“Project Saturn.” Code Name “Monarch.” These and other cloak-and-dagger terms where used by Joseph “Joe” Stegmayer, Daniel “Dan” Urness and apparently others at Cavco Industries (CVCO), per the Securities and Exchange Commission (SEC) case pleadings. The evidence of apparent illegal insider trades at Cavco Industries (CVCO) and related corruption, per the SEC complaint pleadings found herein, went under those and various other code names that will be found below. Despite the announcement that the SEC has finally filed charges against Cavco Industries (CVCO), former Chairman and CEO Stegmayer, and former CFO and briefly Cavco President and acting CEO Urness, there is on this date a widespread near blackout of that news by industry bloggers and other so-called trade media that claim to be serving manufactured housing professionals. Readers can find mention of the new Cavco logo (yawn), which conveniently was rolled out by the company shortly after the SEC complaint was made public. You can find references to the publicly traded Phoenix, AZ based firm hiring Allison K. Aden as Executive Vice President (EVP) and Chief Financial Officer (CFO), another sleepy-time-tea publishing move. But recently documented information about illegal insider trading? About apparent efforts that the complaint provides that are further evidence of an aim to monopolize key segments of HUD Code manufactured housing? Such serious subjects that may actually impact professionals, investors, as well consumers and taxpayers in a meaningful way. They can best or only be found on MHLivingNews and here on MHProNews.

UMH Properties (UMH), Nobility Homes (NOBH), and Deer Valley Homes (DVLY) are among the companies beyond Cavco, Skyline (SKY), and Champion that are mentioned with some level of detail in the report below. Highlighting on some of those named companies found below are added by the Masthead on MHProNews. But that highlighting should be not construed as meaning that other parts of the report are of less interest. Unlike several legal complaints, this one reads well. As noted, it has elements of a good industrial spying novel, save it is a legal document that deals with facts rather than fiction. The factual or evidence-based record of allegations, claims for relief, and more presented by the SEC are all relevant to broader industry issues.

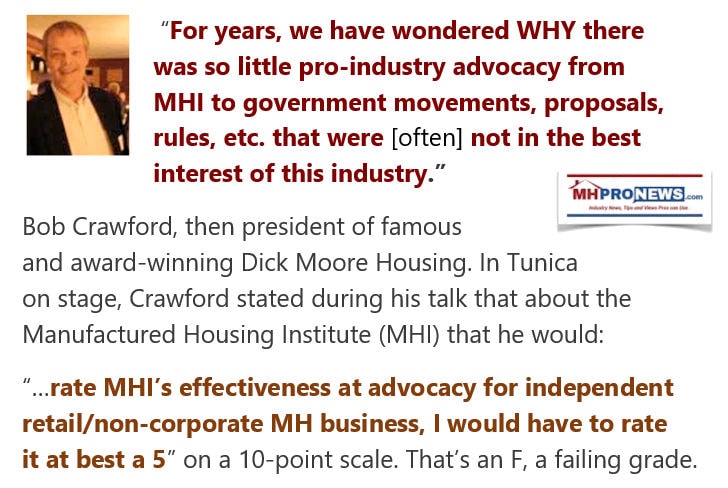

One of several thoughts that may cross the mind of industry readers, investors, and others reading the SEC complaint is this. How is it possible that Manufactured Housing Institute (MHI) leaders could have allowed Stegmayer to stay on as MHI chair following the initial allegations? After all, when the list of companies named below are known, it is likely that others knew too. Rephrased, a reasonable person reading the SEC pleadings may infer that sufficient numbers of MHI leaders knew what was going on with Stegmayer and Urness at Cavco, yet they still thought it fine that Stegmayer should complete his term as MHI chairman.

That decision by MHI leadership in the context of what follows speaks volumes of the ‘insiders club’ that has long been alleged to be at work at MHI, and among numbers of the MHI state affiliates too.

That noted, the SEC’s formal complaint document, along with prior information published at the links below, is a treasure trove and a partial road map that once more arguably confirms efforts by the so-called Big Three members at the Manufactured Housing Institute (MHI) to gain influence and control, if not outright ownership, over the remaining independents found in the once far larger and prouder manufactured home industry.

Even when an MHI connected source, other than our trade media, disclosed the bare essence of this SEC occurrence, it was done so in a brief and bland fashion. It was more of a vaccination instead of a clarion call. When the sheer magnitude of the possible ramifications of this event are consequential to numbers in and beyond of our profession, a meek disclosure type piece that perhaps Cavco and MHI leaders could give a nodding approval to seeing in digital print can be akin to burying what ought to be a headline story on page 16 of the New York Times.

Indeed, doing a blasé, nonchalant report about the SEC-Cavco et al complaint without mentioning the tie-ins between what the SEC revealed and concerns raised by Samuel Strommen with Knudson Law – as but one example – is a disservice to most industry professionals, save to the consolidators and their allies. The SEC has a narrow jurisdiction. It does not include antitrust and other possible violations of the law. That noted, there is now an additional evidence-based argument – thank you, SEC – that Cavco was apparently engaged in antitrust violations, not just pages of evidence-based claims of SEC violations.

In contrast to all others, this report will lay out the bulk of the SEC complaint against Cavco Industries, Stegmayer, and Urness. By doing so, the facts these feds have entered into the record are made available to the maximum number of manufactured housing professionals. It will be noted up front that Cavco has issued a statement denying the claims, saying they will vigorously defend against them. But it must be also noted that Cavco also previously acknowledged that they attempted to negotiate a deal with the SEC. Given that history, a reasonable person may think that the SEC has Cavco, Stegmayer, and Urness by the short hairs.

MHProNews has led the industry in the coverage of this ongoing event since the outset of what a Cavco corporate insider called a “debacle.” We continue to do so, with the “We Provide, You Decide” © mantra that pairs well with “Industry News, Tips, and Views Pros Can Use.” ©

Following the SEC compliant supplied insights will be additional information, an MHProNews analysis in brief, and related commentary.

|

UNITED STATES DISTRICT COURT DISTRICT OF ARIZONA Case 2:21-cv-01507-SRB Document 1 Filed 09/02/21 Securities and Exchange Commission, Plaintiff, vs. Cavco Industries, Inc.; Joseph Stegmayer; and Daniel Urness, Defendants. Attorneys for Plaintiff

|

- Plaintiff Securities and Exchange Commission (“SEC”) alleges:

- JURISDICTION AND VENUE

- The Court has jurisdiction over this action pursuant to Sections 20 and

- 22 of the Securities Act of 1933 (“Securities Act”), 15 U.S.C. §§ 77t, 77v, and 24 Sections 21(d)(1), 21(d)(3)(A), 21(e) and 27(a) of the Securities Exchange Act of 25 1934 (“Exchange Act”), 15 U.S.C. §§ 78u(d)(1), 78u(d)(3)(A), 78u(e) & 78aa(a).

- Defendants have, directly or indirectly, made use of the means or

- instrumentalities of interstate commerce, of the mails, or of the facilities of a

- national securities exchange in connection with the transactions, acts, practices and courses of business alleged in this complaint.

- Venue is proper in this district pursuant to Section 22(a) of the

Securities Act, 15 U.S.C. § 77v(a), and Section 27(a) of the Exchange Act, 15 U.S.C. § 78aa(a), because certain of the transactions, acts, practices and courses of conduct constituting violations of the federal securities laws occurred within this district. In addition, venue is proper in this district because Defendants Cavco Industries, Inc., Joseph Stegmayer, and Daniel Urness reside in this district.

SUMMARY

- This matter involves insider trading by Cavco Industries, Inc.

(“Cavco”) and by its former chief executive officer (“CEO”), Joseph Stegmayer (“Stegmayer”). Cavco bought shares of Skyline Corp. (“Skyline”) at Stegmayer’s direction while Skyline was in merger talks with Cavco and other potential acquirers. In the course of Cavco and Skyline’s merger discussions, Stegmayer signed a non-disclosure agreement with Skyline on behalf of Cavco and received material non-public information about Skyline. Cavco then traded in Skyline shares on the basis of this non-public information. Stegmayer knew, among other things, that Skyline had engaged an investment bank to help with a potential merger, had engaged in talks with Cavco and others, and had at least one other offer to be acquired at a price substantially above its then-current share price. After Cavco bought shares of Skyline, Skyline announced a merger with another company at a price substantially above its then-current share price. This news increased Skyline’s stock price by 48%, resulting in gains for Cavco of approximately $260,000 for the Skyline shares it had purchased based on material, non-public information.

