MHProNews reached out to half-a-dozen sources that are in various ways connected to the Manufactured Housing Institute (MHI) on the headline news that ECN Capital and Skyline Champion (SKY) are forging a “strategic relationship” for financing new HUD Code manufactured homes in a deal announced this week. That strategic relationship, per their media release, will establish a “new captive finance company.” All the sources contacted have a significant range of knowledge and experience in the manufactured housing industry which includes financing, but in some cases, other aspects of the manufactured home industry too. Roughly half responded with some level of reaction or expert thoughts on the announced what has been described as a “Champion-Triad” deal. Interestingly, several messages used the expression “time will tell” to conclude their remarks. Among the sources who provided a response is a c-suite level pro who has previously provided insights to MHProNews on issues that months later proved to be spot-on, well in advance of information from any other known sources. But as noted, all those who have weighed in are informed on these financing issues.

According to Goldman Sachs on May 4, 2023: “Small business owners – much like the U.S. Government – are facing a credit crunch, with 77% of respondents reporting they are concerned about their ability to access capital, a stunning shift from one year ago when 77% said they were confident in their ability to access capital.”

The U.S. Chamber of Commerce said a few weeks earlier that: “Small business owners’ concern over finding capital to run their businesses has grown in the last 5 years.”

So, if the U.S. experiences an increased credit crunch in the foreseeable future, the deal being made by Skyline Champion (SKY) with ECN Capital (5 decades of experience in manufactured home lending, Triad Financial Services’ (TFS) parent company) could well mean another shock to the retail and thus production section of the industry.

Anyone can carry a press release, or quote from a PR. But too few in MHVille are willing to take the time and effort to provide the PR, and then seek/get expert insights that shed light that are not found, or in some cases even hinted at, in the original media release.

- Part I of this report will include the bulk of Triad Financial Services (TFS) parent company, ECN Capital (ECN) press release which announced the deal with Skyline Champion (SKY) published via Berkshire Hathway (BRK) owned BusinessWire. That includes their legal disclosures, which right or wrong, some readers will skip.

- Part II of this report will include the additional information with more MHProNews analysis and commentary. Among the remarks? “It’s very smart for Skyline-Champion with a sizeable investment that should assure financing availability.”

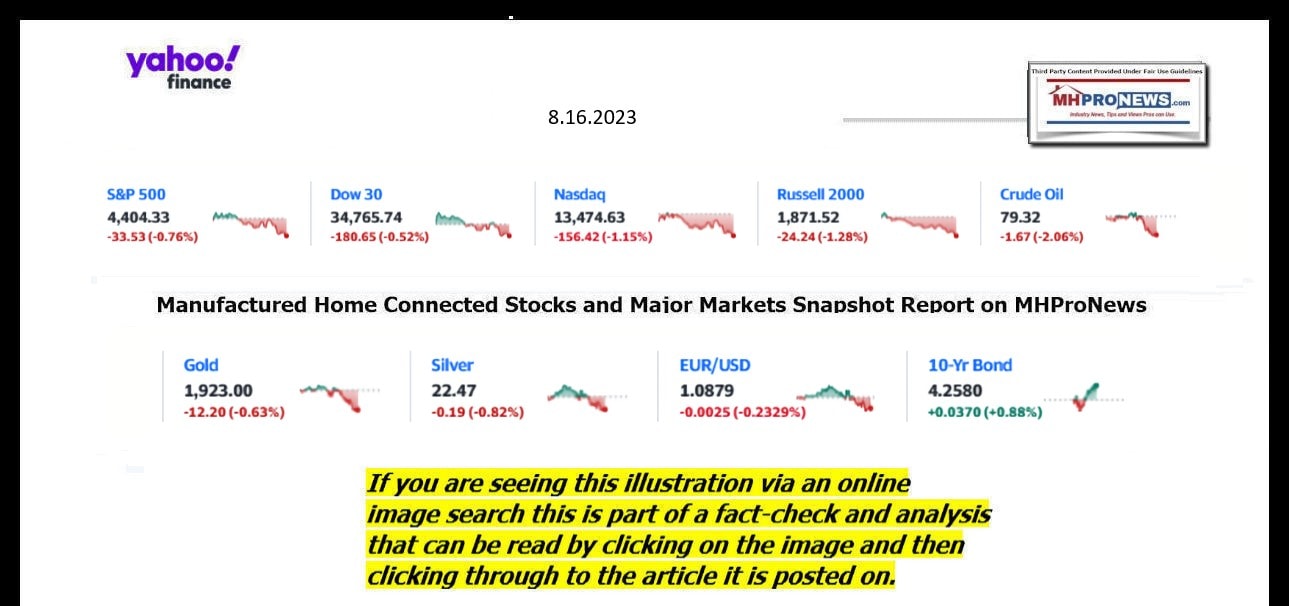

- Part III is our Daily Business News macro- and manufactured housing connected market report, which includes our signature left (CNN) right (Newsmax) headlines. In two or three minutes, readers who may not closely monitor the news can get at-a-glance.

