On January 4, 2022, Ginnie Mae (GNMA) welcomed new President Alanna McCargo. McCargo was unanimously confirmed by the Senate last December, GNMA tweeted on 12.15.2021. Ginnie Mae plays a key role in single family manufactured home lending under the HUD/FHA Title I loan program. That program has been all but dead, per data from the Manufactured Housing Institute (MHI). Only a few dozen HUD Code manufactured homes were financed in a year, out of the roughly 100,000 new manufactured housing units produced annually. While MHI touted HUD Principal Deputy Ast. Secretary of Housing and Federal Housing Administration (FHA) Lopa P. Lolluri’s “manufactured homes comparable to site-built homes” statement in November 2021, where are the MHI memos and engagement regarding GNMA’s McCargo? Given that MHI is the industry’s self-proclaimed umbrella organization that represents “all segments” of production and post-production interests, lending is certainly in that post-production bucket. By contrast, the production-focused Manufactured Housing Association for Regulatory Reform (MHARR) provided their new release on the topic, including their communique to McCargo on manufactured home lending. Those are found below, after the official tweets from GNMA on McCargo’s appointment.

This series of tweets from Ginnie Mae establishes the backdrop to what follows.

Ginnie Mae welcomes Alanna McCargo as President following her unanimous Senate confirmation. Her extensive experience in the industry will drive Ginnie Mae’s mission to provide affordable and accessible housing finance options to homeowners and renters. https://t.co/oIshhpXV5e

— Ginnie Mae (@GinnieMaeGov) December 15, 2021

Hi! I’m Alanna McCargo, the 18th President of @GinnieMaeGov.

I’ll work hard to provide stability for Americans, ensure our Mortgage Backed Securities remain a nimble vehicle to support the mortgage market, and continue to make affordable homeownership available for millions.

— GNMA President Alanna McCargo (@GNMA_McCargo) January 4, 2022

Ginnie Mae welcomes Alanna McCargo as our newly confirmed President. We’re excited for her leadership and experience to propel our mission to expand access and equity for homebuyers and rental property owners across the country.

Read about @GNMA_McCargo: https://t.co/ehA5rn9NjQ pic.twitter.com/wyBd8KIUkj

— Ginnie Mae (@GinnieMaeGov) January 4, 2022

NEW: Strong end to 2021 with over 240K homes and apartment units financed by @GinnieMaeGov in December!

Look forward to continued strength in programs that support veterans, seniors, low-income households and more in 2022! https://t.co/DMY84lwdUA

— GNMA President Alanna McCargo (@GNMA_McCargo) January 10, 2022

MHARR Urges New Ginnie Mae President to Restore Support for – and Integrity of – Manufactured Home Consumer Lending

JANUARY 11, 2022

TO: MHARR MANUFACTURERS

MHARR STATE AFFILIATES

MHARR TECHNICAL REVIEW GROUP

FROM: MHARR

RE: MHARR URGES NEW GINNIE MAE PRESIDENT TO RESTORE SUPPORT FOR – AND INTEGRITY OF – MH CONSUMER LENDING

MHARR, in a January 10, 2022 communication to new Government National Mortgage Association (Ginnie Mae) President, Alanna McCargo (copy attached), has called on that organization to fully restore its statutory support for manufactured home consumer lending and thus re-establish the integrity and full-scale utilization of this government-insured home lending program.

As industry members are aware, the Federal Housing Administration’s (FHA) Title I manufactured housing personal property loan program, providing federally-insured purchase-money loans on HUD Code manufactured homes, ultimately securitized and guaranteed through Ginnie Mae, was once a significant source of consumer financing within the manufactured housing market, providing ten-of-thousands of loans annually.

That level support for the manufactured housing finance market, however, came to an abrupt halt when Ginnie Mae, in the wake of the 2008-2009 home mortgage crisis and weak industry post-production sector representation in Washington, D.C., adopted its infamous “10-10” rule, which effectively excludes the vast majority of manufactured home financing providers from qualifying for participation in the FHA Title I program. Instead, participation in the Title I program during the needlessly-prolonged “10-10” era, has essentially been limited to two lenders affiliated with Clayton Homes and its corporate parent, Berkshire Hathaway, Inc., neither of which have prioritized FHA-based lending. This, in turn, has resulted in a sharp and continuing decline in FHA Title I originations, which have fallen to negligible levels since the imposition of the “10-10” dictate in 2010.