- Cavco had an investment policy that, among other things, required disclosure to its board of directors in advance of stock trading, and an insider trading policy that prohibited trading while in possession of material non-public information about the company whose shares were being traded. These policies applied to Cavco’s trading in shares of Skyline. However, these controls were inadequate, and Cavco’s trading in stocks of companies with which it was in merger talks was not limited to its purchases of Skyline shares. Cavco failed to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurance that transactions would be executed in accordance with management’s general or specific authorization, including its board’s authorization, corporate investment policy, and securities trading policy. Cavco also failed to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurance that access to assets would be permitted only in accordance with management’s general or specific authorization. Stegmayer was aware of these policies, and he circumvented these inadequate controls by placing trades on behalf of Cavco in violation of the policies.

- Daniel Urness (“Urness”), Cavco’s former chief financial officer (“CFO”) and chief compliance officer, was entrusted by Cavco’s board to review and approve any exceptions to the investment policy. Instead of fulfilling that duty, Urness circumvented the investment policy by setting up a system to fund the trades without informing the board or ensuring the trades complied with Cavco’s policies. Stegmayer and Urness also knowingly misled Cavco’s auditor with respect to the Skyline trading and an ongoing regulatory investigation by the Financial Industry Regulatory Authority (“FINRA”) into those trades.

- Additionally, after Cavco received an SEC subpoena concerning the Skyline trading, Stegmayer sold over 11,000 Cavco shares that he personally owned. He made these trades on the basis of material, non-public information: that Cavco had engaged in illegal Skyline trading and that FINRA and the SEC were investigating that trading. After news of the SEC investigation and the Skyline trading came out, Cavco’s share price decreased by 23%. By selling stock in advance of this negative news, Stegmayer avoided losses of over $880,000.

- By this conduct, Cavco violated Sections 10(b) and 13(b)(2)(B) of the Exchange Act and Rule 10b-5 thereunder, Stegmayer violated Section 17(a) of the Securities Act, Sections 10(b) and 13(b)(5) of the Exchange Act, and Rules 10b-5 and 13b2-2 thereunder, and aided and abetted Cavco’s violation of Section

13(b)(2)(B) of the Exchange Act, and Urness violated Section 13(b)(5) of the Exchange Act and Rule 13b2-2 thereunder and aided and abetted Cavco’s violation of Section 13(b)(2)(B) of the Exchange Act.

- The SEC seeks permanent injunctive relief and civil penalties against each defendant.

THE DEFENDANTS

- Defendant Cavco Industries, Inc. is a Delaware corporation headquartered in Phoenix, Arizona, that manufactures homes. Its securities are registered pursuant to Section 12(b) of the Exchange Act and trade on the Nasdaq Global Select Market under the ticker CVCO.

- Defendant Joseph Stegmayer, age 70, resides in Phoenix, Arizona. He was the CEO of Cavco from 2003 to 2018, when he was removed as CEO. He remained at the company as director of strategic initiatives until he retired in January 2020.

- Defendant Daniel Urness, age 52, resides in Mesa, Arizona. He is a CPA licensed in Arizona and was the CFO of Cavco from 2005 to August 2018 and chief compliance officer from at least 2014 to August 2018, when he left to take on an operational role at Cavco as part of its succession planning. After Stegmayer left the CEO role in October 2018, Urness became the acting CEO until 2019, when a permanent CEO was hired and Urness returned to the CFO position. In 2020, he went on a leave of absence after receiving a Wells notice in this matter and then subsequently left Cavco in February 2021.

THE ALLEGATIONS

A. Cavco’s Investment and Insider Trading Policies

- From at least 2014-2018, Cavco had at least two policies which governed securities trading in its accounts, a corporate investment policy and an insider trading policy.

- First, Cavco had a corporate investment policy (“Investment Policy”) in effect from at least 2014-2018, which required Cavco to maintain surplus cash in a “low-risk, high credit quality portfolio,” such as money market accounts and Treasury bonds. It provided that any investment “outside the scope of these guidelines must be approved by both the CEO and CFO and reported to the Board of Directors before any investment is made.”

- The Investment Policy was an internal accounting control within the meaning of the Exchange Act.

- The Investment Policy pertained to the safeguarding of corporate assets and the accuracy of the company’s financial reporting.

- The Investment Policy provided management’s general or specific authorization of transactions.

- The Investment Policy limited which transactions were within management’s general or specific authorization.

- The Investment Policy limited access to company assets and provided management’s general or specific authorization for when company assets could be used for investments.

- The Investment Policy was designed to ensure surplus cash was spent in accordance with management expectations.

- Cavco designated the Investment Policy as an accounting control.

- The Investment Policy was maintained on the accounting department’s shared computer drive in a folder with the other accounting policies.

- The Investment Policy was referenced in Cavco’s Sarbanes-Oxley (“SOX”) controls documentation.

- A summary of the Investment Policy was in Cavco’s internal audit files.

- Cavco’s auditor (“Auditor”) considered the Investment Policy an internal control over financial reporting.

- Cavco’s Auditor referenced the Investment Policy as a control in its work papers relating to investments.

- Second, Cavco had an insider trading policy (“Insider Trading Policy” or “Securities Trading Policy”) in place from at least 2004-2018, which provided that “[n]o employee or director of the Company . . . may buy, sell or otherwise trade in the securities of the Company while such employee or director is in the possession of material non-public information concerning the Company. . . . This policy applies to public securities of other companies where the person learns of the information through his connection with Cavco.”

- The Insider Trading Policy was an internal accounting control within the meaning of the Exchange Act.

- The Insider Trading Policy applied to trading in Cavco’s accounts.

- The Insider Trading Policy pertained to the safeguarding of corporate assets and the accuracy of the company’s financial reporting.

- The Insider Trading Policy provided management’s general or specific authorization of transactions.

- The Insider Trading Policy limited which transactions were within management’s general or specific authorization.

- The Insider Trading Policy limited access to company assets and provided management’s general or specific authorization for when company assets could be used for investments.

- The Insider Trading policy prohibited a misuse of corporate assets.

- The Insider Trading policy prohibited a form of misconduct.

- The Insider Trading Policy was part of Cavco’s Securities Trading Policy.

- The Investment Policy and Insider Trading Policy were adopted by the board prior to 2017.

B. Cavco Engaged in Insider Trading in Skyline while in Merger Talks

1. The Merger Discussions and Non-Disclosure Agreement

- In August 2017, Cavco began merger discussions with one of its competitors, Skyline, after signing a non-disclosure agreement (“NDA”).

- In 2017, shares of Skyline traded publicly under the symbol SKY.

- On August 8, 2017, a member of Skyline’s board of directors contacted Stegmayer to indicate Skyline’s willingness to engage in strategic discussions with Cavco.

- On August 10, 2017, a member of Skyline’s board of directors sent Stegmayer a proposed NDA.

- On August 11, 2017, Stegmayer and Urness communicated about Skyline’s recent financial results and how that information may impact the tone of their discussions with Skyline.

- Also on August 11, 2017, Urness asked another Skyline employee to begin a financial analysis of Skyline.

- On August 15, 2017, a member of Skyline’s board of directors sent Stegmayer and another Cavco employee the signed signature page of the NDA and asked Stegmayer when he was available for a call now that the NDA was in place.

- The NDA, signed by Stegmayer, included both nondisclosure provisions and a standstill agreement, which prohibited Cavco from trading in Skyline’s stock.

- In August and September of 2017, after signing the NDA, Stegmayer and Urness prepared an internal analysis of a potential deal, spoke with Skyline’s investment bank, issued due diligence requests to Skyline, and reviewed nonpublic information provided by Skyline.

- In August and September of 2017, Stegmayer and Urness used a code name to refer to Skyline due to the confidentiality of the discussions with Skyline.

- On August 15, 2017, Urness sent Stegmayer an internal analysis of Skyline using their public financial data, came up with an $8 per share purchase price for Skyline, compared his estimates to returns on investment from other acquisitions, and used the code name “Project Saturn” to refer to the potential Skyline deal.

- On August 15, 2017, Stegmayer had a telephone call with representatives of Skyline’s investment bank.

- On August 17, 2017, Stegmayer and Urness met in person with representatives of Skyline’s investment bank. Skyline’s investment bankers shared a confidential presentation deck, which used the code name “Project Horizon.” During the meeting, Stegmayer and Urness gave Skyline’s investment bankers a list of additional information they wanted to evaluate a potential deal.

- On August 22, 2017, Skyline’s investment bank sent Stegmayer and Urness detailed data about Skyline’s production and costs, including detailed weekly data on production by each of its manufactured home facilities and details on corporate costs, such as employee salaries, insurance, equipment, and other costs.