Part I

ECN Capital and Skyline Champion Announce Strategic Relationship

Business Wire

Mon, August 14, 2023 at 5:40 PM EDT·10 min read

In this article:

Skyline Champion to Make C$185 Million Strategic Investment in ECN Capital

ECN Capital and Skyline Champion to Establish New Captive Finance Company

TORONTO & TROY, Mich., August 14, 2023–(BUSINESS WIRE)–ECN Capital Corp. (TSX: ECN) (“ECN Capital“) and Skyline Champion Corporation (NYSE: SKY) (“Skyline Champion“) today announced that they have entered into a share subscription agreement (the “Subscription Agreement“) pursuant to which Skyline Champion has agreed to make an approximately C$185 million (US$138 million) equity investment in ECN Capital on a private placement basis (the “Private Placement“) in exchange for 33,550,000 common shares of ECN Capital (the “Common Shares“) and 27,450,000 mandatory convertible preferred shares, Series E of ECN Capital (“Convertible Preferred Shares“). Upon closing of the Private Placement, Skyline Champion is expected to beneficially own an approximately 19.9% interest in ECN Capital (assuming the conversion of all Convertible Preferred Shares).

In connection with the Private Placement, ECN Capital and Skyline Champion will form a captive finance company that will be 51% owned by Skyline Champion and 49% owned by Triad Financial Services, Inc. (“Triad“), a wholly-owned subsidiary of ECN Capital. The captive finance company will provide a tailored retail finance loan program for customers and a new branded floorplan offering for Skyline Champion and its affiliates in the manufactured home finance space and will operate with services provided by Triad.

The captive finance company is expected to enable both companies to work more closely together to grow their respective businesses and create value for their stakeholders. Among other things, the captive finance company is expected to:

- drive greater demand for product by providing broader and more attractive financing options and services for Skyline Champion’s customers;

- enhance Skyline Champion’s turn-key homebuying solutions while magnifying the benefits of their digital and direct-to-consumer strategic investments; and

- generate increased retail loan originations and floorplan balances, driving growth and scale efficiencies for Triad.

“We are pleased to announce this new and expanded partnership with Skyline Champion, a leading participant in the North American manufactured housing sector,” said Steven Hudson, Chief Executive Officer of ECN Capital. “This transaction represents the culmination of the strategic review process that we commenced earlier this year, and we are very excited by the significant growth opportunities that the establishment of the new captive finance company will bring to Triad. The concurrent equity and preferred share investments in ECN Capital also represent a strong endorsement of ECN Capital’s business model and the value of our platform.”

“We are excited to announce this new strategic collaboration with one of our long-standing business partners,” said Mark Yost, Skyline Champion’s President and Chief Executive Officer. “The partnership with Triad will help streamline the homebuying experience for our channel partners as well as the consumers of our homes. This will allow us to expand our ability to offer affordable housing solutions more efficiently while driving company-wide growth. The asset-light model of these financing solutions combined with the strength of our balance sheet allow us to partner with ECN Capital while continuing our investments in our longer-term commercial and operational initiatives. We are excited about the future and the benefits this investment will bring to both companies’ stakeholders.”

Key Private Placement Details

Equity Investment

Pursuant to the Subscription Agreement, Skyline Champion has agreed acquire 33,550,000 Common Shares and 27,450,000 Convertible Preferred Shares, in each case at a price per share equal to C$3.04 (the “Share Issue Price“).

The Convertible Preferred Shares are initially convertible on a one-for-one basis into an aggregate of 27,450,000 Common Shares based on an initial liquidation preference and conversion price equal to the Share Issue Price, which are subject to customary anti-dilution adjustments. The Convertible Preferred Shares are convertible at any time at the option of Skyline Champion, are convertible at the option of ECN Capital in connection with a change of control of ECN Capital and will automatically convert into Common Shares on the fifth anniversary of closing of the Private Placement, in each case subject to a conversion cap in the event that, as a result of any conversion, Skyline Champion would hold in excess of 19.9% of outstanding Common Shares.

The Convertible Preferred Shares will receive cumulative cash dividends at a rate of 4.0% per annum on the liquidation preference, payable semi-annually.