This “destruction by regulation” of the statutory FHA Title I manufactured housing program not only stands in violation of Congress’ recently-reiterated support for an active and meaningful FHA/Ginnie Mae Title I lending effort, but also undermines racial equity in home lending, contrary to the most fundamental policies of the Biden Administration, by effectively closing-off a non-discriminatory source of government-sponsored financing for minority homebuyers (and particularly lower and moderate-income families) who face disproportionately-high loan rejection rates within the private-sector home financing market as reported in 2021 by the Consumer Finance Protection Bureau (CFPB).

This de facto administrative elimination of the FHA Title I manufactured housing program, combined with the de facto administrative elimination of the statutory Duty to Serve (DTS) mandate with respect to manufactured housing personal property loans — as MHARR has repeatedly warned the industry, Congress and the Biden administration — has effectively put HUD Code consumers and the industry “between a rock and a hard place,” with absolutely no securitization or secondary market support for the nearly 80 percent of the manufactured home consumer financing market represented by chattel loans, through either federally insured and securitized Title I loans, or private sector loans pursuant to DTS. The historical absence of effective national-level representation for retailers, communities and financing companies, therefore, to fight-back against such destructive policies, has – and continues to – deprive consumers of the benefits of full access to affordable manufactured housing, together with a fully-competitive financing market.

MHARR, will continue to educate and press Congress and the Biden Administration to fully restore and implement these two good laws – FHA Title I manufactured home lending support and DTS — that have been squandered in Washington, D.C. for far too long.

cc: HUD Code Manufactured Housing Producers, Retailers, Communities and Finance Companies

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: manufacturedhousingassociation.org

The MHARR attached MHARR letter to McCargo is linked here and below.

January 10, 2022

VIA FEDERAL EXPRESS AND US MAIL

Ms. Alanna McCargo

President

Government National Mortgage Association

425 3rd St. SW

Suite 500

Washington, DC 20024

Dear Ms. McCargo:

On behalf of the members of the Manufactured Housing Association for Regulatory Reform (MHARR), please accept our congratulations on your confirmation and swearing-in as President of Ginnie Mae.

MHARR is a Washington, D.C.-based national trade organization representing the views and interests of producers of manufactured housing regulated by the U.S. Department of Housing and Urban Development (HUD) pursuant to the National Manufactured Housing Construction and Safety Standards Act of 1974 (1974 Act) as amended by the Manufactured Housing Improvement Act of 2000 (2000 reform law). MHARR’s members are primarily smaller and medium-sized businesses located in all regions of the United States.

As you are undoubtedly aware, HUD-regulated manufactured housing is the nation’s leading source of affordable, non-subsidized homeownership for lower and moderate-income American families. Consequently, we commend you for your early and unequivocal commitment, as President of Ginnie Mae, to advance policies that will “make affordable homeownership and rental housing available for millions of households….”

In order to facilitate the availability and utilization of inherently affordable HUD-regulated manufactured housing, pursuant to and in accordance with the purposes and objectives of the 1974 Act as amended by the 2000 reform law, Congress long ago authorized — and has repeatedly ratified and updated — Federal Housing Administration (FHA)-backed consumer loans for purchases of (i.e., Title I) and improvements to (i.e. Title II) HUD Code manufactured homes.

Unfortunately, however, for more than a decade, an arbitrary Ginnie Mae mandate, applicable only to issuers of manufactured housing-based Mortgage Backed Securities (MBS) (i.e., Part 2, Section C of Chapter 30 of Ginnie Mae’s MBS Guide — Adjusted Net Worth Requirements) has decimated lender participation in FHA’s manufactured home loan programs. As a result, those programs, which helped finance tens of thousands of manufactured home purchases prior to the adoption of the above-referenced section of the MBS Guide have, for years now, seen only negligible levels of participation and loan originations. And the disappearance of FHA/Ginnie Mae support for the manufactured housing lending sector, virtually overnight, helped to fuel a broad and severe downturn in the manufactured housing market which has persisted ever since, with production levels far below historic norms.

