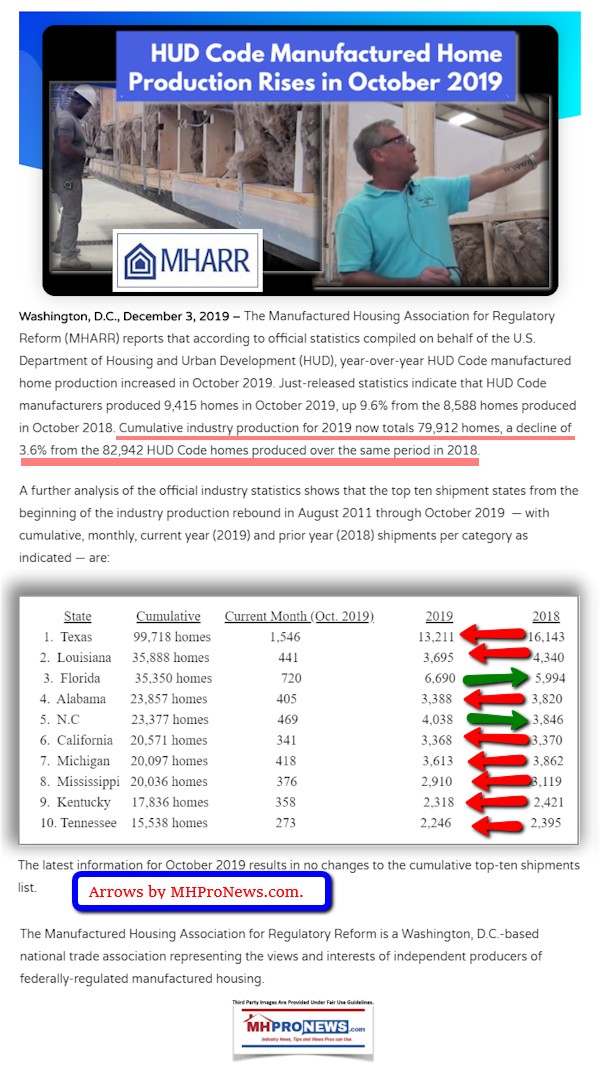

That claim by MHI is demonstrably not true. MHI, in collusion with some key players, has been posturing efforts that repeatedly fail to do what they claim to want. By posturing efforts, outsiders looking in at a casual level may think that MHI is a trade association much like many others.

But that lack of credibility to the claim by MHI of working to “Improve the operating environment for the manufactured housing industry and expand the demand for manufactured homes…” would be undermined by several items already brought to light in this report.

Let’s outline some points which will then be illustrated with articles and items that will take a deeper look at specific details of how MHI is de facto working to consolidate the industry, arguably in violation of antitrust laws, RICO, SEC, U.S. Postal, IRS, and other legal/regulatory issues.

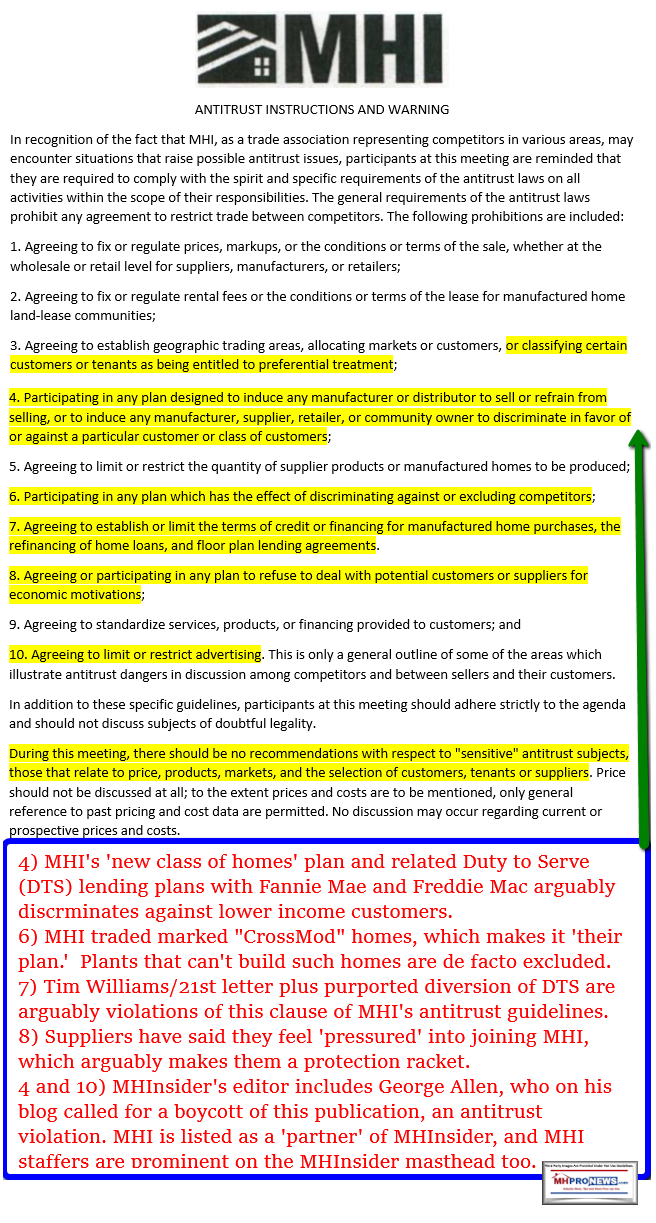

First, MHI is well aware of the antitrust laws, as the screen capture of their antitrust statement that is supposed to be read and/or passed out before meetings makes clear. The same document below also makes it logically plain that those at MHI who participated in this purported scheme did so wittingly.

Again, they routinely read what MHProNews and our sister site MHLivingNews publish, as their own outside attorney John Greiner at Grayson law firm said in an email that he was tasked to do by MHI. If Greiner is monitoring our website that logically means he is reporting back to MHI about that monitoring. Further, MHProNews is by far the most read news, fact check and analysis website in terms of size and audience engagement in the industry.

See the reports above and below to illustrate that point, and those reports have their own impact with respect to SEC and other legal issues. So they do more than merely document our superior audience size. Those reports linked above and below shed light on other purported legal violations involved in this scheme.

Let’s pause for a moment to make this next point.

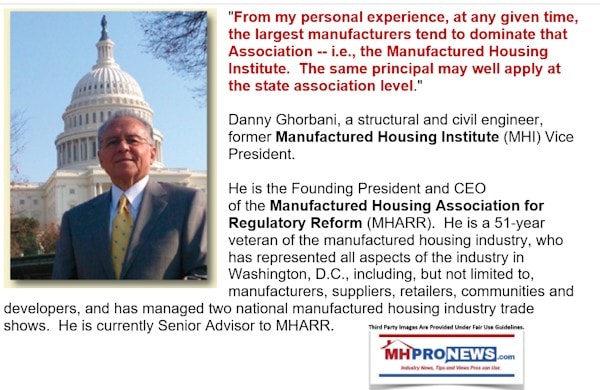

MHProNews and this author had to be shown and/or discover the nature of this scheme step-by-step. To the credit of the Manufactured Housing Association for Regulatory Reform (MHARR), they have raised warnings and concerns for years. Frankly, while we published both MHI and MHARR news items from early on, there were times we thought MHI was correct, other instances when we thought MHARR was right on an issue. That gave rise to our mantra of “We Provide, You Decide.” ©

While we provided – and therefore read or studied the various perspectives of MHI and MHARR, while some points MHARR stressed made sense, there were concerns they raised that seemed to be contradicted by what was visibly being done by MHI. MHI and their ‘big boy’ backers were posturing efforts on financing. It does appear to be convincing. But as time goes on and certain behaviors produce no results or even adverse reactions, normally people and organizations don’t continue to double down on problematic behavior. Furthermore, there were good laws on the books that MHI leaders – when asked by this writer in meetings in front of industry peers – would explain why they were taking their approach instead of a different one. Had their explained approach worked, okay. But when it doesn’t work, why keep doing the same thing to no benefit?

Put differently, leaders at MHI are either:

- unable or unwilling to readily admit an error or poor results.

- are inept, as they appeared to continue to fumble opportunities that existing laws or other circumstances placed before them,

- they failed to take steps to address problematic issues that were increasing, such as zoning and placement battles.

- Summing up, they are either arguably bad at their job, or they are good at posturing, entertaining at nice venues and settings, smiling, missing their own stated goals — and yet achieving one thing that went unstated. Steady consolidation of the industry.

Roughly 6+ years ago, concerns over various issues existed. But there was little hard evidence in our hands at that time, other than to say that MHARR raised concerns. A deep dive into our publications would reflect that point. So, just as this writer as a trade journalist had to discover the fact and evidence in stages, the same was true for many of our readers. That would include some of those who we are making the allegations against. Let me rephrase to make the point plain.

Initially, a relatively small group of people could have set this ploy involving Berkshire brands and MHI into motion. In our view, that would have included, but not necessarily been limited to:

- Tim Williams/21st Mortgage, who sent that letter out that was previously shown above or is linked here.