The holder of the Convertible Preferred Shares will be entitled to vote on an as-converted basis for all matters on which holders of Common Shares vote and, except as otherwise required by law, will vote together as a single class with the Common Shares.

The Convertible Preferred Shares will not be transferrable other than to affiliates of Skyline Champion or with the prior approval of the Board of Directors of ECN Capital. The Common Shares to be acquired by Skyline Champion pursuant to the Private Placement are subject to a two-year lock-up period, subject to permitted transfers to affiliates of Skyline Champion.

While the Convertible Preferred Shares will not be listed on any stock exchange, ECN Capital has applied for conditional approval for the listing of the underlying Common Shares on the TSX. ECN Capital has also applied for conditional approval from the TSX for the listing of the Common Shares to be acquired by Skyline Champion pursuant to the Private Placement.

ECN Capital intends to use the net proceeds of the Private Placement for general corporate purposes.

Investor Rights Agreement

Pursuant to an investor rights agreement to be entered into on closing of the Private Placement (the “Investor Rights Agreement“), Skyline Champion will have the right to nominate one director to serve on the Board of Directors of ECN Capital. On closing, ECN Capital intends to appoint Mark Yost, President and Chief Executive Officer of Skyline Champion, to the Board of Directors of ECN Capital.

The Investor Rights Agreement will also provide for, among other things, customary piggy-pack registration rights, pre-emptive rights, standstill and voting support obligations. In addition, in light of the strategic partnership between ECN Capital and Skyline Champion, consisting of the Private Placement and the captive finance company, ECN Capital will also agree pursuant to the Investor Rights Agreement that for a two-year period from closing of the Private Placement: (i) unanimous approval of the Board of Directors of ECN Capital will be required in order to market the sale of Triad, pursue any material acquisitions or dispositions outside of the ordinary course (subject to certain agreed upon dispositions) or pay any dividends in excess of ECN Capital’s current quarterly dividends on its Common Shares and existing preferred shares and dividends on the Convertible Preferred Shares; and (ii) Skyline Champion will have a right to match in connection with unsolicited offers to acquire ECN Capital or Triad.

Conditions to Closing

The Private Placement is anticipated to close in September 2023, subject to certain customary closing conditions including the receipt of conditional approval from the TSX and the expiration of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Conference Call and Webcast Information:

ECN Capital will be hosting an analyst briefing to discuss its financial statements and management discussion and analysis for the three-month period ended June 30, 2023 and its strategic relationship with Skyline Champion commencing at 6:30 p.m. Eastern Time on August 14, 2023. The call can be accessed as follows:

| Webcast | https://services.choruscall.ca/links/ecncapitalcorp2023q2.html | |

| Toll-free dial in | North America 1-800-319-4610 | |

| International 1-416-915-3239 | ||

| Presentation slides | http://ecncapitalcorp.com/investors/presentations |

A telephone replay of ECN Capital’s conference call may also be accessed until September 14, 2023 by dialing 1-800-319-6413 and entering the passcode 0363#.

Skyline Champion management will host a conference call tomorrow, August 15, 2023, at 9:00 a.m. Eastern Time, to discuss this transaction.

Investors and other interested parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of Skyline Champion’s website at skylinechampion.com. The online replay will be available on the same website immediately following the call.

The conference call can also be accessed by dialing (877) 407-4018 (domestic) or (201) 689-8471 (international). A telephonic replay will be available approximately two hours after the call by dialing (844) 512-2921, or for international callers, (412) 317-6671. The passcode for the live call and the replay is 13740713. The replay will be available until 11:59 P.M. Eastern Time on August 29, 2023.

Additional Information

ECN Capital intends to file a material change report in connection with the transactions contemplated by this news release, which will be available under ECN Capital’s profile on SEDAR+ at www.sedarplus.ca. In connection therewith, a copy of the Subscription Agreement and the exhibits thereto, including the form of Investor Rights Agreement and share terms for the Convertible Preferred Shares (the “Share Terms“), will be filed with the applicable Canadian securities regulators on SEDAR+ at www.sedarplus.ca. The above descriptions of the terms and conditions of the Subscription Agreement, Investor Rights Agreement and Share Terms are expressly qualified in their entirety by the full text of the as filed documents.

Advisors

CIBC Capital Markets, BMO Capital Markets and Goldman Sachs are serving as financial advisors to ECN Capital and Blake, Cassels & Graydon LLP, Cravath, Swaine & Moore LLP and McGlinchey Stafford PLLC are serving as legal counsel.

Jefferies LLC is serving as financial advisor to Skyline Champion, and King & Spalding LLP and McCarthy Tetrault LLP are serving as legal counsel.