This failed and unnecessary policy not only needlessly undermines the availability of affordable, non-subsidized manufactured homes for all lower and moderate-income American families, but also has profound racial and economic equity implications, as emphasized by a May 2021 Consumer Financial Protection Bureau (CFPB) report showing that minority groups which are “overrepresented” among manufactured housing chattel loan applicants, experienced a disproportionate level of rejection by available lenders. Obviously, action to restore FHA/Ginnie Mae-insured lending for manufactured housing would have an extremely positive impact on the market as a whole and for these applicants in particular, by providing them with an alternative, non-discriminatory source of consumer financing.

Given this issue and its overriding importance to both the manufactured housing industry and American consumers of affordable housing, we look forward to meeting you and working with you to help restore FHA’s longstanding and statutorily-directed role in the manufactured housing consumer financing market. We will, therefore, contact your office soon to schedule such a meeting.

Again, congratulations and we look forward to meeting with you soon.

Sincerely,

Mark Weiss

President and CEO

cc: HUD Code Manufactured Housing Producers, Retailers, Communities and Finance Companies

##

Where is the MHI counterpart to this MHARR message and news release?

Additional Information, More MHProNews Analysis and Commentary in Brief

It is increasingly difficult for MHI supporters to say with a straight face that the Arlington, VA based trade group is making any serious effort to increase single family manufactured home lending, as they claim. Yes, MHI puts out letters. Yes, they arrange for photo and video ops that may produce some pull quote that sounds and behaves – as a MHEC member told MHProNews – “Razzle Dazzle.” But where is the MHI beef? Where are the bottom-line measurable results?

The Masthead report and analysis addresses a federal bookend to GNMA, namely the recent FHFA announcement. MHI is apparently silent on both of these key issues. Why? Where is their performance to match years of rhetoric?

Much of the report linked below would apply to the FHA Title I/Ginne Mae topics too. Certainly, the evidence dovetails.

When asked to respond to the growing evidence of their apparent failures to perform, MHI is silent. Consider the obvious questions posed to MHI top staff, ‘elected’ leaders, and their attorneys. Meanwhile, MHI-friendly bloggers and publication continues to fluff them in a disturbingly public fashion.

They have a legal right to stand mute. But they can’t hide from reality forever. Who says? Honest Abe Lincoln, among others.

The MHProNews accountability project is going to continue to bring broader public attention to the issues that appear to account for relatively low sales and production of HUD Code manufactured housing during an affordable housing crisis.

Warren Buffett is increasingly known in manufactured housing circles for paltering and seemingly contradictory statements. But give the man his due. He was quite right that planting a tree and patiently nurturing it will over time produce shade in the years ahead.

If MHI leaders cared about vibrant industry growth – as past MHI President and CEO Richard “Dick” Jennison flaccidly postured without performance claimed – the reports following the quote below paints a picture of opportunities that are begging for robust manufactured housing industry growth.

With that patient and persistent notion in mind, stay tuned for what’s next as MHProNews/MHLivingNews continue to shine the light from facts and evidence that stands alone among other trade publishers and bloggers in explaining why manufactured housing is operating at only some 30 percent of its last high-water mark in 1998. During an affordable housing crisis, instead of primping, posturing, prancing, and paltering, MHI and their corporate leaders have to be held to account for their failures – as measured against MHI’s own stated desired goals.

Manufactured housing could be roaring. But instead, it is snoring. Since MHI claims to be the leaders, aren’t and their corporate masters obviously accountable?

The above is about 8 minutes of reading. The links provide additional evidence and color. They arguably provide more authentic (vs. deception and misdirection) insights as to what has led to the current true state of the manufactured housing industry underperformance during the Berkshire era of manufactured housing in 2022 than all of the MHI memos and their willing fluffers have combined.

It is better to light one candle than to curse the darkness. MHProNews/MHLivingNews will continue to light multiple candles, including via mainstream media press releases, to bring the woes of manufactured housing to the broader public’s attention.