- On August 24, 2017, Skyline’s investment bank sent Stegmayer and Urness additional details about Skyline’s financial situation, including gross margins by product line and deferred tax assets.

- On September 6, 2017, Urness sent Stegmayer “some additional analysis based on the plant specific financial and product information received to date,” referring to the Project Horizon code name for a potential Skyline-Cavco deal. He also provided Stegmeyer with questions to raise during the discussion.

- On September 8, 2017, Stegmayer sent Skyline’s investment bank a request for additional information.

- On September 12, 2017, Skyline’s investment bank sent Stegmayer an information package along with a diligence tracker which listed and explained the documents provided. Stegmayer forwarded it to Urness.

- On September 13, 2017, Stegmayer and Urness met with the CEO of Skyline, the chair of its board of directors, and representatives from Skyline’s investment bank in Chicago. They did not meet at Skyline’s offices to avoid speculation about a potential merger. Urness took extensive handwritten notes of this meeting, which covered many topics including non-public information about Skyline’s operations, personnel, and financial statements.

- On September 13, 2017, Skyline’s investment bank sent Stegmayer and Urness additional financial information in follow up to the meeting that day, including a summary of corporate expense allocation and Skyline’s 2018 budget.

- On September 14, 2017, Skyline’s investment bank sent Stegmayer and Urness additional information regarding specific corporate cost line items they had questions about during the September 13 meeting.

- On September 17, 2017, Urness sent Stegmayer purchase scenarios for Skyline. Urness and Stegmayer then emailed back and forth discussing the purchase scenarios.

2. Cavco’s Purchases of Skyline Stock While in Merger Discussions

- In the evening on September 19, 2017, Stegmayer and Urness called Skyline’s investment bank and expressed interest in acquiring Skyline at a price of $13.50 per share.

- As CEO of Cavco, Stegmayer was authorized to place trades on Cavco’s behalf.

- At the time of the Cavco’s purchases of shares of Skyline in 2017, Stegmayer was the only person who had the ability to place trades in Cavco’s brokerage accounts.

- On September 20, 2017, Stegmayer caused Cavco to buy 2,750 Skyline shares at a cost of approximately $31,186, or approximately $11.34 per share.

- On September 21, 2017, Stegmayer caused Cavco to buy 17,700 Skyline shares at a cost of approximately $202,894, or approximately $11.46 per share.

- On September 22, 2017, Stegmayer caused Cavco to buy 3,200 Skyline shares at a cost of approximately $36,575, or approximately $11.43 per share.

- On September 25, 2017, Stegmayer caused Cavco to buy 5,100 Skyline shares at a cost of approximately $60,206, or approximately $11.81 per share.

- Stegmayer did not report these purchases to Cavco’s board.

- On September 25, 2017, Cavco’s director of financial reporting prepared a chart for Stegmayer showing that Cavco’s total position in Skyline was nearing 5% of outstanding shares.

- Stegmayer had requested that Cavco’s director of financial reporting monitor Cavco’s total position in Skyline so as to avoid triggering a duty to publicly disclose Cavco’s holdings of Skyline, which Stegmayer did not want to disclose.

- Cavco’s director of financial reporting did not report these purchases to Cavco’s board.

- On September 26, 2017, Stegmayer and Urness learned in a call with Skyline’s investment bank that Cavco’s offer was “significantly behind other options,” which Stegmayer believed were in the $18-$20 per share range.

- After the September 26th call, Cavco and Skyline had no further contact regarding a potential deal.

- On September 29, 2017, Stegmayer caused Cavco to buy 3,780 Skyline shares at a cost of approximately $43,883, or approximately $11.61 per share.

- On October 16, 2017, Stegmayer caused Cavco to buy 1,200 Skyline shares at a cost of approximately $12,708, or approximately $10.59 per share.

- On October 31, 2017, Stegmayer caused Cavco to buy 1,000 Skyline shares at a cost of approximately $11,960, or approximately $11.96 per share.

- In total, Cavco purchased 34,730 shares of Skyline at a cost of just under $400,000 after signing the NDA with Skyline. Cavco paid around $11 per share on these trades.

- In the course of its merger discussions with Skyline, Cavco, through its CEO Stegmayer and CFO Urness, received material, non-public information concerning Skyline from Skyline and Skyline’s investment bankers.

- Cavco’s 2017 purchases of Skyline shares were not reported to Cavco’s board of directors in advance of trading.

- Cavco’s 2017 purchases of Skyline shares were not reported to Cavco’s board of directors until October 2018, after the SEC served a subpoena on Cavco for information related to this trading.

- On January 5, 2018, Skyline announced it was merging with a different company that it had been in talks with at the same time as Cavco.

- This other company was the “other option” that Skyline’s investment banker had referenced in its call with Stegmayer and Urness.

- Following the announcement, Skyline’s stock price rose from $12.83 to $19 per share. This resulted in an unrealized gain for Cavco of $260,459 for the shares purchased after signing the NDA with Skyline.

- Stegmayer knew or was reckless in not knowing that he was in possession of material non-public information with respect to Skyline while causing Cavco to purchase shares of Skyline.

- As CEO of Cavco, Stegmayer’s scienter with respect to the purchases he caused Cavco to make are imputed to Cavco.

C. Cavco Engaged in Trading in Shares of Various Acquisition Targets

- From March 2017 until October 2018, when the board first learned of the SEC’s investigation, Cavco traded in three other publicly traded companies in the manufactured home industry.

- None of this trading was reported to Cavco’s board of directors in advance of the trading.

1. Cavco’s 2017-18 Trading in Shares of Nobility

- In March 2017, Cavco was in merger talks with Nobility Homes, Inc. (“Nobility”).

- In 2017, shares of Nobility traded publicly under the symbol NOBH.

- On March 1, 2017, Stegmayer and the CEO of Nobility emailed about an upcoming meeting scheduled for March 3, 2017.

- On March 2, 2017, Stegmayer caused Cavco to purchase 7,700 shares of Nobility at a cost of $121,560.

- The March 2, 2017 purchase of Nobility shares was the first time Cavco had purchased Nobility shares.

- The March 2, 2017 purchase of Nobility shares was the first time Stegmayer had caused Cavco to purchase shares in any company since 2015.

- On March 2, 2017, Stegmayer forwarded the trade information for the Nobility trades to Urness and asked him to arrange to wire $250,000 to Cavco’s brokerage account to cover the trades Cavco had already made and to provide “for additional trades near term.” Stegmayer said that he planned to accumulate “perhaps $1.0 million” worth of Nobility stock.

- On Friday, March 3, 2017, Stegmayer met in person with the CEO of Nobility to discuss a potential merger or other corporate transaction.

- Also on March 3, 2017, Stegmayer caused Cavco to purchase another 6,000 shares of Nobility at a cost of $94,800.

- Also on March 3, 2017, Urness caused Cavco to wire $300,000 to Cavco’s broker to cover Cavco’s trading in Nobility.

- The following business day, Monday, March 6, 2017, Stegmayer sent an analysis of Nobility to Urness and another Cavco employee, using the code word “Monarch” to refer to Nobility.

- In this same email, Stegmayer provided directions for Cavco’s trading in Nobility shares.

- On March 7, 2017, a Cavco employee emailed Urness about the Nobility share purchases, indicating that Cavco’s Auditor had asked about “the approval of purchase of shares.” The Cavco employee referenced the Investment Policy and indicated that the Nobility investment would need to be disclosed to Cavco’s board of directors.

- Also on March 7, 2017, Urness replied to the Cavco employee and said “good point on board approval” and referred to how Cavco had sought approval from its board of directors for its trading in Skyline in 2014. As for the Nobility trading, Urness said “[w]e will see but as this increases we can determine the right time for inclusion at a board meeting.”

- Urness never brought the Nobility trading to the board’s attention or sought its authorization for the trading.

- Also on March 7, 2017, Urness asked another Cavco employee to set up a process for initiating and approving wires to fund Cavco’s trading. That employee proposed a process for Urness’s review, noting that she “took that [Urness] may not want to be in the middle of any of this.”

- The process ultimately approved by Urness did not include any role for Urness to review or approve the trades or the wires funding the trades. The process approved by Urness also did not include any procedure to ensure that the trades complied with Cavco’s Investment Policy or its Insider Trading Policy. Indeed, there were no procedures at all to review or approve the trades themselves.

- On March 9, 2017, a Cavco employee wired $300,000 to Cavco’s brokers for additional Nobility share purchases.

- This wire and the trades it funded were done without notification to or approval of Cavco’s board of directors.

