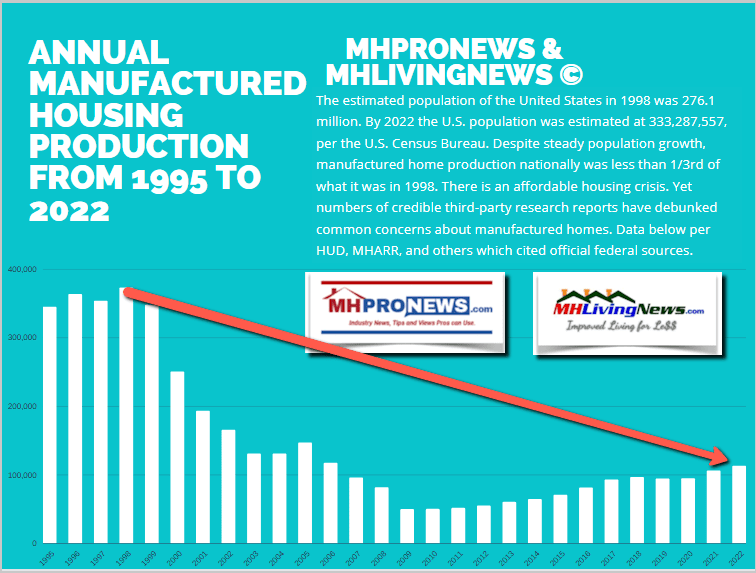

New factual and evidence-based manufactured housing focused infographics are provided in this report. Fresh insights as to the actual numbers of land-lease manufactured home communities are in this article as well. The data challenges previous estimates and claims in significant ways. In fairness to all the sources that will be cited herein, new data is consistently being produced and discovered. For example. As new manufactured home production occurs and some older mobile homes are ‘retired’ by whatever means, the mix of mobile homes (MH) to manufactured homes (MH) continues to shift toward HUD Code manufactured housing (MH). Similarly, while numbers of states have for years kept a listing of licensed manufactured home communities and ‘mobile home parks,’ other states did not. Furthermore, a few new land lease manufactured home communities (MHCs) are being developed in the U.S. annually. More common in some places are the development of additional sites adjacent to existing MHCs. That noted, evidence indicates that more common than new MHC openings are the numbers of communities closed for redevelopment. All such changes mean that the totals on manufactured home communities (MHCs) are routinely shifting. That said, some might think it odd that the Manufactured Housing Institute (MHI), perhaps in concert with their state association affiliates, have not found it relevant enough to investigate the specific community count data and report that figure annually. MHI member Sun Communities’ Gary Shiffman made the observation during an earnings call (SUI) that there is ‘no national repository of information’ on communities, and that the totals amounted to a ‘scarcity’ of such properties.

Given that some MHI members have openly proclaimed to current and potential investors that they are in the business of consolidating a ‘fragmented’ industry, there are those who believe that scarcity is driving up the value of MHC properties. That in turn results in higher lot rents for residents of properties not long after consolidators buy them. Those same locations may have only experienced modest increases in site fees for years under their previous owners.

As part of our periodic series on the “True State of the Manufactured Housing Industry” series, it is with these kinds of dynamics of evolving facts, evidence and expert insights that MHProNews recontacted George C. McCarthy with the Lincoln Institute for Land Policy.

McCarthy’s remarks in a Q&A with MHProNews will be Part I of this report.

Part II will be additional information with more MHProNews analysis and commentary in brief.

Part I – Q&A with George McCarthy, Lincoln Institute of Land Policy and MHProNews

MHProNews to George McCarthy: “In no particular order of importance, the following. Please type your reply under each question that follows and email it back for our mutual accuracy in communications and reporting. No word limits, illustration or attachments are welcome.

A) Have you refined your estimate of how many manufactured home communities (MHCs) are currently in operation nationally in the U.S.?”

MHProNews: B) There have been estimates around the turn of the century that the number of MHCs then operating was in the 50,000 to 55,000 communities’ range. Using your prior estimate of 46,500, that would suggest that some 3500 to 8500 MHCs have closed in about 22 years. Feedback, confirmation, or clarification on that topic?

McCarthy: “I don’t trust those estimates. I think the FEMA data is accurate and I suspect that the number of parks that closed is fewer than 5,000. There is a lot of trade in parks, but closures are relatively rare. I doubt that we averaged 100 per state (~five per year per state).”

MHProNews: C) There are HUD programs that can in principle be used to develop new manufactured home communities under favorable terms. But anecdotally, the impression is that these HUD programs are little used and that a limited number have occurred in the 21st century. Does Lincoln Institute have any insights on that issue?

McCarthy: “I agree that there have been few new MHCs developed in the last 30-40 years. I think the reason is that land prices have risen in places one would want to build a park—in the old days it was easier to sprawl, but now cities have sprawled about as far as they can go. There are more lucrative ways to develop property that would have formerly been developed as an MHC.”

MHProNews: D) Isn’t it apparent that if developing new manufactured home communities are dramatically outpaced by the closure of thousands of land lease communities, that the remaining ones (due to supply and demand) become relatively speaking more attractive to consolidators?