About ECN Capital Corp.

With managed assets of US$4.7 billion, ECN Capital Corp. (TSX: ECN) is a leading provider of business services to North American based banks, credit unions, life insurance companies, pension funds and institutional investors (collectively our “Partners“). ECN Capital originates, manages and advises on credit assets on behalf of its Partners, specifically consumer (manufactured housing and recreational vehicle and marine) loans and commercial (inventory finance or floorplan) loans. Our Partners are seeking high quality assets to match with their deposits, term insurance or other liabilities. These services are offered through two operating segments: (i) Manufactured Housing Finance, and (ii) Recreational Vehicles and Marine Finance.

About Skyline Champion

Skyline Champion Corporation (NYSE: SKY) is a leading producer of factory-built housing in North America and employs approximately 7,600 people. With more than 70 years of homebuilding experience and 44 manufacturing facilities throughout the United States and western Canada, Skyline Champion is well positioned with an innovative portfolio of manufactured and modular homes, ADUs, park-models and modular buildings for the single-family, multi-family, and hospitality sectors.

In addition to its core home building business, Skyline Champion provides construction services to install and set-up factory-built homes, operates a factory-direct retail business with 31 retail locations across the United States, and operates Star Fleet Trucking, providing transportation services to the manufactured housing and other industries from several dispatch locations across the United States.

Skyline Champion builds homes under some of the most well-known brand names in the factory-built housing industry including Skyline Homes, Champion Home Builders, Genesis Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, Titan Homes in the U.S. and Moduline and SRI Homes in western Canada.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities laws (collectively, the “forward-looking statements”). Such statements are based on the current expectations and views of future events of ECN Capital’s and Skyline Champion’s management. In some cases the forward-looking statements can be identified by words or phrases such as “will”, “expect”, “anticipate”, “intend”, “potential”, “estimate”, “believe” or the negative of these terms, or other similar expressions intended to identify forward-looking statements. Forward-looking statements in this press release include those relating to the Private Placement and the establishment of the captive finance company, including the anticipating timing of closing of the Private Placement, the expected use of proceeds of the Private Placement, the expected appointment of Mark Yost to the Board of Directors of ECN Capital and the anticipated benefits of the Private Placement and the captive finance company to ECN Capital and Skyline Champion, including the provision of more attractive financing options for Skyline Champion’s customers, driving greater demand for Skyline Champion’s products and generating increased originations and balances for Triad. The forward-looking statements discussed in this release may not occur and could differ materially as a result of known and unknown risk factors and uncertainties affecting ECN Capital and Skyline Champion, including risks regarding expected timing of the closing of the Private Placement and launch of the captive finance company, the market’s acceptance of the captive finance company’s retail finance program and branded floorplan offering, the parties’ plans, strategies and objectives and other factors beyond the control of ECN Capital and Skyline Champion. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause ECN Capital’s and Skyline Champion’s actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements contained herein. Accordingly, readers should not place undue reliance on such forward-looking statements. A discussion of the material risks and assumptions associated with ECN Capital’s business can be found in ECN Capital’s Management Discussion and Analysis for the three and six months ended June 30, 2023 and Annual Information Form dated March 30, 2023 which can be accessed at www.sedarplus.ca. A discussion of the material risks and assumptions associated with Skyline Champion’s business can be found in Skyline Champion’s Annual Report on Form 10-K for the fiscal year ended April 1, 2023 previously filed with the Securities and Exchange Commission (“SEC”), as well as in Skyline Champion’s Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed with or furnished to the SEC. Accordingly, readers should not place undue reliance on any forward-looking statements or information. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and ECN Capital and Skyline Champion do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. … ##

Part II – Additional Information with More MHProNews Analysis and Commentary

While every part of a press release is provided for various legal and public relations reasons, perhaps one of the key remarks in the ECN-Skyline release above may be this one: “ECN Capital intends to appoint Mark Yost, President and Chief Executive Officer of Skyline Champion, to the Board of Directors of ECN Capital.”

If the respective stock trends post-announcement are an indication, and they should be, then at least short term, Skyline Champion (SKY) has benefited more from investor response to the news than ECN Capital has.

Each of the MHI linked sources were invited to remark on or off the record, and ultimately their remarks all went off the record. That may provide more interesting insights as they are not posturing for the sake of others. In no particular order of importance are the following remarks, with the referencing numbering A-B-C-D by MHProNews used to indicate 4 sets of remarks being published (others were provided that for various reasons were not used).