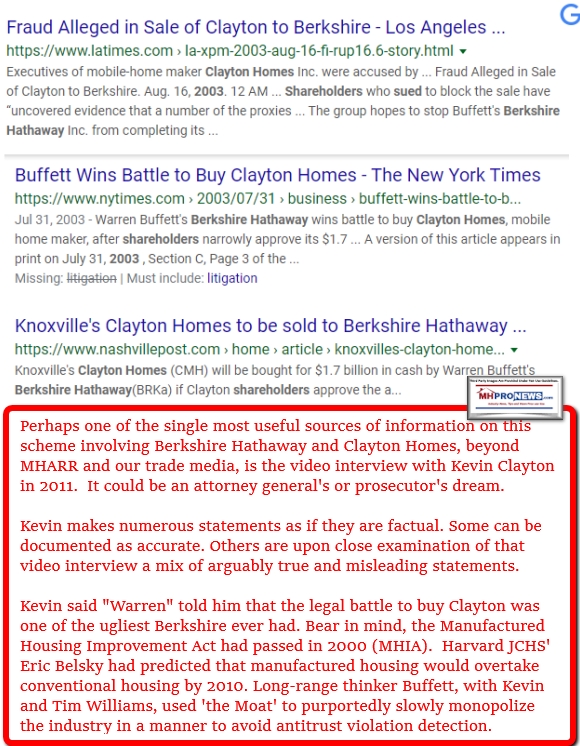

- Kevin Clayton, President and CEO of Clayton Homes, who benefited from that letter and whom it would be hard to imagine was not directly involved in that process. See the video with Kevin Clayton near the end of the related deep dive report at this link here.

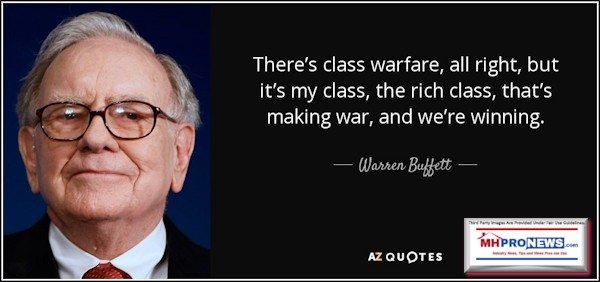

- Warren Buffett, Chairman of Berkshire Hathaway, which wholly owns the companies named above. Kevin Clayton in a video interview near the end of the post linked below, is speaking about his interactions with Warren Buffett at some length. He stresses that Buffett preaches to his unit managers the virtues of being a tough competitor and of widening and deepening their respective business units “Moat” every year. The fact that there is discretion on how 21st or Clayton Homes implemented that doesn’t necessarily absolve Buffett from responsibility for their following generic instructions that Kevin Clayton says ‘Warren’ preaches.

So, at a minimum, Mr. Buffett encouraged the behavior, even if he wasn’t directly part of the planning of the allegedly illegal scheme. Who says? Again, Kevin Clayton on video in an interview near the end of that article linked above. More on that Kevin Clayton video interview later.

There are arguably others that could have been part of this plot early on and/or who became aware of it and failed to report the matter. To name one that comes to mind based upon some evidence is Joe Stegmayer, a former Clayton Homes division president. As Kevin Clayton said in that video, what he and other Berkshire brand leaders are taught they in turn teach their team. So, it stands to reason that Stegmayer learned the Buffett “Castle and Moat” ploy from Kevin and or from others in the Berkshire family of brands.

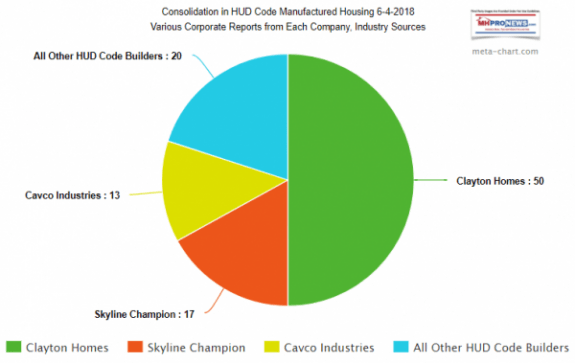

Stegmayer, it should be noted, was the former Chairman of MHI’s Executive Committee. He was served an SEC subpoena that was reported in November 2018. Cavco Industries (CVCO) stock fell sharply in the wake of that announcement. Millions have reportedly been spent in legal maneuvers, per Cavco’s own public statement in fighting that matter, which is not yet been reportedly resolved with the SEC.

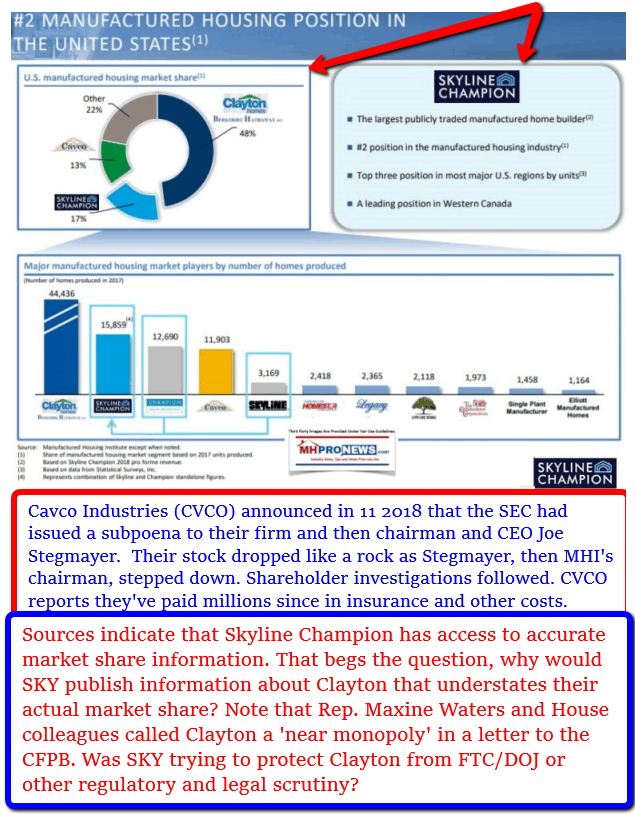

During all of the drama in the manufactured housing industry since 2003, Clayton Homes market share has grown steadily in the wake of the 21st letter from Tim Williams, as was shown above. But for whatever reason, Clayton seemingly wants to mask the size of their market share. It appears that other MHI members are helping them in that regard, as the graphic below reflects.

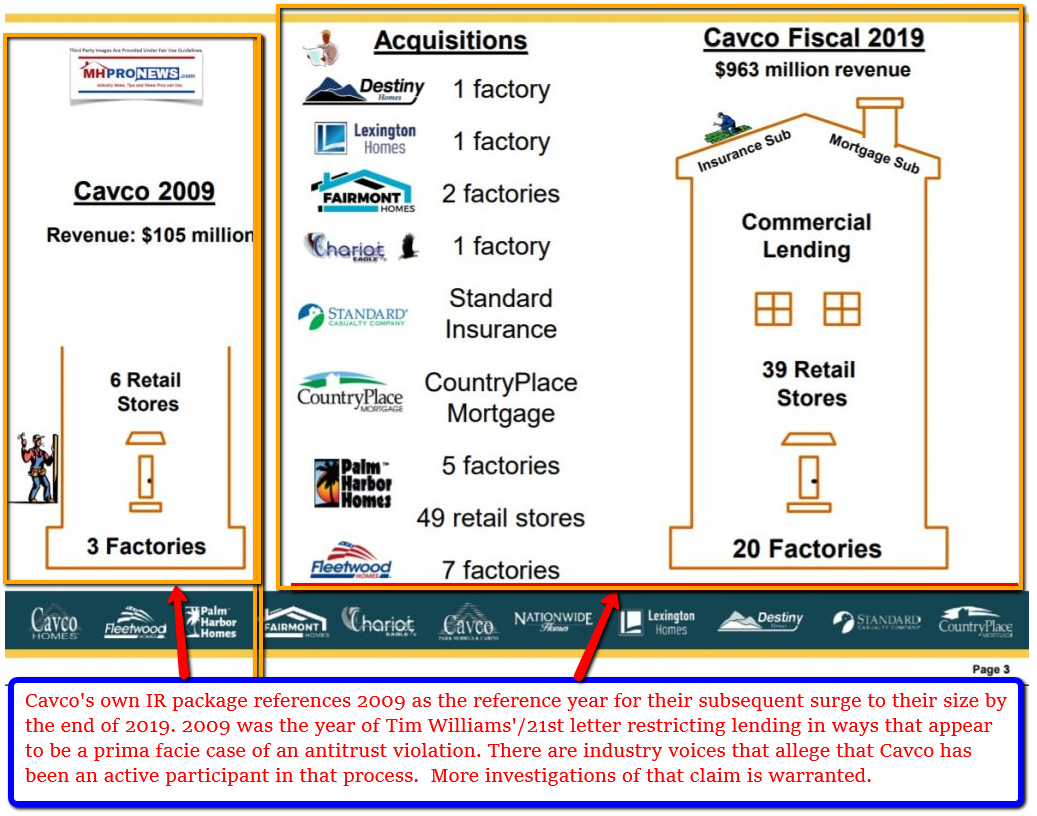

But Clayton isn’t the only one that has benefited from consolidation, so too has Cavco Industries, among others. Cavco has thoughtfully documented that in their own IR PowerPoint graphic shown below. Comments and arrows were added by MHProNews, but the base graphic and data are from Cavco Industries IR package.

The question has long been quietly discussed in manufactured home industry circles – was Cavco and Clayton working behind the scenes with each other? Recall that Stegmayer was a former Clayton division president before joining Cavco.

Fast forward to the Cavco controversy in 2018, note that Stegmayer sold large sums of stock prior to the SEC announcement.

Also the Third Ave. hedge fund involved in Cavco pulled out prior to the announcement of the SEC subpoena. That too begs questions that the SEC and other regulators ought to be investigating.

