Those who’ve read this column for years know that your Masthead writer is:

- Pro-manufactured housing,

- Believes in a potentially strong future for manufactured housing,

- Is a pragmatic optimist.

The last bullet should be understood this way. The pessimist always sees the dark side, the optimist sees the potential in glowing terms.

The pragmatic optimist believes the promise exists, but that it will take time and the proper effort to tap it.

DTS Reality Checks

It may look on the surface like the various voices within manufactured housing’s currently modest world are all on the same page.

They are not.

There are many private agendas at play, and we won’t outline them all today. Suffice it to say that RC Williams’ article on this issue suggests some of the undercurrents that are at work beneath the surface.

No Silver Bullet

Some are still looking – hoping, and praying – for a return to the stupid loans made back in the mid-to-late 1990s and into the early 2000s.

Sorry, but the Masthead believes that the stupid lending of 15 plus years ago should never be restarted.

Part of the reason for the long slide of manufactured housing from its peak in 1998 is precisely because:

- Some lenders and retailers in manufactured housing – many of whom are now long gone – didn’t realize that unsustainable lending was bad for everyone: consumers, lenders, sellers, builders – everyone in the MH mix.

- That an uneven playing field with conventional vs. manufactured homes exists, and that far too few are addressing the true causes or are modeling the solutions needed.

- Paul Bradley and Titus Dare each suggest part of the solutions, see links from RC’s article, referenced above.

Lending and all of manufactured housing must be approached from an ‘everyone in the mix wins’ perspective.

That means, that lenders and home owners alike must be able to count on a sound exit-strategy. Without that sound exit, the secondary market will not embrace manufactured housing in the same way that they do conventional homes.

That’s an educational issue, but is also a systemic one.

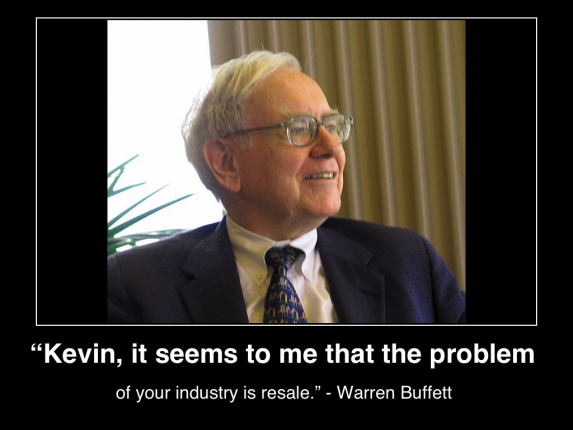

Warren Buffett said it well, when he told Kevin Clayton that the problem with manufactured housing is resale.

Our industry’s potential is many times higher than those of us involved day to day in HUD Code manufactured housing are experiencing today. It would be great to be able to honestly say that a silver bullet exists, but one doesn’t.

Or as John Bostick aptly says, “Easy doesn’t pay well.”

It is precisely because not enough manufactured housing professionals have rallied around the mid-to-long term steps needed to advance manufactured homes into mainstream housing that we are still stuck in a relatively low gear.

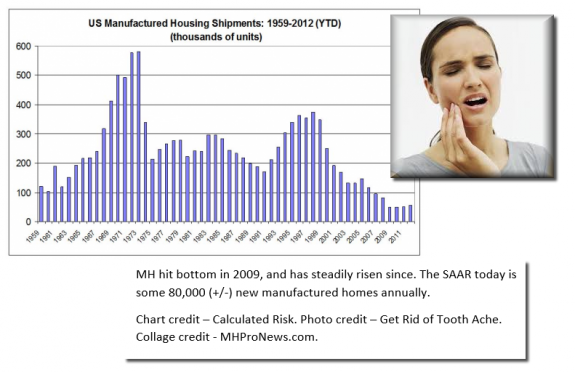

Yes, we may hit some 80,000 homes this year, but that’s only about 22 percent of where manufactured housing was in 1998.

There are many possibilities. One is that a new deep-pockets player will look at MH World, say ‘we can outperform those who are in that field.’ And that player could be an oversees or domestic money source.

Until enough local and regional players decide to get serious about the underlying causes of what holds manufactured housing back, we will slowly climb back to the 100,000 annual shipment market and may in time pass it.

But we won’t hit the 300,000, 400,000 or 500,000 annual shipments of new HUD Code manufactured homes that would otherwise be possible. That promise will only occur when the proper steps are taken to level the playing field for home buyers, lenders, producers, suppliers and sellers in the MH mix.

Don’t look for the DTS rule as it is to be a major game changer. To be a game changer, we must properly change the way we play the mainstream housing game. ##

Update: The Daily Business News report on MHARR’s statement on DTS, linked here.

(Image credits are as shown above.)