When it comes to MHI and their corporate leaders, the case can be made that the parodies, satire, and barbs practically write themselves.

##

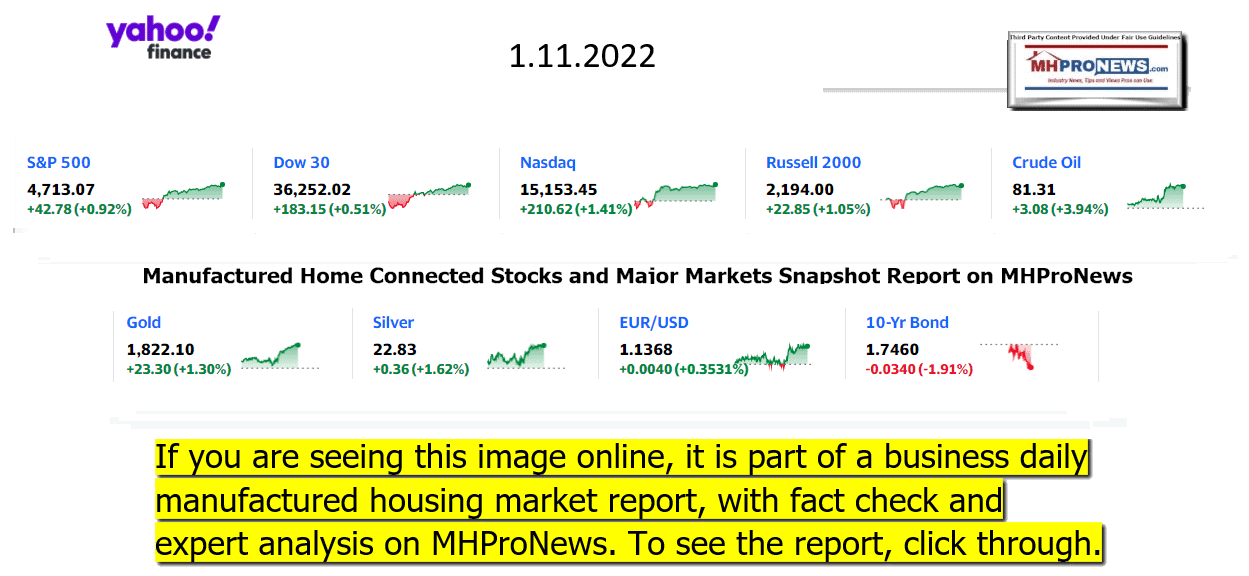

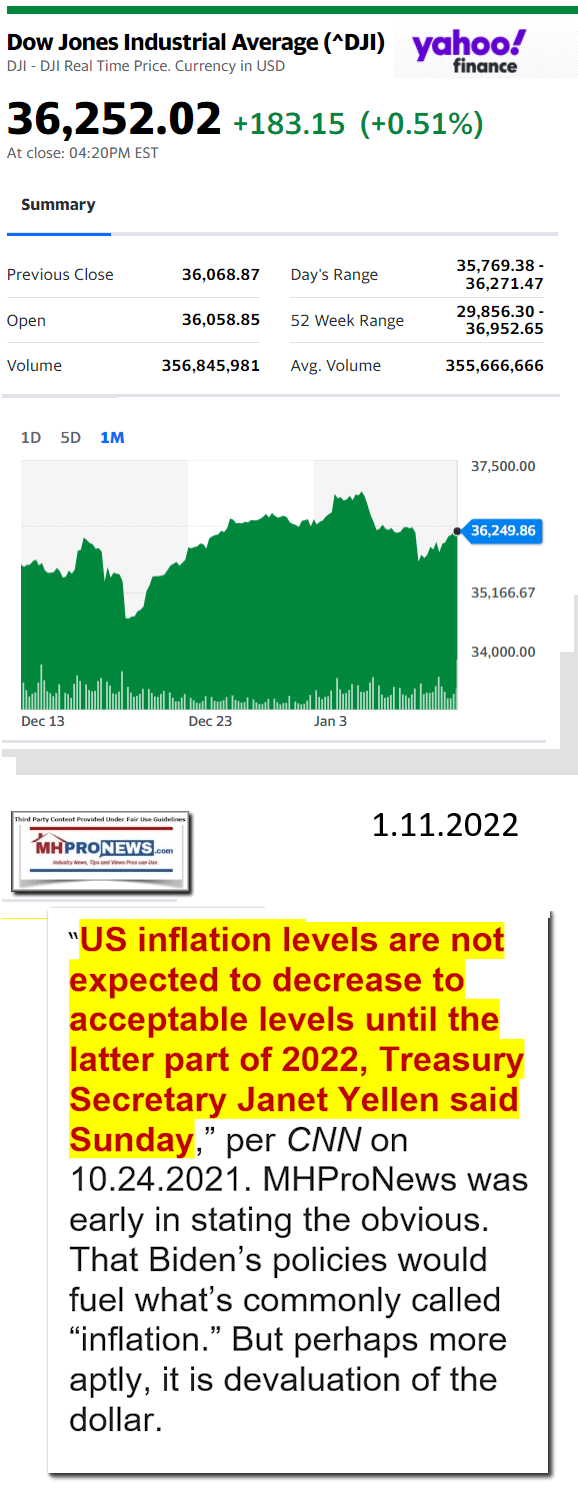

Next up is our business daily recap of yesterday evening’s market report, related left-right headlines, and manufactured housing connected equities.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left (CNN) – Right (Newsmax) Headlines Snapshot. While the layout of this daily business report has been evolving over time, several elements of the basic concepts used previously are still the same. For instance. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ news items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business – from the evening of 1.11.2022

- Shelves are empty. Again

- View of empty shelves at a local Giant supermarket as the omicron covid variant causes widespread supply chain delays resulting in empty shelves in many food markets on January 9, 2022 in Alexandria, Virginia.

- Grocery store aisles across America are wiped clean. Here’s why

- Americans are getting themselves back into debt

- This is the worst inflation in nearly 40 years. But it was much worse back then

- Welcoming immigrants would cool off inflation, US Chamber of Commerce CEO says

- Jerome Powell explains how everyone got inflation so wrong

- Warren uses ‘econ 101’ to grill Jerome Powell