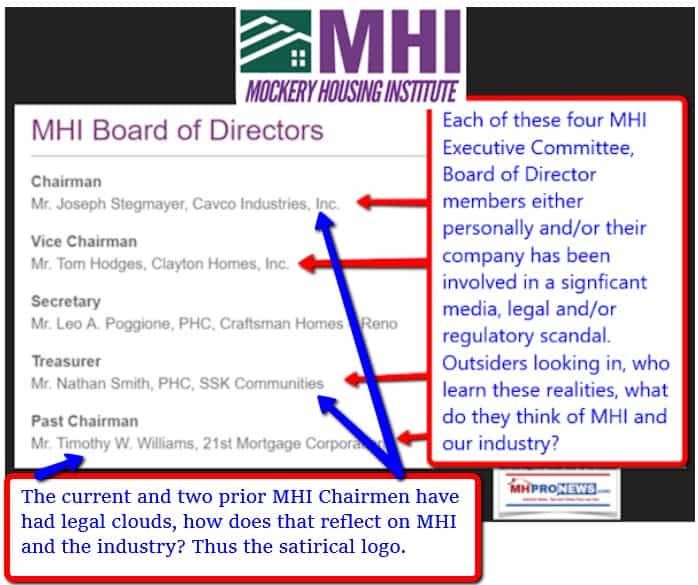

As the next two graphics illustrate, the board of directors or MHI Executive Committee has long had strong ties with Berkshire owned brands.

As one ponders those who are on that board, notice that the majority of them have had some serious legal concerns that have hit the media one or more times associated with them? How can MHI be viewed as a normal trade association? For instance, when Joe Stegmayer stepped down from his role as chairman, president and CEO of Cavco, how is it that Stegmayer stayed on in his role as MHI’s chair?

The more one peels at the layers of the onion, sadly, the more there is to find is what we discovered during our years of research, investigations and news tips from various sources.

But the point for now is this. Initially, many or perhaps most of those who were involved in this scheme may have known little. It is at least arguably possible that a small handful cooked this ploy up and started its execution as this report and those linked from it detail.

But as time moved on, and as industry readers – including those working for MHI – increasingly became aware of these issues, it is hard to imagine that many of those tied to MHI didn’t realize that they – wittingly or not at first – were part of an arguably illegal scheme designed to posture effort while steadily consolidating the industry into ever fewer hands. Because MHI was claiming, not only on their IRS Form 990 that they were working to improve the regulatory environment and improve the acceptance of manufactured homes in the marketplace, their claims – upon which numbers of independent members would rely upon to join and pay dues – were arguably deceptive trade practices. A string of other legal issues arise too. And the evidence that they weren’t performing is as simple as looking at objective data, such as the chart below published by the Urban Institute in 2018.

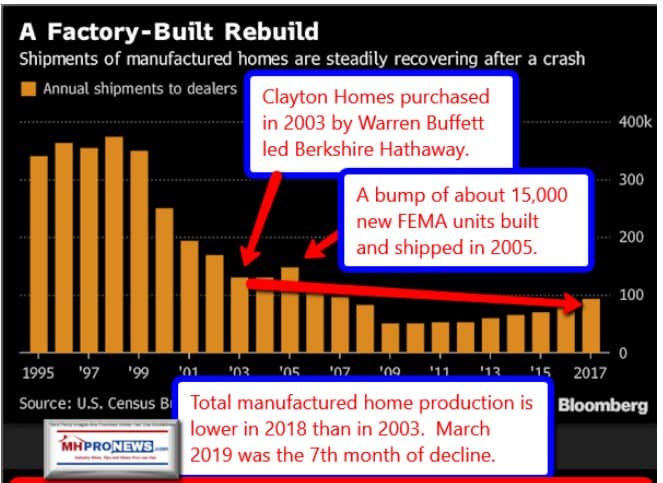

What the base Urban Institute graphic reflected is this. The number of manufactured homes plunged first as a result of problematic lending and a wave or repossessions that hit in the late 1990s and continued into the early 2000s. But as Fast Times reported, by the time Clayton was acquired by Warren Buffett led Berkshire Hathaway in 2003, the industry had ‘bottomed out.’

Beyond the well publicized legal uproar over Berkshire’s successful battle to buy Clayton Homes is described by Reingold, see the linked report above.

So, this likely began as a tight group of conspirators all of whom have clear ties to Berkshire Hathaway and that letter by Tim Williams at 21st. Over time, others may have realized what was occurring. That’s mentioned in fairness to those who may have been working innocently enough initially, but later may have discovered they were caught up in a web of deception that involved illegalities. There are certainly several questions that ought to be asked of MHI staff, which have been a revolving door of people coming and going for many years.

In saying that, one earlier clue for MHProNews in understanding that something was clearly wrong at MHI was the comment below by Richard ‘Dick’ Jennison to me while I was doing a video interview with him in 2014 at the MHI Congress and Expo.

Candidly, this is a snippet of a longer video below from what was supposed to be a softball interview. During his commentary, Jennison said that the industry should grow slowly. I was stunned. Why would the president of a trade group tell an audience of industry professionals that the industry should grow slowly? Sustainable growth was possible rapidly. This comment is an important exhibit in demonstrating that what Jennison said under oath on those IRS Form 990s was arguably simply not true.

It was odd to say the least that Jennison would argue for slow growth. In investigations, reporters and law enforcement alike ask a question. Cui bono? Who benefited from an act or behavior?

In this context, who benefited from slow growth? Surely, not the vast majority of independents, who often need every sale they can get. Still giving the benefit of the doubt, and thus not yet realizing the full nature of what was occurring, this writer contacted Tim Williams at 21st. At the time, Williams and this writer were in routine contact, as I was with much of the manufactured housing industry’s leadership. Interviews and videos on the MHProNews website and/or on MHLivingNews document that point.

Thinking that it was possible that Jennison may have said something merely foolish, I brought the video above and Jennison’s statement that the industry should grow slowly to Williams’ attention. Williams assured me that it would be dealt with.

Indeed, it was.

At the 2015 Louisville Manufactured Housing Show, Jennison made a public address that included the statement that manufactured housing could achieve 500,000 new HUD Code manufactured home shipments.

Note that 500,000 new manufactured homes annually goal was precisely the figure I suggested to Williams. That seemed at that time like a reasonable level of sales that manufactured housing could achieve based on the industry’s potential and the country’s affordable housing needs. This is all important from the perspective of public investigators.

At that same 2015 Louisville event where Jennison reversed his flub from the year before in saying that the industry should grow slowly, Jennison also praised me and our trade media publicly. That too was also previously promised by Tim Williams.

We produced a brief video to commemorate the event, and have all of the raw footage. In producing this clip, we did so with a bit of a satirical touch to it, because while Jennison is indeed praising me and our trade media, but he was arguably doing so under orders. Listen carefully to his tone of voice as he says how I’m his good dear friend.

One of several possible points from those factoids is this. It is at least possible that at some point prior to 2014 and the MHI Congress and Expo that Jennison was brought into the circle of those who planned this scheme to slowly consolidate the industry in part by using MHI as a tool for that purpose. It makes no sense for the CEO of a trade organization that claims to be working to grow the industry to argue for slow growth. Indeed, that brief video of Jennison from 2014 is arguably one more prime facie example of perjury on the associations IRS Form 990 filings.

But there’s more evidence of false statements made under oath. Note that some of those false statements, while not necessarily directly involving the MHI IRS Form 990, nevertheless may include others associated with the trade association.

For example, when people make certain statements to federal public officials, they are presumed by law to be making those statements honestly and to the best of their knowledge and belief. According to Cornell University’s Legal Information Institute website about 18 U.S. Code § 1001. Statements or entries generally

“(a) Except as otherwise provided in this section, whoever, in any matter within the jurisdiction of the executive, legislative, or judicial branch of the Government of the United States, knowingly and willfully—

(1) falsifies, conceals, or covers up by any trick, scheme, or device a material fact;

(2) makes any materially false, fictitious, or fraudulent statement or representation; or

(3) makes or uses any false writing or document knowing the same to contain any materially false, fictitious, or fraudulent statement or entry;

shall be fined under this title, imprisoned not more than 5 years or, if the offense involves international or domestic terrorism (as defined in section 2331), imprisoned not more than 8 years, or both. If the matter relates to an offense under chapter 109A, 109B, 110, or 117, or section 1591, then the term of imprisonment imposed under this section shall be not more than 8 years…”

In that regard, there are arguably several people associated with MHI, either staff or key members, who have made statements to Congressional committees and other bodies that are arguably false, misleading, paltering, deceptive spin and so on. Two examples that come to mind include, but should not be limited to, Mark Yost of Skyline Champion (SKY):

…but also, Lesli Gooch, Ph.D., the new CEO of the MHI, but then the executive vice president of the organization.

Gooch has arguably repeatedly made such false and misleading statements to the FHFA with respect to the Duty to Serve (DTS) manufactured housing, mandated by the Housing and Economic Recovery Act (HERA) 2008. Here is how Lawfare frames the matter.

MHI has the benefit of their general counsel, who was during that timeframe Rick Robinson. He should once again be considered as having potentially suborned perjury, along with other possible violations of his professional code of conduct.

The same should be stressed about others involved with MHI as outside counsels.

But let’s bring this back to the point of MHI’s Form 990 and allegations of perjury. Their top salaried official, Jennison, after review by other key MHI staff and the MHI Executive Committee, stated under oath that they were working to expand the industry and improve the regulatory environment.