A)

Another remark was pithier. The key lines were as follows: “But the loss of an independent finance company may chill the market some, depending on Champion’s operation. Time will tell.” As an aside, it is interesting to note that some tenured manufactured housing industry pros use the full formal name (Skyline Champion) while others simply call the firm “Champion.”

Let’s review some thoughts, general in nature with no application to the present deal, although time tells all.

1. You ask about possible Federal agency participation in industry chattel lending. I had been involved with one of the GSEs for several years working on the subject, I can say the following;

a) there is very little appetite for chattel lending as it is not well understood by them and any lender fears what it does not know.

b) Even if the Feds get involved, lower interest rates are likely the only benefit. Lower rates and easier approvals are highly unlikely to apply.

2. These types of deals have repeatedly occurred in [manufactured housing] in the past. What drives it? Well, except for periods in the 1970s and 1990s, HUD chattel lending has been less than builders and sellers wanted or needed, to generate as much business as they wanted. Both the easy lending of the 70s and 90s brought the industry to its knees. The industry has never recovered from the 1990s episode and may never do so.

…

4. The supposition going in is that having a relationship by ownership in a lender will create better lending for the builder with the mirror of greater volume for the lender. The belief going in is this is a win-win for each of them, greater, controlled volume for the lender and more predictable loan availability for the builder. Jeez, isn’t that how the Clayton group does it? Yes, it does a version of that.

5. Implicit in looking at the deal through the Clayton lens is akin to believe that because a person plays in the NBA they play as well as Lebron James. Look! Clayton has been doing it for years, how hard can it be? One only needs to “own” a good lender and Voila. Done! Would it be.

6. The dynamic which can set up in these relationships is that the builder wants more expansive lending, (read lower rate and deeper buy here), and the lender is always concerned about staying out of high-default purgatory, which can happen so quickly and unobserved as to put a lender at risk and on many fronts. It takes a very knowledgeable and experienced lender who will not be bullied by its builder partner to prevail on safe landing.

7. I firmly believe the industry let the HUD Code story get away from them. [Some at various times and places have had;] poor product quality, less than needed follow up after the sale, predatory community owners, terrible resale market, amongst other industry defects, has put many who have control over our industry in an antagonistic confrontation with [the rest of] us.

8. Worse, it eliminated a purchase desire from many we wanted to sell and finance, real folks looking for their first and last home purchase option. Instead, yes, we get a few upper crust retirees and some others with good credit, but an endless stream of buyers not easily financeable without some “creative” enhancements to their request for credit. Being with a poor credit record surely doesn’t make a person evil, but it does makes them unfinanceable.

9. Credit enhancements (fraud?) are poison and a lender must protect themselves at all times. This often becomes a bone of dispute in these relationships. [In the past it with some of these joint venture relationships] has be resorted to often to increase the number of transactions.

10. Again…my remarks are merely general…about these type of arrangements. It is my hope this relationship will benefit both parties and increase [their] industry penetration.”

below the graphic below or click the image and follow the prompts.

However, the conventional housing industry was allowed to recover. Lenders essentially ‘forgave’ the excesses that led to the mortgage/housing financial crisis meltdown circa 2008. The era of Dodd-Frank was ushered in. There are only a modest number of manufactured home lenders, as a review of CFPB data reflects. Manufactured housing quite obviously never has recovered. Hobbling the industry’s financing hobbled the industry’s sales. The graphic below is from 2022 with 2021 data, but still makes numerous key points with charts, graphics, comparisons, and some expert observations.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

There are some in the finance world who think that the failure of certain regional banks earlier this year reflects a problem that is not yet over or resolved.

There are some who have pointed out, as MHProNews did in the preface above, that capital access is becoming tighter. Again the big, influential financial firm Goldman Sachs said on 5.4.2023: “Small business owners – much like the U.S. Government – are facing a credit crunch, with 77% of respondents reporting they are concerned about their ability to access capital, a stunning shift from one year ago when 77% said they were confident in their ability to access capital.” The U.S. Chamber of Commerce said similarly. To what extent that influenced Skyline Champion and ECN is suggested by their own remarks and actions.