- Mark Wahlberg launched a tequila. He plans to make it No. 1

- United Airlines curbing flights amid Omicron surge

- Global experts are very worried about the future, Davos survey finds

- No more fees for bounced checks at this bank

- Opinion: Drivers, get ready for $4 gas

- Korean automakers outsold Honda in the US for the first time

- Crypto CEO becomes one of the world’s richest billionaires

- Customers are furious after energy supplier tells them to cuddle pets to keep warm

- Oil pumpjacks stand in the Inglewood Oil Field on November 23, 2021 in Los Angeles, California.

- Oil prices climb to two-month high

- Photo appearing to show North Korea testing its latest hypersonic missile on January 5 published by North Korean State newspaper Rodong Sinmun.

- US grounded planes after NORAD alerted a North Korean missile launch, official says

- Oreo Cookies are seen May 13, 2003 in San Francisco.

- Oreo is celebrating its 110th birthday with a first-ever flavor

- GADGETS

- Child wearing an Oculus Quest 2 VR head set.

- In VR, there are no rules, so parents are making up their own

- Five takeaways from CES 2022

- The biggest tech fails of 2021

- This gadget shows you what food is bad for your gut

- Smartphones, laptops and oddball gadgets: CES 2022 showcases tech’s latest innovations

- FOOD + DRINK

- Arby’s Diablo Dare sandwiches, Diablo Chicken and Diablo Brisket.