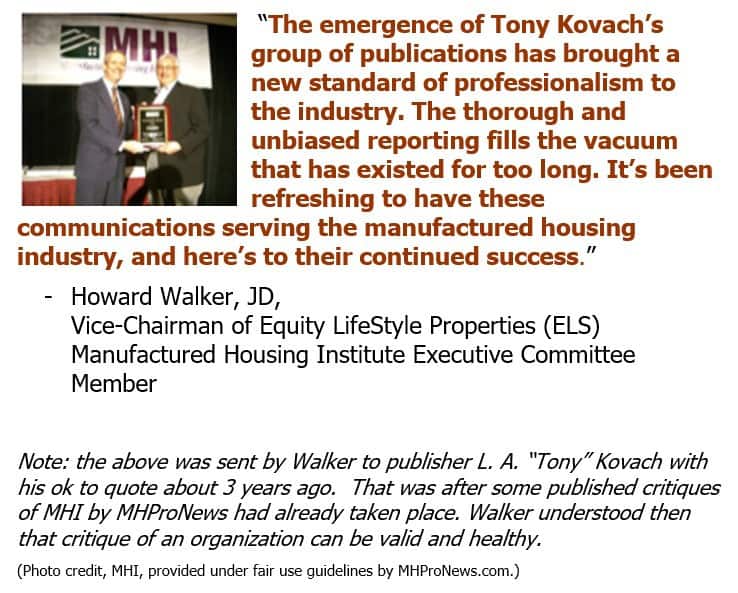

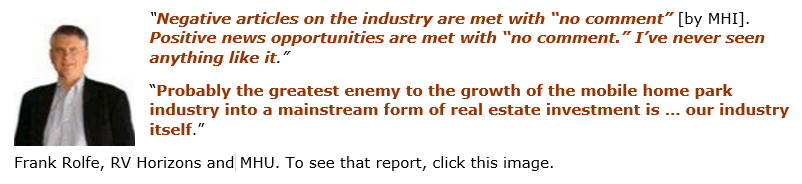

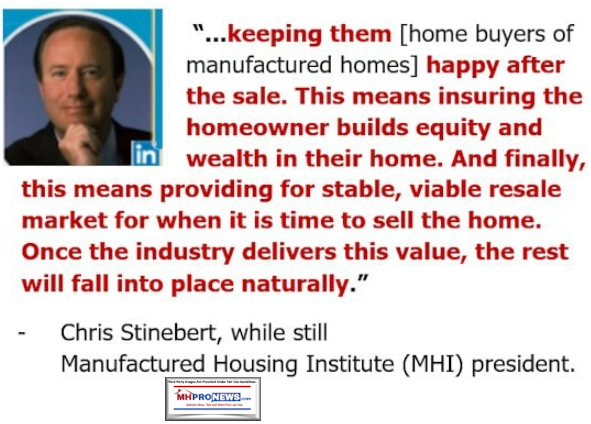

First, let’s consider what some current and prior MHI members have said on the record in recent years. Let’s note that all of these comments need to be understood in the light of the principle of separating the wheat from the chaff. Some of these may be saying something sincerely enough below, but then later their behavior may contradict their own statement. That later pivot doesn’t negate the prior statement. It may in fact call into question why they pivoted in the first place.

There are others, but those quotes are sufficient to make this point. Even within their own membership, past and present, MHI’s claims are called into question. Perhaps more compelling is the statement by MHI’s former president, in his exit statement, cited below.

That statement is part of a report that has his full exit message, which arguably should be understood as an polite slap in the face of the association he was getting ready to leave.

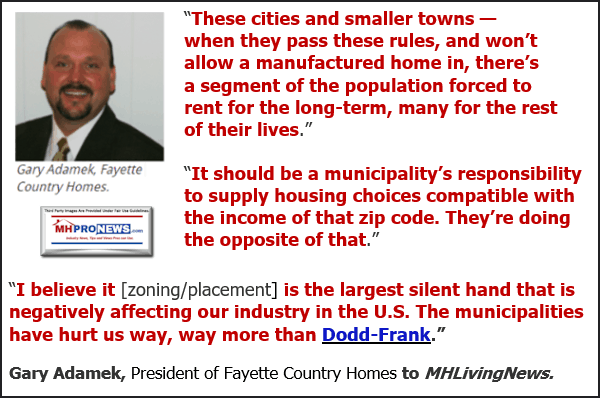

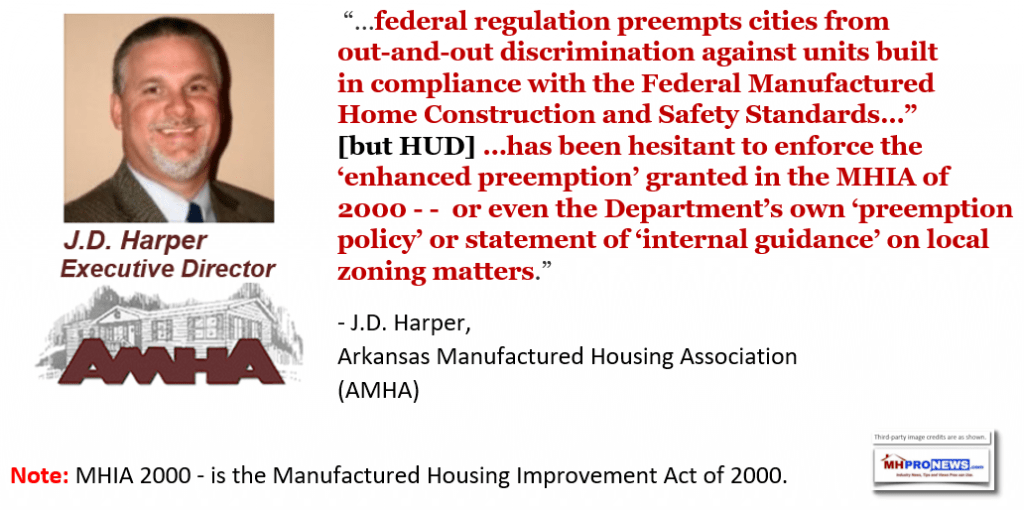

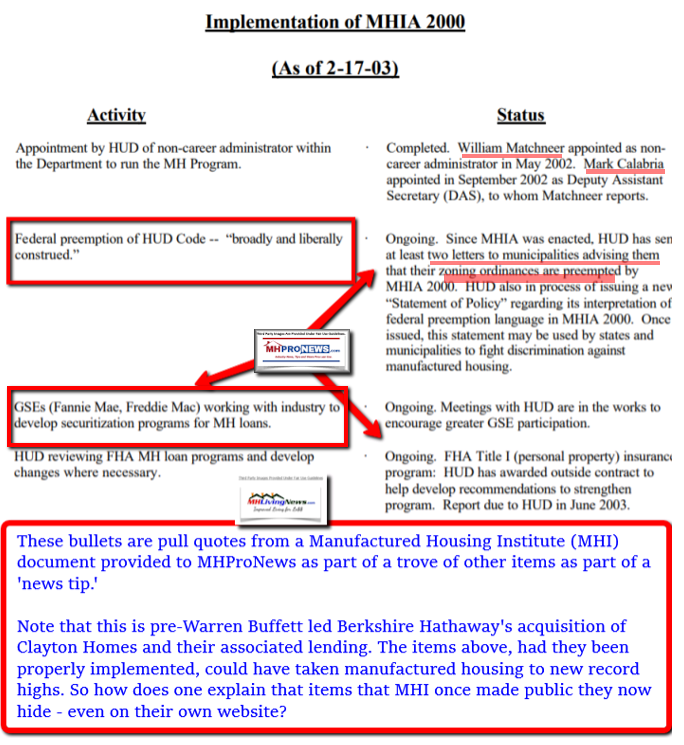

That report above and MHI’s problematic or arguably false claim on their Form 990 brings up a key item that the Urban Institute report raised. As a reminder, they asked, – “Manufactured homes could ease the affordable housing crisis. So why are so few being made?” One answer the panel of Urban Institute’s (UI) expert authors gave was this. “1. Restrictive zoning.” Some might say that is a top reason for the relatively low numbers of manufactured homes being sold and placed, just as UI listed it first too.

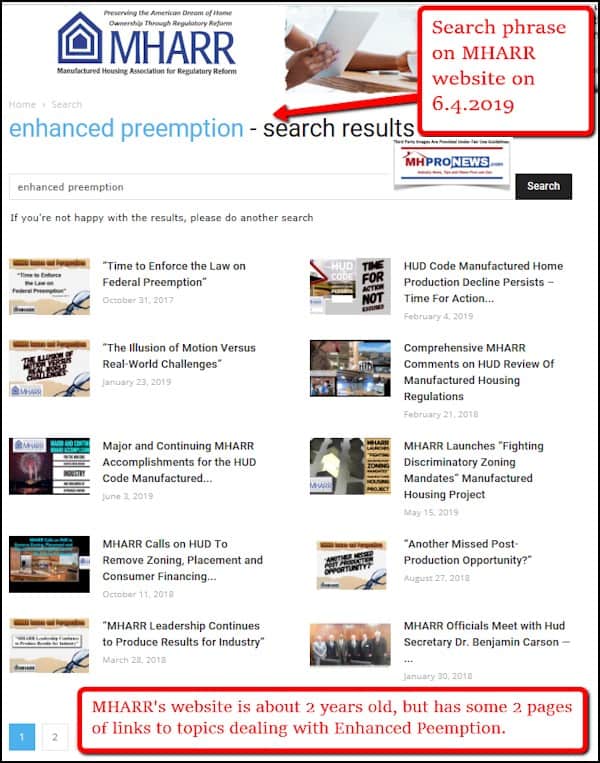

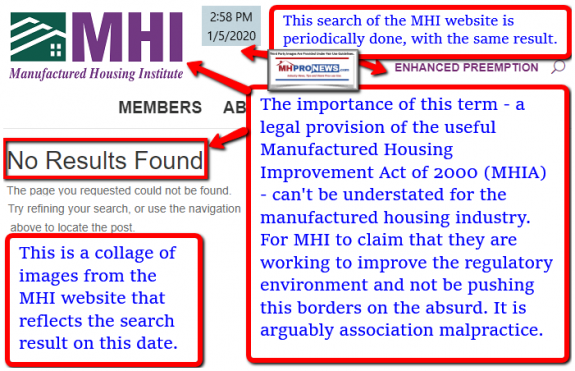

But for those familiar with the federal laws regarding manufactured housing, that too begs several questions. For instance. Manufactured housing has the benefit of the Manufactured Housing Improvement Act (MHIA) of 2000. That law includes, but is not limited to, a provision known as “enhanced preemption.” Under “enhanced preemption” local jurisdictions can’t artificially restrict the placement of manufactured homes…”

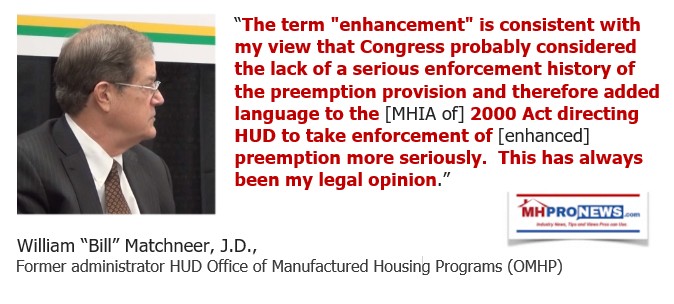

Here is a recent statement by the first administrator of the Office of Manufactured Housing Programs (OMHP) said this.