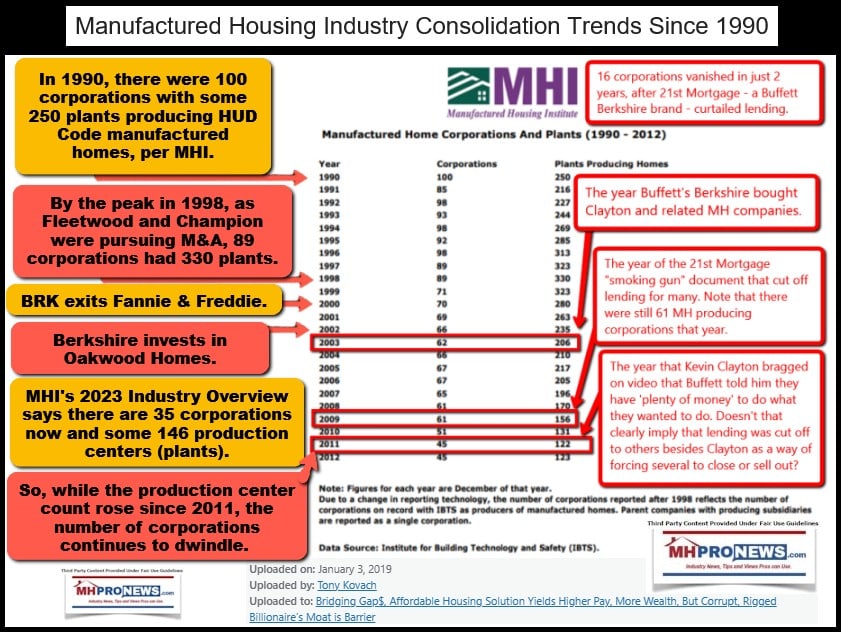

The base graphic from MHI above that reflects how much manufactured housing has consolidated is a reminder that manufactured housing once had almost 3 times as many corporations in 1990. HUD Code manufactured home production was some 4 times higher than industry production is year to date in 2023.

Summing Up, What to Watch, and Conclusions

The importance of this move by Skyline Champion is underscored by the amount of money they are putting into the deal.

below the graphic below or click the image and follow the prompts.

Part III. Daily Business News on MHProNews Markets and Headline News Segment

Headlines from left-of-center CNN Business – from the evening of 8.16.2023

- Debating more rate hikes

- Federal Reserve Board Chairman Jerome Powell speaks during a news conference following a Federal Open Market Committee meeting, at the Federal Reserve in Washington, DC, on July 26, 2023. The US Federal Reserve raised its benchmark lending rate on July 26, 2023, to its highest level since 2001 to tackle above-target inflation, and signaled the possibility of further increases ahead. The quarter percentage-point rise lifts the Fed’s key lending rate to a range between 5.25 percent and 5.5 percent, the US central bank said in a statement, adding that it will “continue to assess additional information and its implications for monetary policy.”

- The Fed is wary that inflation won’t keep slowing unless the economy and labor markets also cool down, minutes show

- The world shed 3.5 million millionaires in 2022 as market losses drained wealth at the top

- Aldi is buying 400 Winn-Dixie and Harveys supermarkets

- What are ‘Big Short’ Michael Burry and Warren Buffett seeing that we aren’t?

- Michael Burry, of ‘Big Short’ fame, just bet $1.6 billion on a stock market crash

- ‘Barbie’ tops ‘The Dark Knight’ to become Warner Bros.’ biggest movie ever at the American box office

- Help is needed as wildfires ravage Hawaii. How to know your donation is going to a legitimate charity

- US home builders ramped up construction in July, beating expectations

- Illinois passes a law that requires parents to compensate child influencers

- Coinbase wins approval to offer crypto futures in the US

- 166-year-old luxury retailer in San Francisco warns: This could be our last year

- A Vietnamese electric carmaker is now worth more than Volkswagen and Ford

- Pride Month backlash hurt Target’s sales. They fell for the first time in six years

- Snapchat users freak out over AI bot that had a mind of its own

- 27 Boston Market restaurants ordered closed in New Jersey for unpaid wages

- Banking glitch allows customers to withdraw money they don’t have

- ‘Ho-hum holiday’ spending expected as shoppers deal with economic cross-currents

- Homeowners are tapping into their home equity to get cash

- UK inflation slows to 6.8% but services are getting even more expensive

- First on CNN: Some of America’s poorest communities are landing clean energy projects worth billions

- Tourists lost their summer vacations. Maui’s locals lost everything

- News outlets went all in on Maui fire coverage. But did they miss a key part of the story?