- The wire itself and the trades it funded were also done without notification to or approval from Urness. Under the funding system Urness had put in place and approved, he was not alerted to nor required to approve trades placed by Stegmayer in the company’s accounts, despite the Investment Policy’s requirement that he review and approve any exceptions to the Investment Policy and that the board be informed in advance of such exceptions.

- Also on March 9, 2017, Stegmayer emailed with the CEO of Nobility to schedule a phone call.

- Also on March 9, 2017, Stegmayer caused Cavco to purchase 14,700 Nobility shares at a cost of approximately $232,260, or approximately $15.80 per share.

- From approximately March-October 2017, Cavco and Nobility continued to engage in merger talks, and Stegmayer continued to cause Cavco to purchase shares of Nobility.

- During the 2017 merger negotiations between Cavco and Nobility, Cavco, through its CEO, Stegmayer, received material non-public information from Nobility.

- During the 2017 merger negotiations between Cavco and Nobility, Cavco personnel used a code name for the potential deal with Nobility.

- During the 2017 merger negotiations between Cavco and Nobility, Cavco, at Stegmayer’s direction, purchased a total of 63,363 shares of Nobility.

- The merger between Cavco and Nobility did not materialize.

- Cavco sold off part of its Nobility holdings in early 2018 before making some purchases of additional Nobility shares in mid-2018.

- Cavco’s board of directors was not notified of Cavco’s 2017-18 trading in shares of Nobility in advance of the trading.

2. Cavco’s 2017-18 Trading in Shares of Deer Valley

- In early December 2017, Stegmayer communicated with a principal at Deer Valley Homebuilders, Inc. (“Deer Valley”), a manufactured home builder, about a possible corporate transaction between the two companies.

- In 2017 and 2018, shares of Deer Valley traded publicly under the symbol DVLY.

- On December 19, 2017, Stegmayer met in person with the Deer Valley principal.

- On December 20, 2017, Stegmayer caused Cavco to purchase 44,676 shares of Deer Valley at a cost of approximately $31,023. This was Cavco’s first purchase of Deer Valley stock.

- Also on December 20, 2017, Stegmayer sent Deer Valley an email referencing the meeting the day before and sending a list of additional information Cavco would like to receive in connection with its consideration of a potential corporate transaction with Deer Valley.

- On December 26, 27, and 28, 2017, Stegmayer caused Cavco to purchase a total of 4,485 shares of Deer Valley.

- On January 2, 2018, Stegmayer caused Cavco to buy another 8,000 Deer Valley shares.

- On January 3, 2018, Stegmayer received a communication from Deer Valley indicating that they would begin sending materials in response to Cavco’s request for more information. Also on January 3, 2018, Stegmayer caused Cavco to buy another 4,900 Deer Valley shares.

- On January 4, 2018, Stegmayer caused Cavco to buy 1,200 Deer Valley shares.

- On January 5, 2018, Deer Valley executives suggested entering into a NDA with Cavco before sending the information and documents that Cavco had requested. On January 5, 2018, Stegmayer caused Cavco to buy another 6,100 Deer Valley shares.

- On January 6, 2018, Stegmayer sent Deer Valley a NDA that he had signed on behalf of Cavco. On January 8, 2018, Deer Valley executives sent Stegmayer a NDA that had also been signed on behalf of Deer Valley. Stegmayer forwarded it to Urness, who forwarded it to others at Cavco with the note that Cavco was considering an acquisition of Deer Valley and that this was confidential.

- On January 6, 2018, Deer Valley sent Stegmayer confidential financial information, which they labeled “Due Diligence materials.” This included financial information from 2016-2017 that had not yet been audited or publicly disclosed.

- On January 8, 2018, Stegmayer forwarded the Deer Valley non-public financial information to Urness.

- On January 8, 2018, Urness shared the non-public Deer Valley information with two other employees of Cavco, and when he did so he asked them to review the information for a possible acquisition and that it was “highly confidential of course.” Urness also tagged the email with a “Company Confidential” tag.

- On January 10, 16, 19, 22, 23, 24, 25, 26, 29, 30, and 31, 2018, Stegmayer caused Cavco to purchase a total of 115,500 shares of Deer Valley.

- On January 30, 2018, a Deer Valley executive sent Stegmayer an internal analysis of how Deer Valley’s financials were impacted by certain external events. Stegmayer forwarded this to Urness who in turn shared it with another Cavco executive.

- On February 1, 2, 5, 6, 7, 8, 9, 12, 15, 16, 20, 21, 23, 26, and 28, 2018, Stegmayer caused Cavco to purchase a total of 280,057 shares of Deer Valley.

- On February 8, 2018, Urness sent a Deer Valley executive a request for additional information about Deer Valley. He copied Stegmayer on the email. 134. On February 13 and 14, 2018, a Deer Valley executive responded to Urness and Stegmayer with additional information about Deer Valley.

- On February 14, 2018, Urness sent Deer Valley another request for information, which Deer Valley responded to on February 16, 2018.

- On February 22, 2018, Stegmayer, Urness, and another Cavco employee attended an in-person due diligence meeting and factory tour with Deer Valley executives and employees.

- On February 22 and 23, 2018, a Deer Valley executive sent Cavco additional information about Deer Valley.

- On February 24, 2018, Stegmayer, Urness, and a Cavco employee emailed about Cavco’s interest in acquiring Deer Valley if they could reach agreement on price. They used a code word, “Project Tide” to refer to the potential acquisition of Deer Valley.

- From March-July 2018, Cavco continued to consider a potential acquisition of Deer Valley.

- Stegmayer caused Cavco to make additional purchases of Deer Valley shares from March-June 2018 totaling 164,378 shares.

- Throughout its discussion with Deer Valley, from December 2017 through June 2018, Cavco was analyzing the Deer Valley due diligence materials, preparing a financial analysis and summary term sheet for the potential acquisition, and referring to the potential merger as “Project Tide” to keep it confidential.

- Cavco ultimately purchased a total of 664,457 shares of Deer Valley from December 2017 to June 2018.

- The merger between Cavco and Deer Valley did not materialize.

- Cavco’s 2017-18 trading in shares of Deer Valley was not reported to Cavco’s board of directors in advance of trading.

3. Cavco’s 2017-18 Trading in Shares of UMH

- UMH Properties (“UMH”) was Cavco’s customer.

- In 2017 and 2018, shares of UMH traded publicly under the symbol

UMH.

- In early 2017, Cavco and UMH discussed a potential joint venture.

- From December 2017 through March 2018, Stegmayer caused Cavco to purchase over 34,000 shares of UMH.

- The joint venture between Cavco and UMH never materialized.

- Cavco’s 2017 trading in shares of UMH was not reported to Cavco’s board of directors in advance of trading.

D. Stegmayer and Urness Circumvented and Failed to Implement Cavco’s Investment Policy and Insider Trading Policy

1. Stegmayer and Urness Knew About the Policies

- At least since 2014, Stegmayer and Urness knew about Cavco’s Investment Policy.

- In 2014, Urness raised the Investment Policy and its requirement of board notification to Stegmayer with respect to securities trading Stegmayer wanted Cavco to pursue.

- At that time, unlike in 2017, Stegmayer and Urness sought and received authorization from Cavco’s board of directors to trade in connection with a takeover attempt that ultimately failed.

- Cavco’s Insider Trading Policy was adopted by its board on December 12, 2003. Stegmayer was on the board when it was adopted.

- In 2007, Cavco issued a guide to compliance with securities laws that referenced insider trading restrictions under the securities laws and included as an attachment Cavco’s Insider Trading Policy.

- Stegmayer proposed amendments to the Insider Trading Policy in October 2017 that the board considered and adopted. Urness attended the board meeting where the amendments were considered and adopted. These amendments added provisions for establishing trading blackout periods for events other than earnings releases. The October 2017 amendments did not alter the part of the policy that prohibited trading while in possession of material non-public information.

- Stegmayer was aware of Cavco’s Insider Trading Policy prior to 2017 and throughout the period of Cavco’s trading in Skyline, Nobility, Deer Valley, and UMH from March 2017 to October 2018 (collectively, the “2017-18 Trading”).

- Urness was aware of Cavco’s Insider Trading Policy prior to 2017 and throughout the period of the 2017-18 Trading.

2. The 2017-18 Trading Violated Cavco’s Investment Policy and Insider Trading Policies

- The 2017-18 Trading was a use of surplus cash in something other than a low-risk, high credit quality portfolio, such as money market accounts and Treasury bonds.

- The 2017-18 Trading was not disclosed to Cavco’s board of directors in advance of the trading.