McCarthy: “Yes and no—it depends on the economics. All real estate is local—there are many places where consolidating MHCs would make sense because they cash flow well. They are the same places that have tight housing markets. In other places, investment might not be very attractive. I remember touring parks in Michigan around 2012—the parks here had high vacancies, lower rents and not great prospects. They might be doing better now, but I doubt anyone wanted to consolidate parks in MI then.”

MHProNews: E) Has anyone with the FHFA or GSEs provided any feedback to you or the Lincoln Institute regarding the statement you made that is quoted as follows?

McCarthy: “Yes. We have gotten conflicting accounts from the GSEs and the FHFA about the problem—concern from the FHFA and mostly evasion from the GSEs. The GSEs claim that they cannot underwrite Resident Owned Communities, and they feel that providing finance for institutional investors is helping to preserve the stock. The FHFA is looking for practical ideas to incentivize capital flows to the more mission-oriented purchasers. I’m anticipating that the topic will come up in the next round of discussions of Duty to Serve.”

With respect to the Q&A on (E) above, note that McCarthy was provided links to comments previously quoted remarks cited by PBS and NPR that were attributed to him. Among them was the following. So, his reply to (E) should be viewed with that in mind.

McCARTHY: “And what’s ironic about it is that one of the missions of Fannie Mae and Freddie Mac is to help preserve affordable housing. And they’re doing exactly the opposite by helping investors come in and make the most affordable housing in the United States less affordable all the time.”

Part II Additional Information, Including New Infographics, with More MHProNews Analysis and Commentary in Brief

As was recently noted in the reports linked below, sources connected with MHI and the Texas Real Estate Research Center (TRERC) have published statements that seem to be at variance with other known statements and facts. As a relevant aside and for comparison purposes, MHProNews has been pointing out for some months that the data on how many millions of housing units are needed to meet the current national demand, the National Association of Realtors (NAR) updated their estimate to reflect precisely that disparity between sources. NAR said in 2022 that some 3.8 million (Freddie Mac’s estimate) to 5.5 million plus housing units (per research commissioned by NAR) are needed. The University of Michigan said in a report on the Economics of the Housing Shortage (12.30.2022) that some economists estimate the current need at 7 million residential units. Meaning, a national trade group in a parallel role to that of MHI has made efforts to correct information that was apparently erroneous or in dispute. It begs the question: why doesn’t MHI do the same on a consistent basis?

Millions of housing units needed. Some 9 million adult Americans moved back in with mom and dad in 2022 due to high housing costs, fueled in part by the housing shortage.

Recent Freddie Mac research asserted that there are some 25 million Americans that are ‘mortgage ready’ and living in ‘MH friendly’ zones across the U.S. Put differently, the numbers who could be buying a new HUD Code manufactured home could easily be at record levels.

Nevertheless, despite amazing potential, manufactured housing is now in month four of its most recent downturn. If not for the higher demand in the first half of 2022, the steady decline in the waning months of 2022 resulted in a documented decline.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic or click the image and follow the prompts.

The above ought to be considered in the light of the fact that for months, MHI builders and others were telling investors about their large backlog of orders for new HUD Code manufactured home orders. Some MH Communities, like UMH Properties, complained that they could not get enough housing.

Put differently, there have been months of conflicting reports and claims on manufactured housing data. Ironically, several of those conflicting statements have emerged from MHI and MHI members.

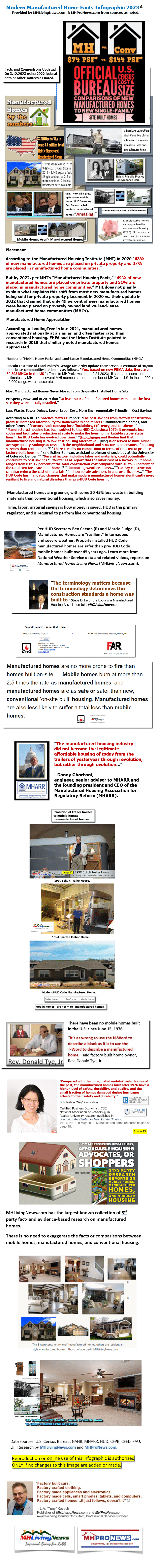

Regrettably, the seemingly simple questions of data collection have not yet yielded consistent and reliable information from MHI and some of their larger members. So, this infographic below provides facts and sources that can yield a better understanding of the industry to newcomers.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic or click the image and follow the prompts.

There is always more to know because the evidence, trends, and facts are routinely shifting. But some of the broader patterns appear to be much the same. See the related reports to learn more. Because as George McCarthy said, “And what’s ironic about it is that one of the missions of Fannie Mae and Freddie Mac is to help preserve affordable housing. And they’re doing exactly the opposite by helping investors come in and make the most affordable housing in the United States less affordable all the time.” It seems that not only are the GSEs credibly accused of that, but so too can manufactured housing industry insider appear to be involved in keeping thousands of industry professionals in the dark by failing to provide basic facts. ###

Trade media can and should be a ‘cheer leader’ when it is appropriate to do so. But authentic trade media also holds the powers that be to account. Who says? The American Press Institute.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’