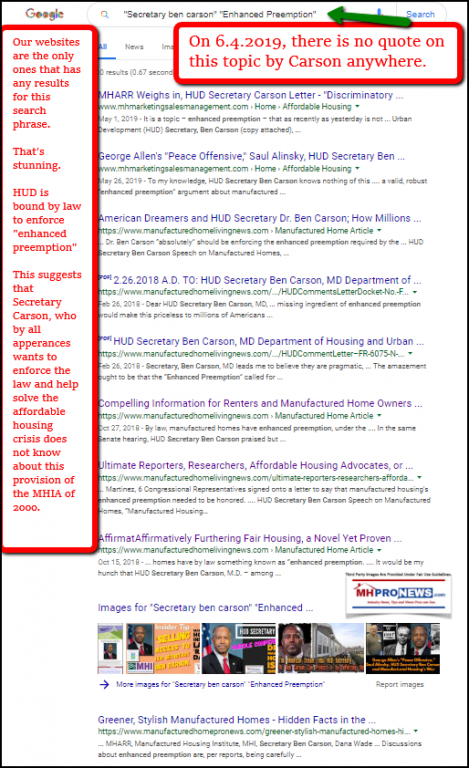

That should be understood in the context of this controversy, initially reported by MHProNews.

To shed more light on why this matters, consider what a state association executive, an MHI affiliate, said about this federally enhanced preemption subject.

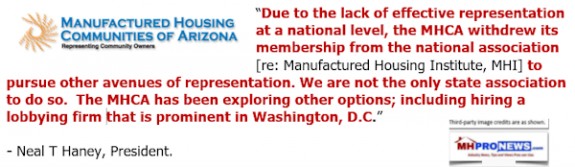

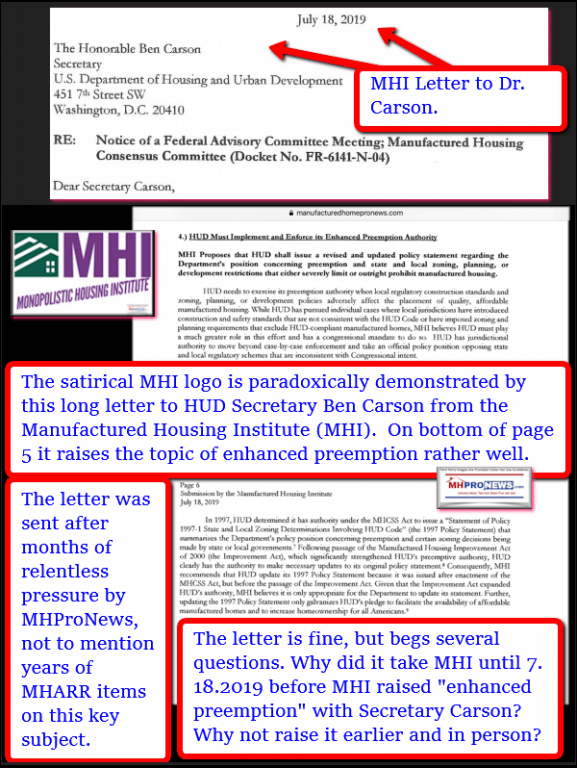

Yet for years, MHI was virtually mute about manufactured housing’s enhanced preemption in terms of consistently and vocally pushing for the enforcement of existing laws. But early on, the point that JD Harper made above was very much on MHI’s mind. Why the shift? Who benefits, other than consolidators who want to stifle growth to reduce business values while forcing more mom and pops out of business?

MHProNews and our sister site, MHLivingNews – along with the Manufactured Housing Association for Regulatory Reform (MHARR) – have made failure to promote “enhanced preemption” by MHI a big issue for some time. As the graphics from MHI’s website from some 16 years ago (above) reflects that they used to have this information publicly available on their website. Sources connected with MHI recently revealed to MHProNews via that document above that previously plain and common sense support for a law that MHI, MHARR and state associations worked together to get enacted. So years later, why is “enhanced preemption” now missing from the MHI website?

When MHI leadership were asked about that issue or others during meetings, they gave polite answers that they wanted to take a softer approach then MHARR was doing. Even if that claim were so, how does that explain the fact that MHI’s own website fails to mention such a critically beneficial law in clear terms?

A MHEC member – the Manufactured Housing Executive’s Council – told MHProNews that several of the years of missteps and fumbles of MHI amounted to ‘association malpractice.’ The search of the MHI website on the date shown above for “Enhanced Preemption” reflected “no result.”

After several months of examples like the above, MHI finally pivoted to this extent. The sent a letter to HUD Secretary Ben Carson to say they wanted enhanced preemption enforced. But they still have not placed that letter or any other article of document on their own website. Rephrased, this snippet below from their letter is arguably more posturing. If they sincerely wanted to push the full enforcement of the law, why didn’t they do it face to face with Secretary Carson, Brian Montgomery or others they have met with several times?

But that is the same result as MHProNews has been getting since we first initiated this search.

One of those that may well have been ‘in on’ the consolidation scheme of the industry by undermining the industry from within is potentially Nathan Smith. Smith was a prior Chairman of MHI and has played a key role for years on the MHI PAC. Smith is politically connected too.

In a video interview during one of the years in question covered by Jennison’s Form 990 filings, Nathan Smith said the following.

Note that at the time, this writer was not yet aware of what was going on. Smith is affable and often witty. So, some of what he said at the time seemed like a joke, as my reaction to one of his comments then reflects. But upon closer scrutiny, that video says much, which is precisely why we have created that focused part of a longer video. Smith made these points, among others.

- MHI had to admit to itself that it had often failed to be pro-active.

- Smith pledged that has MHI’s chairman, he would turn the association around from a re-active trade group into a pro-active trade group.

- That was occurring during the controversy over the MHI backed Preserving Access to Manufactured Housing Act, and the impact constricting lending had – and still has – on manufactured homeowners. What isn’t said on camera, but could be revealed through other research, is that MHI had failed to stop provision of the Dodd-Frank Act that harmed manufactured housing, while realtors or others escaped similar regulations. In hindsight, was that ‘failure’ by MHI to react in time – that Smith is including in the notion of being reactive instead of proactive – a mere mistake? Or was that failure by MHI part of a broader plan to continue to restrict lending and thereby continue the industry’s consolidation?

- Note that Smith is jesting about wanting ‘all of the communities for himself’ – in this same video clip. That did come off as funny at that time, but again, in hindsight, Smith led SSK Communities, which has since rebranded, is one of those firms that has benefited from consolidation at discounted valuations.

- As a final note before leaving Smith, his firm had for some time a “F” rating by the Better Business Bureau. That once more goes to the point that MHI is no ordinary trade association.

What other major trade association would tolerate having a cast of characters that have so many legal and ethical clouds over their heads as MHI has had for some years now? Let me stress that the SSK related concerns had not yet been made evident through media reports at the time that video interview shown above was captured. I was concerned about certain issues, but still in the dark about matters that now in hindsight there is clarity on after years for research, tips, reports and investigations.

MHI after months of steady public pressure from our reports that noted their failure to promote enhance preemption finally de facto relented to this extent. They sent a letter to HUD Secretary Carson that raised the topic. That letter was then sent to MHI readers via their own emails.

But that postured pivot was still being belied by some other items that MHI’s top staff were engaged in. One of several such examples is linked in the report below.

What that report above reflects is MHI’s general counsel, who based on his role had to know about the MHIA 2000 and enhanced preemption, was going to functions and events that he could have been raising the issue, but by their own posturing account failed to press the enhanced preemption issue.

These all go to the heart of the arguably false and perjurious claim that MHI has working to improve the industry’s regulatory conditions and acceptance in the marketplace.

In order to believe that MHI is doing all that they can, one must believe that MHI routinely fumbles the ball and then fails to correct their own mistakes. That MHI has made mistakes, both Nathan Smith and Dick Jennison said on camera. It is thus debatably difficult for them to extricate themselves from their ongoing examples of purported paltering. Each of these are examples that MHI is not doing what they claim under penalties of perjury on their federal 990.

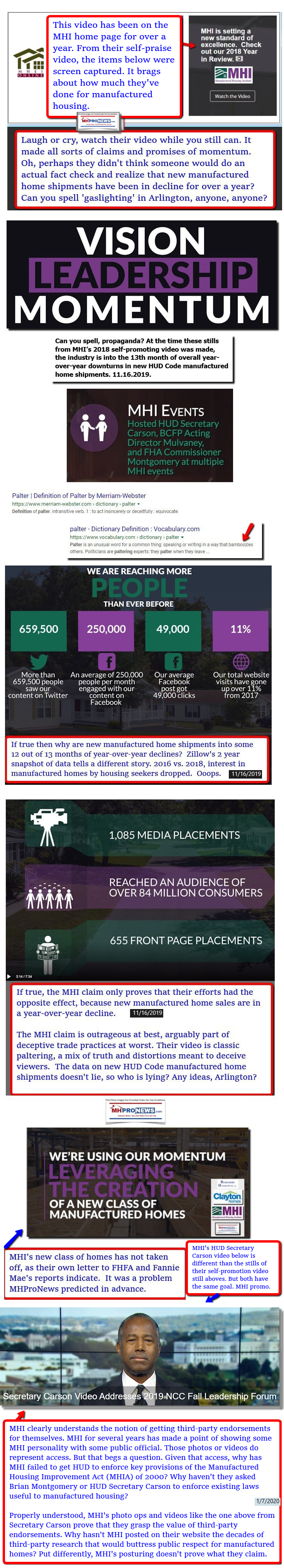

What MHI does promote somewhat successfully are themselves.