- The 2017-18 Trading was in violation of Cavco’s Investment Policy.

- The 2017-18 Trading in shares of Skyline, Nobility, and Deer Valley was done while Cavco was in possession of material non-public information concerning those companies, and that information was obtained by Cavco personnel as a result of their connection with Cavco.

- The 2017-18 Trading in Skyline, Nobility, and Deer Valley was in violation of Cavco’s Insider Trading Policy.

- Stegmayer Caused the 2017-18 Trading, and Urness Abdicated His Role in Preventing Stegmayer’s Trading

- Despite his knowledge of Cavco’s Investment Policy and Insider Trading Policy, Stegmayer circumvented and failed to implement them, which was possible because Cavco’s internal accounting controls were insufficient to provide reasonable assurance that transactions were executed in accordance with, and access to assets was permitted only in accordance with, management’s specific or general authorization.

- Stegmayer directly caused the 2017-18 Trading without consultation with or disclosure to Cavco’s board of directors.

- Urness set up a system to fund the 2017-18 Trading without devising procedures to ensure that the trading complied with the Investment Policy or the Insider Trading Policy.

- When Stegmayer started buying Nobility shares in March 2017, he circulated a Nobility purchase analysis to Urness and Cavco’s director of financial reporting.

- Cavco’s purchase of shares of Nobility was in circumvention of Cavco’s Investment Policy.

- In March 2017, Stegmayer told Urness that he planned to purchase around $1 million of Nobility shares and asked Urness to wire funds to cover the trades, which Urness did without question.

- Later in March 2017, Urness set up a system for Cavco to routinely make wire transfers to Cavco’s brokers to fund trades placed by Stegmayer and to have those wires approved within the accounting department.

- Urness did not, however, put in place any process for approving the trades or confirming they complied with Cavco’s Investment Policy and Insider Trading Policy.

- This system set up by Urness violated, circumvented, enabled, and substantially assisted Cavco’s violation of the Investment Policy.

- Upon learning of the Nobility trading, Cavco’s director of financial reporting immediately alerted Urness that the Nobility trading appeared to be outside of Cavco’s Investment Policy.

- When alerted to the fact that the Nobility trading was outside of Cavco’s Investment Policy, Urness agreed and said he would consider the right timing for bringing it to Cavco’s board of directors.

- Urness did not bring the Nobility trading to the attention of Cavco’s board of directors.

- Urness’s failure to bring the Nobility trading to the attention of Cavco’s board of directors was contrary to the Investment Policy.

- All of the ensuing 2017-18 Trading, including the purchases of shares of Deer Valley, UMH, and Skyline, followed the same process: Stegmayer placed the trades directly with Cavco’s brokers without any prior disclosure to or approval by Cavco’s board of directors. Using the system set up by Urness, the purchases were funded either by existing funds in the brokerage accounts or by wire transfers approved by Cavco’s accounting department without any checks on whether the trades complied with Cavco’s policies, including, but not limited to, whether the trades had been disclose to Cavco’s board of directors, whether Cavco had material non-public information about the companies it was trading in, or whether Cavco had signed an NDA or standstill with the companies it was trading in.

- Urness did not bring any of the 2017-18 Trading to the attention of Cavco’s board of directors.

- Urness’ failure to bring any of the 2017-18 Trading to the attention of Cavco’s board of directors was contrary to the Investment Policy.

- Urness received quarterly investment reports showing Cavco’s investments in Skyline, Nobility, Deer Valley, and UMH.

- On January 24, 2018, Urness received a quarterly investment report showing that as of December 30, 2017, Cavco held 367,392 shares of Skyline, 73,363 shares of Nobility, 49,161 shares of Deer Valley, and 1,500 shares of

UMH.

- On March 14, 2018, Urness received a quarterly investment report showing that as of March 14, 2018, Cavco held 358,402 shares of Skyline, 65,328 shares of Nobility, 481,846 shares of Deer Valley, and 34,400 shares of UMH.

E. Cavco’s Deficient Internal Accounting Controls Allowed Stegmayer and Urness to Violate the Investment and Insider Trading Policies

- Despite Cavco’s Investment Policy, it lacked controls sufficient to provide reasonable assurances that transactions were executed in accordance with management’s general or specific authorization or that access to assets was permitted only in accordance with management’s general or specific authorization.

- Cavco lacked controls specifying how investments outside the

Investment Policy would be identified and reported to Cavco’s board of directors.

- Cavco lacked controls specifying how trades would be checked to ensure they complied with the Investment Policy.

- Cavco lacked controls specifying what steps, such as segregating of duties, would be taken to prevent unauthorized transactions or use of company funds that violated the Investment Policy.

- As a result of these weaknesses, Cavco’s board of directors was never informed about the 2017-18 Trading until after the company received an SEC subpoena.

- Cavco’s board of directors never approved the 2017-18 Trading.

- Despite inquiries, Cavco’s Auditor was also not informed that the 2017-18 Trading was not authorized by Cavco’s board of directors when it was conducting audit work pertaining to the periods in which the 2017-18 Trading occured.

- Cavco provided a quarterly memo to its Auditor that asserted that it held securities investments managed by its corporate office, and that the trading decisions for these investments “are made by Joe Stegmayer, under authorization from the Board.”

- Cavco’s assertions to its Auditor that investments “are made by Joe Stegmayer, under authorization from the Board” were untrue.

- If Cavco’s Auditor had been informed that the 2017-18 Trading was not authorized by Cavco’s board of directors, it would have taken steps to escalate the issue and evaluate whether there was an internal control deficiency and whether it needed to be reported to Cavco’s board of directors.

- Cavco had no controls to review trades in peer companies and to check if Cavco had material non-public information about those companies before trading.

- As a result of such lack of controls, Cavco’s policies were not reasonably designed to provide sufficient assurances that transactions were executed in accordance with management’s general or specific authorization or that access to assets was permitted only in accordance with management’s general or specific authorization.

- Thus, when Stegmayer started placing trades in Nobility in March 2017, there was no inquiry by Cavco into whether Cavco had material non-public information about Nobility.

- Even when Cavco entered into non-disclosure agreements, there was no process for halting trading in companies covered by such agreements.

- Cavco had no process for informing relevant personnel of the entry of NDAs.

- Thus, despite Cavco’s NDAs with Skyline and Deer Valley, Cavco took no steps to halt Cavco’s trading in either issuer.

F. The FINRA Inquiry

- Following the announcement of the Skyline merger in January 2018, FINRA opened an investigation into trading in Skyline that occurred in advance of the merger announcement.

- As part of the investigation, FINRA sent a request for information to Cavco on February 9, 2018.

- The FINRA request was titled “Review of Trading in Skyline

Corporation (SKY)” and sought, among other things, information about Cavco’s contacts with Skyline, a detailed chronology of the merger talks, lists of employees with knowledge of those talks, and the procedures Cavco used to maintain the confidentiality of the talks.

- On February 16, 2018, Cavco’s general counsel forwarded the FINRA request and the draft response to Stegmayer, Urness, and another Cavco employee and asked them to look it over and provide any comments.

- The draft response to FINRA stated that “Cavco did not make an offer for Sky at any time and has no information to report regarding the corporate disclosure.”

- The draft response to FINRA went on to say that “[i]n August 2017, Cavco was contacted by SKY, entered into a Mutual Confidentiality Agreement, and engaged in some brief discussions with SKY regarding a potential transaction.

However, Cavco did not make an offer for SKY.”

- Stegmayer reviewed the FINRA request and the draft response.

- Stegmayer stated that the draft FINRA response “seems correct to my recollection. They mention due diligence. We really never did any formal DD. Their banker provided a limited amount of statistics but it went no further.” 207. Urness reviewed the FINRA request and the draft response.

- Urness did not provide any comments on or corrections of the draft FINRA response.

- On February 20, 2018, Cavco sent FINRA a response stating that “Cavco did not make an offer for Sky at any time and has not information to report regarding the corporate disclosure.”

- The February 20, 2018 Cavco response to FINRA went on to say that

“[i]n August 2017, Cavco was contacted by SKY, entered into a Mutual Confidentiality Agreement, and engaged in some brief discussions with SKY regarding a potential transaction. However, Cavco did not make an offer for SKY.” 211. The February 20, 2018 Cavco response to FINRA did not disclose that Cavco had traded in Skyline shares, and it did not provide a detailed chronology or any of the relevant supporting documents that FINRA had requested.