- Arby’s new sandwich is so spicy it comes with a free shake

- Goldfish is chasing a new demographic: Grown-ups

- Papa Johns plans to open over 1,350 stores in China

- Taco Bell is selling a $10 monthly taco subscription

- One of Coke’s most-popular sodas is becoming a boozy beverage

Headlines from right-of-center Newsmax – evening of 1.11.2022

- New Abortion Test: GOP Bill in Fla. Bans Procedure After 15 Weeks

- The measures by Sen. Kelli Stargel and Rep. Erin Grall are similar to a Mississippi law currently under challenge before the U.S. Supreme Court.It does not go as far, however, as a Texas law banning abortion after six weeks of pregnancy with enforcement provisions allowing citizens to sue abortion providers and anyone who assists in an abortion after a fetal heartbeat is detected. [Full Story]

- Newsmax TV

- Burgess: Still No Closer to Answers on COVID Origins | video

- Tenney: Dems Want Voting Reform So They Can ‘Cheat’ | video

- Gimenez: Americans Have Lost Confidence in the CDC | video

- Hinson: Deny Funds to Places Allowing Noncitizen Voting | video

- Marshall: WH Always ‘Day Late’ in COVID Fight | video

- Alina Habba: NY AG’s ‘Fishing Expedition Has to Stop’ | video

- More Newsmax TV

- Newsfront

- Under-Pressure Biden Takes Gamble on Voting Rights Reform

- Caught between fierce pressure from the left and right, President Joe Biden was set Tuesday to endorse a risky bid to force voting rights reforms through the Senate, arguing that US democracy faces a “defining” moment. Biden flew to Atlanta, the crucible of the civil rights…… [Full Story]

- Rasmussen Poll: Trump More Favorable, Tops Biden in Hypothetical Rematch

- Donald Trump would not only defeat President Joe Biden in a [Full Story]

- Wall Street Closes Higher as Powell Testimony Eases Investors’ ConcernsWall Street Closes Higher as Powell Testimony Eases Investors’ Concerns

- S. stock indexes gained ground on Tuesday with Nasdaq leading the [Full Story]

- WHO Warns Against Treating COVID Like Flu

- The World Health Organization (WHO) on Tuesday warned against [Full Story]

- Related

- South African Studies Suggest Omicron Has Higher Rate of Asymptomatic Cases

- Home COVID Tests to Be Covered by Insurers Starting Saturday

- WHO Says More Research Needed on Vaccine Efficacy Against Omicron

- Biden Wants US Agencies to Mandate COVID-19 Testing for Unvaccinated Employees by Feb. 15

- Omicron May be Headed for a Rapid Drop in US and Britain

- FDA Amends J&J Vaccine Fact Sheet to Include Rare Bleeding Risk

- GOP Bill in Florida Would Ban Abortions After 15 Weeks

- Most abortions would be banned in Florida after 15 weeks of pregnancy [Full Story]

- US Is ‘Losing’ Hypersonic Weapons Race

- Just as nuclear weapons were the measure of world power in the 20th [Full Story] | Platinum Article

- Good Urges Boycott of GOP Club Over Mandates

- Bob Good, R-Va., has called for a boycott of a private [Full Story]

- Iranian Proxies Risk Escalation With US After Drone Attacks on Troops

- A full-blown military conflict between Iran and the U.S. could be on [Full Story] | Platinum Article

- GOP Leader Weighs Lawmaker Stock Trading Ban in ’23

- If Republicans retake Congress next year, Nancy Pelosi may be blocked [Full Story]

- Cruz Questions FBI Official About Bureau Informants at Jan. 6 Capitol Attack

- Ted Cruz, R-Texas, on Tuesday grilled a top FBI official on [Full Story]

- This New German-Engineered Hearing Device is Taking The U.S. by Storm

- Hearing Breakthrough

- Helicopter Crashes in Suburban Philly; No Serious Injuries

- A medical helicopter crashed Tuesday in a residential area of [Full Story]

- Mitch McConnell Vows Retaliation If Filibuster Changed

- High Court Overturn of Vax Mandate Could Benefit White House: Report

- If the Supreme Court decides to overturn the Biden administration’s [Full Story]

- Whole Foods Defends Policy Prohibiting Employees Wearing ‘Black Lives Matter’ Slogans

- Whole Foods is defending its policy against employees wearing slogans [Full Story]

- Boebert: ‘We Have a Socialist Govt Running Our Nation’

- Lauren Boebert blasted President Joe Biden on Tuesday, saying a [Full Story]