MHI’s “Promotion,” Third-Party Claims and Zillow

For clarity, the comment below is an accurate quote, but is being applied to an entirely different issue than what Brad Lovin said. Nevertheless, his point – which is quite correct in general with respect to manufactured housing – arguably would be applicable to something MHI has been doing for quite some time.

MHI is in a sense quite good at doing things that on the surface are effectively promoting themselves. Namely, they use photo or video opportunities, often with ranking public officials, to make themselves look good to their members and others.

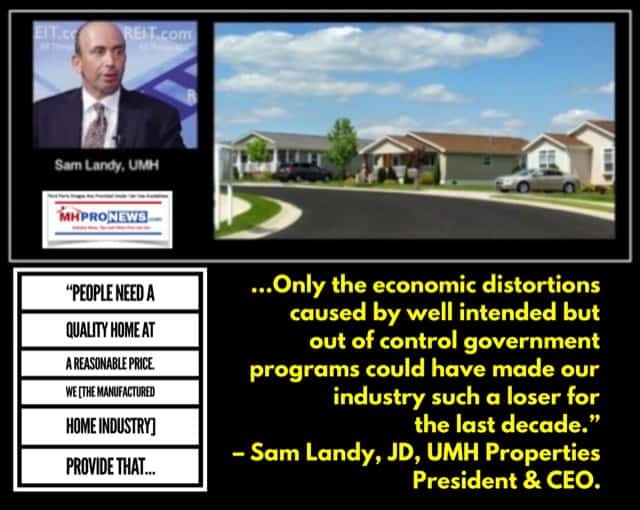

The quote from Sam Landy, made during the Preserving Access to Manufactured Housing Act effort by MHI, perhaps unintentionally proves the point that former MHI chair Nathan Smith made in his video comments shown on this page. What could MHI point to that actually advanced the industry’s implementation of good existing laws? Why did they spend millions pursuing a bill that never passed? An argument can be made that it was all posturing.

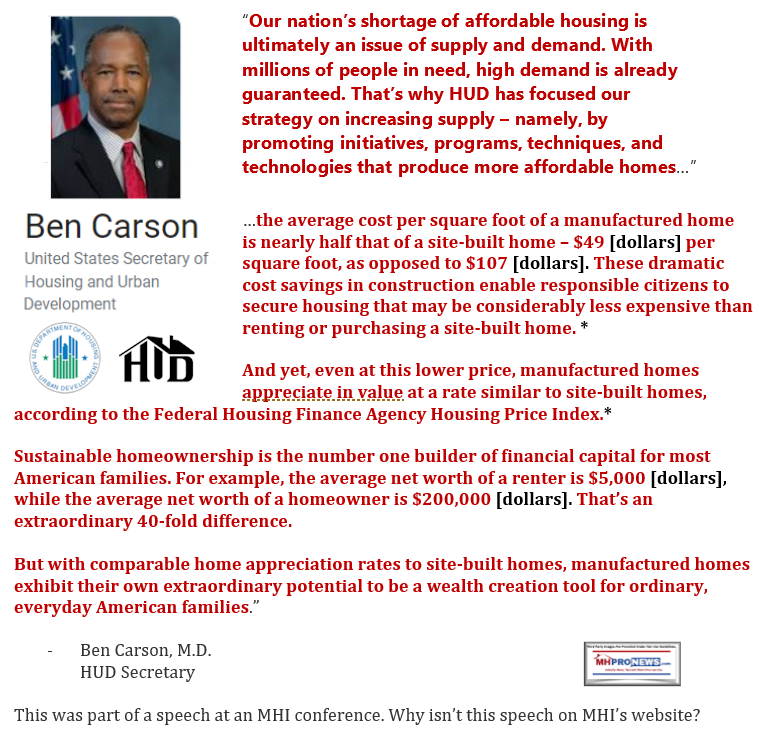

Those are examples of using what at a glance may appear to be third-party endorsements. Perhaps the most impressive, from their perspective, example of that is on their website’s homepage. They have HUD Secretary Ben Carson saying nice things about them and their work.

That’s mentioned for a host of reasons. One, as was mentioned previously, we want to reflect how MHI might defend themselves against the allegations found herein. One obvious method would or will be that they will line up the very people that benefit from consolidation to praise them and their work. Similar to that is to have those who are getting favors from MHI to praise them and their work.

But upon careful scrutiny, that would not be a valid defense against the claims at all, is it?

It is in fact rather part of MHI’s “Razzle Dazzle” campaign. Make themselves look good and important. They had a name for it a few years ago.

In response to that claim, MHProNews published this below.

The 400 Word Executive Summary linked below was published on June 2, 2017.

MHI has largely stopped using that “got clout” with “get it here” at MHI image subsequent to the above being published. That might have been a coincidence, or perhaps they didn’t want to draw attention to a ploy that was publicly unpacked.

But it is mentioned for several reasons. MHI clearly has access to leading federal officials. That much is true enough. The question is, what are they or have they done with that access? To what effect has that access been applied to get issues of importance to thousands of manufactured housing independents and/or consumers advanced?

If it is measured in:

- New Manufactured Home Shipment levels

- Progress in Acceptance in the Marketplace

- Or Progress in Getting Good Existing Laws Put Fully into Effect

then the answer for how has MHI’s access been useful to the broader interests of smaller independent businesses in measurable and positive ways is not favorable.

A common method used by businesses or others seeking to impress others is third-party endorsements. This is not new, it has been done for decades in marketing. One might say it has been done for millennia among humans globally. Like’s on Facebook, recommendations or endorsements on LinkedIn, are among the 21st century iterations. Our organization has valued such third-party kudos, others do too.

Or the hundreds of similar comments and/or endorsements on LinkedIn alone make the point that we’ve gladly had that kind of feedback to share with others.

So, MHI’s desire for photo or video ops and other methods that seem to elevate their stature is understandable.

But that begs a deeper question. If they understand and want that value for themselves, why have they failed to get that value applied to the industry at large in a manner that would truly lift the industry’s posture with the public and public officials? Isn’t that kind of elevation that would accomplish their stated mission to “Improve the operating environment for the manufactured housing industry and expand the demand for manufactured homes…” as stated in their own IRS Form 990?

MHI hired a public relations person. Then another. It isn’t as if they don’t get it how important this element of the industry’s image and acceptance would be to truly “Improve the operating environment for the manufactured housing industry and expand the demand for manufactured homes…”

That being so, then why is it that MHI has failed for years at calling on third-party witnesses on their own website to make the case for manufactured housing?

Why do they instead rely on their own assertions or their own claims?

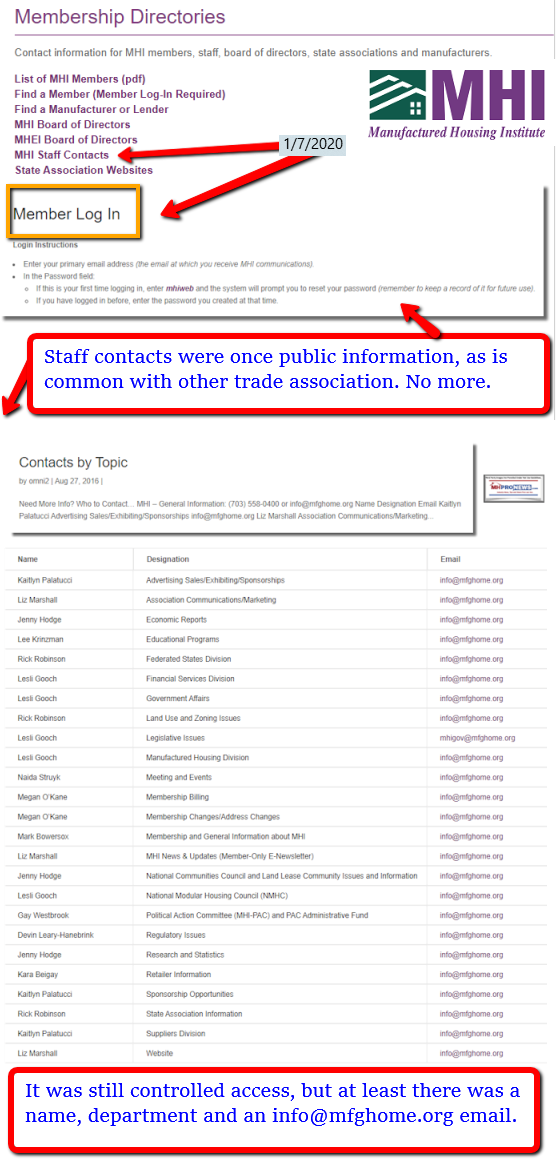

Per an MHI Board Member…

An MHI board member told MHProNews some time ago that the MHI Executive Committee – “leadership” – was increasingly behaving like “a secret society.” Those are strong and colorful words, that without specific evidence may merit curiosity. So that claim was kept in mind.

Besides and apart from that source, state members of MHEC – the Manufactured Housing Executives Council, made up of state association directors, along with MHI and MHARR – told MHProNews of the strong arm tactics that took reluctant state executives and essentially forced them to support Preserving Access. That pressure, per multiple sources came directly from Tim Williams at 21st.