- The February 20, 2018 Cavco response to FINRA tried to downplay Cavco’s discussions with Skyline, and misleadingly said that Cavco had not made an “offer” for Skyline while failing to disclose that Stegmayer communicated Cavco’s interest in acquiring Skyline at $13.50 per share to Skyline’s investment banker.

G. Stegmayer and Urness Misled Cavco’s Auditor

- Stegmayer and Urness provided misleading information to Cavco’s Auditor and, as a result, the Auditor did not become aware of the insider trading, control violations, or the FINRA investigation, until the fall of 2018, after the SEC had subpoenaed Cavco.

- The Auditor did not know that Cavco may have engaged in the 201718 Trading on the basis of material non-public information about the companies in which it was trading.

- When the Auditor directly asked Stegmayer and Urness about potential fraud at the company, which would include insider trading, neither disclosed the trading in Skyline.

- On or about April 4, 2018, the Auditor interviewed Stegmayer about fraud, alleged fraud, or suspected fraud affecting the company. Stegmayer did not disclose the trading in Skyline.

- At the time of the April 4, 2018, interview, Stegmayer was aware of the trading in Skyline, as he had directed it.

- At the time of the April 4, 2018, interview, Stegmayer was aware that he had directed trading in Skyline while in possession of material non-public information concerning Skyline and Cavco’s merger talks with Skyline.

- At the time of the April 4, 2018, interview, Stegmayer was also aware

of FINRA’s investigation into trading in Skyline.

- Stegmayer knowingly misled the Auditor by stating that he had disclosed all known or suspected fraud while not disclosing the Skyline trading.

- Also on or about April 4, 2018, the Auditor interviewed Urness about fraud, alleged fraud, or suspected fraud affecting the company. Urness did not disclose the trading in Skyline.

- At the time of the April 4, 2018, interview, Urness was aware of Cavco’s trading in Skyline, as he received quarterly investment reports reflecting the trading.

- At the time of the April 4, 2018, interview, Urness was also aware of

Cavco’s possession of material non-public information concerning Skyline, as Urness personally participated in the Skyline merger discussions.

- At the time of the April 4, 2018, interview, Urness was also aware of FINRA’s investigation into trading in Skyline.

- Urness knowingly lied to the Auditor by stating that he had disclosed all known or suspected fraud while not disclosing the Skyline insider trading.

- On or about May 24, 2018, and again on May 30, 2018, the Auditor interviewed Stegmayer about, among other things, the entity’s compliance with laws and regulations.

- In the interviews with the Auditor on or about May 24, 2018, and May 30, 2018, Stegmayer knowingly and falsely represented to the Auditor that Cavco was in compliance with all applicable laws and regulations and did not disclose the Skyline insider trading.

- On or about May 23, 2018, and again on May 30, 2018, the Auditor interviewed Urness about, among other things, the entity’s compliance with laws and regulations.

- In the interviews with the Auditor on or about May 23, 2018, and May

30, 2018, Urness knowingly and falsely represented to the Auditor that Cavco was in compliance with all applicable laws and regulations and did not disclose the Skyline insider trading.

- In addition, both Stegmayer and Urness signed a management representation letter to the Auditor dated May 30, 2018, in which they both affirmatively represented that “[w]e have disclosed to you all information that we are aware of regarding fraud or suspected fraud affecting the Company received in communications from employees, former employees, analysts, regulators, short sellers, or others.”

- Stegmayer knowingly did not disclose the Skyline insider trading in the management representation letter he signed dated May 30, 2018.

- Urness knowingly did not disclose the Skyline insider trading in the management representation letter he signed dated May 30, 2018.

- In addition, in the May 30, 2018, management representation letter,

Stegmayer and Urness knowingly made the false representation that “[t]here are no [v]iolations or possible violations of laws or regulations whose effects should be considered for disclosure in the financial statements or as a basis for recording a loss contingency.” They knowingly did not disclose the Skyline insider trading.

- Stegmayer and Urness also failed to disclose the FINRA letter to the Auditor, even when the Auditor asked to inspect correspondence with regulatory authorities.

- The Auditor’s inquiries for the Financial Year 2018 audit took place in the spring of 2018, after Cavco had received a request for information from FINRA as part of FINRA’s investigation into Skyline trading.

- On or prior to May 22, 2018, the Auditor asked Stegmayer and Urness about any communications or correspondence with licensing or regulatory authorities.

- FINRA is a regulatory authority that had communicated or corresponded with Cavco.

- At the time on or prior to May 22, 2018, that the Auditor asked Stegmayer and Urness about any communications or correspondence with licensing or regulatory authorities, Stegmayer knew that Cavco had communications and correspondence with FINRA.

- At the time on or prior to May 22, 2018, that the Auditor asked Stegmayer and Urness about any communications or correspondence with licensing or regulatory authorities, Urness knew that Cavco had communications and correspondence with FINRA.

- Both Stegmayer and Urness received FINRA’s communication to Cavco and Cavco’s response to FINRA.

- In response to the inquiry on or prior to May 22, 2018, about any communications or correspondence with licensing or regulatory authorities, Stegmayer and Urness knowingly and falsely told the Auditor that there weren’t any communications or correspondence with regulatory authorities.

- In addition, both Stegmayer and Urness signed a management representation letter to the Auditor dated May 30, 2018, in which they both affirmatively represented that “[t]here have been no communications from regulatory agencies concerning noncompliance with, or deficiencies in, financial reporting practices.”

- At the time Stegmayer signed the management representation letter to the Auditor dated May 30, 2018, he knew that Cavco had communications and correspondence with FINRA regarding potential insider trading in Skyline.

- At the time Urness signed the management representation letter to the Auditor dated May 30, 2018, he knew that Cavco had communications and correspondence with FINRA regarding potential insider trading in Skyline.

- The FINRA letter should have been disclosed because the trading in

Skyline was reported as part of Cavco’s financial statements, thus making the

FINRA inquiry relevant to Cavco’s financial reporting practices, and Stegmayer and Urness’ statements to the Auditor regarding regulatory communications were false.

- Urness was specifically aware that FINRA inquiries should be disclosed to Cavco’s Auditor, as he had previously done so.

- Cavco had previously received a letter from FINRA inquiring as to trading in Skyline in 2014.

- In 2014, Urness caused the 2014 FINRA letter to be disclosed to Cavco’s Auditor.

H. Stegmayer Engaged in Insider Trading in Cavco Stock

- Stegmayer also engaged in insider trading in the shares of Cavco stock that he personally owned.

- In 2018, shares of Cavco traded publicly under the symbol CVCO.

- As of August 20, 2018, Stegmayer personally owned approximately 529,141 shares of Cavco.

- The SEC sent a subpoena for documents concerning trading in Skyline to Cavco’s general counsel by email on August 20, 2018.

- Stegmayer learned about the subpoena that afternoon.

- The next morning, on August 21, Stegmayer called his personal broker and placed an order to sell 10,000 shares of his Cavco stock.

- That same day, Cavco’s former General Counsel sent an email to Stegmayer, Urness, and another Cavco employee about the subpoena.

- Stegmayer’s broker was unable to sell all 10,000 shares on August 21, so Stegmayer instructed him to keep selling the next day.

- When the broker reported on his progress on August 22, Stegmayer told him to lower the limit price at which he would sell.

- In total, over the two days following service of the subpoena,

Stegmayer sold 11,740 shares of Cavco at an average price of more than $240 per share.

- Stegmayer placed these trades on the basis of material, non-public information about the Skyline insider trading he had caused Cavco to engage in, the FINRA investigation into Skyline trading, and the SEC investigation into that trading.

- When news of the SEC subpoena and Cavco’s trading became public more than two months later, Cavco’s share price dropped to $165.20 per share.

- By selling prior to the news, Stegmayer avoided losses of approximately $883,374.

I. Cavco’s Board of Directors Learned of the 2017-18 Trading

- Cavco’s board of directors only learned of the 2017-18 Trading in October 2018, upon learning of the SEC subpoena.

- The next month, Stegmayer stepped down as CEO but remained at the company as director of strategic initiatives before retiring effective January 31, 2020.

- Urness remained CFO until February 2021.

FIRST CLAIM FOR RELIEF

Fraud in the Connection with the Purchase and Sale of Securities

Violations of Section 10(b) of the Exchange Act and Rule 10b-5

(against Defendants Cavco and Stegmayer)

- The SEC realleges and incorporates by reference paragraphs 1 through 264 above.