- X appears to slow load times for links to several news outlets and rival platforms

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 8.16.2023

- Trump Drags Bidenomics as WH Celebrates Inflation Act’s Anniversary

- As President Joe Biden hailed his Bidenomics this week in Milwaukee, former President Donald Trump shot back with a new campaign economic policy video contrasting the administrations on economic success. [Full Story]

- Related Stories

- Group Rebukes Inflation Reduction Act on Anniversary

- Manchin Vows to Push Back on WH Implementation of IRA

- One Year On, Biden Still Needs to Explain IRA

- Fed: Inflation Still a Threat, Could Require Higher Rates

- Atlanta Targets Trump

- Trump Trial Would Draw Super Bowl-Like TV Ratings

- Prosecutor Seeks March Trial for Trump, 18 Others

- Alina Habba: Trump Charges in State Court ‘by Design’ | video

- Trump Lawyer Halligan: Give Feds Ga. Case | video

- Rudy Giuliani to Newsmax: Ridiculous Application of RICO Statute | video

- Meadows: Shift Ga. Charges to Federal Court | video

- DiGenova: DA Willis ‘Terrorist in Prosecutor’s Uniform’ | video

- 2 Hurdles at Outset: Jury Picks, Big Enough Courtroom

- Trump Indictments

- Pence: Trump ‘Entitled to Presumption of Innocence’

- Special Counsel Obtained Trump DMs, Draft Tweets

- Buck: Trump Troubles Distraction for GOP

- Alina Habba: Criminalizing One Side ‘Un-American’ | video

- Greene: Constituents Want Cheaper Gas, Not Biden Locking Up Trump | video

- Tim Scott: Nation’s Legal System ‘Weaponized’

- Hinson: Trump Indictments ‘Politicized’ | video

- Mar-a-Lago Manager Pleads Not Guilty in Docs Case | video

- DOJ: Trump’s Request for Secure Facility ‘Unjustified’

- Special Counsel’s Secret Trump Twitter Request Is ‘Troubling’ |Platinum Article

- Newsmax TV

- Steil: Comer, Jordan Still Unearthing Biden Evidence

- Billy Dieckman: Time to Restore Redskins Name | video

- Bacon: China Hack Over Stance on Taiwan, Uyghurs

- Burchett: Time ‘to Take The Gloves Off’ | video

- Dean Cain: Snow White Actor Parrots Disney | video

- Hinson: Trump Indictments ‘Politicized’ | video

- Navarro: How Much Does It Cost to Sell Out America? | video

- Riley Gaines: Men in Women’s Sports Is ‘Humiliating’ | video

- Whitaker: Weiss Pick Meant to Avoid Judicial Oversight | video

- Blackburn: Weiss May Be ‘Collaborator’ With Biden | video

- More Newsmax TV

- Newsfront

- Rasmussen Poll: 60 Percent of Republicans Favor Trump

- Former President Donald Trump has 60% of Republican primary voters’ support, according to a new Rasmussen poll shared with The Daily Signal. The poll was taken Aug. 11-14, before Trump’s latest indictment in Fulton County, Georgia…… [Full Story]

- Related Stories

- Quinnipiac Poll: DeSantis at Lowest Point in Primary

- DeSantis’ Security, Travel Costs Up 70 Percent

- Security and travel costs for Florida Gov. Ron DeSantis rose by [Full Story]

- Tropical Storm Hilary Forms off Mexico’s Southern Pacific Coast

- Tropical Storm Hilary formed Wednesday far off Mexico’s southern [Full Story]

- Social Security Checks up to $4,555 Go to Older Retirees

- The Social Security Administration Wednesday began sending monthly [Full Story]

- Report: Gen. Milley to Assess Israel Military Crisis

- Axios reportedthat U.S. Joint Chiefs of Staff Chairman Gen. Mark [Full Story]

- Maui Wildfire Death Toll Reaches 106

- Federal officials sent a mobile morgue with coroners, pathologists, [Full Story]

- Related

- White House: Biden to Visit Hawaii Monday, Meet With Survivors

- Hawaiian Electric Share Drop 31% After Maui Fire

- Hawaii Warns Against Purchasing Land of Wildfire Victims

- Biden Will Go to Maui ‘Soon,’ ‘Don’t Want to Get in the Way’

- Ukraine Retakes Urozhaine Village From Russian Troops

- Ukrainian forces have recaptured the village of Urozhaine from [Full Story]

- Related

- Russia Hits Ukrainian Grain Depots again as a Foreign Ship Tries out Kyiv’s New Black Sea Corridor

- Trump: ‘End Bidenomics,’ ‘Biden’s Economic Catastrophe’

- Trump: ‘End Bidenomics,’ ‘Biden’s Economic Catastrophe’

- As President Joe Biden hailed his Bidenomics this week in Milwaukee, [Full Story] | video

- Disney+, Hulu Raise Prices as Boycott Grows

- Disney is facing falling profits and economic difficulties as it has [Full Story]

- Related

- Disney’s Future, Hot Topic Among Hollywood Elite

- Branding Expert: New ‘Snow White’ Could Ruin Disney

- DeSantis’ Appointees Ask Judge to Rule Against Disney Without Trial

- Quinnipiac Poll: DeSantis at Lowest Point in Primary

- Florida Gov. Ron DeSantis hit a new low in Quinnipiac University’s [Full Story]