- Liz Cheney’s ‘Radical’ Comment Slammed by Wyoming Republicans

- The Wyoming Republican Party has lambasted GOP Rep. Liz Cheney after [Full Story]

- Manchin Reiterates Support for Filibuster Ahead of Biden Speech

- Joe Manchin reiterated his support for the filibuster on Tuesday [Full Story]

- Betty White Died 6 Days After Suffering a Stroke

- Betty White died six days after suffering from a stroke, her death [Full Story]

- Indiana State Lawmaker Walks Back Comments on Nazi History in Schools

- An Indiana state lawmaker who said teachers should be “impartial” [Full Story]

- Gimenez to Newsmax: Americans Have Lost Confidence in the CDC

- Americans are having much less confidence in the Centers for Disease [Full Story] | video

- Trump Announces Speaker Line Up for First Rally of New Year

- Former President Donald Trump announced the program speakers Tuesday [Full Story]

- Rubio Slams Dem Voting Reform as Attempt to Create ‘Election Chaos’

- Marco Rubio on Tuesday accused Democrats of trying to [Full Story]

- Federal Judge Dismisses Vaccine Mandate Lawsuit by LA Police Officers

- A lawsuit brought by Los Angeles police officers challenging the [Full Story]

- Poll: Nearly 90% Say They Know Someone Who’s Gotten COVID-19

- A full 88% of Americans say they personally know someone in the U.S. [Full Story]

- NC Voters Sue to Disqualify Rep. Cawthorn From Running for 2nd Term

- Eleven North Carolina voters have filed a challenge to prevent [Full Story]

- Jordan Exposes Partisan Jan. 6 Panel’s ‘Dangerous Precedent’

- The Jan. 6 Select Committee is entering a crossroads in its pursuit [Full Story]

- Report: States, Cities Earmark $5.6M for Lawyers for Immigrants

- State and local governments have set aside at least $5.6 million to [Full Story]

- Chicago Cardinal Cupich ‘Hopeful’ Legal Protection for Unborn Coming Soon

- A Chicago cardinal expressed hope that legal protections for the [Full Story]

- FAA Briefly Grounds Flights After Suspected NKorea Missile Launch

- A brief, full ground stop at all West Coast airports was ordered by [Full Story]

- European Parliament President David Sassoli Dies at Age 65

- David Sassoli, an Italian journalist who worked his way up in [Full Story]

- Kremlin Says No Reason to Be Optimistic After Talks With US

- The Kremlin said on Tuesday it saw no reason to be optimistic after [Full Story]

- Trump Issues Free Holster To All Supporters, (Liberals Demanding It Be Banned!)

- Finance

- Omicron Turbulence Looms Over US Airline Earnings

- S. airlines have come a long way since the spring of 2020 when COVID-19 brought the industry to its knees. Yet the pandemic will loom large when big carriers report quarterly earnings starting on Thursday…. [Full Story]

- US Judge Rejects Facebook Request to Dismiss FTC Antitrust Lawsuit

- Biden Wants US Agencies to Mandate COVID-19 Testing for Unvaccinated Employees by Feb. 15

- Omicron May be Headed for a Rapid Drop in US and Britain

- Pfizer to Cut US Sales Staff as Meetings Move to Virtual

- More Finance

- Health

- Home COVID Tests to be Covered by Insurers Starting Saturday

- Starting Saturday, private health insurers will be required to cover up to eight home COVID-19 tests per month for people on their plans. The Biden administration announced the change Monday as it looks to lower costs and make testing for the virus more convenient amid…… [Full Story]