- By engaging in the conduct described above, each of Defendants Cavco and Stegmayer, directly and indirectly, bought and sold securities in Skyline between on or about September 20, 2017 and on or about October 31, 2017, while in possession of, and on the basis of, Skyline’s material, non-public information, including (1) details about Skyline’s internal financial information, personnel, and factory operations, (2) that Skyline was actively pursuing a potential merger or other business combination, (3) that Skyline had retained an investment banker to advise it on a potential merger and was in talks with more than one potential partner, and (4) that Skyline had other options it was pursuing at a price significantly above the price its stock was trading at, while subject to a nondisclosure agreement with Skyline. Defendants Cavco and Stegmayer knew, or were reckless in not knowing, that this trading was in breach of the duty of confidence established by both the NDA and the parties’ relationship and course of conduct.

- By engaging in the conduct described above, each of Defendants Cavco and Stegmayer, directly or indirectly, in connection with the purchase or sale of a security, by the use of means or instrumentalities of interstate commerce, of the mails, or of the facilities of a national securities exchange: (a) employed devices, schemes, or artifices to defraud; (b) made untrue statements of a material fact or omitted to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading; and (c) engaged in acts, practices, or courses of business which operated or would operate as a fraud or deceit upon other persons.

- By engaging in the conduct described above, each of Defendants Cavco and Stegmayer violated, and unless restrained and enjoined will continue to violate, Section 10(b) of the Exchange Act, 15 U.S.C. § 78j(b), and Rules 10b-5(a),

10b-5(b), and 10b-5(c) thereunder, 17 C.F.R. §§ 240.10b-5(a), 240.10b-5(b) & 240.10b-5(c).

SECOND CLAIM FOR RELIEF

Failure to Devise and Maintain Sufficient Internal Accounting Controls in

Violation of Section 13(b)(2)(B) of the Exchange Act

(against Defendant Cavco)

- The SEC realleges and incorporates by reference paragraphs 1 through 264 above.

- By engaging in the conduct described above, Defendant Cavco failed

to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurance that its corporate securities trading would be executed in accordance with Cavco’s board of directors’s authorization, its Corporate Investment Policy, and its Insider Trading Policy.

- By engaging in the conduct described above, Defendant Cavco failed to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurances that, among other things, transactions are executed in accordance with management’s general or specific authorization and that access to assets is permitted only in accordance with management’s general or specific authorization.

- By reason of the conduct described above, Defendant Cavco violated, and unless restrained and enjoined will continue to violate, Section 13(b)(2)(B) of the Exchange Act, 15 U.S.C. § 78m(b)(2)(B).

THIRD CLAIM FOR RELIEF

Aiding and Abetting Cavco’s Failure to Devise and Maintain Sufficient

Internal Accounting Controls in Violation of Section 13(b)(2)(B) of the

Exchange Act

(against Defendants Stegmayer and Urness) 273. The SEC realleges and incorporates by reference paragraphs 1 through 264 above.

- Defendant Cavco violated Section 13(b)(2)(B) of the Exchange Act, 15 U.S.C. § 78m(b)(2)(B).

- By engaging in the conduct described above, Defendant Stegmayer knowingly or recklessly provided substantial assistance for Cavco’s violations by placing trades in Cavco’s account without informing Cavco’s board of directors and while he was in non-public merger discussions with Skyline, Nobility, and Deer Valley.

- By engaging in the conduct described above, Defendant Urness

knowingly or recklessly provided substantial assistance for Cavco’s violations by setting up a wire approval control that funded all trades placed by Stegmayer regardless of whether they had been disclosed to, were approved by, or were consistent with the instructions of Cavco’s board of directors.

- By engaging in the conduct described above, each of Defendants

Stegmayer and Urness knowingly or recklessly provided substantial assistance in Cavco’s failure to devise and maintain sufficient internal accounting controls.

- By reason of the conduct described above, each of Defendants Stegmayer and Urness aided and abetted Defendant Cavco’s violation of, and unless restrained and enjoined will continue to violate, Section 13(b)(2)(B) of the

Exchange Act, 15 U.S.C. § 78m(b)(2)(B), pursuant to Section 20(e) of the Exchange Act, 15 U.S.C. § 78t(e).

FOURTH CLAIM FOR RELIEF

Circumventing and Failing to Implement Internal Accounting Controls in

Violation of Section 13(b)(5) of the Exchange Act

(against Defendants Stegmayer and Urness) 279. The SEC realleges and incorporates by reference paragraphs 1 through 264 above.

- By engaging in the conduct described above, Defendant Stegmayer knowingly circumvented and failed to implement internal accounting controls regarding securities trading by causing Cavco to trade in Skyline and the other issuers in violation of the Investment Policy and Insider Trading Policy.

- By engaging in the conduct described above, Defendant Urness knowingly circumvented and failed to implement internal accounting controls regarding securities trading by setting up a funding process to bypass Cavco’s board of directors, the Investment Policy, and his duty under the Investment Policy to review and approve exceptions to the policy.

- By reason of the conduct described above, each of Defendants

Stegmayer and Urness violated, and unless restrained and enjoined will continue to violate, of Section 13(b)(5) of the Exchange Act, 15 U.S.C. § 78m(b)(5).

FIFTH CLAIM FOR RELIEF

Misleading the Auditor in Violation of Rule 13b2-2 under the Exchange Act

(against Defendants Stegmayer and Urness) 283. The SEC realleges and incorporates by reference paragraphs 1 through 264 above.

- Defendants Stegmayer and Urness are officers of Cavco, an issuer.

- By engaging in the conduct described above, Defendant Stegmayer knowingly and falsely represented that he was not aware of any fraud or suspected fraud affecting Cavco, knowingly and falsely represented that Cavco was in compliance with all applicable laws and regulations, knowingly failed to disclose the insider trading he had directed at the company, and knowingly and falsely represented that Cavco had not received any regulatory inquiries when he met with the Auditor in April and May 2018 and then signed a management representation letter to them in May 2018.

- By engaging in the conduct described above, Defendant Urness knowingly and falsely represented that he was not aware of any fraud or suspected fraud affecting Cavco, knowingly and falsely represented that Cavco was in compliance with all applicable laws and regulations, knowingly failed to disclose the insider trading in Skyline, and knowingly and falsely represented that Cavco had not received any regulatory inquiries when he met with the Auditor in April and May 2018 and then signed a management representation letter to them in May 2018.

- By engaging in the conduct described above, each of Defendants Stegmayer and Urness directly or indirectly made or caused to be made a materially false or misleading statement to an accountant, or omitted to state, or caused another person to omit to state, a material fact necessary in order to make statements made, in light of the circumstances under which such statements were made, not misleading, to an accountant in connection with financial-statement audits, reviews, or examinations or the preparation or filing of any document or report required to be filed with the SEC.

- By reason of the conduct described above, Defendants Stegmayer and Urness violated, and unless restrained and enjoined will continue to violate, Rule 13b2-2 under the Exchange Act, 17 C.F.R. § 240.13b2-2.

SIXTH CLAIM FOR RELIEF

Fraud in the Connection with the Purchase and Sale of Securities In Violation of Section 17(a) of the Securities Act, Section 10(b) of the Exchange Act, and

Rule 10b-5 thereunder

(against Defendant Stegmayer)

- The SEC realleges and incorporates by reference paragraphs 1 through 264 above.

- By engaging in the conduct described above, Defendant Stegmayer, directly and indirectly, sold securities in Cavco between on or about August 21, 2018 and on or about August 22, 2018, while in possession of, and on the basis of, material, non-public information about Cavco, including (1) Cavco’s receipt of an SEC subpoena, (2) Cavco’s repeated illegal trading that was also contrary to Cavco policy, and (3) that Cavco had received a FINRA inquiry and provided a misleading response. Defendant Stegmayer knew, or was reckless in not knowing, that this trading was in breach of his duty as CEO of Cavco to Cavco shareholders.

- By engaging in the conduct described above, Defendants Stegmayer, directly or indirectly, in connection with the purchase or sale of a security, by the use of means or instrumentalities of interstate commerce, of the mails, or of the facilities of a national securities exchange: (a) employed devices, schemes, or artifices to defraud; (b) made untrue statements of a material fact or omitted to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading; and (c) engaged in acts, practices, or courses of business which operated or would operate as a fraud or deceit upon other persons.

- By engaging in the conduct described above, Defendant Stegmayer violated, and unless restrained and enjoined will continue to violate, Section 10(b) of the Exchange Act, 15 U.S.C. § 78j(b), Rules 10b-5(a), 10b-5(b), and 10b-5(c) thereunder, 17 C.F.R. §§ 240.10b-5(a), 240.10b-5(b) & 240.10b-5(c), and Section 17(a) of the Securities Act, 15 U.S.C. § 77q(a).