- ‘Complete Lack of Accountability’ 2 Years After Afghan Pullout

- Two years after the U.S. military’s chaotic withdrawal from Kabul, [Full Story] | Platinum Article

- Wall Street Falls as Bond Market Cranks Up Pressure

- Wall Street’s weak August worsened, with the S&P 500 is closing 0.8% [Full Story]

- Moon Race Between US, China, Russia All About ‘Survival’

- America is again announcing “We choose to go to the moon” – and China [Full Story] | Platinum Article

- Feinstein’s Daughter Alleges Elder Abuse in Lawsuit

- The daughter of Sen. Dianne Feinstein, D-Calif., has filed a lawsuit [Full Story]

- Trump Trial Would Draw Super Bowl-Like TV Ratings

- A media expert predicted that apotential March 2024 trial in Georgia [Full Story] | video

- Blinken Taking Heat for Summer Passport ‘Crisis’

- Secretary of State Antony Blinken is taking heat from all sides this [Full Story]

- Max Miller Apologizes For Tweet

- Max Miller apologized not long after receiving harsh criticism [Full Story]

- Enes Kanter Freedom to Newsmax: Maybe I’ll Join WNBA

- Former NBA player Enes Kanter Freedom, after saying on social media [Full Story]

- Group Rebukes Inflation Reduction Act on Anniversary

- Not everyone Wednesday parrotedPresident Joe Biden and Democrats’ [Full Story]

- AOC Faced Student Loan Debt When Promoting Forgiveness

- New York Democrat Rep. Alexandria Ocasio-Cortez appears to have had a [Full Story]

- US Appeals Court Rules to Restrict Abortion Pill Use

- A U.S. appeals court ruled Wednesday to restrict access to the [Full Story]

- San Fran Conditions Could Force Legendary Store’s Closure

- Rampant homelessness and drug abuse could force an iconic San [Full Story]

- NY Gov. Hochul: NYC Mayor Adams Slow to Act in Migrant Crisis

- New York Gov. Kathy Hochul in a scathing letter sent Tuesday to New [Full Story]

- Fed: Inflation Still a Threat, Could Require Higher Rates

- Most Federal Reserve officials last month still regarded high [Full Story]

- Paid Rep. Santos Campaign Adviser Indicted by Biden DOJ

- A paid campaign adviser for embattled Rep. George Santos, R-N.Y., has [Full Story] | video

- Report: Biden Admin Aided Palestinians Despite Concerns

- The Biden administration moved forward on a plan to send hundreds of [Full Story]

- Ipsos Poll: Americans Back Tariffs, Military Prep v. China

- Bipartisan majorities of Americans favor more tariffs on Chinese [Full Story]

- Buck: Big Tech Fight Won’t Be Won ‘in This Congress’

- Ken Buck, R-Colo., is admitting his leadership in the fight to [Full Story] | video

- US Housing Starts Surge in Boost to Economy

- US Housing Starts Surge in Boost to Economy

- S. single-family homebuilding surged in July and permits for future [Full Story]

- Pence: Trump ‘Entitled to Presumption of Innocence’

- Former President Donald Trump and the other 18 people indicted [Full Story]

- Powerlifter: Transgender Athlete’s Victory ‘Unfair’

- Female powerlifter April Hutchinson saidit’s “completely unfair” that [Full Story]

- Ringing Ears? Scientists: when Tinnitus Won’t Stop, Do This (Watch)

- Stop Tinnitus

- More Newsfront

- Finance

- One Year On, Biden Still Needs to Explain IRA

- U.S. President Joe Biden Wednesday marks the first anniversary of signing his signature clean energy legislation called the Inflation Reduction Act by leading a campaign to better explain to Americans what, exactly, it does…. [Full Story]

- Inflation Likely to Dissipate More Quickly Than Expected

- Everything You ‘Know’ About IRA’s & 401(k)’s Is a Lie

- Looking at Retracements on SPY, QQQ, IWM & TLT

- Target’s Problem With Stolen Goods Is Stabilizing

- More Finance

- Health

- Ozempic Trains Brain to Give Warnings on Overeating

- Highly touted weight loss drugs prove that biology, not willpower, triggers obesity…. [Full Story]

- Pig Kidney Works in a Donated Body for Over a Month

- FDA IDs Recall of Philips Respirators as Most Serious

- Israeli Nanotech Breakthrough Improves Breast Cancer Treatment

- Duran Duran’s Andy Taylor Says Cancer Drug Extended Life

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.