- Omicron May be Headed for a Rapid Drop in US and Britain

- FDA Amends J&J Vaccine Fact Sheet to Include Rare Bleeding Risk

- Olive Oil Linked to Longer Life: Study

- CDC Weighs Recommending Better Masks Against Omicron: Report

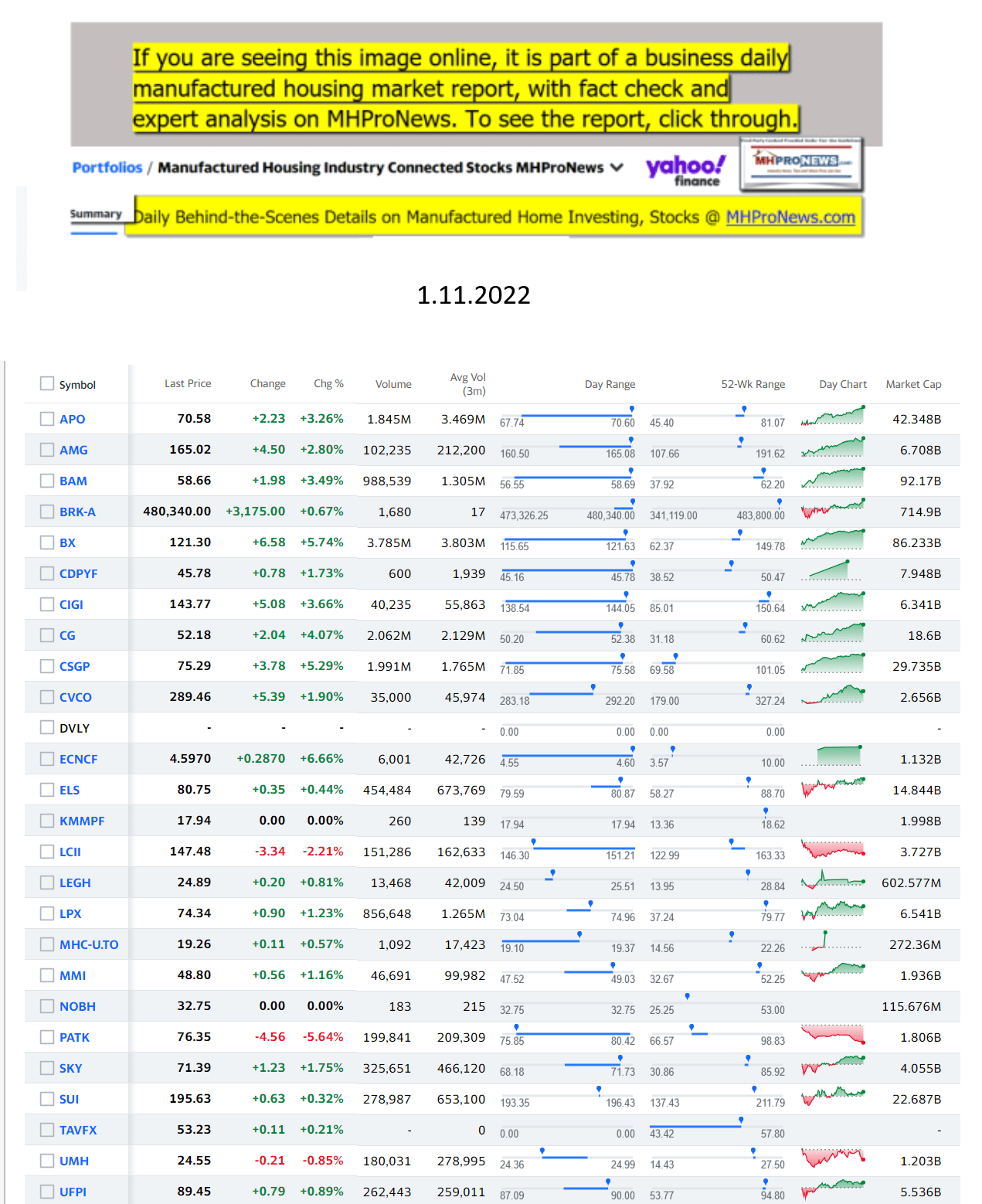

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

-

-

https://www.manufacturedhomepronews.com/steve-lawler-deer-valley-corporation-dvc-otcmkts-dvly-announces-merger-plus-manufactured-home-investing-stock-updates/

https://www.manufacturedhomepronews.com/nobility-homes-financial-position-very-strong-sales-strong-but-challenges-including-lending-and-others-examined-plus-manufactured-housing-stocks-update/ - As 2021 draws to a close…Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12th year of serving the industry as the runaway most-read trade media.

- As 2021 draws to a close…Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.