MHI has touted their Ducker research, but has released only a few claims from it. A typical nonprofit, if they want their research to have credence releases their research in full. Consider that MHAction has their co-branded white paper available as a free download from their website. The CFPB, GAO, Fannie Mae Foundation, our Harvard’s Joint Center for Housing Studies (JCHS) are all available as free downloads. So why is MHI’s vaunted research hidden behind a paywall? Why did pro-MHI state association executive “tie” getting that MHI commissioned Ducker research in with becoming an MHI member? Why did another state MHEC member tell MHProNews in advance of the Ducker release that the research would likely support a plan that MHI’s leaders wanted?

If Ducker’s research was valid, why has the roll-out of the Clayton-MHI backed new class of homes such a dud? Why did the GSEs at FHFA’s St Louis Listening Session say that only 10 such loans had been closed nationally in 2018 and 2019? Where was that groundswell of demand that MHI and Ducker claimed?

If Ducker and MHI were sincere and correct about the ‘demand’ for this new class of homes, why did MHI EVP Lesli Gooch in her letter to FHFA say the association would be okay with a reduction in the GSE’s stated target for buying such “new class of homes” loans? Why did David Dworkin say – who worked within Fannie Mae for years – make a pithy and stronger statement that manufactured housing was necessary, and the GSEs could perform? Who’s deceiving whom?

If MHI was a normal trade association, and not an increasingly “secret society” as that board member alleged, then why does MHI no longer even show their staff names on their own website? What makes the names – once published and public not so long ago – also a matter of a members only login now?

The MHI behavior is bizarre at best, once scrutinized. Who has a cast of characters as their executive committee that is largely under legal scrutiny by state and federal officials? Or who are being sued by sizable numbers of their own customers?

Is it any wonder that MHI wanted the ‘credibility’ of political figures? That they want photo ops or video opportunities because when carefully examined their leadership and polices are largely devoid of value?

In the light of the dizzying array of oddities, reconsider what others have publicly said about their own trade group.

In the case of Frank and Dave, consider the principle of separating the wheat from the chaff. Because while they point fingers, there are arguably three proverbial fingers pointing right back at themselves.

As MHProNews, and even MHI toady George Allen noted, there are specific firms tied to much of the bad news that has arisen from the community sector.

In an arguably oblique response to MHProNews reports, along with those from MHARR, MHI finally re-affirmed their so-called ‘Code of Professional Conduct’ last summer. Their code is linked here as a download.

But that code is itself a curiosity. Has it been enforced since it’s release? There are notorious examples of how it’s been ignored.

Indeed, it turns out that it is often MHI members who are the source of problematic news about alleged predatory behavior.

It is Clayton Homes, 21st, VMF and Warren Buffett who not only are the focus of several industry controversies, but it is also Buffett’s “donations” that can be traced via dark money sources to the very sources who then spark problematic reports that often make the industry at large look bad.

The use of nonprofits is mentioned by Kevin Clayton in the video near the end of this post here.

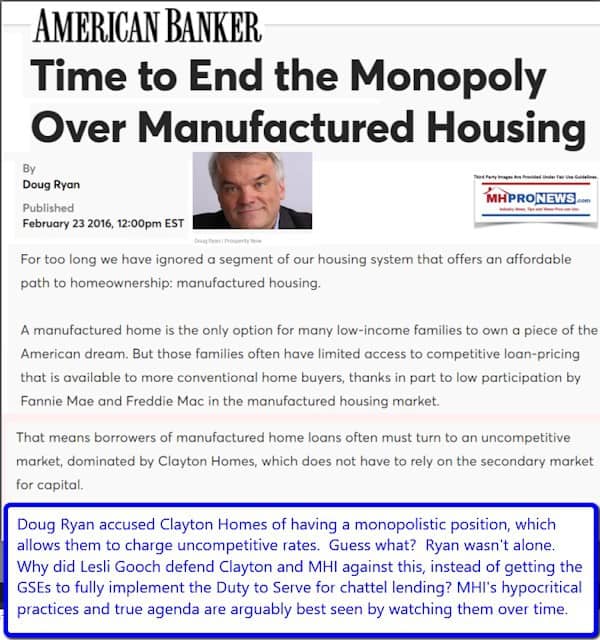

Prosperity Now’s manufactured housing point-man, Doug Ryan battled MHI and Clayton, calling Clayton a monopolistic organization in an Op-Ed .

Fast forward to 2019, now Prosperity Now, Clayton and MHI are now allies on various issues?

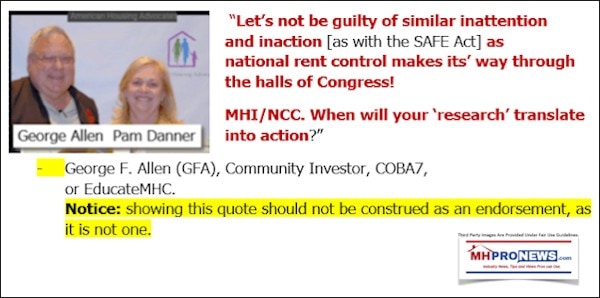

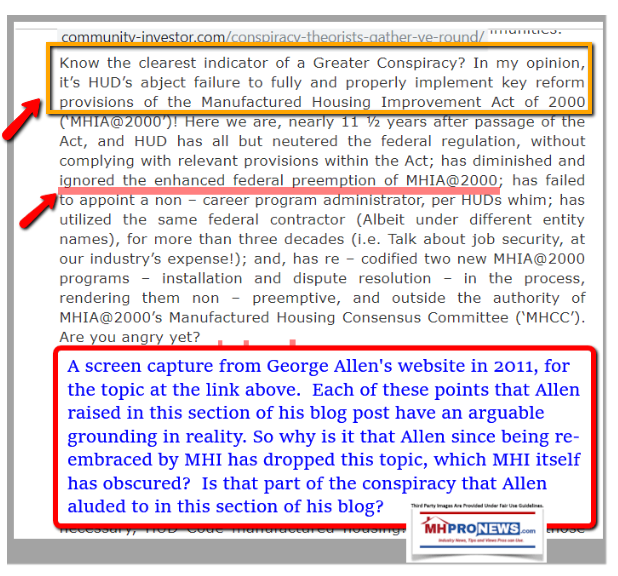

Such details would be missed by a casual observer or those busy with their day to day business. They could be termed as a ‘conspiracy theory’ as George Allen claimed, in publicly calling for a boycott of MHProNews’ reports and analysis.

But what Allen – and his puppet masters? – failed to explain is that Allen himself, before reportedly being ‘rewarded’ (i.e.: read bought off by MHI) had previously called MHI and Clayton our for very similar allegations, before going quite on them.

The truth is stranger than fiction in MHVille. This may make a great made for TV movie some day, because the plot is so brazen as to be difficult to imagine. It is arguably larger than Bernie Madoff’s scheme, which while different, has this in common. Madoff also operated in broad daylight. It was years before Harry Markopolis and others finally persuaded the SEC and others that something was wrong.

The Razzle Dazzle for MHI and their masters isn’t likely over. But it is exposed. The mantra of a criminal con is to never give up the confidence game.

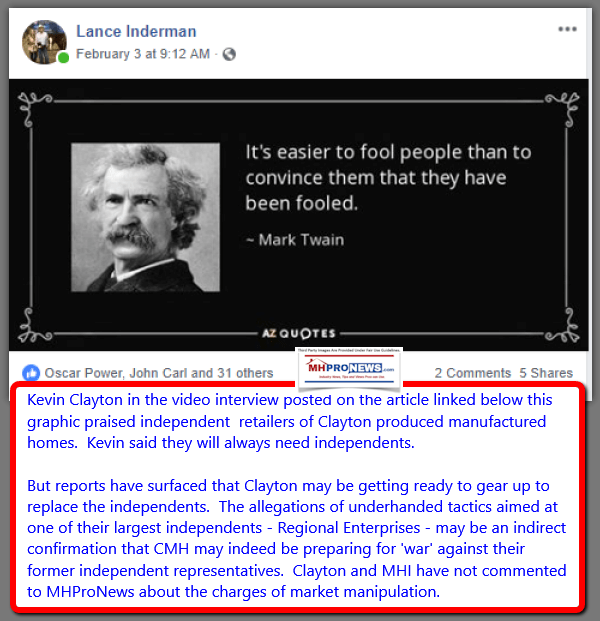

Lance Inderman has at times shared his own concerns about Clayton’s et al’s business practices via his blog.

Inderman pointed out publicly what he viewed as illicit behavior. He’s reportedly conversant with the strategic moat that Kevin Clayton described in the video above. The video, properly understood and used by prosecutors or investigators, reveals much of the their claimed scheme, given an understanding of what is sincere and what’s paltering.

But in truth, there are a few that are benefiting from consolidation. Others are fearful to speak out publicly, perhaps wanting to avoid being the next one swallowed up.

Because even though there has not been as brazen a ploy as that 2009 letter, sources say that 21st monitors firms and can tip them into insolvency in certain cases if they do floor-planning for them.

There is no lack of evidence against Clayton, 21st, or MHI. The problem may be that there is so much and it is so bizarre at times as to be incredible for outsiders to grasp.

But that’s why the examples of mainstream reports are useful. While they lack some granular details this report has, they took made similar allegations.

- The Atlantic,without specifying how the monopolization was being accomplished, noted that the independent retailers in manufactured housing were being rapidly eliminated/consolidated, that report is linked here.

- GuruFocussaid “Warren Buffett Can’t Escape Unethical Strategic Moats,” their specific points are linked here.

- The Nationcalled it “The Dirty Secret Behind Warren Buffett’s Billions…” and specifies Clayton Homes among those using the strategic moat in ‘dirty’ ways.

- The Jacksonville Florida Times Union summarized the connection between the John Oliver viral hit video dubbed “Mobile Homes,” MHI, Clayton Homes, and their related lenders. That op-ed was first fact-checked by an editor, before it was published not only in the one newspaper it was submitted, but at least in 5 Florida newspapers.