PRAYER FOR RELIEF

WHEREFORE, the SEC respectfully requests that the Court:

I.

Issue findings of fact and conclusions of law that Defendants committed the alleged violations.

II.

Issue judgments, in forms consistent with Rule 65(d) of the Federal Rules of Civil Procedure, permanently enjoining Defendant Cavco, and its officers, agents, servants, employees and attorneys, and those persons in active concert or participation with any of them, who receive actual notice of the judgment by personal service or otherwise, and each of them, from violating Sections 10(b) and 13(b)(2)(B) of the Exchange Act [15 U.S.C. §§ 78j(b) and 78m(b)(2)(B)], and Rule 10b-5 thereunder [17 C.F.R. § 240.10b-5].

III.

Issue judgments, in forms consistent with Rule 65(d) of the Federal Rules of Civil Procedure, permanently enjoining Defendant Stegmayer, and his officers, agents, servants, employees and attorneys, and those persons in active concert or participation with any of them, who receive actual notice of the judgment by personal service or otherwise, and each of them, from violating Sections 10(b),

13(b)(2)(B), and 13(b)(5) of the Exchange Act [15 U.S.C. §§ 78j(b), 78m(b)(2)(B), and 78m(b)(5)], and Rules 10b-5 and 13b2-2 thereunder [17 C.F.R. §§ 240.10b-5 and 240.13b2-2]; and Section 17(a) of the Securities Act [15 U.S.C. § 77q(a)].

IV.

Issue judgments, in forms consistent with Rule 65(d) of the Federal Rules of Civil Procedure, permanently enjoining Defendant Urness, and his officers, agents, servants, employees and attorneys, and those persons in active concert or participation with any of them, who receive actual notice of the judgment by personal service or otherwise, and each of them, from violating Sections 13(b)(2)(B) and 13(b)(5) of the Exchange Act [15 U.S.C. §§ 78m(b)(2)(B) and 78m(b)(5)], and Rule 13b2-2 thereunder [17 C.F.R. § 240.13b2-2]. V.

Issues judgment, in forms consistent with Rule 65(d) of the Federal Rules of Civil Procedure, permanently prohibiting Stegmayer from acting as an officer or director of any issuer that has a class of securities registered pursuant to Section 12 of the Exchange Act or that is required to file reports pursuant to Section 15(d) of the Exchange Act.

V.

Order Defendants Cavco, Stegmayer, and Urness to pay civil penalties under Section 21(d)(3) of the Exchange Act [15 U.S.C. § 78u(d)(3)], and order Defendants Cavco and Stegmayer to pay civil penalties under Section 21A of the Exchange Act [15 U.S.C. § 78u-1].

VI.

Order Defendants Cavco, Stegmayer, and Urness to pay civil penalties under Section 21(d)(3) of the Exchange Act [15 U.S.C. § 78u(d)(3)], and order Defendants Cavco and Stegmayer to pay civil penalties under Section 21A of the Exchange Act [15 U.S.C. § 78u-1].

///

///

VII.

Retain jurisdiction of this action in accordance with the principles of equity and the Federal Rules of Civil Procedure in order to implement and carry out the terms of all orders and decrees that may be entered, or to entertain any suitable 5 application or motion for additional relief within the jurisdiction of this Court.

VIII.

Grant such other and further relief as this Court may determine to be just and necessary.

- Dated: September 2, 2021

- /s/ Daniel O. Blau

- Daniel O. Blau

Jasmine M. Starr

- Attorneys for Plaintiff

Securities and Exchange Commission

##

The pdf of the SEC complaint and pleadings are found at this link here.

Additional Information, more MHProNews Analysis and Commentary in Brief

Let’s note for the record that there is no apparent evidence from the pleadings that people at Nobility (NOBH), Deer Valley Homebuilders (DVLY), or UMH Properties were aware of any possible wrongdoing by Stegmayer, Urness, and perhaps others at Cavco. Discussions about possible acquisitions by a competitor are not uncommon in manufactured housing, as the above and other reports previously published by MHProNews/MHLivingNews reflects.

That noted, the SEC pleadings potentially sheds new light on previously reported evidence of possible antitrust violations.

Presuming the accuracy of the facts and evidence found in the SEC complaint, which on this date have not yet been litigated, they reflect an apparent willingness to violate federal law. If someone or some company is willing to violate federal laws under the SEC jurisdiction several times, when would there be any surprise if other federal laws, such as antitrust or RICO could be violated by Cavco too?

Cavco Industries “Killer Acquisition,” CVCO’s New Controversy Tests Antitrust Resolve

To set the legal context for the newest controversy involving Cavco Industries (NASDAQ:CVCO), a brief background of a top antitrust official’s statement is useful. In one of several previously reported speeches, the June 11, 2019 “…And Justice for All…”

That said, evidence of an apparent antitrust violation before the SEC complaint details were published are found in the report linked above.

Furthermore, in the context of Lexington Homes, along with other acquisitions by Cavco Industries (CVCO), or for that matter, the Skyline-Champion combination (SKY) can in hindsight reveal an apparent targeting for buyout, stock ownership, and/or NDAs with members of the Manufactured Housing Association for Regulatory Reform (MHARR).

Documents obtained from a source outside of MHARR, which does not publish or discuss their member list, have provided MHProNews with a reasonably good insight into which firms were, are, and are not MHARR members.

For instance, Lexington Homes was a MHARR member. Cavco, which has been announcing expansions of their production elsewhere, oddly closed down Lexington after that acquisition. Per industry sources, Lexington Homes was previously profitable as an independent. Why did Cavco actually close Lexington? See that report linked above for more details.

With that quick backdrop of Lexington Homes in mind, Strommen and others have raised concerns that Lexington could be an example of Cavco engaging in a “killer acquisition.” A killer acquisition, buying a competitor out in order to ultimately close that competitor down, could be an antitrust violation. Some antitrust violations may involved felony charges, not just civil risks, Strommen has noted.

Strommen has gone so far as to say that there are several apparent examples of evidence that MHI is itself involved in this conspiracy to consolidate the manufactured housing industry. Strommen argued that a possible Noerr defense, a possible legal cover for MHI in the face of an antitrust charge, should not be available to MHI, due to the nature of their behavior.

The elimination of MHARR through the steady acquisitions by larger MHI member firms of MHARR members would be one way to stop that apparent thorn in the side of the MHI members focused on consolidation.

When the stakes are high, there are certain cards that a good player does not show until necessary, or before the player is ready to show them. By analogy, when the stakes for independents in HUD Code manufactured housing are perhaps higher than at any times since the notorious 2009 Tim Williams letter, there may be reasons for MHARR not to discuss these wrinkles at this time. That noted, for those who have not yet carefully digested and/or looked anew at the Strommen case and related materials, the SEC complaint makes it plain that ripples go well beyond Cavco. Prudent non-MHARR members should take note. Those who have not seen the obvious benefits of being in MHARR should look at what the SEC said, what Strommen has laid out, and take a fresh look at MHARR. Absent years of MHARR efforts, there are evidence-based reasons to think that the industry may have fewer if any producers left, other than what Strommen called the Big Three absent MHARR. As Strommen put it, MHI “appears to act directly on behalf” of “the Big 3 manufacturers.”

MHI insiders well know that MHARR’s efforts on issues such as the DOE energy rule and other topics has protected the interests of not only producers, but other segments of the industry that MHARR technically has no role in defending, because they are a producers focused trade group. Back door efforts to eliminate MHARR is the highest form of praise that MHI brands could pay them. The fact that it would be achieved through consolidation is a two-for-one.

To learn more about these issues and trends, that relate to Cavco, Stegmayer, Urness, and others, see the report linked below.

The Nobility Homes report is also arguably related, because Stegmayer et al may have been using the posturing of a possible buy-out as a means to learn insider information.

As a final note before closing, there are several reasons to believe that there is more coming on the topics raised by the SEC complaint that go beyond the strict confines of the SEC. This SEC complaint is arguably the tip of a larger iceberg. Don’t just read this report once, read it twice if you really want to get your head around what is actually taking place in the manufactured housing that others don’t want to reveal. Despite the protestations of their supporters, the evidence for the case for illegal behavior in our industry just became stronger. Take a new or fresh look at Strommen and related below. Because the would-be defenders against Strommen’s legal thesis are gathered up and examined. It is the most comprehensive such report to date in our profession. Project Saturn. Code name, Monarch. These were thinly veiled ways of communicating about illegal behavior by people that in some circles are still considered icons in manufactured housing, more specifically among those involved at MHI. If the SEC pleadings mean anything, watch for more ahead.

###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]