- Forbes – Warren Buffett’s Exploitative Mobile Home Investment

The piece de residence may be this simple but eye opening point.

Manufactured housing is smaller today that in 2003.

How could that be so, unless Buffett and his brands wanted it to be so?

Buffett too is arguably guilt of paltering. Some things are said accurately and with wit, but others are purportedly mere head fakes.

But the rationale is clear when considered in toto in the light of the evidence.

Manufactured housing is necessary. There are good laws on the books that make it highly valuable.

To get beyond antitrust concerns, you create an illusion that market forces are causing consolidation. After all, how many would think to use nonprofits as Buffett and his brands have done?

The Problems and Opportunities that Regulators and Public Officials Face

Let’s be clear. As was noted at the top, special interests by definition have influence. The notion of going up against Warren Buffett and his allies can’t be fun. But it wasn’t easy to get the SEC at first to act against Bernie Madoff either. Today, the once vaunted billionaire sits in federal prison.

This scheme is arguably more sophisticated that Madoff’s. It is bigger in scope and in its impacts. But that’s because the payoff for those involved is potentially so big.

The bad news for public officials? They are facing the tentacles of a large organization with deep pockets.

The good news for public officials is that they also have deep pockets to pick in doing so.

By doing to Buffett’s Berkshire’s Brands and their allies what state and federal officials have tentatively begun with big tech, they could have specific advantages.

- A) The evidence for a case in several instances as this report outlined is easier to make. Prima facie evidence is an advantage to prosecutors and public officials.

- B) There are large numbers of the public clearly harmed. If public officials announced hearing or investigations, the numbers who would come out of the woods would make Harvey Weinstein’s growing list of accusers look small. Thousands of independents have been harmed by this scheme. Hundreds of thousands of manufactured home community residents have been too.

Explain to manufactured home owners what the implications are of the Urban Institute statement below, and a untold thousands would arise.

The movement of resident groups is already underway. They only need the clarity of facts like those shared.

In under a day of reading and video viewing someone could grasp the main elements of this case.

The powers that be in the Omaha-Knoxville-Arlington axis know that. Which is why they’ve rattled sabers and tried a mud-slinging and whisper campaign. But while they clearly have deeper pockets than little old me, they themselves have praised our reasoning and research for years, as was shown above.

The NAR’s Scholastica Cororaton, Dr. Lisa Tyler and the CFPB have all cited our work or acknowledged me personally by name for our pro-industry efforts.

While typos are a nag and drag, they picked on a fellow – moi – who once the aha! moments arose – wouldn’t let go. My background in history is good. “Award-winning” in history and in this industry our batting record is good.

While they reportedly dug for dirt on me to try to discredit our work, what they learned was this. Everyone has some secret embarrassment, but mine are not such that they could deter me from publishing what we believe the evidence supports. My parents gave us kids the examples of standing up to real honest to God Nazis, not ersatz ones. They gave us the lives examples of standing for civil rights for minorities.

Buffett’s bunch picked on the wrong guy when they tried to have several attorneys and anonymously sent letters deter us.

Some Arguably Corrupt Public Officials Are Involved Too

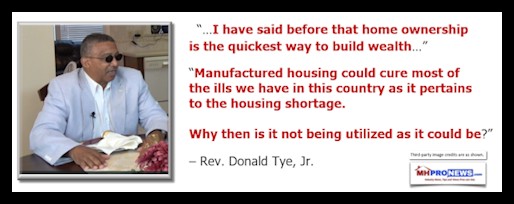

Laws are what they are. Aspects of the Manufactured Housing Improvement Act (MHIA) or the Duty to Serve (DTS) mandated for the Enterprises of Fannie Mae and Freddie Mac by HERA should not depend on the action or inaction of trade associations.

Laws are meant to be enforced and followed.

But we know from the statements of people like William ‘Bill’ Matchneer, J.D., the first administrator for the Office of Manufactured Housing Programs (OMHP) under the MHIA that aspects of the law were thwarted from within HUD early on.

Additional statements have indicated that several public officials who know these laws have – for whatever reasons – failed to enforce them properly, or at all. That begs investigation to see if corruption is involved.

Let’s note that this writer filed a complaint in 2017 with a federal agency that in time witnessed two individuals involved in that matter both departing that agency. While there may well have been other factors beyond my complaint that sparked those departures, and federal agencies don’t tend to reveal the reason someone is being separated, there are reasons to believe that my complaints played a role. There were several communications with the federal investigators assigned to that matter.

Let’s also note that at the state level, some years before, another legal concern I reported resulted in arrests and at least one state official losing their office. I’ve been involved in several legal controversies over the years, and because I keep good records and state what I know as accurately as possible, I routinely come out having backed the winning side. I’ve been told by attorneys that I make a good witness.

The relevance to this matter ought to be clear. This was not a battle we sought out, in some ways, it was evidence from others and the consistent behavior of those I’ve made allegations against herein that in some ways gave me little choice but to do what was necessary and right. When we launched MHProNews over a decade ago, it was not with the idea that we’d be investigating corruption in the manufactured home industry. But facts are what they are, and you deal with reality as it becomes apparent.

That’s said for a variety of reasons, including this.

- Brian Montgomery, J.D. at HUD,

- Teresa Payne, J.D. at HUD,

- HUD’s General Counsel, past and present,

- FHFA’s Jim Gray, program manager over DTS,

all in my view of the law, evidence and allegations against them merit a thorough investigation. They should be suspended from their current duties. In the case of Montgomery, I’d argue that he should not be confirmed by the Senate for the position he has been nominated to fill.

There are likely others, but each of these the facts already outlined, view through the lens of the laws that they are supposed to administer, should be held to account. When the clear mandates, such as FHFA’s website summarizes, are matched up to what has occurred, it will be clear that at a minimum these people are for whatever reasons – perhaps corrupt, perhaps inept, whatever – have failed to follow and enforce existing laws.

That in turn has had serious ramifications for thousands of businesses, investors, and for millions of current and potential consumers of HUD Code manufactured homes.

But there are reasons to believe that these individuals have worked in collusion with ‘special interests.’ Investigations using subpoena powers would likely uncover whatever ties they would have to MHI, Clayton Homes, other Berkshire Hathaway business units, and likely other ‘big boy’ interests in manufactured housing.

Summing Up, Final Factoids, Conclusions and Next Steps

What this report does is document several items ripe for investigation and action by public officials. Some of them are ‘prima facie,’ but others require a more granular level of understanding of the industry.

These facts, the evidence, logic and allegations reflect harm to

- literally over ten thousand independent businesses – manufactured home retailers – in the manufactured housing sector.

- The loss of those independent retail businesses has never been recovered, as a survey today of the remaining independent retailers (a.k.a. ‘dealers’) of manufactured homes would reveal buy a shadow of the number that existed some 2 decades ago.

- Low sales volumes have acted as a barrier for entry, maintenance, and exit in the industry.

- Low sales volumes and a steady stream of problematic news reports, often associated with allegations of predatory, racially biased or other problematic practices key MHI member firms, cast doubts about manufactured homes quality or durability. Yet decades of research reveal that manufactured housing is superior to what most today have been led to believe.

- Misinformation about manufactured homes, coupled with relatively low sales volumes, a lack of lending options and other factors all tend to depress the value of existing manufactured homes. Who says? That is the logic of the Urban Institute’s 2018 research. But it is also the truth based upon the well-known law of supply and demand.

- Rephrased, this “castle and moat” scheme to slow motion create a monopoly purportedly advocated by Buffett and deployed by Tim Williams, Kevin Clayton and others in association with them has harmed the market value of millions of manufactured homes. Those Berkshire firms – often in apparent collusion with other ‘big boys’ at MHI – have upset decades of affordable living in manufactured home communities that has sparked calls for rent control in the wake of often nose-bleed level.

- All of this has several other impacts on the government and the broader economy. Manufactured homes, as several researchers have said, is the largest source of mostly unsubsidized affordable housing in America. More manufactured homes benefits federal and state budgets in a variety of ways. More manufactured homeowners, as HUD Secretary Ben Carson has noted, could get more people who now rent on the path to building equity. Greater household wealth would result.

- This is arguably an illegal scheme that has been operating in plain sight for at least a decade. Some of this is more discernable in hindsight, through the lens of history.

- When MHI’s claims of working to “Improve the operating environment for the manufactured housing industry and expand the demand for manufactured homes…” are carefully, examined, it is a purportedly preposterous claim.

- When the actions of Clayton and others are carefully examined, several federal laws have and are arguably being violated.

The Bad News and Good News for Federal or State Officials

The bad news is that Berkshire Hathaway has deep pockets and is not likely to roll over and play dead, even in the face of strong evidence.

The good news is that this is Berkshire Hathaway and MHI, there is strong evidence of legal improprieties and that beating them would likely result in large fines and other punishments that could make this worth the effort of public officials.

There is always more, but this is sufficient to get serious minds to begin doing what is necessary. We encourage those serious seekers of truth to read the related reports. Given the length of this report, it could be useful to read this again, as the second time around it will make more sense for many.

[cp_popup display=”inline” style_id=”146657″ step_id = “1”][/cp_popup]

Want a stronger economy and economic justice? Want to see the law apply to all? That’s the effect of this ‘ask.’

State attorneys general have launched investigations into big tech. Feds have too. Why not do the same for the important issue of affordable housing? Given hearings in Congress and/or statehouses and actions by various agencies and law enforcement could surprise us all. “We Provide, You Decide.” © ## See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them. Any third-party images and content are provided under fair use guidelines.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and was recognized with the prestigious Lottinville Award in history from the University of Oklahoma, where he also studied business management with a perfect 4.0 and made the Dean’s List. Tony has earned multiple awards in manufactured housing and in history. He’s a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

Office 863-213-4090 |Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Sign Up Today!

Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates.

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.